Escolar Documentos

Profissional Documentos

Cultura Documentos

Pacific West Power Rate Decision

Enviado por

The Chronicle Herald0 notas0% acharam este documento útil (0 voto)

33K visualizações75 páginasNOVA SCOTIA UTILITY and REVIEW BOARD 2012 NSUARB 126 M04862 IN THE MATTER OF THE PUBLIC UTILITIES ACT -and- IN THE MATTER OF AN APPLICATION by PACIFIC WEST COMMERCIAL CORPORATION for approval of a Load Retention Rate mechanism for the Point Tupper paper mill and related approvals. HEARING DATES: July 16, 17 and 18, 2012 FINAL SU

Descrição original:

Título original

Pacific West power rate decision

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoNOVA SCOTIA UTILITY and REVIEW BOARD 2012 NSUARB 126 M04862 IN THE MATTER OF THE PUBLIC UTILITIES ACT -and- IN THE MATTER OF AN APPLICATION by PACIFIC WEST COMMERCIAL CORPORATION for approval of a Load Retention Rate mechanism for the Point Tupper paper mill and related approvals. HEARING DATES: July 16, 17 and 18, 2012 FINAL SU

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

33K visualizações75 páginasPacific West Power Rate Decision

Enviado por

The Chronicle HeraldNOVA SCOTIA UTILITY and REVIEW BOARD 2012 NSUARB 126 M04862 IN THE MATTER OF THE PUBLIC UTILITIES ACT -and- IN THE MATTER OF AN APPLICATION by PACIFIC WEST COMMERCIAL CORPORATION for approval of a Load Retention Rate mechanism for the Point Tupper paper mill and related approvals. HEARING DATES: July 16, 17 and 18, 2012 FINAL SU

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 75

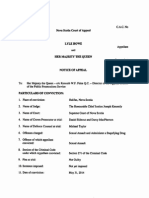

DECISION

NOVA SCOTIA UTILITY AND REVIEW BOARD

2012 NSUARB 126

M04862

IN THE MATTER OF THE PUBLIC UTILITIES ACT

-and-

IN THE MATTER OF AN APPLICATION by PACIFIC WEST COMMERCIAL

CORPORATION and NOVA SCOTIA POWER INCORPORATED for approval of a

Load Retention Rate mechanism for the Point Tupper paper mill and related approvals

BEFORE:

APPLICANTS:

PARTICIPANTS:

BOARD COUNSEL:

Document: 206878

Peter W. Gurnham, Q.C., Chair

Murray E. Doehler, C.A., P.Eng., Member

Roberta J. Clarke, Q.C., Member

PACIFIC WEST COMMERCIAL CORPORATION

DavidS. MacDougall, LL.B.

James MacDuff, LL.B.

Jessie Irving, LL.B.

NOVA SCOTIA POWER INCORPORATED

Rene Gallant, LL.B.

Colin Clarke, LL.B.

AVON GROUP

Nancy G. Rubin, LL.B.

Maggie A. Stewart, LL.B.

CONSUMER ADVOCATE

William L. Mahady, LL.B.

PROVINCE OF NOVA SCOTIA

Mark V. Rieksts, LL.B.

John Traves, Q.C.

SMALL BUSINESS ADVOCATE

E.A. Nelson Blackburn, Q.C.

S. Bruce Outhouse, Q.C.

HEARING DATES: July 16, 17 & 18, 2012

FINAL SUBMISSIONS: July 31, 2012

LIST OF PARTIES: Appendix A

DECISION DATE: August 20, 2012

DECISION: Application is granted with conditions, see summary

paragraphs 220 to 242

Document: 206878

TABLE OF CONTENTS

1.0 INTRODUCTION AND BACKGROUND .............................................................. .4

2.0 THE APPLICATION .............................................................................................. ?

2.1 Load Retention Tariff Pricing and Dividend Calculation Mechanism .......... 9

2.2 Arrangements Relating to the Biomass Plant.. ......................................... 10

2.3 Tax Structure ............................................................................................ 11

2.4 The Agreements ....................................................................................... 11

2.5 The Negotiations ...................................................................................... 16

2.6 Informal Submissions ............................................................................... 18

3.0 ISSUES AND FINDINGS .................................................................................... 19

3.1 Jurisdiction ............................................................................................... 19

3.1.1 Findings ......................................................................................... 21

3.2 Necessity and Sufficiency ......................................................................... 22

3.2.1 Findings ......................................................................................... 31

3.3 Pricing Mechanism for Electricity .............................................................. 33

3.3.1 Incremental Costs .......................................................................... 34

3.3.1.1 Determination of Incremental Price ....................................... 35

3.3.1.2 Agreed Additional Incremental Costs .................................... 36

3.3.1.3 Other Incremental Costs ....................................................... 38

3. 3.1.4 Findings ................................................................................ 39

3.3.2 Contribution to FCR Deferral ......................................................... 40

3.3.2.1 Findings ................................................................................ 41

3.3.3 Administration Costs.................. .. .. . .. .. .. . . . . . .. . . . .. . . .. . . . . .. .42

3.3.3.1 Finding .................................................................................. 42

3.3.4 Credit Risk ..................................................................................... 42

3.3.4.1 Finding .................................................................................. 43

3.4 Settlement Mechanism ............................................................................. 43

3.4.1 Finding ........................................................................................... 44

3.5 Overall Findings on the Mechanism ........................................................ .44

3.6 Tax Structure and Risk ............................................................................ .44

3.6.1 Findings ......................................................................................... 48

3.7 Term and Reopener ................................................................................. 48

3.7.1 Findings .......................................................................... , .............. 50

3.8 Steam Supply ................................................ , .......................................... 51

3.8.1 Findings ........................................................... , ............................. 52

3.9 Risk ............. , ............................................................................................ 52

3.9.1 Findings ......................................................................................... 58

3.1 0 RES Costs ................................................................................................ 57

3.1 0.1 Findings ................................. , ....................................................... 59

3.11 Regulatory Accounting Issues .................................................................. 60

3.11.1 Findings ......................................................................................... 61

3.12 Environmental Issues ............................................................................... 61

3.12.1 Findings ......................................................................................... 63

3.13 Reporting and Audit.. ................................................................................ 64

3.13.1 Findings ......................................................................................... 65

3.14 FCR Deferral ............................................................................................ 66

3.14.1 Findings ......................................................................................... 68

4.0 COMPLIANCE FILING ........................................................................................ 68

5.0 SUMMARY OF BOARD FINDINGS .................................................................... 69

Appendix A- List of Parties ........................................................................................... 75

Document: 206878

-4-

1.0 INTRODUCTION AND BACKGROUND

[1] Despite having what has been described as world class equipment for

making supercalendared paper, a reputation for a high quality product, and a dedicated

work force, the paper mill located at Point Tupper (the "mill") continues to face

challenges.

[2] The mill has been manufacturing paper since 1962, and has two

papermaking machines, PM1 which manufactures newsprint, and PM2 which

manufactures supercalendared paper. The mill uses an electrically-driven mechanical

pulping process and steam to dry the paper during manufacture.

[3] During an application before the Nova Scotia Utility and Review Board

(the "Board" or "NSUARB") in September, 2011, in which the then owner of the mill,

New Page Port Hawkesbury Inc. (NPPH), together with Bowater Mersey Paper

Company Limited ("Bowater"), the operator of a paper mill in Brooklyn, were seeking

relief by way of a Load Retention Tariff for the costs of electricity supplied by Nova

Scotia Power Inc. ("NSPI"), NPPH announced the shutdown of the mill. It then made

application to the Supreme Court of Nova Scotia (the "Court") under the Companies'

Creditors Arrangement Act. R.S.C. 1985, c. C-36, as amended (the "CCAA").

