Escolar Documentos

Profissional Documentos

Cultura Documentos

Types of Shares

Enviado por

MARDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Types of Shares

Enviado por

MARDireitos autorais:

Formatos disponíveis

Types of shares A company may have many different types of shares that come with different conditions and

rights. There are four main types of shares:

Ordinary shares are standard shares with no special rights or restrictions. They have the potential to give the highest financial gains, but also have the highest risk. Ordinary shareholders are the last to be paid if the company is wound up. Preference shares typically carry a right that gives the holder preferential treatment when annual dividends are distributed to shareholders. Shares in this category receive a fixed dividend, which means that a shareholder would not benefit from an increase in the business' profits. However, usually they have rights to their dividend ahead of ordinary shareholders if the business is in trouble. Also, where a business is wound up, they are likely to be repaid the par or nominal value of shares ahead of ordinary shareholders. Cumulative preference shares give holders the right that, if a dividend cannot be paid one year, it will be carried forward to successive years. Dividends on cumulative preference shares must be paid, despite the earning levels of the business, provided the company has distributable profits. Redeemable shares come with an agreement that the company can buy them back at a future date - this can be at a fixed date or at the choice of the business. A company cannot issue only redeemable shares.

What is a Debenture? A Debenture is a debt security issued by a company (called the Issuer), which offers to pay interest in lieu of the money borrowed for a certain period. In essence it represents a loan taken by the issuer who pays an agreed rate of interest during the lifetime of the instrument and repays the principal normally, unless otherwise agreed, on maturity. These are long-term debt instruments issued by private sector companies. These are issued in denominations as low as Rs 1000 and have maturities ranging between one and ten years. Long maturity debentures are rarely issued, as investors are not comfortable with such maturities Debentures enable investors to reap the dual benefits of adequate security and good returns. Unlike other fixed income instruments such as Fixed Deposits, Bank Deposits they can be transferred from one party to another by using transfer from. Debentures are normally issued in physical form. However, corporates/PSUs have started issuing debentures in Demat form. Generally, debentures are less liquid as compared to PSU bonds and their liquidity is inversely proportional to the residual maturity. Debentures can be secured or unsecured. What are the different types of debentures? Debentures are divided into different categories on the basis of: (1)convertibility of the instrument (2) Security Debentures can be classified on the basis of convertibility into: Non Convertible Debentures (NCD): These instruments retain the debt character and can not be converted in to equity shares Partly Convertible Debentures (PCD): A part of these instruments are converted into Equity

shares in the future at notice of the issuer. The issuer decides the ratio for conversion. This is normally decided at the time of subscription. Fully convertible Debentures (FCD): These are fully convertible into Equity shares at the issuer's notice. The ratio of conversion is decided by the issuer. Upon conversion the investors enjoy the same status as ordinary shareholders of the company. Optionally Convertible Debentures (OCD): The investor has the option to either convert these debentures into shares at price decided by the issuer/agreed upon at the time of issue. On basis of Security, debentures are classified into: Secured Debentures: These instruments are secured by a charge on the fixed assets of the issuer company. So if the issuer fails on payment of either the principal or interest amount, his assets can be sold to repay the liability to the investors Unsecured Debentures: These instrument are unsecured in the sense that if the issuer defaults on payment of the interest or principal amount, the investor has to be along with other unsecured creditors of the company.

Definition of 'Stock Option' A privilege, sold by one party to another, that gives the buyer the right, but not the obligation, to buy (call) or sell (put) a stock at an agreed-upon price within a certain period or on a specific date. In the U.K., it is known as a "share option".

Convertible note A convertible note is a debt security that can be converted into equity, or shares of stock, at the noteholder's discretion or upon the occurrence of certain events. As a debt security, the notes pay regular interest and have a fixed maturity date. Convertible notes are a type of convertible bond. Notes are most often shorter term debt instruments with maturities of five years or less, and bonds will have maturities of 10 years or more.

Definition of 'Convertible Preferred Stock' Preferred stock that includes an option for the holder to convert the preferred shares into a fixed number of common shares, usually anytime after a predetermined date. Also known as "convertible preferred shares".

Definition of 'Warrant' A derivative security that gives the holder the right to purchase securities (usually equity) from the issuer at a specific price within a certain time frame. Warrants are often included in a new debt issue as a "sweetener" to entice investors.

