Escolar Documentos

Profissional Documentos

Cultura Documentos

Assignment - Financial and Management Accounting - Mb0041

Enviado por

Rahul YadavDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Assignment - Financial and Management Accounting - Mb0041

Enviado por

Rahul YadavDireitos autorais:

Formatos disponíveis

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041

ASSIGNMENT SET - 1

Q.1 Assure you have just started a Mobile store. You sell mobile sets and currencies of Airtel, Vodaphone, Reliance and BSNL. Take five transactions and prepare a position statement after every transaction. Did you firm earn profit or incurred loss at the end? Make a small comment on your financial position at the end.

Stock

Particulars Debtors Cash Capital Creditors Hand set vouchers

Started business with cash

purchased nokia handsets 25000

40000 40000

-25000

purchased BSNL and Reliance recharge vouchers 5000 -5000 sold a handset for 6000 costing 5850 -5850 6000 150

Sold recharge vouchers of 1500 profit 6% -1500 1590 90 Puchased a second hand cell on crerdit 3000 sold a handset for 10000 costing 9150 -9150 Repair work of the second hand set 3000 10000 850

-1000 -1000

Sold the hand set for 5000 -3000 Sold a hand set on credit for 10000

5000 2000

costing 9500 on credit -9500 10000 500 Realised 70% from the customer Customer became bad debt -7000 7000

-3000 -3000

500 3500 0 38590 39590 3000

42590 42590

Page 2

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041

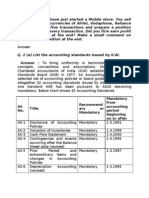

Q.2 (a) List the accounting Standards as issued by ICAI.

Accounting Standards (ASs) AS 1 Disclosure of Accounting Policies AS 2 Valuation of Inventories AS 3 Cash Flow Statements AS 4 Contingencies and Events Occurring after the Balance Sheet Date AS 5 Net Profit or Loss for the period, Prior Period Items and Changes in Accounting Policies AS 6 Depreciation Accounting AS 7 Construction Contracts (revised 2002) AS 8 Accounting for Research and Development AS 9 Revenue Recognition AS 10 Accounting for Fixed Assets AS 11 The Effects of Changes in Foreign Exchange Rates (revised 2003), AS 12 Accounting for Government Grants AS 13 Accounting for Investments AS 14 Accounting for Amalgamations AS 15 Employee Benefits Limited Revision to Accounting Standard (AS) 15, Employee Benefits AS 15 (issued 1995) Accounting for Retirement Benefits in the Financial Statement of Employers AS 16 Borrowing Costs

AS 17 Segment Reporting AS 18, Related Party Disclosures AS 19 Leases AS 20 Earnings Per Share AS 21 Consolidated Financial Statements AS 22 Accounting for Taxes on Income. AS 23 Accounting for Investments in Associates in Consolidated Financial Statements AS 24 Discontinuing Operations AS 25 Interim Financial Reporting AS 26 Intangible Assets AS 27 Financial Reporting of Interests in Joint Ventures AS 28 Impairment of Assets AS 29 Provisions,Contingent` Liabilities and Contingent Assets AS 30 Financial Instruments: Recognition and Measurement and Limited Revisions to AS 2, AS 11 (revised 2003), AS 21, AS 23, AS 26, AS 27, AS 28 and AS 29 AS 31, Financial Instruments: Presentation Accounting Standard (AS) 32, Financial Instruments: Disclosures, and limited revision to Accounting Standard (AS) 19, Leases

Page 3

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041

Q.2 (b) Write short notes of IFRS.

IFRS The IFRS Foundation is an independent, not-for-profit private sector organisation working in the public interest. Its principal objectives are: to develop a single set of high quality, understandable, enforceable and globally accepted international financial reporting standards (IFRSs) through its standard-setting body, the IASB; to promote the use and rigorous application of those standards; to take account of the financial reporting needs of emerging economies and small and medium-sized entities (SMEs); and to bring convergence of national accounting standards and IFRSs to high quality solutions. The governance and oversight of the activities undertaken by the IFRS Foundation and its standard-setting body rests with its Trustees, who are also responsible for safeguarding the independence of the IASB and ensuring the financing of the organisation. The Trustees are publicly accountable to a Monitoring Board of public authorities. Standard-setting The IASB (International Accounting Standards Board) The IASB is the independent standard-setting body of the IFRS Foundation. Its

