Escolar Documentos

Profissional Documentos

Cultura Documentos

Financial Status-IL & FS Transportation LTD 2011-12

Enviado por

Roshankumar S PimpalkarDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Financial Status-IL & FS Transportation LTD 2011-12

Enviado por

Roshankumar S PimpalkarDireitos autorais:

Formatos disponíveis

Cover

Name of entity Status Financial Year

- IL &FS TRANSPO - PUBLIC LIMITED - 2011-12

Page 1

Cover

f entity

al Year

- IL &FS TRANSPORTATION NETWORKS LTD - PUBLIC LIMITED COMPANY - 2011-12

Page 2

Cover

Page 3

fin stat

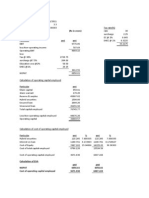

Particular Equity and Liabilities Own funds Capital Reserve and surplus

Balance Sheet as at March 31,2012 Rs. In Lakhs

Rs. In Lakhs

19,427.00 256,952.00 276,379.00

Minority interest Non-current liabilities Long term borrowing Deffered tax liabilities Other long term liabilities Long term provisions Current liabilities current maturities of long term debt current maturities of finance lease obligation Short term borrowing Trade payables Other current liabilities Short term provisions

29,347.00

697,376.00 20,465.00 22,910.00 7,509.00

105,255.00 652.00 219,308.00 113,044.00 18,600.00 13,953.00 470,812.00 Total 1,524,798.00

Asset Non current assets Fixed assets Non-current investment Godwill on consolidation Deffered tax assets Long term loans, advances and deposities other non-current assets Current Assets Current investments Inventories Trade receivables Cash and cash equivalent Short-term loans and advances Other Current assets

638,723.00 38,319.00 52,657.00 52.00 79,443.00 486,236.00

1,222.00 2,101.00 88,201.00 28,379.00 91,985.00 17,480.00 229,368.00 Total Diff 1,524,798.00 0.00

Page 4

fin stat

Page 5

fin stat

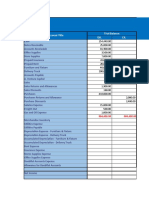

Profit and loss statement for the year ended March 31,2012 Particular Rs. In Lakhs Sales/Revenue from operation(net) 560,562.00 less: Cost of goods sold 12,420.00 Gross profit Add: Operating income less: Operating expense Employee benefit expenses construction contract cost operation and maintenance Other expenses Operating PBIDT Less:Depreciation Operating PBIT Add: other income Add/less:extraordinary items PBIT Less: Interest PBT Less: Tax PAT

indicates amts to be filled

Tax rate

0.3605

Average Assets Opening total asset Closing total asset

942,260.00 1,524,798.00 1,233,529.00

Average capital employed Opening capital employed Closing capital employed

583,823.00 973,755.00 778,789.00 88,826.55 748,260.00 276,379.00

Post tax op. PBIT Debt Equity Average owners fund opening capital

223,922.00

Page 6

fin stat

closing capital

276,379.00 250,150.50

Average inventory

2,361.50

Page 7

fin stat

d March 31,2012 Rs. In Lakhs

548,142.00 0.00

36,939.00 305,125.00 18,475.00 41,048.00 401,587.00 146,555.00 7,655.00 138,900.00 12,381.00 0.00 151,281.00 72,821.00 78,460.00 24,572.00 49,696.00

10.30% 20.60% 30.90% 41.20% 51.50% 36.05%

Page 8

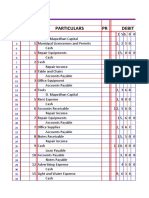

Ratio

Working capital Net worth Profitability ratios Gross profit Margin Operating profit margin Net profit margin Return on asset(ROA) Return on investment(ROI) Return on net worth(RONW) Return on long term funds Return on owners capital Individual Expense ratio Employee benefit expenses construction contract cost operation and maintenance Other expenses

-241444 305,726.00

Quick asset Intrinsic value Liquidity ratios

97.78% 24.78% 8.87% 3.26% 4.03% 16.26% 9.12% 19.87%

Current ratio Quick ratio Debt and Risk ratio Interest coverage ratio Leverage Financial leverage Low DOL and High DFL is preffered

6.58963683% 54.43198076% 3.29579957% 7.32265120%

Suggestion: 1) working capital need immediate atten 2) Reduce debt 3) Improve capital turnover ratio

