Escolar Documentos

Profissional Documentos

Cultura Documentos

Steel Industry Update #275

Enviado por

Michael LockerDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Steel Industry Update #275

Enviado por

Michael LockerDireitos autorais:

Formatos disponíveis

Steel Industry Update/275

June 2012

Locker Associates, 225 Broadway, Suite 2625 New York NY 10007

Tel: 212-962-2980

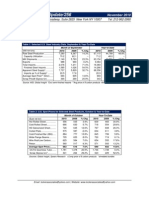

Table 1: Selected U.S. Steel Industry Data, April & Year-to-Date, 2012

Month of April

2012

2011

8,630

7,772

(000 net tons)

Raw Steel Production ...............

% Chg

11.0%

2012

34,216

Year-to-Date

2011

31,195

% Chg

9.7%

Capacity Utilization .................

80.9

74.4

--

79.7

74.4

--

Mill Shipments ..........................

8,245

7,259

13.6%

33,663

29,761

13.1%

Exports .....................................

1,167

1,027

13.6%

4,844

4,169

16.2%

Total Imports.............................

3,145

2,549

23.4%

11,748

8,976

30.9%

Finished Steel Imports ............

2,484

1,929

28.8%

8,988

6,936

29.6%

Apparent Steel Supply* .............

9,563

8,161

17.2%

37,808

32,527

16.2%

Imports as % of Supply*..........

26.0

23.6

--

23.8

21.3

--

Average Spot Price** ($/ton) ......

$805

$969

-16.9%

$819

$904

-9.4%

Scrap Price# ($/ton) ...................

$430

$442

-2.7%

$443

$443

-0.1%

Sources: AISI, SteelBenchmarker

*Excl semi-finished imports

**Avg price of 3 carbon products

#shredded scrap

Table 2: U.S. Spot Prices for Selected Steel Products, June & Year-to-Date, 2012

Hot Rolled Band....

Cold Rolled Coil........

Coiled Plate..................

Month of June

2012

2011

% Chg

628

756

-16.9%

726

853

-14.9%

879

1038

-15.3%

2012

690

790

921

Average Spot Price....

$744

$882

-15.6%

$800

$917

-12.7%

OCTG*

1,992

1,915

4.0%

2,023

1,825

10.8%

#1 Heavy Melt...

Shredded Scrap...

#1 Busheling.

336

373

383

405

440

490

-17.0%

-15.2%

-21.8%

388

429

450

404

440

473

-3.9%

-2.5%

-4.8%

($ per net ton)

Year-to-Date

2011

% Chg

825

-16.4%

918

-14.0%

1,006

-8.4%

Sources: World Steel Dynamics, Spears Research, 6/12; *OCTG data is May 2012

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

Steel Industry Update/275

Table 3: World Crude Steel Production, May & Year-to-Date, 2012

Month of May

Year-to-Date

(000 metric tons)

2012

2011

%

Chg

2012

2011

Region

European Union.

15,300

16,534

-7.5%

74,204

74,639

Other Europe.

3,307

2,742

20.6%

16,003

12,084

% Chg

-0.6%

32.4%

C.I.S.

9,305

9,553

-2.6%

46,136

44,806

3.0%

North America

10,639

9,932

7.1%

59,912

46,794

13.1%

South America...

3,990

3,664

8.9%

19,864

17,519

13.4%

Africa/Middle East.....

3,077

2,793

10.2%

14,755

13,559

8.8%

Asia..

84,475

78,475

7.6%

409,403

373,037

9.7%

Oceania......

473

687

-31.2%

2,355

3,286

-28.3%

Total

130,566

124,381

5.0%

635,633

585,726

8.5%

61,234

9,228

55,877

9,724

9.6%

-5.1%

296,261

44,870

267,491

45,221

10.8%

-0.8%

Country

China.......

Japan...

United States..

7,669

7,264

5.6%

38,709

33,808

14.5%

India(e).

6,200

5,860

5.8%

30,200

28,440

6.2%

Russia(e).

6,100

5,937

2.7%

30,125

27,447

9.8%

South Korea.......

