Escolar Documentos

Profissional Documentos

Cultura Documentos

Corporate Finance FlexText™ 3e

Enviado por

djmphdDireitos autorais

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Corporate Finance FlexText™ 3e

Enviado por

djmphdDireitos autorais:

1

Corporate Finance

Third Edition FlexText

TM

David J. Moore, Ph.D.

http://www.ecientminds.com

2

Copyright (c) 2010, 2011, 2012, 2013, 2014 By David J. Moore, Ph.D.

All rights reserved.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any

form, or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the

prior consent of the author. For more information contact the author via

http://www.ecientminds.com.

3

4

What is FlexText

TM

?

I have taught corporate nance at the introductory undergraduate, intermediate undergraduate, and

introductory MBA levels. While teaching those courses I noticed signicant overlap in the material

covered. For instance, net present value is covered at all levels. To promote eciency I have combined

my lecture notes from all three levels into this single text.

This book oers a new approach for multilevel instruction. With this Corporate Finance book

professors can choose their own subset of chapters tailored to the level of instruction. In so doing

professors and students have a consistent text for a sequence of corporate nance courses.

About this book

It is my wish that these notes equip the reader in at least three ways. First, I would like the reader to

understand ways to improve operating, investing, and nancing activities. Second, I would like the

reader to learn the tools for project selection, project risk assessment, and project risk management.

Third, I would like the reader to become familiar with the implications of debt vs. equity nancing.

Throughout the notes you will nd questions to check your understanding of the material. These

questions foster classroom interaction. Answers are available at the end of the book. Also, I in-

tentionally omitted numerical example details to encourage note taking during class. Numerical

examples will be worked in class so you can ll in the blanks. So, watch for the symbol that

indicates a numerical example is near.

These lecture notes are organized into three parts. Part I covers the fundamental concepts of

nancial management including the nancial managers role, corporate governance, the time value

5

of money, bond valuation, stock valuation, and risk and return. Part II utilizes the concepts of Part

I to analyze and forecast forecast nancial statements, compute the cost of capital, and to increase

awareness of the debt vs. equity choice.

While Part II is focused on broader issues in corporate value, Part III is focused on project

selection concepts. Part III includes detailed discussions on project selection criteria, project risk

assessment, and managing project risk using decision trees and real options.

Thank you for purchasing this text. Lets learn how to make our corporations more valuable...

-David J. Moore, Ph.D.

Whats new in the Third Edition?

1. Added answers to embedded questions at the end of the book.

2. Added several appendices to Chapter 4: (1) using the nancial calculator, (2) formulas for n,

and (3) approximation of i.

3. Updated Discounted Free Cash Flow valuation discussion (Section 5.7).

4. Updated Market Multiple valuation discussion (Section 5.8).

5. Updated CAPM and SML estimation (Section 7.4.3) with reference to CAPM inputs and

equation for direct computation of .

6

6. Added 3 inches of space to the bottom of each page so students may take notes.

7. Corrected equation numbering.

8. Standardized variable notation to capital letter with lowercase subscripts.

9. Miscellaneous typographical error corrections.

Contents

I Fundamental concepts 19

1 Corporate nance introduction 21

1.1 Financial managers role . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

1.2 Cash ows . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

1.3 Three fundamental decisions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

1.4 Legal business forms . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

1.5 Typical corporation organization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

2 Corporate governance 31

2.1 Stockholder-manager agency conict . . . . . . . . . . . . . . . . . . . . . . . . . . . 32

2.2 Stockholder-creditor conict . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

2.3 Financial reporting . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

2.4 Are ethics important to business? . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

2.5 Preventing managerial entrenchment . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

2.6 The compensation carrot . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

7

8 CONTENTS

2.7 Optimal corporate governance structure . . . . . . . . . . . . . . . . . . . . . . . . . 43

3 Time value of money 45

3.1 Why is there a time value of money? . . . . . . . . . . . . . . . . . . . . . . . . . . . 46

3.2 Future value, simple interest, and compound interest . . . . . . . . . . . . . . . . . . 47

3.3 Present value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 48

3.4 Additional information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50

3.5 Multiple cash ows . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51

3.6 Annuities and perpetuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52

3.7 Growing annuities and perpetuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . 58

3.8 Five ways to describe interest rates . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60

3.9 Three bonus examples . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61

4 Bond valuation 65

4.1 Bond prices and yields . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 66

4.2 Sinking fund provisions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69

4.3 Interest and reinvestment rate risk . . . . . . . . . . . . . . . . . . . . . . . . . . . . 70

4.4 The Malkiel theorems of bond price changes . . . . . . . . . . . . . . . . . . . . . . . 72

4.5 Default risk and bond contract provisions . . . . . . . . . . . . . . . . . . . . . . . . 78

4.6 Bond ratings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79

4.7 Bond markets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82

4.8 Term structure of interest rates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82

4.9 Real vs. nominal rates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84

4.10 Market interest rate components . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87

CONTENTS 9

4.11 Bond price and duration example . . . . . . . . . . . . . . . . . . . . . . . . . . . . 89

4.A Financial calculators: behind the scenes . . . . . . . . . . . . . . . . . . . . . . . . . 92

4.B The elusive n . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94

4.C The more elusive i . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 101

5 Stock valuation 105

5.1 Legal issues . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 105

5.2 Common stock markets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 107

5.3 The dividend discount model (DDM) . . . . . . . . . . . . . . . . . . . . . . . . . . 108

5.4 The constant growth DDM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 111

5.5 From DDM to expected return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 114

5.6 Multiple growth rate DDM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 115

5.7 Discounted FCF approach . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 115

5.8 Valuation by market multiple . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 116

5.9 Preferred stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 118

5.A Preemptive right workaround . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 119

5.B Multi-growth rate DDM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 122

