Escolar Documentos

Profissional Documentos

Cultura Documentos

Conservative Composite 2QTR 2012

Enviado por

jai6480Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Conservative Composite 2QTR 2012

Enviado por

jai6480Direitos autorais:

Formatos disponíveis

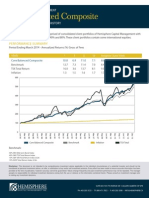

HEMISPHERE CAPITAL MANAGEMENT

Conservative Composite

PERFORMANCE SUMMARY AND HISTORY

The Conservative Composite is comprised of consolidated client portfolios of Hemisphere Capital Management where

equity is less than 15% of the asset mix. These portfolios provide capital preservation, modest income, and low risk to

clients.

PERFORMANCE SUMMARY

Period Ending June 2012 - Annualized Returns (%) Gross of Fees

YEARS

10

Inception (June/1993)

Conservative Composite

3.1

4.8

5.1

5.4

5.7

Benchmark

3.8

3.8

5.1

4.6

5.4

Inflation

2.0

1.6

1.7

1.8

1.7

350

300

250

200

150

100

50

0

Jun 12

Jun 11

Jun 10

Jun 09

Jun 08

Jun 07

Jun 06

Benchmark

Jun 05

Jun 04

Jun 03

Jun 02

Jun 01

Jun 00

Jun 99

Jun 98

Jun 97

Jun 96

Jun 95

Jun 94

Jun 93

Conservative Composite

Inflation

Benchmark:

June 1993 - December 2002

60% DEX Short-term Bond Indices

40% T-bill 91 days

January 2003 - Current

100% DEX Short-term Bond Indices

Disclaimer: This document is not intended to be comprehensive investment advice applicable to the individual circumstances of a potential investor and should not be

considered as personal investment advice, an offer, or solicitation to buy and/or sell investment products. Every effort has been made to ensure accurate information has been

provided at the time of publication, however accuracy cannot be guaranteed. Values change frequently and past investment performance may not be repeated. The manager

accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein. Please consult an investment manager prior

to making any investment decisions.

