Escolar Documentos

Profissional Documentos

Cultura Documentos

OIL and GAS

Enviado por

Kuldeep KumarDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

OIL and GAS

Enviado por

Kuldeep KumarDireitos autorais:

Formatos disponíveis

Introduction

As one of the six core industries in India, the oil and gas industry has a very significant role to play in the growth of the Indian economy. The petroleum and natural gas sector which includes transportation, refining and marketing of petroleum products and gas constitutes over 16 percent of the country's gross domestic product (GDP). About two decade and ago, the petroleum sector was almost completely controlled by national oil companies. Presently, there are many players both in the upstream and downstream sectors. With the significant discoveries of oil and gas in various sites in recent years, India is looking at huge investments in the sector. Growth continues apace, and the Indian oil sector looks vibrant with opportunities.

Key players

PSUs in Oil and Gas Sector

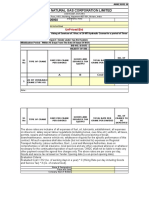

Installed capacity Refinery throughout crude

Public Sector (in thousand tonnes) IOCL BPCL HPCL KRL CPCL BRPL NRL ONGC MRPL Reliance Essar 47,350 12,000 13,000 7,500 10,500 2,350 3,000 78 96,90 33,000 10,500 47,401 12,748 16,818 8,134 10,266 2,020 2,568 63 12,525 36,931 6,631

Private Sector (in thousand tonnes)

The key players in the industry are the PSUs operating under the Ministry. Some of the leading players in the industry are as follows: Gas Authority of India Ltd. (GAIL) GAIL is Indias flagship natural gas company, present along all aspects of the natural gas value chain (including E&P, processing, transmission, distribution and Marketing.

Oil India Limited (OIL) OIL is a premier national oil company, engaged in the business of E&P and development of crude oil and natural gas, transportation of crude oil and production of LPG. The company has over 100,000 square feet of license area. Today, it is an integrated upstream petroleum company. ONGC ONGC is Indias flagship energy company.ONGC is ranked number one amongst E&P companies in Asia and third amongst global E&P companies. It figures in the Fortune Global 500 list of 2007. Bharat Petroleum Corporation Limited (BPCL) BPCL is one of Indias largest PSU companies. It is involved in the refining and retailing of petroleum products, which include Speed brand of petrol, high speed diesel, auto lubricants, LPG and aviation turbine fuel. BPCL has a number of refineries in India. Hindustan Petroleum Corporation Limited (HPCL) HPCL is Indias second largest oil company and is involved in the refining and retailing of petroleum products. HPCL has a number of refineries in India. Indian Oil Corporation Limited (IOCL) IOCL was formed in 1964 through the merger of Indian Oil Company Ltd. and Indian Refineries Ltd. Important Private Players 1. Reliance Industries 2. Essar 3. British Gas 4. Cairn Energy SUs in Oil and Gas Sector

Natural Gas

Gas demand in India is dominated by the power and fertilizer sectors which account for 66 percent of the current consumption. Encouraged by this scenario, a number of players have evinced a keen interest in laying pipelines in the domestic market to supply gas to the consumers. nes supplemented by spur lines crisscrossing the country.

Growth in Production

Domestic production of crude oil and gas has been increasing steadily.

While production grew by 5.6 percent in 2006-07 to 33.98 million tonne (MT) from 32.19 MT in 2005-06, it has increased to 34.11 MT during 2007-08. The production of petroleum products went up to 144.93 MT in 2007-08, (between April 2007 to February 2008), from 135.26 MT in 2006-07. The production of natural gas went up to 32.27 billion cubic metres tonnes in 2007-08, (between April 2007 to February 2008), from 31.747 billion cubic metres tonnes in 2006-07. Further, explorations for the discovery of natural gas and oil are underway in various river basins and sites.

India presently imports 2,000,000 barrels of oil per day, while Cairn India Ltd is expecting a maximum production of 175,000 barrels per day, which would be accounting for 25 percent of Indias present production.

Growth in Consumption

However, Indias domestic demand for oil and gas is also on the rise. As per the Ministry of Petroleum, demand for oil and gas is likely to increase from 176.40 million tonnes of oil equivalent (mmtoe) in 2007-08 to 233.58 mmtoe in 2011-12.