members (currently 15 full-time members) are responsible for the development and publication of IFRSs, including the IFRS for SMEs and for approving Interpretations of IFRSs as developed by the IFRS Interpretations Committee (formerly called the IFRIC). All meetings of the IASB are held in public and webcast. In fulfilling its standard-setting duties the IASB follows a thorough, open and transparent due process of which the publication of consultative documents, such as discussion papers and exposure drafts, for public comment is an important component. The IASB engages closely with stakeholders around the world, including investors, analysts, regulators, business leaders, accounting standardsetters and the accountancy profession. The IFRS Interpretations Committee The IFRS Interpretations Committee (formerly called the IFRIC) is the interpretative body of the IASB. The Interpretations Committee comprises 14 voting members appointed by the Trustees and drawn from a variety of countries and professional backgrounds. The mandate of the Interpretations Committee is to review on a timely basis widespread accounting issues that have arisen within the context of current IFRSs and to provide authoritative guidance (IFRICs) on those issues. Interpretation Committee meetings are open to the public and webcast. In developing interpretations, the Interpretations Committee works closely with similar national committees and

follows a transparent, thorough and open due process. Page 4

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041

Q.3 Prepare Three-column Cash Book of M/s Thuglak & Co. from following particulars

20X1Jan 1. Cash in hand Rs. 50,000, Bank Overdraft Rs. 20,000

2. Paid into bank Rs. 10,000 3. Bought goods from Hari for Rs, 200 for each 4. Bought goods for Rs. 2,000 paid cheque for them, discount allowed 1% 5. Sold goods to Mohan for each Rs. 1.175 6. Received a cheque from Shyam to whom goods were sold for Rs. 800.Discount allowed 12.5% 7. S hyams cheque deposited into bank 8. Purchased an old typewriter for Rs. 200 , Spent Rs. 50 on its repairs 9. B ank notified that Shyams cheque has been returned dishonored and debited the account in respect of charges Rs. 10 10. Received a money order Rs. 25 from Hari 11. Shyam settled account by cheque for Rs. 820,Rs.20 for interest charged. 12.Withdrew from the bank Rs. 10,000 18. Discounted a B/E for Rs. 1,000 at 1% through bank 20. Honored our own acceptance by cheque Rs. 5,000 22. Withdrew fir personal use Rs. 1,000 24. Paid tread expenses Rs. 2,000 25. Withdrew from bank for private expenses Rs. 1,500

26. Purchased machinery from Rajiv for 5,000 and paid him by means of a bank draft purchased for Rs. 5,005 27. Issued cheque to Ram Saran for cash purchased of furniture Rs. 1,575 28. Received commission cheque Rs. 500 from R.& Co, deposited in bank 29. Ramesh who owned us Rs. 500 became bankrupt paid 50 paise in rupee 30. Received payment of a loan of Rs. 5,000 & deposited Rs. 3,000 into bank 31. Paid rent to landlord Mohan by cheque of Rs. 220 31. Interest allowed by bank Rs. 30 31. Half-yearly bank charges Rs. 50 Page 5

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041

Solution

Dr In the books of M/s Tuglak& Co. Cash Book

Cr

Date Partriculars LF VN Cash Bank Disc Date Partriculars LF VN Cash Bank Disc 2011 2011 50000 1-Jan By, Balance B/d 20000

1-Jan To, Balance B/d 2-Jan To, Cash 5-Jan To, Mohan 6-Jan To, Shyam 7-Jan To, Cash 10-Jan To, Hari

10000 2-Jan By, Bank 10000 1175 3-Jan By, Hari 200 1980 20

700 100 4-Jan By, Purchase 700 7-Jan By, Bank 700 25 8-Jan By, Typewriter 820 9-Jan By, Shyam 250 700

11-Jan To, Shyam

12-Jan To, Bank 10000

9-Jan By, Charges 10 1218-Jan To, Bills Receivable 990 Jan By, Cash 10000 2028-Jan To, Commission 500 Jan By, Bills Payable 5000 2229-Jan To, Ramesh 250 Jan By, Drawings 1000 To, Loan 2430-Jan Repayment 2000 3000 Jan By, Trade Exp 2000 2531-Jan To, Interest 30 Jan By, Drawings 1500 26Jan By Machinery 5005 27Jan By, furniture 1575

31Jan By, Rent 220 31Jan By, Bank Charge 50 3131-Jan To, Balance c/d 29750 Jan By, Balance c/d 63900 46040 100 63900 46040 20

