Escolar Documentos

Profissional Documentos

Cultura Documentos

A Greek Cliff-Hanger

Enviado por

ING Economisch BureauTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

A Greek Cliff-Hanger

Enviado por

ING Economisch BureauDireitos autorais:

Formatos disponíveis

FINANCIAL MARKETS RESEARCH A Greek cliff-hanger May 2012

Economics

25 May 2012

A Greek cliff-hanger

GDP growth (YoY%)

What could happen if Greece defaults

Even if it is still hard to see how anyone in the Eurozone could benefit from a Greek exit, latest developments have shown that politics does not always exclusively follow economic rationale. A Greek exit has again become more possible in recent weeks. While our baseline scenario remains cautiously optimistic that a Greek exit could be avoided, we take a closer look at the practicalities of the unthinkable.

Following the inconclusive result to the 6 May elections, we warned that the subsequent month would likely be characterised by high volatility in markets. Developments since then have confirmed our view. We believe a Greek exit has become possible, depending on the results of the 17 June elections. Even if a Greek default within the Eurozone looks possible in theory, it is doubtful whether the rest of the Eurozone would have much sympathy for Greece staying if it reneges on the entire bailout deal. An exit from the Eurozone is not anticipated in the European Treaties, but the ECB could de facto push Greece out of the euro. While a smooth and orderly return to a new Greek currency looks unlikely, in our view, the direct impact on Eurozone governments and private sector participants could be significant. At the same time, we believe immediate fire-fighting following a Greek exit would be mainly in the hands of the ECB. Although a financial crisis triggered by a Greek exit could have a silver lining, pushing the Eurozone towards greater integration, it is still hard to see how anyone in the Eurozone would benefit from a Greek exit. The Greek cliff-hanger looks likely to continue.

10 5 0 -5 -10 Q1 Q1 Q1 Q1 Q1 Q1 Q1 06 0 7 08 09 1 0 11 12 GDP growth (YoY%)

Source: ELSTAT

Budget deficit (% of GDP)

20 15 10 5 0

Source: Eurostat

General govt debt (%of GDP)

200 150 100 50 0

20 00 20 02 20 04 20 06 20 08 20 10

Political situation

Over the first week of the new campaign, political parties have been positioning themselves for the next polling date. Two opposite fronts have been emerging, even if the debate has not yet been radicalised. On the one hand, a group of parties, led by ND, Pasok, Dimar, and three small liberal parties that could not breach the 3% threshold in May, is moving along the lines of the last campaign. Keeping Greece within the Eurozone is its main objective. Aggregations within this group are already happening, with the Democratic Alliance, a liberal party that gained 2.6% of the votes in the 6 May elections, already merging back into ND, with Drasi, Liberal Alliance and Dimiourgia Xana (DX), three other small pro-bailout parties, announcing they would join forces ahead of the June 17 elections. In principle, parties within this broad group all pledge to renegotiate some aspects of the austerity programme, without reneging on its backbone. The political alternative to the pro-bailout parties is led by Syriza, which came second in the 6 May election, leveraging on Greeks adjustment fatigue with a staunch anti-austerity message. While still campaigning for reneging on the bailout accords, Syrizas leader, Tsipras, has so far maintained that he has no intention of taking Greece out of the Eurozone. In a speech in Berlin, he stated that if in government after the 17 June elections, he would be prepared to negotiate with the Eurozone, but remained vague about the object of such negotiations.

