Escolar Documentos

Profissional Documentos

Cultura Documentos

Foreign Assets Held Outside India

Enviado por

mohitvishal34Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Foreign Assets Held Outside India

Enviado por

mohitvishal34Direitos autorais:

Formatos disponíveis

Foreign Assets held outside India

If any individual has assets located outside India (foreign assets), such individuals are required to file a tax return to report such foreign assets irrespective of the income of the assessee.

Applicability

Individual or HUF Resident and Ordinarily Resident.

Points to be noted

Section 139(1) is amended by Finance Bill 2012, which states the following points: o If the Individual or HUF ROR has foreign assets, filing of tax return is mandatory even if the resident does not have any taxable income. o Return has to be filed electronically even if the taxable income does not cross 10 Lakhs New ITR forms (ITR-2, ITR-3 and ITR-4) have been notified by government for F.Y.201112. In these forms Schedule FA has been inserted. The information is required to be reported in INR.

Foreign Assets

Foreign Bank Accounts; or Financial Interest In any Entity outside India; or Immovable Property outside India; or Any other Asset outside India; or Details of account(s) in which the assessee has signing authority

Clarity on Foreign Assets

The ITR form requires details of 'Financial Interest'/'any other asset' located outside India without defining what would be considered to be a 'Financial Interest' or an 'asset' o Which would mean that all assets held outside India, such as motor car, jewellery, etc., would be required to be reported The word used in the Finance Bill 2012 any asset is wide enough to cover all assets held by an individual outside India

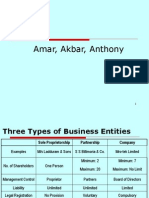

Types of Entity

Types of Entity in US

Types of Entity in US

Corporations S Corporation C Corporation

Taxed in the hands of Shareholders in proportion of their Shareholding Taxed separately from its owners

Non Corporation LLC LLP LP

Professional Corporations

LLLP PLLC General Partnership Sole Proprietorship

Corporations (Corp Inc.,)

o S Corporation: S corporations do not pay any federal income taxes. Instead, the corporation's income or losses are divided among and passed through to its shareholders. The shareholders must then report the income or loss on their own individual income tax returns. Cannot have more than 100 Shareholders C Corporation: C corporation refers to any corporation that, under United States income tax law, is taxed separately from its owners Professional Corporations (PC) : Are those corporate entities for which many corporation statutes make special provision, regulating the use of the corporate form by licensed professionals such as attorneys, architects, accountants, and doctors Limited Liability Companies (LLC) LLP: Same as Indian LLP Limited Partnership (LP) : a partnership where at least one partner has unlimited liability and one or more partners have limited liability Limited Liability Limited Partnership (LLLP): a combination of LP and LLP 2

o o

Non Corporations:

o o o o

o o o

Professional Limited Liability Company (PLLC): States which do not allow professionals to form LLC instead allows forming PLLC. Same as that of LLC General Partnership Sole Proprietorship

Types of entity in United Kingdom (UK):

o Company Private Company Limited by Shares Limited by Guarantee Public Company Unlimited company Non Companies General Partnership LLP (Limited Liability Partnership) LP (Limited Partnership) Sole proprietorship

Types of entity in Singapore:

o o o o Company LLP General Partnership Sole Proprietorship

Examples of Any other assets outside India

Current Assets such as cash and cash equivalents, Investments in foreign markets such as American depository receipts, U.S. Traded Foreign stocks, etc., Jewellery, Diamonds etc., Intangible Assets such as Patents, copyrights, franchises, trademarks etc.,

Conclusion

An Individual or HUF ROR is required to disclose all his foreign assets (as mentioned above), if any while filing the return of income in Schedule FA

Você também pode gostar

- International Taxation In Nepal Tips To Foreign InvestorsNo EverandInternational Taxation In Nepal Tips To Foreign InvestorsAinda não há avaliações

- UAE Company LawDocumento28 páginasUAE Company LawAgastya ChauhanAinda não há avaliações

- FATCA Declaration HUFDocumento7 páginasFATCA Declaration HUFDrAjay SinghAinda não há avaliações

- Limited Liability Partnership in India: 1.0 OverviewDocumento5 páginasLimited Liability Partnership in India: 1.0 OverviewShivam AgarwalAinda não há avaliações

- Business Owners Guide1Documento34 páginasBusiness Owners Guide1Shailendra KelaniAinda não há avaliações

- Choice of ITRDocumento7 páginasChoice of ITRravirockz128Ainda não há avaliações

