Escolar Documentos

Profissional Documentos

Cultura Documentos

Insurance Law Outline

Enviado por

Simon BurnettDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Insurance Law Outline

Enviado por

Simon BurnettDireitos autorais:

Formatos disponíveis

Bernstein INSURANCE OUTLINE Principle sellers of ins are stock and mutual companies Insurance transfer of risk; provides

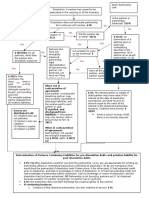

s security; encourages investment FUNCTIONS OF INSURANCE 1. Risk-transfer transforms a small risk of a large loss into a large risk of paying a smaller sum (ins premium) 2. Pool the risk if we get 10K policies, one will get stolen, but theres enough money to cover anticipated loss PROBLEM OF IMPERFECT INFO MAIN PROBLEMS 1. ADVERSE SELECTION a. High risk parties elect to be insured in greater proportions than low-risk. When high risk parties have to get insurance and thus, insurance companies are forced to raise premiums. b. The way to get around this: i. Law of large numbers group together a large amt; the greater the prob that my experience will meet predicted proob car not getting stolen ii. insurance attempt to get a large number of applications. all stats are based on pop as a whole we may insure the riskiest people. Red-lining to avoid adverse selection 2. MORAL HAZARD a. Possibility that people, when they take insurance, will become more risky b/c they know insurance company will cover. b. The Value of Transferring Risk i. Risk preferring = people who would choose to forego the certain loss in the hope of incurring no loss, despite the equal probability of suffering a large loss ii. Risk neutral = person indifferent to the alternatives iii. Risk adverse = people who would choose to lose $500 with the certainty of confronting the 50% chance of losing twice as much 3. How Do Insurance Companies Deal With This? a. They underwrite. This person is responsible for gathering information. A. BREACH OF WARRANTY - Warranty in a policy of ins is a condition or a contingency, and unless that be performed, there is no K - The policyholders breach of a warranty voided the policy even if that breach did not contribute to the loss in question, and even if it did not increase the risk that a loss would occur - Warranties and representations v. coverage provisions o warranties and representations apply to potential causes of loss, whereas o coverage provisions apply to actual causes. o EXP: a policy provision that there is no coverage against loss by fire while gasoline is stored on the insured premises would constitute a warranty, a provision that there is no coverage against loss by fire caused by the ignition of gasoline started on the premises would constitute a coverage provision.

Vlastos v. Sumitomo Marine & Fire Ins. Co. - Was this provision material? Court decided it was a warranty, so they held that it was material. If this provision is put in the warranty cubby hole, then as a matter of law it is important, we dont care why the ins co put it there. IF not complied with, then as a matter of law, the ins co is off the hook. - Was the provision complied with? The ct says that the proper test is what the state of affairs was when the policy was signed. All that the warranty requires is that for that one night that the policy was signed, the janitor had to be on the 3rd floor. o Trial ct said that in order for the provision to be complied with, the entire 3rd floor had to be occupied by the janitor o The Cir Ct, said, NO, all that the provision requires was that on the night in question, the janitor was residing somewhere on the 3rd floor. Types of Warranties: i. Affirmative true on the date signed; ii. Promissory has to be true for the life of the policy. Promising for the future iii. Ambiguous, then court will deem as affirmative. Only need substantial compliance. 1. Insured wins over insurance companies b/c they had the pen, they could have drafted it differently

B. MISREPRESENTATION AND CONCEALMENT - The party injured in this case is the insured - The major fx is to combat adverse selection - Standard Rule of voiding K is that the representation be o False - have to show deliberate intent to deceive o Material if question had been answered truthfully, would the co have issued the same policy with the same terms? o Induce justifiable reliance Ward v. Durham Life Ins. Co (co relied upon justifiably) - An ins co cant avoid liability on a policy on the basis of facts known to it at the time the policy went into effect. Knowledge of or notice to an agent of an insurer is imputed to the insurer itself, absent collusion bw the agent and the insured. The insured relied on the assurance of the agent that his previous incidents were fine when he signed the policy - However, if the agent put false info and the insured reads it over and says its okay, then this is a misrepresentation. Neil v. Nation Wide Facts o Owned a Mobil home and insured it for fire prices. o He did not name prior fire policies. o Nationwide denied his claim b/c of misrepresentation Procedure o Arkansas Ct. Granted Summary Judgment for misrepresentation o Arkansas Ct. of Appeals Said there was a question of fact, and therefore, the case should go to trial.

There was a question about the Agent and what was asked and answered by both parties. Keys to this case: o Agent was not called as a witness by the Insurance company b/c he is not necessarily on their side. If agent messed up, they would be able to sue him if judgment was made against them. Therefore, the agent is intuitively going to protect himself.

