Escolar Documentos

Profissional Documentos

Cultura Documentos

Income Taxation and Tax Rates in The Philippines

Enviado por

jionxiyuDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Income Taxation and Tax Rates in The Philippines

Enviado por

jionxiyuDireitos autorais:

Formatos disponíveis

Income taxation and tax rates in the Philippines

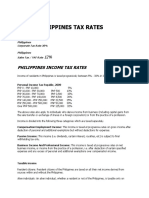

What are the allowable personal and additional exemptions? Individuals who are earning compensation income, engaged in business or deriving income from the practice of profession are entitled to the following Personal Exemptions: For single individual or married individual judicially decreed as legally separated with no qualified dependents P50,000 For head of family P50,000 For each married individual P50,000 (to be claimed only by the spouse deriving gross income) Taxpayers may also claim an Additional Exemption of P25,000 for each qualified dependents, up to four (4) dependents. How is income tax payable computed? The formula to compute the income tax payable is: Gross Income Less: Allowable Deductions (Itemized or Optional) Net Income Less: Personal & Additional Exemptions Net Taxable Income Applicable Tax Rate (see Tax Rate Table below) Income Tax Due Less: Tax Withheld Income Tax Payable What is the income tax rate in the Philippines? For individuals earning purely compensation income and those engaged in business and practice of profession, the applicable tax rate table is as follows:

Taxable More than 0 P10,000 P30,000 P70,000 P140,000 P250,000 P500,000

Income But less than P10,000 P30,000 P70,000 P140,000 P250,000 P500,000

Tax Rate 5% P500 + 10% of the Excess over P10,000 P2,500 + 15% of the Excess over P30,000 P8,500 + 20% of the Excess over P70,000 P22,500 + 25% of the Excess over P140,000 P50,000 + 30% of the Excess over P250,000 P125,000 + 32% of the Excess over P500,000 in 2000 and onward

For domestic corporations, the corporate tax rate is 30% of the Net taxable income from all sources starting January 1, 2009. For proprietary educational institutions and non-stock, non-profit hospitals, the tax rate is 10% of the Net taxable income, provided that the gross income from unrelated trade, business or other activity does not exceed 50% of the total gross income. For GOCCs, agencies & instrumentalities, the tax rate is 32% of the Net taxable income from all sources. For all taxable partnerships, the tax rate is also 32% of the Net taxable income from all sources. International Carriers are taxed 2.5% on their Gross Philippine Billings. For Regional Operating Headquarters (ROHQ), the tax rate is 10% of Taxable Income.

Você também pode gostar

- What Is The Income Tax Rate in The Philippines?Documento4 páginasWhat Is The Income Tax Rate in The Philippines?Anonymous zQNRQq2YAinda não há avaliações

- Income Taxation and Tax Rates in The PhilippinesDocumento3 páginasIncome Taxation and Tax Rates in The Philippinesओतगो एदतोगसोल एहपोीूदAinda não há avaliações

- Annual Income Tax Comp1Documento3 páginasAnnual Income Tax Comp1dhuno teeAinda não há avaliações

- Categories of Income and Tax RatesDocumento5 páginasCategories of Income and Tax RatesRonel CacheroAinda não há avaliações

- Philippines Tax RatesDocumento7 páginasPhilippines Tax RatesRonel CacheroAinda não há avaliações

- Tax On Individuals Tax Rate:: Premium Payments On Health And/or Hospitalization Insurance Not To Exceed 2,400Documento1 páginaTax On Individuals Tax Rate:: Premium Payments On Health And/or Hospitalization Insurance Not To Exceed 2,400arloAinda não há avaliações

- Tax Reform For Acceleration and Inclusion LawDocumento28 páginasTax Reform For Acceleration and Inclusion LawGloriosa SzeAinda não há avaliações

- Philippines Tax RatesDocumento7 páginasPhilippines Tax RatesJL GEN0% (1)

- Philippines Income Tax RatesDocumento6 páginasPhilippines Income Tax RatesKristina AngelieAinda não há avaliações

- General Principles of VatDocumento2 páginasGeneral Principles of VatCali Shandy H.Ainda não há avaliações

- Income Taxation Finals - CompressDocumento9 páginasIncome Taxation Finals - CompressElaiza RegaladoAinda não há avaliações

- Lecture Notes - Atty Steve Part 1Documento9 páginasLecture Notes - Atty Steve Part 1Tesia MandaloAinda não há avaliações

- Abm 11 - Fabm2 2ND Semester Finals Module 4 (Pielago)Documento11 páginasAbm 11 - Fabm2 2ND Semester Finals Module 4 (Pielago)edjay.mercado85Ainda não há avaliações

- Income and Business TaxationDocumento69 páginasIncome and Business TaxationMarie CarreraAinda não há avaliações

- Personal Income TaxDocumento5 páginasPersonal Income TaxAian Kit Jasper SanchezAinda não há avaliações

- FABM 2 Module 4 Income and Business TaxationDocumento19 páginasFABM 2 Module 4 Income and Business TaxationOkim MikoAinda não há avaliações

- Indonesia: in Case of Branches of Foreign Companies, TheDocumento2 páginasIndonesia: in Case of Branches of Foreign Companies, TheVioni HanifaAinda não há avaliações

- For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionDocumento5 páginasFor Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionMarvin H. Taleon IIAinda não há avaliações

- Tax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963Documento41 páginasTax Reform For Acceleration and Inclusion (Train Law) : Republic Act No. 10963maricrisandem100% (2)

- Train Law: Tax Reform For Acceleration and Inclusion Republic Act No. 10963Documento13 páginasTrain Law: Tax Reform For Acceleration and Inclusion Republic Act No. 10963Faith JandayanAinda não há avaliações

