Escolar Documentos

Profissional Documentos

Cultura Documentos

Vai 11

Enviado por

Soumya PoojariDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Vai 11

Enviado por

Soumya PoojariDireitos autorais:

Formatos disponíveis

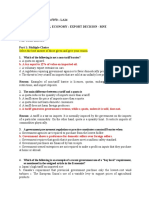

services, management information systems, operations and maintenance support mainly for SMEs in a variety of sectors like agriculture,

agro-industry, consumer goods, light engineering, telecom. Top 5. What are the various types of financial facilities provided by Exim Bank to Indian Companies for export of turnkey/ construction projects, export of services and export of capital/ engineering goods & consumer durables ? Exim Bank provides financial assistance to Indian Companies by way of a variety of lending programmes, viz., Non-Funded Funded Pre-shipment Rupee Credit Post-shipment Rupee Credit Foreign Currency Loan Overseas Buyer's Credit Lines of Credit Loan under FREPEC programme Refinance of Export Loans Top 6. What are the various types of financial facilities provided by Exim Bank to Indian Companies for export capability creation? Exim Bank provides financial assistance to Indian Companies for export capability creation by way of a variety of lending programmes, viz., Lending Programme for Export Oriented Units Production Equipment Finance Programme Import Finance Export Marketing Finance Programme Lending Programme for Software Training Institutes Programme for Financing Research & Development Programme for Export Facilitation: Port Development Export Vendor Development Lending Programme Foreign Currency Pre-Shipment Credit Working Capital Term Loan Programme for Export Oriented units Top 7. What type of financial assistance is extended by Exim Bank in setting up joint ventures? Bid Bond Advance Payment Guarantee Performance Guarantee Guarantee for release of Retention Money Guarantee for raising Borrowings Overseas Other guarantees

Assistance is extended to Indian Promoter Companies by way of programmes that address to different requirements of the promoter company in setting up of the joint venture. Overseas Investment Finance Programme for setting up joint ventures and wholly owned subsidiaries abroad. Asian Countries Investment Partners (ACIP) Programme for creation of a joint venture in India with East Asian countries, through four facilities that address different stages of a project cycle.

Home : About Us : Organisation :: ORGANISATION

THE INSTITUTION Export-Import Bank of India is the premier export finance institution of the country, set up in 1982 under the Export-Import Bank of India Act 1981. Government of India launched the institution with a mandate, not just to enhance exports from India, but to integrate the countrys foreign trade and investment with the overall economic growth. Since its inception, Exim Bank of India has been both a catalyst and a key player in the promotion of cross border trade and investment. Commencing operations as a purveyor of export credit, like other Export Credit Agencies in the world, Exim Bank of India has, over the period, evolved into an institution that plays a major role in partnering Indian industries, particularly the Small and Medium Enterprises, in their globalisation efforts, through a wide range of products and services offered at all stages of the business cycle, starting from import of technology and export product development to export production, export marketing, pre-shipment and post-shipment and overseas investment. THE INITIATIVES

Exim Bank of India has been the prime mover in encouraging project exports from India. The Bank provides Indian project exporters with a comprehensive range of services to enhance the prospect of their securing export contracts, particularly those funded by Multilateral Funding Agencies like the World Bank, Asian Development Bank, African Development Bank and European Bank for Reconstruction and Development. The Bank extends lines of credit to overseas financial institutions, foreign governments and their agencies, enabling them to finance imports of goods and services from India on deferred credit terms. Exim Banks lines of Credit obviate credit risks for Indian exporters and are of particular relevance to SME exporters. The Banks Overseas Investment Finance programme offers a variety of facilities for Indian investments and acquisitions overseas. The facilities include loan to Indian companies for equity participation in overseas ventures, direct equity participation by Exim Bank in the overseas venture and non-funded facilities such as letters of credit and guarantees to facilitate local borrowings by the overseas venture.

The Bank provides financial assistance by way of term loans in Indian rupees/foreign currencies for setting up new production facility, expansion/modernization/upgradation of existing facilities and for acquisition of production equipment/technology. Such facilities particularly help export oriented Small and Medium Enterprises for creation of export capabilities and enhancement of international competitiveness. Under its Export Marketing Finance programme, Exim Bank supports Small and Medium Enterprises in their export marketing efforts including financing the soft expenditure relating to implementation of strategic and systematic export market development plans. The Bank has launched the Rural Initiatives Programme with the objective of linking Indian rural industry to the global market. The programme is intended to benefit rural poor through creation of export capability in rural enterprises. In order to assist the Small and Medium Enterprises, the Bank has put in place the Export Marketing Services (EMS) Programme. Through EMS, the Bank seeks to establish, on best efforts basis, SME sector products in overseas markets, starting from identification of prospective business partners to facilitating placement of final orders. The service is provided on success fee basis. Exim Bank supplements its financing programmes with a wide range of value-added information, advisory and support services, which enable exporters to evaluate international risks, exploit export opportunities and improve competitiveness, thereby helping them in their globalisation efforts.

