Escolar Documentos

Profissional Documentos

Cultura Documentos

(BANKING LAWS) Classification of Banks

Enviado por

Zyril MarchanDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

(BANKING LAWS) Classification of Banks

Enviado por

Zyril MarchanDireitos autorais:

Formatos disponíveis

BANK CLASSIFICATION UNIVERSAL BANKS

GOVERNING LAW

BUSINESS NAME RULES

PURPOSE -

SCOPE/POWERS/AUTHORITY The powers of a commercial bank The powers of an investment house The power to invest in non-allied enterprises The general powers incident corporations All such powers as may be necessary to carry on business of commercial banking, such as: o Accepting drafts and issuing letters of credit; o Discounting and negotiating promissory notes, drafts, bills of exchange and other evidences of debt o Accepting or creating demand deposits o Receiving other types of deposits and deposit substitutes o Buying and selling foreign exchange and gold or silver bullion o Acquiring marketable bonds and other debt securities o Extending credit subject to such rules as the Monetary Board may promulgate Accept savings and time deposits Open current or checking accounts o Bank must has at least Php20M worth of net assets o Subject to the guidelines established by the Monetary Board Shall be allowed to clear its demand deposit operations with the BSP and the PCHC Acts as correspondent for other financial institutions Acts as collection agent for government entities subject to the guidelines set forth by the MB Acts as official depository of national agencies and municipal, city or provincial funds where the thrift bank is located subject to the guidelines set forth by the MB Rediscount paper with the PNB, Land Bank of the Philippines and the DBP Issue, buy and sell mortgage and chattel mortgage subject to the guidelines set forth by the MB Purchase, hold and convey real estate under the same conditions as those governing commercial banks Engage in quasi-banking and money market operations subject to the guidelines set forth by the MB

COMMERCIAL BANKS

Only a bank that is granted universal/commercial banking authority may represent itself to the public as such in connection with its business name

Republic Act No. 7906: Thrift Banks Act

THRIFT BANKS

Allowed to adopt and use any name With the following words affixed after its business name: A Thrift Bank, Savings Bank, A Private Development Bank or A Stock Savings and Loan Association

Accumulating the savings of depositors and investing them, together with capital loans secured by bonds, mortgages, and others and investing them in the furtherance of economic objectives Providing short-term working capital, medium- and long-term financing, to businesses engaged in agriculture, services, industry and housing Providing diversified financial and allied services for its chosen market and

1|R e e n F a b i a , S a n B e d a C o l l e g e o f L a w

BANK CLASSIFICATION

GOVERNING LAW

BUSINESS NAME RULES

PURPOSE constituencies specially for small and medium enterprises and individuals -

SCOPE/POWERS/AUTHORITY Open domestic letters of credit Extend credit facilities to private and government employees Extend credit against the security of jewelry, precious stones and articles of similar nature subject to the guidelines set forth by the MB Offer other banking services

Republic Act No. 7353: Rural Banks Act

RURAL BANKS

May adopt a corporate name or use a business name/style Required words: Rural or Coop, A Cooperative Bank or A Rural Bank Required size: at least one-half of the size of the business name Fine for unauthorized usage: Php50 per day -

To make needed credit available and readily accessible in the rural areas Meeting the normal credit needs of farmers, fishermen and farm families owning or cultivating land dedicated to agricultural production as well as the normal credit needs of cooperatives and merchants Organized by the majority of shares of which is owned and controlled by, cooperatives primarily to provide financial and credit services to cooperatives Membership of a cooperative bank shall include only cooperatives and federations of

Give preference to application of farmers and merchants in granting loans Where there are no government banks, rural banks may deposit in private banks more than the amount prescribed by the Single Borrowers Limit subject to Monetary Board obligations

COOPERATIVE BANKS

Republic Act No. 6938: Cooperative Code

To carry on banking and credit services for the cooperatives To receive financial aid or loans from the Government and the BSP for and in behalf of the cooperative banks and primary cooperatives and their federations engaged in businesses and supervise the lending and collection of loans To mobilize savings of its members for the benefit of the cooperative movement To act as a balancing medium for the surplus of funds of cooperatives and their federations To discount bills and promissory notes issued and drawn by cooperatives To issue negotiable instruments to facilitate the activities of cooperatives

