Escolar Documentos

Profissional Documentos

Cultura Documentos

Ambuja 3QCY2012RU

Enviado por

Angel BrokingDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ambuja 3QCY2012RU

Enviado por

Angel BrokingDireitos autorais:

Formatos disponíveis

3QCY2012 Result Update | Cement

October 19, 2012

Ambuja Cements

Performance Highlights

Quarterly results (Standalone)

Y/E Dec. (` cr) Net Sales Operating profit OPM (%) Rep. Net Profit 3QCY2012 2,168 522 24.0 304 2QCY2012 2,566 735 28.5 469 % chg qoq (15.5) (29.0) (451)bp (35.2) 3QCY2011 1,805 319 17.4 171 % chg yoy 20.1 63.4 657bp 77.3

NEUTRAL

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Net Debt (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Cement 31,802 (3,243) 0.8 221/136 250,277 2 18,682 5,684 ABUJ.BO ACEM@IN

`206 -

Source: Company, Angel Research

During 3QCY2012, Ambuja Cements (ACEM) posted a strong 77.3% yoy improvement in its bottom-line, which was in-line with our estimates. The growth in the bottom-line was on account of a healthy 18.6% yoy improvement in realization. However, volume growth remained modest at 1.4% on a yoy basis.

ACEMs top-line grew by 17.9% yoy to `2,168cr aided by an 18.6% yoy growth in realization. However, the volume growth was muted at 1.4% on a yoy basis. Strong realization resulted in a 657bp yoy improvement in operating margins. The companys per tonne operating cost was higher by 7.8% on a yoy basis, with raw material and freight and forwarding costs going up by 10.0% yoy and 19.0% yoy respectively.

OPM at 24.0%, up 657bp yoy: Outlook and valuation: We expect ACEM to register a 17.6% and 26.9% CAGR in its top-line and bottom-line, respectively, over CY2011-13E. At the current market price, the stock is trading at a rich valuation of EV/tonne of US$173 on CY2013E capacity, which we believe factors in the positives of a favorable locational presence. Hence, we continue to remain Neutral on the stock.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 50.7 10.6 28.9 9.8

Abs. (%) Sensex ACEM

3m 8.1 23.6

1yr 9.3 43.0

3yr 7.8 68.9

Key financials (Standalone)

Y/E Dec. ( ` cr) Net sales % chg Adj. net profit % chg OPM (%) FDEPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales EV/tonne (US$) Installed capacity (mtpa) EV/EBITDA (x)

Source: Company, Angel Research

CY2010

7,390 4.4 1,237 1.5 26.4 8.1 25.5 4.3 17.9 20.8 3.9 239 25 14.9

CY2011

8,514 15.2 1,253 1.3 23.4 8.2 25.3 4.3 16.3 18.6 3.4 206 27 14.5

CY2012E

10,183 19.6 1,757 40.2 26.4 11.5 18.0 3.9 20.8 23.9 2.7 182 27 10.3

CY2013E

11,774 15.6 1,980 12.7 26.1 12.9 16.0 3.5 21.1 25.4 2.2 176 27 8.6

V Srinivasan

022-39357800 Ext 6831 v.srinivasan@angelbroking.com

Please refer to important disclosures at the end of this report

Ambuja Cements | 3QCY2012 Result Update

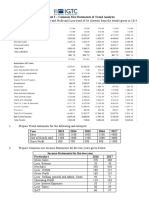

Exhibit 1: 3QCY2012 performance (Standalone)

Y/E Dec. (` cr) Net sales Other operating income Total operating income Net raw-material costs (% of sales) Power & fuel (% of sales) Staff costs (% of sales) Freight & forwarding (% of sales) Other expenses (% of sales) Total expenditure Operating profit OPM (%) Interest Depreciation Other income Exceptional Inc./(Exp.) PBT Provision for taxation (% of PBT) Reported PAT PATM (%) EPS (`)

Source: Company, Angel Research

3QCY12 2,168 7 2175 46 2.1 562 25.9 115 5.3 503 23.2 426 19.7 1,653 522 24.0 17 137 89 457 154 33.6 304 14.0 2.0

2QCY12 2,566 13 2578 116 4.5 599 23.3 124 4.8 587 22.9 418 16.3 1,844 735 28.5 18 122 78 674 205 30.4 469 18.3 3.1

% chg qoq (15.5) (45.5) (15.6) (60.2) (6.1) (6.9) (14.2) 2.0 (10.3) (29.0) (451)bp (8.3) 13.0 14.2 (32.1) (25.0) (35.2) (426)bp (35.2)

3QCY11 1,805 29 1834 144 8.0 495 27.4 103 5.7 416 23.1 356 19.7 1,514 319 17.4 14 108 57 255 83 32.7 171 9.5 1.1

% chg yoy 20.1 (76.2) 18.6 (68.0) 13.6 11.5 21.0 19.8 9.2 63.4 657bp 20.0 27.3 56.6 79.5 84.1 77.3 452bp 77.3

9MCY12 7,370 40 7,410 328 4.4 1,788 24.3 342 4.6 1,694 23.0 1,235 16.8 5,387 2,023 27.3 51 380 261 279 1,573 488 31.0 1,085 14.7 7.1

9MCY11 6,197 37 6,233 299 4.8 1,540 24.9 308 5.0 1,425 23.0 1,133 18.3 4,705 1,529 24.5 43 321 181 1,346 420 31.2 927 15.0 6.1

% chg 18.9 9.4 18.9 9.7 16.1 11.1 18.9 9.0 14.5 32.3 278bp 20.2 18.2 43.7 16.9 16.4 17.1 (23)bp 17.1