Source: Eurostat

Paolo Pizzoli

Milan +39 02 89629 2648 paolo.pizzoli@ing.it

Peter Vandenhoute

Brussels +32 2 547 8009 peter.vandenhoute@ing.be

Carsten Brzeski

Brussels +32 2 547 8652 carsten.brzeski@ing.be

20 00 20 02 20 04 20 06 20 08 20 10

research.ing.com

1 SEE THE DISCLOSURES APPENDIX FOR IMPORTANT DISCLOSURES & ANALYST CERTIFICATION

A Greek cliff-hanger

May 2012

The first bout of the new campaign has thus brought about some repolarisation of the political spectrum, but has not yet transformed into a referendum on the euro. Indeed, according to opinion polls, the Greek paradox on the issue seems to be holding: some 80% of Greeks are reported to be in favour of Greece remaining in the Eurozone, while at the same time two-thirds of Greeks are reportedly against the austerity package. We still expect this delicate and ambiguous issue to enter centre stage in the campaign very soon, as the growing volume of international speculation on contingency plans about a Greek exit will be weighing on the domestic debate. The outcome of the next elections remains highly uncertain. Opinion polls, conducted since the new elections were announced, signal that ND and Syriza are contending for the leading position (which will be worth an extra 50 seats), while recently Syriza seems to have taken the lead. Pasok follows at a distance. The number of reported undecided voters hovers at c.8%. While still too close to call, the campaign has yet to take on the last wave of alarming signals coming from financial markets.

Our baseline scenario

While acknowledging that the risk of a Greek exit has substantially increased, our baseline scenario is still for Greece to remain in the Eurozone for the time being, though a Syriza-led government might make this scenario somewhat more challenging. For our baseline scenario to materialise, a trade-off on the concessions/rigour front will be required on both sides. Even if a Greek exit is currently neither in the interest of the Eurozone or Greece Given the high costs that a Greek exit would entail for all players, we think the Eurozone has an interest in promising Greeks some form of softening (or delay) of the requested adjustment and/or expect some form of pro-growth targeted initiatives. In our report, EMU Break-up: Pay now, pay later (December 2011), we tried to assess the economic impact of a Greek exit and concluded with estimates that suggested it would be extremely severe for most of the involved parties. Sticking to the Eurozone, the estimated GDP growth cost (measured by the difference with the base case) varied from c.1.2% of GDP in 2012F for the average core country to c.2% for the average peripheral (ex Greece) and 7.5% for Greece itself. Moreover, a Greek exit would create a precedent that could induce an acceleration of contagion at a time when the Eurozone is not yet endowed with strong enough fiscal and monetary weapons to fight speculative attacks. Still, with the debate on the Greek exit scenario no longer an academic exercise, a closer eye on its financial consequences appears warranted.

the debate is no longer an academic one

Triggering a Greek exit

as a complete anti-bailout stance by a new government would probably end the Eurozones patience How could a Greek exit be triggered? In the event that a new Greek government adopted a pure anti-bailout stance following elections, without any willingness to negotiate, but at the same time insisting on Greek Eurozone membership, we believe Eurozone patience would probably be over. As a result, the Eurozone would most likely stop any bailout payments, probably forcing the Greek government to default. However, a default does not automatically lead to a Greek exit. Note that there are no legal possibilities to push a country outside of the Eurozone (even a voluntary exit is not anticipated in the European Treaties, only an exit from the entire EU). As an alternative to leaving the Eurozone, some commentators moot the idea of introducing a parallel currency, which would still allow Greece to avoid a default and remain within the Eurozone. The Greek government could start paying public workers and bills with IOUs that could be used as a means of payment. At the same time, capital controls would have to be installed to prevent euros flowing out of the country. The IOUs issued by the government would likely fall in value, fostering an internal devaluation in Greece. The trouble with this plan is that all domestic and foreign debts are still denominated in euro, which would create a situation of debt deflation, at least for the

2

Parallel currency unlikely to be a panacea

A Greek cliff-hanger

May 2012

private sector. While it may allow the Greek government to avoid temporarily defaulting on its payments, it is unlikely to be a panacea, certainly if Greece does not manage to establish a primary surplus quickly. Similar schemes in Argentina, introduced in 2001, did not prevent the country from eventually having to abandon the currency board with the dollar at the start of 2002. Moreover, it is doubtful that other Eurozone countries would have much sympathy for Greece staying in the Eurozone after reneging on the entire bailout deal. ECB holds the key for Greeces membership of the Eurozone The most likely road towards a possible Greek exit from the Eurozone goes through the ECB, or more explicitly through the banking sector. Greek banks have become increasingly dependent on central bank liquidity (see Figure 1). Cutting off Greek banks from liquidity assistance could force Greece out of the Eurozone. Indeed, the ECB can, with a two-thirds majority, block a steep and unsustainable increase in ELA provided by the Bank of Greece. As ECB Governing Council member Luc Coene put it, ELA is liquidity assistance, not solvency assistance. As long as the ECB is willing to provide emergency liquidity, Greece could probably allow a complete anti-bailout stance without leaving the Eurozone. But without the ELA support, we believe it is unlikely that Greece could remain within the Eurozone.