49750

Page 6

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041

Q.4 Choose an Indian Company of your choice that has adopted Balance Score Card

and detail on it. Tata motors Tata Motors is the first Indian company to be inducted in the Balance Scorecard Hall of Fame. Joins the thirty-member elite club of organizations including Hilton Hotels, BMW Financial Services, US Army, Korea Telecom and Norwegian Air Force for achieving excellence in performance. The commercial vehicle business unit (CVBU) of Tata Motors, India's largest automobile manufacturer, received prestigious Balanced Scorecard Collaborative, The coveted Steuben crystal 'Rising Star' trophy was presented at Balanced Scorecard Asia Pacific Summit held at Australia. Tata Motors-CVBU has been recognized for having achieved a significant turnaround in its overall performance. The implementation of the Balanced Scorecard has enabled greater focus on different elements of operational performance. Defining, cascading and communicating strategies across the organisation have brought about transparency and alignment. The scorecard incorporates SQDCM (safety, quality, delivery, cost and morale) and VMCDR (volume, market share, customer satisfaction, dealer satisfaction and receivables).Ravi Kant, executive director, CVBU, Tata Motors,

said, "While we were conscious of the benefits of the Balanced Scorecard when we began implementing it three years back, we are extremely pleased that it has helped us achieve significant improvements in our overall performance. I am quite positive that the BSC will play an important part in our objective to become a world-class organization."Balanced Scorecard Collaborative president Dr David P Norton said, "We created the Hall of Fame to publicly acknowledge the hard work and remarkable results of implementing the Balanced Scorecard to create the strategy-focused organization. The Balanced Scorecard Hall of Fame pays tribute to the success that each organization has attained. Tata Motors- CVBU shares the honour with the city of Brisbane and Korea Telecom (KT).The Balanced Scorecard (BSC) concept-created by Dr Robert S Kaplan and Dr David P Norton in 1992, has been implemented in thousands of corporations, organizations, and government agencies worldwide. Based on the simple premise that "measurement motivates," the BSC puts strategy at the centre of the management process, allowing organizations to implement strategies rapidly and reliably. Balanced Scorecard Collaborative, Inc. is a new kind of professional services firm dedicated to the worldwide awareness, use, enhancement, and integrity of the Balanced Scorecard as a value-added management process. Tata Motors range of commercial vehicles spans

over 135 models and can haul loads ranging from 2 to 40 tones. The product portfolio also includes 12 to 60-seater buses, tippers and tractor-trailers. Tata Motors vehicles meet the stringent Euro emission norms. The company currently has an export base in most parts of South Asia, Africa, Middle East and Europe. Tata Motors recently crossed the 3-million production milestone. Page 7

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041

Q.5 From the following data of Jagdish Company prepare (a) a statement of source

and uses of working capital (funds) (b) a schedule of changes in working capital Assets 2008 2007 Cash 1,26,000 1,14,000 Short-term investment 42,400 20,000 Debtors 60,000 50,000 Stock 38,000 28,000 Long term Investment 28,000 44,000 Machinery 2,00,000 1,40,000 Building 2,40,000 80,000 Land 14,000 14,000 Total 7,48,400 4,90,000 Liabilities and Equity Accumulated depreciation 1,10,000 60,000 Creditors 40,000 30,000 Bills Payable 20,000 10,000 Secured loans 2,00,000 1,00,000 Share capital 2,20,000 1,60,000 Share premium 24,000 Nil Reserves and surplus 1,34,400 1,30,000 Total 7,48,400 4,90,000

Income statement Sales 2,40,000 Cost of goods sold 1,34,600 Gross Profit 1,05,200

Page 8

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041 Less Operating expenses: Depreciation machinery Depreciation building Other expenses Net profit from operation 20,000 32,000 40,000 92,000 13,200

Gain on sale on long-term investment 4,800 Total 18,000 Loss on sale of machinery 2,000 Net Profit 16,000

Adjustments: Machinery worth Rs.70000 was purchased and worth Rs.10000 was sold during the year [Accumulated depreciation on machinery is Rs.18000 after adjusting depreciation on machinery sold]. Proceeds from the sale of machinery were Rs.6000 Dividends paid during the year Rs.11600

Solution

Schedule of change in working capital Effect in working Capital

Particulars 2007 2008 Increase Decrease Current Assets Cash 114000 126000 12000 Short term investment 20000 42400 22400 debtors 50000 60000 10000 Stock 28000 38000 10000 (A) 212000 266400 Current Liabilities Creditors 30000 40000 10000 Bills Payable 10000 20000 10000 (B) 40000 60000 Net working capital (A-B) 172000 206400 Increase in working capital 34400 206400 206400 54400 54400 34400

Page 9

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041

Adjusted P/L A/c Partriculars Rs Partriculars Rs dividend paid 11600 By balance b/d 130000 Depreciation on profit on sale of building 32000 investment 4800 Depreciation on machinery 20000 Fund from operation 65200 loss on sale of machinery 2000

To, Balance c/d 134400 200000 200000

Fund flow statement

Source Rs Application Rs increase in working Loan taken 100000 capital 34400 share issued at premium 84000 dividend paid 11600 Sale of investment 20800 purchase of building 192000 sale of machinery 6000 purchase machinery 70000 Fund from operation 65200 Sale of machinery 32000

308000 308000

Page 10

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041

Q.6 What is a cash budget? How it is useful in managerial decision making?