[4] The mill was the largest single customer of NSPI, consuming in excess of

10% of the electricity NSPI produced. Its permanent closure would mean a substantial

reduction in the load requirements of the electricity system. It also would mean the loss

of the mill's contribution to the fixed costs of the system.

Document: 206878

- 5 -

[5]

Since the CCAA application the mill has remained in a "hot idle" state.

While not producing paper the mill would be able to re-commence operations in a

relatively short time.

[6] Ernst & Young, the monitor appointed by an order of the Court, undertook

a process to find a buyer for the mill. This process resulted in acceptance of a proposal,

subject to creditor approval, from Pacific West Commercial Corporation ("PWCC"), a

member of the Stern Group of Companies, to purchase and operate the mill, provided it

could obtain or negotiate satisfactory agreements with various parties, including its

unionized work force, the Province of Nova Scotia {the "Province") regarding wood fibre,

and NSPI with respect to energy costs. The latter has been described as the largest

component of its costs of operation.

[7] Recognizing the declining market for newsprint, it is the intention of PWCC

to operate PM2 only. This machine is reported to produce more than 20% of the North

American supercalendared paper output. Operating PM2 only would result in a

significant reduction (approximately 450,000 MWh annually) in the amount of electricity

required in the mill operation.

[8] As a result of negotiations between PWCC and NSPI, a means of

addressing the cost of electricity which would satisfy both parties was developed,

hinged on the acceptability to Canada Revenue Agency ("CRA") of the use of non-

capital losses accumulated by NPPH and tax-free payment of dividends. NSPI and

PWCC through their respective tax advisors have requested an Advance Tax Ruling

("ATR") from CRA regarding the proposed transaction.

Document: 206878

- 6 -

[9]

PWCC and NSPI applied to the Board for approval of a Load Retention

Tariff ("LRT") pricing and dividend calculation mechanism. Each of them filed

Applications, dated April 27, 2012, with the Board, which then set down a hearing to

commence on July 16, 2012 at its offices in Halifax.

[1 0] Notice of the Hearing was published in both the Halifax Chronicle Herald

and the Cape Breton Post on April 28, May 2, and May 5, 2012.

[11] PWCC was represented by David MacDougall, James MacDuff, and

Jessie Irving. It filed direct and reply evidence as well as responses to Information

Requests ("IRs"). Testimony was given at the hearing by a panel consisting of Ron

Stern, President of PWCC; Wayne Nystrom, a business partner of Mr. Stern and

consultant to PWCC; Shawn Lewis, General Counsel and Secretary of PWCC; Bill

Stewart, Director of Woodlands and Strategic Initiatives, NPPH; and Douglas Ewens,

Q.C. of McCarthy Tetrault.

[12] NSPI was represented by Colin Clarke and Rene Gallant. It also filed

direct and reply evidence and responses to IRs. The panel testifying at the hearing on

behalf of NSPI consisted of Rob Bennett, President and Chief Executive Officer; Mark

Sidebottom, Vice-President, Power Generation and Delivery; and Eric Ferguson,

Director, Regulatory Affairs.

[13] The Consumer Advocate (the "CA") represented by John Merrick, Q.C.,

and William Mahody, the Small Business Advocate (the "SBA") represented by E. A.

Nelson Blackburn, Q.C., the Avon Group ("Avon") represented by Nancy Rubin and

Maggie Stewart, the Province represented by Mark V. Rieksts, the Municipal Electric

Utilities of Nova Scotia Co-operative ("MEUNSC"), and the Municipal Action Group

Document: 206878

- 7-

("MAG") represented by James R. Gogan, were granted Intervenor status.

Subsequently, MAG withdrew as an Intervenor and participated in the public session

only. MEUNSC did not participate in the hearing.

[14] Direct evidence of Paul Chernick, of Resource Insight, Inc., was filed by

the CA. Mr. Chernick testified at the hearing, and had filed responses to IRs, as did

Todd Williams, of Navigant Consulting, who filed direct evidence and testified on behalf

of the Province. The direct evidence and IR responses of John Athas of LaCapra

Associates, on behalf of the SBA, as well as the direct evidence and IR responses of

Mark Drazen of Drazen Consulting Group, Inc., on behalf of Avon, were filed but Mr.

Athas and Mr. Drazen did not testify because none of the parties required their

attendance for the purpose of cross-examination.

[15] S. Bruce Outhouse, Q.C., appeared as Board Counsel. Jack Bernstein

and Stuart Bollefer of Aird & Berlis LLP, and J. Richard Hornby, of Synapse Energy

Economics Inc., filed direct evidence and IR responses. They testified via telephone

conference on behalf of Board Counsel.

[16] This Decision follows the hearing of the Applications over the period from

July 16-18, 2012, inclusive.

2.0 THE APPLICATION

[17] In its Application, PWCC says it is " ... applying for approval of an

arrangement that would allow it to acquire control of NPPH and enter into agreements

that would enable NPPH to self-supply electricity to the Mill" (Exhibit P-3, p. 5). The

self-supply requires a relationship with NSPI whereby certain assets are dedicated to

the use of a partnership in which initially each of NPPH and NSPI will be limited

Document: 206878

- 8 -

partners. In exchange for the dedication of the assets, NSPI would receive prescribed

distributions of cash tied to a defined quantity of electricity consumed by the mill. The

proposed structure would allow PWCC to utilize tax losses of NPPH, and NSPI to

receive inter-corporate dividends which, unlike revenue from the sale of electricity,

would not be subject to income tax.

[18] PWCC also proposes that NPPH would self-supply steam through a

dedicated use agreement with NSPI for certain quantities of steam generated from the

adjacent Biomass Plant owned by NSPI.

[19] The term of the arrangement is seven and one-half years.

[20] In its Application, NSPI asked the Board to approve, as filed, the Load

Retention Tariff Pricing and Dividend Calculation Mechanism (the "Mechanism") and the

Dedication of Use Agreement for the dedicated facilities ("DUA 1 "); the arrangements

regarding the Biomass Plant including the Dedication of Use Agreement for that facility

("DUA2"). It also asked for approval to extend the 2012 General Rate Application Fixed

Cost Recovery Deferral ("FCR Deferral") during 2013 and 2014 and to apply dividends

received for fixed costs contributions from NPPH to the FCR Deferral, and approval to

account for the arrangements on a cost basis, and for the arrangements to cease if

NSPI is unable to follow "rate regulated accounting for external reporting purposes at

any time in the future" (Exhibit P-4, p. 26). Its final request was for:

Confirmation from the Board that, subject to the usual requirements of prudent operation

of the utility, NS Power will not be at risk for any consequences of the arrangements

proposed herein, including tax consequences.

[Exhibit P-4, p. 26)

Document: 206878

2.1

(21]

- 9 -

Load Retention Tariff Pricing and Dividend Calculation Mechanism

The Mechanism is set out in Appendix E of PWCC's direct evidence. It is

stated to be available only to the partnership that owns the mill, and is for a term ending

December 31, 2019. The partnership is required to reduce its electrical load in a similar

manner to customers of NSPI who take service under interruptible riders.

[22] The proposed LRT states:

This Mechanism is intended to result in Nova Scotia Power Inc ("NSP!") rece1v1ng

dividends from NPPH and direct compensation from the Partnership in an aggregate

amount economically equivalent to and determined by reference to NSPI's otherwise

incremental costs of serving the Mill including all variable costs, plus a significant positive

contribution to fixed costs, with the result that other customers are better off by retaining

the Mill load rather than having the Mill shut down and make no contribution to fixed cost

recovery. The dividends will provide equity distributions to NSPI for its dedication of

certain of its generating facilities ("Facilities") to the use of the Partnership.

[Exhibit P-3, Appendix E, p. 1)

[23] As discussed in greater detail later, NSPI is entitled to receive dividend

payments calculated in accordance with a formula set out in the tariff, as well as

payment for any energy taken by the mill above what is produced by the dedicated

facilities. In addition, NSPI is to be paid an administration fee of $20,700 per month.