MacKenzie v. Prudential Ins. Co of America disclosing changes during processing of application - Facts o Died from a pulmonary embolism. He falls off his bike and bruses his chest. o Had $40,000 in life insurance o His first application was filed out right the first time. However he wanted another policy for cheaper. o He goes to the doctor after the application and is told he had high blood pressure. By that time the insurance company finally underwrites and accepts his application. - Any answer that is made to a question on an app is deemed to be a continuing obligation. If any of the answers change before all the steps of processing the app are finished, then insured has an obligation to disclose THIS IS THE RULE o he had an obligation to tell the ins co that he took high BP medication after he filled out the app, but before the policy was delivered. C. INS K FORMATION AND MEANING CONSTRUING AMBIGUITIES AGAISNT THE INSURER - invoke doc when the policy lang in question will bear a pro-coverage interpretation - invoke doc if the policy language could reasonably have been drafted more clearly and the insured could reasonably have expected the coverage at issue Rusthoven v. Commercial Standard Ins. Co. - when policy is ambiguous or susceptible to 2 meanings, it must be given the meaning which is favorable to the finding of ins coverage - The policy allowed for stacking the ER who owned the policy under which the P is suing owned 67 trucks and had each one insured for 25K. The co says that it only has to cover up to 25K, and the P says that he is covered up to 1.675M. Ambiguous policy interpret for the insured - there is also an implicit understanding that ambiguities, which in most cases might be resolved in more than just one of the other of two ways, would be resolved favorably to the insureds claim only if a reasonable person in his position would have expected coverage. Vargas v Ins. Co of N America - Insurer must est that the words and expressions used not only are susceptible of the construction sought by the insurer but that it is the only construction which may fairly be placed on them. The insurer is obliged to show o That it would be unreasonable for the avg man reading the policy to construe it as the insured does o And that its own construction was the only one that fairly could have been placed on the policy - Drafter of the policy, the insurer, has control of its language and therefore the capacity to make it clear D. DUTY TO READ

a. we have a duty to rea HONORING THE REASONABLE EXPECTATIONS OF THE INSURED Atwood v. Harford accident & indemnity co - The objectively reasonable expectations of the insured will be honored even though a study of the policy would have negated those expectations - Theory behind the Expectations Principle o The insurer in some way has misrepresented what is in the policy o The insurer is estopped to deny coverage bc it has allowed the insured to labor under a misimpression about the policys contents - Duty to let insured know what he was or wasnt buying in the policy. Atwater Creamery - The Doc of protecting the reasonable expectations of the insured is closely related to the doc of Ks of adhesion o Unequal bargaining power o Take it or leave it o Lay person lacks skills to read and understand policy o People purchase ins relying on agent to provide a policy that meets their needs - ambiguity ought not be a condition precedent to the application of the reasonable expectations doc - Most cts recognize that insured seldom see the policy until the premium is paid STANDARDIZATION THE ROLE OF INTERMEDIARIES 2 types of intermediaries o agents representatives of ins cos ind agents not the EEs of any one ins co, but instead are independent contractors who contract with multiple insurers to sell and service their policies Exclusive agents work only for a single insurer Gen Agents have authority to bind the co (except in life ins, where the home office alone makes binding decisions) Soliciting no power to bind ins co o Brokers place orders for ins with companies designated by their policy holder clients or with companies of their own choice

THE AUTHORITY OF THE AGENT Elmer Tallant Agency, Inc. v. Bailey Wood independent agent, apparent authority - Where an app for ins is made to an agent who represents several cos, no K of ins is engendered bw the insured, and any particular co until such co is designated by the agent. But where the co is selected by the agent, and in some manner designated as the co in which the ins is to be written, a binding K results. In such case the agent becomes the agent of the insured for the purpose of selecting the co - The insured was designated by the agent prior to the loss - Tallant didnt have actual authority, but apparent authority to bind Zurich. Once you make someone your agent and you give that agent authority to do a certain thing, then third parties have the right to believe that that agent has authority to make decisions Bailey has the right to believe that Tallant had authority to bind Zurich

WAIVER AND ESTOPPEL Waiver voluntary relinquishment of a known right Estoppel results from a change of position by the insured as a consequence of some representation or act by the insurer Roseth v. St. Paul Prop - Maj. Rule estoppel is not available to bring within the coverage of a policy those risks not covered by its terms or expressly excluded by the policy - Conduct which occurs before or at the inception of the K can generate an estoppel but conduct that occurs later cannot do so. - Waiver and Estoppel cannot be used to bring within the scope of the policy something that the policy doesnt cover. PUBLIC POLICY ON K TERMS Hartford v. Powell - gen rule is that regardless of the lang of the pol, as a matter of pub pol, ins cos are not obligated to pay punitive First Bank Billings - The basis on which punitive can be granted have broadened. So now, cts are willing in some of these broadened situations, to make the ins co pay the punitive damages. If the insured is not protected against punitive damages, the ins that it buys isnt going to do it much good Strickland v. Gulf Life Ins - An ins limitation forcing a gruesome choice may be void against pub pol CHP 4 FIRE AND PROP INS FIRE AND PROP INS INSURABLE INTEREST - Prop ins pol is a K of indemnity - Insurable interest in order to recover, the insured must have an insurable interest at the time of the loss. You can take a policy out on a prop that you do not own, but you cant recover if you dont own it at the time of the loss. - No insurable interest claim can only be raised by the ins co - 2 tests o legal test based upon whether or not you have an enforceable interest that would be legally enforceable o Economic test as to whether the insured stands to benefit from the continued existence of the insured prop Gossett v. Farmers Ins - Record doesnt reveal any obligation on Ps part to purchase the prop - Opportunities for net gain thru ins should be regarded as inimical to pub pol - Principle of indemnity payments limited to loss; put you in the same position as before the loss the insureds had no documented indebtedness; they would be placed in a far better position than they were before the fire - Pd didnt have any enforceable interest. The only interest that they had was to the improvements that they made. So even though they purchased ins for the entire house, they can only get paid for the improvements they made. SUBROGATION legal substitution; refers to an assignment by operation of law insurer cannot have subrogation against its own insured