Cash budget is an estimation of the cash inflows and outflows for a business or individual for a specific period of time. Cash budgets are often used to assess whether the entity has sufficient cash to fulfill regular operations and/or whether too much cash is being left in unproductive capacities. A cash budget is extremely important, especially for small businesses, because it allows a company to determine how much credit it can extend to customers before it begins to have liquidity problems. For individuals, creating a cash budget is a good method for determining where their cash is regularly being spent. This awareness can be beneficial because knowing the value of certain expenditures can yield opportunities for additional savings by cutting unnecessary costs. For example, without setting a cash budget, spending a dollar a day on a cup of coffee seems fairly unimpressive. However, upon setting a cash budget to account for regular annual cash expenditures, this expenditure comes out to an annual total of $365, which may be better spent on other things. If you frequently visit specialty coffee shops, your annual expenditure will be substantially more. The importance of cash budget may be summarized as follow:-

(1) Helpful in Planning. Cash budget helps planning for the most efficient use of cash. It points out cash surplus or deficiency at selected point of time and enables arrange for the deficiency before time or to plan for investing the surplus money as profitable as possible without any threat to the liquidity. (2) Forecasting the Future needs. Cash budget forecasts the future needs of funds, its time and the amount well in advance. It, thus, helps planning for raising the funds through the most profitable sources at reasonable terms and costs. (3) Maintenance of Ample cash Balance. Cash is the basis of liquidity of the enterprise. Cash budget helps in maintaining the liquidity. It suggests adequate cash balance for expected requirements and a fair margin for the contingencies. (4) Controlling Cash Expenditure. Cash budget acts as a controlling device. The expenses of various departments in the firm can best be controlled so as not to exceed the budgeted limit. (5) Evaluation of Performance. It acts as a standard for evaluating the financial performance. (6) Testing the Influence of proposed Expansion Programme. Cash budget forecasts the inflows from a proposed expansion or investment programme and testify its impact on cash position. (7) Sound Dividend Policy. Cash budget plans for cash dividend to shareholders, consistent with the liquid position of the firm. It helps in following a sound consistent dividend policy.

(8) Basis of Long-term Planning and Co-ordination. Cash budget helps in coordinating the various finance functions, such as sales, credit, investment, working capital etc. it is an important basis of long term financial planning and helpful in the study of long term financing with respect to probable amount, timing, forms of security and methods of repayment.

Page 11

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041

ASSIGNMENT SET - 2

Q.1 Selected financial information about Vijay merchant company is given below: 2010 2009 Sales 69,000 43,000 Cost of Goods Sold 57,000 32,500 Debtors 7,200 3,000 Inventories 11,400 5,500 Cash 1,500 800 Other current assets 4,000 2,700 Current liabilities 16,000 11,000 Compute the current ratio, quick ratio, average debt collection period and inventory turnover for 2009 and 2010. State whether there is a favorable or unfavorable change in liquidity from 2009 to 2010. At the beginning of 2009, the company had debtors of Rs..2500 and inventory of Rs.3000.

Year Current Assets Current Liabilities Current Ratio 2009 12000 11000 1.090909091 2010 24100 16000 1.50625 Year Quick Assets Quick Liability Quick ratio

2009 6500 11000 0.590909091 2010 12700 16000 0.79375 Year Credit Sales Average Debtors Debtors Turn over 2009 43000 4500 9.555555556 2010 69000 6100 11.31147541 Debt Collection Year Year in days Debtors Turnover period 2009 365 9.555555556 38.19767442 2010 365 11.31147541 32.26811594 Stock Turnover Year Cost of goods sold Inventory period 2009 32500 5500 5.909090909 2010 57000 11400 5

Page 12

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041

Q.2 Explain different methods of costing. Your answer should be studded with

examples (preferably firm name and product) for each method of costing Job Costing:

This is a product related classification of costing system. The cost is ascertained for each job or work order processed. This system is used where most of the manufacturing activities are planned and carried out for distinct jobs or customers. The utility of this method increases when there is great variability in nature of jobs or work orders processed.