5,973

5,246

13.9%

29,188

23,930

22.0%

Germany...

3,713

4,073

-8.8%

18,157

18,888

-3.9%

Turkey

3,081

2,536

21.5%

14,991

11,006

36.2%

Brazil...

2,887

2,856

1.1%

14,640

13,530

8.2%

Ukraine(e)...

2,600

2,906

-10.5%

13,102

14,168

-7.5%

All Others....

21,881

22,102

-1.0%

105,390

101,797

3.5%

Source: World Steel Association, 6/12; e=estimate

Graph 1: World Crude Steel Production, May 2012

Source: World Steel Association, 6/12; in million metric tons

-2-

Steel Industry Update/275

Graph 2: World Steel Capacity Utilization, May 2012

Source: World Steel Association, 6/12

Table 4: European Crude Steel Production Data for January - May 2012

Country

Austria

May'11

627

May'12

676

% Chg

-7.3%

J-May'11

3,198

J-May'12

3,267

% Chg

-2.1%

Belgium

680

Bulgaria

65

751

-9.4%

3,241

3,824

-15.3%

80

-18.9%

314

363

-13.4%

Czech Republic

487

Finland

346

508

-4.2%

2,313

2,391

-3.3%

385

-10.3%

1,777

1,908

-6.9%

France

1,475

1,457

1.3%

7,042

6,740

4.5%

Germany

3,713

4,112

-9.7%

18,157

19,313

-6.0%

80

201

-60.2%

561

850

-34.0%

Greece

Hungary

141

149

-5.1%

695

698

-0.4%

2,568

2,656

-3.3%

12,412

12,134

2.3%

Luxembourg

200

241

-16.9%

896

1,199

-25.3%

Netherlands

520

614

-15.3%

2,817

2,987

-5.7%

Poland

810

718

12.8%

3,950

3,569

10.7%

Italy

Romania

335

260

29.1%

1,640

1,536

6.8%

Slovakia

385

325

18.5%

1,937

1,860

4.1%

Slovenia

60

62

-3.0%

295

293

0.6%

1,293

1,501

-13.9%

6,240

7,332

-14.9%

406

496

-18.2%

2,102

2,358

-10.9%

Spain

Sweden

United Kingdom

918

845

8.6%

3,682

4,127

-10.8%

Other EU (e)

192

155

23.5%

935

856

9.2%

15,300

16,191

-5.5%

74,204

77,606

-4.4%

European Union (27)

Source: World Steel Association, 6/12

-3-

Steel Industry Update/275

Table 5: US Exports of Ferrous Scrap by Destination, April 2012

Country

Canada

China

Egypt

Hong Kong

India

Japan

Malaysia

Mexico

South Korea

Taiwan

Thailand

Turkey

Others

Total

April

104,549

176,620

380

4,540

156,106

5,514

61,722

46,827

213,065

300,544

50,644

617,711

151,016

1,889,238

March

108,734

303,483

38,515

4,475

140,209

4,763

70,768

31,638

352,106

346,249

46,996

561,934

139,629

2,149,519

Feb

128,438

229,001

83,998

9,298

29,622

5,773

2,545

68,073

308,671

223,783

53,945

600,524

75,890

1,859,561

YTD12

447,951

642,865

214,145

24,100

437,045

19,771

168,897

176,142

1,118,489

1,130,631

164,539

2,149,885

420,462

7,314,922

YTD11

549,103

1,380,867

129,727

44,832

188,087

66,529

397,734

221,497

1,144,353

1,016,305

364,291

1,284,551

485,577

7,273,453

% Chg

-18.4%

-39.0%

65.1%

-46.2%

132.4%

-70.3%

-57.5%

-20.5%

-2.3%

11.2%

-54.8%

67.4%

-13.4%

0.6%

Source: American Metal Market, 6/14/12

Table 6: US Slab Imports by District, 2012

Mobile, AL

Los Angeles, CA

Columbia-Snake

Philadelphia, PA

Houston-Galveston, TX

New Orleans, LA

Detroit, MI

Buffalo, NY

Total

April 2012

216,335

129,871

54,224

53,339

41,420

37,079

19,898

12,625

570,848

March 2012

265,941

194,267

117,092

88,259

5,369

2,742

23,718

18,066

724,732

April 2011

136,108

186,034

68,189

-26,084

1,840

55,591

41,252

518,687

Source: American Metal Market, 6/14/12

Steel Industry Update (ISSN 1063-4339) published 12 times/year by Locker Associates, Inc. Copyright 2012 by Locker Associates, Inc. All

rights reserved. Reproduction in any form forbidden w/o permission. Locker Associates, Inc., 225 Broadway Suite 2625 New York NY 10007.