[24] NSPI is entitled to terminate DUA 1 at any time upon seven days' notice in

its " ... sole and unrestricted discretion ... ". Further, the tariff requires that NSPI terminate

DUA 1 on specified conditions, unless the Board orders otherwise, including: NPPH's

failure to make any payment on time; NPPH's inability to declare dividends; written

notice from CRA of revocation of the ATR; any action by PWCC " ... that would

jeopardize the validity of the tax consequences of the structure provided for. .. " in the

ATR; changes to Generally Accepted Accounting Principles ("GAAP") preventing NSPI's

use of rate regulated accounting for external reporting purposes; or, direction by the

Board. In all but the last of these instances there are short curative provisions.

Document: 206878

- 10-

[25) The Board notes that the tariff also provides that dividends are to be paid

to NSPI on a weekly basis, in advance, based on estimates, with true-up adjustments to

reflect actual consumption.

[26] The partnership is not to be charged with any cost recovery for Demand

Side Management {"DSM"), and no Fuel Adjustment Mechanism ("FAM") charges or

credits apply to the partnership. The rate is designed to cover actual hourly fuel costs.

2.2

[27]

Arrangements Relating to the Biomass Plant

As noted earlier, NSPI owns the cogeneration biomass fired boiler (the

"Boiler") located on property adjacent to the mill. This Boiler and the arrangements

between NSPI and NPPH were the subject of a hearing before the Board in 2010.

[28] The Boiler creates thermal energy in the form of steam to generate

electricity. Pursuant to the Renewable Electricity Regulations, N.S. Reg155/2010,

made pursuant to the Electricity Act, R.S.N.S. 2004, c. 25, NSPI is entitled to include

the electricity generated by the Biomass Plant as part of its Renewable Energy

Standards ("RES") compliance requirements.

[29] NSPI will continue to own and operate the Biomass Plant. Under the

terms of DUA2, NSPI dedicates to the use of the partnership a 24% undivided interest

in the Boiler, which entitles the partnership to 24% of the thermal energy produced by

the Boiler. This energy is then used to heat and operate the mill, and is intended to be

a self-supply.

[30] NSPI described the arrangements in its Application thus:

NS Power plans to operate the Port Hawkesbury Biomass plant. A dedication of use

agreement will exist for the proportional component of the steam plant that supplies the

Partnership, so that the Partnership will be self-supplying steam. NS Power will be

provided equity distributions by way of Second Preferred Shares based on the mill's

anticipated steam consumption. This will result in tax-effected value to NS Power of

Document: 206878

2.3

[31 J

- 11 -

$4.72 million, with up to 24% of the biomass steam production being taken by the mill. In

addition, the mill will provide sufficient fuel to produce its required steam.

The Partnership will supply various services to NS Power, such as water, compressed

air, fire protection, demineralized water and storeroom, for an annual cost to NS Power of

$750,000. In certain circumstances, NS Power will operate but have no responsibility to

maintain such common services. This will be documented in a Biomass Operating

Maintenance and Shared Services Agreement. ...

[Exhibit P-4, p. 20]

Tax Structure

Both NSPI and PWCC point to the joint request made by their respective

tax advisors to CRA for an ATR on the proposed structure. They confirmed both in

direct evidence and testimony at the hearing that a favourable ATR is a condition

precedent for the proposed arrangements. If it is not granted, neither party will proceed

further. PWCC describes the request thus:

[32]

[331

2.4

[34]

.. the Mill intends to self-supply electricity and steam via the facilities and Boiler DUAs,

wh1ch would form a critical part of the Mill's restructuring to enable the Partnership to

earn a profit from operating the Mill. This would enable NPPH to pay preferential cash

dividends to NSPI on its preferred shares and further dividends to NSPI on its common

shares. PWCC and NSPI have jointly requested an Advance Tax Ruling from the Canada

Revenue Agency to ensure that the tax treatment noted above will be accorded to NSPI

for dividends on its preferred and common shares of NPPH, and that there will not

otherwise be any adverse income tax consequences on NSPI or PWCC. A favourable

Advance Tax Ruling is a prerequisite to PWCC's investment in the Mill and obviously

integral to the overall electricity and steam self-supply arrangements discussed above.

[Exhibit P-3, p. 16]

NSPI says in its Application that:

" ... in the absence of the ATR, it would not be prudent to proceed with the proposed

transaction. On that basis, NS Power suggests that Board approval of the proposal be

conditional upon receipt of the ATR."

[Exhibit P-4, p. 17]

The Board discusses this issue later in this Decision.

The Agreements

NSPI listed the relevant agreements underpinning the structure of the

arrangement and the proposed LRT for the mill, all of which have been provided to the

Document: 206878

- 12-

Board for review. The Board has synthesized a brief description of each document, as

understood by the Board, for the purposes of this Decision, as follows:

1. Load Retention Tariff Pricing and Dividend Calculation Mechanism -

described in Section 2.1 above.

2. Net Settlement Model - appears as Appendix 1 to the Net Settlement

Agreement and also at the end of the Mechanism; it is intended to illustrate " ... the value

flow methodology applicable to the net settlement provisions agreed ... " by the

partnership and NSPI regarding " ... (i) the net settlement of Energy delivered by the

Partnership to the System and the subsequent delivery of electricity by NSPI to the

Partnership, and (ii) the provision for payment by the Partnership for electricity which is

consumed by the Partnership in excess of the amount of Energy generated by the

Facilities ... " (Exhibit P-7, p. 7).

3. Net Settlement Agreement - the agreement between NSPI and the

partnership whereby the partnership is to deliver the energy produced by the dedicated

facilities under DUA 1 to the NSPI electricity transmission system in exchange for which

NSPI delivers an identical quantity of electricity to be used by the mill to make paper. If

there is an excess of energy produced over the amount consumed, it can be carried

forward. The agreement adopts the Net Settlement Model referred to above.

4. Facilities Dedication of Use Agreement ("DUA1") - the agreement

between NSPI and the partnership whereby NSPI dedicates the use and enjoyment of

certain hydro and wind electricity generating facilities to the partnership, which will then

use the facilities to generate the same volume of electricity which the mill operation will

consume. The partnership will reduce its load when NSPI deems it necessary. NSPI

Document: 206878

- 13-

has the right to terminate the agreement on seven days' notice. The facilities remain

the property of NSPI, and it remains responsible for their capital requirements.

5. Boiler Dedication of Use Agreement ("DUA2") - the agreement between

NSPI and the partnership whereby NSPI dedicates a 24% undivided interest in the

boiler and related assets at NSPI's cogeneration biomass plant to the partnership which

is then entitled to use that interest to generate steam to help heat and operate the mill.

The arrangements relating to the biomass plant are outlined in Section 2.2 above. NSPI

remains responsible for the capital requirements of the biomass plant. NSPI has the

right to terminate the agreement on seven days' notice.

6. Facilities Operating and Maintenance Agreement ("FOMA")- pursuant to

DUA 1, the partnership and NSPI agree on the manner in which the dedicated facilities

will be operated by NSPI as an independent contractor and not as an agent of the

partnership. The partnership may terminate the agreement if NSPI fails to operate and

maintain the facilities, and NSPI may terminate on seven days' notice if payments

required under the agreement are not made. NSPI agrees to carry out all necessary

operations of the facilities, and the partnership agrees to pay the prior week's estimated

billing. NSPI is required to deliver to the transmission system all of the energy output

of the facilities as set out in DUA 1. The prescribed rate payable by the partnership for

services is stated to be $10 per MWh. The agreement contains provisions for resolution

of disputes.