- Kinds of CompaniesDocumento30 páginasKinds of Companiesahirvar.govindAinda não há avaliações

- Limited Company: TypesDocumento5 páginasLimited Company: TypesAndrew CharlesAinda não há avaliações

- FATCA Self-Certification For Legal Entity Clients: Supporting Document For Plausibility Checks (V1.1)Documento8 páginasFATCA Self-Certification For Legal Entity Clients: Supporting Document For Plausibility Checks (V1.1)DhavalAinda não há avaliações

- Reits: Overview: Micah W. Bloomfield and Mayer Greenberg, Stroock & Stroock & Lavan LLPDocumento10 páginasReits: Overview: Micah W. Bloomfield and Mayer Greenberg, Stroock & Stroock & Lavan LLPoleetcoAinda não há avaliações

- The Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015Documento43 páginasThe Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015Anup VermaAinda não há avaliações

- Deductions and E-Filing ITR For Partnership BusinessDocumento20 páginasDeductions and E-Filing ITR For Partnership BusinessAyushi BhallaAinda não há avaliações

- Company LawDocumento26 páginasCompany LawAlways OPAinda não há avaliações

- Tax AssignmentDocumento14 páginasTax Assignmentrushi sreedhar100% (1)

- Types of Business Entities in IndiaDocumento13 páginasTypes of Business Entities in IndiaDipali MahalleAinda não há avaliações

- Draft Tax Advice SarensDocumento26 páginasDraft Tax Advice SarensDavid FraileAinda não há avaliações

- Doing Business in Australia - Feb 2012Documento4 páginasDoing Business in Australia - Feb 2012woeifhAinda não há avaliações

- Establishing A Business in IndiaDocumento45 páginasEstablishing A Business in IndiaAryaman SharmaAinda não há avaliações

- Kinds of CompaniesDocumento25 páginasKinds of CompaniesTera KalAinda não há avaliações

- Limited Liability Partnership: Anjum TanwarDocumento14 páginasLimited Liability Partnership: Anjum TanwarKartik GambhirAinda não há avaliações

- Limited Liability PartnershipDocumento6 páginasLimited Liability PartnershipRana Gurtej100% (1)

- Wepik Exploring The Legal Framework A Comprehensive Analysis of The Limited Liability Partnership Act 20 20231109181347AjHPDocumento23 páginasWepik Exploring The Legal Framework A Comprehensive Analysis of The Limited Liability Partnership Act 20 20231109181347AjHPaaddyy290Ainda não há avaliações

- Income Tax PPT Revised 130617182402 Phpapp01Documento184 páginasIncome Tax PPT Revised 130617182402 Phpapp01Vishal Singh JaswalAinda não há avaliações

- Company Registration in CambodiaDocumento5 páginasCompany Registration in CambodiatangbunnaAinda não há avaliações

- Forms of Business EntityDocumento20 páginasForms of Business EntityMain Daiictian HuAinda não há avaliações

- Edited FABM2 Q2 MOD3 Income and Business TaxationDocumento17 páginasEdited FABM2 Q2 MOD3 Income and Business Taxationleslie sabateAinda não há avaliações

- Virginia Business GuideDocumento82 páginasVirginia Business GuidesshelkeAinda não há avaliações

- Doing Business in The PhilippinesDocumento10 páginasDoing Business in The Philippinesgilberthufana446877Ainda não há avaliações

- FATCA Declaration Non Individuals Retail FinalDocumento7 páginasFATCA Declaration Non Individuals Retail FinalMOHAN SAinda não há avaliações

- Sole Proprietorship vs. One Person CorporationDocumento10 páginasSole Proprietorship vs. One Person CorporationRecobdAinda não há avaliações

- Company Act 1956Documento24 páginasCompany Act 1956Tanmay SaxenaAinda não há avaliações

- Foreign Direct InvestmentDocumento27 páginasForeign Direct InvestmentAbhishek ChordiaAinda não há avaliações

- Research Incorporation of A Foreign CorporationDocumento4 páginasResearch Incorporation of A Foreign CorporationJoyce Hidalgo PreciaAinda não há avaliações

- Types of ITR Forms For FY 2022-23 (AY 2023-24)Documento21 páginasTypes of ITR Forms For FY 2022-23 (AY 2023-24)DRK FrOsTeRAinda não há avaliações

- Export Procedure M COM IMDocumento34 páginasExport Procedure M COM IMVivek SinghAinda não há avaliações

