Escolar Documentos

Profissional Documentos

Cultura Documentos

Periodicity Assumption

Enviado por

Ella SimoneDireitos autorais

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Periodicity Assumption

Enviado por

Ella SimoneDireitos autorais:

PERIODICITY ASSUMPTION

Periodicity Assumption In accounting, periodicity refers to the equal length of time or relatively short periods of the economic life of the organization. Periodicity assumption lets divide the life of a company into artificial time periods to provide timely information. Periodic would mean monthly, quarterly, semi-annually or annually. Periodicity assumption correlates with the qualitative characteristic of timeliness. Economic transactions and events are captured and recorded in the time period in which they happened. Financial Statements are prepared periodically so that users of the economic information can know the financial standing of the business at a certain period and may think of courses of actions and strategies to implement and make decisions accordingly. Hence, when preparing financial statements, it is important to indicate the date and time period it covers. As a requirement, annual financial statements must be submitted and filed to BIR, consequently companies prepare such reports. While, financial reporting is done annually and reported externally, internally, financial statements are prepared in time periods shorter than one accounting year. The practice of organizations formed under the Philippine law the annual time period or accounting period is the same year as the calendar year, while in some countries, practices corresponds to the natural business year of the business. So, in our financial reporting, Financial Statements covers the time period from January 1 to December 31. This refers to as the calendar year. The natural business year is the 12-month period that ends when the business activities of a company reach their lowest point in the annual cycle. Thats why there are companies which end their annual financial statements in months other than December 31. This is which is referred to as fiscal year. Fiscal year is a 12-month period which begins from any month other than January 1. Aside from the annual time periods, in accounting, theres also the so-called interim periods. Interim period is any short time period within an accounting period. Interim period can be weekly, monthly, quarterly or semi-annually. The reports prepared during the interim period are called interim reports.

References : Intermediate Accounting by Spiceland, Sepe, Nelson. McGrawhill, 2011

Researched by WBBBB Accounting & Management Services. Click & visit our internet site: http://wbbbb-ams.blogspot.com/ Email us: wbbbb.ams@gmail.com Call/Text CP: 0917 767 78 56 / 0908 741 97 42 Call DL: 378 54 04 Services Offered: Business Registration Management Advisory Services Accounting/Bookkeeping Tax Advisory/Services Loans/Projects Proposals External Auditing Tax Returns Payroll Computation Services Financial Statements Financial Reports Assistance to SEC, BIR, SSS, Pag-ibig, Phil-health, etc Tutorials, Training or Consulting Services

Você também pode gostar

- WEEK 4.4 - 5.4 - Accounting Learning GainsDocumento1 páginaWEEK 4.4 - 5.4 - Accounting Learning Gainskyla perezAinda não há avaliações

- Accounting: A Simple Guide to Financial and Managerial Accounting for BeginnersNo EverandAccounting: A Simple Guide to Financial and Managerial Accounting for BeginnersAinda não há avaliações

- 1 - Understanding AccountingDocumento12 páginas1 - Understanding AccountingNicole DuranteAinda não há avaliações

- Accounting: Accounting Made Simple for Beginners, Basic Accounting Principles and How to Do Your Own BookkeepingNo EverandAccounting: Accounting Made Simple for Beginners, Basic Accounting Principles and How to Do Your Own BookkeepingNota: 5 de 5 estrelas5/5 (2)

- Financial AccountingDocumento17 páginasFinancial Accountinggift lunguAinda não há avaliações

- Accounting ResearchDocumento12 páginasAccounting ResearchAhmed HamdyAinda não há avaliações

- Basics of Book Keeping and AccountingDocumento4 páginasBasics of Book Keeping and AccountingNiya Maria NixonAinda não há avaliações

- 1.3.7 Summary of Basic Accounting Concepts and PrinciplesDocumento1 página1.3.7 Summary of Basic Accounting Concepts and PrinciplesDrinx LlyAinda não há avaliações

- Assignment 7 Bhs. Inggris SintaDocumento3 páginasAssignment 7 Bhs. Inggris Sintasinta NuriaAinda não há avaliações

- Assignment 1 (1) IaDocumento4 páginasAssignment 1 (1) IaKartikAinda não há avaliações