-4-

Steel Industry Update/275

Table 7: World DRI Production by Region, 2011

Region

Latin America

Argentina

Brazil

2001

2003

2005

2007

2009

2010

2011

1.28

0.43

1.74

0.41

1.83

0.43

1.81

0.36

0.81

0.01

1.57

--

1.68

--

Mexico

3.67

5.62

5.98

6.26

4.15

5.37

5.85

Peru

0.07

0.08

0.09

0.09

0.10

0.10

0.09

Trinidad & Tobago

2.31

2.28

2.25

3.47

1.99

3.08

3.03

Venezuela

6.38

6.90

8.95

7.71

5.61

3.79

4.47

2.37

5.00

2.87

5.62

2.90

6.85

2.79

7.44

2.91

8.20

2.86

9.35

2.97

10.37

Middle East/N. Africa

Egypt

Iran

Libya

1.09

1.34

1.65

1.64

1.11

1.27

0.30

Qatar

0.73

0.78

0.82

1.30

2.10

2.16

2.23

Saudi Arabia

2.88

3.29

3.63

4.34

5.03

5.51

5.81

Australia

China

1.37

0.11

1.95

0.31

-0.41

-0.60

-0.08

---

---

India

5.59

7.67

12.04

19.06

22.03

23.42

21.97

Asia/Oceania

Indonesia

1.48

1.23

1.39

1.42

1.23

1.36

1.32

Malaysia

1.12

1.60

1.38

1.84

2.30

2.39

2.16

Myanmar

0.04

0.04

--

--

--

--

--

-0.12

0.50

0.21

0.59

0.22

0.91

0.25

0.34

--

0.60

--

0.70

--

2.51

2.91

3.34

3.41

4.67

4.79

5.20

1.56

1.54

1.78

1.74

1.39

1.12

1.41

Germany

0.21

0.59

0.44

0.59

0.38

0.45

0.38

World Total

40.32

49.45

56.99

67.22

64.44

70.37

73.32

North America

Canada

US

Former USSR/E. Europe

Russia

Sub-Saharan Africa

South Africa

Western Europe

Source: Midrex, 2011 World DRI Statistics Report; in million metric tonnes

Table 8: World DRI Production by Process, 2011

Name

MIDREX

HYL/Energiron

2001

26.99

2003

32.06

2005

34.96

2007

39.72

2009

38.62

2010

42.01

2011

44.38

8.04

9.72

11.12

11.3

7.99

9.9

11.12

Other Shaft Furn/Retort Process

0.14

0.04

--

--

--

--

--

Fluidized Bed Processes

1.93

2.57

1.52

1.05

0.5

0.34

0.48

Rotary Kiln, Coal-based

3.18

5.04

9.17

14.9

17.33

18.12

17.34

--

--

0.22

0.25

--

--

--

40.32

49.45

56.99

67.22

64.44

70.37

73.72

Rotary Hearth, Coal-based*

World Total

Source: Midrex, 2011 World DRI Statistics Report; in million metric tonnes

-5-

Steel Industry Update/275

Table 9: Service Center Transactions, 2011-2012

Date

2/2/11

3/10/11

3/11/11

3/24/11

4/29/11

5/18/11

5/25/11

7/1/11

8/2/11

9/13/11

11/15/11

11/18/11

12/1/11

12/16/11

12/30/11

1/3/12

2/14/12

3/12/12

3/12/12

Seller

MISA non-automotive SC business

D.S. Brown

Richard Trident

Singer Steel

Macsteel Service Centers USA

Chicago Tube & Iron

Stainless Pipe and Fittings Australia

Basic Stainless

Continental Alloys & Services

Versatile Processing

Sierra Alloys

Niagara Lasalle

Coleman Co., Propane Cylinder business

Tube Supply

Fushi Copperweld

Angus Industries

Winchester Metals

Gregor Technologies

HD Supply Industrial PVF

Buyer

Worthington Industries

Gibraltar Industries

Metals USA

Ryerson

Klockner & Co.