Batch Costing : This method determines the cost associated with each batch pf products manufactured. This differs from job or work order costing in the variability of the production batches. In this case the production batches consist of mostly standard products or components. What varies is mostly the size of batches and the timing of their processing. Process Costing: In this method of costing the costs are determined for various different manufacturing activities or processes. These costs are the assigned to different products on the basis of some criteria like

quantity processed or the time taken for processing. This method of costing is suitable for manufacturing units that use continuous processes or mass production techniques. This method is particularly suitable where there are many different products and process routes, where output of one process becomes input for another. Operation Costing: This method is similar to the process costing. However the products manufactured have limited variation. For example a cement plant may use this method. Multiple costing: Most of the organizations use a combination of different costing method rather than just one method. Multiple costing refers to such combinations of different methods.

Page 13

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041

Q.3 State the importance of differentiating between the fixed costs and variable costs

in managerial decision.

Variable costs are costs that can be varied flexibly as conditions change. In the John Bates Clark model of the firm that we are studying, labor costs are the variable costs. Fixed costs are the costs of the investment goods used by the firm, on the idea that these reflect a longterm commitment that can be recovered only by wearing them out in the production of goods and services for sale. The idea here is that labor is a much more flexible resource than capital investment. People can change from one task to another flexibly (whether within the same firm or in a new job at another firm), while machinery tends to be designed for a very specific use. If it isn't used for that purpose, it can't produce anything at all. Thus, capital investment is much more of a commitment than hiring is. In the eighteen-hundreds, when John Bates Clark was writing, this was pretty clearly true. Over the past century, a) education and experience have become more important for labor, and have made labor more specialized, and b) increasing automatic control has made some machinery more flexible. So the differences between capital and labor are less than they once were, but all the same, it seems

labor is still relatively more flexible than capital. It is this (relative) difference in flexibility that is expressed by the simplified distinction of long and short run. Of course, productivity and costs are inversely related, so the variable costs will change as the productivity of labor changes. Here is a picture of the fixed costs (FC), variable costs (VC) and the total of both kinds of costs (TC) for the productivity

Output produced is measured toward the right on the horizontal axis. The cost numbers are on the vertical axis. Notice that the variable and total cost curves are parallel, since the distance between them is a constant number -- the fixed cost.

Page 14

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041

Q.4 Following are the extracts from the trial balance of a firm as at 31st March 2009

Name of the account Dr Cr Sundry debtors 2,05,000 Bad debts 3,000 Additional Information 1) After preparing the trial balance, it is learnt that Mr.X a debtor has become insolvent and nothing could be recovered from him and entire 5,000 due from him was irrecoverable. 2) Create 10% provision for doubtful debt. Required: Pass the necessary journal entries and show the sundry debtors account, bad debts account, provision for doubtful debts account, P&L a/c and Balance sheet as at 31st March 2009. Sundry debtors 205000 Less Bad debt 5000 less PBD 20000 180000 Date Particulars LF Dr Cr Bad debt A/c 5000 . Dr 5000 To, Debtors A/c P/L A/c 5000

5000 Dr To Bad debt A/c P/L A/c 20000 .. 20000 Dr To, Provision for bad debt A/c

Dr Bad Debt A/c Cr Date Partriculars LF Rs Date Partriculars LF Rs By, Debtors To P/L A/c 5000 A/c 5000

5000

5000

Page 15

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041 Dr P/L A/c Cr Date Partriculars LF Rs Date Partriculars LF Rs To Bad debt A/c 5000 To, PBD 20000

25000

Balance Sheet Liability Rs Assets Rs

Sundry debtors 205000 LESS Bad debt 5000 LESS PBD 20000 180000

Q.5 A change in credit policy has caused an increase in sales, an increase in discounts taken, a decrease in the amount of bad debts, and a decrease in investment in accounts receivable. Based upon this information, the companys (select the best one

and give reason) 1) Average collection period has decreased 2) Percentage discount offered has decreased 3) Accounts receivable turnover has decreased 4) Working Capital has increased. Solution 1) Average collection period has decreased Since sales have increased, you would expect accounts receivable to increase too, if the Average collection period remained the same. But you're told that AR has decreased, so the Average collection period must have decreased, i.e. the customers are taking fewer days to pay up.

Page 16

ASSIGNMENT - FINANCIAL AND MANAGEMENT ACCOUNTING - MB0041

Q.6 Identify the users of accounting information.