- Basic Accounting PrinciplesDocumento3 páginasBasic Accounting PrinciplesJeremy TurquesaAinda não há avaliações

- Assingment Financial Accounting1Documento9 páginasAssingment Financial Accounting1ANURAG SHUKLAAinda não há avaliações

- Trial BalanceDocumento4 páginasTrial Balancepri_dulkar4679Ainda não há avaliações

- What Is Accounting: Cash FlowsDocumento6 páginasWhat Is Accounting: Cash FlowsJohn Rancel MulinyaweAinda não há avaliações

- Accounting and Finance in Hospitality and Tourism IndustryDocumento11 páginasAccounting and Finance in Hospitality and Tourism IndustryLea Jane NarteaAinda não há avaliações

- Accounting OverviewDocumento13 páginasAccounting OverviewMae AroganteAinda não há avaliações

- Financial Accounting FinalDocumento39 páginasFinancial Accounting FinalShrividhya Venkata Prasath100% (1)

- Week 1 RTP 1Documento1 páginaWeek 1 RTP 1Sagun AryalAinda não há avaliações

- Scope of AccountingDocumento9 páginasScope of AccountingRhency SisonAinda não há avaliações

- Types of Accounts in AccountingDocumento6 páginasTypes of Accounts in Accountingasmamaw fissehaAinda não há avaliações

- Acconting Concepts and ConventionsDocumento5 páginasAcconting Concepts and ConventionsshamshamanthAinda não há avaliações

- Definition of 'Accrual Accounting'Documento8 páginasDefinition of 'Accrual Accounting'satish_ban91Ainda não há avaliações

- FR Notes Pre MidDocumento30 páginasFR Notes Pre Midrafiasarwar5Ainda não há avaliações

- Indian Accounting Standard 34Documento17 páginasIndian Accounting Standard 34Reetika VaidAinda não há avaliações

- Accountancy T20Documento38 páginasAccountancy T20Nischal HathiAinda não há avaliações

- Nature of AccountingDocumento2 páginasNature of AccountingElla Simone100% (5)

- Acctg 2Documento18 páginasAcctg 2Cindy GajelanAinda não há avaliações

- What Is Financial AccountingDocumento9 páginasWhat Is Financial Accountingjohn mhrjnAinda não há avaliações

- Accounting NotesDocumento6 páginasAccounting NotesHimanshu SinghAinda não há avaliações

- What Is Budgetary CycleDocumento6 páginasWhat Is Budgetary CycleHelen HaileAinda não há avaliações

- The Purpose and Use of The Accounting Records Which Used in MontehodgeDocumento15 páginasThe Purpose and Use of The Accounting Records Which Used in MontehodgeNime AhmedAinda não há avaliações

- Notes in AccountingDocumento7 páginasNotes in AccountingSolis XIIIAinda não há avaliações

- Unethical Accounting Practices Not Only Cause Instability in The MarketDocumento12 páginasUnethical Accounting Practices Not Only Cause Instability in The MarketGada AbdulcaderAinda não há avaliações

- What Is Accounting?Documento29 páginasWhat Is Accounting?gowthami ACCOUNTSAinda não há avaliações

- What Is AccountingDocumento1 páginaWhat Is AccountingAtharva ChandrakarAinda não há avaliações

- To Accounting: BM 111: Fundamentals of Accounting FSM 122: Principles of AccountingDocumento21 páginasTo Accounting: BM 111: Fundamentals of Accounting FSM 122: Principles of AccountingChreann RachelAinda não há avaliações

- Chap 1 Accounting Nature Scope Concept and ConventionDocumento5 páginasChap 1 Accounting Nature Scope Concept and Conventionyousaf.mast777Ainda não há avaliações

- Research Paper - AccountingDocumento7 páginasResearch Paper - AccountingYayoAinda não há avaliações

- Difference Between Accounting and BookkeepingDocumento3 páginasDifference Between Accounting and Bookkeepingwathiqahzainol100% (3)

- FABM 1 Lesson-6-Accounting-Concepts-and-PrinciplesDocumento3 páginasFABM 1 Lesson-6-Accounting-Concepts-and-PrinciplesPrincess Smaeranza Campos-DulayAinda não há avaliações