Subrogation helps to allocate ultimate financial responsibility for some insured losses to the third parties who cause them without producing windfalls - EXP: Subrogation arises in ins in the context of A owning a piece of prop, and has a policy for 100K on it. The loss was caused by the negligence of B who is potentially liable for 100K. The insured has the option of either suing the tortfeasor or suing the ins co. Insured cant do both, it would violate the principle of indemnity. The ins co gets off the hook if recovery can be made from the tortfeasor. If A goes after the ins co first and collects, thats when we get into subrogation. When the ins co pays the 100k to A, it is subrogated to As claim the claim is assigned by operation of law to the ins co, and the ins co has a right to recovery from the tortfeasor. - Equitable subrogation the ins co is subrogated even if there is nothing about subrogation in the policy - Contractual subrogation there is a specific clause in the policy that the ins co is subrogated against anyone the insured has a claim against. - If A goes after B and only gets partial recovery can go after ins co for the rest - No subrogation if ins co voluntarily pays and doesnt have to. Great Northern Oil Co v. St. Paul fire and marine - P, in the absence of a prohibition in the ins K against entering into any exculpatory agreements, is not precluded from pursuing its action to recover its loss under the ins pol - P cant release the tortfeasor after the loss has occurred bc it impairs the subrogation rights of the ins co. - The thing is here, the release happened prior to the loss. - If the ins co wants to protect itself against pre-loss releases, they have to put something in the policy LIMITED INTERESTS 1) MORTGAGES - Situation is that A wants to buy a house and wants to borrow from the bank; bank now has a secured interest in the prop - Bc bank has a secured interest, it has an insurable interest. Bank makes a stipulation that forces A to insure the prop o Go out and buy a policy to protect the bank (not smart bc ins co can come after you for subrogation) o Take out a policy where A is the only insured and bank is a loss payee (bank doesnt like this bc A might not fulfill all of its obligations under the policy and the bank wont get paid) o Bank and buyer are both named insureds. Ins co has obligations to the buyer and the bank. So, if the buyer breaches an obligation, the bank is still insured Northwest Farm v. Althauser - Ins co has paid mortgage to bank - Ins now goes to the buyer in subrogation for the payment to the bank bc of material misrepresentations on the part of the buyer. - The result of the fact that the buyer has breached one of the terms of the policy voids the policy as to him, but not to the mortgagee, bank. So, once the ins co pays the bank it has the right to be subrogated. 2) LEASEHOLDS Alaska Ins Co v. RCA - A commercial tenant is an implied co-insured under its LLs fire ins policy when a provision in the lease requires the LL to obtain and keep in effect an ins policy on the leased premise - Insurer cannot recover by means of subrogation against its own insured 3) REAL ESTATE SALES Paramount Fire Ins Co v. Aetna Casualty and Surety Co

at the time of the fire, the K for sale has been entered into, but the sale hasnt been executed. The seller still has a fee on the land, but the buyer has an insurable interest bc seller has the right to demand specific performance. The risk of loss at moment of K is on buyer - Fire happen night before closing and both parties have ins. Which co has to pay? - Sup Ct says that bc risk of loss was completely on the buyer, the seller suffered no economic loss and therefore the buyers policy had to pay the full amt. - Gen Rule is that the risk shifts from seller to buyer. 4) OTHER LIMITED INTERESTS The Home Ins Co v. Adler died 19 minutes after the fire started - still alive when it burned down; Life Tenant who insures prop in his name is not precluded from recovering the full amt of the policy proceeds. The Folger Coffee Co v. The Great American Ins. Co - The underlying non-ins legal rule involved is that ARKAMO is the bailee of Folgers prop. All the prop is destroyed - Under bailment law, the bailee is required to return the goods as good a shape as received unless the goods are destroyed other then by the negligence of the bailee - The prop was destroyed here, not by the bailees negligence, but Folgers nonetheless goes to the bailees insurer and demands to be reimbursed. They do this based on a provision in the bailees policy that says that the insurer will be liable. Folgers recovers. EXCLUSIONS AND EXCEPTIONS most exclusions are designed to address one or more of the following in prop ins o adverse selection o moral hazard o catastrophic loss o avoiding duplication of coverage provided by different kinds of policies - 2 issues arise when exclusions come into play o concurrent causation when there is coverage of a loss that has more than one cause, if losses resulting from one cause are excluded from coverage and losses resulting from the other cause are not excluded. o Increased risk what is the interplay bw the effort to combat moral hazard that is at the heart of many of the common prop ins exclusions, and the insureds legitimate expectation that even losses caused by ordinary carelessness or negligence are covered by the standard policy? 1) THE PROBLEM OF CAUSATION State Farm Fire v. Bongen - Ps house destroyed by mudslide which they say is caused by the construction Efficient Proximate Cause - There was an exception in the policy for mudslides - Ins Co doesnt have to pay bc of exclusion - Most cts say that for every loss there is one cause EPC, if its covered in the policy, then they can recover - The reason that ins co wins is bc the exclusion for mudslides was very broad 2) THE PROBLEM OF INCREASED RISK Commercial Union Ins v. Taylor - Ins Co denied claim on the basis that the policy provided ins co wouldnt be liable for a loss where hazards were increased by means within control and knowledge of insured - Control presupposes knowledge and Taylor didnt know sprinklers were off -

