Escolar Documentos

Profissional Documentos

Cultura Documentos

Treasury Functions

Enviado por

sunshine9016Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Treasury Functions

Enviado por

sunshine9016Direitos autorais:

Formatos disponíveis

Treasury Functions

Ultimately, the treasury department ensures that a company has sufficient cash available at all times to meet the needs of its primary business operations. However, its responsibilities range well beyond that single goal. It also has significant responsibilities in the following areas:

Cash forecasting. The accounting staff generally handles the receipt and disbursement of cash, but the treasury staff needs to compile this information from all subsidiaries into short-range and long-range cash forecasts. These forecasts are needed for investment purposes, so the treasury staff can plan to use investment vehicles that are of the correct duration to match scheduled cash outflows. The staff also uses the forecasts to determine when more cash is needed, so that it can plan to acquire funds either through the use of debt or equity. Cash forecasting is also needed at the individual currency level, which the treasury staff uses to plan its hedging operations. Working capital management. A key component of cash forecasting and cash availability is working capital, which involves changes in the levels of current assets and current liabilities in response to a companys general level of sales and various internal policies. The treasurer should be aware of working capital levels and trends, and advise management on the impact of proposed policy changes on working capital levels. Cash management. The treasury staff uses the information it obtained from its cash forecasting and working capital management activities to ensure that sufficient cash is available for operational needs. The efficiency of this area is significantly improved by the use of cash pooling systems. Investment management. The treasury staff is responsible for the proper investment of excess funds. The maximum return on investment of these funds is rarely the primary goal; instead, it is much more important to not put funds at risk, and also to match the maturity dates of investments with a companys projected cash needs. Treasury risk management. The interest rates that a company pays on its debt obligations may vary directly with market rates, which present a problem if market rates are rising. A companys foreign exchange positions could also be at risk if exchange rates suddenly worsen. In both cases, the treasury staff can create risk management strategies and implement hedging tactics to mitigate the companys risk. Management advice. The treasury staff monitors market conditions constantly, and so is an excellent in-house resource for the management team, should they want to know about interest rates that the company is likely to pay on new debt offerings, the availability of debt, and probable terms that equity investors will want in exchange for their investment in the company. Credit rating agency relations. When a company issues marketable debt, it is likely that a credit rating agency will review the companys financial condition, and assign a credit rating to the debt. The treasury staff responds to information requests from the credit agencys review team, and provides it with additional information over time. Bank relationships. The treasurer meets with the representatives of any banks that the company uses, to discuss the companys financial condition, the banks fee structure, any debt granted to the company by the bank, and such other services as foreign exchange transactions, hedges, wire transfers, custodial services, cash pooling, and so on. A long-term and open relationship can lead to some degree of bank cooperation if a company is having financial difficulties, and may sometimes lead to modest reductions in bank fees.

Fund raising. A key function is for the treasurer to maintain excellent relations with the investment community for fund raising purposes. This community is comprised of the sell side, which are those brokers and investment bankers who sell the companys debt and equity offerings to the buy side, which are the investors, pension funds, and other sources of cash who buy the companys debt and equity. While all funds ultimately come from the buy side, the sell side is invaluable for its contacts with the buy side, and so is frequently worth the cost of its substantial fees associated with fund raising. Credit granting. The granting of credit to customers can lie within the purview of the treasury department, or may be handed off to the accounting staff. This task is useful for the treasury staff to manage, since it allows the treasurer some control over the amount of working capital locked up in accounts receivable. Systems. The treasury staff should examine all existing and proposed company systems to determine their impact on cash flows, and advise senior management regarding possible changes to those systems that could improve the amount, timing, or risk profile of cash flows. Other activities. If a company engages in mergers and acquisitions on a regular basis, then the treasury staff should have expertise in integrating the treasury systems of acquirers into those of the company. For larger organizations, this may require a core team of acquisition integration experts. Another activity is the maintenance of all types of insurance on behalf of the company. This chore may be given to the treasury staff on the grounds that it already handles a considerable amount of risk management through its hedging activities, so this represents a further centralization of risk management activities.

Clearly, the original goal of maintaining cash availability has been expanded by the preceding points to encompass some types of asset management, risk management, working capital management, and the lead role in dealing with banks and credit rating agencies. Thus, the treasury department occupies a central role in the finances of the modern corporation.