6 Financial options 125

6.1 Financial options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 125

6.2 Binomial option pricing model . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 128

6.3 The Black-Scholes option pricing model . . . . . . . . . . . . . . . . . . . . . . . . . 137

6.4 Put options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 141

6.5 Corporate nance applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 142

10 CONTENTS

7 Risk and return 145

7.1 Stand alone return and risk . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 146

7.2 Portfolio return and risk . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 150

7.3 Ecient portfolios and portfolio selection . . . . . . . . . . . . . . . . . . . . . . . . 157

7.4 Asset pricing models . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 160

7.5 Tests of the CAPM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 163

7.6 Stock market equilibrium . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 164

II Corporate valuation 169

8 Managerial accounting 171

8.1 Financial reports . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 172

8.2 Balance sheet (BS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 172

8.3 Income statement (IS) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 178

8.4 Statement of cash ows (SoCF) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 183

8.5 Modifying accounting data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 188

8.6 Free cash ow (FCF) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 192

8.7 MVA and EVA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 194

8.8 Federal tax considerations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 196

9 Financial statement analysis 203

9.1 Why ratio analysis? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 204

9.2 Liquidity ratios . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 204

CONTENTS 11

9.3 Asset management ratios . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 205

9.4 Debt management ratios . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 209

9.5 Protability ratios . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 211

9.6 Market value ratios . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 213

9.7 Trend, common size, and percent change analysis . . . . . . . . . . . . . . . . . . . . 214

9.8 The DuPont equation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 216

9.9 Benchmarking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 218

9.10 Closing comments on ratio analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . 219

9.11 Qualitative analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 220

10 Financial statement forecasting 223

10.1 Financial planning . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 224

10.2 Sales forecast . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 226

10.3 Percent of sales forecasting method . . . . . . . . . . . . . . . . . . . . . . . . . . . . 227

10.4 The AFN formula . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 238

10.5 Forecasting with variable balance sheet ratios . . . . . . . . . . . . . . . . . . . . . . 241

11 Cost of capital 245

11.1 The weighted average cost of capital (WACC) . . . . . . . . . . . . . . . . . . . . . . 246

11.2 Cost of debt R

d

(1 ) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 247

11.3 Cost of preferred stock R

ps

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 247

11.4 Cost of common equity R

s

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 248

11.5 WACC factors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 255

11.6 Divisional and project risk adjustments . . . . . . . . . . . . . . . . . . . . . . . . . 256

12 CONTENTS

11.7 Flotation cost adjustments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 257

11.8 Cost of capital estimation problems . . . . . . . . . . . . . . . . . . . . . . . . . . . 260

11.9 Common WACC estimation mistakes . . . . . . . . . . . . . . . . . . . . . . . . . . 260

11.A Example R

s

estimation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 261

12 Value based management 263

12.1 Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 263

12.2 Corporate valuation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 264

12.3 The corporate valuation model . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 264

12.4 Value-based Management (VBM) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 270

13 Capital structure 277

13.1 Tax free world . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 278

13.2 A world with taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 280

13.3 Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 281

III Project selection 283

14 Project selection criteria 285

14.1 Project classications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 285

14.2 Decision rules . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 286

14.3 Implementation of capital budgeting methods . . . . . . . . . . . . . . . . . . . . . . 295

14.4 Special applications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 299

14.5 The optimal project mix . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 300

CONTENTS 13

14.A Another look at IRR vs. MIRR plus incremental IRR . . . . . . . . . . . . . . . . . 302

15 Estimating project cash ows 307

15.1 Who estimates cash ows? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 308

15.2 Relevant cash ows: incremental free cash ow . . . . . . . . . . . . . . . . . . . . . 308

15.3 Tax eects . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 314

15.4 Capital budgeting project example . . . . . . . . . . . . . . . . . . . . . . . . . . . . 316

15.5 Ination adjustment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 320

16 Equivalent annual cost 323

16.1 The AEC procedure and interpretations . . . . . . . . . . . . . . . . . . . . . . . . . 324

16.2 Acme Inc. example . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 325

16.3 Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 329

17 Project risk analysis 331

17.1 Project (stand-alone) risk . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 331

17.2 Incorporating project risk . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 335

17.3 Phased decisions and risk management . . . . . . . . . . . . . . . . . . . . . . . . . . 336

17.4 Real options introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 337

18 Real options 341

18.1 Real option valuation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 341

18.2 Investment timing option . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 342

18.3 Growth option . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 346

18.4 Use of real options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 348

14 CONTENTS

19 Change Log 349

20 Answers to embedded questions 353

List of Tables

4.1 Discount rate interpretations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

4.2 Reinvestment rate risk illustration . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71

4.3 Bond price sensitivity to market yields and maturity . . . . . . . . . . . . . . . . . . 73

4.4 Maturity-interest rate change sensitivity . . . . . . . . . . . . . . . . . . . . . . . . . 75

4.5 Coupon - interest rate sensitivity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

4.6 Malkiel Theorem Implications . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

4.7 Perspectives and signs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94

5.1 DDM denitions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 110

5.2 Value vs. years of dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 113

6.1 The long and short of call and put . . . . . . . . . . . . . . . . . . . . . . . . . . . . 126

8.1 Balance sheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 174

8.2 Income statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 179

8.3 Statement of cash ows . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 185

15

16 LIST OF TABLES

9.1 ROE interpretations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 215

10.1 Forecasted income statement . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 229

10.2 Forecasted balance sheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 234

10.3 AFN formula inputs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 239

14.1 Project classications, analysis, and rewards . . . . . . . . . . . . . . . . . . . . . . . 286

14.2 Capital budgeting method matrix . . . . . . . . . . . . . . . . . . . . . . . . . . . . 296

14.3 Capital budgeting methods used in industry . . . . . . . . . . . . . . . . . . . . . . . 298

List of Figures

1.1 U.S. Business Forms in 2008. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

3.1 Interest and principal over time . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 56

3.2 Sample QIR and APR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 62

6.1 Stock price tree . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 129

6.2 Call option value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 130

6.3 Option replicating portfolio . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 131

7.1 Portfolio risk vs. number of securities . . . . . . . . . . . . . . . . . . . . . . . . . . 153

17

18 LIST OF FIGURES

Part I

Fundamental concepts

19

Chapter 1

Corporate nance introduction

Overview

What is a corporation supposed to do?

Why would KKR/TPG borrow money and pay a 20% to 27.5% premium for TXU (February

2007)? Because they expect to make money!

How do they expect to make money on the deal?

1. Taking over management and selecting the right projects.

2. Choosing the lowest cost (most ecient) means of funding those projects.

3. Improving day-to-day operational eciency

21

22 CHAPTER 1. CORPORATE FINANCE INTRODUCTION

1.1 Financial managers role

The basic goal of a nancial manager or managers of a rm in general is to maximize share-

holder value subject to government-imposed constraints.

QUESTION: What are some of those constraints? What are some laudable

self-imposed constraints?

1.1

Inadequate oversight leaves poor management in place erosion of shareholder value.

Examples: Enron, Worldcom, Satyam (India), current nancial crisis, etc.

Recent gains in oversight: concentrated ownership by institutional investors and regulatory

changes/enforcement.

1.1.1 Societal considerations

How maximizing shareholder value (subject to government-imposed constraints) with a long term

focus can simultaneously maximize social well being:

Benet to consumers Maximizing prot implies reducing production costs and developing prod-

ucts that add value to consumers. Prices charged to consumers are impacted by competition.

QUESTION: How else does competition benet consumers?

1.2

Benet to employees Shareholder value maximization is a result of a companys ability to attract,

develop, and retain quality employees.

1.1. FINANCIAL MANAGERS ROLE 23

Other benets High stock prices lead to (1) wealthier people (and increased spending) and (2)

greater corporate investment via enhanced ability to raise capital.

1.1.2 Managerial actions to maximize shareholder wealth

Firm value is a function of current and future free cash ows (FCFs).

FCFs are a function of revenues, costs, required new investments.

The current value of future FCFs related to size, timing, and risk (discount rate) of those FCFs.

QUESTION: Is it clear what managerial actions should accomplish?

1.3

Regarding FCFs, managers can act to

1. Increase sales: develop products people want (an ongoing endeavor).

2. Reduce production costs: be mindful that cheap labor and materials may produce poor

quality products or products that consumers do not want.

3. Minimize reinvestment costs: reduce capital requirements (e.g., use just-in-time inventory

management).

An overview of all the considerations of a nancial manager):

1. Financing decisions: debt vs. equity, what kind of debt and equity, which project?

2. Reinvestment decision: reinvest earnings, pay dividends, or repurchase stock?

24 CHAPTER 1. CORPORATE FINANCE INTRODUCTION

1.1.3 Market vs. intrinsic value

The intrinsic or fundamental value is based on investors estimate of cash ows.

The market value is the aggregation of cash ow estimates from all investors.

QUESTION: Should nancial managers maximize market or intrinsic value?

1.4

Equilibrium is attained when market value equals true fundamental value.

QUESTION: Who knows the true fundamental value?

1.5

1.1.4 Short-term vs. long-term price

The current stock price reects all [publicly and some privately] available information (short-

term price).

QUESTION: Should nancial managers maximize short term or long term stock

price?

1.6

Some private information at time t does not become publicly available until time t +n (long-

term price).

QUESTION: What types of information take time before public revelation?

1.7

1.2. CASH FLOWS 25

1.2 Cash ows

Financial manager should make decisions to maximize cash ows to shareholders. These

decisions should balancing dividend payments, stock repurchases, and reinvestment in the

rm.

Three board decision categories

1. Capital budgeting

2. Financing

3. Working capital management

These are the same decisions and analysis KKR and TPG should have done as part of the

TXU leveraged buyout.