- Foreign Exchange Management Act - 2Documento48 páginasForeign Exchange Management Act - 2Vaibhav VermaAinda não há avaliações

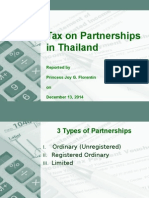

- Taxation of Partnerships in ThailandDocumento23 páginasTaxation of Partnerships in Thailandpriginflo26Ainda não há avaliações

- Corporation: Basic Concepts in Establishing OneDocumento26 páginasCorporation: Basic Concepts in Establishing OnearctikmarkAinda não há avaliações

- Important FDI Compliance Under FEMA - EbizfilingDocumento3 páginasImportant FDI Compliance Under FEMA - EbizfilingSoumik ChatterjeeAinda não há avaliações

- Kinds of Income TaxpayersDocumento20 páginasKinds of Income TaxpayersWalter FernandezAinda não há avaliações

- Export DocumentationDocumento44 páginasExport DocumentationKomal Singh100% (2)

- Overseas Company Incorporation: Adv. (CS) Ameya Munagekar, CPA (USA)Documento32 páginasOverseas Company Incorporation: Adv. (CS) Ameya Munagekar, CPA (USA)Ravi Sankar ELTAinda não há avaliações

- Direct Tax Code: Ms. Ankita AgrawalDocumento16 páginasDirect Tax Code: Ms. Ankita AgrawalPooja SwamyAinda não há avaliações

- Types of Business in The PhilippinesDocumento6 páginasTypes of Business in The PhilippinesBelle JizAinda não há avaliações

- Doing Business in IndiaDocumento43 páginasDoing Business in IndiaSamrat JonejaAinda não há avaliações

- Income TaxationDocumento27 páginasIncome TaxationAries Gonzales CaraganAinda não há avaliações

- Business Tax Guide PDFDocumento66 páginasBusiness Tax Guide PDFSpamblocker1Ainda não há avaliações

- Tax Planning - Intro NotesDocumento7 páginasTax Planning - Intro NotesBest How To StudioAinda não há avaliações

- Changes in New Schedule VI: Sr. No. Particulars Old Schedule Vi Revised Schedule ViDocumento3 páginasChanges in New Schedule VI: Sr. No. Particulars Old Schedule Vi Revised Schedule ViSanoj Kumar YadavAinda não há avaliações

- Limited Liability Partnership - Wikipedia PDFDocumento51 páginasLimited Liability Partnership - Wikipedia PDFNAVAMY MRAinda não há avaliações

- Various Income Taxes & Income Tax Returns Forms: Group 3 Ortega Angel Duterte Dela Cruz Argonsola Marquez AgustinDocumento26 páginasVarious Income Taxes & Income Tax Returns Forms: Group 3 Ortega Angel Duterte Dela Cruz Argonsola Marquez AgustinTophe ProvidoAinda não há avaliações

- Limited Liability Partnership: Business LawDocumento24 páginasLimited Liability Partnership: Business LawMahbubul Islam KoushickAinda não há avaliações

- Limited Liability Partnership Act, 2008: Concept of LLPDocumento3 páginasLimited Liability Partnership Act, 2008: Concept of LLPridhi soodAinda não há avaliações

- Fatca-Crs - Icici BankDocumento8 páginasFatca-Crs - Icici BankSankaram KasturiAinda não há avaliações

- Doing Business in Tanzania, Questions and AnswersDocumento26 páginasDoing Business in Tanzania, Questions and Answersimran hameerAinda não há avaliações

- VAT1-Notes EnglishDocumento16 páginasVAT1-Notes EnglishHadi GhamarzadehAinda não há avaliações

- TaxDocumento28 páginasTaxMeenakshi SwaminathanAinda não há avaliações

- FM Index Reaction Time 2016Documento8 páginasFM Index Reaction Time 2016mohitvishal34Ainda não há avaliações

- The Passion Formula PDFDocumento18 páginasThe Passion Formula PDFmohitvishal34Ainda não há avaliações

- Transfer Pricing AnalystDocumento2 páginasTransfer Pricing Analystmohitvishal34Ainda não há avaliações

- How Is Net Neutrality Working For The Countries That Have ItDocumento5 páginasHow Is Net Neutrality Working For The Countries That Have Itmohitvishal34Ainda não há avaliações

- Handbook To WSS Final PDFDocumento38 páginasHandbook To WSS Final PDFmohitvishal34Ainda não há avaliações

- Statistical System 23nov09 FinalDocumento314 páginasStatistical System 23nov09 Finalmohitvishal34Ainda não há avaliações

