Escolar Documentos

Profissional Documentos

Cultura Documentos

Description: Tags: GEN0303c

Enviado por

anon-52210Descrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Description: Tags: GEN0303c

Enviado por

anon-52210Direitos autorais:

Formatos disponíveis

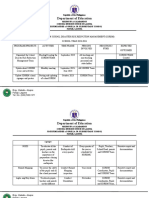

Federal Family Education Loan Program (FFELP) Guarantor, Program, or Lender Identification

Federal PLUS Loan Information

and School Certification

WARNING: Any person who knowingly makes a false statement or misrepresentation on this form

is subject to penalties which may include fines, imprisonment, or both, under the United States

Criminal Code and 20 U.S.C. 1097.

(Reserved for school, lender, or guarantor mailing address as appropriate) 1. School Code

2. School Information (Name, Address, and Phone Number)

Borrower (Parent) and Student Information

3. Parent Borrower’s Last Name First Name MI 4. Parent’s Social Security Number

5. Permanent Street Address 6. Home Telephone Number

( )

City State Zip 7. Parent’s Date of Birth (MM/DD/Birth Year)

8. Lender Name City State 9. Lender Code, if known

10. Parent’s Requested Loan Amount 11. Student’s Loan Period (Month/Year)

$ .00 From: To:

12. Student’s Last Name First Name MI 13. Student’s Social Security Number 14. Student’s Date of Birth (MM/DD/Birth Year)

School Certification Information (To be completed only by the school.)

15. Enrollment Status (Check one) 16. Anticipated (Completion) Graduation Date (Month/Day/Year)

❒ Full Time ❒ At Least Half Time

17. Loan Period (Month/Day/Year) 18. Grade Level 19. Certified Loan Amount

From: To: $ .00

20. Recommended Disbursement Date(s) (Month/Day/Year)

1st 2nd 3rd 4th 5th 6th

This space reserved for additional disbursement dates, if needed.

School Certification (To be completed only by the school.)

I hereby certify that the student named on this Certification is accepted for enrollment as a regular student in an eligible program on at least a half-time

basis, is a U.S. citizen, permanent resident, or other eligible non-citizen, and is making satisfactory academic progress. I certify that the borrower is an

eligible borrower in accordance with the Higher Education Act of 1965, as amended, and applicable U.S. Department of Education regulations (collectively

referred to as the Act) and has been determined eligible for a loan in the amount certified. I further certify that the disbursement schedule complies with

the requirements of the Act. I further certify that, based on records available and appropriate inquiry, the student has met the requirements of the Selective

Service Act, is not incarcerated, and that neither the parent borrower nor the student is liable for an overpayment of any federal grant or loan made under

the Act, is not in default, or if so, has made satisfactory payment arrangements with the holder(s) of any defaulted loan(s), does not have property subject

to a judgement lien for a debt owed to the U.S., and that the information provided in this Certification is true, complete, and accurate to the best of my

knowledge and belief. I agree to provide the borrower (i) with confirmation of any transfer of funds through electronic funds transfer (EFT) or master

check to the borrower’s dependent student’s account, and (ii) an opportunity to cancel or reduce any disbursement of a loan.

21. Signature of Authorized School Official ___________________________________________________________ 22. Today’s Date (Month/Day/Year) ___________________________

Name/Title (Printed or Typed) ___________________________________________________________________

Please refer to the instructions for completing this form.

Instructions for Completing Federal PLUS Loan Information

and School Certification

Items 1 and 2 may be prefilled or completed Item 9: Enter the lender code, if known. Otherwise, Item 16: Enter the date the student is expected to

by the school. leave this item blank. complete the program at your institution. Use

Item 10: Enter the maximum total amount the numbers in a month/day/year format; for example,

Item 1: Enter the code for your institution. 6/9/2004. If you are unsure of the actual completion

This code is provided by the U.S. Department borrower wishes to borrow under the PLUS Loan

Program for the dependent student listed in Item 12 date in the future, enter the last day of the month.

of Education.

for the loan period listed in Item 11. Item 17: Enter the dates covered by the student’s

Item 2: Enter your school name, address, and cost of attendance. These dates must coincide with

telephone number, including area code, of a Note to Parent: Apply only for what you will need

to pay your dependent’s educational costs this year, actual term starting and ending dates. At a school

school official who can answer questions about without academic terms, these dates must coincide

this certification. keeping in mind your ability to repay your loan(s).