Bankruptcy occurs if expenses persistently exceed income.

1.3 Three fundamental decisions

26 CHAPTER 1. CORPORATE FINANCE INTRODUCTION

Captial Budgeting Decisions Project selection {includes estimates of future cash ows}, patents

to purchase, machines to purchase, anything that will generate, or contribute in the generation

of, cash ows.

Financing Decisions How do you pay for the assets you decided to buy?

Debt Obtain loans or issue bonds

Equity Issue stock or use cash

Capital Structure The mix of debt and equity at a point in time.

Working Capital Decisions The management of working capital including the collection of sales

revenues, repayment of debt, inventory management, etc.

QUESTION: What is the denition of working capital?

1.8

1.4 Legal business forms

1.4.1 Sole proprietorship

Owned by one person (hence use of the word sole)

Easy to start

Unlimited liability exposure

1.4. LEGAL BUSINESS FORMS 27

Income taxed at normal income tax rate

Dicult to sell the business since there are no shares of stock must sell o assets

1.4.2 Partnership

Like a proprietorship but with two or more owners joined together legally

Legal agreement includes initial investments, management roles and decisions, prot distribu-

tion, sale of business, actions after death of partner, etc.

General Partnership: Everyone has unlimited liability

Limited Partnership: General partners have unlimited liability.

QUESTION: What kind of liability do limited partners have?

1.9

1.4.3 Corporations

Entity distinct from its owners (stockholders)

Limited liability for owners: If you were a stockholder of Exxon during the Valdez accident,

you could not be sued but could your investment if Exxon were sued and lost and went

bankrupt

28 CHAPTER 1. CORPORATE FINANCE INTRODUCTION

Can be publicly held (shares traded on public markets such as NYSE and NASDAQ) or

closely held (smaller number of investors and not publicly traded).

QUESTION: What are some advantages and disadvantages of having a business

in the form of a corporation as opposed to a sole proprietorship?

1.10

1.4.4 Hybrid forms

We are not talking about fuel ecient cars

LLPs/LLCs have two advantages

Limited Liability for Partners: If one partner commits malpractice the whole rm is not

taken down.

Single-taxation.

QUESTION: Can anyone distinguish between single taxation for partnerships and

double taxation for corporations?

1.11

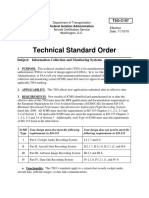

Figure 1.1 illustrates that the majority of businesses in the United States are sole proprietorships

while most of the income is attributed to corporations.

1.4. LEGAL BUSINESS FORMS 29

!"#$ &'"(')$*"'+,)(

-./

&0'*1$'+,)(

23/

4"'("'05"1

26/

!"#$%& () *"+,-%++%+

!"#$ &'"(')$*"'+,)(

-./

&0'*1$'+,)(

23/

4"'("'05"1

.6/

!"# %&'()"

Figure 1.1: U.S. Business Forms in 2008.

Source: Table 744, U.S. Census Bureau, Statistical Abstract of the United States: 2012

30 CHAPTER 1. CORPORATE FINANCE INTRODUCTION

1.5 Typical corporation organization

Lets take a look at a typical org chart...

External Auditor Are the nancial statements a fair representation of the rms nancial position?

QUESTION: Did Arthur Andersen do a good job of this when they were external

auditor for Enron back in the day?

1.12

Audit committee A group of board members who oversee the accounting of a rm

Compliance and Ethics Director

Reports to the boards audit committee to ensure independence.

QUESTION: Why might one be skeptical of true independence?

1.13

This position is distinct from the Internal Auditor.

QUESTION: How so?

1.14

Chapter 2

Corporate governance

Overview

In this chapter we look at some of the issues surrounding corporate governance including

agency conicts,

ethics,

managerial entrenchment, and

compensation.

31

32 CHAPTER 2. CORPORATE GOVERNANCE

2.1 Stockholder-manager agency conict

The principal (owner, stockholder) hires the agent (management) to manage (control) rm

such that principals interests are taken care of, that is, stock price maximization.

Agency conict sources:

1. Since agent (manager) does not own 100% of the rm, manager will receive less than

100% of the prots might put in less than 100% eort

2. Agent will bear less than 100% of expenses also agent can use 100% of the private jet

but using the principals money to buy the jet!

3. Ownership is disperse (many shareholders) so it is dicult to get together and discipline

or remove poor management

Studies suggest that in practice managers are concerned with rm size maximization (Wild-

smith, 1974) more job security (harder to takeover), more compensation, more ego

Stockholders incur agency costs in order to reduce the agency conict.

Two extremes for dealing with agency conict:

1. Compensate solely on long-run stock performance near-zero agency costs

Good: could minimize falsied accounting statements.

QUESTION: How so?

2.1

2.1. STOCKHOLDER-MANAGER AGENCY CONFLICT 33

Bad: (1) economic events beyond managers control could impact stock price; (2)

managers need income during the time it takes from good decision to market price

increase

2. Monitory every managerial action (high agency costs)

Costly (time, money, and inecient)

If shareholders have that kind of time they should manage the rm themselves.

Optimum solution is somewhere between the extremes however...

Tools to align principal (stockholder) and agent (management) interests:

1. Compensation tied to rm performance.

QUESTION: What are some problems with this?

2.2

2. Managerial labor market.

Theory: If you do well, other rms will want to pay you big bucks. If you do poorly, no

one will want to hire you.

Practice: Poor performance does not appear to stop those who have connections and

the compensation of poor performers comes at the expense of others.

3. Board of directors.

Theory: Hire the best managers, monitor, set compensation fairly, etc. so that share-

holder value is maximized.

34 CHAPTER 2. CORPORATE GOVERNANCE

Practice: Hire buddy and pay him as much as possible.

4. Other managers.

Theory: Competition within rm for CEO position will keep everyone on their toes.

Practice: Cut-throat and clique-ish environment where everyone is pursuing self-interest

which, at times, is at the expense of the rm (and rms owners).

5. Large stockholders.

Theory: Have enough skin in the game to take the time and attend board meetings and

pushing through meaningful management changes to maximize shareholder wealth.

Practice: (1) Maybe large stockholder wants another company they own to acquire the

target on the cheap. (2) Maybe large stockholder knows nothing about the particular

business and will mess it up.

6. The takeover market.

Theory: Management makes bad decisions stock price drops rm is taken over

management is red. Knowing this progression, management gets their act together

to maximize stock price and save their jobs.

Practice: (1) Sometimes management blocks shareholder wealth-enhancing acquisitions

to hold on to their jobs such as the Microsoft attempted takeover of Yahoo (2)

Sometimes management allows acquisitions that reduce shareholder value

7. Legal environment. Can we really legalize Morality?

2.2. STOCKHOLDER-CREDITOR CONFLICT 35

2.2 Stockholder-creditor conict

Creditors lend at a rate based on perceived risk at the time of the loan.

Stockholders want rms to take risky projects since they will benet if the projects succeed.

Thus, rms could take money from creditors (banks) and invest in risky projects or repurchases

stock (which increases leverage and bankruptcy risk but can enhance gains).

If creditors sense rms will do a bait and switch with borrowed money, they (creditors) will

charger higher rates or impose constraints on how the debt is used.

QUESTION: How well has our government done this with bailout funds?

2.3

2.3 Financial reporting

Market transparency: reliable and accurate information available to all.

Securities Act of 1933 - Requires companies to register with the SEC

Securities Exchange Act of 1934 - extends disclosure requirements

1933 and 1934 Acts include safeguards to ensure transparency (and consequently, eciency) :

1. Publicly-owned rms (POFs) are supposed to follow GAAP.

2. POFs must have nancial statements examined by independent auditors.

36 CHAPTER 2. CORPORATE GOVERNANCE

3. Accounting industrys Public Oversight Board is supposed to set policy and discipline

those who do not follow it.