STOCK EXCHANGE BUILDING - SUITE 1280 300 5TH AVENUE SW CALGARY, ALBERTA T2P 3C4

PH: 403-205-3533 TF: 800-471-7853 F: 403-205-3588 INFO@HEMISPHERE.CA

PAGE 2

CONSERVATIVE COMPOSITE

PERFORMANCE HISTORY

1Q

3Q

4Q

YTD

Gross Fee

1.1%

4.6%

5.7%

Net Fee

1.0%

4.1%

5.1%

Benchmark

1.8%

3.0%

4.9%

3.4%

-0.2%

0.7%

Year

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

Gross Fee

-1.3%

2Q

-1.0%

# of

Port

Year

2006

2007

1Q

2Q

3Q

4Q

YTD

Gross Fee

1.5%

-0.5%

2.2%

1.1%

4.4%

Net Fee

1.3%

-0.7%

1.9%

0.9%

3.4%

Benchmark

0.3%

1.3%

1.7%

0.7%

3.9%

Gross Fee

0.9%

-0.2%

1.2%

1.2%

3.2%

Net Fee

-1.6%

-1.2%

3.2%

-0.4%

-0.2%

Net Fee

0.7%

-0.4%

0.9%

1.0%

2.2%

Benchmark

-1.9%

-0.3%

3.2%

0.8%

1.8%

Benchmark

0.9%

-0.2%

1.9%

2.9%

5.6%

Gross Fee

2.2%

2.7%

0.9%

3.3%

9.3%

Gross Fee

1.9%

1.0%

-0.2%

1.1%

3.9%

Net Fee

2.0%

2.6%

0.8%

3.3%

8.9%

Net Fee

1.6%

0.8%

-0.5%

0.9%

2.7%

Benchmark

1.7%

0.6%

1.3%

2.8%

6.6%

Gross Fee

2.1%

2.5%

2.3%

1.3%

8.5%

Net Fee

1.8%

2.2%

2.0%

1.0%

7.3%

2008

Benchmark

3.6%

2.3%

3.2%

3.2%

12.8%

Gross Fee

1.3%

3.8%

1.3%

3.7%

10.5%

Net Fee

1.3%

3.8%

1.3%

3.6%

10.3%

Benchmark

0.6%

1.9%

4.0%

1.1%

7.8%

Gross Fee

-0.1%

1.9%

2.3%

0.6%

4.7%

Net Fee

-0.3%

1.7%

2.1%

0.4%

4.0%

Net Fee

0.6%

1.2%

2.1%

0.6%

4.5%

Benchmark

0.4%

2.2%

1.4%

0.5%

4.6%

Benchmark

0.4%

1.7%

1.6%

-0.2%

3.6%

Gross Fee

1.7%

1.0%

2.3%

1.4%

6.5%

Gross Fee

0.6%

1.2%

1.1%

1.2%

4.2%

Net Fee

1.5%

0.8%

2.1%

1.3%

5.8%

Net Fee

0.3%

0.9%

0.8%

1.0%

3.0%

2.3%

0.5%

4.7%

Benchmark

1.1%

0.9%

2.3%

1.2%

5.6%

Gross Fee

1.0%

0.3%

0.9%

-0.1%

2.1%

Net Fee

0.9%

0.1%

0.7%

-0.3%

1.4%

Benchmark

1.1%

0.1%

0.8%

0.6%

2.8%

Gross Fee

1.4%

1.1%

1.7%

2.0%

6.3%

Net Fee

1.2%

0.9%

1.5%

1.8%

5.6%

Benchmark

1.7%

1.8%

1.7%

2.8%

8.3%

Gross Fee

2.1%

0.9%

2.2%

1.9%

7.4%

Net Fee

1.9%

0.7%

1.9%

1.7%

6.4%

Benchmark

1.2%

1.6%

3.7%

0.2%

6.8%

Gross Fee

0.4%

1.2%

2.1%

1.7%

5.5%

Net Fee

0.2%

1.0%

1.9%

1.5%

4.6%

Benchmark

0.3%

2.0%

1.3%

0.9%

4.5%

Gross Fee

0.1%

2.6%

1.7%

2.0%

6.5%

Net Fee

-0.1%

2.4%

1.5%

1.8%

5.7%

Benchmark

1.2%

2.1%

1.0%

2.5%

7.0%

Gross Fee

2.8%

-1.0%

2.0%

2.4%

6.2%

Net Fee

2.6%

-1.2%

1.8%

2.2%

5.4%

Benchmark

0.9%

-0.1%

1.6%

1.9%

4.4%

Gross Fee

1.9%

2.8%

1.3%

0.8%

7.0%

Net Fee

1.7%

2.5%

1.1%

0.6%

6.0%

Benchmark

0.8%

1.2%

-0.5%

0.5%

2.0%

2009

2010

2011

2012

Benchmark

2.0%

0.7%

1.6%

0.5%

4.8%

Gross Fee

0.9%

1.5%

2.4%

0.8%

5.7%

Benchmark

0.3%

1.5%

Gross Fee

1.1%

-0.4%

Net Fee

0.9%

-0.6%

Benchmark

0.0%

0.9%

# of

Port

6

Benchmark:

3

June 1993 - December 2002

60% DEX Short-term Bond Indices

40% T-bill 91 days

January 2003 - Current

100% DEX Short-term Bond Indices

10

STOCK EXCHANGE BUILDING - SUITE 1280 300 5TH AVENUE SW CALGARY, ALBERTA T2P 3C4

PH: 403-205-3533 TF: 800-471-7853 F: 403-205-3588 INFO@HEMISPHERE.CA

Você também pode gostar

- MAPS Coaching - Business Plan For AgentsDocumento12 páginasMAPS Coaching - Business Plan For AgentsJohn McMillanAinda não há avaliações

- XLS092-XLS-EnG Tire City - RaghuDocumento49 páginasXLS092-XLS-EnG Tire City - RaghuSohini Mo BanerjeeAinda não há avaliações

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosAinda não há avaliações

- Conservative Composite - 4QTR 2012-5Documento2 páginasConservative Composite - 4QTR 2012-5Jason BenteauAinda não há avaliações