You may borrow up to the student’s estimated cost with the student’s program of study if that is less

Items 3-14 may be completed by the parent borrower, of education at the school the student will attend than an academic year in length, or the academic

school, or lender. If the parent is completing this minus any estimated financial assistance the student year. Use numbers in a month/day/year format.

section and any information has been prefilled has or will be awarded during the period of Item 18: Enter the grade level of the student. Select

by the school or lender, the parent should review enrollment. the proper grade level indicator using the standard

it for correctness. If any part of the prefilled Item 11: Enter the beginning and ending dates grade level codes provided:

information is incorrect, cross out the incorrect (month/year) of the academic period for which 1. Freshman/First Year (including proprietary

information and print the correct information. this loan is to be used (for example, 9/2003 to institution programs that are less than one year in

Item 3: Enter the borrower’s last name, then first 6/2004). These dates must not be more than duration)

name and middle initial. 12 months apart. 2. Sophomore/Second Year

Item 4: Enter the borrower’s nine-digit Social Item 12: Enter the last name, then first name 3. Junior/Third Year

Security Number. This loan cannot be processed and middle initial of the student for whom the 4. Senior/Fourth Year

without the borrower’s Social Security Number. parent is borrowing. 5. Fifth Year/Other Undergraduate (including sixth

year undergraduate and continuing education

Item 5: Enter the borrower’s permanent home street Item 13: Enter the student’s nine-digit Social students)

address, apartment number, city, state and zip code. Security Number. This loan cannot be processed

If the borrower has a Post Office Box and a street without the student’s Social Security Number. Item 19: Enter the maximum amount of PLUS Loan

address, list both. the borrower is eligible to receive for the academic

Item 14: Enter the month, day, and four-digit year of period covered in Item 17. This amount cannot

Item 6: Enter the area code and telephone number the student’s birth. Use only numbers. Be careful exceed the student’s Cost of Attendance minus Other

for the address listed in Item 5. If the borrower does not to enter the current year. Financial Aid.

not have a telephone, enter N/A.

Items 15-22 are to be completed only by the Item 20: Enter the disbursement dates for this

Item 7: Enter the month, day and four-digit year of school. This information is to be certified by a loan as determined in accordance with the Act.

the borrower’s birth. Use only numbers. Be careful financial aid administrator or other school official Use numbers in a month/day/year format.

not to enter the current year. authorized to certify financial aid forms. If Item 21: Your signature acknowledges that you

Item 8: Enter the name and address of the lender certification information is transmitted electroni-

have read and agree to the provisions in the School

from which the borrower wishes to borrow this loan. cally, the School Certification form does not have

Certification. You must sign the Certification and

to be submitted.

Note to Parent: If you do not have a lender for this print your name and title.

loan, contact the school’s financial aid office, a bank Item 15: Indicate whether the student is (or plans

Item 22: Enter the date of Certification.

or other financial institution, or the guarantor or to be) enrolled at least half time or full time. Parents

Use numbers in a month/day/year format.

program listed on this form for information on of students enrolled (or planning to enroll) less than

lenders willing to make Federal PLUS Loans. half time are not eligible for a Federal PLUS Loan.

Você também pode gostar

- Higher Education Student Financial Aid: Compare and Contrast State Managed Higher Education Student Financial Aid in Canada and the America with the Ngo-Managed Grameen Bank Higher Education Financial Aid Services in BangladeshNo EverandHigher Education Student Financial Aid: Compare and Contrast State Managed Higher Education Student Financial Aid in Canada and the America with the Ngo-Managed Grameen Bank Higher Education Financial Aid Services in BangladeshAinda não há avaliações

- Description: Tags: G02338MPNSchCert02FinalDocumento2 páginasDescription: Tags: G02338MPNSchCert02Finalanon-928735Ainda não há avaliações

- Description: Tags: Gen0114aDocumento9 páginasDescription: Tags: Gen0114aanon-300392Ainda não há avaliações