The increase risk has to be both substantial and long term If you store TNT on your prop and while its there the roof catches fire, there is no coverage even though risk had nothing to do with the harm. Smith v Lumbermens freezing of boiler and water pipes - any temp vacancy caused by or incident to change or removal of tenants is not within the vacancy or unoccupancy clause and that reasonable time will be allowed the insured to obtain other tenants before the forfeiture of the policy may be effected - vacancy refers to furnishings, unoccupied refers to people. THE MEASURE OF RECOVERY Efficient Proximate Cause for every loss there is one cause that is the real cause - the measure of recovery is not the face of the policy, that amt is the ceiling - The actual cash value of the prop at the time of the loss is what is recovered Zochert v National Silos - P says actual cash value of silo is 15k; Ins co says, no, the actual cash value is replacement less depreciation - 3 tests to determine actual cash value o Market value hard to calculate for houses o Replacement less depreciation o Broad Evidence Rule Look at everything COINSURANCE IN FIRE AND PROP COVERAGE says you have to insure 80% of the value of the prop at the time of the loss EXP: Prop worth 100K, and you only have 40K policy on the prop, and you sustain 10K loss. Coinsurance says you need 80K, buy you only have 40K, so you get half 5K. The aim is to neutralize the incentive to insure only against partial losses EXP: o Face amt = 60K; replacement of entire prop = 100K; replacement cost of damaged prop = 30K o X = face amt of policy / .8 * replacement cost of the entire prop 60/(.8)(100) = .75 (.75)(30k) = 22,500

BUSINESS INTERRUPTION INSURANCE - sold as an adjunct to prop ins. If a particular prop is destroyed by a covered peril and the insureds business is suspended as a result, the business interruption kicks in Omaha Paper - Ins contends that the increased use of output at the 2nd plant means business wasnt suspended - The ins is prop specific, so it doesnt matter what happens at another prop - If prop is destroyed by something covered, business interruption is additional amts based on profits lost bc business out of operation LIFE, HEALTH, AND DISABILITY INS an investment more so than indemnity Term ins (main type); keyed to morality tables Sold in 2 basic different ways o Someone takes out ins on the life of another o An ins policy on their own life

Incontestability after a policy is 2 years old, if the CQV is still alive, the co cant contest Suicide suicide is only a def for on year; after on year, the insured gets full amt Misstatement of age or sex it doesnt void the policy, just that the amt you get is the amt you would get for your true age or sex - Beneficiary owner can change the beneficiaries 1) THE APPLICATION Gaunt v. John Hancock Mutual Life Ins co - all underwriting decision for life ins are centralized at headquarters, and agent have no authority whatsoever to bind the co to cover a person; they can only take apps - The ct should enforce the reasonable expectation of the insured. A lay person would not understand all these technical advantages. They would believe that once they completed all necessary, they would be covered from that moment on. - The weight of authority is that in effect if not in actual legal doctrine that when the insured pays the premium up front, that basically you have 2 separate ins policies. Once is the long term policy that the person has just paid for, and the other is the short term policy that is active from the date of the application to the date the co accepts the application. If the co rejects the application, then the short term policy ends at that point. 2) THE REQUIREMENT OF AN INSURABLE INTEREST - 2 ways to arrange life ins o CQV takes it out o 3rd party takes it out on the life of the CQV there is where you need insurable interest Ryan v. Tickle - Insurable Interest in a matter of life and health ins, exists when the beneficiary bc of relationship, either pecuniary or from ties of blood or marriage, has some reason to expect some benefit from the continuance of the life of the insured - Only the insurer can raise the objection of want of an insurable interest. If ins co pays, insurable interest cant be raised by anyone else - Only need insurable interest when policy is taken out - If policy is taken out by someone who is purely a creditor, then they can only get reimbursement. 3) CHANGE OF BENEFICIARY AND ASSIGNMENT Engleman v. Conn Gen Life Ins - change of beneficiary in a life ins policy can be accomplished by substantial compliance with the policy requirements - Will have effectively changed beneficiary if: o Owner clearly intended to change beneficiary o Owner has taken substantial affirmative action to effectuate the change Grigsby v. Russell - If there was no rule of law that stated that any claim against the co arising under any assignment of the policy shall be subject to proof of interest, and the co saw fit to pay, the clause did nto diminish the rights of Grigsby as against the administrators of Burchards estate 4) LIMITATIONS ON RECOVERY BY BENEFICIARES New Eng Mutual Life v. Null - a life ins policy is void when it is shown that ht beneficiary thereof procured the policy with a present intention to murder the insured - it is void at inception and no one is entitled to the rights. State Mutual Life Assurance Co of America v. Hampton

Is a named beneficiary under a life ins policy who is acquitted of the insureds murder automatically entitled to recover the ins proceeds so that relitigation of the issue of the beneficiarys criminal responsibility barred? No acquittal does not per se entitle recovery - All you need for acquittal is reasonable doubt for acquittal a civil action based on the same facts could produce a different result since a lesser burden of proof, a preponderance of the evidence, is required 5) INCONTESTABILITY - Purpose is to provide insured with assurance that once period of incontestability passes, his coverage is firm and beneficiaries protected - Even out the playing field - Required in every life in policy Amex Life Assurance Co v. Superior Ct. discoverability test - Insured knew he had HIV when he applied and he lied - Impostor Def when insured uses the name of someone else no coverage. - But here, P sent in someone to take test for him duty on insured to discover - After contestability expired, insurer may not assert the def that an impostor took the medical exam if insured personally applied for insurance Limitations v. conditions???????? 6) LIMIATIATIONS OF RISK - Many limitations on coverage contained in life ins policies clearly are not subject to the incontestability clause Silverstein v. Met Life - ulcer was not a disease within common sense of the word Charney v. Ill Mutual Life Casualty Co - Every state has a specific stat that says you can exclude death by suicide if it occurs within a stipulated period. - Here, only refund in the event of the insured takes his life by his own hand, whether sane or insane, within 2 years of the policy. Here, they are defining suicide for you. - The ins co has the sane or insane clause bc they dont want intent to play that much of a part. 7) NEGLIGENCE ACTIONS AGAISNT THE INSURER Mauroner v. Mass Indemnity - No damages on K bc of the delay - Damages in tort for negligence P has to show that they were damaged - Duty to act within a reasonable time, and damages if there is harm as a result of the delay GROUP INS - Exists almost exclusively in life ins Paulson v. Western Life Ins - Is the ER-policyholder the agent of the insurer, of the insured worker, or the agent of neither? - Ins is a unilateral K. The promisor is the ins co who made a promise to the ER. P is the third party beneficiary of the ins. - P was told by ER that he could elect coverage anytime within the 1st 6 months without evidence of insurability. But, this isnt want the brochure stated that P was supposed to get. - If plan is exclusively administered by the insurer, no agency relationship exists bw the insurer and ER. If the ER performs all of the administration, an agency relationship exists bw the insurer and ER DISABILITY for injuries that arent work related