Page 9

Ratio

Page 10

Ratio

Quick asset Intrinsic value Liquidity ratios Current ratio Quick ratio Debt and Risk ratio Interest coverage ratio Leverage Financial leverage Low DOL and High DFL is preffered

227267 157.373536

Closing price on 27/04/2012 No. of shares Cash position ratio

0 194267732

0.48717535 0.48271285

Absolute cash ratio

0.06287223

Capital structure ratios 2.07743645 Debt equity ratio Debt ratio 1.92812898 Fixed asset to long term funds Proprietary ratio 2.70736923 77% 0.6559381 18%

1) working capital need immediate attention 2) Reduce debt 3) Improve capital turnover ratio

Page 11

Ratio

Page 12

Ratio

CMP/BV

Turnover ratio Capital turnover ratio Fixed asste turnover ratio Working capital turnover ratio Inventory turnover ratio 0.719787 0.877629 -2.32171 5.259369

Page 13

If you make any changes please share it with everyone

Você também pode gostar

- Revised Schedule VIDocumento16 páginasRevised Schedule VIRoshankumar S PimpalkarAinda não há avaliações

- Lease IdentifierDocumento9 páginasLease IdentifierRoshankumar S PimpalkarAinda não há avaliações

- General Anti-Avoidance Rule (GAAR) : Roshankumar S PimpalkarDocumento3 páginasGeneral Anti-Avoidance Rule (GAAR) : Roshankumar S PimpalkarRoshankumar S PimpalkarAinda não há avaliações

- 234a, B, CDocumento28 páginas234a, B, CRoshankumar S PimpalkarAinda não há avaliações

- WiproDocumento18 páginasWiproRoshankumar S PimpalkarAinda não há avaliações

- Crowding OutDocumento3 páginasCrowding OutRoshankumar S PimpalkarAinda não há avaliações

- Venture CapitalDocumento16 páginasVenture CapitalRoshankumar S PimpalkarAinda não há avaliações

- As 30 Part-IiDocumento23 páginasAs 30 Part-IiRoshankumar S PimpalkarAinda não há avaliações

- As 30Documento40 páginasAs 30Roshankumar S PimpalkarAinda não há avaliações

- CoalDocumento16 páginasCoalRoshankumar S PimpalkarAinda não há avaliações

- Harshad MehtaDocumento32 páginasHarshad MehtaRoshankumar S PimpalkarAinda não há avaliações

- India in A Debt TrapDocumento4 páginasIndia in A Debt TrapRoshankumar S PimpalkarAinda não há avaliações

- Reasons For Exchange Rate FluctuationDocumento13 páginasReasons For Exchange Rate FluctuationRoshankumar S PimpalkarAinda não há avaliações

- Pirated Product MarketDocumento1 páginaPirated Product MarketRoshankumar S PimpalkarAinda não há avaliações

- Working Capital Management 5Documento3 páginasWorking Capital Management 5Roshankumar S PimpalkarAinda não há avaliações

- Lovable LingerieDocumento3 páginasLovable LingerieRoshankumar S Pimpalkar100% (1)

- Working Capital Management 1Documento6 páginasWorking Capital Management 1Roshankumar S PimpalkarAinda não há avaliações

- Working Capital Management 2Documento5 páginasWorking Capital Management 2Roshankumar S PimpalkarAinda não há avaliações

- Working Capital Management 3Documento4 páginasWorking Capital Management 3Roshankumar S PimpalkarAinda não há avaliações

- NewsDocumento253 páginasNewsRoshankumar S Pimpalkar0% (1)

- Management Information SystemDocumento4 páginasManagement Information SystemRoshankumar S PimpalkarAinda não há avaliações

- Indian It SectorDocumento6 páginasIndian It SectorRoshankumar S PimpalkarAinda não há avaliações

- Working Capital Management 4Documento4 páginasWorking Capital Management 4Roshankumar S PimpalkarAinda não há avaliações

- Tisco EvaDocumento2 páginasTisco EvaRoshankumar S PimpalkarAinda não há avaliações

- Financial Status-Transcorp International LTD 2011-12Documento15 páginasFinancial Status-Transcorp International LTD 2011-12Roshankumar S PimpalkarAinda não há avaliações

- Fiscal Responsibility Budget Management ActDocumento4 páginasFiscal Responsibility Budget Management ActRoshankumar S PimpalkarAinda não há avaliações

