Escolar Documentos

Profissional Documentos

Cultura Documentos

DIVIDEND and Transversality Condition

Enviado por

Saumitra BhaduriDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

DIVIDEND and Transversality Condition

Enviado por

Saumitra BhaduriDireitos autorais:

Formatos disponíveis

STOCK MARKETS AND BUBBLES

Emiliano Brancaccio

*

1. Introduction

The analysis of stock prices dynamics has always been a field

of scientific controversies. Mainstream economists have

usually defended a specific version of the Present Value

Model (PVM), according to which stock prices can be

considered rational forecasts of discounted future dividends

(for a survey, see Campbell et al. 1997). However, since the

publication of Shillers (1981) volatility tests, various

empirical rejections to PVM convinced economists to re-

examine its basic hypotheses.

In order to defend the idea that stock prices correctly

reflect fundamentals it has been said that PVM still holds if the

hypothesis of a constant discount rate for future dividends is

substituted by the assumption that it can change over time

because of modifications in agents preferences or behaviour

towards risk (Campbell et al. 1997). On the other side, the

critics of PVM interpreted its empirical rejections as a proof of

the existence of speculative bubbles, i.e. systematic price

deviations from effectual dividends. We can distinguish at

*

DASES University of Sannio (Benevento, Italy). This paper is a revised

version of a paper presented at SOAS, University of London in 1999. I am

grateful to Daniela Marconi, Satoshi Miyamura, Pasquale Scaramozzino and

Domenico Suppa for their useful comments. The usual disclaimers apply.

26

least two different theoretical supports for bubbles. The first

one was developed by Blanchard and Watson (1982). They

removed the transversality condition from PVM in order to

admit rational bubbles, that is price deviations deriving from

rational behaviour. The second one can be seen as a

conventional interpretation of the old heterodox view

according to which agents are not able to predict future

dividends because they are influenced by irrational waves

(Galbraith 1972, Minsky 1982, Kindleberger 1989).

Sometimes, neoclassical economists have tried to give a

formal expression of this view simply eliminating two basic

PVM hypothesis: rational expectations (REH) and efficient

markets (EMH).

It is important to specify that the removal of both the

transversality condition and the hypotheses of rational

expectations and efficient markets do not imply a rejection of

the mainstream neoclassical model (which is the theoretical

foundation of PVM). In this work, after a short review of these

different interpretations of Shillers findings, we propose a

third kind of theoretical support for bubbles. It is based on a

model of classical-circuit type and aims to represent a

theoretical alternative to mainstream analyses of stock

markets.

2. Behind the Present Value Model

According to the present-value model prices can be considered

rational forecasts of discounted future dividends (Campbell et

al. 1997). Let us start from the following definition: stock

returns R

t+1

are given by capital gains (P

t+1

- P

t

) plus dividends

D

t+1

, all divided by current prices P

t

:

27

(1) R

P P D

P

t

t t t

t

+

+ +

=

+

1

1 1

This is only an accounting definition. However, it is possible

to give theoretical support to this definition in order to

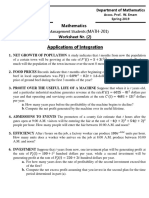

determine the final PVM equation. This diagram provides the

steps followed by neoclassical economists:

At the basis of this sequence there is the standard New

Classical Macroeconomics model. Hypothesis H1 indicates

that preferences about consumption, savings and wealth

allocation do not change over time, which implies a constant

equilibrium level of the discount rate R. According to

hypothesis H2 it is not excluded that actual dividends may

H1: constant intertemporal

preferences and behaviour

towards risk

H2: agents believe they

cannot improve their

expectations on future

dividends (REH and EMH)

H3: transversality condition

constant expected

stock return R

final PVM

equation

28

diverge from agents expectations;

1

H2 only considers these

deviations ex-ante unpredictable. In other words changes in R

are ex-ante random, which is why agents can only assume that

R will remain constant on average. Hypothesis H2 is a

consequence of two assumptions: rational expectations (REH)

and efficient markets (EMH). EMH admits that agents do not

have the same information set I

t,.