- meant to replace income during a period which you cant work Mossa - 2 types of disability o occupational cant do own job o total cant do any gainful employment - other occupation job in which insured has been trained and has worked during his life; consider age, training, experience, reputation, station in life, and other circumstances in order to determine in what other gainful occupation P might reasonably be expected to engage bc of his education, training or experience Heller v. Equitable - Policy stated that insured must be disabled and under regular care of physician - Under care of physician doesnt mean he has to get surgery - Doesnt have to assume a big risk, but has to do something like take pills. Liability for bad faith breach Silberg v. Cal Life Ins - this is a breach of K under Hadley get reasonably foreseeable damages at the time K was entered into - there are circumstances under which a refusal of an ins co to pay is not only a K claim, but also a tort claim bad faith breach - Negligence breach of duty - Ins could have paid the claim and gotten a lien on the workers comp - To get punitive, need intent of malice LIABILITY INS CGLs AY Mc Donald Ind, Inc - the term damages includes amts that arent fust fixed money awards, but any costs incurred bc of legal proceeding - In a CGL, coverage is for expenses for prop damage on someone elses prop - What if the govt intervenes bf there is damage to someone elses prop? o Maj no coverage o Min govt owns all land, so if you damage your prop, youre really damaging govts prop, so theres coverage 1) TRIGGER AND ALLOCATION OF COVERAGE AHP v. Liberty Mutual - Ins is liable only when there has been bodily injury or prop damage within policy period - During the time the product was on the market, there were different insurers for AHP - AHP puts forth Exposure Theory - Ins Co puts forth Mnifestation Theory - Ct says proper test is injury in fact period when pill actually harmed the body hard to show - Triple Trigger Theory every ins co who was on the risk when there was exposure, when there was injury in fact, and when there was manifestation is liable. Northern States Power - trigger is when bodily injury or prop damage occurs during the policy period - This is an environmental claim where the ct cant pinpoint where and how the injury occurred. o Apportion damages as proven each co would only have to pay for damages during their time on the risk too hard, not feasible

o Pro rata by time on the risk determine how many years each policy was in effect and portion out liability based on time (this is what the ct did) o Can say join and several MCC v. American - liability is based on occurrence some event and some resulting harm - when trying to determine number of occurrences ct looks at cause even though when trying to find the time liability occrues they look at effects - Cause what is the occasion that brought about the loss? - Look at the last point at which the insured could have avoided liability shipping of product 2) EXCLUSIONS AND CONDITIONS a. EXPECTED OR INTENDED HARM Stonewall - For exclusions, ins cos have the burden of proof to show expected or intentional harm - The test is subjective that the co expected or intended injury - Ordinary negligence does not constitute an intention to cause damage, and a calculated risk doesnt amt to expected damages Unigard v. Argonaut - must have intent to cause harm (prop or bodily) cant just be negligence - Means v. Results the intentional exclusion doesnt turn on whether the means were intentional but on whether the results were intentional Weedo v. Stone E - Business Risk Exclusion cost of remedying your own defective work - Only coverage for defective workmanship if it causes tort damages American States v. Koloms - Pollution exclusion - The purpose for the exclusion was for environmental pollution 3) NOTICE CONDITIONS duties of the insured when a loss occurs - initial obligation to give general notice to the ins co as soon as practicable - There is a second obligation later on when more info becomes available to give ins co detailed specific notice. Mighty Midgets - where there is a reasonable basis for the delay, then the delay is excused West Bay Exploration - When ins co says that they wont cover bc of delay they have to show prejudice 4) OTHER FORMS OF LIABILITY INS PROFESSIONAL LIABILITY INS - malpractice ins covers physicians, att, accountants, and other professionals against liability arising out of the professional services - Claims made Policy (CMP) v. Occurrence based o CMP Ins co will cover for claims that are made in the year The injury could have been made in 1902, but if the claim is made in the year stated, its covered This helps ins cos bc they can judge how much they paid out during the year Retroactive date in addition to the claim having been made during the policy period the occurrence had to have happened after the retroactive date Thoracic Cardiovascular Association - CMP only covers you for claims during policy period - Definition of when a claim was made is when the report is made to the co

The suit in this case wasnt filed until after the policy was cancelled, but the occurrence happened during the policy period Ct says the lang is unambiguous, claims made turns on when notice was given to the insurer. It must be given during the policy peirod