- Financial Status-Orient Paper & Industries LTDDocumento14 páginasFinancial Status-Orient Paper & Industries LTDRoshankumar S PimpalkarAinda não há avaliações

- Financial Status-Sumeet Industries LTDDocumento14 páginasFinancial Status-Sumeet Industries LTDRoshankumar S PimpalkarAinda não há avaliações

- Financial Status-Procter & Gamble Hygiene & Health Care Ltd.Documento14 páginasFinancial Status-Procter & Gamble Hygiene & Health Care Ltd.Roshankumar S PimpalkarAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- PR 15-A - 3022220013 - Senapati Yudha Garda PerkasaDocumento7 páginasPR 15-A - 3022220013 - Senapati Yudha Garda PerkasaSenapati PerkasaAinda não há avaliações

- Bad Debts and Provision For Doubtful Debts Bad DebtsDocumento28 páginasBad Debts and Provision For Doubtful Debts Bad DebtsAngel LawsonAinda não há avaliações

- RekhaDocumento13 páginasRekhasuraj kumarAinda não há avaliações

- Operating Assets: Property, Plant, and Equipment, Natural Resources & IntangiblesDocumento37 páginasOperating Assets: Property, Plant, and Equipment, Natural Resources & Intangiblesakram oukAinda não há avaliações

- Qualifying Exam Reviewer 1Documento26 páginasQualifying Exam Reviewer 1dlaronyvette100% (2)

- Chapter 5 Corporations NoteDocumento5 páginasChapter 5 Corporations NoteLihui ChenAinda não há avaliações

- Slm-Iii Sem - Corpo AccountingDocumento304 páginasSlm-Iii Sem - Corpo AccountingAlbin K BijuAinda não há avaliações

- Budgeting CTRLDocumento9 páginasBudgeting CTRLJoseph PamaongAinda não há avaliações

- DPR For Walnut ProcessingDocumento74 páginasDPR For Walnut ProcessingMohd touseefAinda não há avaliações

- Assign 2 and 10 Excel - 7edDocumento17 páginasAssign 2 and 10 Excel - 7edNelson Gonzalez0% (2)

- Cwip Theory AccountingDocumento33 páginasCwip Theory AccountingRebeccaNandaAinda não há avaliações

- Wire and Wire ProductsDocumento29 páginasWire and Wire ProductsThomas MAinda não há avaliações

- Posting To LedgerDocumento34 páginasPosting To LedgerBridgett Florence CaldaAinda não há avaliações

- Quality Auto Repair Shop Template2-1Documento38 páginasQuality Auto Repair Shop Template2-1Gianne Denise Reynoso100% (2)

- Business Plan: Sections To Be CoveredDocumento50 páginasBusiness Plan: Sections To Be CoveredDavid Caen MwangosiAinda não há avaliações

- Module 9 Deductions From Gross IncomeDocumento13 páginasModule 9 Deductions From Gross IncomeNineteen AùgùstAinda não há avaliações

- Case Study BpsDocumento8 páginasCase Study BpsMariella Angob100% (2)

- June 2017 1 5: Problem 5Documento2 páginasJune 2017 1 5: Problem 5Roqui M. GonzagaAinda não há avaliações

- Aklan DakDocumento39 páginasAklan DakConi AyuAinda não há avaliações

- Final ReportDocumento52 páginasFinal ReportAriharan HariAinda não há avaliações

- Cfap 5 2019 PKDocumento194 páginasCfap 5 2019 PKSummar FarooqAinda não há avaliações

- Business Analysis and Valuation 3 4Documento23 páginasBusiness Analysis and Valuation 3 4Budi Yuda PrawiraAinda não há avaliações

- Book Answers BalanceDocumento9 páginasBook Answers BalanceIza Valdez100% (1)

- No 4 Business Property IncomeDocumento4 páginasNo 4 Business Property Incomeroukaiya_peerkhanAinda não há avaliações

- PrintDocumento28 páginasPrintTanvir MahmudAinda não há avaliações

- CH 3Documento12 páginasCH 3landmarkconstructionpakistanAinda não há avaliações

- ICPA Final Pre-Board - TaxationDocumento31 páginasICPA Final Pre-Board - TaxationAlexis SosingAinda não há avaliações

- Accounting ProjectDocumento135 páginasAccounting ProjectMylene SalvadorAinda não há avaliações

- ProjectDocumento70 páginasProjectnramkumar00775% (4)