Olympic Steel

McJunkin Red Man

Samuel, Son & Co.

Reliance Steel & Aluminum

Insight Equity

Platte River Ventures

The Optima Group

Worthington Industries

A.M. Castle

TPG, Abax Global Capital

Worthington Industries

Pennsylvania Steel Co.

Metals USA

Towerbrook/Inland Shale

Source: Meter Center News, April 2012

Graph 1: US vs China and Other Markets Cost Gap, 2005, 2011 & 2013p

-6-

Steel Industry Update/275

Table 10: Voestalpine 2011-2011 FY Results

(in EUR millions)

Revenue

EBITDA

EBITDA (margin in %)

2010-11

10,953.7

1,605.6

2011-12

12,058.2

1,301.9

% Chg

10.1

-18.9

14.7%

10.8%

--

EBIT

984.8

704.2

-28.5

EBITmargin (in %)

9.0 %

5.8%

--

Profit before tax

781.0

504.4

-35.4

Profit for the period**

594.6

413.3

-30.5

3.04

1.98

--

57.8%

53.5%

--

EPS (in EUR)

Gearing ratio( in %)

Source: SteelGuru.com, 5/31/12

Table 11: Magnitogorsk Financial Results, 1st Quarter 2012

Q1'12

2,425

2,099

33

293

267

-18

42

2

14

(in US$ million)

Revenue

Cost of sales

Operating profit

EBITDA

Steel segment (Russia)

Steel segment (Turkey)

Coal segment

Consolidation effect

Profit for the period

Q4'11

2.243

1,987

-47

203

227

-67

46

-3

-67

% Chg

8%

6%

44%

18%

-9%

-

Q1'12

2,425

2,099

33

293

267

-18

42

2

14

Q1'11

2.216

1,775

155

403

337

-4

70

0

134

% Chg

9%

18%

-79%

-27%

-21%

-40%

-90%

Sources: SteelGuru.com, 6/16/12

Table 12: Turkish Crude Steel Output, 2011-2012 YTD

Billet

Slab

2011

24,400

9,707

Jan-May 11

9,856

3,724

Jan-May 12

11,162

3,825

% Chg

13.3%

2.7%

Total

34,107

13,580

14,987

10.4%

EAF

25,275

10,007

11,273

12.7%

BOF

8,832

3,573

3,714

3.9%

(in 000 tonnes)

Source: SteelGuru.com, 6/16/12

Table 13: Turkish Exports to MENA Region, Q112

Country

Saudi Arabia

Iraq

UAE

Libya

Egypt

Israel

Yemen

Morocco

Lebanon

Iran

Q1'12

473,715

385,488

310,320

179,192

167,963

157,321

150,497

761,02

69,892

44,896

Q1'11

241,391

238,287

638,916

79,173

110,655

131,456

54,818

98,811

77,846

185,561

Source: SteelGuru.com, 6/16/12; MENA: Middle East, North Africa

-7-

Steel Industry Update/275

Locker Associates Steel Track: Spot Prices

U.S. Flat-Rolled Prices

U.S. Scrap Prices

($ per ton)

($ per ton)

500

1100

#1 Busheling

Plate

1000

450

Shredded Scrap

900

400

CR Coil

#1 Heavy Melt

800

350

700

Rebar

HR Band

300

600

250

500

200

400

'07 '08 '09 '10 1q 2q

'07 '08 '09 '10 1q 2q

Locker Associates Steel Track: Performance

10.0

U.S. Raw Steel Production

2012

2012

2011

9.0

80%

7.0

70%

6.0

60%

5.0

50%

4.0

40%

2011

90%

8.0

3.0

U.S. Capacity Utilization

100%

(mil net tons)

30%

2012 8.5 8.3 8.8 8.6

2012 78% 81% 80% 81%

2011 7.9 7.4 8.1 7.8

2011 73% 75% 75% 74%

Steel Mill Products: US Imports, April & Year-to-Date, 2012

Imports: Country of Origin

(000 net tons)

Canada..