- Accounting 001Documento31 páginasAccounting 001Win Lwin OoAinda não há avaliações

- What Is 'Accounting'Documento4 páginasWhat Is 'Accounting'asteriaAinda não há avaliações

- Concept of BookkeepingDocumento2 páginasConcept of BookkeepingGhost DemonAinda não há avaliações

- Accounting Concept 2Documento15 páginasAccounting Concept 2TreasureAinda não há avaliações

- Study MaterialDocumento22 páginasStudy MaterialSukrit SunderAinda não há avaliações

- Accounting Basics - Quick Guide Accounting - OverviewDocumento75 páginasAccounting Basics - Quick Guide Accounting - Overviewdebaditya_hit326634Ainda não há avaliações

- Week 4 Fabm1Documento68 páginasWeek 4 Fabm1ks505eAinda não há avaliações

- 1ST Onlinemodule 1-3Documento32 páginas1ST Onlinemodule 1-3Jennifer De Leon100% (1)

- Accounting As The Language of BusinessDocumento2 páginasAccounting As The Language of BusinessjuliahuiniAinda não há avaliações

- Sulema InglesDocumento11 páginasSulema InglesBanmer AjanelAinda não há avaliações

- FINANCE 101: Financial Terms & Statements - OverviewDocumento2 páginasFINANCE 101: Financial Terms & Statements - OverviewLarrah Belle LeganiaAinda não há avaliações

- Fundamental of Accounting and Taxation NotesDocumento20 páginasFundamental of Accounting and Taxation NotesMohit100% (1)

- Introduction To AccountingDocumento34 páginasIntroduction To AccountingDhruv BhagatAinda não há avaliações

- Accounting CycleDocumento9 páginasAccounting CycleEjigayehu TesfayeAinda não há avaliações

- MEANING & SCOPE OF ACCOUNTING NOV 22 For Ca NotesDocumento53 páginasMEANING & SCOPE OF ACCOUNTING NOV 22 For Ca Notesdfghjiuy7392000996Ainda não há avaliações

- Cat 1 Advanced Accounting 1 October 2021Documento5 páginasCat 1 Advanced Accounting 1 October 2021ditai julius kayeregeAinda não há avaliações

- Fundamentals OF Accounting: Accounting by Meigs, Williams, Haka, BettnerDocumento64 páginasFundamentals OF Accounting: Accounting by Meigs, Williams, Haka, BettnerAliya SaeedAinda não há avaliações

- All Accounting NotesDocumento46 páginasAll Accounting NotesThabiso MaikanoAinda não há avaliações

- Unit 1 AnswersDocumento119 páginasUnit 1 AnswersSafaetplayzAinda não há avaliações

- BN Application Form (20110613)Documento2 páginasBN Application Form (20110613)Yourtv Inyourpc100% (6)

- BIR Form No. 1901 (ENCS) - PAGE 2: (To Be Filled Up by BIR)Documento1 páginaBIR Form No. 1901 (ENCS) - PAGE 2: (To Be Filled Up by BIR)Basil Maramag CastañoAinda não há avaliações

- PhilHealth Penalties For Non-Remitting and Non-Reporting EmployersDocumento1 páginaPhilHealth Penalties For Non-Remitting and Non-Reporting EmployersElla SimoneAinda não há avaliações

- BIR Form 1901Documento1 páginaBIR Form 1901Abdul Nassif Faisal80% (5)

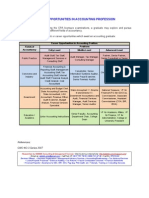

- Career Opportunities in Accounting ProfessionDocumento1 páginaCareer Opportunities in Accounting ProfessionElla SimoneAinda não há avaliações

- Relationships Among The Financial StatementsDocumento1 páginaRelationships Among The Financial StatementsElla Simone100% (1)

- Diagram of Conceptual FrameworkDocumento1 páginaDiagram of Conceptual FrameworkElla Simone100% (4)

