Escolar Documentos

Profissional Documentos

Cultura Documentos

Astr 1

Enviado por

Ravi AroraDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Astr 1

Enviado por

Ravi AroraDireitos autorais:

Formatos disponíveis

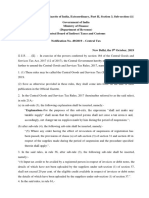

FORM ASTR-1 (Application for filing a claim of rebate of service tax and cess paid on taxable services exported)

(PART A: To be filled by the applicant) Date. Place To, Assistant Commissioner of Central ..(full postal address). Madam/Sir, I/We..,(name of the person claiming rebate) holding service tax registration No. , located in. (address of the registered premises) hereby declare that I/We have exported service (name of the taxable service) under rule 5 of the Export of Service Rules, 2005 to (name of the country to which service has been exported), and on which service tax amounting to . (amount in rupees of service tax) and education cess amounting to . (amount in rupees of cess) has been paid. Excise/Deputy Commissioner of Central Excise

2.

I/We also declare that the payment against such service exported has already been received in

India in full. (details of receipt of payment).

3.

I/We request that the rebate of the taxable service exported by me/us in terms of rule 3 of the

Export of Service Rules, 2005 may be granted at the earliest. The following documents are enclosed in support of this claim for rebate. 1. 2. 3. (Signature and name of the service provider or his authorised agent with date.)

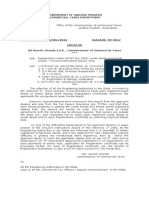

(PART B: To be filled by the sanctioning authority) Date of receipt of the rebate claim : ______________

Date of sanction of the rebate claim : ______________ Amount of rebate claimed: Amount of rebate sanctioned: Rs. ______________ Rs. ______________

If the claim is not processed within 15 days of the receipt of the claim, indicate briefly reasons for delay: Place: Date: Signature of the Assistant Commissioner/ Deputy Commissioner of Central Excise.

Você também pode gostar

- Form Astr-2 (Application For Filing A Claim of Rebate of Duty Paid On Inputs, Service Tax and Cess Paid On Input Services)Documento1 páginaForm Astr-2 (Application For Filing A Claim of Rebate of Duty Paid On Inputs, Service Tax and Cess Paid On Input Services)Krishan ChanderAinda não há avaliações

- Itr 62 Form 16Documento4 páginasItr 62 Form 16Hardik ShahAinda não há avaliações

- Form16fy10 11Documento3 páginasForm16fy10 11atishroyAinda não há avaliações

- PF Withdrawal Form GuideDocumento7 páginasPF Withdrawal Form GuideHarish LohaniAinda não há avaliações

- Form of Declaration To Be Made in Respect of A Motor Vehicle Used or Kept For Use in The StateDocumento2 páginasForm of Declaration To Be Made in Respect of A Motor Vehicle Used or Kept For Use in The StateRohit JainAinda não há avaliações

- What Is Service Tax ?Documento15 páginasWhat Is Service Tax ?Nawab SahabAinda não há avaliações

- Application For Condonation of Delay in Filing of Form VII & VIII ToDocumento2 páginasApplication For Condonation of Delay in Filing of Form VII & VIII Tokrishna gattaniAinda não há avaliações

- (See Rule 31 (1) (A) ) : Form No. 16Documento4 páginas(See Rule 31 (1) (A) ) : Form No. 16Ejaj HassanAinda não há avaliações

- LTC Bill FormDocumento4 páginasLTC Bill FormANJAN DASAinda não há avaliações

- Printed From WWW - Incometaxindia.gov - in Page 1 of 4Documento4 páginasPrinted From WWW - Incometaxindia.gov - in Page 1 of 4Thil ThilAinda não há avaliações

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Documento3 páginasLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461Ainda não há avaliações

- Application Form For Tax ExemptionDocumento5 páginasApplication Form For Tax ExemptionMacdonald RichardAinda não há avaliações

- Surrendering of RCDocumento2 páginasSurrendering of RCsaran91Ainda não há avaliações

- ST 1 (Service Tax Reg)Documento10 páginasST 1 (Service Tax Reg)praveensaxena2009Ainda não há avaliações

- EPF Form 19 10 C FormatDocumento6 páginasEPF Form 19 10 C FormatMohammed RafiqueAinda não há avaliações