2|R e e n F a b i a , S a n B e d a C o l l e g e o f L a w

BANK CLASSIFICATION

GOVERNING LAW

BUSINESS NAME RULES

PURPOSE cooperatives -

SCOPE/POWERS/AUTHORITY To issue debentures subject to the approval of and under conditions and guarantees to be prescribed by the Government To borrow money from banks and other financial institutions within the limits prescribed by the BSP To carry out all other functions as may be prescribed by the Cooperative Development Authority subject to prior approval by the BSP Authorized to operate an investment house pursuant to PD 129 and as a venture capital corporation pursuant to PD 1688 May have a direct interest as a shareholder, partner, owner or any other capacity in any commercial, industrial, agricultural, real estate or development project under mudarabah form of partnership or musharaka joint venture agreement or by decreasing participation, or otherwise invest under any of the various contemporary Islamic financing techniques or modes of investment for profit sharing May carry on commercial operations for the purpose of realizing its investment banking objectives by establishing enterprises or financing existing enterprises or otherwise by participating in any way with other companies May perform all business ventures and transactions as may be necessary to carry out the objectives of its charter within the framework of the Islamic banks financial capabilities and technical considerations provided that these shall not involve any riba or other activities prohibited by the Islamic Sharia principles

To promote and accelerate the socioeconomic development of the Autonomous Region by performing banking, financing and investment operations To establish and participate in agricultural, commercial and industrial ventures based on the Islamic concept of banking -

ISLAMIC BANKS

Republic Act No. 6848: Charter of Al Amanah Islamic Investment Bank of the Philippines

3|R e e n F a b i a , S a n B e d a C o l l e g e o f L a w

Você também pode gostar

- World Trade LawDocumento17 páginasWorld Trade LawLuisa Lopes100% (1)

- Samson v. GaborDocumento2 páginasSamson v. GaborMarkJobelleMantillaAinda não há avaliações

- What Is MortgageDocumento3 páginasWhat Is MortgagesandeepAinda não há avaliações

- AccessionDocumento3 páginasAccessionjuraiineAinda não há avaliações

- 2010copyright Laws and CasesDocumento75 páginas2010copyright Laws and Casesmajemafae100% (1)

- Cristobal Vs CA and Corona Vs United Harbor Pilots Assoc of The PhilsDocumento3 páginasCristobal Vs CA and Corona Vs United Harbor Pilots Assoc of The PhilsTriciaAinda não há avaliações

- Classification of BanksDocumento1 páginaClassification of BanksLemar B CondeAinda não há avaliações

- World Trade Organization (WTO)Documento18 páginasWorld Trade Organization (WTO)Waqas MazharAinda não há avaliações

- Classification of BanksDocumento12 páginasClassification of BanksTayyab SardarAinda não há avaliações

- Corporation Law Case DigestsDocumento9 páginasCorporation Law Case DigestsTeltel TagudandoAinda não há avaliações

- Labor Standards Course Outline 2017-2018Documento7 páginasLabor Standards Course Outline 2017-2018Rommel BellonesAinda não há avaliações

- Constitutional Law II Reviewer MidtermsDocumento443 páginasConstitutional Law II Reviewer MidtermsatenioncAinda não há avaliações

- 1 PresentationDocumento12 páginas1 PresentationNabajit GhoshalAinda não há avaliações

- Philippine National Bank v. AmoresDocumento6 páginasPhilippine National Bank v. AmoresRoemma Kara Galang PaloAinda não há avaliações

- Consti Chalc PC MidtermsDocumento42 páginasConsti Chalc PC MidtermsOshAinda não há avaliações

- AMLA With AmendmentsDocumento22 páginasAMLA With AmendmentsMak Francisco100% (1)

- Data Privacy ActDocumento9 páginasData Privacy Actkarla126Ainda não há avaliações

- Alternative Dispute ResolutionDocumento3 páginasAlternative Dispute ResolutionJannat TaqwaAinda não há avaliações

- 2018 Bar Examinations (POLITICAL LAW)Documento12 páginas2018 Bar Examinations (POLITICAL LAW)PrincessAinda não há avaliações

- Phil Rules of CourtDocumento244 páginasPhil Rules of Courtjinnee_jinx100% (1)