Você também pode gostar

- Information Assurance and Security II Lectures Quizzes and Activities Compress 1Documento26 páginasInformation Assurance and Security II Lectures Quizzes and Activities Compress 1Jireh SalinasAinda não há avaliações

- Chapter 5Documento7 páginasChapter 5intelragadio100% (1)

- Lecture Credit and Collection Chapter 1Documento7 páginasLecture Credit and Collection Chapter 1Celso I. MendozaAinda não há avaliações

- Transfer and Business Tax 2014 Ballada 1Documento25 páginasTransfer and Business Tax 2014 Ballada 1Aira DivinagraciaAinda não há avaliações

- TAX-311-InCOME-TAXATION-https Urios - Neolms.com Student Quiz Assignment Submissions 24706119Documento6 páginasTAX-311-InCOME-TAXATION-https Urios - Neolms.com Student Quiz Assignment Submissions 24706119Myco PaqueAinda não há avaliações

- Credit and CollectionDocumento53 páginasCredit and CollectionApril CastilloAinda não há avaliações

- Asset Allocation 5E (PB): Balancing Financial Risk, Fifth EditionNo EverandAsset Allocation 5E (PB): Balancing Financial Risk, Fifth EditionNota: 4 de 5 estrelas4/5 (13)

- Cpa Review School of The Philippines ManilaDocumento2 páginasCpa Review School of The Philippines ManilaAljur Salameda50% (2)

- Chapter 2Documento5 páginasChapter 2Sundaramani SaranAinda não há avaliações

- DILG Resources 2011216 85e96b8954Documento402 páginasDILG Resources 2011216 85e96b8954jennifertong82Ainda não há avaliações

- Business Administration International Business and TradesDocumento2 páginasBusiness Administration International Business and TradesTracy Van TangonanAinda não há avaliações

- FortiClient EMSDocumento54 páginasFortiClient EMSada ymeriAinda não há avaliações

- 16) Tayug Vs Rural BankDocumento3 páginas16) Tayug Vs Rural BankJohn Ayson100% (2)

- Stake In, or Claim On, Some Aspect of A Company's Products, Operations, MarketsDocumento5 páginasStake In, or Claim On, Some Aspect of A Company's Products, Operations, MarketsPaul Mark DizonAinda não há avaliações

- Central Monetary Authority - PhilippinesDocumento24 páginasCentral Monetary Authority - PhilippinesmercxAinda não há avaliações

- General Purpose Financial Statements (Basic Financial Statements)Documento3 páginasGeneral Purpose Financial Statements (Basic Financial Statements)Jolly CharmzAinda não há avaliações

- Chapter 1 Introduction To Consumption TaxesDocumento6 páginasChapter 1 Introduction To Consumption TaxesJason MablesAinda não há avaliações

- Chap 2 QuizDocumento2 páginasChap 2 QuizLeonard CañamoAinda não há avaliações

- Sotto v. Mijares - 28 SCRA 17 (1969) & Meat Packing Corp.#59 SCRADocumento4 páginasSotto v. Mijares - 28 SCRA 17 (1969) & Meat Packing Corp.#59 SCRANadzlah BandilaAinda não há avaliações

- An Overview of Financial ManagementDocumento8 páginasAn Overview of Financial ManagementCHARRYSAH TABAOSARESAinda não há avaliações

- Ojt Journal 1Documento11 páginasOjt Journal 1Gerald F. SalasAinda não há avaliações

- Coop HandoutsDocumento4 páginasCoop HandoutsdessaAinda não há avaliações

- Gross IncomeDocumento6 páginasGross IncomeJane TuazonAinda não há avaliações

- Cap BudDocumento29 páginasCap BudJorelyn Joy Balbaloza CandoyAinda não há avaliações

- Banking CH 2 Central BankingDocumento10 páginasBanking CH 2 Central BankingAbiyAinda não há avaliações

- Payout Policy Elements of Payout PolicyDocumento6 páginasPayout Policy Elements of Payout PolicyMarlon A. RodriguezAinda não há avaliações

- Credit & Collection + Capital MarketDocumento8 páginasCredit & Collection + Capital MarketMilky CoffeeAinda não há avaliações

- Catanduanes State University College of Business and Accountancy Virac, CatanduanesDocumento9 páginasCatanduanes State University College of Business and Accountancy Virac, CatanduanesClyde TabliganAinda não há avaliações