Fig 1 Greek banks increasingly rely on ELA

180 160 140 120 bn 100 80 60 40 20 0 Jan-10 Jan-11 Jan-12

Open market operations

Source: Bank of Greece, ECB

ELA

* ING estimates

and stopping ELA and shutting Greece out of Target2 would de facto push Greece out of the euro

Even if the Greek central bank were to continue providing ELA without the ECBs official blessing, payments to and from Greek entities would likely be shut out of the TARGET2 system. However, this is not a decision that the ECB would make alone. Ultimately, this would likely be a joint decision made by the heads of state of the Eurozone and the ECB. Shutting the Bank of Greece out of the Target2 system would prevent clearance of crossborder payments out of Greece, de facto pushing Greece out of the euro. Being cut off from sources of financing, we believe an isolated Bank of Greece would probably have little alternative to printing money, recapitalising Greek banks and monetising the state deficit.

Practicalities of a Greek exit

Introducing a new currency can turn out to be a burdensome process Historical evidence shows that break-ups or exits from monetary unions can turn out to be a burdensome process. For starters, the decision to leave the Eurozone, be it voluntary or forced, would involve a logistical nightmare. The conversion of vendor machines, parking meters and other machines using coins and notes from euro into drachma would take many months. The conversion of software for electronic payment systems and contracts would not only take time, but in the case of contracts, this could also give rise to legal battles (while the introduction of the euro guaranteed continuity of contracts, the same cannot be said of a switch back to a national currency). Unless the

3

A Greek cliff-hanger

May 2012

Greek central bank was already secretly printing new drachmas, there is likely to be a difficult transition period where new cash would have to be brought into circulation, which could take several months. and would probably lead to two currencies: a new legal tender and the euro as tender in the shadow economy The immediate period following a Greek return to a new currency would probably see a longer bank holiday period, as in the US in the 1930s (four days). During this period, the government could decide to only accept stamped euros as legal tender (stamping has been a common practise in earlier break-ups). However, it is very unlikely that many private holdings would be offered for stamping, as an unstamped euro would be considered to be worth more. In our view, the euro would therefore likely be used on the black market or shadow economy, but disappear from official circulation. Moreover, Greece would need to install capital controls or even freeze bank accounts just to prevent savings denominated in euros to leaving the country. This might even include strong border controls to counter the smuggling of euro bank notes out of the country. To try to remedy the lack of cash, the Greek government might execute all of its cash payments initially in IOUs (that could be later exchanged into the new drachma), which could also be considered as legal tender. Following default and exit from the monetary union, we believe the Greek government would set the conversion rate on a 1:1 basis, meaning that all prices, loans and deposits would initially be converted at par into new drachmas. However, this parity would be unlikely to last very long. We anticipate a potential depreciation of up to 80% against the euro over the first two years. Important capital controls in combination with the ensuing logistical chaos would likely have a deterring impact on tourism, limiting at first the potential positive impact of significant drachma depreciation. and a smooth or orderly return to a new Greek currency looks unlikely More generally, it is hard to see a smooth or orderly return to a new Greek currency. The introduction of the euro for example was a result of many years of preparation and a smaller period of double-pricing, not a couple of weeks.