Definition of 'Rights' A security giving stockholders entitlement to purchase new shares issued by the corporation at a predetermined price (normally less than the current market price) in proportion to the number of shares already owned. Rights are issued only for a short period of time, after which they expire. A rights issue is an invitation to existing shareholders to purchase additional new shares in the company. More specifically, this type of issue gives existing shareholders securities called "rights," which give the shareholders the right to purchase new shares at a discount to the market price on a stated future date. Essentially, the company is giving shareholders a chance to increase their exposure to the stock at a discount price. Until the date at which the new shares can be purchased, shareholders may trade the rights on the market the same way they would trade ordinary shares. The rights issued to a shareholder have a value, thus compensating current shareholders for the future dilution of their existing shares' value.

When a company sells its stock to an investor, a stock subscription agreement must be prepared. If the offering is considered "public" rather than "private" under U.S. securities law, burdensome reporting requirements apply. A good private subscription agreement defines the relationship between the company and the investor and establishes that the offering qualifies as a private placement rather than a public offering.

Stock Purchase

A subscription agreement is essentially a promise by the company to sell a given number of shares to a particular investor at a certain price, and an agreement by the investor to pay that price. Since shares of stock are abstract entities, they are represented by share certificates issued by the company. Most subscription agreements allow the company to cancel the sale and refuse to issue the share certificates even after the subscription agreement is signed under certain conditions (such as misrepresentation by the investor).

A rights issue is an issue of additional shares by a company to raise capital under a seasoned equity offering. The rights issue is a special form of shelf offering or shelf registration. With the issued rights, existing shareholders have the privilege to buy a specified number of new shares from the firm at a specified price within a specified time.[1] A rights issue is in contrast to an

initial public offering, where shares are issued to the general public through market exchanges. Closed-end companies cannot retain earnings, because they distribute essentially all of their realized income, and capital gains each year. [2] They raise additional capital by rights offerings. Companies usually opt for a rights issue either when having problems raising capital through traditional means or to avoid interest charges on loans.[3] What is a rights issue? A rights issue is an issue of new shares for cash to existing shareholders in proportion to their existing holdings. A rights issue is, therefore, a way of raising new cash from shareholders - this is an important source of new equity funding for publicly quoted companies. Why issue shares to existing shareholders? Legally a rights issue must be made before a new issue to the public. This is because existing shareholders have the right of first refusal (otherwise known as a preemption right) on the new shares. By taking these preemption rights up, existing shareholders can maintain their existing percentage holding in the company. However, shareholders can, and often do, waive these rights, by selling them to others. Shareholders can also vote to rescind their preemption rights. Definition of 'Dividend Reinvestment Plan - DRIP' A plan offered by a corporation that allows investors to reinvest their cash dividends by purchasing additional shares or fractional shares on the dividend payment date.

Company options

Right to take up certain securities on specified terms within or at a specified time. Company options are issued by companies for the purpose of raising funds. They give shareholders an opportunity to buy new shares at a fixed price on or before a predetermined date. This gives the company the ability to raise funds for future projects. The exercise of company issued options results in an increase in the company's capital. The terms and conditions are determined solely by the company. All company options are call options. Exchange traded options (ETOs) are traded over existing shares. Their exercise results in a transfer of ownership of the underlying shares, and not in an increase in the company's capital. The company is not a party to the contracts traded.

Você também pode gostar

- New Financial InstrumentsDocumento9 páginasNew Financial Instrumentsmanisha guptaAinda não há avaliações

- Bond InvestmentDocumento8 páginasBond InvestmentMingmiin TeohAinda não há avaliações

- PWC Mutual Fund Regulatory Services Brochure PDFDocumento31 páginasPWC Mutual Fund Regulatory Services Brochure PDFramaraajunAinda não há avaliações

- A Guide To Mutual Fund Investing: Helping You Reach Your Financial GoalsDocumento8 páginasA Guide To Mutual Fund Investing: Helping You Reach Your Financial GoalsSAURABHAinda não há avaliações

- Total Common Dividend Numbers of Shares (Common) Dividend Per Share Market ValueDocumento4 páginasTotal Common Dividend Numbers of Shares (Common) Dividend Per Share Market ValueKeziah AliwanagAinda não há avaliações