However, it provides that

nobody will be able to make profits exploiting his own

informative advantages because market prices immediately

tend to reveal and diffuse them. REH means, in this context,

that agents manage their information sets in the same, best

way according to the right model of the economy.

2

A first

result of EMH and REH is that agents tend to have the same

expectations on future dividends D

t+i

. A second result is that

unexpected changes in D (and consequently in R) will depend

only on changes in the information set from I

t

to I

t+1

(with I

t

c

I

t+1

). It is clear that these changes are unpredictable in t: this is

the reason for which future changes in R can only be

considered random.

So, given H1 and H2 we can write:

(H1, H2) E R R

t t

[ ]

+

=

1

Given (H1, H2), after few steps (1) becomes:

1

This implies that actual R will deviate from its expected value until

expectations remain wrong; that is, until P reflects the new dividends path.

2

This is a specific way to conceive rational expectations, generally

associated to New Classical Macroeconomics (see Lucas 1972, Sargent

1976): it holds in case REH is associated with the hypothesis that there is

just one representative flexprice model of the economy, which does not

move from the unique walrasian equilibrium path.

29

(2) P E

P D

R

t t

t t

=

+

+

(

+ + 1 1

1

Seen that P

t+1

=E

t+1

[(P

t+2

+ D

t+2

)/(1+R)] and applying the Law

of Iterate Expectations,

3

we obtain:

(3) P E

R

D E

R

P

t t

i

t i

i

k

t

k

t k

=

+

|

\

|

.

|

(

(

+

+

|

\

|

.

|

(

(

+

=

+

1

1

1

1

1

From equation (3) we learn that despite a constant R and just

one expected temporal path for D, there is still more than one

solution for P

t

. In fact, P

t

also depends on P

t+i

, that is on its

own temporal path. As a consequence P

t

may grow simply

because an increase in the future P

t+i

is expected, without any

regard to D.

The only way to eliminate this bubble is the

introduction of hypothesis H3, the transversality condition:

(H3) lim

k t

k

t k

E

R

P

+

+

|

\

|

.

|

(

(

=

1

1

0

3

Given the information set I

t

c I

t+1

, an agent cannot predict what will be his

t+1 expectation about P

t+2

. He can only forecast P

t+2

according to his current

information I

t

. This means that E

t

[E

t+1

[P

t+2

]]= E

t

[P

t+2

]. See Campbell et al.

(1997).

30

which holds when dP/dt < R. Given (H3), equation (3)

becomes:

(4) P E

R

D

t t

i

t i

i

=

+

|

\

|

.

|

(

(

+

=

1

1

1

This is the final PVM equation: current stock prices are

rational forecasts of future dividends, discounted at a constant

rate R.

2. Empirical rejections to the Present Value Model

Equation (4) has been subjected to many empirical tests, in

order to check to what extent stock prices reflect real

dividends. For this purpose, we can define P volatile if it

(the left-hand side of (4)) fluctuates too much in comparison

with dividends (the right-hand side of (4)). If volatility is high,

we could reject the idea that current prices reflect real future

dividends. In order to estimate price volatility Shiller proposed

a solution which became a framework for subsequent analysis.

Shiller stated that if prices are driven by other determinants

besides future dividends, they should vary even when

dividends do not change (Shiller 1981).

Shiller test is based on a comparison between real

stock prices P and a theoretical stock price P, calculated ex-

post on the basis of actual registered dividends. Shiller stated

31

that PVM equation (4) can be accepted only in case P

variance exceeds P variance. The reason is that being only a

prediction of P, P cannot incorporate suprises; so, it should

move less than P. But the empirical results contradicted this

theoretical conclusion: with reference to S&P stock price data

between 1871 and 1980, Shiller found that VAR(P)/VAR(P)

was more than 5, revealing that prices seem to be highly

volatile in comparison with real dividends (that is, too much

volatile to reflect only fundamentals). This result has been

substantially confirmed by subsequent, more powerful tests.

4

Given these results, the only way to reconcile data and

theory was to change the latter, re-examining the hypotheses

behind equation (4). As we will see, economists decided to

change H1, H2 or H3 depending on their different views on

stock markets and PVM.