LIABILITY INS Def and Settlement 1) SCOPE OF THE DUTY Beckwith potentiality test - if insurer assumes insureds def without a reservation nof rights the insurer will later be precluded from denying coverage - if complaint brings claims potentially within the scope of coverage, ins co must defend - Damages def costs and damages Insurer estopped from claiming Beckwith wasnt covered 2) CONFLICT OF INTEREST - insurer wants there to be either no liability or for insured to be found intentional - insured wants there to be either no liability or for insured to be found negligent Gray v. Zurich - Its not enough that Jones claimed intentional harm - Ins co is obliged to defend bc of the pos that Jones may change his complaint Parsons v. Continental - once an att, provided by the ins co, def insured, att cant defend ins co in a garnishment hearing later conflict 3) SETTLEMENT Crisci - Test would an insure without a policy limit have taken the settlement - Ins co breached the implied covenant of good faith and fair dealing to give consideration to the insureds interest - Obligation to accept ressonable settlement offers whats crucial is the evaluation of the case by the def counsel - Refusal to accept reasonable settlement sounds in torts and contract o Tort from obligation of good faith and fair dealing McCARRAN-FERGUSON ACT business of ins, and every person engaged therein, shall be subject to the laws of the several states which relate to the regulation or taxation of such business o the business of ins is exempted form the reach of fed anti-trust laws o anti-trust applicable to extent that business isnt regulated by st law o regardless of st law M-F doesnt render Sherman Act inapplicable to any agreement to boycott, coerce, or intimidate Congress reserves the right to take over the entire business Anti-trust applicable to the extent that its not regulated by state law

3 criteria relevant in determining whether practice is part of of the business of ins, exempted form the anti-trust laws. o Whether practice has the effect of transferring or spreading policyholders risk o Whether practice is integral part of the policy relationship o Whether practice is limited to entities within the ins industry What is boycott, Coercion, or Intimidation? - chiropractor case, peer review committee

o use the 3 pronged approach St. Paul v Barry switch from occurrence to claims based - the boycott exception can apply to arrangements that adversely affect non-ins cos primarily policyholders Hartford Ins Co v. Cal Boycott definition - under MF Act, Boycotts need more than one actor - Boycott is the refusal to deal on unrelated terms in order to accomplish something on other terms (an unrelated purpose) - Boycotts dont have to be uncondicitonal.

Você também pode gostar

- Reaching the Bar: Stories of Women at All Stages of Their Law CareerNo EverandReaching the Bar: Stories of Women at All Stages of Their Law CareerAinda não há avaliações

- Insurance OutlineDocumento29 páginasInsurance OutlineMissPardisAinda não há avaliações

- Law School Survival Guide (Volume II of II) - Outlines and Case Summaries for Evidence, Constitutional Law, Criminal Law, Constitutional Criminal Procedure: Law School Survival GuidesNo EverandLaw School Survival Guide (Volume II of II) - Outlines and Case Summaries for Evidence, Constitutional Law, Criminal Law, Constitutional Criminal Procedure: Law School Survival GuidesAinda não há avaliações

- Insurance Percy Spring 2012 BOOMDocumento54 páginasInsurance Percy Spring 2012 BOOMJason M. AivazAinda não há avaliações

- Insurance Bernstein2Documento17 páginasInsurance Bernstein2JobaiyerAinda não há avaliações

- Insurance Law OutlineDocumento6 páginasInsurance Law OutlineDave Wenger100% (2)

- MPRE Unpacked: Professional Responsibility Explained & Applied for Multistate Professional Responsibility ExamNo EverandMPRE Unpacked: Professional Responsibility Explained & Applied for Multistate Professional Responsibility ExamAinda não há avaliações

- BA OutlineDocumento17 páginasBA OutlineCarrie AndersonAinda não há avaliações

- Insurance Law Outline by Chris BrownDocumento46 páginasInsurance Law Outline by Chris BrownJemaine100% (1)

- Business Associations - ChartDocumento9 páginasBusiness Associations - Chartmkelly2109100% (1)

- Contracts OutlineDocumento48 páginasContracts Outlinekino321100% (2)

- Criminal Procedure OutlineDocumento94 páginasCriminal Procedure OutlinejorgenslotsAinda não há avaliações

- Business Organizations Law OutlineDocumento65 páginasBusiness Organizations Law OutlineNas YasinAinda não há avaliações

- Business Associations Outline - Klein, 3rd EdDocumento75 páginasBusiness Associations Outline - Klein, 3rd Edjanklewich100% (2)

- Business Associations OutlineDocumento34 páginasBusiness Associations OutlineIsabella L100% (1)

- Personal Professional Responsibility OutlineDocumento20 páginasPersonal Professional Responsibility OutlineNicholas PetrakosAinda não há avaliações

- Model Rule 8.4: Misconduct: PR Class 1Documento48 páginasModel Rule 8.4: Misconduct: PR Class 1U'nek Clarke100% (1)

- Business Associations OutlineDocumento59 páginasBusiness Associations OutlineCfurlan02100% (1)

- ABA Rules #ProfessionalresponsibilityDocumento15 páginasABA Rules #ProfessionalresponsibilityRooter Cox100% (1)

- Agency N PartnershipDocumento19 páginasAgency N Partnershipbi2345Ainda não há avaliações

- Insurance Law OutlineDocumento27 páginasInsurance Law Outlinepmariano_5100% (1)

- MBE-Con Law OutlineDocumento31 páginasMBE-Con Law OutlineStacy Oliveira100% (3)

- Business Organizations Rules OutlineDocumento56 páginasBusiness Organizations Rules OutlinePeteChemaAinda não há avaliações

- Conlaw Outline To MemorizeDocumento8 páginasConlaw Outline To Memorizemn2218Ainda não há avaliações

- New York Course Constitutional Law: Professor Erwin ChemerinskyDocumento58 páginasNew York Course Constitutional Law: Professor Erwin ChemerinskyJae Yong Lee100% (5)