- Rep. vs. CA and Lastimado DigestDocumento2 páginasRep. vs. CA and Lastimado DigestXyrus BucaoAinda não há avaliações

- Insular Bank of Asia Vs IAC - G.R. No. 74834. November 17, 1988Documento8 páginasInsular Bank of Asia Vs IAC - G.R. No. 74834. November 17, 1988Ebbe DyAinda não há avaliações

- Baste 2010 Final Examination Questions - Tax 2Documento2 páginasBaste 2010 Final Examination Questions - Tax 2Judith AlisuagAinda não há avaliações

- Anti-Money Laundering Act of 2001 (AMLA), As Amended by RA 9194, RA 10167, RA 10365, RA 10927Documento70 páginasAnti-Money Laundering Act of 2001 (AMLA), As Amended by RA 9194, RA 10167, RA 10365, RA 10927Gayle Mendiola DoriaAinda não há avaliações

- 'Lecture 2 - MeaningDocumento11 páginas'Lecture 2 - MeaningRodney UlyateAinda não há avaliações

- 1f Nature and Effects of Obligations by DeleonDocumento17 páginas1f Nature and Effects of Obligations by DeleonFerry FrondaAinda não há avaliações

- A. Plumptre v. RiveraDocumento6 páginasA. Plumptre v. RiveraervingabralagbonAinda não há avaliações

- Ra 11232 RCCDocumento72 páginasRa 11232 RCCTugadiWayneAinda não há avaliações

- RULE 13 Two ColumnsDocumento17 páginasRULE 13 Two ColumnsAnonymous jUM6bMUuRAinda não há avaliações

- Commercial Law Reviewer 2012Documento427 páginasCommercial Law Reviewer 2012Eisley Sarzadilla-GarciaAinda não há avaliações

- Negotiable Instruments Act 1881Documento40 páginasNegotiable Instruments Act 1881Knt Nallasamy Gounder100% (1)

- Articles of PartnershipDocumento4 páginasArticles of PartnershipUSD 654Ainda não há avaliações

- Banking LawsDocumento72 páginasBanking LawsMariel MontonAinda não há avaliações

- Banking Laws Villanueva OCRDocumento20 páginasBanking Laws Villanueva OCRJohn Rey Bantay RodriguezAinda não há avaliações

- March 3 Case DigestDocumento39 páginasMarch 3 Case DigestJillian AsdalaAinda não há avaliações

- 8 - Ursal vs. Court of Appeals, 473 SCRA 52, G.R. No. 142411 October 14, 2005Documento18 páginas8 - Ursal vs. Court of Appeals, 473 SCRA 52, G.R. No. 142411 October 14, 2005gerlie22Ainda não há avaliações

- First Draft PracticabilityDocumento3 páginasFirst Draft PracticabilityNoreen CatapangAinda não há avaliações

- Onapal V CADocumento10 páginasOnapal V CAMp CasAinda não há avaliações

- Capital Market and ParticipantsDocumento21 páginasCapital Market and ParticipantsRahul RaghwaniAinda não há avaliações

- Zalamea Vs CA SCRADocumento6 páginasZalamea Vs CA SCRAlawboyAinda não há avaliações

- I. Fe Marie 1. Is Chapter IV of The CPR Applicable To All Lawyers? ExplainDocumento62 páginasI. Fe Marie 1. Is Chapter IV of The CPR Applicable To All Lawyers? ExplainPee-Jay Inigo UlitaAinda não há avaliações

- Art III - Bill of RightsDocumento13 páginasArt III - Bill of Rightstinababes7100% (1)

- Dr. Ram Manohar Lohiya National Law UniversityDocumento13 páginasDr. Ram Manohar Lohiya National Law UniversityAkankshaAinda não há avaliações

- Ethics DigestsDocumento49 páginasEthics DigestsIc San PedroAinda não há avaliações

- Buslaw 1 - SyllabusDocumento9 páginasBuslaw 1 - SyllabusStephanie Head AmbrosioAinda não há avaliações

- Digested Cases Legal EthicsDocumento7 páginasDigested Cases Legal EthicsCoyzz de GuzmanAinda não há avaliações

- Property Wednesday FinalDocumento9 páginasProperty Wednesday FinalNeon True BeldiaAinda não há avaliações