7. Indemnity Agreement- this agreement between NPPH and NSPI provides

for certain indemnities from NPPH to NSPI for environmental claims, for employee

Document: 206878

- 14-

related claims and for risks associated with the ATR. The agreement also provides that

NSPI will have no liability to NPPH for termination of either or both DUA 1 and DUA2.

8. Real Time Energy Protocol - this document sets out the manner in which

the incremental cost of electricity taken by the mill from the NSPI system is calculated

and recovered. It provides:

The purpose of this Protocol is to ensure that PWCC covers the actual incremental cost

of electricity for all electricity taken from NSPI's system and that NSPI's customers do not

incur any additional cost as a result of PWCC load requirements. Whenever this Protocol

can be interpreted in multiple ways, the option that best protects the interests of NSPI's

customers (which for clarity does not include PWCC) shall prevail.

Based on the following Protocol, PWCC and NSPI agree to operate under a Cost-

Quantity (CQ) Pair structure on a day-ahead and hourly basis. NSPI will provide PWCC

with hourly price forecasts for specific blocks of incremental load and PWCC shall

provide NSPI its forecast load requirements within the CO-Pairs based on these price

forecasts.

[Exhibit P-3, Appendix J]

9. Boiler Operating Maintenance Agreement ("SOMA") - pursuant to DUA2,

the partnership and NSPI agree on the manner in which the Boiler is operated by NSPI

in terms similar to those found in the FOMA, and obliges NSPI to deliver 24%, or not

more than 1.2 million gigajoules ("GJ"), of the steam/thermal energy output of the Boiler

to the mill.

10. Shared Services Agreement - made between NSPI and the partnership,

the agreement notes that the partnership owns the mill, NSPI owns the biomass

cogeneration plant, and the partnership owns defined assets within the cogeneration

plant facility and at the mill which are used to provide shared services as outlined in the

agreement, and requires each of the parties to provide to the other party the

responsibilities outlined. While the term of the agreement is ten years, with rights to

renew for successive four year terms, it can be terminated earlier and, in particular, by

NSPI on seven days' notice. NSPI is required to pay $62,500 monthly, in advance, for

Document: 206878

- 15-

the provision of shared services. The partnership is required to provide adequate fuel to

meet its steam requirements, and to pay NSPI $393,333 monthly in advance for the

steam. These payments may escalate after seven years based on a CPI formula.

11. Shareholder and Related Party Agreement - this agreement between

PWCC or an affiliate, NSPI, and Port Hawkesbury Paper Inc. ("PHP") provides for NSPI

to have 30% of the common shares of NPPH (to become PHP) and all of the first and

second preferred shares. It imposes an obligation on PWCC or its affiliate and gives it

rights in place of a new company ("NewCo1 ") which holds the remaining 70% of the

common shares. The agreement prevents PHP from taking certain actions without the

consent of both NSPI and NewCo1. It includes "Put and Call" options in the event that

either of the DUAs are terminated, or one of the parties becomes insolvent It also

imposes restrictions on the transfer of shares, includes 'Tag Along" and "Drag Along"

rights which NSPI may exercise or have imposed upon it, as well as a dividend policy

which confirms the intention of PHP to pay dividends as required.

12. Limited Partnership Agreement - this agreement is made between NSPI

and Port Hawkesbury Paper GP Ltd. ("PHPGP Ltd.") who form the limited partnership.

NSPI is a limited partner and PHPGP Ltd. is the general partner. They will admit NPPH

to the limited partnership if the PWCC and NSPI applications are approved by the

Board, and a favourable ATR is received, as a result of which NPPH transfers the mill to

the limited partnership in exchange for a defined interest. The partnership is for the

manufacture and sale of paper and will be managed by the general partner. The

partnership may not sell all or substantially all of its assets without the consent of the

limited partners, and the liability of each limited partner is restricted to its contribution

Document: 206878

- 16-

and any outstanding share of any undistributed partnership net earnings. The

agreement provides for the interests of each party and sets out the terms of the

payments due to the unit holders. It includes the distribution policy upon which the cash

distributions will be made.

13. General Partner Agreement - this agreement is made between NSPI and

PHPGP Ltd. and sets out the rights and obligations of PHPGP Ltd. as general partner.

It includes "Special Minority Protections" which prevent PHPGP Ltd. from taking certain

actions without having first obtained the written approval of NSPI, and prescribes the

basis on which related party transactions may occur.

[35] NSPI has requested approval of the agreements and documents as part of

its Application. The Board considers approval of the Mechanism below NSPI's request

for approval of the other agreements and documents is addressed as part of the

Board's discussion of its jurisdiction later in this Decision.

2.5

[36]

The Negotiations

Mr. Stern described, in his opening statement on behalf of PWCC, the

negotiations which led to the Applications:

In order to arrive at the proposal in front of the Board today, there were vigorous

negotiations carried out for more than six months between Pacific West and Nova Scotia

Power, with the participation of the government of Nova Scotia and the court-approved

appointed monitor.

Those negotiations are fully documented in the record of this proceeding, and

demonstrate the considerable effort made by all parties to achieve a resolution that

meets the business requirements of Pacific West and the mill, while at the same time

meeting the regulatory requirements for the applied load-retention tariff mechanism,

which will provide, in our view, a significant benefit to all other ratepayers.

[Transcript, p. 43]

[37] Mr. Bennett testified that the parties had undergone " ... a very difficult set

of negotiations ... " (Transcript, p. 489) in which the parties " ... started out at opposite

Document: 206878

- 17-

ends of the spectrum ... " (Transcript, p. 296). Agreeing that the negotiations were

vigorous as Mr. Stern had indicated, Mr. Bennett stated that NSPI was, over the lengthy

period, negotiating in the best interests of its customers. In response to a question from

Mr. Mahady, he said they were " ... negotiating as if it was our own money ... "

(Transcript, p. 289).

[38] Mr. Stern confirmed that the price in the LRT which was before the Board

is higher than his company's original objective, and he was aware that NSPI had sought

a shorter term for the LRT and an earlier re-opener date or trigger. In response to a

question from the CA about the re-opener, Mr. Stern testified in greater detail about the

nature of the negotiations:

MR. STERN: ... With respect, Mr. Mahady, as you've seen from the materials, we've

been going at this for over six months. To say that the negotiations were vigorous is an

understatement They were very, very hard, extensive negotiations. In that process, in

that process we indeed moved a great deal from what our original objectives were,

always looking at what our overall position was going to be for the business going

forward. And with all due respect, and it's hard for us to -- you say well -- you always

want to say, "Well, you can do this," because you're looking to get a deal done, but we

have reached the point in our negotiations where we've gone as far as we believe we can

prudently go to and that's why I'm saying -- that's why I'm saying that the terms that

we've presented here are our minimum terms. They already -- as a result of our

negotiations with Nova Scotia Power, we have modified our original objectives, shortened

the term, increased the risks that we're undertaking and really tried, really tried to meet

the requirements of a load retention tariff as articulated to us by Nova Scotia Power and

by our own counsel.

So we tried to take that into account and balance that with what we feel is required to

make this an investment that we're prepared to make and really a restart that we're

prepared to commit ourselves to. The last thing in the world we want to do is to get

involved in this mill and the restart of it -- and we're very committed to it, but the last thing

we want to do is be involved and do it in a way where we haven't gone far enough. We

haven't quite made it competitive enough to survive. And that's why, in our discussions

with the union we said, "This is what we have to have," and they understood that. And

we're saying to this Board, with respect, after all our negotiations with Nova Scotia

Power this is what we have to have. We've modified it as much as we can and, you

know, 'we don't want to appear disrespectful but we've reached the conclusion that this is

what's required. We hope very much that the Board can support that.

MR. MAHODY: Mr. Stern, your comments seem to put a great deal of weight on the

nature of the negotiations that you had with Nova Scotia Power. My understanding,

having reviewed the record in this matter, is that Nova Scotia Power indicated to you on

at least one occasion that they weren't really your counterparty in this matter and what

they could do would be to assist you with designing a rate which may be acceptable to

Document: 206878

- 18-

other ratepayers and may receive favourable consideration from this Board. Have I got

that wrong?