Opportunities

Global Refining Destination India is emerging as the global hub for oil refining as it enjoys a competitive cost advantage, with capital costs lower by as much as 25 to 50 percent over other Asian countries. 1. Public sector undertaking Indian Oil Corporation Ltd (IOCL) plans to increase its refining capacity from 60.2 mtpa to 80 mtpa. 2. The two public sector undertakings, GAIL (India) Ltd and IOCL are looking at setting up a US$ 2.09 billion petrochemical plant at Barauni, which would be of a minimum 3 lakh tonnes capacity. 3. ONGC plans to scale up its refining capacity up to 45.5 million tonnes by 2009-10 from about 13 mtpa in 2006. 4. Reliance Industries Ltd is constructing a new refinery in the Jamnagar SEZ with a capacity of 29 mtpa, which will be operational shortly. 5. Nagarjuna Oil Corp is planning a new refinery at Cuddalore with a capacity of 6 mtpa to be operational by 2011 at an investment of US$ 1.05 billion. Retail Sector Due to the surge in automobile sales, significant investments are being made to develop and expand the petroleum retail market. Automobile sales, which number about a million vehicles per year, are likely to grow to about 20 million a year by 2030, making India the third largest automobile market in the world.

Government Initiatives

The government has been taking many progressive measures to create a more conducive policy and regulatory framework to attract investments into this industry. FDI up to 100 percent under the automatic route is permitted in exploration activities of oil and natural gas fields, infrastructure related to marketing of petroleum products, actual trading and marketing of petroleum products, petroleum product pipelines, natural gas and LNG pipelines, market study and formulation and petroleum refining in the private sector. FDI up to 49 percent is permitted under the government route in petroleum refining by the public sector undertakings. After a revision of the extant policy for the Petroleum & Natural Gas sector, it has been decided that: 1. The condition of compulsory divestment of up to 26 percent equity within 5 years for actual trading and marketing of petroleum products will be removed. 2. FDI up to 49 percent will be permitted (with prior approval of FIPB) in petroleum refining by PSUs. This will be done without involving any divestment of dilution of domestic equity in the existing PSUs. 3. The government has eased norms in order to permit companies in the mining, exploration and refineries sectors to bring in up to US$ 500 million as external commercial borrowing (ECB) for rupee expenditure. Previously the limit was US$ 50 million. In November 2008, the Cabinet Committee on Economic Affairs (CCEA) agreed to the awarding of 44 oil and gas exploration blocks under the seventh round of auction of the New Exploration Licensing Policy (Nelp-VII). With this, the overall number of blocks brought under exploration exceeded 200. According to an official release by the Ministry of Petroleum and Natural Gas, Indias

Investments and Acquisitions

Indian Oil Corp aims to expand the capacity of its Panipat plant to meet the growing fuel demand. The refinery expansion will cost US$ 224.8 million. Mahanagar Gas Ltd (MGL) will invest over US$ 3.37 billion in a span of 5-6- years to lay infrastructure for the supply of both Compressed Natural Gas (CNG) and Piped Natural Gas (PNG). The Ruias of Essar Group have injected US$ 293 million in Essar Oil by subscribing to global depository shares (GDS) to part finance its US$ 1.7-billion expansion plans. The proposed expansion plan includes scaling up of the Jamnagar refinery capacity by 25 percent to 375,000 barrels. State-owned gas firm GAIL India will invest about US$ 3.37 billion over the next 2-3 years in laying pipelines to connect consumption centres in North India to fuel sources. Energy major Reliance Industries gained an overseas foothold by agreeing to pay US$ 1.7 billion to form a joint venture with U.S.-based Atlas Energy.

Indian state-run Oil & Natural Gas Corp will invest US$ 7.11 billion for the first phase development of three marginal fields located in Mumbai offshore on the western coast.

Global Tie-ups

The government has made considerable progress in its bilateral cooperation with a number of countries. 1. The India-Romania Joint Working Group met to discuss the possibility of Indian companies participating in the utilization and upgradation of refineries, and GAIL setting up a CNG/ piped gas distribution network in Romania. 2. The India-Turkey Joint Working Group also looked at the scope of investment by the Indian oil companies in Turkeys pipelines and refineries. 3. In April 2008, a Joint Venture agreement was signed between OVL and CVP of Venezuela to utilize the San Cristobal field in Venezuela. 4. In September 2008, an MOU for bilateral cooperation was signed with Colombia. 5. India and South Africa will be working on a number of areas of cooperation in South Africas hydrocarbon sector. 6. In November 2008, the India-Russia Joint Working Group met and identified areas of investment by ONGC/ OVL in the upstream sector of Russia.