Capital controls would be required

Measuring the direct impact of a Greek exit

The default that a Greek exit would entail would leave many players exposed to substantial potential losses. Eurozone governments would be hit both directly and indirectly by a Greek exit Eurozone governments would be hit both directly and indirectly through their central banks. Eurozone governments have direct exposure of 52.9bn through bilateral loans disbursed in the first Greek package and of 72.9bn through EFSF exposure put in place with the second Greek package. EFSF exposure would also likely include 35bn lent to Greece for collateral enhancement. Losses to the ECB would materialise through its SMP exposure to Greek government bonds, which is estimated at c.40bn and through losses on collateral in refinancing operations. The net liabilities of the Bank of Greece to the Eurosystem (Target2, including banknotes) amounts to c.120bn, or 113bn when excluding the 7bn held by the BOG under the SMP. The private sector would be affected, too, with the Greek banking system first in the line of fire. Having suffered a substantial outflow of deposits (c.35bn or -17% in the 12 months to the end of March), following Februarys haircut Greek banks are still exposed to Greek government bonds to the tune of c.23.7bn. Non-Greek banks would also take a substantial hit, but here the cost would be concentrated on France and Germany. According to BIS data, at the end of December 2011, the outstanding exposure of non-Greek reporting banks to Greek government bonds was c.US$23bn (17.1bn), with European banks taking the lions share (96%) of this. Taking into account the haircut, exposure might still be in the region of US$11bn (8.4bn). When looking at exposure to the Greek non-bank private sector, France emerges clearly as the most exposed country. Out of the total US$69.4bn of foreign claims, c.US$37.6bn pertain to France, mainly due

while losses in the private sector would mainly be carried by the Greek banking sector

A Greek cliff-hanger

May 2012

to its direct involvement in the Greek banking system through a big local bank fully owned by a French parent bank. Could the IMF stay out of the fire? Lastly, the IMF, which has 21.7bn of exposed to Greece. As a Greek exit would likely prevent any substantial financing from the Eurozone/EU, the IMF would presumably be the first external source of emergency funding for an exited Greece. In this light, a Greek default procedure could possibly see the country making extra efforts not to default on IMF loans to keep the door open for future IMF financing. Moreover, and perhaps ironically, as long as Greece remains a member of the European Union following an exit from the Eurozone, it could still apply for the EUs so-called balance of payment assistance.

Fig 2 Eurozone governments and IMF exposure to Greece (bn)

52.9 72.9 35.0 120 40 21.7 342.5

Eurozone bilateral loans EFSF second package EFSF collateral enhancement ECB Target2 + banknotes ECB holdings of Greek sovereign debt IMF Total Eurozone + IMF exposure

Source: ING, various sources

In the wake of a Greek default, the question remains how big the ultimate losses of creditors could turn out to be. Since most Greek debt is now governed by foreign law, it would be hard for Greece to redominate this in new drachmas. With the need to continue to service its debt to the IMF, there seems to be little to recoup for the other creditors. There is a very slim chance that PSI bond holders would still be serviced through the escrow account created under the second bail-out plan, though it is almost unimaginable that the terms of the second bail-out plan would still be applicable in the case of a Greek exit and default. Non-IMF creditors could be wiped out almost entirely If Greece manages to redominate its debt in drachmas, creditors are likely to lose close to 80% through depreciation alone, not even taking into account a potential haircut. Under most scenarios, it therefore looks likely that non-IMF creditors would be nearly entirely wiped out.

Fire-fighting after a Greek exit

A Greek exit would likely cause bank runs in other peripheral countries The fall-out of a Greek exit and it effect on the rest of the Eurozone countries would be hard to contain. Bank runs in other peripheral countries would seem unavoidable, threatening to collapse the banking system. But even core countries such as France would not escape the turmoil, as French banking exposure to Greece is important. In our view, contagion would likely spread to other banks in the Eurozone as well, creating a panic potentially dwarfing the crisis precipitated by the Lehman bankruptcy. At the same time, we believe peripheral debt would likely plunge, closing capital markets for countries such as Spain and Italy. In these circumstances, we feel the ECB is likely to act decisively to save the Eurozone. As such, we believe a rate cut to 0.50% looks a near certainty (an even lower rate cannot be excluded). On top of this, we expect the ECB to have to provide the needed liquidity to keep weaker banks afloat. Special longer-term liquidity operations would appear very likely. This might also involve the loosening of collateral rules to make sure that there are no limits on liquidity injections. This would likely apply to the normal refinancing operations (since here funds are lent at the refi rate), although it is not impossible that some of the emergency financing would run through ELA. At the same time, we believe the ECB will have to assume directly or indirectly the role of lender of last resort for vulnerable Eurozone sovereigns. A reactivation of the SMP programme looks likely, although its effectiveness has been hurt by the de facto preferential creditor status of the

