Escolar Documentos

Profissional Documentos

Cultura Documentos

Angelo A Padula JR

Enviado por

Angus Davis0 notas0% acharam este documento útil (0 voto)

1 visualizações4 páginasPlanning Board - Municipality

Título original

Angelo A Padula Jr

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoPlanning Board - Municipality

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

1 visualizações4 páginasAngelo A Padula JR

Enviado por

Angus DavisPlanning Board - Municipality

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF ou leia online no Scribd

Você está na página 1de 4

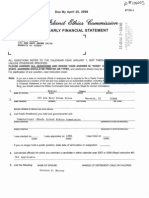

Due By April 28, 2006 OSFS-L

Khade Island. Ethier, Commission

2005 YEARLY FINANCIAL STATEMENT

4

A IR

GELO A PADUL:

ee WAKEFIELD STREET

WEST WARHICK RT

I

ALL QUESTIONS REFER TO THE CALENDAR YEAR JANUARY 1, 2005 THROUGH DECEMBER 31, 2005

UNLESS OTHERWISE SPECIFIED.

Please answer all questions and where your answer is "none" or "not applicable" so state. ANSWERS SHOULD BE

PRINTED OR TYPED, and additional sheets may be used if more space is needed. For clarification of any question,

read instruction sheet

Note: Ifyou are a state or municipal official or employee that is required to file a Yearly Financial Statement, a fallure

to file the Statement is a violation of the law and may subject you to substantial penalties, including fines. If

you received a 2005 Yearly Financial Statement in the mail but believe you did not hold @ public position in

2005 or 2006 that requires such filing, you should contact the Ethics Commission (See Instruction Sheet for

‘contact informati

«cern ihe PaDt A Auseco _fA:

Tae oF OFFAL oo ay

2 SS fUiteeFewd ST Wwuww~khD. Aare.

‘on aaa ‘rman (erro wer cooey

‘BRL RODRESS aon ame ST

PURLE FORTIN, a 0m

TATEOR REGIONAL

I was elected in Iwas appointed in_OS | was hired in

wear) (year) (ean)

Ifyou no longer hold a public position, state year of termination or resignation

4. List elected office(s) for which you were/are a candidate in either calendar year 2005 or 2006 (Read instruction #4)

Nt.

5. List the following: NAME OF SPOUSE NAME(S) OF DEPENDENT CHILD OR CHILDREN:

Nowr—

6. List the names of any employer from which you, your spouse, or dependent child received $1,000 or more gross

income during calendar year 2005. If self-employed, list any occupation from which $1,000 or more gross income

was received, If employed by a state or municipal agency, or if self-employed and services were rendered to a

state or municipal agenoy for an amount of income in excess of $250.00, list the date and nature of services

rendered. If the public position or employment listed in #3, above, provides you with an amount of gross income in

‘excess of $250.00 it must be listed here. (Do Not List Amounts.)

NAME OF FAMILY. NAME AND ADDRESS DATES AND NATURE

‘MEMBER EMPLOYED. (OF EMPLOYER OR OCCUPATION (OF SERVICES RENDERED

howe

7. List the address or legal description of any real estate, other than your principal residence, in which you, your

spouse, or dependent child had a financial interest.

Naves NATURE OF INTEREST [ADDRESS OR DESCRIPTION

Augers Pree TR OvweR de hive ST> w-ww,

five eo rower Te Ora CAvUR ST. W..,

8 List the name of any trust, name and address of the trustee of any trust, from which you, your spouse, or

dependent child or children individually received $1,000 or more gross income. List assets if known. (Do Not List

Amounts.)

~*~

NAME OF TRUST: _b-4,AL pra

NAME OF TRUSTEE AND ADDRESS:

NAME OF FAMILY MEMBER

RECEIVING TRUST INCOME:

ASSETS:

9. List the name and address of any business, profit or non-profit, in which you, your spouse, or dependent child held

@ position as a director, officer, partner, trustee, or a management position,

NAME OF FAMILY MEMBER NAME AND ADDRESS OF BUSINESS POSITION

fi6ceco Houck Arete Prioyestson ha fers i. fhe,

Hoseo owt ch frpeto fhowAtin fete Sees — fateR

arr eereerseneeee

410. List the name and address of any interested person, or business entity, that made total gifts or total contributions in

‘excess of $100 in cash or property during calendar year 2005 to you, your spouse, or dependent child. Certain

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- 2009 Top 75Documento6 páginas2009 Top 75Angus DavisAinda não há avaliações

- James V MurrayDocumento4 páginasJames V MurrayAngus DavisAinda não há avaliações

- George C MooreDocumento5 páginasGeorge C MooreAngus DavisAinda não há avaliações

- Mildred S MorrisDocumento4 páginasMildred S MorrisAngus DavisAinda não há avaliações

- Vincent MonafoDocumento4 páginasVincent MonafoAngus DavisAinda não há avaliações

- Hector M MunozDocumento4 páginasHector M MunozAngus DavisAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)