Mexico

Other W. Hemisphere..

European Union

Other Europe*..

Asia.

Oceania.

Africa..

Total

Imports: Customs District

Atlantic Coast

Gulf Coast/Mexican Border

Pacific Coast.

Gr Lakes/Canadian Border

Off Shore

Month of April

2012

2011

% Chg

539

555

-2.9

227

241

-5.8

406

215

88.8

525

312

68.3

487

227

114.5

946

833

13.6

13

156

-91.7

2

11

-81.1

3,145

2,549

23.4

362

1,530

520

713

19

257

1,083

546

647

17

Source: AISI; *includes Russia

Update #275

-8-

40.0

41.3

-4.8

10.2

11.8

2012

2,031

868

1,628

1,813

1,778

3,507

101

22

11,748

1,526

5,822

1,998

2,321

79

Year-to-Date

2011

1,991

1,118

845

1,347

762

2,507

349

58

8,976

1,106

3,836

1,771

2,192

71

% Chg

2.0

-22.4

92.7

34.6

133.3

39.9

-71.1

-62.1

30.9

38.0

51.8

12.8

5.9

11.3

Locker Associates, Inc.

LOCKER ASSOCIATES is a business-consulting firm that specializes in enhancing the

competitiveness of businesses and industries on behalf of unions, corporate and government

clients. By combining expert business and financial analysis with a sensitivity to labor issues,

the firm is uniquely qualified to help clients manage change by:

leading joint labor/management business improvement initiatives;

facilitating ownership transitions to secure the long-term viability of a business;

conducting strategic industry studies to identify future challenges and opportunities;

representing unions in strategic planning, workplace reorganization and bankruptcy

formulating business plans for turnaround situations; and

performing due diligence for equity and debt investors.

Over the last 28 years, the firm has directed over 225 projects spanning manufacturing,

transportation, distribution and mining industries. Typical projects involve in-depth analysis of a

firms market, financial and operating performance on behalf of a cooperative labormanagement effort. Locker Associates also produces a widely read monthly newsletter, Steel

Industry Update that circulates throughout the U.S. and Canadian steel industry.

MAJOR CLIENTS

United Steelworkers

Bank of Boston

Congress Financial

Santander Investment Securities

AEIF-IAM/AK Steel Middletown

Prudential Securities

US Steel Joint Labor-Mgmt Comm

LTV Steel Joint Labor-Mgmt Committee

Intl Union of Electrical Workers

Bethlehem Joint Labor-Mgmt Comm

Inland Steel Joint Labor-Mgmt Comm

Northwestern Steel and Wire

Boilermakers

American Federation of Musicians

USS/KOBE

Sysco Food Services of San Francisco

International Brotherhood of Teamsters

Development Bank of South Africa

J&L Structural Steel

Air Line Pilots Association/Delta Air Lines MEC

Sharpsville Quality Products

IPSCO

International Association of Machinists

CSEA/AFSCME

United Auto Workers

Service Employees International Union

American Fed of Television & Radio Artists

Supervalu

United Mine Workers

Algoma Steel

North American Refractories

UNITE/HERE

AFL-CIO George Meany Center

Watermill Ventures

Wheeling-Pittsburgh Steel

Canadian Steel Trade & Employment Congress

Minn Gov's Task Force on Mining

Special Metals

RECENT PROJECTS

Metallic Lathers and Reinforcing Ironworkers (2010-2011): strategic industry research and

ongoing advisement on major industry trends and companies to help enhance the competitive

position of the unionized NYC construction industry

Metallurgical Coal Producer (2011): prepared a detailed study on the major trends in the

world metallurgical coal market for a major metallurgical coal producer

Business Plan for High-Tech Startup (2009-present): drafted detailed business plan to raise

capital and promote a new hydrogen battery technology

IBT-Supervalu (2010): assist union and management to identify major operational problems

impacting warehouse performance and provide recommendations for joint improvement