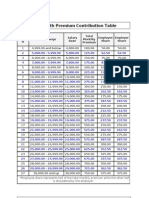

- Phil Health Contribution TableDocumento1 páginaPhil Health Contribution TableElla SimoneAinda não há avaliações

- Relationships Among The Financial StatementsDocumento1 páginaRelationships Among The Financial StatementsElla Simone100% (1)

- Monetary Unit AssumptionDocumento1 páginaMonetary Unit AssumptionElla SimoneAinda não há avaliações

- SSS Contribution TableDocumento1 páginaSSS Contribution TableElla SimoneAinda não há avaliações

- Accounting EquationDocumento1 páginaAccounting EquationElla SimoneAinda não há avaliações

- Going Concern AssumptionDocumento1 páginaGoing Concern AssumptionElla SimoneAinda não há avaliações

- Economic Entity AssumptionDocumento1 páginaEconomic Entity AssumptionElla SimoneAinda não há avaliações

- Definition of AccountingDocumento1 páginaDefinition of AccountingElla Simone100% (1)

- Specialized Fields and Branches of AccountingDocumento2 páginasSpecialized Fields and Branches of AccountingElla Simone100% (2)

- Forms of Business OrganizationDocumento1 páginaForms of Business OrganizationElla Simone100% (3)

- Philippine Regulatory AuthorityDocumento1 páginaPhilippine Regulatory AuthorityElla SimoneAinda não há avaliações

- Objectives and Purpose of AccountingDocumento1 páginaObjectives and Purpose of AccountingElla Simone100% (1)

- Nature of AccountingDocumento2 páginasNature of AccountingElla Simone100% (5)

- Accounting Processing CycleDocumento1 páginaAccounting Processing CycleElla SimoneAinda não há avaliações

- 51977069Documento1 página51977069Beginner RanaAinda não há avaliações

- Sample of Memorandum of Agreement (MOA)Documento12 páginasSample of Memorandum of Agreement (MOA)Johanna BelestaAinda não há avaliações

- Objectives and Success of Different Five Year Plans in IndiaDocumento4 páginasObjectives and Success of Different Five Year Plans in IndiaGursimrat BawaAinda não há avaliações

- Anastasia Chandra - .Akuntanis A 2014 - Tugas 6xDocumento21 páginasAnastasia Chandra - .Akuntanis A 2014 - Tugas 6xSriAinda não há avaliações

- The Swot of Taco BellDocumento2 páginasThe Swot of Taco BellJennyfer PaizAinda não há avaliações

- Set 5Documento21 páginasSet 5Ako Si Paula MonghitAinda não há avaliações

- AideD&D n5 Basse-Tour (Suite Pour Un Diamant)Documento7 páginasAideD&D n5 Basse-Tour (Suite Pour Un Diamant)Etan KrelAinda não há avaliações

- Consumer Behavior Assignment: Stimulus GeneralizationDocumento3 páginasConsumer Behavior Assignment: Stimulus GeneralizationSaurabh SumanAinda não há avaliações

- PARCOR-SIMILARITIESDocumento2 páginasPARCOR-SIMILARITIESHoney Lizette SunthornAinda não há avaliações

- Leave To Defend SinghalDocumento6 páginasLeave To Defend SinghalLavkesh Bhambhani50% (4)

- Lean Production SystemDocumento8 páginasLean Production SystemRoni Komarul HayatAinda não há avaliações

- Staffing - Responsibilities, Tools and Methods of SelectionDocumento30 páginasStaffing - Responsibilities, Tools and Methods of SelectionAmreen KhanAinda não há avaliações

- BBP TrackerDocumento44 páginasBBP TrackerHussain MulthazimAinda não há avaliações

- Integrated Review Ii: Advanced Financial Accounting and Reporting Module 3: Special Revenue Recognition I. Installment SalesDocumento18 páginasIntegrated Review Ii: Advanced Financial Accounting and Reporting Module 3: Special Revenue Recognition I. Installment SalesDarren Joy CoronaAinda não há avaliações

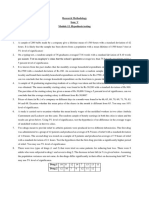

- Module 12. Worksheet - Hypothesis TestingDocumento3 páginasModule 12. Worksheet - Hypothesis TestingShauryaAinda não há avaliações