- Doing Business in DubaiDocumento23 páginasDoing Business in DubaiAmira MohamedAinda não há avaliações

- GWCDN RosewayDocumento3 páginasGWCDN Rosewayapi-26372760Ainda não há avaliações

- E. Limited PartnershipDocumento14 páginasE. Limited PartnershipClyde TanAinda não há avaliações

- Illustrative Financial Statements: Private Equity & Venture CapitalDocumento36 páginasIllustrative Financial Statements: Private Equity & Venture CapitalCreative MarqetingAinda não há avaliações

- Appendix 1: Sample Limited Partnership AgreementDocumento70 páginasAppendix 1: Sample Limited Partnership AgreementectrimbleAinda não há avaliações

- State Bank of India Project FinancingDocumento87 páginasState Bank of India Project Financingrangudasar83% (12)

- Partnership 2Documento74 páginasPartnership 2kakaoAinda não há avaliações

- DKT 1 - 2019.06.06 - ComplaintDocumento137 páginasDKT 1 - 2019.06.06 - ComplaintAristegui NoticiasAinda não há avaliações

- Partnership in Commendam AnalysisDocumento2 páginasPartnership in Commendam AnalysisNana Mireku-BoatengAinda não há avaliações

- BogaziciDocumento106 páginasBogazicimanishjethva2009Ainda não há avaliações

- Counterclaim 1Documento57 páginasCounterclaim 1RAINBOW AVALANCHEAinda não há avaliações

- ABM 1 EVALUATION WEEK 4 and 5Documento4 páginasABM 1 EVALUATION WEEK 4 and 5Christel Fermia RosimoAinda não há avaliações

- PARTNERSHIP AGREEMENT Located in The State of TennesseeDocumento12 páginasPARTNERSHIP AGREEMENT Located in The State of TennesseenowayAinda não há avaliações

- Business Economics II: (C) UPESDocumento430 páginasBusiness Economics II: (C) UPESAditya SharmaAinda não há avaliações

- RJCNortheasDocumento2 páginasRJCNortheastrentonianAinda não há avaliações

- $100 Million Defamation Suit Filed Against Bloomberg L.P., Reporter Matt Robinson and Editor Jesse WestbrookDocumento42 páginas$100 Million Defamation Suit Filed Against Bloomberg L.P., Reporter Matt Robinson and Editor Jesse WestbrookamvonaAinda não há avaliações

- ObligationsDocumento57 páginasObligationsFordan AntolinoAinda não há avaliações

- Instructions: Use and Edit This File To Answer The Second Part of Your Final Examination Submit TheDocumento4 páginasInstructions: Use and Edit This File To Answer The Second Part of Your Final Examination Submit TheDia Mae Ablao GenerosoAinda não há avaliações

- CH 15Documento59 páginasCH 15Sherine Lois QuiambaoAinda não há avaliações

- PartnershipDocumento49 páginasPartnershipJulius MilaAinda não há avaliações

- EntrepreneurDocumento84 páginasEntrepreneurMark John Paul CablingAinda não há avaliações

- Business Law A2 Mai Huong (Recovered)Documento6 páginasBusiness Law A2 Mai Huong (Recovered)Mai HươngAinda não há avaliações

- Partnership and Trust Bar QuestionsDocumento10 páginasPartnership and Trust Bar QuestionsIrish Ann BaulaAinda não há avaliações

- Thesis Water Station (11-08-20)Documento31 páginasThesis Water Station (11-08-20)sunshine apura100% (1)

- CIV2 Tip SheetDocumento23 páginasCIV2 Tip Sheetdenbar15Ainda não há avaliações

- LBO BMC Course Manual - 5c34e57d43e95 PDFDocumento135 páginasLBO BMC Course Manual - 5c34e57d43e95 PDFSiddharth JaswalAinda não há avaliações

- Aaron Greenspan LawsuitDocumento146 páginasAaron Greenspan Lawsuitrobinwauters100% (2)

- 4&5 AssignmentDocumento18 páginas4&5 AssignmentQaulan Tsaqila100% (2)

- AIP Client ListDocumento139 páginasAIP Client ListSaurabh ChauhanAinda não há avaliações

- D&A: 08102020 Form D Staple Street Capital Notice of Exempt Offering SEC ReportDocumento10 páginasD&A: 08102020 Form D Staple Street Capital Notice of Exempt Offering SEC ReportD&A Investigations, Inc.Ainda não há avaliações