- TAXATION - Taxation of Individuals, Partnerships and Co-Ownerships, Estates and Trusts, and CorporationsDocumento13 páginasTAXATION - Taxation of Individuals, Partnerships and Co-Ownerships, Estates and Trusts, and CorporationsJohn Mahatma Agripa100% (2)

- Income TaxationDocumento32 páginasIncome Taxationblackphoenix303Ainda não há avaliações

- Train LawDocumento41 páginasTrain LawJoana Lyn GalisimAinda não há avaliações

- FABM2 Week 12 13 AsynchDocumento8 páginasFABM2 Week 12 13 AsynchKhaira PeraltaAinda não há avaliações

- Tax Structure of Pakistan: (A Bird Eye View)Documento16 páginasTax Structure of Pakistan: (A Bird Eye View)Kiran AliAinda não há avaliações

- The Philippines Income TaxDocumento8 páginasThe Philippines Income TaxmendozaivanrichmondAinda não há avaliações

- Philippines TaxDocumento3 páginasPhilippines TaxerickjaoAinda não há avaliações

- Income Tax On Individuals Part 2Documento22 páginasIncome Tax On Individuals Part 2mmhAinda não há avaliações

- Lesson Income TaxDocumento8 páginasLesson Income TaxEfren Lester ReyesAinda não há avaliações

- Scope of Progressive TaxDocumento3 páginasScope of Progressive TaxGeriel FajardoAinda não há avaliações

- 3 Income Tax ConceptsDocumento37 páginas3 Income Tax ConceptsRommel Espinocilla Jr.Ainda não há avaliações

- FABM2-MODULE 10 - With ActivitiesDocumento8 páginasFABM2-MODULE 10 - With ActivitiesROWENA MARAMBAAinda não há avaliações

- Philippines - Income Tax: Tax Returns and ComplianceDocumento11 páginasPhilippines - Income Tax: Tax Returns and ComplianceUnknown NameAinda não há avaliações

- TaxationDocumento6 páginasTaxationApril Mae JunioAinda não há avaliações

- Income Tax - ElaineDocumento11 páginasIncome Tax - ElaineSamsung AccountAinda não há avaliações

- Front - Maintain Training FacilitiesDocumento5 páginasFront - Maintain Training FacilitiesRechie Gimang AlferezAinda não há avaliações

- 05b Concept of Taxable IncomeDocumento36 páginas05b Concept of Taxable IncomeGolden ChildAinda não há avaliações

- Train Law Additional ReadingsDocumento2 páginasTrain Law Additional ReadingsMaria Angelica PanongAinda não há avaliações

- CHAPTER 2 3 BIR and Individual TaxpayerDocumento31 páginasCHAPTER 2 3 BIR and Individual TaxpayerAisha A. UnggalaAinda não há avaliações

- Study of The New Income Tax Schedule of The TRAIN LawDocumento16 páginasStudy of The New Income Tax Schedule of The TRAIN LawJeannie de leon82% (17)

- Pure Compensation Income Earner.Documento6 páginasPure Compensation Income Earner.Daisy Diane TorresAinda não há avaliações

- Income Tax Note 02Documento4 páginasIncome Tax Note 02Hashani Anuttara AbeygunasekaraAinda não há avaliações

- Income Tax Rate Table For Individual Taxpayers in The PhilippinesDocumento1 páginaIncome Tax Rate Table For Individual Taxpayers in The PhilippinesJan Mae LumiaresAinda não há avaliações

- Regular Income TaxationDocumento2 páginasRegular Income TaxationAlyza CaculitanAinda não há avaliações

- Chapter 5 - Final Income TaxationDocumento13 páginasChapter 5 - Final Income TaxationBisag AsaAinda não há avaliações

- 02A Income Taxes: Clwtaxn de La Salle UniversityDocumento46 páginas02A Income Taxes: Clwtaxn de La Salle UniversityTrisha RuzolAinda não há avaliações

- From An Employee To A SelfDocumento3 páginasFrom An Employee To A SelfChristine BobisAinda não há avaliações

- Income Taxation: Gross Revenue PXXXXX Deductions XXXXXDocumento8 páginasIncome Taxation: Gross Revenue PXXXXX Deductions XXXXXPSHAinda não há avaliações

- Income Taxation For Domestic CorporationDocumento6 páginasIncome Taxation For Domestic CorporationPaul Anthony AspuriaAinda não há avaliações

- Personal and Additional Exemptions Have Been RemovedDocumento4 páginasPersonal and Additional Exemptions Have Been RemovedRaquelDollisonAinda não há avaliações

- Budget SummaryDocumento16 páginasBudget SummaryMichael FelthamAinda não há avaliações

- Tax-on-Individuals PhilippinesDocumento21 páginasTax-on-Individuals PhilippinesMaria Regina Javier100% (2)

- Tax Reductions Rebates and CreditsDocumento15 páginasTax Reductions Rebates and Creditskhans827Ainda não há avaliações

- Train TaxDocumento11 páginasTrain TaxLucela InocAinda não há avaliações

- Corporate TaxesDocumento6 páginasCorporate TaxesfranAinda não há avaliações

- Taxation For Professional Services: TopicDocumento35 páginasTaxation For Professional Services: TopicLANCEAinda não há avaliações

- Income and TaxationDocumento37 páginasIncome and TaxationStephanie Mharie EugenioAinda não há avaliações

- Normal Tax Rates Applicable To An IndividualDocumento12 páginasNormal Tax Rates Applicable To An IndividualAnonymous 9Yv6n5qvSAinda não há avaliações

- Primer On TRAIN LAW 2018 As of March 13Documento16 páginasPrimer On TRAIN LAW 2018 As of March 13Niel Edar BallezaAinda não há avaliações