MR. STERN: They said that but they didn't act that way.

[Transcript, pp. 63-65)

[39] Mr. Williams, the consultant engaged by the Province to assist in the

negotiations, stated in his direct evidence:

Both parties bargained hard for their respective positions and, from my perspective, were

pretty far apart when I got involved in the discussions. Both parties also worked hard to

understand the other party's perspective and worked together to explore various

alternative approaches and arrangements. That they have been able to come to a

common agreement as reflected in the application given their different perspectives and

objectives indicates to me that the proposed Load Retention Rate Mechanism is a fair

deal for both parties and a fair deal for NSPI's customers.

[Exhibit P-26, p. 16]

[40] In closing submissions, Avon argued that it was the Stern group which

undertook the hard bargaining and that, NSPI, in representing customers' interests

should have " ... drawn a line in the sand". In response, Counsel for PWCC suggests

that this does not accurately characterize what the record shows, nor does it reflect the

evidence of Mr. Stern and Mr. Bennett.

[41] The Board has before it, as part of the record, over 3,000 pages consisting

of meeting notes, email communications, and draft documents between the teams

negotiating on behalf of NSPI and PWCC as well as Mr. Williams and the court-

appointed monitor. As noted in the hearing, the record is as full and complete as seen

by the Board.

2.6 Informal Submissions

[42] During the public session, the Board received presentations from two

registered speakers. Ray Larkin, Q.C., accompanied by officials of Local 972 of the

Communications, Energy and Paperworkers' Union (the "Union") and its National office,

Document: 206878

- 19-

offered comments in support of the proposal before the Board on behalf of unionized

workers and retired union members at the mill. Billy Joe Maclean, Mayor of Port

Hawkesbury, who spoke on behalf of MAG, strongly supported the re-opening of the

mill. They noted the accommodations made by current and former members of the

Union, suppliers and contractors, to allow the PWCC proposal to the mill's creditors to

go forward.

[43] The Board also received several letters of comment from members of the

public, none of which supported any subsidy of the costs of electricity for the mill.

[44] The Board appreciates that the speakers and members of the public have

taken the time to have their respective views made known.

3.0 ISSUES AND FINDINGS

3.1 Jurisdiction

[45] In this Application NSPI and PWCC seek, among other things:

[46]

(a)

(b)

Approval of the Mechanism, including DUA 1;

Approval of arrangements relating to the Biomass Plant, including DUA2.

Based on NSPI's pre-filed evidence it appeared that NSPI was seeking

approval of each of the 13 specific agreements previously described.

[47] Mr. Bennett clarified, however, that what NSPI expected was confirmation

that NSPI had negotiated a reasonable set of project agreements:

MR. OUTHOUSE: And what it said was -- I'm just going to -- it's not necessary to enter

this as an exhibit, Mr. Chair. This is just part of the Board's decision.

In paragraph -- starting at paragraph 30 through 33, after describing the contracts and

saying that to understand the prudence of the project it needed to look at the contract

terms referred to them as definitive contractual terms, signed contracts, talked about

which'were the most important contracts. And then said:

Document: 206878

"The Board is satisfied in general terms that NSPI has negotiated a

reasonable set of project agreements." (As read)

-20-

Now, is that the sort of approval you're talking about here?

MR. BENNETT: Yes.

MR. OUTHOUSE: Okay. You're not looking for a formal Order approving these

contracts?

MR. BENNETI: We're looking for acknowledgement that we've put together a package

that makes sense for ratepayers and for the mill. And to the degree that making that

decision requires knowledge of all of the agreements, we've provided the agreements for

that approval.

[Transcript, pp. 599-600]

[48] NSPI seemed to return to its original position in its reply brief; however,

the Board accepts the evidence of Mr. Bennett as that of NSPI, outlining the Company's

request to the Board.

[49] Avon suggested that the extent of the Board's jurisdiction should be to

supervise the use of facilities that are in the rate base and further that the Board has

authority to ensure that payments received related to the provision of electricity through

commercial arrangements related to the facilities, benefit ratepayers. Avon contended

that, while the Board has the authority to approve the Mechanism, the remaining

agreements and contracts, particularly those related to NSPI's arrangement surrounding

the Biomass Plant should only be reviewed, if at all, to assess if the Board is satisfied

that NSPI has negotiated a reasonable set of project agreements.

[50] Avon cautioned that the Board should not fetter its discretion under s.45(2)

of the Public Utilities Act, R.S.N.S. 1989, c.380, as amended (the "PUA'), to review the

reasonableness and prudence of NSPI's operating expenses by issuing a premature

declaration of prudence with respect to a complex set of private commercial

arrangements.

Document: 206878

- 21 -

[51] The SBA argued that the Board may only make orders with respect to

rates, tolls and charges and the dividend arrangements may be beyond the Board's

authority to approve.

[52] PWCC submitted that the Application falls within s.64 of the PUA as it is a

specific request for determination of the ultimate rate that NSPI will be entitled to charge

PWCC for the provision of electricity. If approved, PWCC noted that it will be

responsible for the payment of this rate for such service pursuant to the conditions

established by the Mechanism. PWCC goes on to say:

Having previously found the jurisdiction to consider "the approval of a well designed

LRT ... to help prevent the closure or relocation of an extra large industrial customer due

to economic distress", it is difficult to see how the Board might somehow lack jurisdiction

to consider the appropriateness of the underlying business arrangements necessary for,

and integral to, the proper implementation of such a rate, and to ensure it meets the

Board-approved regulatory requirements.

[PWCC Closing Submission, pp. 45-46]

3.1.1 Findings

[53] While unique and complex, this transaction involves a supply of power and

energy in exchange for "dividends" that recover the incremental cost of supplying the

power and energy and make a contribution to the fixed costs of producing that power

and energy. The calculation of the rate is designed to recover the incremental cost

obligation, including a contribution to fixed costs for the service. The actual usage

multiplied by the rate determines the liability of the partnership. The non-taxable

dividend is a settlement mechanism designed to satisfy the liability. As such, the Board

finds it meets the test of a charge to be paid to a public utility for services rendered or

facilities provided (see s.44 of the PUA). The Board is satisfied that, pursuant to the

provisions of s.44 and s.64 of the PUA, it has jurisdiction to approve the Mechanism and

the tariff in a broad sense, as described in the tariff and various documents.

Document: 206878

-22-

[54]

Based on the evidence of Mr. Bennett, the Board is not required to

all of the 13 project agreements. The Board does make comments on the

agreements in the risk section of this Decision.

3.2

[55]

Necessity and Sufficiency

The opening statements of the CA, the SBA, PWCC, and the Province all

address the question of whether a load retention rate is necessary for the mill operation,

and whether the proposed rate and mechanism is sufficient. Both the CA and the SBA

questioned whether the reduced rate is in fact necessary, in contrast with the position of

PWCC and the Province who claim that it is, for PWCC to take over and operate the

mill.

[56] Mr. Stern, in his opening statement. described PWCC's desire for a long-

term and sustainable operation of the mill, saying:

MR. STERN: ... In order to be successful on a long-term basis -- and I emphasize that

because we are only interested in this if we can reach the conclusion -- it can be

successful on a long-term basis. In order to be successful on a long-term basis, it is

simply imperative that the Port Hawkesbury mill substantially reduce its input costs.

Electricity is the mill's biggest cost. As is clear from our restructuring plan, the recent

history of pulp and paper mills in Nova Scotia and elsewhere, and as supported by the

TO Report that NSPI has filed in this Proceeding, unless the Port Hawkesbury mill can

become a very low-cost operation, it simply will not succeed.