- Fin33 3rdexamDocumento3 páginasFin33 3rdexamRonieOlarteAinda não há avaliações

- MODULE 1 AND 2 FOR FINMAN SubjectDocumento8 páginasMODULE 1 AND 2 FOR FINMAN SubjectCarl John Andrie CabacunganAinda não há avaliações

- Introduction To Managerial Finance/Financial Management: The Resources or 8Ms of Management AreDocumento3 páginasIntroduction To Managerial Finance/Financial Management: The Resources or 8Ms of Management AreBai Nilo100% (2)

- Credit and Collection: Chapter 6 - Credit Decision MakingDocumento51 páginasCredit and Collection: Chapter 6 - Credit Decision MakingQuenne Nova DiwataAinda não há avaliações

- Govacc AccountsDocumento88 páginasGovacc AccountsEunice Rae De GuzmanAinda não há avaliações

- Lesson 1 (Mutual Funds)Documento14 páginasLesson 1 (Mutual Funds)JINKY MARIELLA VERGARAAinda não há avaliações

- The Fifteen Principles of Personal FinanceDocumento5 páginasThe Fifteen Principles of Personal FinancePRECIOUS50% (2)

- Lecture 01 Financial Controllership Week 01 Student HandoutsDocumento5 páginasLecture 01 Financial Controllership Week 01 Student HandoutsReiner GGayAinda não há avaliações

- Interest Rates and Their Role in FinanceDocumento17 páginasInterest Rates and Their Role in FinanceClyden Jaile RamirezAinda não há avaliações

- Mutual Funds: PRELIM ModuleDocumento11 páginasMutual Funds: PRELIM ModulejchazneyAinda não há avaliações

- IMCPlan UCMHousingFA2016Documento39 páginasIMCPlan UCMHousingFA2016Anonymous GKpP05Ainda não há avaliações

- Better Business, 2e (Solomon) Chapter 6 Forms of Business OwnershipDocumento40 páginasBetter Business, 2e (Solomon) Chapter 6 Forms of Business OwnershipAngelita Dela cruzAinda não há avaliações

- Final Exam Taxation 101Documento8 páginasFinal Exam Taxation 101Live LoveAinda não há avaliações

- Ramon Magsaysay Memorial Colleges-Marbel Inc Accounting Education Program Purok Waling-Waling, Arellano Street, Zone II, Koronadal CityDocumento3 páginasRamon Magsaysay Memorial Colleges-Marbel Inc Accounting Education Program Purok Waling-Waling, Arellano Street, Zone II, Koronadal Cityalajar opticalAinda não há avaliações

- Final Examination INVESTMENT AND PORTFOLIO MANAGEMENTDocumento2 páginasFinal Examination INVESTMENT AND PORTFOLIO MANAGEMENTRemar Allen Bautista100% (1)

- Reaction PaperDocumento8 páginasReaction PaperMarlon CorpuzAinda não há avaliações

- Bdo Unibank Incorporated Activity2Documento47 páginasBdo Unibank Incorporated Activity2beth alviolaAinda não há avaliações

- Preparation of A Cash Flow Statement FromDocumento22 páginasPreparation of A Cash Flow Statement FromUddish BagriAinda não há avaliações

- FinMan Theories 2Documento6 páginasFinMan Theories 2Marie GonzalesAinda não há avaliações

- Chapter 6 Exercises (Bonds & Interest)Documento2 páginasChapter 6 Exercises (Bonds & Interest)Shaheera SuhaimiAinda não há avaliações

- Chapter 10Documento4 páginasChapter 10ashibhallauAinda não há avaliações

- Good Gov 7-9 With Q&ADocumento74 páginasGood Gov 7-9 With Q&AJoshua JunsayAinda não há avaliações

- Chapter 4 Financial Management IV BbaDocumento3 páginasChapter 4 Financial Management IV BbaSuchetana AnthonyAinda não há avaliações

- Module 6 Community Relations and Strategic PhilanthropyDocumento21 páginasModule 6 Community Relations and Strategic Philanthropychoose1Ainda não há avaliações

- Regular - Limited To Cooperative Organizations Which Are Holders of Associate - Those Subscribing and Holding Preferred Shares of TheDocumento3 páginasRegular - Limited To Cooperative Organizations Which Are Holders of Associate - Those Subscribing and Holding Preferred Shares of TheJaylordPataotaoAinda não há avaliações