- IP OutlineDocumento28 páginasIP OutlineMichael LangerAinda não há avaliações

- Wills LectureDocumento6 páginasWills LectureBrenna Snow RahmlowAinda não há avaliações

- BA - FreerDocumento121 páginasBA - FreerEugene Yanul100% (1)

- Checklist PRDocumento8 páginasChecklist PRDouglas GromackAinda não há avaliações

- Corporations OutlineDocumento61 páginasCorporations OutlineDan StewartAinda não há avaliações

- Civil Procedure Rule SummariesDocumento5 páginasCivil Procedure Rule SummariesAdrian PegueseAinda não há avaliações

- CrimLaw FlowchartDocumento1 páginaCrimLaw FlowchartAndrew Smith100% (1)

- Internet Law Attack OutlineDocumento7 páginasInternet Law Attack OutlineIkram AliAinda não há avaliações

- Barbri Outline - NY (2005) - Conflict of LawsDocumento5 páginasBarbri Outline - NY (2005) - Conflict of LawssobethebeardieAinda não há avaliações

- MPRE OutlineDocumento14 páginasMPRE Outlineesquire1010Ainda não há avaliações

- Really Good Prop OutlineDocumento60 páginasReally Good Prop OutlineJustin Wilson100% (3)

- Final Criminal Procedure OutlineDocumento86 páginasFinal Criminal Procedure OutlineLetty Bea100% (2)

- ConLaw Outline-MAGICDocumento34 páginasConLaw Outline-MAGICOnyi Ibe100% (1)

- 2016 Evidence OutlineDocumento6 páginas2016 Evidence OutlineJanice Parmar100% (2)

- Business Associations OutlineDocumento30 páginasBusiness Associations OutlineClaudia GalanAinda não há avaliações

- UPA DissolutionDocumento1 páginaUPA DissolutionNiraj ThakkerAinda não há avaliações

- Conflict of Laws OutlineDocumento54 páginasConflict of Laws OutlinesjanvieAinda não há avaliações

- Conflicts of Laws OutlineDocumento56 páginasConflicts of Laws Outlinekristin1717Ainda não há avaliações

- One Sheet J&J (Exam Day)Documento3 páginasOne Sheet J&J (Exam Day)Naadia Ali-Yallah100% (1)

- 296060485-MBE-Memorization-Chart For Printing Feb. 22 Bar ExamDocumento85 páginas296060485-MBE-Memorization-Chart For Printing Feb. 22 Bar ExamRosely Torres50% (2)

- 36.1 Basic Concepts: Chapter 36 - AntitrustDocumento11 páginas36.1 Basic Concepts: Chapter 36 - AntitrustpfreteAinda não há avaliações

- Fundamentals of Intellectual Property OutlineDocumento35 páginasFundamentals of Intellectual Property OutlineMatthew BurkettAinda não há avaliações

- Business Associations & Corporations OutlineDocumento103 páginasBusiness Associations & Corporations Outlinemtpangborn100% (3)

- Magicsheets - Civil Procedure - Time LimitsDocumento1 páginaMagicsheets - Civil Procedure - Time LimitsCK D100% (1)

- Business Associations OutlineDocumento34 páginasBusiness Associations Outlinebobsmittyunc100% (1)

- Remedies Outline and NotesDocumento79 páginasRemedies Outline and NoteslawnessdAinda não há avaliações

- Bar Prep - Outline - Remedies - ShortDocumento11 páginasBar Prep - Outline - Remedies - ShortAnonymous Cbr8Vr2SX100% (2)

- Business AssociationsDocumento109 páginasBusiness AssociationsCory StumpfAinda não há avaliações

- Corporations, Kraakman, Fall 2012Documento61 páginasCorporations, Kraakman, Fall 2012Chaim SchwarzAinda não há avaliações

- Heavold Short Evidence OutlineDocumento17 páginasHeavold Short Evidence OutlineChristopher YoungAinda não há avaliações

- Business OrganizationsDocumento71 páginasBusiness Organizationsjdadas100% (2)

- Partnership Law Attack SheetDocumento1 páginaPartnership Law Attack SheetKylee ColwellAinda não há avaliações

- Professional Responsibility and EthicsDocumento29 páginasProfessional Responsibility and EthicsMissy MeyerAinda não há avaliações

- RM-1 Zoning GuideDocumento20 páginasRM-1 Zoning GuideSimon BurnettAinda não há avaliações

- Veterans Law OutlineDocumento32 páginasVeterans Law OutlineSimon Burnett100% (2)

- Crim Pro OutlineDocumento106 páginasCrim Pro OutlineSimon BurnettAinda não há avaliações

- Bakke's Fate: Yale Law School Legal Scholarship RepositoryDocumento37 páginasBakke's Fate: Yale Law School Legal Scholarship RepositorySimon Burnett100% (1)

- Personal Income Tax Pike Fall2003 1Documento37 páginasPersonal Income Tax Pike Fall2003 1Simon BurnettAinda não há avaliações

- Commercial MultipleDocumento23 páginasCommercial MultipleShahraiz gillAinda não há avaliações

- Encinas v. National Bookstore, IncDocumento8 páginasEncinas v. National Bookstore, IncColenAinda não há avaliações

- Public Law: Internal As Well As External AdministrationDocumento2 páginasPublic Law: Internal As Well As External AdministrationJed Anthony GallosAinda não há avaliações

- Spec Pro Feb 28Documento13 páginasSpec Pro Feb 28Marivic EscuetaAinda não há avaliações