Looking Ahead

An expanding economy with its concomitant increase in energy demand is likely to throw open huge investment opportunities in the oil and gas industry. Indias energy sector will provide investment avenues worth US$ 120 billion-US$ 150 billion over the next five years. Major discoveries of oil and gas have been made in recent years. However, with large areas of Indias sedimentary basins remaining unexplored, the Indian oil scenario is ripe with possibilities.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Authority Letter For Attending TenderDocumento1 páginaAuthority Letter For Attending Tendersribalajicyber100% (3)

- New Staff Selection For IGDTUW Anveshan FoundationDocumento5 páginasNew Staff Selection For IGDTUW Anveshan FoundationKuldeep KumarAinda não há avaliações

- Interesting Facts About Starch in FoodDocumento4 páginasInteresting Facts About Starch in FoodKuldeep KumarAinda não há avaliações

- Guidelines For Set Up incubators-in-Educational-InstitutionsDocumento10 páginasGuidelines For Set Up incubators-in-Educational-InstitutionsKuldeep KumarAinda não há avaliações

- (9783110455403 - Microwave and Radio-Frequency Technologies in Agriculture) 6 Techniques For Measuring Dielectric PropertiesDocumento26 páginas(9783110455403 - Microwave and Radio-Frequency Technologies in Agriculture) 6 Techniques For Measuring Dielectric PropertiesKuldeep KumarAinda não há avaliações

- Rcra Sw-846 Methods For Determining Chlorine and Other Halogens in Used OilDocumento4 páginasRcra Sw-846 Methods For Determining Chlorine and Other Halogens in Used OilKuldeep KumarAinda não há avaliações

- Parts List Hero HondaDocumento16 páginasParts List Hero HondaKuldeep KumarAinda não há avaliações

- Central Tuber Crops Research Institute JobDocumento2 páginasCentral Tuber Crops Research Institute JobKuldeep KumarAinda não há avaliações

- Dcnorth @nic - In: Phone No. E-MailDocumento6 páginasDcnorth @nic - In: Phone No. E-MailKuldeep KumarAinda não há avaliações

- Cash Less Authorized WorkshopDocumento24 páginasCash Less Authorized WorkshopKuldeep KumarAinda não há avaliações

- Women's Studies and Development Centre: Application Form For Teaching PostsDocumento4 páginasWomen's Studies and Development Centre: Application Form For Teaching PostsKuldeep KumarAinda não há avaliações

- Brake Shoes 2WH Brake Shoes - Spark Minda Ashok Minda Group - Powered by PassionDocumento4 páginasBrake Shoes 2WH Brake Shoes - Spark Minda Ashok Minda Group - Powered by PassionKuldeep KumarAinda não há avaliações

- FPM Brochure 2018 Web VerDocumento37 páginasFPM Brochure 2018 Web VerKuldeep KumarAinda não há avaliações

- NSEZ Unit Details - 310516Documento45 páginasNSEZ Unit Details - 310516Anonymous 9AnxnHaW3D0% (1)

- HPI Training BrochureDocumento4 páginasHPI Training BrochureKuldeep KumarAinda não há avaliações

- RHEL Red HatDocumento6 páginasRHEL Red HatKuldeep KumarAinda não há avaliações

- Trainings in ITDocumento1 páginaTrainings in ITKuldeep KumarAinda não há avaliações

- Trainings in ITDocumento1 páginaTrainings in ITKuldeep KumarAinda não há avaliações

- HPI Training BrochureDocumento4 páginasHPI Training BrochureKuldeep KumarAinda não há avaliações

- Learning and Development at Workplace-Changing Paradigms and Emerging TrendsDocumento50 páginasLearning and Development at Workplace-Changing Paradigms and Emerging TrendsKuldeep KumarAinda não há avaliações

- List of Key Personnel in Power HRDocumento4 páginasList of Key Personnel in Power HRKuldeep KumarAinda não há avaliações

- Knowledge Management BrochureDocumento4 páginasKnowledge Management BrochureKuldeep KumarAinda não há avaliações

- Guiding Through Tech ChangeDocumento6 páginasGuiding Through Tech ChangeKuldeep KumarAinda não há avaliações

- Nsez Unit Details - 301112Documento44 páginasNsez Unit Details - 301112aasimshaikh111Ainda não há avaliações