5

A rate cut to 0.50% would follow

combined with unlimited liquidity injections into the banking sector

and support for peripheral bond markets

A Greek cliff-hanger

May 2012

ECB. In this regard, the EFSF could also help, eg, by guaranteeing short-term debt from peripheral countries to get them through a period of liquidity shortages. Lastly, the ECB might decide to give the ESM access to ECB liquidity to create a wall of money to deter speculation against peripheral debt. While this might be seen as monetary financing of public deficits, it is essentially not dissimilar from the LTRO operations. Proposals for a European bank resolution and deposit guarantee scheme would likely get traction Despite the financial crisis, a Greek exit could prove to have a silver lining, as we believe European leaders would realise that a more integrated financial framework is needed to ward off financial mayhem in the future and to preserve the advantages of an integrated financial market. Already there are signs that Eurozone capital markets are fracturing with both banks and multinationals trying to manage their European exposure along national lines, a practice that is likely to exacerbate the credit crunch in countries with an insufficient deposit base. In this regard, there is a potential role for the ESM as a bank resolution scheme is likely to be considered, with the ESM having the possibility of directly recapitalises systemic banks across Europe. In the same vein, discussions on the European Deposit Guarantee Scheme would likely get a new impetus, in our view. That said, these more structural changes are only likely to be discussed after the more immediate fire-fighting has been carried out.

Greek cliff-hanger likely to continue

In our view, it is still hard to see how anyone in the Eurozone would benefit from a Greek exit. As we have stated, both the direct and indirect cost to the Eurozone would be enormous. At the same time, a Greek exit would hardly be better than austerity and reform for the country itself. However, latest developments have shown that politics does not always exclusively follow economic rationale. Some commentators even suggest that to prevent member states from blackmailing the rest of the Eurozone in future, it might be worth let Greece go to make an example of the country. In this sense, one might wonder whether, with hindsight, the Fed would still opt to let Lehman brothers go bankrupt. The Greek cliff-hanger looks likely to continue.

A Greek cliff-hanger

May 2012

Disclosures Appendix

ANALYST CERTIFICATION The analyst(s) who prepared this report hereby certifies that the views expressed in this report accurately reflect his/her personal views about the subject securities or issuers and no part of his/her compensation was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this report. IMPORTANT DISCLOSURES Company disclosures are available from the disclosures page on our website at http://research.ing.com. The remuneration of research analysts is not tied to specific investment banking transactions performed by ING Group although it is based in part on overall revenues, to which investment banking contribute. Securities prices: Prices are taken as of the previous days close on the home market unless otherwise stated. Conflicts of interest policy. ING manages conflicts of interest arising as a result of the preparation and publication of research through its use of internal databases, notifications by the relevant employees and Chinese walls as monitored by ING Compliance. For further details see our research policies page at http://research.ing.com. FOREIGN AFFILIATES DISCLOSURES Each ING legal entity which produces research is a subsidiary, branch or affiliate of ING Bank N.V. See back page for the addresses and primary securities regulator for each of these entities.

A Greek cliff-hanger

May 2012

AMSTERDAM

Tel: 31 20 563 9111 Bratislava Tel: 421 2 5934 6111 Bucharest Tel: 40 21 222 1600 Budapest Tel: 36 1 235 8800 Buenos Aires Tel: 54 11 4310 4700 Dublin Tel: 353 1 638 4000

BRUSSELS

Tel: 32 2 547 2111 Geneva Tel: 41 22 593 8050 Hong Kong Tel: 852 2848 8488 Istanbul Tel: 90 212 329 0752 Kiev Tel: 380 44 230 3030 Madrid Tel: 34 91 789 8880

LONDON

Tel: 44 20 7767 1000 Manila Tel: 63 2 479 8888 Mexico City Tel: 52 55 5258 2000 Milan Tel: 39 02 89629 3610 Moscow Tel: 7 495 755 5400 Paris Tel: 33 1 56 39 32 84