- AuditDocumento5 páginasAuditKyanna Mae LecarosAinda não há avaliações

- Mutual Funds 10-17Documento49 páginasMutual Funds 10-17I'm YouAinda não há avaliações

- Finn 22 - Financial Management Questions For Chapter 2 QuestionsDocumento4 páginasFinn 22 - Financial Management Questions For Chapter 2 QuestionsJoongAinda não há avaliações

- What Is Community Tax?: Speaker: Valerie A. OngDocumento25 páginasWhat Is Community Tax?: Speaker: Valerie A. Ongmarz busaAinda não há avaliações

- Test Begins HereDocumento6 páginasTest Begins HereRichardDinongPascual100% (1)

- Prelim Exam in Special Topics in Finance - SAMONTEDocumento2 páginasPrelim Exam in Special Topics in Finance - SAMONTESharina Mhyca SamonteAinda não há avaliações

- SM City Management Report and AnalysisDocumento15 páginasSM City Management Report and AnalysisVal Benedict MedinaAinda não há avaliações

- Fin Man ReviewerDocumento5 páginasFin Man ReviewerJea BalagtasAinda não há avaliações

- Loan and Discount Functions Loans VS DiscountsDocumento2 páginasLoan and Discount Functions Loans VS DiscountsMegan Adeline HaleAinda não há avaliações

- Letter To Future SelfDocumento1 páginaLetter To Future Selfapi-548321759Ainda não há avaliações

- Chapter 4 (Review Questions)Documento4 páginasChapter 4 (Review Questions)Hads LunaAinda não há avaliações

- Value Chain Management Capability A Complete Guide - 2020 EditionNo EverandValue Chain Management Capability A Complete Guide - 2020 EditionAinda não há avaliações

- IT Environment Audit ICQDocumento9 páginasIT Environment Audit ICQsunshine9016Ainda não há avaliações

- Types of OpinionDocumento1 páginaTypes of Opinionsunshine9016Ainda não há avaliações

- REvision Pack 08-Questions and AnswersDocumento37 páginasREvision Pack 08-Questions and Answerssunshine9016Ainda não há avaliações

- REvision Pack 08-Questions and AnswersDocumento45 páginasREvision Pack 08-Questions and Answerssunshine9016Ainda não há avaliações

- Types of OpinionDocumento1 páginaTypes of Opinionsunshine9016Ainda não há avaliações

- Active Accounting 06Documento24 páginasActive Accounting 06vetriit4Ainda não há avaliações

- Financial Formulas - Ratios (Sheet)Documento3 páginasFinancial Formulas - Ratios (Sheet)carmo-netoAinda não há avaliações

- Financial Statement Analysis - PracticeDocumento54 páginasFinancial Statement Analysis - Practicesunshine9016Ainda não há avaliações

- RatiosDocumento2 páginasRatiossunshine9016Ainda não há avaliações

- Financial Formulas - Ratios (Sheet)Documento3 páginasFinancial Formulas - Ratios (Sheet)carmo-netoAinda não há avaliações

- Comprehensive Income: AccountingDocumento1 páginaComprehensive Income: Accountingzuzu11111Ainda não há avaliações

- RatiosDocumento2 páginasRatiossunshine9016Ainda não há avaliações

- Financial Formulas - Ratios (Sheet)Documento3 páginasFinancial Formulas - Ratios (Sheet)carmo-netoAinda não há avaliações

- 2011 Paper F1 QandA Sample Download v2Documento28 páginas2011 Paper F1 QandA Sample Download v2sunshine9016Ainda não há avaliações

- 1 - Blank & Title PageDocumento2 páginas1 - Blank & Title Pagesunshine9016Ainda não há avaliações

- Tool Category E: Political Development and Governance: 19. Civic Society-BuildingDocumento4 páginasTool Category E: Political Development and Governance: 19. Civic Society-Buildingsunshine9016Ainda não há avaliações

- Electronic ChartDocumento1 páginaElectronic Chartsunshine9016Ainda não há avaliações

- Back of Seectronic ChartDocumento1 páginaBack of Seectronic Chartsunshine9016Ainda não há avaliações

- Finding Right MomentDocumento3 páginasFinding Right Momentsunshine9016Ainda não há avaliações

- Free NotesDocumento1 páginaFree Notessunshine9016Ainda não há avaliações

- Free NotesDocumento1 páginaFree Notessunshine9016Ainda não há avaliações

- Start Up India AbstractDocumento5 páginasStart Up India Abstractabhaybittu100% (1)