Accounting plays a very important role in all businesses but it is not just the business itself that finds accounting information useful. There are other stake holders who rely on accounting information to make decisions. These stakeholders include:

1. Shareholders - Shareholders use the balance sheet and profit and loss account produced by limited companies to decide if they are going to increase or decrease their holding. 2. Management - Management in every level of the business from director level to supervisor level rely on accounting information to do their job properly. They all use the same information for different purposes. For example, directors use it for strategic purposes and middle management can use it to see if they are meeting their financial targets. 3. Suppliers - Along with other data suppliers will look at a company's balance sheet and profit and loss account to see if and how much credit they are willing to give to present and potential customers. 4. Lenders - Similar to suppliers lenders also need to make sure a company is in a healthy financial situation before they start to lend money.

5. Government - Governments use the information provided by a company about its finances to levy tax on the profits. 6. Customers - Before another company becomes a customer or enters into a joint venture, they will look at the company's finances to make sure the company is not in trouble and that their supplies are not about to dry up. 7. Employees - Employees also have an interest in how well their employer is doing so use financial accounting information for this purpose.

Page 17

Você também pode gostar

- Solutions-Debraj-Ray-1 Dev EcoDocumento62 páginasSolutions-Debraj-Ray-1 Dev EcoDiksha89% (9)

- Final Practical NAVTTCDocumento8 páginasFinal Practical NAVTTCParwaiz Ali JiskaniAinda não há avaliações

- Technical IndicatorsDocumento54 páginasTechnical IndicatorsRavee MishraAinda não há avaliações

- Assignment: Statistics For ManagementDocumento17 páginasAssignment: Statistics For ManagementShravanti Bhowmik SenAinda não há avaliações

- MB0041Documento8 páginasMB0041Gaurang VyasAinda não há avaliações

- MB0041-Fin & MGMT AccountingDocumento12 páginasMB0041-Fin & MGMT AccountingRamesh SoniAinda não há avaliações

- MB0041 Financial and Management AccountingDocumento12 páginasMB0041 Financial and Management AccountingDivyang Panchasara0% (2)

- Recommend Ary or Mandatory Mandatory From Accounting Period Beginning On or AfterDocumento7 páginasRecommend Ary or Mandatory Mandatory From Accounting Period Beginning On or AfterdnbiswasAinda não há avaliações

- Q.1 Assure You Have Just Started A Mobile Store. You Sell MobileDocumento16 páginasQ.1 Assure You Have Just Started A Mobile Store. You Sell MobileUttam SinghAinda não há avaliações

- Documents - CAAH2013 - MBA 2 Acc Dec Making Workbook Jan 2013 PDFDocumento96 páginasDocuments - CAAH2013 - MBA 2 Acc Dec Making Workbook Jan 2013 PDFSatyabrataNayak100% (1)

- NBP Internship Report by Umer RashidDocumento75 páginasNBP Internship Report by Umer RashidKT LHR 2Ainda não há avaliações

- 3-5 MCQ - DikshaDocumento2 páginas3-5 MCQ - DikshabenAinda não há avaliações

- Chapter Zakat Acc For Ibis-1 - 42051Documento20 páginasChapter Zakat Acc For Ibis-1 - 42051Aisyah AnuarAinda não há avaliações

- IMT-61 (Corporate Finance) Need Solution - Ur Call Away - 9582940966Documento5 páginasIMT-61 (Corporate Finance) Need Solution - Ur Call Away - 9582940966Ambrish (gYpr.in)Ainda não há avaliações

- Sample PaperDocumento28 páginasSample PaperSantanu KararAinda não há avaliações

- Capinew Account June13Documento7 páginasCapinew Account June13ashwinAinda não há avaliações

- Mba025 Set1 Set2 520929319Documento16 páginasMba025 Set1 Set2 520929319tejas2111Ainda não há avaliações

- MBA Semester 1 Spring 2015 Solved Assignments - MB0041Documento3 páginasMBA Semester 1 Spring 2015 Solved Assignments - MB0041SolvedSmuAssignmentsAinda não há avaliações

- Accounting For Managers MB003 QuestionDocumento34 páginasAccounting For Managers MB003 QuestionAiDLo0% (1)

- LeonsDocumento34 páginasLeonsFeilix BennyAinda não há avaliações

- Ratio Analysis Numerical QuestionsDocumento9 páginasRatio Analysis Numerical Questionsnsrivastav1Ainda não há avaliações

- MBA 8 Year 2 Accounting For Decision Making Workbook January 2020Documento94 páginasMBA 8 Year 2 Accounting For Decision Making Workbook January 2020weedforlifeAinda não há avaliações