A truly extraordinary amount of effort has gone in to developing this proposal for a load-

retention mechanism that is critical for us to complete the acquisition of the mill and

resume the manufacturing of paper while at the same time providing a significant

contribution to the fixed costs of the utility, to the benefit of all ratepayers in Nova Scotia.

This is a compelling and beneficial scenario for everyone involved.

The arrangement before the Board is comprehensive. In reaching it, we've agreed to the

maximum costs that are acceptable to us, including taking on all risk for fuel changes.

The 30 percent equity interest provides an equitable and substantial participation in the

future profits for other ratepayers. The $2 per megawatt fixed costs and cost-saving for

the biomass project, together, provide a significant minimum contribution to fixed costs of

the utility.

Document: 206878

-23-

We also recognize that, for the residents of Eastern Nova Scotia, the reopening of the

mill is of critical importance. This is reflected in the enormous support that has been

provided to the process and the development of a sound restructuring plan. We very

much appreciate the support that it was given.

(Transcript, pp. 41-44 J

[57]

The CA explored PWCC's desire to produce supercalendared paper at the

lowest cost with Mr. Stern:

MR. MAHODY: And you state further on in that paragraph that electricity is the mill's

biggest cost

Does it follow, Mr. Stern, that in order to be the lowest-cost producer of SC paper, the mill

requires to-- requires, effectively, the lowest electricity costs?

MR. STERN: No, sir, it doesn't.

MR MAHODY: Okay. The effective electricity costs which you're seeking in this

application, have you determined where they would fit from a competitive cost

perspective on a North American basis?

MR STERN: Not comprehensively. We could try to dig into that. Our focus has been

the cost structure of the mill, complete, all -- as an entity, and that's why we have focused

-- not only we're talking here about electricity costs but, similarly, I mean, the efforts going

into all the other areas of costs of the mill have been similarly rigorous.

MR. MAHODY: But is it fair to say that if electricity represents your biggest area of cost,

that the effective rate of those costs needs to be either the lowest or among the lowest on

a North American basis?

MR STERN: Yes.

MR. MAHODY: And in this application, Mr. Stern, there are two mechanisms which

combine to reduce the effective electricity costs for the mill. There's the load retention

mechanism and then there is the dividend transfer mechanism. Do you agree with that?

MR. STERN: I'm not sure I heard the first part of your question. Perhaps you should just

repeat it so I'm correct.

MR. MAHODY: Sure. In order to reach your goal of the --among the lowest electricity

costs, this application achieves that through the load retention mechanism, coupled with

the dividend or tax structure. Is that correct?

MR STERN: Yes, that's correct.

MR MAHODY: And so the load retention rate has the effect of bringing down the rate to

be charged electricity to an acceptable level to Pacific West?

MR. STERN: The load retention rate, together with the CRA ruling, would together bring

it to a rate that, in fact, is higher than our original objective in the negotiations in the

process we went through, considerably higher, but we determined that we would live with

and go forward on that basis.

Document: 206878

[58]

-24-

MR. MAHODY: And if you can achieve, Mr. Stern, your anticipated cost savings for

electricity and the other areas which you've identified, when do you anticipate the mill

would begin to turn a profit?

MR. STERN: It would be in the year 2013.

MR. MAHODY: And is it fair to say, Mr. Stern, that your business objective is to operate

the mill at a certain level of profit during the term of this arrangement, the seven and a

half years that the rate's been applied for?

MR. STERN: Yes, of course, as with any business, that's our objective.

[Transcript, pp. 47-50)

Mr. Stern responded to the SBA by saying that in view of the competitive

environment in the paper manufacturing business, " ... it may well be that it is only the

lowest-cost producer that really is going to be soundly profitable." (Transcript, p. 93)

[59] He elaborated further in response to Ms. Rubin:

MS RUBIN. Do you perceive this deal or this arrangement to be a risky one?

MR. STERN: I think it's a difficult thing to do just about anything in the paper industry

today. If I can go on for a moment-- I've been told to keep my answers short. I'm not

doing a very good job on that. But I think it is a very challenging one, but l do think it's a

worthwhile one. Otherwise, we wouldn't be here.

The -- as you know, the consumption of paper is declining at a material level, and there's

more production capacity than is needed to meet the market You know, so it's risky

because of the uncertainties of the market, in terms of pricing of paper, volume of paper.

There's risk attached to what the future prices of fuel will be.

But we've reached the view -- we've reached the view, with the -- all of the things being

put into place -- I mean, there's some very talented people in Port Hawkesbury who've

agreed to a labour agreement that is very progressive and very flexible, and can make a

big difference in terms of the costs and the effectiveness of production. There is a

marvellous physical set of assets there, probably the best paper machine in North

America. It's a phenomenal asset.

If we can put into place the power rates that are needed and all the other things we're

doing, we think that we will have a very sound opportunity for this to be a successful

operation.

But nobody would say that it -- there wasn't, you know, significant risks in terms of going

into the paper industry with just about any mill today, and here's one that we have to

restart that has complications to it. We've got to break into the market and all those

things.

Document: 206878

[60]

-25-

But if we can -- if it makes sense for us to have the power rate we need and we can get

the CRA approval that we need, we then think we will have an operation that should start.

[Transcript, pp. 79-81]

Mr. Stern told Mr. Mahady that PWCC was not prepared to increase its

contributions to fixed costs:

[61]

... our concern is that we not burden the mill to any greater level of fixed costs than we

absolutely have to because, as you appreciate, the paper industry is challenging and it's

going to be -- it's going to be a very hard process getting this mill back in and getting the

share of the market that we have to take because the competitors are going to fight us

very hard. So that's why we're very cautious of not wanting to take on any more fixed

costs than we absolutely have to.

[Transcript, p. 67]

However, Mr. Stern testified in response to the SBA about the impact of

an increase in costs on the viability of the business, particularly fuel costs:

MR. STERN: Without getting into the details of the confidential information, at $5 or $10

increase, our business wou!d obviously be a lot less attractive, but we would sttl! be

there. We would be there digging, trying to find other ways to save money to try to make

up for it, but we would still be viable at that level.

We wouldn't be here --we wouldn't be here if we were starting it up that close to the line,

in theory. I mean, this is just a model you're using. The real world is-- always turns out

a bit differently. But-- so we're still, you know, we're still there. We're not on the line, but

many things often change at once. But if it's just the power costs, because the fuel costs

are up $5 or $10, we're going to still be in business and ---

MR. BLACKBURN: But if the fuel costs went up $20, you may not be?

MR. STERN: You know, if everything else was the same, we would still be hanging in

there. It would be getting pretty marginal, but we would still be there. We're not going to

run away. We -- you work on these things on a long-term basis to -- and you're always

hoping that the market is going to get better and you're going to find other ways.

There's all sorts of other things we're going to be working on, you know, to lower our

costs, and although we say that fuel costs are our biggest single cost, they're just one of

many costs, and there's the revenue side. I mean, fuel is critical. We need what we're

asking for here.

We know going into this that we're not going to have the lowest cost fuel of anybody in

North America. We know that. We know we buy electricity for less in our other m1lls.

We're doing that today. We're doing that last year and the last several years. We're

paying less for electricity than we're proposing here. We're proposing this because we

understand that this is the only level that this jurisdiction can go to with not just the

regulatory process, but the nature ---

Document: 206878

[62]

-26-

MR BLACKBURN: Okay. So in a nutshell, you're saying that with respect to the fuel

costs and other incremental costs, if things get out of proportion, you're prepared to make

some adjustments and stick with the mill?

MR STERN: We can tell you we've done that before and that's why we have a capital

structure in this case that we think gives us a certain level of resilience and staying

power. And you know, and I can tell you, if need be on a confidential basis --we can

show you times where we've worked harder than ever with mills during periods where

they've been losing money and eventually seen them come around so that they're once

again profitable.