- Infringement CasesDocumento5 páginasInfringement CasesRonellie Marie TinajaAinda não há avaliações

- Metrobank V BA FinanceDocumento1 páginaMetrobank V BA FinanceRubyAinda não há avaliações

- Labor Standards Law PointersDocumento56 páginasLabor Standards Law PointersNoel GuzmanAinda não há avaliações

- Texaco Overseas Petroleum Company and California ADocumento49 páginasTexaco Overseas Petroleum Company and California ASyafiq Affandy100% (3)

- Oblicon Prelim ReviewerDocumento13 páginasOblicon Prelim ReviewerRafael VallejosAinda não há avaliações

- Constitutional Law I: Judicial Elaboration of The ConstitutionDocumento11 páginasConstitutional Law I: Judicial Elaboration of The ConstitutionGary EgayAinda não há avaliações

- Session 6 Cases CivproDocumento125 páginasSession 6 Cases CivproRitch LibonAinda não há avaliações

- Crawford Co. v. Hathaway - 67 Neb. 325Documento33 páginasCrawford Co. v. Hathaway - 67 Neb. 325Ash MangueraAinda não há avaliações

- Module Chapter 5 CSR 2021Documento14 páginasModule Chapter 5 CSR 2021Kyle DTAinda não há avaliações

- Different Classifications of BanksDocumento48 páginasDifferent Classifications of BanksNash DenverAinda não há avaliações

- Banking Laws: Regulatory Framework For Business TransactionsDocumento100 páginasBanking Laws: Regulatory Framework For Business TransactionsMarian Roa100% (1)

- Unibank and Commercial Bank HandoutsDocumento4 páginasUnibank and Commercial Bank HandoutsmorningmindsetAinda não há avaliações

- Chapter 3 Government Banking InstitutionsDocumento31 páginasChapter 3 Government Banking InstitutionsChichay KarenJoyAinda não há avaliações

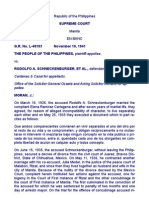

- People Vs SchneckenburgerDocumento3 páginasPeople Vs SchneckenburgerZyril MarchanAinda não há avaliações

- People Vs TandaDocumento5 páginasPeople Vs TandaZyril MarchanAinda não há avaliações

- People Vs PerrerasDocumento6 páginasPeople Vs PerrerasZyril MarchanAinda não há avaliações

- People Vs NarvaesDocumento6 páginasPeople Vs NarvaesZyril MarchanAinda não há avaliações

- People Vs MendezDocumento16 páginasPeople Vs MendezZyril MarchanAinda não há avaliações

- People Vs BugtongDocumento28 páginasPeople Vs BugtongZyril MarchanAinda não há avaliações

- People Vs BerialesDocumento5 páginasPeople Vs BerialesZyril MarchanAinda não há avaliações

- Art. 6 Notes (Pgs. 94-121)Documento5 páginasArt. 6 Notes (Pgs. 94-121)Zyril MarchanAinda não há avaliações

- Tobias v. Abalos, 239 SCRA 106Documento4 páginasTobias v. Abalos, 239 SCRA 106zatarra_12Ainda não há avaliações

- People Vs BayyaDocumento5 páginasPeople Vs BayyaZyril MarchanAinda não há avaliações

- Legal MaximsDocumento61 páginasLegal Maximsmarkuslagan06100% (8)

- OBLICON Definition of TermsDocumento5 páginasOBLICON Definition of TermsDia Santos96% (25)

- 1987 Constitution 1973 Constitution 1935 Constitution: PreambleDocumento29 páginas1987 Constitution 1973 Constitution 1935 Constitution: PreambleZyril MarchanAinda não há avaliações

- ACC 310F: Foundations of Accounting Class Notes - Chapter 1 (Pages 2-8), Chapter 2 and Chapter 3 (Pages 74-79)Documento11 páginasACC 310F: Foundations of Accounting Class Notes - Chapter 1 (Pages 2-8), Chapter 2 and Chapter 3 (Pages 74-79)shower_of_gold100% (1)

- Government Accounting PHDocumento14 páginasGovernment Accounting PHrylAinda não há avaliações

- 1.business1 Trade and CommerceDocumento20 páginas1.business1 Trade and CommerceAkash MehtaAinda não há avaliações