- Basic Laws On The Professionalization of Teaching PD 1006 Edited Oct 11 2019Documento6 páginasBasic Laws On The Professionalization of Teaching PD 1006 Edited Oct 11 2019Renjie Azumi Lexus MillanAinda não há avaliações

- Audit of A Multi-Site Organization 1. PurposeDocumento4 páginasAudit of A Multi-Site Organization 1. PurposeMonica SinghAinda não há avaliações

- KMPDU Private Practice CBA EldoretDocumento57 páginasKMPDU Private Practice CBA Eldoretapi-175531574Ainda não há avaliações

- Research - Procedure - Law of The Case DoctrineDocumento11 páginasResearch - Procedure - Law of The Case DoctrineJunnieson BonielAinda não há avaliações

- Moovo Press ReleaseDocumento1 páginaMoovo Press ReleaseAditya PrakashAinda não há avaliações

- MOFCOM SCHOLARSHIP(2019 Enrollment Guide) - Scholarships - 留学中国Documento9 páginasMOFCOM SCHOLARSHIP(2019 Enrollment Guide) - Scholarships - 留学中国qweku jayAinda não há avaliações

- Heterosexism and HomophobiaDocumento6 páginasHeterosexism and HomophobiaVictorAinda não há avaliações

- Interconnect 2017 2110: What'S New in Ibm Integration Bus?: Ben Thompson Iib Chief ArchitectDocumento30 páginasInterconnect 2017 2110: What'S New in Ibm Integration Bus?: Ben Thompson Iib Chief Architectsansajjan9604Ainda não há avaliações

- Yayen, Michael - MEM601Documento85 páginasYayen, Michael - MEM601MICHAEL YAYENAinda não há avaliações

- 1 Types of Life Insurance Plans & ULIPSDocumento40 páginas1 Types of Life Insurance Plans & ULIPSJaswanth Singh RajpurohitAinda não há avaliações

- Smartplant Reference Data: Setup and User'S GuideDocumento35 páginasSmartplant Reference Data: Setup and User'S Guidepareen9Ainda não há avaliações

- (NAME) (NAME) : Day A.M P.M Undertime Day A.M P.M UndertimeDocumento2 páginas(NAME) (NAME) : Day A.M P.M Undertime Day A.M P.M UndertimeAngelica Joy Toronon SeradaAinda não há avaliações

- ACTBFAR Unit 2 Partnership Part 3 Partnership Operations Study GuideDocumento3 páginasACTBFAR Unit 2 Partnership Part 3 Partnership Operations Study GuideMatthew Jalem PanaguitonAinda não há avaliações

- Performance Bank Guarantee FormatDocumento1 páginaPerformance Bank Guarantee FormatSRIHARI REDDIAinda não há avaliações

- 7-Neutrality VsDocumento19 páginas7-Neutrality VsPrem ChopraAinda não há avaliações

- 5.opulencia vs. CADocumento13 páginas5.opulencia vs. CARozaiineAinda não há avaliações

- VMA FCC ComplaintsDocumento161 páginasVMA FCC ComplaintsDeadspinAinda não há avaliações

- China National Technical: Item No. Contents in ITT &TDS Clarification Request Employer's ResponseDocumento2 páginasChina National Technical: Item No. Contents in ITT &TDS Clarification Request Employer's ResponseMd Abdur RahmanAinda não há avaliações

- SaraikistanDocumento31 páginasSaraikistanKhadija MirAinda não há avaliações

- Lesson 4the Retraction Controversy of RizalDocumento4 páginasLesson 4the Retraction Controversy of RizalJayrico ArguellesAinda não há avaliações

- Position Paper in Purposive CommunicationDocumento2 páginasPosition Paper in Purposive CommunicationKhynjoan AlfilerAinda não há avaliações

- Η Πολιτική Νομιμοποίηση της απόθεσης των παιδιώνDocumento25 páginasΗ Πολιτική Νομιμοποίηση της απόθεσης των παιδιώνKonstantinos MantasAinda não há avaliações

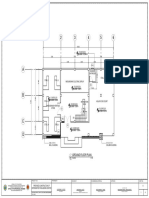

- Ground Floor Plan: Office of The Provincial EngineerDocumento1 páginaGround Floor Plan: Office of The Provincial EngineerAbubakar SalikAinda não há avaliações