3. In praise of PVM: time-varying R

The supporters of PVM stated that volatility tests should be

rejected being based on an unrealistic constant R (hypothesis

H1). According to this view, R changes over time because of

modifications in fundamentals, like preferences and behaviour

towards risk (Campbell et al. 1997, chap. 8). If H1 is rejected,

Shiller empirical results can be explained by changes in R

instead of P volatility. Obviously, in this case R would change

ex-ante and not ex-post: in other words, modifications in R

would be a cause instead of a consequence of changes in P.

4

See for example Campbell et al. (1997, chap. 7), Blanchard and Fischer

(1989, chap. 5).

32

4. Bubbles

A different line of research interprets volatility tests as a clear

evidence that stock prices are dominated by speculative

bubbles. The term bubble describes a situation in which

current prices are no longer justified by future dividends.

There are many ways to explain the origin and the

growth of bubbles. According to the traditional heterodox

view on stock markets, bubbles develop because, especially

during what has been called the euphoric phase of stock

markets (Minsky 1981, Kindleberger 1989), agents tend to

overestimate future dividends. In other words, their behaviour

becomes irrational. Neoclassical economists interpreted this

expression in the following way: irrational bubbles appear

because agents do not know the right model of the economy.

This means that irrational bubbles clash with hypothesis H2:

its removal implies that even in case a single equilibrium path

for D exists, there is no reason to be sure that agents will be

able to forecast it.

But the rejection of H2 is not the only way to admit

bubbles. By relaxing H3 (transversality condition) a more

recent line of research has developed the concept of rational

bubble (Blanchard and Watson 1982). Without H3 stock

price equation is (3), which can be rewritten in the following

form:

(3.1) Bt D

R

E P

i

i t

i

t t

+

(

(

|

.

|

\

|

+

=

=

+

1

1

1

33

where Bt Et

B

R

t

=

+

(

+1

1

Equation (3.1) states that the additional term B appears just

because it is expected to appear in the following period. This

can be defined a rational bubble for the following reason.

Agents are able to distinguish between fundamentals (i.e.

future dividends) and the bubble component B. However, it is

rational for them to enclose B in the determination of prices

simply because it is expected to persist in the future. The

conclusion is that given infinite possible paths for B we have

infinite paths for P, partly independent from fundamentals D.

Sometimes economists have tried to propose mixed

interpretations of bubbles. For example, those who generally

refuse H2 tend also to offer some arguments against H1: a

typical link is the idea that if agents are euphoric, not only they

tend to overestimate dividends, but also they reduce risk-

aversion (Minsky 1982). Others see in Kindleberger (1989) an

implicit admission of typical rational bubble behaviours

(when the rest of the world is mad, we must imitate it in some

measure). Furthermore, by removing H2 it would be possible

to provide some explanations for the beginning and the burst

of rational bubbles, which Blanchard and Watson, in their

famous 1982 contribution, did not give. These sort of merges

between rational and irrational views have been highlighted

also by Shiller (2000). He has recently provided a collection of

arguments in support of his volatility tests. According to

Shiller, stock prices dynamics is basically dominated by

irrationality, fashions, misleading interpretations of events,

etc. In such a context even those agents who perceive the

overestimation of future dividends will prefer to adequate their

behaviour to the dominant trend, maybe trying to exploit the

34

bubble until it bursts. This interaction between irrational and

rational behaviours, Shiller says, is at the basis of the strong

divergence, from 1994 to 2000, between the Dow Jones

Industrial Average (+200%) and dividends (only +60% during

the same period).

5. A possible alternative view on bubbles

It is difficult to say whether the current mainstream

interpretations of bubbles can represent a real development in

comparison with the old view of heterodox economists. To

this regard, it should be remembered the controversy between

rational and irrational bubbles theorists. For example,

Kindleberger (1989) defined rational bubble models a useless

mathematical ceremonial; on the other hand, Blanchard

counterattacked criticising the anecdotal methodology of the

old theorists. Probably, a good way to better distinguish this

views is to offer a stronger theoretical basis for heterodoxy.