That's what you do with a business. You don't cut and run, but at the same time, you

don't get into them unless you think you've got a good sound plan and you've got a

capital plan that will allow you to work through a!! of those issues.

[Transcript, pp. 1 08-112]

Both counsel for the SBA and Avon pursued with Mr. Bennett the question

of the necessity of a LRT if the mill becomes profitable. Ms. Rubin suggested there

should be a trigger to evaluate whether the rate should continue:

MS. RUBIN: ... what I'm asking is should the Board review the rate to evaluate its

necessity at the proposed level in light of excessive profits?

MR BENNETT: Well, in the event that there are profits, it's beneficial for everyone,

including ratepayers, and if the profits are significant to the degree as they're forecast in

the business plan, then they will approach the Load Retention Rate that's been agreed

on in the past.

MS. RUBIN: But it may not be necessary to be on a Load Retention Rate at all, and I'm

asking in light of excessive profits should the Board review the rate to evaluate its

ongoing necessity?

MR. BENNETT: That's not the package that's being proposed. The package that's being

proposed is a package that provides some degree of stability for PWCC's planning

purposes over the next seven and a half years and affords the ability for us to share in

success if that success can be had.

And by "we" I mean the global "we" customers, but that's not the nature of the proposal

that's here today.

MS. RUBIN: I understand that's not the nature of the proposal, but I'm asking that the

reason for a Load Retention Rate is because it's necessary, and if the rate is no longer

necessary because of excessive profits, shouldn't there be a trigger if there's excessive

profits?

MR. BENNETT: Well, that's not the arrangement that has been successfully negotiated

at this point. So I'm not saying that this should be opened in the event that people are

uncomfortable that a contribution -- a too high of a contribution is being made to fixed

costs.

Document: 206878

[63]

-27-

At the end of the rate period there's an opportunity to do that when a new rate is set. But

again, this is a very complex matter and we negotiated for the shortest term possible to

afford that opportunity for review, but a term shorter than seven and a half years was not

acceptable.

[Transcript, pp. 485-487]

In its opening statement, PWCC maintained that if the mill is profitable,

NSPI will share in that profit by way of the common share dividends.

[64J In his direct evidence, Mr. Athas, the SBA consultant, opined on the

concept of using an LRT, relating it to the mill's situation:

[65]

I believe that rate reductions from Load Retention Tariffs are beneficial to other

ratepayers and the local economy only when they are demonstrated to be both

'necessary' due to a business downturn vulnerability, to aide a business in its plan to

become competitive in its markets, or competitive customer generation opportunity, and

'sufficient' to actually change the economics of an industrial customer continuing to

remain in business or considering the restart of a dormant operation. Loss of large

electrical load negatively impacts other electric ratepayers and could result in both a

direct and an indirect loss of jobs in Nova Scotia. The direct loss of jobs refers to workers

laid off when ttie Mill closed. The indirect effect refers to a multiplier effect where JObs are

lost as a result of the Mill no longer purchasing from suppliers in Nova Scotia. This

unemployment increase will most likely result in less retail purchasing and less household

consumption of electricity, further increasing electric rate upward pressures as NSPI's

fixed costs are spread over reduced total electric sales.

[Exhibit P-24, p. 10]

In Mr. Athas's opinion, there is insufficient evidence on the record to

conclude that the mill would not re-open without the LRT. However, in response to the

question whether PWCC or NSPI had " ... provided adequate justification of the

necessity of the proposed complex LRT arrangement. .. ", he answered in the

affirmative, and went on to comment on PWCC's restructuring plan. Mr. Athas

concluded that:

... this discount is greater than the level necessary merely to operate competitively.

1 believe that the level of discount granted by this arrangement is greater than the level

needed to simply be a solvent, profitable operation.

[Exhibit P-24, pp. 16-17]

Document: 206878

-28-

[66] Mr. Athas stated that permitting the mill to "achieve minimal profitability"

would not be desirable and sought assurance that NPPH could not accumulate excess

profits instead of declaring dividends. He suggested that there should be an increase in

the mill's contribution to fixed costs as it becomes more profitable, concluding that the

proposed LRT is more generous than is necessary.

[67] PWCC stated in its closing submission that the evidence before the Board

satisfies the test of necessity to retain the mill's load, and sufficiency to allow its

operation. It stated that the granting of its Application is a prerequisite to the re-opening

of the mill. It suggests that there was no "fundamental challenge" to the PWCC

restructuring plan which shows the LRT is sufficient to allow the mill operation to be

successful. Additionally, PWCC pointed to the report which NSPI had commissioned

from TO Securities, which in PWCC's view supported its business plan.

[68] In its closing submission, NSPI said:

The future of the Port Hawkesbury paper mill has been the subject of numerous

regulatory proceedings over past decades. It has now reached a point where, pending

the response from CRA, the parties to this proceeding will be deciding whether this

facility will have an opportunity to continue to operate. While the Board's approval of this

Application will not guarantee long-term success of the mill, an approval will provide a

realistic opportunity to help customers with the fixed costs of the system.

NS Power supports the Board's approval of its joint Application with PWCC. The

arrangement will provide for the continued operation of the Port Hawkesbury facility,

while providing a guaranteed contribution to utility fixed costs that would otherwise not be

realized. Further, the arrangement provides NS Power's customers with an opportunity to

increase their benefits should the mill flourish. It is a deal which is in the public interest

and beneficial to all customers.

[NSPI Closing Submission, p. 4]

[69] The CA identified the test which the Board must apply in such an

Application:

This Board succinctly set out the test to be applied when considering an application for a

Load Retention Rate in 2011 NSUARB 184:

Document: 206878

-29-

[174} Load retention tariffs are utilized in circumstances where providing

the discounted tariff benefits not only the customers qualifying for the

tariff but also the other customers on the system. Other customers will

benefit if the customer receiving the discounted tariff would cease

purchasing power in the absence of a discount and the discounted tariff

fully recovers the marginal cost of supplying power to the customer, in

addition to making a contribution to the fixed and common costs of a

utility's electricity system.

{175] Mr. Todd succinctly set out the legal test:

Hence, an LRT is in the public interest if and only if its use is limited to

circumstances in which:

(i) making the LRT available to the customer is necessary

and sufficient for retaining the load; and

(ii) the total revenue received from the LRT customer

exceeds the total incremental cost of serving that

customer.

[CA Closing Submission, p. 2]

[70] Mr. Mahady went on to address whether other ratepayers are receiving a

benefit by the contribution to fixed costs. The Board considers this in greater detail

below. Suffice it to say at this point, Mr. Mahady concludes the benefit is minimal at

best.

[71] The SBA submits that PWCC and NSPI have met the tests of necessity

and sufficiency "to justify a special rate", but that the rate should be amended to provide

for greater contribution to fixed costs. In other words, there should be a LRT, but not

the one proposed. As suggested by its consultant, the SBA is satisfied with a "larger

discount in the early years ... in order to give PWCC some flexibility in operating costs in

a volatile industry" {Exhibit P-24, p.19), but asks the Board to order higher contributions

in later years of the term.

[72] Saying that a load retention rate ("LRR") must benefit other ratepayers, be

necessary and sufficient to retain the load and exceed the incremental cost of serving it,

Document: 206878

- 30-

Ms. Rubin adopted the test identified by the CA. She elaborated a little further by

adding the following from the Board's 2011 NPB Load Retention decision:

[185] The test that the Board has applied in this case is whether, on a balance of

probabilities, the other customers of NSPI would be better off by having NPB remain on

the system (on the load retention rate) than those customers would be if NPB stopped

taking service. The test is satisfied if the load retention rate fully recovers avoided costs

of supplying NPB and makes a positive contribution to the fixed and common costs of

NSPI. The Board will not, and indeed cannot, approve a rate in circumstances where the

other customers are worse off (because they are subsidizing NPB) than they would be if

these customers left the system.