4. POFs must submit nancial statements to SEC then SEC makes statements freely avail-

able.

5. POFs must release information to all investors simultaneously.

6. Analysts are supposed to form objective opinions based on available information and make

honest recommendations.

7. Violators are supposed to be prosecuted expeditiously with sucient penalties.

Late 1990s, early 2000s these safeguards were not in place and/or insucient (Enron)

Sarbanes-Oxley Act of 2002 (SOX)

Auditors were complicit because they were not independent.

QUESTION: Why not?

2.4

Analyst recommendations were at times dishonest and not necessarily independent.

QUESTION: Why not?

2.5

Penalties for these violations were too weak to prevent their recurrence.

2.4. ARE ETHICS IMPORTANT TO BUSINESS? 37

SOX regulation designed to reduce/eliminate these violations by ensuring that

1. auditors are suciently independent,

2. key executive (e.g., CEO) personally certies completeness and accuracy of nancial

statements,

3. audit committee is relatively independent of management,

4. analysts are relatively independent of POFs they analyze, and

5. Companies release all important information publicly and promptly.

2.4 Are ethics important to business?

Ethics: what is right and what is wrong (set of moral principals)

Some corporate nance textbooks reference the Golden Rule in the Bible: do unto others as

you wish others to do unto you.

The capitalist mantra pursue self-interest appears to be at odds with considering the impact

of your actions on others.

Read about the triple bottom line on Wikipedia (people, planet, prot)

For historical context, read Religion, Discipline, and the Economy in Calvins Geneva.

38 CHAPTER 2. CORPORATE GOVERNANCE

Is business like poker where you deceive to make a prot? As a result of the accounting scandals

previously mentioned, $2.3T in stockholder value was lost.

It is dicult to attract capital in the presence of corruption and investment is needed for

economic growth.

Agency costs and conicts of interest are two types of ethical issues in business (see earlier

examples).

Another is information asymmetry: do you tell someone interested in your used car the

full story?

Since the legal systems and market forces have proven insucient mechanisms to ensure ethical

business, the book suggests establishing an ethical business culture.

This culture is set at the top of the organization. Contrast Enrons management with Googles.

QUESTION: Upon graduation would you choose a $50,000 salary at a company

with some obvious ethical problems or $45,000 at a company with solid ethics?

2.6

Ethical failings have serious consequences: in the past you would get a slap on the wrist now

you will go to jail for decades.

2.5 Preventing managerial entrenchment

A manager is entrenched when conditions exist that impede the ability to remove that manager.

2.5. PREVENTING MANAGERIAL ENTRENCHMENT 39

Consequences include excess non-pecuniary benets, empire-building, and reluctance to cancel

underperforming divisions or projects.

2.5.1 Barriers to hostile takeovers

Microsoft attempted to takeover in Q1 2008 Yahoo management rejected MSFTs $33/share

oer Yahoo management entrenched and concerned about their egos stock closed at 12.50

on 2008.11.07 after MSFT rejected the begging of Yahoos CEO for MSFT to make another

oer.

QUESTION: So what is the barrier here?

2.7

Target share repurchases (greenmail): Allows poorly performing rm to repurchase stock from

raider at an elevated price in exchange for agreement to cease takeover attempts for a specied

number of years.

Poison pill (shareholder rights provision): Enables existing shareholders to purchase additional

shares at a bargain price if an acquisition attempt is detected (e.g., once a raider acquires 20%

of the rm)

Restricted voting rights: if you own more than X% of the stock, your voting rights are restricted

to Y % where Y < X. For example, you could own 50% of the rm but only have voting rights

as if you owned 25%.

40 CHAPTER 2. CORPORATE GOVERNANCE

2.5.2 Monitoring by board members

Insider: board member who also holds management position within the rm

Outsider: does not have a management position within the rm

Problems (the good ol boy network)

1. If the CEO is also chairman of the board disagreement will get you kicked o the board

and/or red.

2. Outsider is not necessarily independent.

QUESTION: Why not?

2.8

3. Combined eect: entrenched CEO

The [alleged] improvements in board structure

Stock and options instead of cash compensation for board members

More independent outsiders

Additional entrenchment mechanisms

Non-cumulative voting plus 51% ownership: you own the board.

QUESTION: What is the dierence between cumulative and non-cumulative

voting?

2.9

2.6. THE COMPENSATION CARROT 41

staggered terms: fewer board seats up for election each year

QUESTION: What has caused boards to be more eective in recent times?

2.10

2.6 The compensation carrot

Average package breakdown: 21% salary, 79% performance-based bonuses.

QUESTION: Why do I question performance-based?

2.11

Bonus breakdown: 34% short term goals (e.g., current year EPS growth), 20% long term goals,

46% stock price

Can be cash, stock, options, non-pecuniary. May not vest immediately

QUESTION: What does vesting mean?

2.12

2.6.1 Stock options

Theory: if executives own options, their interests are in alignment with shareholder interests

Reality: not so. An important example...

Additional problems

42 CHAPTER 2. CORPORATE GOVERNANCE

Falsied nancial statements

Options are not worth the Black-Scholes value to the recipients even though the company

expenses them using that value.

QUESTION: Why?

2.13

2.6.2 Employee stock ownership plans

ESOP formation process

1. Issue 500,000 shares @ $100 per share (50M).

2. Form legal entity (ESOP) to purchase newly issued shares with a loan guaranteed (and

paid indirectly) by the parent company (thus, an o-balance sheet liability since debt

appears on the books of the ESOP not the parent company).

3. Parent company makes payments to the ESOP sucient to cover loan payments.

4. Equity builds as the loan is paid o, and this equity is associated with the ESOP partic-

ipants (employees).

5. Employees receive pro rata amount of parent company stock at retirement.

Reasons for ESOPs

1. Motivate employees to be more productive thereby improving shareholder value.

2. More money at retirement.

2.7. OPTIMAL CORPORATE GOVERNANCE STRUCTURE 43

3. Employee retention.

4. Tax benet for borrower (ultimately the parent company) and lender if ESOP owns 50%

of parent company stock. Dividend payments to ESOP for distribution to participants

or loan repayment are tax deductible by the parent company.

5. Makes labor cutbacks as a result of acquisition more dicult (benets employees, not

shareholders).

QUESTION: What does this sound like?

2.14

In sum, ESOPs can be used to boost employee motivation, retention, and retirement income

but can also be used to entrench management (i.e., make takeover less attractive)

QUESTION: Are ESOPs more prevalent with privately held companies? Why or

why not?

2.15

2.7 Optimal corporate governance structure

Okay, so we have seen dierent types of sticks, carrots, monitoring, and take-over prevention mech-

anisms.

QUESTION: What is the optimum mix?

2.16

44 CHAPTER 2. CORPORATE GOVERNANCE

Chapter 3

Time value of money

Overview

Assume you have plenty of money and are considering the purchase of a new $36,000 car. You

go to the dealer and are given 2 options:

Option 1: Pay cash and receive a $3,321 discount sale price = $32,679

Option 2: Finance the car for 3 years @ 0% but pay full price = $36,000

QUESTION: Which option do you choose? What if CD rates were 3%? 7%?

3.1

Understanding this chapter is critical for your understanding of corporate nance (Parrino

and Kidwell, 2010). I would argue this applies to personal nance also.

45

46 CHAPTER 3. TIME VALUE OF MONEY

Value Creation: From a corporations perspective, buying productive assets today at cost $X

with hopes (belief) future cash ows will be $X.

3.1 Why is there a time value of money?

Simple example (that is similar to our car example): winning the lottery:

Option 1: Receive $60 million today.