First of all, let us examine in more detail the neoclassical

foundations of PVM. For simplicity, we consider a one-sector

model. Equation (1) can be derived from the typical own rate

of return:

(5)

'

1

'

1

+

= +

t

t

P

P

r

where P are relative prices, respectively given by monetary

prices P:

35

1

1 '

1

1

'

;

) 1 (

+

+

+

+

=

+

=

t

t

t

t

t

t

P

P

P

P

i P

P

and i is the usual monetary interest rate on a risk-free asset.

Then, we can rewrite (5):

(5.1)

t

t

P

P r

i

1

) 1 (

1

+

+

= +

If we consider R=i, and D

t+1

= r P

t+1

, equation (5.1) is

equivalent to (1). Now, in a neoclassical context, the term i is

strictly connected with the fundamentals of the model. In fact,

monetary prices are given by money supply. Furthermore, in

equilibrium we have:

) 1 (

) ( '

) ( '

1

1

+ = +

+ t

t

C U

C U

r

where U are the marginal utilities deriving from consumption

C and is the usual subjective rate of discount.

5

In this

theoretical framework it is then clear that stock returns can be

easily determined. Apart from monetary shocks or changes in

the utility function and other fundamentals, there is no reason

to consider the term i unpredictable. So, with the exception of

their rational version, in this context bubbles cannot persist.

However, it is possible to interpret equation (5.1) in a

totally different way. By substituting the neoclassical

5

See Blanchard and Fischer (1989).

36

framework with a model of classical-circuit type, it is

possible to define i = r, where (see Brancaccio 2005):

(

|

.

|

\

|

+ =

1

) (

) 1 ( ) 1 (

1

1

k

k f

r

u

r

t

In this context becomes much more difficult to make a correct

prediction of stock returns. In fact, in a classical-circuit

framework r (which also determines the technical choice k) is

a normal profit rate and is given by the state of social

relationships. The terms u and indicate respectively the

deviations from the normal utilization rates of machinery

and normal prices. They are given by the decisions of

capitalists and political authorities about production and

demand. It would be hard to consider these variables as

steady pivots analogous to neoclassical fundamentals. It

would be also difficult to distinguish, in this context, between

rational and irrational behaviours. For these features, classical-

circuit analysis may be considered a promising alternative

framework for the study of speculative bubbles.

37

Bibliographical references

BLANCHARD O.J., FISCHER S. (1989), Lectures on Macroeconomics, MIT

Press.

BLANCHARD O.J., WATSON M. (1982), Bubbles, Rational Expectations and

Financial Markets, in Wachtel P., Crises in the Economic and Financial

Structure, Lexington Books.

BRANCACCIO E. (2005), Un modello di teoria monetaria della produzione

capitalistica, forthcoming on Il pensiero economico italiano.

CAMPBELL J.Y, LO A.W., MACKINLAY A. (1997), The Econometrics of

Financial Markets, Princeton University Press.

GALBRAITH J.K. (1972), The Great Crash, Houghton Mifflin

KINDLEBERGER C.P. (1989), Manias, Panics and Crashes, 2

nd

ed.

MacMillan.

MINSKY H.P. (1982), Can It Happen Again ?, M.E. Sharpe.

SHILLER R. J. (1981), Do Stock Prices Move Too Much to Be Justified by

Subsequent Movements in Dividends ?, American Economic Review, 71(3):

421-36.

SHILLER R.J. (2000), Irrational Exuberance, Princeton University Press.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Capital Structure Saumitra 2011Documento120 páginasCapital Structure Saumitra 2011Saumitra BhaduriAinda não há avaliações

- Research Paper 229 FinalDocumento61 páginasResearch Paper 229 FinalSaumitra BhaduriAinda não há avaliações

- Alternative Herding 2011Documento28 páginasAlternative Herding 2011Saumitra BhaduriAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Guha Bhaduri Jie 1Documento20 páginasGuha Bhaduri Jie 1Saumitra BhaduriAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Another Look at Measures of Forecast AccuracyDocumento18 páginasAnother Look at Measures of Forecast AccuracySaumitra BhaduriAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Case 1Documento19 páginasCase 1Ragini RangaramuAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Lily S Villamil Vs Sps. ErguizaDocumento2 páginasLily S Villamil Vs Sps. Erguizakristel jane caldoza100% (2)