- Teacher Loan Forgiveness ApplicationDocumento8 páginasTeacher Loan Forgiveness ApplicationAlexander RosentalAinda não há avaliações

- Description: Tags: GEN0303bDocumento8 páginasDescription: Tags: GEN0303banon-281081Ainda não há avaliações

- Application Form For Pre Matric Scholarship To Minority StudentsDocumento6 páginasApplication Form For Pre Matric Scholarship To Minority StudentsNikitaAinda não há avaliações

- Teacher Loan ForgivenessDocumento8 páginasTeacher Loan ForgivenessJazareth AngueiraAinda não há avaliações

- Pre Metric Application - 2010-11Documento5 páginasPre Metric Application - 2010-11akhilcsAinda não há avaliações

- Description: Tags: GEN0205BDocumento2 páginasDescription: Tags: GEN0205Banon-819912Ainda não há avaliações

- Description: Tags: GEN0205ADocumento2 páginasDescription: Tags: GEN0205Aanon-440688Ainda não há avaliações

- Description: Tags: GEN0503AttachDocumento2 páginasDescription: Tags: GEN0503Attachanon-302580Ainda não há avaliações

- Saleem ScholarshipDocumento3 páginasSaleem Scholarshipghazi computersAinda não há avaliações

- Application Form USAID Funded Merit & Need Based Scholarship For Regular Mba Students Seeking Admission in Fall 2014Documento13 páginasApplication Form USAID Funded Merit & Need Based Scholarship For Regular Mba Students Seeking Admission in Fall 2014IrtizahussainAinda não há avaliações

- In-School Deferment RequestDocumento3 páginasIn-School Deferment RequestSirLockInBottomAinda não há avaliações

- New-Promise-Scholarship-Application Class of 2024Documento3 páginasNew-Promise-Scholarship-Application Class of 2024api-648719695Ainda não há avaliações

- Description: Tags: Gen0115cDocumento2 páginasDescription: Tags: Gen0115canon-161511Ainda não há avaliações

- Vidya Lakshmi Common Education Loan Application FormDocumento4 páginasVidya Lakshmi Common Education Loan Application FormPondy UnionAinda não há avaliações

- Scheme of Scholarship For Students Belonging To The Ews Category (Under Govt. of Uttar Pradesh)Documento6 páginasScheme of Scholarship For Students Belonging To The Ews Category (Under Govt. of Uttar Pradesh)Ritika JainAinda não há avaliações

- Application Form 2022 23Documento2 páginasApplication Form 2022 23aftab aliAinda não há avaliações

- Usaid Funded Merit & Need Based Scholarship Scheme: Dear Student/viewersDocumento15 páginasUsaid Funded Merit & Need Based Scholarship Scheme: Dear Student/viewersjunaid_abbasi4uAinda não há avaliações

- Description: Tags: FP0705AttFAppPNoteStandardDocumento18 páginasDescription: Tags: FP0705AttFAppPNoteStandardanon-23498Ainda não há avaliações

- Description: Tags: GEN0502Attach3Documento4 páginasDescription: Tags: GEN0502Attach3anon-528395Ainda não há avaliações

- Edl Application FormDocumento7 páginasEdl Application FormDevesh FayeAinda não há avaliações

- Description: Tags: GEN0502Attach2Documento4 páginasDescription: Tags: GEN0502Attach2anon-560955Ainda não há avaliações

- Bank of India Loan Application FormDocumento4 páginasBank of India Loan Application Formankurkumar95720Ainda não há avaliações

- DFIS GenericDocumento1 páginaDFIS GenericjayrelayAinda não há avaliações

- 6post Matric MinorihfdjfsjdfdsjftyDocumento6 páginas6post Matric MinorihfdjfsjdfdsjftyrevathisudhaAinda não há avaliações

- 23-24 Foundation Scholarship Application 073023Documento6 páginas23-24 Foundation Scholarship Application 073023mortensenkAinda não há avaliações

- Description: Tags: GEN0613AttachADocumento4 páginasDescription: Tags: GEN0613AttachAanon-801905Ainda não há avaliações

- Form No GJS1Documento6 páginasForm No GJS1NIKHIL SWAMY B C0% (1)

- Friends of 440 Scholarship Application 2012Documento16 páginasFriends of 440 Scholarship Application 2012Mrs. LibbyAinda não há avaliações