- Customs, Excise & Service Tax Appellate Tribunal West Zonal Bench at AhmedabadDocumento7 páginasCustoms, Excise & Service Tax Appellate Tribunal West Zonal Bench at AhmedabadcustomsrraahmedabadAinda não há avaliações

- LTC Claim FormDocumento5 páginasLTC Claim FormRahul SinghAinda não há avaliações

- ITR62 Form 15 CADocumento5 páginasITR62 Form 15 CAMohit47Ainda não há avaliações

- Form 16 Salary CertificateDocumento2 páginasForm 16 Salary CertificateGopal TrivediAinda não há avaliações

- Application For Commutation PDFDocumento15 páginasApplication For Commutation PDFDOPEYW BIRBHUMAinda não há avaliações

- FORM I & Receipt GratuityDocumento4 páginasFORM I & Receipt Gratuityemin100% (3)

- Simple RFQ ServicesDocumento4 páginasSimple RFQ ServicesAbadit TadesseAinda não há avaliações

- Undetaking For Remittance For NRDocumento5 páginasUndetaking For Remittance For NRhds1979Ainda não há avaliações

- Rti ApplicationDocumento2 páginasRti ApplicationGautam JayasuryaAinda não há avaliações

- Northern Railway - Tender DocumentDocumento52 páginasNorthern Railway - Tender Documentabhi_1mehrotaAinda não há avaliações

- ANNEXURE 2 - Tender FormDocumento2 páginasANNEXURE 2 - Tender FormSunil MadbhagatAinda não há avaliações

- New rules for income tax formsDocumento4 páginasNew rules for income tax formsBibhuChhotrayAinda não há avaliações

- TR 47Documento2 páginasTR 47Anoop Chandran SavithriAinda não há avaliações

- Formst 1Documento3 páginasFormst 1arulantonyAinda não há avaliações

- Ahrpv0731f 2013-14Documento2 páginasAhrpv0731f 2013-14Shiva KumarAinda não há avaliações

- PT Challan MTR 6Documento1 páginaPT Challan MTR 6mak_palkar772Ainda não há avaliações

- Prj54392171draft of Application Form FairfoxDocumento10 páginasPrj54392171draft of Application Form FairfoxPKCL027 Rishabh JainAinda não há avaliações

- 5254__Tax regime_2024_240408_212256Documento3 páginas5254__Tax regime_2024_240408_212256sunil78Ainda não há avaliações

- Cent27 2012 AnnxDocumento4 páginasCent27 2012 Annxyogesh_gunaAinda não há avaliações

- NTPC Circular - EPS 95 - Joint Option Form - 06.02.2023Documento10 páginasNTPC Circular - EPS 95 - Joint Option Form - 06.02.2023Manjunaath S G GAinda não há avaliações

- PF Form 19 & 10C (Speciman Copy)Documento6 páginasPF Form 19 & 10C (Speciman Copy)teniyaAinda não há avaliações

- CGST Sixth Amendment Rules 2019Documento5 páginasCGST Sixth Amendment Rules 2019Yatrik GandhiAinda não há avaliações

- Sample RTI Applications EnglishDocumento45 páginasSample RTI Applications EnglishGiri KanyakumariAinda não há avaliações

- Form No.16: Part ADocumento3 páginasForm No.16: Part AYogesh DhekaleAinda não há avaliações

- Form 16Documento2 páginasForm 16SIVA100% (1)

- The Andhra Pradesh Agricultural LandDocumento10 páginasThe Andhra Pradesh Agricultural LandKishore KrishnaAinda não há avaliações

- Ishida India Pvt. Ltd.Documento2 páginasIshida India Pvt. Ltd.Reshmi VarmaAinda não há avaliações

- Case 1Documento5 páginasCase 1abdur rahamanAinda não há avaliações

- Application Form EMPLOYEES CAR LOAN SCHEME (New/Reconditioned Car)Documento4 páginasApplication Form EMPLOYEES CAR LOAN SCHEME (New/Reconditioned Car)assadAinda não há avaliações

- 2012CT - CC 25Documento4 páginas2012CT - CC 25Diya PandeAinda não há avaliações

- APPLICATION APPROVEDDocumento31 páginasAPPLICATION APPROVEDSameer HusainAinda não há avaliações

- Service Tax AssignmentDocumento9 páginasService Tax AssignmentRahat AdenwallaAinda não há avaliações

- Performa For Joint Request Under Paragraph 26 (Final)Documento2 páginasPerforma For Joint Request Under Paragraph 26 (Final)Nihar Ranjan TripathyAinda não há avaliações