THE LEADERSHIP Since inception, Exim Bank has had, at the helm of its affairs, leading banking professionals as Chief Executive Officers. Shri R.C. Shah, a seasoned banker, with vast commercial and international banking experience, was the first Chairman and Managing Director of Exim Bank during January 1982-January 1985. His vision helped the setting up of the institution as a unique organizational model, with a flat, non-hierarchical culture, multi-disciplinary approach to problem solving, access to the latest technology and a climate for innovation. He was succeeded by Shri Kalyan Banerji, who was the Chairman and Managing Director during February 1985April 1993. Shri Banerji had long years of commercial banking experience, with exposure to international banking. Ms. Tarjani Vakil took over as the Chairperson and Managing Director of the Bank in August 1993 and guided the institution in its endeavours for export capability creation, till October 1996. Ms. Vakil had long years of development banking experience and was associated with Exim Bank since its inception. She was succeeded by Shri Y.B. Desai, who was the Managing Director of the Bank during August 1997-April 2001. Shri Desai had vast commercial banking experience and joined Exim Bank in the initial years of the institution. Shri T.C. Venkat Subramanian took over as Chairman and Managing Director of Exim Bank from May 1, 2001. Shri Subramanian has both commercial banking and development banking

experience and has been associated with Exim Bank since its inception. Under the stewardship of Shri Subramanian, Exim Bank has crossed significant milestones in business promotion as well as other initiatives as the premier export finance institution of the country. THE BOARD In its endeavours, Exim Bank of India has, all along, been guided, at the Board level, by senior policy makers, expert bankers, leading players in industry and international trade as well as professionals in exports or imports or financing thereof. The Board currently includes top level functionaries from the Ministries of Finance, Commerce, External Affairs and Industry, Government of India, a Deputy Governor from the Reserve Bank of India, Chairmen of Industrial Development Bank of India, Export Credit Guarantee Corporation of India, State Bank of India, Punjab National Bank and Bank of Baroda and the Director General of Research and Information System for Developing Countries. Some of the illustrious Board Members in the past, include Dr. Montek Singh Ahluwalia (former Secretary, Ministry of Finance, Government of India and currently Deputy Chairman, Planning Commission of India), Shri Kamlesh Sharma (former Indian High Commissioner in the UK and currently the Commonwealth Secretary General), Dr. Abid Hussain (former Commerce Secretary, Government of India and Indian Ambassador to USA), Dr. Bimal Jalan (former Secretary, Ministry of Finance, Government of India and Governor, RBI and currently a Member of Parliament in the Rajya Sabha), Shri S. Venkitaramanan (former Secretary, Ministry of Finance, Government of India and Governor, RBI), Dr. Deepak Nayyar (former Chief Economic Advisor, Ministry of Finance, Government of India and currently Professor of Economics, Jawaharlal Nehru University, New Delhi), Shri Tejendra Khanna (former Commerce Secretary, Government of India and currently Lt. Governor of Delhi), Dr. S.S.Sidhu (former Industry Secretary, Government of India and currently Governor of Goa ), Shri. T.R. Prasad (former Industry Secretary and Cabinet Secretary, Government of India ) and Shri S.S. Tarapore (former Deputy Governor, RBI, who led the Tarapore Committee on Capital Account Convertibility).

http://www.scribd.com/doc/16949773/Exim-Bank INTRODUCTION

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Duty Drawback SchemeDocumento7 páginasDuty Drawback SchemeMALAYALYAinda não há avaliações

- Jabatan Kastam Diraja Malaysia: Royal Malaysian Customs DepartmentDocumento2 páginasJabatan Kastam Diraja Malaysia: Royal Malaysian Customs DepartmentFaisal MuhammadAinda não há avaliações

- Tariff and Custom CodeDocumento12 páginasTariff and Custom CodeAmy Olaes Dulnuan100% (1)

- An International Business PlanDocumento2 páginasAn International Business Planishwar_chheda75% (4)