- 23-24 Foundation Vocational Application 073023Documento6 páginas23-24 Foundation Vocational Application 073023mortensenkAinda não há avaliações

- Description: Tags: cb0113bPerkinsOpenEndnewDocumento5 páginasDescription: Tags: cb0113bPerkinsOpenEndnewanon-840603Ainda não há avaliações

- Full TimeDocumento2 páginasFull Timeabhishekmittal4uAinda não há avaliações

- FBI JN Teen Academy Application 2022Documento5 páginasFBI JN Teen Academy Application 2022WLBT News67% (3)

- HEC-USNBS Scholarship ApplicationDocumento15 páginasHEC-USNBS Scholarship ApplicationAsif AliAinda não há avaliações

- 1application FormDocumento10 páginas1application Formthehijabigirl03Ainda não há avaliações

- Description: Tags: GEN0205CDocumento2 páginasDescription: Tags: GEN0205Canon-95037Ainda não há avaliações

- 20-21 Foundation Scholarship ApplicationDocumento9 páginas20-21 Foundation Scholarship ApplicationmortensenkAinda não há avaliações

- Scholar Ship Form 2023Documento2 páginasScholar Ship Form 2023malikshahzain.1436100% (1)

- FIS Statement Website Packet Rev. 6 6 5 19 2Documento10 páginasFIS Statement Website Packet Rev. 6 6 5 19 2Rob WrightAinda não há avaliações

- For Office Use Only: Last Date of Receipt: 5.00 PM On 31 OCTOBER 2007Documento10 páginasFor Office Use Only: Last Date of Receipt: 5.00 PM On 31 OCTOBER 2007mrgkkAinda não há avaliações

- Admission Form 2020Documento2 páginasAdmission Form 2020Muhammad FaizanAinda não há avaliações

- Virtual Class Program Enrollment Form v1.2Documento2 páginasVirtual Class Program Enrollment Form v1.2hazelcuicolopezAinda não há avaliações

- Description: Tags: GEN0205DDocumento2 páginasDescription: Tags: GEN0205Danon-4443Ainda não há avaliações

- Appendix 7 1819Documento9 páginasAppendix 7 1819cipher.james.businessAinda não há avaliações

- Format of Application: For Official Use Only SL - No. of Application Year Course Whether ApprovedDocumento8 páginasFormat of Application: For Official Use Only SL - No. of Application Year Course Whether Approvedabhishek123hitAinda não há avaliações

- 2011-12 International CSSDocumento4 páginas2011-12 International CSStuan1812Ainda não há avaliações

- MOE FAS Application FormDocumento7 páginasMOE FAS Application FormRoyAinda não há avaliações

- TLF Word ENDocumento5 páginasTLF Word EN711635Ainda não há avaliações

- Description: Tags: Gen0115bDocumento3 páginasDescription: Tags: Gen0115banon-71090Ainda não há avaliações

- Iqbal Scholarship Form NEST2Documento3 páginasIqbal Scholarship Form NEST2Syed Fawad MarwatAinda não há avaliações

- MOE ISB Application Form Revised On 14 October 2022Documento6 páginasMOE ISB Application Form Revised On 14 October 2022Abhimanyu GunalanAinda não há avaliações

- Education Loan Application FormDocumento9 páginasEducation Loan Application FormJeydar De YesteAinda não há avaliações

- Bill Distributor-Fesco Application FormDocumento3 páginasBill Distributor-Fesco Application FormMughal Raza GAinda não há avaliações

- Description: Tags: Gen0115aDocumento3 páginasDescription: Tags: Gen0115aanon-440096Ainda não há avaliações

- Application FormatDocumento7 páginasApplication FormatSameer ShaikhAinda não há avaliações

- How to Pay for College: A Guide to Student Loans, Scholarships, and Making School AffordableNo EverandHow to Pay for College: A Guide to Student Loans, Scholarships, and Making School AffordableNota: 5 de 5 estrelas5/5 (1)

- Study Permit: Working While Studying, Exemptions & How to ApplyNo EverandStudy Permit: Working While Studying, Exemptions & How to ApplyAinda não há avaliações