- Conservative Composite - 1QTR 2014Documento2 páginasConservative Composite - 1QTR 2014jai6480Ainda não há avaliações

- Income Balanced Composit 2QTR 2012Documento2 páginasIncome Balanced Composit 2QTR 2012jai6480Ainda não há avaliações

- Core Balanced Composite 2QTR 2012Documento2 páginasCore Balanced Composite 2QTR 2012jai6480Ainda não há avaliações

- Income Balanced Composite - 1QTR 2014Documento2 páginasIncome Balanced Composite - 1QTR 2014jai6480Ainda não há avaliações

- Core Balanced Composite 2QTR 2013Documento2 páginasCore Balanced Composite 2QTR 2013Jason BenteauAinda não há avaliações

- Core Balanced Composite - 3QTR 2013Documento2 páginasCore Balanced Composite - 3QTR 2013jai6480Ainda não há avaliações

- Income Balanced Composite: Performance SummaryDocumento2 páginasIncome Balanced Composite: Performance Summaryjai6480Ainda não há avaliações

- Core Balanced Composite - 2QTR 2014Documento2 páginasCore Balanced Composite - 2QTR 2014jai6480Ainda não há avaliações

- Core Balanced Composite - 1QTR 2014Documento2 páginasCore Balanced Composite - 1QTR 2014jai6480Ainda não há avaliações

- Core Balanced Composite: Performance SummaryDocumento2 páginasCore Balanced Composite: Performance Summaryjai6480Ainda não há avaliações

- Canadian Value Fund 1QTR 2012Documento2 páginasCanadian Value Fund 1QTR 2012Jason BenteauAinda não há avaliações

- 4Q08 Conference Call PresentationDocumento17 páginas4Q08 Conference Call PresentationJBS RIAinda não há avaliações

- Fidelity Investment Managers: All-Terrain Investing: November 2010Documento26 páginasFidelity Investment Managers: All-Terrain Investing: November 2010art10135Ainda não há avaliações

- MR RIC EmergingMarketsEquityFund A enDocumento2 páginasMR RIC EmergingMarketsEquityFund A enabandegenialAinda não há avaliações

- Gds Two Pager 2011 DecDocumento2 páginasGds Two Pager 2011 DecridnaniAinda não há avaliações

- Alok Industries LTD: Q1FY12 Result UpdateDocumento9 páginasAlok Industries LTD: Q1FY12 Result UpdatejaiswaniAinda não há avaliações

- Supreme Industries FundamentalDocumento8 páginasSupreme Industries FundamentalSanjay JaiswalAinda não há avaliações

- Security Analysis and Portfolio ManagementDocumento48 páginasSecurity Analysis and Portfolio Managementmanishsingh6270Ainda não há avaliações

- 36ONE Fact Sheets SeptemberDocumento3 páginas36ONE Fact Sheets Septemberrdixit2Ainda não há avaliações

- Q2 2013 Market UpdateDocumento57 páginasQ2 2013 Market Updaterwmortell3580Ainda não há avaliações

- Deloitte GCC PPT Fact SheetDocumento22 páginasDeloitte GCC PPT Fact SheetRakawy Bin RakAinda não há avaliações

- Allan Gray Equity Fund: BenchmarkDocumento2 páginasAllan Gray Equity Fund: Benchmarkapi-217792169Ainda não há avaliações

- Diversified Option Writing Strategy: Past Performance Is Not Necessarily Indicative of Future ResultsDocumento1 páginaDiversified Option Writing Strategy: Past Performance Is Not Necessarily Indicative of Future Resultsapi-103183332Ainda não há avaliações

- FY 2011-12 Third Quarter Results: Investor PresentationDocumento34 páginasFY 2011-12 Third Quarter Results: Investor PresentationshemalgAinda não há avaliações

- BIMBSec - TM 1QFY12 Results Review - 20120531Documento3 páginasBIMBSec - TM 1QFY12 Results Review - 20120531Bimb SecAinda não há avaliações