- Master of Business Administration - Semister - 1 Mb0041 - Fianncial Management Accounting SET - 2Documento10 páginasMaster of Business Administration - Semister - 1 Mb0041 - Fianncial Management Accounting SET - 2Asha JyothiAinda não há avaliações

- Accounts Question BankDocumento12 páginasAccounts Question BankSRMBALAAAinda não há avaliações

- Cherat-Cement-Company Final Report 2Documento21 páginasCherat-Cement-Company Final Report 2UbaidAinda não há avaliações

- Swagat 2010 2011 Training BookletDocumento108 páginasSwagat 2010 2011 Training Bookletbitus92Ainda não há avaliações

- References BitCoinDocumento27 páginasReferences BitCoinVeerAinda não há avaliações

- Financial Accounting (Unsolved Papers of ICMAP)Documento48 páginasFinancial Accounting (Unsolved Papers of ICMAP)Platonic0% (1)

- Individual Assignment: Analysis of Audit Reports of Premier Bank LimitedDocumento7 páginasIndividual Assignment: Analysis of Audit Reports of Premier Bank LimitedSohel MahmudAinda não há avaliações

- Assignment Front Sheet: BusinessDocumento13 páginasAssignment Front Sheet: BusinessHassan AsgharAinda não há avaliações

- Consumer LoansDocumento28 páginasConsumer LoansSyed AliAinda não há avaliações

- Bba Banking Fin1Documento10 páginasBba Banking Fin1kotit35Ainda não há avaliações

- MB41Documento5 páginasMB41Prajeesh Kumar KmAinda não há avaliações

- Financial Accounting I SemesterDocumento25 páginasFinancial Accounting I SemesterBhaskar KrishnappaAinda não há avaliações

- Project of MCBDocumento55 páginasProject of MCBSana JavaidAinda não há avaliações

- PPTDocumento35 páginasPPTShivam ChauhanAinda não há avaliações

- Account Project OrginalDocumento41 páginasAccount Project OrginalshankarinadarAinda não há avaliações

- UBL ReportDocumento65 páginasUBL ReportNoman Iqbal100% (1)

- Allied Bank PresentationDocumento74 páginasAllied Bank Presentationtyrose88100% (3)

- Get Answers of Following Questions Here: MB0041 - Financial and Management AccountingDocumento3 páginasGet Answers of Following Questions Here: MB0041 - Financial and Management AccountingRajesh SinghAinda não há avaliações

- Insurance & BankingDocumento33 páginasInsurance & BankingbobbyhandsomeAinda não há avaliações

- Annual Report 2011Documento233 páginasAnnual Report 2011Khalid FirozAinda não há avaliações

- Topic 5 CFDocumento18 páginasTopic 5 CFAmalMdIsaAinda não há avaliações

- NBFC-L&T Finance: Group MembersDocumento29 páginasNBFC-L&T Finance: Group Membershayden28Ainda não há avaliações

- Balance Sheet Analysis Quick BookletDocumento16 páginasBalance Sheet Analysis Quick BookletSwatiRanjanAinda não há avaliações

- IMT 57 Financial Accounting M1Documento4 páginasIMT 57 Financial Accounting M1solvedcareAinda não há avaliações

- FA - Excercises & Answers PDFDocumento17 páginasFA - Excercises & Answers PDFRasanjaliGunasekeraAinda não há avaliações

- Advanced Auditing and Assurance - Revision KitDocumento244 páginasAdvanced Auditing and Assurance - Revision Kitmulika99Ainda não há avaliações

- Isc Accounts 5 MB: (Three HoursDocumento7 páginasIsc Accounts 5 MB: (Three HoursShivam SinghAinda não há avaliações

- Cash BudgetDocumento6 páginasCash BudgetSalahuddin ShahAinda não há avaliações

- Advanced AccountingDocumento13 páginasAdvanced AccountingprateekfreezerAinda não há avaliações

- Kotak Mahindra Bank Limited Swot Analysis BacDocumento8 páginasKotak Mahindra Bank Limited Swot Analysis BacAsh DesaiAinda não há avaliações

- Soneri Annual Report 2010Documento57 páginasSoneri Annual Report 2010Muqaddas IsrarAinda não há avaliações

- 11 CaipccaccountsDocumento19 páginas11 Caipccaccountsapi-206947225Ainda não há avaliações

- Capii Advaccount June13Documento14 páginasCapii Advaccount June13casarokarAinda não há avaliações

- Financial Results 201920Documento26 páginasFinancial Results 201920Ankush AgrawalAinda não há avaliações

- Financial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteNo EverandFinancial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteAinda não há avaliações