NEW YORK

Tel: 1 646 424 6000 Prague Tel: 420 257 474 111 Sao Paulo Tel: 55 11 4504 6000 Seoul Tel: 82 2 317 1800 Shanghai Tel: 86 21 2020 2000 Sofia Tel: 359 2 917 6400

SINGAPORE

Tel: 65 6535 3688 Taipei Tel: 886 2 8729 7600 Tokyo Tel: 81 3 3217 0301 Warsaw Tel: 48 22 820 5018

Research offices: legal entity/address/primary securities regulator

Amsterdam Bratislava Brussels Bucharest Budapest Istanbul Kiev London Manila Mexico City Milan Moscow Mumbai New York Prague Singapore Sofia Warsaw ING Bank N.V., Foppingadreef 7, Amsterdam, Netherlands, 1102BD. Netherlands Authority for the Financial Markets ING Bank N.V., pobocka zahranicnej banky, Jesenskeho 4/C, 811 02 Bratislava, Slovak Republic. National Bank of Slovakia ING Belgium S.A./N.V., Avenue Marnix 24, Brussels, Belgium, B-1000. Financial Services and Market Authority (FSMA) ING Bank N.V. Amsterdam - Bucharest Branch, 48 Lancu de Hunedoara Bd., 011745, Bucharest 1, Romania. Romanian National Securities and Exchange Commission, Romanian National Bank ING Bank N.V. Hungary Branch, Dozsa Gyorgy ut 84\B, H - 1068 Budapest, Hungary. Hungarian Financial Supervisory Authority ING Bank A.S., ING Bank Headquarters, Resitpasa Mahallesi Eski Buyukdere Cad. No: 8, 34467 Sariyer, Istanbul , Turkey. Capital Markets Board ING Bank Ukraine JSC, 30-a, Spaska Street, Kiev, Ukraine, 04070. Ukrainian Securities and Stock Commission ING Bank N.V. London Branch, 60 London Wall, London EC2M 5TQ, United Kingdom. Authorised by the Dutch Central Bank ING Bank N.V., Manila Branch, 20/F Tower One, Ayala Triangle, Ayala Avenue, 1226 Makati City, Philippines. Philippine Securities and Exchange Commission ING Grupo Financiero (Mxico) SA de CV, Bosque de Alisos 45-B, Piso 4, Bosques de las Lomas, 05120, Mexico City, Mexico. Comision Nacional Bancaria y de Valores ING Bank N.V. Milano, Via Paleocapa, 5, Milano, Italy, 20121. Commissione Nazionale per le Societ e la Borsa ING BANK (EURASIA) ZAO, 36, Krasnoproletarskaya ulitsa, 127473 Moscow, Russia. Federal Financial Markets Service ING Vysya Bank Limited, Plot C-12, Block-G, 7th Floor, Bandra Kurla Complex, Bandra (E), Mumbai - 400 051, India. Securities and Exchange Board of India ING Financial Markets LLC, 1325 Avenue of the Americas, New York, United States,10019. Securities and Exchange Commission ING Bank N.V. Prague Branch, Plzenska 345/5, 150 00 Prague 5, Czech Republic. Czech National Bank ING Bank N.V. Singapore Branch, 19/F Republic Plaza, 9 Raffles Place, #19-02, Singapore, 048619. Monetary Authority of Singapore ING Bank N.V. Sofia Branch, 49B Bulgaria Blvd, Sofia 1404 Bulgaria. Financial Supervision Commission ING Bank Slaski S.A, Plac Trzech Krzyzy, 10/14, Warsaw, Poland, 00-499. Polish Financial Supervision Authority