[Avon Closing Submission, p. 3]

[73] Ms. Rubin went on to suggest that there was limited evidence of the

necessity of the rate during the hearing and what little there was came from PWCC

through Mr. Stern's testimony. Ms. Rubin submitted:

The Applicants have asked the Board to approve the entire package "as is" and it is open

to the Board to do so if it is satisfied that the Pricing Mechanism and the entire set of

arrangements surrounding the Biomass Plant are both necessary and sufficient to allow

the Mill to resume operation and if the Board is further satisfied that other ratepayers will

not be subsidizing the Mill's operations.

[Avon Closing Submission, p. 24)

[74] Ms. Rubin concluded that the rate does not meet the "basic test" for a

LRT. Her submissions regarding the sufficiency of the contribution are discussed in

greater detail below.

(75] Mr. Williams' evidence was that the proposed rate mechanism

represented a "fair deal" for both PWCC and NSPI and for NSPI's customers (Exhibit P-

26, p. 16). He also described it as striking "the appropriate balance" and opined that

" ... any material movement - either way - from this delicate balance point. .. " might

make the customers worse off than they would be under the proposal (Exhibit P-26, p.

17). However, the Province made no closing submissions on the necessity or

sufficiency of the arrangements. It commented, in its opening statement, on the

Document: 206878

- 31 -

importance of the mill to the economy, and went on to say the test had been met,

adopting PWCC's view that it is necessary for it to acquire control of the mill, and it is

sufficient for its long term viability. The Province's opening statement observed that if

the mill does not re-open there will be no contribution to fixed costs.

3.2.1 Findings

[76] In the September, 2011 hearing before the Board, NPPH and Bowater

("NPB") proposed that the LRT be extended to situations where, due to economic

distress of NSPI's largest customer(s), closure of the business was potentially imminent.

The Board found it had jurisdiction to permit a LRT in such circumstances; however,

while finding that Bowater qualified for a new LRR, it made amendments to the

proposed rate.

[77] The Board adopted the test referred to above by both the CA and Avon.

Identifying challenges of currency fluctuation, reduction of demand for paper, high costs

for fibre and labour, and significantly expensive electricity, which the Board described as

"daunting", and based on the evidence before it, the Board concluded that both

companies met the necessity part of the test. The Board recognized that evidence of

sufficiency was difficult to provide, but based on the terms it approved, accepted the

evidence of Bowater on this issue.

[78] As for NPPH, because of the announcement of the mill closure, and the

process to find a new owner, the Board said:

When the owner is identified, provisions of the LRT, as proposed by NewPage, should be

followed in that the new company should apply to NSPI who would then come to the

Board. The focus of any examination by NSPI and the Board would be whether the mill

and its new owner continue to meet the necessity test. In saying that, the Board believes

that the LRR being approved in this Decision would have been an appropriate LRR for

NewPage, had it continued to operate the mill.

[2011 NSUARB 184, para. 224]

Document: 206878

-32-

[79] The financial challenges facing NPPH were previously recognized by the

Board in the biomass decision of October, 2010 [2010 NSUARB 196]. It appears to the

Board that there has been no improvement in the intervening years. The mill has not

manufactured paper and has been in a "hot idle" state since September, 2011.

[80] The Board understands that PWCC will not proceed with the acquisition of

the mill if the present Application is not approved or if changes are made to the proposal

in either the financial terms, or the term, of the relevant Agreements.

[81] The court-appointed monitor went through a process of seeking buyers for

the mill over a period of approximately six months. The Board notes that only two

bidders who intended to carry on operations came forward, and that the bid of PWCC

was accepted, subject to the approval of the Court and creditors of NPPH. In the view

of the Board, this in itself is indicative of the necessity of a load retention rate in order

for the mill to operate.

[82] The Board also notes that the Province, the representatives of the union,

and Mayor Maclean all point to a need to maintain the mill operation as a vital part of

the economy of Nova Scotia, and particularly the northeastern part of the province.

[83] Pursuant to the provisions of the PUA, the Board regulates NSPI in the

public interest. In its 2011 decision, the Board stated:

[171) Moreover, the establishment of an LRT based on economic distress is grounded

on long-established and well accepted ratemaking principles applied in various

jurisdictions, including by the Board in this province.

[172) Further, such rates are in the public interest. In the end, the approval of a well

designed LRT, whether it is to avoid the switching of load in the instance of co-generation

by the customer, or to help prevent the closure or relocation of an extra large industrial

customer due to economic distress, benefits all other customer classes on the system. In

the Board's opinion, such a result provides for rates that are reasonable and appropriate

for all customers.

[2011 NSUARB 184, paras. 171-172]

Document: 206878

- 33-

[84] The Board observes that the Bowater mill closed during the course of this

proceeding. Even with the LRT granted in November, 2011 to Bowater, the operation

was clearly not successful as its owners had hoped. While this might lead to questions

about the efficacy of the LRT, the Board notes that in the case of the NPPH mill, both

Mr. Stern, who testified to the success PWCC has had with other mills, some of which

were struggling, and the evidence filed by NSPI as a result of its due diligence review of

the PWCC business plan, suggest that the proposed rate and payment mechanism may

yield positive results. The Board is not, however, making any finding on the business

plan itself, nor predicting the likelihood of its success.

[85] The Board is satisfied that the evidence of PWCC establishes the need for

a LRR in order for the mill to re-open and afford it the prospect of long-term viability

The Board considers that some contribution to fixed costs is better than the other

ratepayers having to bear all of the costs. The Board therefore finds that the granting of

a load retention rate is necessary.

[86] While the Board understands from the testimony of Mr. Stern that the rate

is sufficient, from PWCC's perspective, to allow it to meet its financial objectives, the

Board cannot ignore the question raised by Mr. Athas on behalf of the SBA as to

whether it is more than sufficient. Further, the Board considers that a crucial question is

whether or not the rate is sufficient from the perspective of the other ratepayers. The

Board examines this issue below in its discussion of the recovery of incremental costs.

3.3 Pricing Mechanism for Electricity

[87] The pricing mechanism has four components: incremental costs,

contribution to overall fixed costs, administration costs and credit risk. Within

Document: 206878

- 34-

incremental costs are the fuel costs, variable operating costs, and incremental capital

expenditures.

[88) In this section all prices and costs are expressed on a per megawatt hour

(MWh) basis for the LRT pricing. The payment is made through a settlement

mechanism which reduces it to an "after tax" rate.

3.3.1 Incremental Costs

[89] The Application proposes the partnership will be charged for electricity to

operate the mill at the incremental costs to serve it:

The purpose of this Protocol is to ensure that PWCC covers the actual incremental cost

of electricity for all electricity taken from NSPI's system and that NSPI's customers do not

incur any additional cost as a result of PWCC load requirements. Whenever this Protocol

can be interpreted in multiple ways, the option that best protects the interests of NSPI's

customers (which for clarity does not include PWCC) shall prevail.

[Exl1ibit P-3, Appendix .J, p. 1]

[90] The interests of the customers was explored with the NSPI panel:

MR OUTHOUSE: ... If I were to say that the governing principle is that this proposal, this

package proposal that's being presented to the Board, must meet is that it provides a

benefit to other customers, do you agree?

MR. BENNETT: Yes.

MR. OUTHOUSE: And I'm not going to get into parsing what's significant or what's not

significant, but it must provide a benefit, correct?

MR. BENNETT: That's correct.

MR. OUTHOUSE: And it means, to me anyway, and I think to you and the Board, that

other customers will be better off as a result of this mill coming back on the system under

this proposal than if it just simply disappears from the system?

MR. BENNETT: That has been the absolute intention all along, yes.

MR. OUTHOUSE: And that's the way we test incremental costs?

MR. BENNETT: Yes.

[Transcript, pp. 573-574]