- Statement of Cash Flows: Preparation, Presentation, and UseNo EverandStatement of Cash Flows: Preparation, Presentation, and UseAinda não há avaliações

- Fast-Track Tax Reform: Lessons from the MaldivesNo EverandFast-Track Tax Reform: Lessons from the MaldivesAinda não há avaliações

- Business Financial Information Secrets: How a Business Produces and Utilizes Critical Financial InformationNo EverandBusiness Financial Information Secrets: How a Business Produces and Utilizes Critical Financial InformationAinda não há avaliações

- Chapter 05 Questions and ProblemsDocumento4 páginasChapter 05 Questions and Problemsglobinho111Ainda não há avaliações

- Ring Type JointsDocumento12 páginasRing Type JointsdamicesterAinda não há avaliações

- THREE Bonds and Stock Valuation.. STOCKDocumento19 páginasTHREE Bonds and Stock Valuation.. STOCKRaasu KuttyAinda não há avaliações

- Air Thread Case FinalDocumento49 páginasAir Thread Case FinalJonathan GranowitzAinda não há avaliações

- Bond PricingDocumento4 páginasBond PricingKyrbe Krystel AbalaAinda não há avaliações

- HDFC Life Insurance ProjectDocumento18 páginasHDFC Life Insurance Projectshubham moonAinda não há avaliações

- UGRD-ITE6301 Technopreneurship Midterm Quiz 2Documento15 páginasUGRD-ITE6301 Technopreneurship Midterm Quiz 2DanicaAinda não há avaliações

- Bernie Madoff - Overview, History, and The Ponzi SchemeDocumento7 páginasBernie Madoff - Overview, History, and The Ponzi SchemeElleAinda não há avaliações

- Drills Dissolution Admission of A PartnerDocumento4 páginasDrills Dissolution Admission of A PartnerSSGAinda não há avaliações

- Clinton Foundation Before NY StateDocumento99 páginasClinton Foundation Before NY StateDaily Caller News FoundationAinda não há avaliações

- Asian Paints Limited Dividend Distribution PolicyDocumento3 páginasAsian Paints Limited Dividend Distribution PolicyJaiAinda não há avaliações

- A STUDY ON DEPOSITORY SYSTEM - Docx NewDocumento19 páginasA STUDY ON DEPOSITORY SYSTEM - Docx NewRajni WaswaniAinda não há avaliações

- Fin405 Assignment 2 Group 7Documento18 páginasFin405 Assignment 2 Group 7Esraah AhmedAinda não há avaliações

- WEEK 2 - Chapter 2-An Overview of Financial SystemDocumento26 páginasWEEK 2 - Chapter 2-An Overview of Financial SystemSipanAinda não há avaliações

- DebentureDocumento34 páginasDebentureSOHEL BANGIAinda não há avaliações

- Asset Management ISO55Documento50 páginasAsset Management ISO55helix2010Ainda não há avaliações

- Study The Effect of Economic Growth On The Real Estate Industry in Major Cities of IndiaDocumento46 páginasStudy The Effect of Economic Growth On The Real Estate Industry in Major Cities of IndiamtamilvAinda não há avaliações

- Chater Two Leacture NoteDocumento26 páginasChater Two Leacture NoteMelaku WalelgneAinda não há avaliações

- Business GKDocumento21 páginasBusiness GKapi-19620791Ainda não há avaliações

- Hul PPT (CTP)Documento31 páginasHul PPT (CTP)vedantAinda não há avaliações

- Max's GroupDocumento29 páginasMax's GroupEnzy Crema100% (1)

- Ac557 W3 HW HBDocumento2 páginasAc557 W3 HW HBHasan Barakat100% (2)

- Economic Impact of Libraries in New York CityDocumento14 páginasEconomic Impact of Libraries in New York CityCity Limits (New York)Ainda não há avaliações

- Impact of Inflation On Economic Growth: A Survey of Literature ReviewDocumento13 páginasImpact of Inflation On Economic Growth: A Survey of Literature ReviewgayleAinda não há avaliações

- Capital BudgetingDocumento53 páginasCapital BudgetingSaahil LedwaniAinda não há avaliações

- Executive Summary: Human Resource Practices in Reliance InsuranceDocumento54 páginasExecutive Summary: Human Resource Practices in Reliance Insurancevenkata siva kumarAinda não há avaliações

- Risk Management ProposalDocumento13 páginasRisk Management ProposalromanAinda não há avaliações

- Accounting CONCEPTS Multiple Choice QuestionsDocumento7 páginasAccounting CONCEPTS Multiple Choice Questionspatsjit50% (2)