- Let Export Copy: Indian Customs Edi SystemDocumento10 páginasLet Export Copy: Indian Customs Edi Systemsaikatpaul22Ainda não há avaliações

- Eleventh Edition, Global EditionDocumento21 páginasEleventh Edition, Global EditionBilge SavaşAinda não há avaliações

- INB302 Individual Assignment ID 1722075Documento3 páginasINB302 Individual Assignment ID 1722075Jagannath SahaAinda não há avaliações

- Tariffs: Meaning and Types - International Trade - EconomicsDocumento6 páginasTariffs: Meaning and Types - International Trade - EconomicsLuz AlbanoAinda não há avaliações

- JNPT Vs KPT: Presented by &Documento11 páginasJNPT Vs KPT: Presented by &Syed Mubashir Ali H ShahAinda não há avaliações

- Customs Duty & M.P. Stamp SyllabusDocumento30 páginasCustoms Duty & M.P. Stamp Syllabusnousheen riyaAinda não há avaliações

- Foreign Trade Procedures 2015-2020Documento209 páginasForeign Trade Procedures 2015-2020stephin k jAinda não há avaliações

- Exports and Economic Growth in EthiopiaDocumento103 páginasExports and Economic Growth in Ethiopiagizachewnani2011Ainda não há avaliações

- The Rubber Board: ( Éé Êh É V É B Éæ Té Ä M É Éæjé É É É, Éé®Úié ºé®ú Eò É®Ú)Documento17 páginasThe Rubber Board: ( Éé Êh É V É B Éæ Té Ä M É Éæjé É É É, Éé®Úié ºé®ú Eò É®Ú)Chandrasekharan NairAinda não há avaliações

- COMOS Piña Fiber Wallets & PursesDocumento1 páginaCOMOS Piña Fiber Wallets & PursesJoy Jarin100% (2)

- World: Lard - Market Report. Analysis and Forecast To 2020Documento7 páginasWorld: Lard - Market Report. Analysis and Forecast To 2020IndexBox MarketingAinda não há avaliações

- 1.2 History: Figure 2 - First LNG Cargo Ship, The Methane PioneerDocumento4 páginas1.2 History: Figure 2 - First LNG Cargo Ship, The Methane PioneerabdoAinda não há avaliações

- B. A Tax Equal To 12% of Value On Imported OilDocumento4 páginasB. A Tax Equal To 12% of Value On Imported Oilmarissa002Ainda não há avaliações

- IB: Export & Global SourcingDocumento12 páginasIB: Export & Global Sourcingحبا عرفانAinda não há avaliações

- FAQ CustomsDocumento5 páginasFAQ Customssandeep_shinuAinda não há avaliações

- China Africa Infrastructure Model FailDocumento6 páginasChina Africa Infrastructure Model Failbambangsoegeng753Ainda não há avaliações

- Pakur Stone Specification for Bangladesh ExportDocumento1 páginaPakur Stone Specification for Bangladesh Exportriyadh al kamalAinda não há avaliações

- The Recent Development of The Indonesian Palm Oil Industry - Indonesian Palm Oil Association (GAPKI IPOA)Documento6 páginasThe Recent Development of The Indonesian Palm Oil Industry - Indonesian Palm Oil Association (GAPKI IPOA)Green Sustain EnergyAinda não há avaliações

- IEC RegistrationDocumento6 páginasIEC RegistrationParas MittalAinda não há avaliações

- European-Vietnam Free Trade Agreement Evfta ImpactDocumento13 páginasEuropean-Vietnam Free Trade Agreement Evfta ImpactKhoa TranAinda não há avaliações

- Operating InstructionsDocumento3 páginasOperating InstructionsShami MudunkotuwaAinda não há avaliações

- Middle East Asia: Group MembersDocumento28 páginasMiddle East Asia: Group MembersGuneesh ChawlaAinda não há avaliações

- NPTEL Course Global Marketing Management Assignment IDocumento3 páginasNPTEL Course Global Marketing Management Assignment IShikha singhAinda não há avaliações

- International Trade Assignment # 01Documento4 páginasInternational Trade Assignment # 01ArifaAinda não há avaliações

- International Economics I (: Econ 2081)Documento36 páginasInternational Economics I (: Econ 2081)Gidisa LachisaAinda não há avaliações

- BEMS - Pre-Requisite For ExportsDocumento25 páginasBEMS - Pre-Requisite For ExportsAKARSH JAISWALAinda não há avaliações