- Oil ExplorationDocumento14 páginasOil ExplorationshobanaaaradhanaAinda não há avaliações

- India Venezuela RelationsDocumento24 páginasIndia Venezuela RelationsDon RodrigoAinda não há avaliações

- Industry Analysis of ONGCDocumento8 páginasIndustry Analysis of ONGCHarshil ShahAinda não há avaliações

- Financial Analysis of Reliance Industry LimitedDocumento69 páginasFinancial Analysis of Reliance Industry LimitedWebsoft Tech-Hyd100% (1)

- Yash Bansal - Training Report PDFDocumento45 páginasYash Bansal - Training Report PDFYash BansalAinda não há avaliações

- Summer Training Report ON: "Networking Infrastructure of Ongc"Documento90 páginasSummer Training Report ON: "Networking Infrastructure of Ongc"Aditya Pratap SinghAinda não há avaliações

- Recommendation Prashant GoyalDocumento4 páginasRecommendation Prashant GoyalPrasant GoelAinda não há avaliações

- Status of Coal Bed Methane Investigations in IndiaDocumento12 páginasStatus of Coal Bed Methane Investigations in Indiawelltest2012Ainda não há avaliações

- Synopsis PDFDocumento7 páginasSynopsis PDFSharda SharmaAinda não há avaliações

- Employee Motivation and Performance AppraisalDocumento155 páginasEmployee Motivation and Performance AppraisalMayank RaturiAinda não há avaliações

- CPO-5 Block - Llanos Basin - Colombia, South AmericaDocumento4 páginasCPO-5 Block - Llanos Basin - Colombia, South AmericaRajesh BarkurAinda não há avaliações

- Oct Quiz BankingDocumento11 páginasOct Quiz BankingVicky KumarAinda não há avaliações

- OngcDocumento40 páginasOngcDsdhruwey5939Ainda não há avaliações

- Rsy M - KSX LQJ (KK Funs'kky : ISO 9001:2015 CertifiedDocumento20 páginasRsy M - KSX LQJ (KK Funs'kky : ISO 9001:2015 CertifiedKunalAnandAinda não há avaliações

- Intern Report ONGCDocumento41 páginasIntern Report ONGCSaptarshi MajiAinda não há avaliações

- Acoustic Enclosures121029183715Documento89 páginasAcoustic Enclosures121029183715gopvij1Ainda não há avaliações

- Short Name Full Form or AbbreviationsDocumento16 páginasShort Name Full Form or Abbreviationsrizwan0086Ainda não há avaliações

- Workover Operations and Well InterventionDocumento52 páginasWorkover Operations and Well Interventionpradeepika04100% (3)

- II Pipeline Design Codes and Standards-MSGDocumento74 páginasII Pipeline Design Codes and Standards-MSGSanjay Kumar100% (3)

- Annexure V Bidder Response SheetDocumento2 páginasAnnexure V Bidder Response SheetAshishAinda não há avaliações

- Sociology Term PaperDocumento11 páginasSociology Term Paperkamal RathoreAinda não há avaliações

- Resurgent India Limited Weekly Newsletter Aug 13 2010Documento5 páginasResurgent India Limited Weekly Newsletter Aug 13 2010Udrrek Vikram DharnidharkaAinda não há avaliações

- Delloite Oil and Gas Reality Check 2015 PDFDocumento32 páginasDelloite Oil and Gas Reality Check 2015 PDFAzik KunouAinda não há avaliações

- Equity Research On Oil & Gas SectorDocumento35 páginasEquity Research On Oil & Gas Sectordoshi tejasAinda não há avaliações

- Specification of Methods and Procedures For Acquiring The Information Needed.Documento68 páginasSpecification of Methods and Procedures For Acquiring The Information Needed.Vipul TandonAinda não há avaliações

- Resume Sourav Biswas UpdatedDocumento3 páginasResume Sourav Biswas UpdatedSourav BiswasAinda não há avaliações

- Ongc & ImperialDocumento13 páginasOngc & ImperialKarthik GhorpadeAinda não há avaliações

- Report - No - 9 - of - 2017 - On - Compliance - Audit - Observations - Union - Government PDFDocumento262 páginasReport - No - 9 - of - 2017 - On - Compliance - Audit - Observations - Union - Government PDFravindrarao_mAinda não há avaliações

- Study Material Class 8 ScienceDocumento3 páginasStudy Material Class 8 Scienceabhijith mohanAinda não há avaliações