Institute of Scrap Recycling Industries (2010): presented a status report on the U.S. steel

market before the Institute of Scrap Recycling Industries Commodities roundtable

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

Você também pode gostar

- CWA-CVC Investor Briefing Presentation 4-15-13Documento20 páginasCWA-CVC Investor Briefing Presentation 4-15-13Michael LockerAinda não há avaliações

- Steel Industry Update 283Documento9 páginasSteel Industry Update 283Michael LockerAinda não há avaliações

- Steel Industry Update #281Documento6 páginasSteel Industry Update #281Michael LockerAinda não há avaliações

- Steel Industry Update #279Documento8 páginasSteel Industry Update #279Michael LockerAinda não há avaliações

- Steel Industry Update #271Documento9 páginasSteel Industry Update #271Michael LockerAinda não há avaliações

- Steel Industry Update #276Documento7 páginasSteel Industry Update #276Michael LockerAinda não há avaliações

- Steel Industry Update #274Documento8 páginasSteel Industry Update #274Michael LockerAinda não há avaliações

- Steel Industry Update #282Documento9 páginasSteel Industry Update #282Michael LockerAinda não há avaliações

- Steel Industry Update #280Documento10 páginasSteel Industry Update #280Michael LockerAinda não há avaliações

- Steel Industry Update #278Documento9 páginasSteel Industry Update #278Michael LockerAinda não há avaliações

- Steel Industry Update #270Documento9 páginasSteel Industry Update #270Michael LockerAinda não há avaliações

- Steel Industry Update #269Documento8 páginasSteel Industry Update #269Michael LockerAinda não há avaliações

- Steel Industry Update #277Documento9 páginasSteel Industry Update #277Michael LockerAinda não há avaliações

- Steel Industry Update #272Documento7 páginasSteel Industry Update #272Michael LockerAinda não há avaliações

- Steel Industry Update #273Documento8 páginasSteel Industry Update #273Michael LockerAinda não há avaliações

- Steel Industry Update #267Documento9 páginasSteel Industry Update #267Michael LockerAinda não há avaliações

- Steel Industry Update #265Documento7 páginasSteel Industry Update #265Michael LockerAinda não há avaliações

- Steel Industry Update #268Documento13 páginasSteel Industry Update #268Michael LockerAinda não há avaliações

- Steel Industry Update #266Documento8 páginasSteel Industry Update #266Michael LockerAinda não há avaliações

- Steel Industry Update #263Documento10 páginasSteel Industry Update #263Michael LockerAinda não há avaliações

- Locker RPA Transcript 6-9-11Documento2 páginasLocker RPA Transcript 6-9-11Michael LockerAinda não há avaliações

- Steel Industry Update #264Documento10 páginasSteel Industry Update #264Michael LockerAinda não há avaliações

- Steel Industry Update #261Documento8 páginasSteel Industry Update #261Michael LockerAinda não há avaliações

- Steel Industry Update #262Documento7 páginasSteel Industry Update #262Michael LockerAinda não há avaliações

- Steel Industry Update #257Documento8 páginasSteel Industry Update #257Michael LockerAinda não há avaliações

- Steel Industry Update #258Documento8 páginasSteel Industry Update #258Michael LockerAinda não há avaliações

- Steel Industry Update #260Documento6 páginasSteel Industry Update #260Michael LockerAinda não há avaliações

- Steel Industry Update #259Documento10 páginasSteel Industry Update #259Michael LockerAinda não há avaliações

- Steel Industry Update #256Documento11 páginasSteel Industry Update #256Michael LockerAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5783)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Regional District Sales Manager in Charlotte NC Resume Teresa McDonaldDocumento3 páginasRegional District Sales Manager in Charlotte NC Resume Teresa McDonaldTeresaMcDonaldAinda não há avaliações

- Chap 21-2Documento8 páginasChap 21-2JackAinda não há avaliações

- Qatar Online Business DirectoryDocumento13 páginasQatar Online Business DirectoryTed LiptakAinda não há avaliações