- Wah Seong 4QFY11 20120223Documento3 páginasWah Seong 4QFY11 20120223Bimb SecAinda não há avaliações

- Still A Long Way To Go: Otto MarineDocumento6 páginasStill A Long Way To Go: Otto MarineckyeakAinda não há avaliações

- TM 4QFY11 Results 20120227Documento3 páginasTM 4QFY11 Results 20120227Bimb SecAinda não há avaliações

- NielsenDocumento17 páginasNielsenCanadianValue0% (1)

- PTTEP FinalDocumento27 páginasPTTEP FinalBancha WongAinda não há avaliações

- Done PDFDocumento1 páginaDone PDFMatthew RiveraAinda não há avaliações

- Confident Guidance CG 09-2013Documento4 páginasConfident Guidance CG 09-2013api-249217077Ainda não há avaliações

- Performance Data in Philippine Peso (PHP)Documento1 páginaPerformance Data in Philippine Peso (PHP)Teresa Dumangas BuladacoAinda não há avaliações

- Value Partners Classic Fund Q1 2015 CommentaryDocumento8 páginasValue Partners Classic Fund Q1 2015 CommentaryCharlie TianAinda não há avaliações

- Harness Performance and AttributionsDocumento12 páginasHarness Performance and AttributionsyochamAinda não há avaliações

- Are Hedge Funds Becoming Regular Asset Managers or Are Regular Managers Pretending To Be Hedge Funds?Documento45 páginasAre Hedge Funds Becoming Regular Asset Managers or Are Regular Managers Pretending To Be Hedge Funds?mayur8898357200Ainda não há avaliações

- Ishares Core S&P 500 Etf: Historical Price Performance Quote SummaryDocumento3 páginasIshares Core S&P 500 Etf: Historical Price Performance Quote SummarywanwizAinda não há avaliações

- 2010 May - Morning Pack (DBS Group) For Asian StocksDocumento62 páginas2010 May - Morning Pack (DBS Group) For Asian StocksShipforAinda não há avaliações

- 2014 09 September Monthly Report TPOIDocumento1 página2014 09 September Monthly Report TPOIValueWalkAinda não há avaliações

- CCR Arbitrage Volatilité 150: Volatility StrategyDocumento3 páginasCCR Arbitrage Volatilité 150: Volatility StrategysandeepvempatiAinda não há avaliações

- Basics of Analysis: The Star Logo, and South-Western Are Trademarks Used Herein Under LicenseDocumento18 páginasBasics of Analysis: The Star Logo, and South-Western Are Trademarks Used Herein Under LicenseKGGGGAinda não há avaliações

- Basics of Analysis: The Star Logo, and South-Western Are Trademarks Used Herein Under LicenseDocumento18 páginasBasics of Analysis: The Star Logo, and South-Western Are Trademarks Used Herein Under LicenseKGGGGAinda não há avaliações

- Nomura Global Quantitative Equity Conference 435935Documento48 páginasNomura Global Quantitative Equity Conference 435935Mukund Singh100% (1)

- STENHAM Targeted ALL FactsheetDocumento2 páginasSTENHAM Targeted ALL FactsheetgneymanAinda não há avaliações

- Camels & Pearls Rating System in VietnamDocumento41 páginasCamels & Pearls Rating System in VietnamgiangAinda não há avaliações

- Fid MoneybuilderDocumento2 páginasFid Moneybuildersnake1977Ainda não há avaliações

- Company Visit Q1 11 ThaiDocumento49 páginasCompany Visit Q1 11 ThaiMeghna GuptaAinda não há avaliações

- ANNUAL REPORT 2008 CHAIRMAN'S REVIEW ECONOMIC CHALLENGESDocumento145 páginasANNUAL REPORT 2008 CHAIRMAN'S REVIEW ECONOMIC CHALLENGESWaqas NawazAinda não há avaliações

- JF Asia New Frontiers: Fund ObjectiveDocumento1 páginaJF Asia New Frontiers: Fund ObjectiveMd Saiful Islam KhanAinda não há avaliações

- AMANX FactSheetDocumento2 páginasAMANX FactSheetMayukh RoyAinda não há avaliações