- Warrants and Convertible SecuritiesDocumento2 páginasWarrants and Convertible Securitiesalbert.lumadedeAinda não há avaliações

- Maricris G. Alagar BA-101 Finance IIDocumento5 páginasMaricris G. Alagar BA-101 Finance IIMharykhriz AlagarAinda não há avaliações

- Series Seed Term Sheet (v2)Documento2 páginasSeries Seed Term Sheet (v2)zazenAinda não há avaliações

- Securities Macro OutlineSpring 2006-PreviewDocumento21 páginasSecurities Macro OutlineSpring 2006-PreviewMonica LewisAinda não há avaliações

- Contingent Value Rights (CVRS) : Igor Kirman and Victor Goldfeld, Wachtell, Lipton, Rosen & KatzDocumento12 páginasContingent Value Rights (CVRS) : Igor Kirman and Victor Goldfeld, Wachtell, Lipton, Rosen & KatzTara SinhaAinda não há avaliações

- Investment and Portfolio ManageemntDocumento2 páginasInvestment and Portfolio Manageemntumair aliAinda não há avaliações

- Spartina Convertible Note MemoDocumento6 páginasSpartina Convertible Note MemospartinaAinda não há avaliações

- Scribd NotesDocumento14 páginasScribd NotesLeeAnn MarieAinda não há avaliações

- Valuation of SecuritiesDocumento18 páginasValuation of Securitiessam989898Ainda não há avaliações

- Glossary On Mutual FundsDocumento17 páginasGlossary On Mutual FundsBabasab Patil (Karrisatte)Ainda não há avaliações

- Glossary of Financial TermsDocumento17 páginasGlossary of Financial Termsandfg_05Ainda não há avaliações

- Secondary MarketDocumento27 páginasSecondary MarketAmit BharwadAinda não há avaliações

- General Principles of Insurance ContractDocumento46 páginasGeneral Principles of Insurance ContractKammanai PhothongAinda não há avaliações

- Lecture 2 Financial System and InstrumentsDocumento44 páginasLecture 2 Financial System and InstrumentsLuisLoAinda não há avaliações

- Fiduciary Handbook for Understanding and Selecting Target Date Funds: It's All About the BeneficiariesNo EverandFiduciary Handbook for Understanding and Selecting Target Date Funds: It's All About the BeneficiariesAinda não há avaliações

- Finance - Chapter-03-Risk in FinanceDocumento25 páginasFinance - Chapter-03-Risk in FinanceMehedi HassanAinda não há avaliações

- Securities Law-An Introduction and OverviewDocumento6 páginasSecurities Law-An Introduction and Overviewmuneebmateen01Ainda não há avaliações

- Stock Market TerminologiesDocumento19 páginasStock Market TerminologiesAfshan GulAinda não há avaliações

- Types of CDOsDocumento9 páginasTypes of CDOsKeval ShahAinda não há avaliações

- Warrant N ConvertibleDocumento18 páginasWarrant N ConvertibleJhabindra PokharelAinda não há avaliações

- Corporate Finance CheatsheetDocumento4 páginasCorporate Finance CheatsheetAbhisek PandaAinda não há avaliações

- SREI Infrastructure Bond Application FormDocumento8 páginasSREI Infrastructure Bond Application FormPrajna CapitalAinda não há avaliações

- Los: 40 Portfolio Management: An Overview: A Portfolio Perspective On InvestingDocumento2 páginasLos: 40 Portfolio Management: An Overview: A Portfolio Perspective On InvestingArpit MaheshwariAinda não há avaliações

- Comparing The Agreements For Landry'sDocumento80 páginasComparing The Agreements For Landry'sDealBookAinda não há avaliações

- Fin DomDocumento111 páginasFin DomRohit PanigrahiAinda não há avaliações

- Business Structure Comparison Chart: Document 1109ADocumento3 páginasBusiness Structure Comparison Chart: Document 1109ASameera Sri VidurangaAinda não há avaliações

- CMBS Pitchbook Ver 1 13112011Documento17 páginasCMBS Pitchbook Ver 1 13112011Rashdan IbrahimAinda não há avaliações