- Elton John Demetita - Unit II Activity 2 Business Ethical CasesDocumento6 páginasElton John Demetita - Unit II Activity 2 Business Ethical CasesLaiven Ryle100% (1)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Worksheet 2Documento2 páginasWorksheet 2alyAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Business Intelligence AutomotiveDocumento32 páginasBusiness Intelligence AutomotiveElsaAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Full Download Test Bank For Managerial Economics 5th Edition Luke M Froeb Brian T Mccann Michael R Ward Mike Shor PDF Full ChapterDocumento36 páginasFull Download Test Bank For Managerial Economics 5th Edition Luke M Froeb Brian T Mccann Michael R Ward Mike Shor PDF Full Chapterhospital.epical.x6uu100% (20)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Merchandise PlanDocumento71 páginasMerchandise PlanLakshana KAinda não há avaliações

- Profit and LossDocumento10 páginasProfit and LossDebasis BetalAinda não há avaliações

- Ind As-2 SummaryDocumento7 páginasInd As-2 Summarysagarsingla1234509876Ainda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Purchase Order Form Terms and Conditions Apj Jan 2011Documento8 páginasPurchase Order Form Terms and Conditions Apj Jan 2011AartiAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- United MuslimDocumento10 páginasUnited MuslimSocAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- JVZOO Cash Ebook PDFDocumento38 páginasJVZOO Cash Ebook PDFderic soon100% (2)

- Determinants of Interest RatesDocumento42 páginasDeterminants of Interest RatesJigar LakhaniAinda não há avaliações

- Vocabulary For TOEIC - 9 - Earnings, Rewards and BenefitsDocumento2 páginasVocabulary For TOEIC - 9 - Earnings, Rewards and BenefitsTeacherAinda não há avaliações

- AFOA Trade Rules - DomesticDocumento12 páginasAFOA Trade Rules - Domestichada33100% (1)

- Tender For Tamping MachineDocumento90 páginasTender For Tamping MachineMasood Ahmad NajarAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Intro To Business ForDigitalDocumento170 páginasIntro To Business ForDigitalJohn DoeAinda não há avaliações

- Cooper Tire & Rubber CompanyDocumento14 páginasCooper Tire & Rubber CompanySteven LeeAinda não há avaliações

- DrVijayMalik Company Analyses Vol 7Documento399 páginasDrVijayMalik Company Analyses Vol 7dhavalAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Appendix 18 - NEC3 Options: A380 SDLR Kingskerswell Bypass Major Scheme Business CaseDocumento6 páginasAppendix 18 - NEC3 Options: A380 SDLR Kingskerswell Bypass Major Scheme Business CasejcfunkyAinda não há avaliações

- exam1BD SolutionsDocumento8 páginasexam1BD SolutionsGamze ŞenAinda não há avaliações

- Capital Market in BangladeshDocumento39 páginasCapital Market in BangladeshSadia PressAinda não há avaliações

- VuQuocHuyDocumento175 páginasVuQuocHuyHuy Vu QuocAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- Chapter 15 Transfer Pricing QDocumento9 páginasChapter 15 Transfer Pricing QMaryane AngelaAinda não há avaliações

- Cargill India PVTDocumento42 páginasCargill India PVTOps Zibraltar100% (1)

- MGT480 Term PaperDocumento32 páginasMGT480 Term PaperShurovi UrmiAinda não há avaliações

- Agency DoctrinesDocumento24 páginasAgency DoctrinesYerdXXAinda não há avaliações

- Me005 Engineering Economics (Module 1)Documento36 páginasMe005 Engineering Economics (Module 1)SHEILA MAE TANAinda não há avaliações

- Order FlowDocumento184 páginasOrder Flowvaclarush100% (11)

- ECON1Documento10 páginasECON1Marklaren SanchezAinda não há avaliações