- New 7 QC ToolsDocumento106 páginasNew 7 QC ToolsRajesh SahasrabuddheAinda não há avaliações

- Coi D00387Documento101 páginasCoi D00387Fazila KhanAinda não há avaliações

- ExerciseQuestions SolutionDocumento11 páginasExerciseQuestions SolutionMaria Zakir100% (2)

- Six Sigma Black Belt Wk1 Define Amp MeasureDocumento451 páginasSix Sigma Black Belt Wk1 Define Amp Measuremajid4uonly100% (1)

- G2 Group5 FMCG Products Fair & Lovely - Ver1.1Documento20 páginasG2 Group5 FMCG Products Fair & Lovely - Ver1.1intesharmemonAinda não há avaliações

- 5 Things You Can't Do in Hyperion Planning: (And How To Do Them - . .)Documento23 páginas5 Things You Can't Do in Hyperion Planning: (And How To Do Them - . .)sen2natAinda não há avaliações

- The Power of Early Contractor Involvement Volume 12 Issue 2Documento4 páginasThe Power of Early Contractor Involvement Volume 12 Issue 2Odilon KongoloAinda não há avaliações

- Planning & Managing Inventory in Supply Chain: Cycle Inventory, Safety Inventory, ABC Inventory & Product AvailabilityDocumento24 páginasPlanning & Managing Inventory in Supply Chain: Cycle Inventory, Safety Inventory, ABC Inventory & Product AvailabilityAsma ShoaibAinda não há avaliações

- Alok Kumar Singh Section C WAC I 3Documento7 páginasAlok Kumar Singh Section C WAC I 3Alok SinghAinda não há avaliações

- CH 07Documento41 páginasCH 07Mrk KhanAinda não há avaliações

- History of HeinekenDocumento9 páginasHistory of Heinekenrully1234Ainda não há avaliações

- Bcom Final Year ProjectDocumento65 páginasBcom Final Year ProjectSHIBIN KURIAKOSE87% (69)

- Yujuico vs. Far East Bank and Trust Company DigestDocumento4 páginasYujuico vs. Far East Bank and Trust Company DigestEmir MendozaAinda não há avaliações

- Business CombinationDocumento20 páginasBusiness CombinationabhaybittuAinda não há avaliações

- Fundamentals of Accounting II AssignmentDocumento2 páginasFundamentals of Accounting II Assignmentbirukandualem946Ainda não há avaliações

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)No EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Nota: 4.5 de 5 estrelas4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)No EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Nota: 4.5 de 5 estrelas4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyNo EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyNota: 4.5 de 5 estrelas4.5/5 (37)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindNo EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindNota: 5 de 5 estrelas5/5 (231)

- Getting to Yes: How to Negotiate Agreement Without Giving InNo EverandGetting to Yes: How to Negotiate Agreement Without Giving InNota: 4 de 5 estrelas4/5 (652)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantNo EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantNota: 4.5 de 5 estrelas4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyNo EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyNota: 5 de 5 estrelas5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItNo EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItNota: 5 de 5 estrelas5/5 (13)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditNo EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditNota: 5 de 5 estrelas5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)No EverandFinance Basics (HBR 20-Minute Manager Series)Nota: 4.5 de 5 estrelas4.5/5 (32)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceAinda não há avaliações

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelAinda não há avaliações

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)No EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Nota: 4 de 5 estrelas4/5 (33)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineAinda não há avaliações

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNo EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNota: 5 de 5 estrelas5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesAinda não há avaliações

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeNo EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeNota: 4 de 5 estrelas4/5 (21)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsNo EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsNota: 4 de 5 estrelas4/5 (7)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageNo EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageNota: 4.5 de 5 estrelas4.5/5 (109)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)No EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Nota: 4.5 de 5 estrelas4.5/5 (5)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)No EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Nota: 4.5 de 5 estrelas4.5/5 (24)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingNo EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingNota: 4.5 de 5 estrelas4.5/5 (760)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNo EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanNota: 4.5 de 5 estrelas4.5/5 (79)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesNo EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesNota: 5 de 5 estrelas5/5 (4)