- Deluao Vs CasteelDocumento2 páginasDeluao Vs Casteeldmcflores100% (2)

- Lirag Textile Vs SssDocumento3 páginasLirag Textile Vs Sssgianfranco0613Ainda não há avaliações

- Obli. Solidary and Joint ObligationDocumento3 páginasObli. Solidary and Joint ObligationAdah Gwynne TobesAinda não há avaliações

- Cahambing VS EspinosaDocumento2 páginasCahambing VS EspinosaMark Anjo AtienzaAinda não há avaliações

- So vs. Food Fest Land IncDocumento9 páginasSo vs. Food Fest Land IncalexredroseAinda não há avaliações

- Dimmit County LawsuitDocumento33 páginasDimmit County LawsuitMariah MedinaAinda não há avaliações

- SpecPro Rules 92-95Documento28 páginasSpecPro Rules 92-95BananaAinda não há avaliações

- Torts II Final Exam Spring 2015 Coulisse Canyon Model AnswerDocumento8 páginasTorts II Final Exam Spring 2015 Coulisse Canyon Model AnswerStacy MustangAinda não há avaliações

- People Vs Lizada People Vs Ladrillo: Parte and Entered A Plea of Not Guilty To Each of The ChargesDocumento6 páginasPeople Vs Lizada People Vs Ladrillo: Parte and Entered A Plea of Not Guilty To Each of The ChargesWindy Awe MalapitAinda não há avaliações

- Offer and Acceptance: Advertisement Is An Invitation To TreatDocumento3 páginasOffer and Acceptance: Advertisement Is An Invitation To Treatsajetha sezliyanAinda não há avaliações

- 3.formation of CompanyDocumento17 páginas3.formation of CompanyHarsha KharidehalAinda não há avaliações

- Contract of LeaseDocumento3 páginasContract of LeaseRandy Castañares100% (1)

- Chapter-1 Indian Contract Act 1872Documento100 páginasChapter-1 Indian Contract Act 1872aahana77Ainda não há avaliações

- Andres Quiroga vs. Parsons Hardware CoDocumento2 páginasAndres Quiroga vs. Parsons Hardware CoMarilou Olaguir SañoAinda não há avaliações

- Torts and Damages (Concepts)Documento9 páginasTorts and Damages (Concepts)Champagne CanlasAinda não há avaliações

- Toms River Business Administrator Lou Amoroso Court Docket - Homophobic SlursDocumento15 páginasToms River Business Administrator Lou Amoroso Court Docket - Homophobic SlursShore News NetworkAinda não há avaliações

- Principal of Severability PDFDocumento1 páginaPrincipal of Severability PDFShashank YadauvanshiAinda não há avaliações

- Credit Transactions DigestsDocumento266 páginasCredit Transactions DigestsDianne YcoAinda não há avaliações

- Distinction: Writ of Habeas Corpus, Amparo, Habeas DataDocumento4 páginasDistinction: Writ of Habeas Corpus, Amparo, Habeas DataPring SumAinda não há avaliações

- CPC ProjectDocumento26 páginasCPC Projectgfvjgvjhgv100% (1)

- PartnershipDocumento24 páginasPartnershipPhebegail ImmotnaAinda não há avaliações

- Rule 70 - Case Digests PDFDocumento33 páginasRule 70 - Case Digests PDFChrissy SabellaAinda não há avaliações

- G. R. No. 151908 - August 12, 2003Documento5 páginasG. R. No. 151908 - August 12, 2003Ellen Mae JavillonarAinda não há avaliações

- Talent ContractDocumento4 páginasTalent ContractRocketLawyer100% (4)

- GML Investissement Ltée AND Ireland Blyth Limited: Amalgamation ProposalDocumento44 páginasGML Investissement Ltée AND Ireland Blyth Limited: Amalgamation Proposalelvis007Ainda não há avaliações

- 138 AuthoritiesDocumento300 páginas138 AuthoritiesAmit Sharma81% (16)

- Getting to Yes: How to Negotiate Agreement Without Giving InNo EverandGetting to Yes: How to Negotiate Agreement Without Giving InNota: 4 de 5 estrelas4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!No EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Nota: 4.5 de 5 estrelas4.5/5 (14)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)No EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Nota: 4.5 de 5 estrelas4.5/5 (14)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineAinda não há avaliações

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindNo EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindNota: 5 de 5 estrelas5/5 (231)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesAinda não há avaliações

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNo EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsNota: 5 de 5 estrelas5/5 (1)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)No EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Nota: 4 de 5 estrelas4/5 (33)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)No EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Nota: 4.5 de 5 estrelas4.5/5 (5)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingNo EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingNota: 4.5 de 5 estrelas4.5/5 (760)

- Project Control Methods and Best Practices: Achieving Project SuccessNo EverandProject Control Methods and Best Practices: Achieving Project SuccessAinda não há avaliações

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsAinda não há avaliações

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsNo EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsNota: 4 de 5 estrelas4/5 (7)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeNo EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeNota: 4 de 5 estrelas4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCNo EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCNota: 5 de 5 estrelas5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItNo EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItNota: 4.5 de 5 estrelas4.5/5 (14)

- Controllership: The Work of the Managerial AccountantNo EverandControllership: The Work of the Managerial AccountantAinda não há avaliações

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookNo EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookAinda não há avaliações

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessNo EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessNota: 4.5 de 5 estrelas4.5/5 (28)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsNo EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsNota: 4 de 5 estrelas4/5 (4)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetNo EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetNota: 4.5 de 5 estrelas4.5/5 (14)