- Bertelsmann 2017 05 EngDocumento68 páginasBertelsmann 2017 05 EngChess PadawanAinda não há avaliações

- MM10 Service EntryDocumento44 páginasMM10 Service Entryina23ajAinda não há avaliações

- Process Design AssignmentDocumento2 páginasProcess Design Assignmentcarlme012132100% (5)

- IBM Oil - Cognos Performance Blueprint Offers Solutions For UpstreamDocumento7 páginasIBM Oil - Cognos Performance Blueprint Offers Solutions For UpstreamIBM Chemical and PetroleumAinda não há avaliações

- OD125549891478426000Documento1 páginaOD125549891478426000अमित कुमारAinda não há avaliações

- Editorial Board - 2022 - Industrial Marketing ManagementDocumento1 páginaEditorial Board - 2022 - Industrial Marketing ManagementMisael Diaz HernandezAinda não há avaliações

- JetBlue Case Study SolutionDocumento3 páginasJetBlue Case Study SolutionNithin Joji Sankoorikkal100% (1)

- Swot Analysis On Yes BankDocumento19 páginasSwot Analysis On Yes Bankrutika2611Ainda não há avaliações

- HR Practices of Marks and Spencer Selfri PDFDocumento46 páginasHR Practices of Marks and Spencer Selfri PDFbalach100% (1)

- 10 Steps To Implement A Disaster Recovery Plan - QTS White PaperDocumento14 páginas10 Steps To Implement A Disaster Recovery Plan - QTS White PaperShiva PrasadAinda não há avaliações

- Part 3 4 SPECS CONTRACTSDocumento45 páginasPart 3 4 SPECS CONTRACTSKristin ArgosinoAinda não há avaliações

- My Peace Plan FormDocumento2 páginasMy Peace Plan FormStephen PhiriAinda não há avaliações

- The Law On Sales, Agency and Credit Transactions Sales Summary ReportDocumento4 páginasThe Law On Sales, Agency and Credit Transactions Sales Summary ReportchiwaAinda não há avaliações

- Aditya Birla MoreDocumento11 páginasAditya Birla Morearunabh3245Ainda não há avaliações

- Thesis Main - Nishanth VadduriDocumento56 páginasThesis Main - Nishanth VaddurinishanthnaiduAinda não há avaliações

- Liste de Pièces de RechangeDocumento3 páginasListe de Pièces de RechangeGERALD SIMONAinda não há avaliações

- AMEREX Stainless Steel ShapesDocumento9 páginasAMEREX Stainless Steel ShapesCharlie HAinda não há avaliações

- FMDocumento386 páginasFMArpan PatelAinda não há avaliações

- Deed of Absolute Sale - Golden Rod, Inc. (Mandarin)Documento7 páginasDeed of Absolute Sale - Golden Rod, Inc. (Mandarin)Antonio Timothy FernandezAinda não há avaliações

- Key Performance Indicators MST NDocumento14 páginasKey Performance Indicators MST NmscarreraAinda não há avaliações

- Unit IDocumento32 páginasUnit Ithebrahyz0% (1)

- Midterm PtaskDocumento4 páginasMidterm PtaskJanine CalditoAinda não há avaliações

- Value Stream MappingDocumento35 páginasValue Stream MappingNevets NonnacAinda não há avaliações

- Project Procurement Management: Shwetang Panchal Sigma Institute of Management StudiesDocumento30 páginasProject Procurement Management: Shwetang Panchal Sigma Institute of Management StudiesShwetang Panchal100% (3)

- Balance Sheet - Tata Motors Annual Report 2015-16 PDFDocumento2 páginasBalance Sheet - Tata Motors Annual Report 2015-16 PDFbijoy majumderAinda não há avaliações

- Paediatric Consumer Health in The Philippines PDFDocumento4 páginasPaediatric Consumer Health in The Philippines PDFMae SampangAinda não há avaliações

- 05 ERP Scope of WorkDocumento14 páginas05 ERP Scope of WorkDr. Syed Masrur67% (3)