- Kyc Individual FormDocumento21 páginasKyc Individual FormNino NinosAinda não há avaliações

- Debt SecuritizationDocumento20 páginasDebt SecuritizationSandeep KulshresthaAinda não há avaliações

- 46370bosfinal p2 cp6 PDFDocumento85 páginas46370bosfinal p2 cp6 PDFgouri khanduallAinda não há avaliações

- 2871f Ratio AnalysisDocumento24 páginas2871f Ratio Analysisumar321Ainda não há avaliações

- TechStars Bridge Forms - Convertible Note1Documento5 páginasTechStars Bridge Forms - Convertible Note1joessAinda não há avaliações

- Confidential Disclosure AgreementDocumento4 páginasConfidential Disclosure Agreementstephen roloffAinda não há avaliações

- Mutual Fund TerminologyDocumento17 páginasMutual Fund TerminologySanadiip KumbharAinda não há avaliações

- Arbitrage PDFDocumento60 páginasArbitrage PDFdan4everAinda não há avaliações

- Investment Fund (Share Class)Documento272 páginasInvestment Fund (Share Class)bobjaseAinda não há avaliações

- Treasury Bills: Working Capital Management Assignment - 1Documento4 páginasTreasury Bills: Working Capital Management Assignment - 1Divya Gopakumar100% (1)

- Fire InsuranceDocumento18 páginasFire InsuranceMayurRawoolAinda não há avaliações

- Private Placement Due Diligence Request List ExampleDocumento16 páginasPrivate Placement Due Diligence Request List Examplecah2009a100% (1)

- What Is The Meaning of Share?: in Other WordsDocumento27 páginasWhat Is The Meaning of Share?: in Other WordsSIddharth CHoudhary0% (1)

- UAW Contract Summary With GMDocumento20 páginasUAW Contract Summary With GMWXYZ-TV Channel 7 Detroit100% (7)

- TRP Mutual Fund New Account FormDocumento3 páginasTRP Mutual Fund New Account Formambasyapare1Ainda não há avaliações

- Non Convertible DebenturesDocumento3 páginasNon Convertible DebenturesAbhinav AroraAinda não há avaliações

- Katten - ESOP Fact SheetDocumento8 páginasKatten - ESOP Fact SheetRichandCo100% (1)

- Glossary For Capital IQDocumento26 páginasGlossary For Capital IQHimanshu RanjanAinda não há avaliações

- Fixed Income Securities: IntroductionDocumento33 páginasFixed Income Securities: IntroductionYogaPratamaDosen100% (1)

- Confidential Private Placement Memorandum: (For Private Circulation Only)Documento48 páginasConfidential Private Placement Memorandum: (For Private Circulation Only)Pratim MajumderAinda não há avaliações

- Postmoney Safe - Valuation Cap Only v1.1 (Singapore)Documento7 páginasPostmoney Safe - Valuation Cap Only v1.1 (Singapore)Krishana RanaAinda não há avaliações

- Project FinanceDocumento9 páginasProject FinancebrierAinda não há avaliações

- Final Formula Sheet DraftDocumento5 páginasFinal Formula Sheet Draftsxzhou23Ainda não há avaliações

- Debt SecuritizationDocumento19 páginasDebt SecuritizationJames RossAinda não há avaliações

- Unit 1.17 - Capital Market InstrumentsDocumento30 páginasUnit 1.17 - Capital Market InstrumentsBhuviAinda não há avaliações

- Sabbir Hossain 111 161 350Documento37 páginasSabbir Hossain 111 161 350Sabbir HossainAinda não há avaliações

- Hybrid Financing ReportDocumento46 páginasHybrid Financing ReportChristian Acab Gracia100% (2)

- DebentureDocumento9 páginasDebenturedrsurendrakumarAinda não há avaliações

- Sec 04 Quality Control ProcessDocumento37 páginasSec 04 Quality Control Processapi-3699912Ainda não há avaliações

- Chap 5 Pcs Bm3303Documento40 páginasChap 5 Pcs Bm3303Kayula Carla ShulaAinda não há avaliações

- VJ2Documento4 páginasVJ2Thư TrầnAinda não há avaliações

- CV Miranda Fides AprilDocumento2 páginasCV Miranda Fides AprilEra DelloAinda não há avaliações