- Form - Xxxix: Department of Commercial Taxes, Government of Uttar Pradesh (Documento3 páginasForm - Xxxix: Department of Commercial Taxes, Government of Uttar Pradesh (varung14Ainda não há avaliações

- Transfer ApplicationDocumento2 páginasTransfer ApplicationAbhishek GanvirAinda não há avaliações

- DAR FormsDocumento18 páginasDAR FormsAmitabh Narula0% (1)

- LTA Declaration Form Form 12BBDocumento3 páginasLTA Declaration Form Form 12BBAmitomSudarshanAinda não há avaliações

- TDS Certificate DetailsDocumento2 páginasTDS Certificate DetailsAnonymous SMqp9rZuAinda não há avaliações

- (See Rule 31 (1) (A) ) : Form No. 16Documento8 páginas(See Rule 31 (1) (A) ) : Form No. 16Amol LokhandeAinda não há avaliações

- Bar Review Companion: Taxation: Anvil Law Books Series, #4No EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Ainda não há avaliações

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsAinda não há avaliações

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesAinda não há avaliações

- Act on Special Measures for the Deregulation of Corporate ActivitiesNo EverandAct on Special Measures for the Deregulation of Corporate ActivitiesAinda não há avaliações

- Returns and RebatesDocumento1 páginaReturns and RebatesRavi AroraAinda não há avaliações

- Negative List of ServicesDocumento15 páginasNegative List of ServicesShyam AgarwalAinda não há avaliações

- Exemptions To Small Scale IndustriesDocumento2 páginasExemptions To Small Scale IndustriesRavi AroraAinda não há avaliações

- Job WorkDocumento2 páginasJob WorkRavi AroraAinda não há avaliações

- Courier AgenciesDocumento2 páginasCourier AgenciesRavi AroraAinda não há avaliações

- Filing of Service Tax ReturnDocumento1 páginaFiling of Service Tax ReturnRavi AroraAinda não há avaliações

- MODVATDocumento3 páginasMODVATRavi AroraAinda não há avaliações

- Returns and RebatesDocumento1 páginaReturns and RebatesRavi AroraAinda não há avaliações

- CLASIFICATIONDocumento4 páginasCLASIFICATIONRavi AroraAinda não há avaliações

- Due Date Service TaxDocumento7 páginasDue Date Service TaxRavi AroraAinda não há avaliações

- Cenvat Credit RuleDocumento2 páginasCenvat Credit RuleRavi AroraAinda não há avaliações

- General Insurance CompaniesDocumento1 páginaGeneral Insurance CompaniesRavi AroraAinda não há avaliações

- Cenvat Credit RuleDocumento2 páginasCenvat Credit RuleRavi AroraAinda não há avaliações

- Cenvat Credit RuleDocumento2 páginasCenvat Credit RuleRavi AroraAinda não há avaliações

- Rates of Service TaxDocumento1 páginaRates of Service TaxRavi AroraAinda não há avaliações

- Avoid Service TaxDocumento7 páginasAvoid Service TaxRavi AroraAinda não há avaliações

- Form A For Cenvat CreditDocumento3 páginasForm A For Cenvat CreditRavi AroraAinda não há avaliações

- TelephoneDocumento2 páginasTelephoneRavi AroraAinda não há avaliações

- FormsDocumento1 páginaFormsRavi AroraAinda não há avaliações

- ST-3 Return eFiling RequestDocumento1 páginaST-3 Return eFiling RequestKrishan ChanderAinda não há avaliações

- Advertising AgenciesDocumento2 páginasAdvertising AgenciesRavi AroraAinda não há avaliações

- Stock BrokingDocumento1 páginaStock BrokingRavi AroraAinda não há avaliações

- Aar st1Documento5 páginasAar st1KALPITANAAinda não há avaliações

- Service Tax Form-7Documento2 páginasService Tax Form-7Ravi AroraAinda não há avaliações

- Service Tax Form-6Documento2 páginasService Tax Form-6Ravi AroraAinda não há avaliações

- Service Tax Form-5Documento2 páginasService Tax Form-5Ravi AroraAinda não há avaliações

- Service Tax Form-3aDocumento1 páginaService Tax Form-3aRavi AroraAinda não há avaliações

- ST 4Documento2 páginasST 4Rajendra SwarnakarAinda não há avaliações