- REITs WatchlistDocumento9 páginasREITs WatchlistKhriztopher PhayAinda não há avaliações

- HSBCDocumento9 páginasHSBCMohammad Mehdi JourabchiAinda não há avaliações

- Goldman Sachs - MarketPulse - Special Edition - Ten For 2013Documento3 páginasGoldman Sachs - MarketPulse - Special Edition - Ten For 2013cdietzrAinda não há avaliações

- 3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Documento10 páginas3.7 Strategic Financial Management (Old Syllabus) of ACCA Past Papers With Answers From2002-2006Sajid Ali0% (1)

- Bank of Kigali Announces Q1 2010 ResultsDocumento7 páginasBank of Kigali Announces Q1 2010 ResultsBank of KigaliAinda não há avaliações

- European Monthly SummaryDocumento2 páginasEuropean Monthly SummaryEma EmAinda não há avaliações

- FXG10 UPDATEDocumento7 páginasFXG10 UPDATEShahbaz AslamAinda não há avaliações

- Core Balanced Composite - 3QTR 2013Documento2 páginasCore Balanced Composite - 3QTR 2013jai6480Ainda não há avaliações

- Canadian Value Fund: Performance SummaryDocumento2 páginasCanadian Value Fund: Performance Summaryjai6480Ainda não há avaliações

- Canadian Value Fund - 2QTR 2014Documento2 páginasCanadian Value Fund - 2QTR 2014jai6480Ainda não há avaliações

- Select Shares US Fund 2QTR 2012Documento2 páginasSelect Shares US Fund 2QTR 2012jai6480Ainda não há avaliações

- Canadian Value Fund - 2QTR 2014Documento2 páginasCanadian Value Fund - 2QTR 2014jai6480Ainda não há avaliações

- Canadian Value Fund: Performance SummaryDocumento2 páginasCanadian Value Fund: Performance Summaryjai6480Ainda não há avaliações

- Core Balanced Composite: Performance SummaryDocumento2 páginasCore Balanced Composite: Performance Summaryjai6480Ainda não há avaliações

- Income Balanced Composite: Performance SummaryDocumento2 páginasIncome Balanced Composite: Performance Summaryjai6480Ainda não há avaliações

- Canadian Value Fund - 2QTR 2014Documento2 páginasCanadian Value Fund - 2QTR 2014jai6480Ainda não há avaliações

- Core Balanced Composite - 2QTR 2014Documento2 páginasCore Balanced Composite - 2QTR 2014jai6480Ainda não há avaliações

- Core Balanced Composite - 1QTR 2014Documento2 páginasCore Balanced Composite - 1QTR 2014jai6480Ainda não há avaliações

- Select Shares US Fund 2QTR 2012Documento2 páginasSelect Shares US Fund 2QTR 2012jai6480Ainda não há avaliações

- Canadian Value Fund - 2QTR 2014Documento2 páginasCanadian Value Fund - 2QTR 2014jai6480Ainda não há avaliações

- Core Balanced Composite - 3QTR 2013Documento2 páginasCore Balanced Composite - 3QTR 2013jai6480Ainda não há avaliações

- Canadian Value Fund - 3QTR 2013Documento2 páginasCanadian Value Fund - 3QTR 2013jai6480Ainda não há avaliações

- Conservative Composite 2QTR 2012Documento2 páginasConservative Composite 2QTR 2012jai6480Ainda não há avaliações

- Canadian Value Fund 2QTR 2012Documento2 páginasCanadian Value Fund 2QTR 2012jai6480Ainda não há avaliações

- Select Shares US Fund 2QTR 2012Documento2 páginasSelect Shares US Fund 2QTR 2012jai6480Ainda não há avaliações

- Nemalux BrochureDocumento15 páginasNemalux Brochurejai6480Ainda não há avaliações

- BHEL AR 12-13 Eng For Web PDFDocumento300 páginasBHEL AR 12-13 Eng For Web PDFKumar KoteAinda não há avaliações

- Mgnm581:Organizational Behaviour and Human Resource Dynamics-IDocumento2 páginasMgnm581:Organizational Behaviour and Human Resource Dynamics-IsudhaAinda não há avaliações