Option 2: Receive $100 million spread out evenly over 26 years ($3,846,154 per year)

Thus we say the time value of money, or the market price of 26 annual payments of $3,846,154

is $60,000,000

QUESTION: Why is the lump-sum payment so much less than $100,000,000?

3.2

Since humans are impatient (and risk averse) they must be compensated for deferring con-

sumption (and taking risk).

Problem Solving tool : Time lines...

Future vs. Present Value:

Future Value is found by compounding cash ows.

Present Value is found by discounting cash ows.

3.2. FUTURE VALUE, SIMPLE INTEREST, AND COMPOUND INTEREST 47

Use of Financial Calculator: You will need to use a nancial calculator to solve problems in the

remainder of this course (and when you are sitting at the car dealer or the real estate brokers

desk).

3.2 Future value, simple interest, and compound interest

One, two, and n-period calculation

FV

1

= P

0

+ (P

0

i) = P

0

(1 + i) = PV (1 + i) (3.1)

FV

2

= FV

1

(1 + i) = (P

0

(1 + i)) (1 + i) = PV (1 + i)

2

(3.2)

FV

n

= P

0

(1 + i)

n

= PV (1 + i)

n

(3.3)

Simple vs. Compound Interest

Simple: interest gained on principal investment

Compound: interest gained on prior earned interest

Compound interest in a powerful phenomenon from both a good and bad perspective. From

a good perspective, you will gain interest on top of interest (i.e., on money in excess of what

you invested).

QUESTION: How can compound interest be a bad thing?

3.3

Another example of the power of compound interest: The Rule of 72...

48 CHAPTER 3. TIME VALUE OF MONEY

Lets work through a few FV, simple interest, and compound interest calculations...

QUESTION: How long will it take for a $100 investment to double @8%?

3.4

Thus far we have discussed annual compounding. What if compounding is quarterly, monthly,

daily, or continuous? A simple modication to the FV formula:

FV

n

= PV

_

1 +

i

m

_

mn

(3.4)

Where n is number of years and m is the number of times per year that interest is compounded.

QUESTION: What is m for semi-annual, quarterly, monthly, and daily

compounding? What about continuous compounding?

3.5

Lets take a look at compounding bank deposit rates and compounding frequency...

More frequent compounding more compound interest

3.3 Present value

Present value = todays value of a future cash ow.

Future values are discounted to account for (1) delayed consumption and (2) risk.

3.3. PRESENT VALUE 49

The discount rate is the rate used to arrive at the present value of future cash ows.

n-period calculation:

PV =

FV

n

(1 + i)

n

(3.5)

QUESTION: Look familiar?

3.6

Lets look at how time n, interest rates i, and future value FV impact the present value PV ...

Important note when doing PV/FV calculations on your nancial calculator: PV is a negative

number and FV is a positive number.

QUESTION: Why?

3.7

One more discounting example: Lottery payo options. You have access to a 10% CD if you

have the minimum $1M investment. Fortunately, you won the lottery and have been presented

the following choices:

Take money today PV=$1,000,000

2 years from now receive FV

2

= $1, 200, 000

5 years from now receive FV

5

= $1, 500, 000

8 years from now receive FV

8

= $2, 000, 000

QUESTION: Which option do you choose and why?

3.8

50 CHAPTER 3. TIME VALUE OF MONEY

3.4 Additional information

Finding the interest rate. As I write these notes I cannot help but think most students would

take the $1,000,000 today without doing a simple calculation. However, there must be some

amount you would be willing to wait for.

QUESTION: What is that amount and what interest rate is associated with that

amount?

3.9

Another example: You want to purchase a $50,000 car, do not have the money now, and are

expecting a bonus in a couple years (or expecting to somehow save with the same mindset used

to buy a car you do not have cash for). You violate a second rule and ask a family member

to loan the down payment of $20,000 and have agreed to pay that family member $28,800 in

two years to settle the debt.

QUESTION: Is that a good deal for the borrower? the lender?

3.10

Money is not the only thing subject to compounding. In the book Richest Man in Babylon

(I think), the author refers to money as your children and how your children have children and

so on.

Thus, population is something else that compounds.

Simply use population for PV/FV and call the compound growth rate g

FV

n

= PV (1 + g)

n

(3.6)

3.5. MULTIPLE CASH FLOWS 51

Other examples include sales, GDP, commodities prices, etc.

An example: U.S. Population in 1970 was 203,211,926. Somehow Wikipedia has 2010 census

data and puts the number at 309,162,581.

QUESTION: What was the U.S. population growth rate CAGR from 1970 to 2010?

3.11

The computation of sales CAGR is a preliminary step in forecasting nancial statements.

QUESTION: Why would you want to forecast nancial statements?

3.12

Lets compute Apples sales CAGR...

3.5 Multiple cash ows

Example 3.1. Future Value. Simple example: put $1,000 in savings account today, then another

$1,000 in your account next year. What is the value (total) of the account in two years if the interest

rate is 3%?

QUESTION: What is the rst step to solving this problem?

3.13

Example 3.2. Future Value. You deposit $3,000 today, $4,000 next year, and $5,000 two years

from now. What is the value in year 3 if the interest rate = 8%?

Present Value. You have a friend that wants to borrow $3,000 from you today and pay you

back $1,000 per year for 3 years.

52 CHAPTER 3. TIME VALUE OF MONEY

QUESTION: What are two reasons to reject the loan?

3.14

Example 3.3. Lets say your friend does go to a bank and rates for 3 year loans are 7%. We can

examine this problem from two angles: (1) if your friend does not need $3,000, how much will bank

lend today such that repayment is $1,000 per year for 3 years such that the bank earns 7%? (2)

Your friend needs $3,000 today so how much must he/she repay each year for the next 3 years to

ensure the bank earns 7%? Lets take a look...

Cash ows in the previous example were the same in each year, so you could use the N, I,

PMT, FV, PV buttons to arrive at the answers.

You cannot do so when the cash ows are uneven. Rather, you can use the CF

0

, CF

i

, I, NPV

buttons. I will redo Ex. 2 using these buttons...

Example 3.4. You go to a car dealer to purchase a car. You can nance $35,000 for 5 years @ 9%

or 4 years @ 7%.

QUESTION: Which do you choose and why?

3.15

3.6 Annuities and perpetuities

Both annuities and perpetuities have level cash ows

Annuities have a nite number of previous while perpetuities are innite

3.6. ANNUITIES AND PERPETUITIES 53

The present value of an annuity (PVA) (or perpetuity) is the present value (PV) of all future

cash ows.

PV A

n

=

CF

1

1 + i

+

CF

2

(1 + i)

2

+ +

CF

n

(1 + i)

n

=

n

t=1

CF

t

(1 + i)

t

(3.7)

Moreover, we know

CF

1

= CF

2

= = CF

n

CF

therefore

PV A

n

= CF

_

1

1 + i

+

1

(1 + i)

2

+ +

1

(1 + i)

n

_

. (3.8)

This equation simplies to

PV A

n

=

CF

i

_

1

1

(1 + i)

n

_

(3.9)

where CF is the cash ow received at the end of the rst period.

Example 3.5. How much should you pay (i.e., the maximum you would pay) for an 8% annuity

with 3,500 annual payments for 4 years?

QUESTION: How would you begin this problem?

3.16

54 CHAPTER 3. TIME VALUE OF MONEY

You can also nd the interest rate of an annuity given (1) the length of the annuity, (2) the

size of the cash ow, and (3) the price of the annuity.

QUESTION: What is the interest rate of 3-year 2,000 per year annuity selling for

5,154.19?