- Leasing Presentation Atrium MallDocumento31 páginasLeasing Presentation Atrium MallSahaj anandAinda não há avaliações

- Data Science Techniques For Predictive Modelling and Decision Making Full PaperDocumento4 páginasData Science Techniques For Predictive Modelling and Decision Making Full PaperSoniya DattiAinda não há avaliações

- Development Bank of The Philippines vs. AguirreDocumento2 páginasDevelopment Bank of The Philippines vs. AguirreBibi JumpolAinda não há avaliações

- Chapter 2Documento27 páginasChapter 2nabil hashimAinda não há avaliações

- PayslipDocumento1 páginaPayslipJames PuckeyAinda não há avaliações

- Bus 3910 Syllabus Winter 2021 EgyptDocumento4 páginasBus 3910 Syllabus Winter 2021 EgyptFareeda ShakerAinda não há avaliações

- Strategic Pricing - Value Based ApproachDocumento4 páginasStrategic Pricing - Value Based ApproachdainesecowboyAinda não há avaliações

- A Proposal To Optimise and Forecast ROM Fragmentation at Minas Chinalco PDFDocumento9 páginasA Proposal To Optimise and Forecast ROM Fragmentation at Minas Chinalco PDFEliseo Abdias Alcala CabelloAinda não há avaliações

- Meter Mimic - Menzies PDFDocumento4 páginasMeter Mimic - Menzies PDFaashrayenergyAinda não há avaliações

- PPGDocumento10 páginasPPGReyna Jane YuntingAinda não há avaliações

- Resume Nur Syaza 2021Documento2 páginasResume Nur Syaza 2021syazasuhaimyAinda não há avaliações

- Get MAD With Value Stream ManagementDocumento13 páginasGet MAD With Value Stream ManagementPradipAinda não há avaliações

- Zainab Abisola Tinubu Truthfinder ReportDocumento18 páginasZainab Abisola Tinubu Truthfinder ReportDavid Hundeyin100% (1)

- HBR Article - How To Sell Services More ProfitablyDocumento7 páginasHBR Article - How To Sell Services More ProfitablyNikhil GulviAinda não há avaliações

- Examining Global Price Disparities A Comparative Analysis of Relative Prices Across World MarketsDocumento12 páginasExamining Global Price Disparities A Comparative Analysis of Relative Prices Across World MarketsOnycha SyAinda não há avaliações

- OptiStruct For Linear Dynamics v13 Rev20141128 PDFDocumento103 páginasOptiStruct For Linear Dynamics v13 Rev20141128 PDFGonzalo Anzaldo50% (2)

- Indemnification Undertaking by StudentDocumento2 páginasIndemnification Undertaking by StudentSoumyadip Roychowdhury100% (2)

- Cup Loan Program PDFDocumento17 páginasCup Loan Program PDFJames David100% (1)

- Airtight Pipeline Reviews: The - Point Checklist ForDocumento3 páginasAirtight Pipeline Reviews: The - Point Checklist ForPete MajkowskiAinda não há avaliações

- Laldin 2008 Islamic Financial SystemDocumento22 páginasLaldin 2008 Islamic Financial SystemMuhammad Yahya SaifuddinAinda não há avaliações

- Strategic Transport Management Models-The Case Study of An Oil IndustryDocumento27 páginasStrategic Transport Management Models-The Case Study of An Oil IndustryputriAinda não há avaliações

- Payslip 2023030Documento1 páginaPayslip 2023030Sivaram PopuriAinda não há avaliações

- Business PlanDocumento24 páginasBusiness PlanMuhammad Arsalan Akram90% (10)

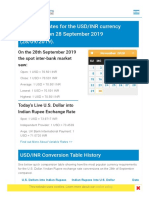

- U.S. Dollar To Indian Rupee Exchange Rate History - 28 September 2019 (28 - 09 - 2019) UsdDocumento6 páginasU.S. Dollar To Indian Rupee Exchange Rate History - 28 September 2019 (28 - 09 - 2019) UsdAnish KumarAinda não há avaliações

- Bonded Labour Report ChennaiDocumento11 páginasBonded Labour Report ChennairameshvadivelAinda não há avaliações

- Converted 1930640Documento13 páginasConverted 1930640Upasana RayAinda não há avaliações