- Starbucks Success Built on Ethics and QualityDocumento19 páginasStarbucks Success Built on Ethics and QualityReuben EscarlanAinda não há avaliações

- 3 The Importance of Operations ManagementDocumento35 páginas3 The Importance of Operations ManagementAYAME MALINAO BSA19Ainda não há avaliações

- Assistant Property Manager in Falls Church VA Resume Kathryn Jane RipleyDocumento2 páginasAssistant Property Manager in Falls Church VA Resume Kathryn Jane RipleyKathrynJaneRipleyAinda não há avaliações

- Public Procurement Reform in Developing Countries - The Uganda Experience PDFDocumento19 páginasPublic Procurement Reform in Developing Countries - The Uganda Experience PDFByaruhanga EmmanuelAinda não há avaliações

- OutsourcingDocumento24 páginasOutsourcingihabkarinaAinda não há avaliações

- IA3 Statement of Financial PositionDocumento36 páginasIA3 Statement of Financial PositionHello HiAinda não há avaliações

- MMSS 10 - Mai Sao - Imc Strengthen MSB Brand PDFDocumento108 páginasMMSS 10 - Mai Sao - Imc Strengthen MSB Brand PDFVũ Mạnh CườngAinda não há avaliações

- Introduction To PaintsDocumento43 páginasIntroduction To Paintstwinklechoksi100% (1)

- Life-Cycle Cost Analysis in Pavement DesignDocumento1 páginaLife-Cycle Cost Analysis in Pavement DesignSergio McAinda não há avaliações

- Adani's Holistic Approach for India's FutureDocumento26 páginasAdani's Holistic Approach for India's FutureRow Arya'nAinda não há avaliações

- Blackberry CoDocumento2 páginasBlackberry CoHusseinAinda não há avaliações

- Indian Auto Industry IntegrationDocumento28 páginasIndian Auto Industry IntegrationJankiAinda não há avaliações

- Larsen Toubro Infotech Limited 2015 DRHP PDFDocumento472 páginasLarsen Toubro Infotech Limited 2015 DRHP PDFviswanath_manjula100% (1)

- Multinational Cost of Capital and Capital StructureDocumento11 páginasMultinational Cost of Capital and Capital StructureMon LuffyAinda não há avaliações

- Brand India from Local to Global: Patanjali's Growth StrategyDocumento30 páginasBrand India from Local to Global: Patanjali's Growth StrategyJay FalduAinda não há avaliações

- FB - Solution Readiness Dashboard - L2 - SP06Documento34 páginasFB - Solution Readiness Dashboard - L2 - SP06Alison MartinsAinda não há avaliações

- Merchandising Operations IncomeDocumento46 páginasMerchandising Operations IncomeSina RahimiAinda não há avaliações

- Business Organization and Management - IntroductionDocumento17 páginasBusiness Organization and Management - Introductiondynamo vj75% (4)

- Commercial Excellence Your Path To GrowthDocumento6 páginasCommercial Excellence Your Path To GrowthBiswajeet PattnaikAinda não há avaliações

- The Importance of Reverse Logistics (#274692) - 255912Documento11 páginasThe Importance of Reverse Logistics (#274692) - 255912I'malookIubeAinda não há avaliações

- CENG 4339 Homework 11 SolutionDocumento3 páginasCENG 4339 Homework 11 SolutionvanessaAinda não há avaliações

- EU-28 - SBA Fact Sheet 2019Documento52 páginasEU-28 - SBA Fact Sheet 2019Ardy BAinda não há avaliações

- Salo Digital Marketing Framework 15022017Documento9 páginasSalo Digital Marketing Framework 15022017Anish NairAinda não há avaliações

- China Green (Holdings) LimitedDocumento17 páginasChina Green (Holdings) LimitedcageronAinda não há avaliações

- Reviewquestion Chapter5 Group5Documento7 páginasReviewquestion Chapter5 Group5Linh Bảo BảoAinda não há avaliações

- Business PlanDocumento17 páginasBusiness PlanMariaAinda não há avaliações