3.17

Perpetuities pay periodic cash ows forever. Recall equation 3.9:

PV A

n

=

CF

i

_

1

1

(1 + i)

n

_

(3.10)

To determine the value of a perpetuity, take the limit as n approaches

PV A

= lim

n

CF

i

_

1

1

(1 + i)

n

_

=

CF

i

(1 0) =

CF

i

(3.11)

Thus far we have covered ordinary annuities, annuities with cash payments that occur at the

end of each period. With an annuity due cash payments occur at the beginning of each period.

The simplest way to compute the value of an annuity due is (1) ignore the fact that payments

are at the beginning and calculate the ordinary annuity value; (2) multiply the ordinary annuity

value by (1+i):

Annuity due value = Ordinary annuity value (1 + i) (3.12)

Example 3.6. Redo the previous example for an annuity due.

3.6. ANNUITIES AND PERPETUITIES 55

Monthly Payments. When purchasing a car or home you are typically presented with an

annual rate and monthly payments. To ensure you are not being cheated, use this information

to calculate the monthly payments yourself.

Example 3.7. You are about to purchase a new car for $30,000 and have obtained 1.9% annual

nancing for 5 years. What will your monthly payment be?

QUESTION: To begin, what values do you put into N and I?

3.18

The dealer oers to lower your repayment to 400 by increasing the length of the loan from 60

to 111 months.

QUESTION: Do you take the deal?

3.19

Amortization Schedule. By the way, you want an amortizing loan, that is, a loan in which

the principal balance is reduced with each payment. Please be sure you see amortized before

you sign. With amortized loans, you pay more principle and less interest with each successive

payment:

56 CHAPTER 3. TIME VALUE OF MONEY

Figure 3.1: Interest and principal over time

Lets create an amortization schedule for a $50,000 30 year mortgage nanced @ 5.25%. in

particular, we want to compare the interest and principal payments at the end of years 1, 12,

and 29...

QUESTION: By the way, what is the monthly payment for this mortgage?

3.20

Okay, now on to the amortization schedule

3.6. ANNUITIES AND PERPETUITIES 57

Future Value of an Annuity. Perhaps you have a monthly savings plan, or retirement plan

that has xed payments (contributions to the plan) and you receive a lump sum at the end.

(Also has xed interest rate). This is nothing more than an annuity and you can calculate the

future value dierent ways.

1. Compute FV of each cash ow then add

2. Compute PV A

n

then multiply by (1 + i)

n

QUESTION: Which do you think is easier?

3.21

Now for the formula:

FV A

n

= PV A

n

(1 + i)

n

=

CF

i

_

1

1

(1 + i)

n

_

(1 + i)

n

=

CF

i

((1 + i)

n

1) (3.13)

Note: This is similar to what we did with Ex 2.

QUESTION: What is the FVA for a perpetuity?

3.22

Example 3.8. Suppose you are saving for a retirement and purchase an annuity (which I cannot

recommend). You are going to retire in 15 years, will save $1,000 per month, and see that the going

rate for 15 year annuities is 4%. How much will you have in 15 years?

58 CHAPTER 3. TIME VALUE OF MONEY

Rewind: Viewing/Valuing preferred stock as a perpetuity. On September 24, 2008 Warren

Buets company purchased $5B of perpetual preferred shares of Goldman Sachs that pay a

10% dividend.

QUESTION: What is the annual cash ow? Was this a good idea?

3.23

3.7 Growing annuities and perpetuities

Think back to the XYZ example at the beginning of the chapter

Company X=Starbucks, Company Y=Low Point Coee, Z=how much should Starbucks pay

for Low Point Coee

Example 3.9. Suppose Low Points after-tax cash ows are 100,000 per year, there is a 50-year

lease already in place so we assume the coee shop will be in business for 50 years, and cash ows

will grow each year at the estimated ination rate of 3%.

QUESTION: How much should Starbucks pay for Low Point when using a discount

rate of 15%?

3.24

We begin by modifying the PVA formula to include growing payments:

PV A

n

=

CF

1

i g

_

1

_

1 + g

1 + i

_

n

_

(3.14)

where CF is the cash ow at the end of the rst period. By the way, i must be larger than g (i > g).

3.7. GROWING ANNUITIES AND PERPETUITIES 59

QUESTION: Why?

3.25

Now, on to the estimated coee shop value...

Several notes:

1. The discount rate, in this case 15%, is reective of the riskiness associated with future

cash ows.

2. The growth rate, in this case 3%, is constant.

3. Unfortunately, there is not a button to enter the growth rate on the HP12C. However,

you can search for HP 12C growing annuity on the Internet and nd steps to do so.

The last example (Ex 9) was a growing annuity, now we look at growing perpetuities:

PV A

=

CF

1

i g

(3.15)

where CF is the cash ow at the end of the rst period.

Example 3.10. Suppose the Low Point Coee Shop to be acquired by Starbucks is anticipated

to be in business forever (you can obtain an indenite lease just like the United States did with

Guantanamo Bay).

QUESTION: Now what should Starbucks pay for an innitely-lived Low Point Coee

Shop?

3.26

60 CHAPTER 3. TIME VALUE OF MONEY

3.8 Five ways to describe interest rates

1. Quoted Interest Rate (QIR): The simple annual interest rate obtained by multiplying the

number of compounding periods by the per-period rate. E.g., 1% per month represents a QIR

of 12%. This rate does not include fees such as closing costs nor does it include compounding

eects.

2. Annual Percentage Rate (APR): In Parrino and Kidwell (2010) this is the same as QIR. In

the real world this will include fees. APR is typically associated with loans.

3. Nominal APR: Not mentioned in Parrino and Kidwell (2010) but is the same as QIR.

4. Eective Annual Interest Rate or Eective APR (EAR): In Parrino and Kidwell (2010) this

is the annualized rate that includes compounding eects but not fees:

EAR =

_

1 +

QIR

m

_

m

1 (3.16)

In the real world, EAR includes fees and compounding eects.

5. Annual Percentage Yield (APY ): Not mentioned in Parrino and Kidwell (2010). The annual-

ized interest rate that does take into account the eects of compounding.

APY =

_

1 +

i

m

_

m

1 (3.17)

where i = QIR or nominal APR. APY is typically associated with deposit instruments (CDs,

deposit accounts, etc.).

3.9. THREE BONUS EXAMPLES 61

Two paths to the same summit

Path 1: Compute EAR, then use annual FV formula (3.3)

Path 2: Forget about EAR and use modied FV formula (3.4)

3.9 Three bonus examples

Bonus 1: Your business is in need of $100,000 loan to expand operations and have received quotes

from three dierent lenders as follows:

Lender Interest rate (QIR) Compounding

A 10.40% monthly

B 10.90% annually

C 10.50% quarterly

QUESTION: Which lender do you choose and why?

3.27

Bonus 2: Compute the future value of a $100 investment in a ve year savings bond that pays 10%

interest compounded monthly using two approaches. First, compute EAR then use the simple

FV formula. Then try using the modied FV formula.

Bonus 3: You are purchasing a $100,000 home and have the 20% down payment. You are going

to nance the remaining $80,000 with a 30 year xed rate home loan. You take a look at

Bankrate.com and see quotes from several lenders:

62 CHAPTER 3. TIME VALUE OF MONEY

9/18/10 8:51 AM Mortgage Rates in Memphis, Tennessee by Bankrate

Page 1 of 3 http://www.bankrate.com/funnel/mortgages/mortgage-results.aspx?loan=80000&prods=1&market=82&perc=20&points=Zero

advertisement

Sort by:

APR

APR: 5.052% Point: 0 Est. payments: $423

Adv: Get your 3-Bureau Credit Score

Mortgage Rates: Memphis, TN

Find the best and latest Mortgage rates for Memphis, Tennessee.