Disclaimer

This report has been prepared on behalf of ING (being for this purpose the commercial banking business of ING Bank NV and certain of its subsidiary companies) solely for the information of its clients. ING forms part of ING Group (being for this purpose ING Groep NV and its subsidiary and affiliated companies). It is not investment advice or an offer or solicitation for the purchase or sale of any financial instrument. While reasonable care has been taken to ensure that the information contained herein is not untrue or misleading at the time of publication, ING makes no representation that it is accurate or complete. The information contained herein is subject to change without notice. ING Group and any of its officers, employees, related and discretionary accounts may, to the extent not disclosed above and to the extent permitted by law, have long or short positions or may otherwise be interested in any transactions or investments (including derivatives) referred to in this report. In addition, ING Group may provide banking, insurance or asset management services for, or solicit such business from, any company referred to in this report. Neither ING Group nor any of its officers or employees accepts any liability for any direct or consequential loss arising from any use of this report or its contents. Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved. Any investments referred to herein may involve significant risk, are not necessarily available in all jurisdictions, may be illiquid and may not be suitable for all investors. The value of, or income from, any investments referred to herein may fluctuate and/or be affected by changes in exchange rates. Past performance is not indicative of future results. Investors should make their own investigations and investment decisions without relying on this report. Only investors with sufficient knowledge and experience in financial matters to evaluate the merits and risks should consider an investment in any issuer or market discussed herein and other persons should not take any action on the basis of this report. Clients should contact analysts at, and execute transactions through, an ING entity in their home jurisdiction unless governing law permits otherwise. Additional information is available on request. Country-specific disclosures: EEA: This report constitutes investment research for the purposes of the Markets in Financial Instruments Directive and as such contains an objective or independent explanation of the matters contained herein. Any recommendations contained in this report must not be relied on as investment advice based on the recipients personal circumstances. If further clarification is required on words or phrases used in this report, the recipient is recommended to seek independent legal or financial advice. Hong Kong: This report is distributed in Hong Kong by ING Bank N.V., Hong Kong Branch which is licensed by the Securities and Futures Commission of Hong Kong under the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong) (SFO). This document does not constitute a solicitation or an offer of securities or an invitation to the public within the meaning of the SFO. This report is to be circulated only to professional investors as defined in the SFO. India: Any recipient of this report wanting additional information or to effect any transaction in Indian securities or financial instruments mentioned herein must do so by contacting a representative of ING Vysya Bank Limited (ING Vysya) which is responsible for distribution of this report in India. ING Vysya is an affiliated company of ING. ING Vysya does not accept liability for any direct or consequential loss arising from any use of information provided in this report. Italy: This report is issued in Italy only to persons described in Article No. 31 of Consob Regulation No. 11522/98. Singapore: This document is provided in Singapore by or through ING Bank N.V., Singapore Branch and is provided only to accredited investors, expert investors and institutional investors, as defined in Section 4A of the Securities and Futures Act, Cap. 289. If you are an accredited investor or expert investor, please be informed that in INGs dealings with you, ING is relying on the following exemptions to the Financial Advisers Act, Cap. 110 (FAA): (1) the exemption in Regulation 33 of the Financial Advisers Regulations (FAR), which exempts ING from complying with Section 25 of the FAA on disclosure of product information to clients; (2) the exemption set out in Regulation 34 of the FAR, which exempts ING from complying with Section 27 of the FAA on recommendations; and (3) the exemption set out in Regulation 35 of the FAR, which exempts ING from complying with Section 36 of the FAA on disclosure of certain interests in securities. United Kingdom: This report is issued in the United Kingdom by ING Bank N.V., London Branch only to persons described in Articles 19, 47 and 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 and is not intended to be distributed, directly or indirectly, to any other class of persons (including private investors). United States: Any person wishing to discuss this report or effect transactions in any security discussed herein should contact ING Financial Markets LLC, which is a member of the NYSE, FINRA and SIPC and part of ING, and which has accepted responsibility for the distribution of this report in the United States under applicable requirements. The distribution of this report in other jurisdictions may be restricted by law or regulation and persons into whose possession this document comes should inform themselves about, and observe, any such restrictions.