- SDRRM Action Plan 2023-2024Documento3 páginasSDRRM Action Plan 2023-2024Lerma EmAinda não há avaliações

- Activities To Promote EntrepreneurshipDocumento12 páginasActivities To Promote EntrepreneurshipRichell PayosAinda não há avaliações

- Writing - Sample EssayDocumento4 páginasWriting - Sample EssayHazim HasbullahAinda não há avaliações

- Soal BigDocumento3 páginasSoal BigRiaAinda não há avaliações

- PURPOSIVE!!Documento6 páginasPURPOSIVE!!junita ramirez50% (2)

- Unit I Overview of EntrepreneurshipDocumento25 páginasUnit I Overview of EntrepreneurshipAndrei AgustinAinda não há avaliações

- Hon. Janice Vallega DegamoDocumento5 páginasHon. Janice Vallega DegamoJobert HidalgoAinda não há avaliações

- Modules in Religious Ed 1Documento3 páginasModules in Religious Ed 1Jane GawadAinda não há avaliações

- Physical Therapy DocumentationDocumento5 páginasPhysical Therapy Documentationamrutharam50% (2)

- Her Research Was Concerned With Managers and How They Coped With Pressure in The WorkplaceDocumento1 páginaHer Research Was Concerned With Managers and How They Coped With Pressure in The Workplacewaqasbu100% (1)

- Tesol Methods Day 6 - GTMDocumento40 páginasTesol Methods Day 6 - GTMNargiza MirzayevaAinda não há avaliações

- Informative JournalDocumento2 páginasInformative JournalMargie Ballesteros ManzanoAinda não há avaliações

- Derive 6Documento5 páginasDerive 6Flavio BacelarAinda não há avaliações

- Lesson Plan - Sequence Days of The WeekDocumento3 páginasLesson Plan - Sequence Days of The Weekapi-295597073Ainda não há avaliações

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12Documento34 páginasSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 12jasperkennedy078% (27)

- The Life of The Angelic Doctor Thomas Aquinas PDFDocumento200 páginasThe Life of The Angelic Doctor Thomas Aquinas PDFhotrdp5483Ainda não há avaliações

- Solution-Focused Counseling in Schools: Suggested APA Style ReferenceDocumento8 páginasSolution-Focused Counseling in Schools: Suggested APA Style ReferenceYoselin Urbina MezaAinda não há avaliações

- Cambridge O Level: Chemistry 5070/12 October/November 2020Documento3 páginasCambridge O Level: Chemistry 5070/12 October/November 2020Islamabad ALMA SchoolAinda não há avaliações

- Ethical Principles of ResearchDocumento15 páginasEthical Principles of ResearchAstigart Bordios ArtiagaAinda não há avaliações

- Second Semester-First Periodical Examination Work Immersion Oo2Documento1 páginaSecond Semester-First Periodical Examination Work Immersion Oo2JC Dela Cruz100% (1)

- English 6Documento9 páginasEnglish 6Aris VillancioAinda não há avaliações

- Lesson Plan For Math Grade 9Documento4 páginasLesson Plan For Math Grade 9Sindaw Youth Association for ProgressAinda não há avaliações

- CTET Exam Books - 2016Documento16 páginasCTET Exam Books - 2016Disha Publication50% (2)

- City College of Tagaytay: Republic of The PhilippinesDocumento5 páginasCity College of Tagaytay: Republic of The PhilippinesJeff Jeremiah PereaAinda não há avaliações

- AchievementsDocumento4 páginasAchievementsapi-200331452Ainda não há avaliações

- Purposive Behaviorism by Edward Chance TolmanDocumento3 páginasPurposive Behaviorism by Edward Chance TolmanAris Watty100% (1)

- Unit 1C - Extra MaterialDocumento2 páginasUnit 1C - Extra Materialjorge AlbornosAinda não há avaliações

- Chapter 4 Science and Technology in The PhilippinesDocumento37 páginasChapter 4 Science and Technology in The PhilippinesJesy Mae GuevaraAinda não há avaliações

- Social Interactionist TheoryDocumento13 páginasSocial Interactionist TheorySeraphMalikAinda não há avaliações

- Syllabus SPRING 2012Documento5 páginasSyllabus SPRING 2012Soumya Rao100% (1)