Your Search Results Range

Bankrate.com

National Average

Bankrate.com

Site Average

30 yr fixed mtg, 0 Points 4.44% APR - 5.05% APR 4.54% RATE 4.52% RATE

Add other products

30 yr fixed mtg, 0 Points - Sorted by APR

Lender APR Rate Costs and fees Comments

4.438%

Fri Sep 17

4.375%

at 0.000 pts

30 day rate

lock

Fees in APR:

$595

Est payment:

$399

TENNESSEE IS

OUR HOME

STATE

Contact Us

4.444%

Fri Sep 17

4.375%

at 0.000 pts

30 day rate

lock

Fees in APR:

$647

Est payment:

$399

Getting you the

home loan that's

right for you is our

business.

Contact Us

4.464%

Fri Sep 17

4.250%

at 0.000 pts

30 day rate

lock

Fees in APR:

$1,995

Est payment:

$394

Apply & Lock Rate

24/7! View Online

GFE

Contact Us

4.564%

Fri Sep 17

4.500%

at 0.000 pts

30 day rate

lock

Fees in APR:

$597

Est payment:

$405

102 Year Old

Family-Owned

National Bank.

Calls Answered

24/7/365!

Contact Us

4.618%

Fri Sep 17

4.500%

at 0.000 pts

30 day rate

lock

Fees in APR:

$1,095

Est payment:

$405

A+ Rating Close in

10 days Visit our

web site

Contact Us

5.052%

Fri Sep 17

4.875%

at 0.000 pts

45 day rate

lock

Fees in APR:

$1,600

Est payment:

$423

A+ Rating with the

Better Business

Bureau!

Contact Us

BancorpSouth Bank

4.668%

Thu Sep

16

4.625%

at 0.000 pts

30 day rate

lock

Fees in APR:

$399

Est payment:

$411

Regions Bank

4.592%

Wed Sep

15

4.500%

at 0.000 pts

30 day rate

lock

Fees in APR:

$855

Est payment:

$405

The rates on this table are valid for credit scores of 700 and above. For scores from 680 to 699,

borrowers would typically see increased fees up to 1% of the loan value, or an adjustment in the

rate. If you believe that you have received an inaccurate quote or are otherwise not satisfied with the

services provided to you by the lender you choose, please click here.

Quality Assurance

Compare rates with confidence. Rates are accurate and available as of the date seen for

advertisement

advertisement

Home Rates News Calculators

Search Summary

E-mail

Facebook Twitter

Figure 3.2: Sample QIR and APR

QUESTION: Calculate the fees associated with each option. Which lender do you

choose and why?

3.28

To get you started, I will calculate the fees associated with EverBank.

1. Compute the monthly payment of a $80,000 loan using the APR. This payment is the amount

3.9. THREE BONUS EXAMPLES 63

of the check you will send to the lender.

PV = 80, 000

N = 30 12

I = 4.444/12

FV = 0

PMT 402.69

2. Given that monthly payment and QIR compute the present value of the loan.

N = 30 12

I = 4.375/12

FV = 0

PMT = 402.69

PV 80, 653.43

Therefore you are being charged $653.43 in fees with this loan (close to the $647 estimate quoted

on Bankrate.com). Thus, an $80,000 loan at the APR of 4.444% is the same as an $80,653.43 loan

at the quoted interest rate of 4.375%. After you sign the closing papers you will have an $80,653.43

loan if you do not pay the $653.43 fees at closing. Now your turn to repeat the calculations for the

other lenders.

In Step #1 the fees are included (embedded) in the APR. In Step #2 the fees are explicitly

included in the loan amount. In both cases fees are accounted for just once. It would be incorrect

to use the higher APR and the higher loan amount simultaneously.

64 CHAPTER 3. TIME VALUE OF MONEY

Chapter 4

Bond valuation

Overview

Review bond price and yield calculations (including callable and non-callable bonds)

Interest rate and reinvestment risk

Changes in bond prices

Default risk and bond contract provisions

Bond ratings (including a brief discussion of junk bonds and bankruptcy)

Bond markets

65

66 CHAPTER 4. BOND VALUATION

Before I begin,

QUESTION: Who issues bonds and why?

4.1

4.1 Bond prices and yields

4.1.1 Non-callable bonds

Value of any nancial asset = present value of all future cash ows discounted at rate appro-

priate for asset

P =

n

t=1

PMT

(1 + R

d

)

t

+

FV

(1 + R

d

)

n

(4.1)

where R

d

is the market yield (a.k.a., discount rate, yield to maturity or YTM) and PMT is

the coupon payment.

The summation can be replaced with the formula for the present value of an annuity:

P =

PMT

R

d

_

1

1

(1 + R

d

)

n

_

+

FV

(1 + R

d

)

n

(4.2)

Coupon rate-discount rate relationship:

4.1. BOND PRICES AND YIELDS 67

Table 4.1: Discount rate interpretations

Rate Meaning

R

d

< R

coupon

bond will sell at a premium

R

d

= R

coupon

bond will sell at par value

R

d

> R

coupon

bond will sell at a discount

If payments are semi-annual, substitute 2n for n, PMT/2 for PMT, and R

d

/2 for R

d

.

Example 4.1. Consider a bond with the following characteristics:

AAA rated corporate bond

10% annual coupon rate

3 years until maturity

semi-annual coupon payments

face value of $1,000

current price of $1,052.42

QUESTION: Why is the current price greater than $1,000?

4.2

QUESTION: What is the yield to maturity?

4.3

68 CHAPTER 4. BOND VALUATION

QUESTION: What would the bonds price be if the yield to maturity were

12%?

4.4

Current yield

The ratio of a bonds annual coupon divided by current market price:

CY =

annual coupon

current market price

=

10%$1, 000

$1, 052.42

= 9.5% (4.3)

Better than quoting just the coupon rate because you will have to incur a cost to receive

the coupon.

Does not include PV of future redemption at par value.

4.1.2 Callable bonds

Corporate bonds may be callable, typically after some deferred call period

QUESTION: Why might a corporation call in a bond?

4.5

QUESTION: What does this tell you about the yield on callable bond vs. an

otherwise identical non-callable bond?

4.6

4.2. SINKING FUND PROVISIONS 69

The yield to call measure can be extracted from:

P =

fc

t=1

PMT

(1 + Y TC)

t

+

CP

(1 + Y TC)

fc

(4.4)

where

P = current price of bond

fc = number of periods until rst call date

Y TC = yield to call

PMT = coupon payment

CP = call price to be paid by issuer

4.2 Sinking fund provisions

A sinking fund is money set aside to ensure repayment of face value at maturity.

The sinking fund can also be used to repurchase a portion of the existing bonds periodically

at a specied price. The repurchase price is typically lower than that of a callable bond.

In contrast to callable bonds where the entire issue can be repurchased, there is a limit to the

amount that can be repurchased under sinking fund provisions.

Required funds level can be obtained a few ways

70 CHAPTER 4. BOND VALUATION

1. Cash

2. Call in a small percentage of bonds (specic bonds chosen randomly) at a specic price

3. Purchase bonds on the open market

When bonds with sinking fund provisions are called in, the amount of required funds will drop

proportionally.

QUESTION: Why?

4.7

In short, a sinking fund provision is both good and bad for the investor.

Good: The presence of a sinking fund lowers default risk.

Bad: The realized yield will decline as repurchases are made.

4.3 Interest and reinvestment rate risk

Interest rate risk

Denition: Risk of bond price decrease due to an interest rate increase.

A bond price increase due to an interest rate decrease is not considered risk. This subtle

point has signicance later in our discussion.

Reinvestment risk

4.3. INTEREST AND REINVESTMENT RATE RISK 71

Denition: The risk that future reinvestment rates will be less than the YTM at the time

bond was purchased.