- 1559051463267lQpqLbRWjUIPzaEz PDFDocumento8 páginas1559051463267lQpqLbRWjUIPzaEz PDFSibu SorenAinda não há avaliações

- Chapter 23 Audit of Cash and Financial InstrumentsDocumento37 páginasChapter 23 Audit of Cash and Financial InstrumentsYasmine Magdi100% (1)

- Click Here To View Your Aliyah Benefits at A GlanceDocumento1 páginaClick Here To View Your Aliyah Benefits at A GlanceAyelen FlintAinda não há avaliações

- Chap 010Documento20 páginasChap 010Annie VAinda não há avaliações

- Brigham & Ehrhardt: Financial Management: Theory and Practice 14eDocumento53 páginasBrigham & Ehrhardt: Financial Management: Theory and Practice 14eSamah Refa'tAinda não há avaliações

- 1 30 2012 4Documento546 páginas1 30 2012 4Dante FilhoAinda não há avaliações

- Analysis of Section 139 A IT Act 1961Documento13 páginasAnalysis of Section 139 A IT Act 1961padam jainAinda não há avaliações

- Chapter 3-Cash&ReceivablesDocumento22 páginasChapter 3-Cash&ReceivablesDr. Mohammad Noor Alam100% (1)

- CH 03Documento61 páginasCH 03Muhammad RamzanAinda não há avaliações

- Topic 4 AdditionalDocumento15 páginasTopic 4 AdditionalBaby KhorAinda não há avaliações

- Howework 1 FFMDocumento7 páginasHowework 1 FFMparikshat7Ainda não há avaliações

- A Study On Financial Performance For Axis BankDocumento20 páginasA Study On Financial Performance For Axis BankJayaprabhu PrabhuAinda não há avaliações

- The Fern Residency Mundra: MR - Yash VithalaniDocumento2 páginasThe Fern Residency Mundra: MR - Yash VithalaniPREM KUMAR KUSHAWAHAAinda não há avaliações

- Tf27jan17 IbuaeDocumento12 páginasTf27jan17 IbuaeMohammed AlsheriefAinda não há avaliações

- If 1 - Forex MarketDocumento30 páginasIf 1 - Forex MarketSaurav GoyalAinda não há avaliações

- Abhinay Axis Project FinalDocumento97 páginasAbhinay Axis Project FinalabhinaygoenkaAinda não há avaliações

- Equity InvestmentsDocumento6 páginasEquity Investmentsela kikayAinda não há avaliações

- Payment Card Statement From 01.01.2023 To 31.01.2023: New TransactionsDocumento2 páginasPayment Card Statement From 01.01.2023 To 31.01.2023: New TransactionsBlacky BurnAinda não há avaliações

- Fulvian Zahid Kuis MenkeuDocumento3 páginasFulvian Zahid Kuis MenkeuCarihunian DepokAinda não há avaliações

- Blank Accounting Worksheet TemplateDocumento17 páginasBlank Accounting Worksheet TemplateJhazz LandaganAinda não há avaliações

- OL Accounting P2Documento480 páginasOL Accounting P2Luqman KhanAinda não há avaliações

- Brechner6e - Ch07 Invoices, Trade & Cash DiscountsDocumento45 páginasBrechner6e - Ch07 Invoices, Trade & Cash DiscountsadamAinda não há avaliações

- Ronnies Resume 05-15-2017Documento3 páginasRonnies Resume 05-15-2017api-363361065Ainda não há avaliações

- Sbi Product Profile FinalDocumento45 páginasSbi Product Profile FinalSuman DasAinda não há avaliações

- Exercise 3 SolutionDocumento3 páginasExercise 3 SolutioneyAinda não há avaliações

- Name: Curie Falentina Pandiangan Class: International MBA - 10 NIM: 20/465214/PEK/26217 Financial Management AssignmentsDocumento4 páginasName: Curie Falentina Pandiangan Class: International MBA - 10 NIM: 20/465214/PEK/26217 Financial Management AssignmentsDuren JayaAinda não há avaliações

- Speccom - NCBA GBL ReviewerDocumento10 páginasSpeccom - NCBA GBL ReviewerSarah CadioganAinda não há avaliações