FM

8 Additional information is available on request

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Advanced Accounting 12th Edition Beams Test BankDocumento26 páginasAdvanced Accounting 12th Edition Beams Test BankNathanToddkprjq100% (66)

- Financial Statements - Sept13 - 1stmake Up ClassDocumento8 páginasFinancial Statements - Sept13 - 1stmake Up Classkeith niduelanAinda não há avaliações

- Diminishing Musharakah Concept for Asset FinancingDocumento26 páginasDiminishing Musharakah Concept for Asset FinancingHasan Irfan SiddiquiAinda não há avaliações

- CH 12 - Musharaka - ModarbaDocumento11 páginasCH 12 - Musharaka - Modarbatalhaqm123Ainda não há avaliações

- Project AppraisalDocumento19 páginasProject AppraisalSagar Parab100% (2)

- Delpher Trades Corporation vs IAC takes control of properties to save on inheritance taxesDocumento7 páginasDelpher Trades Corporation vs IAC takes control of properties to save on inheritance taxesIan Van MamugayAinda não há avaliações

- Financial Institution PI - Proposal FormDocumento17 páginasFinancial Institution PI - Proposal FormNimesh Prakash /Insurance/SreiAinda não há avaliações

- Effects of Oil Prices, Euro Exchange Rate, and Interest Rates on Gold PricesDocumento11 páginasEffects of Oil Prices, Euro Exchange Rate, and Interest Rates on Gold PricesJam Faisal Aftab DaharAinda não há avaliações

- Reporting AddendumDocumento19 páginasReporting AddendumthtengAinda não há avaliações

- NBFC Thematic On Securitisation - Spark - 25nov19Documento35 páginasNBFC Thematic On Securitisation - Spark - 25nov19chetankvoraAinda não há avaliações

- Investment AlternativesDocumento4 páginasInvestment AlternativesAjay Kumar SharmaAinda não há avaliações

- Financial ServicesDocumento16 páginasFinancial ServicesArun RanaAinda não há avaliações

- QuizDocumento68 páginasQuizpuneet_1985Ainda não há avaliações

- Beta finance measure stock market riskDocumento11 páginasBeta finance measure stock market riskshruthid894Ainda não há avaliações

- Articles of PartnershipDocumento4 páginasArticles of PartnershipO.r. Cadz100% (1)

- Nabtrade Financial Services GuideDocumento12 páginasNabtrade Financial Services GuideksathsaraAinda não há avaliações

- Corporate LiquidationDocumento7 páginasCorporate Liquidationjustine valdez0% (2)

- MAS 2 - Optimal Capital StructureDocumento5 páginasMAS 2 - Optimal Capital StructureNathallie CabalunaAinda não há avaliações

- DCF and PirDocumento2 páginasDCF and PirVamsi HashmiAinda não há avaliações

- Thesis - Boboss PDFDocumento26 páginasThesis - Boboss PDFEngr Lando100% (1)

- Hull RMFI3 RD Ed CH 20Documento20 páginasHull RMFI3 RD Ed CH 20Ella Marie WicoAinda não há avaliações

- The Banking Firms During MughalsDocumento13 páginasThe Banking Firms During MughalsNitishKumar50% (4)

- Investors Perception Towards Investment in Mutual FundsDocumento56 páginasInvestors Perception Towards Investment in Mutual Fundstanya dhamija100% (1)

- Holder In Due Course ExplainedDocumento7 páginasHolder In Due Course ExplainedshakoorandwhatAinda não há avaliações

- Janney PDFDocumento18 páginasJanney PDFAnonymous Feglbx5Ainda não há avaliações

- The Credit Rating Agencies in India Mainly Include ICRA and CRISILDocumento1 páginaThe Credit Rating Agencies in India Mainly Include ICRA and CRISILsameerkalAinda não há avaliações

- Fin2bsat Quiz1 InvProperty Fund PpeDocumento5 páginasFin2bsat Quiz1 InvProperty Fund PpeMarvin San JuanAinda não há avaliações

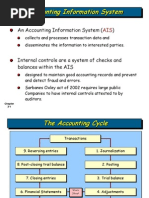

- Wiley - Chapter 3: The Accounting Information SystemDocumento36 páginasWiley - Chapter 3: The Accounting Information SystemIvan BliminseAinda não há avaliações

- Ifs Last Three UnitsDocumento27 páginasIfs Last Three UnitsVarshini NagarajuAinda não há avaliações