YTM calculations assume coupon payments (interest payments) are reinvested at the

YTM rate and gain interest again. Since interest rates are not constant one can not

reasonably expect all future reinvestment of coupon payments to be at the YTM.

Table 4.2 emphasizes the impact of the assumed reinvestment rate risk:

Table 4.2: Reinvestment rate risk illustration

Income for a 10% annual coupon 20 year bond purchased at face value and held until maturity.

Coupon income Reinvestment rate Reinvestment income Total income

2000 8% 2576.20 5576.20

2000 10% 3727.50 6727.50

2000 12% 5205 8205

Note the large percentage of total dollar return attributable to reinvestment.

QUESTION: Anyone familiar with duration matching?

4.8

A couple yield measures that incorporate time-varying market rates:

Realized compound yield One of the assumptions in the YTM calculation was reinvest-

ment of coupon payments at the YTM rate. An after-the-fact measure, called realized com-

72 CHAPTER 4. BOND VALUATION

pound yield can be calculated to assess the actual yield realized:

RCY =

_

total ending wealth

purchase price of bond

_

1/n

1.0 (4.5)

Horizon (or total) return An ex-ante estimate of total return based on explicit reinvest-

ment rate assumptions.

4.4 The Malkiel theorems of bond price changes

Ultimately, bonds will be worth their face value as the maturity date approaches

Before the maturity date however, interest rates and bond prices do change.

Burton Malkiel (1962) derived ve bond price and yield theorems.

Here I present three. Table 4.3 shall be used to illustrate the following theorems and corollaries.

4.4.1 Theorem 1: Bond price - interest rate relationship

Theorem Bond prices move inversely to interest rates. This is evident by equation (4.1). In

equation form:

P

r

< 0 (4.6)

4.4. THE MALKIEL THEOREMS OF BOND PRICE CHANGES 73

Table 4.3: Bond price sensitivity to market yields and maturity

Bond prices for a $1,000 face value 10% coupon bond.

Market yield

TTM 8% 10% 12%

5 years 1,081 1,000 926

15 years 1,173 1,000 862

30 years 1,226 1,000 838

where r is the market yield (or Y TM).

Proof Simply take the partial derivative with respect to r of (4.1):

P

r

=

n

t=1

c

t

t(1 + r)

t1

((1 + r)

t

)

2

+

FV n(1 + r)

n1

((1 + r)

n

)

2

=

_

n

t=1

c

t

t(1 + r)

t1

+ FV n(1 + r)

n1

_

< 0 (4.7)

4.4.2 Percentage change - interest rate relationship

A corollary

1

to the previous theorem.

1

a proposition that follows from one already proven

74 CHAPTER 4. BOND VALUATION

Corollary A decrease in rates will raise bond prices more on a percentage basis than a correspond-

ing increase in rates will lower prices.

Proof Simplify the bond price equation to be P = 1/X where X embodies the interest rate. The

percent change in bond price for an increase in interest rates is:

P

1

P

0

=

1

X+z

1

X

=

X

X + z

(4.8)

Similarly the percent change in bond price for a corresponding decrease in rate is:

P

1

P

0

=

1

Xz

1

X

=

X

X z

(4.9)

Clearly the percent change for a decrease is larger than the percent change for an increase:

X

X z

>

X

X + z

(4.10)

4.4.3 Theorem 2: Bond price - maturity relationship

Theorem As interest rates change, the prices of longer term bonds will change more than the

prices of shorter term bonds, ceteris paribus. Let P

n

and P

m

represent the the change in prices

for bonds with maturities n and m, respectively. Let n > m. In equation form:

P

n

r

>

P

m

r

(4.11)

4.4. THE MALKIEL THEOREMS OF BOND PRICE CHANGES 75

Proof Clearly the longer the maturity, the more terms that are added in (4.1).

Example 4.2. Consider two bonds:

Table 4.4: Maturity-interest rate change sensitivity

Bond M Bond N

Coupon 10% 10%

Maturity 15 yr 30 yr

Price @ Y TM = 12% 862 838

Price @ Y TM = 10% 1000 1000

Price @ Y TM = 8% 1173 1226

As shown, in either case (increase from 10 to 12 or decrease from 10 to 8), the change in bond

price is larger for the longer maturity bond M. Also see the graph on page 140 of Brigham and Daves

(2010).

4.4.4 Percentage change - maturity relationship

A corollary to the previous theorem.

76 CHAPTER 4. BOND VALUATION

Corollary As TTM increases, the percentage price change that occurs increases at a diminishing

rate. Let %P represent the percentage price change that occurs from a change in interest rate.

Restating Theorem 2 in equation form:

(%P)

TTM

> 0 (4.12)

This Corollary states:

2

(%P)

TTM

2

< 0 (4.13)

Proof Maybe another time...

4.4.5 Theorem 3: Bond - coupon price relationship

Theorem Bond price volatility, measured in terms of percentage-price uctuations, is inversely

related to coupon rate (not the Y TM). Let %P represent the bond price percentage change as a

result of a change in interest rates. In equation form:

2

(%P)

cr

< 0 (4.14)

In other words, the change in price due to a change in interest rates of larger coupon bonds is less

than that of smaller coupon bonds.

4.4. THE MALKIEL THEOREMS OF BOND PRICE CHANGES 77

Proof by example Given two bonds, X and Y , identical in all aspects except the coupon rate.

The prices of each bonds at dierent Y TMs are shown below:

Table 4.5: Coupon - interest rate sensitivity

Bond X Bond Y

Coupon 10% (100) 15% (150)

Maturity 15 yr 15 yr

Price @ Y TM = 10% 1000 1384

Price @ Y TM = 15% 705 1000

%P 29.5% 27.7%

As shown, the percentage change in bond price decreases as the coupon rate increases, the inverse

relationship we were looking for.

4.4.6 Malkiel theorem implications

1. If interest rates are anticipated to decline investors should purchase low-coupon, long-maturity

bonds.

2. If interest rates are anticipated to rise investors should purchase short-maturity, high-coupon

bonds.

78 CHAPTER 4. BOND VALUATION

Table 4.6: Malkiel Theorem Implications

r increase r decrease

P

r

< 0 (The 1) bond price decreases bond price increases

(%P)

TTM

> 0 (The 2) want short maturity to minimize

exposure to price decrease

want long maturity to maximize

exposure to price increase

(%P)

c

< 0 (The 3) want high coupons to minimize

exposure to bond price decrease

want low coupons to maximize

exposure to price increase

4.5 Default risk and bond contract provisions

Bond indentures Legal document describing bondholders protection

Administered by trustee

Approved by SEC

Recall default-risk: risk that a company will default and be unable to repay its obligations.

QUESTION: How can indentures reduce default risk?

4.9

Mortgage bonds Bond secured by pledged assets.

QUESTION: How does this impact the ordinary unwinding of assets in a

bankruptcy?

4.10

4.6. BOND RATINGS 79

Debentures Unsecured bond; claims secured by un-pledged property

Subordinated debentures Claims subordinate to all other debt

Development bonds A means to subsidize private industry by issuing tax-exempt bonds on their

behalf in the name of development.

QUESTION: Why is it a subsidy?

4.11

Municipal bond insurance Insurance against municipal default.

QUESTION: What impacts the default risk reduction associated with municipal

bond insurance?

4.12

4.6 Bond ratings

Ratings are supposed to reect default-risk.

High-rated (AAA, AA) bonds are called investment grade.

Low rated (BB and lower) bonds are called junk or high yield bonds.

80 CHAPTER 4. BOND VALUATION

4.6.1 Rating criteria

Criteria include nancial ratios, legal standing, time to maturity, and many other items. See

page 135, 136 of Brigham and Daves (2007) or page 136 of Brigham and Daves (2010).