Exhibit 2: Financial performance

3,000 2,500 2,000 (` cr) 1,500 1,000 500 0 2QCY11 3QCY11 Net Sales Source: Company, Angel Research 4QCY11 1QCY12 2QCY12 3QCY12 Net Profit OPM (RHS) 348 302 171 312 469 20.0 304 15.0 2,173 1805 (%) 25.0 2329 2,633 35.0 2,566 2168 30.0

October 19, 2012

Ambuja Cements | 3QCY2012 Result Update

Exhibit 3: 3QCY2012 Actual vs Angel estimates

(` cr) Net sales Operating profit OPM (%) Net profit

Source: Company, Angel Research

Actual 2,168 522 24.0 304

Estimates 2,123 497 23.2 307

Variation (%) 2.1 4.9 81bp (1.0)

Performance highlights

Higher realization drives top-line growth

ACEM posted a 20.1% yoy growth in its net sales to `2,168cr during 3QCY2012, aided by a 18.6% yoy growth in realization to `4,614 per tonne and a moderate 1.4% yoy volume growth to 4.7mn tonne. Even on a qoq basis realization was down only by 0.4% as delayed monsoon resulted in prices remaining healthy in this seasonally weak quarter. Cement prices in fact rose in the month of July before witnessing a decline in the month of August and September.

Realizations lead to marginal expansion in OPM on yoy basis

A strong realization growth on a yoy basis resulted in the OPM going up by 657bp on a yoy basis, despite the increase in operating costs. The companys per tonne operating costs were higher by 7.8% on a yoy basis, with raw material and freight and forwarding costs going up by 10.0% yoy and 19.0% yoy, respectively.

Per tonne analysis

For 3QCY2012, ACEMs realization/tonne improved strongly by 18.6% to `4,614. Power and fuel expenses/tonne increased by 12.1% yoy and 10.6% qoq to `1,196. Freight cost/tonne also rose by 19.4 yoy to `1,071 due to higher petroleum products costs and railway freight charges. The operating profit/tonne stood at `1,096, higher by 74.8% yoy.

Exhibit 4: Per tonne analysis

(`) Realization/tonne Net raw-material cost/tonne Power and fuel cost/tonne Freight cost/tonne Other costs/tonne Operating profit/tonne

Source: Company, Angel Research

3QCY12 4,614 395 1,196 1,071 907 1,096

2QCY12 4,632 275 1,081 1,060 754 1,304

3QCY11 % chg (yoy) % chg (qoq) 3,891 312 1,067 897 767 627 18.6 26.8 12.1 19.4 18.2 74.8 (0.4) 43.6 10.6 1.1 20.3 (16.0)

October 19, 2012

Ambuja Cements | 3QCY2012 Result Update

Investment rationale

Most favorable capacity location among cement majors

ACEM has 81% of its total capacity located in states where supply is either less than demand or if in excess, can be economically sold to nearby supply-deficit states. Logically, capacities in these states are expected to report relatively high utilization and margins.

Capacity addition to aid volume growth

During the past two years, ACEM added ~5mtpa of grinding capacities at various locations to reach its current overall capacity of ~27mtpa. Going ahead, we expect these capacity expansions to drive the companys volume growth.

New clinker capacities to aid margin expansion

Stabilization of production at the company's new clinker plants with capacity of 2.2mtpa each at Bhatapara and Rauri has resulted in elimination of external high-cost clinker purchase.

Outlook and valuation

We expect ACEM to register a 17.6% and 26.9% CAGR in its top-line and bottomline, respectively, over CY2011-13E. At the current market price, the stock is trading at rich valuations of EV/tonne of US$173 on CY2013E capacity, which we believe factors in the positives of a favorable locational presence. Hence, we continue to remain Neutral on the stock.

Exhibit 5: Change in estimates

Parameter (` cr) Net sales Op. expenses Op. profit Depreciation Interest PBT Tax PAT

Source: Angel Research

CY12E Earlier

10,074 7,602 2,561 496 40 2,047 614 1,712

CY13E Var. (%)

1.1 (0.2) 4.9 6.2 13.2 2.6

Revised

10,183 7,585 2,687 496 40 2,173 695 1,757

Earlier

11,619 8,836 2,893 507 35 2,736 821 1,915

Revised

11,774 8,815 3,069 507 35 2,912 932 1,980

Var. (%)

1.3 (0.2) 6.1 6.4 13.5 3.4

October 19, 2012

Ambuja Cements | 3QCY2012 Result Update

Exhibit 6: One-year forward EV/tonne

350,000 300,000 250,000 EV (` mn) 200,000 150,000 100,000 50,000 0 May-06 May-07 May-08 May-09 May-10 May-11 May-12 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Sep-06 Sep-07 Sep-08 Sep-09 Sep-10 Sep-11 Jan-12 Sep-12 136 184 63 50 65 138 209

EV/tonne Source: BSE, Company, Angel Research

$110

$140

$170

$200

Exhibit 7: Recommendation summary

Company ACC* Ambuja Cements* India Cements JK Lakshmi Madras Cement Shree Cements# UltraTech Cements Reco Neutral Neutral Neutral Neutral Neutral Neutral Neutral CMP (`) 1,408 206 98 116 187 4,206 2,010 Tgt. Price (`) Upside (%) FY2014E P/BV (x) 3.1 3.5 0.8 0.9 1.6 3.5 3.2 FY2014E P/E (x) 17.0 16.0 8.0 6.5 10.3 16.1 18.2 FY2012-14E EPS CAGR 8.5 25.7 12.8 41.7 6.2 20.0 11.3 FY2014E RoE (%) 19.2 21.1 10.2 14.6 17.0 23.6 18.7 EV/tonne^ US $

Source: Company, Angel Research; Note: *Y/E December; ^ Computed on TTM basis;#Y/E June

Company Background

Swiss cement major, Holcim acquired a controlling stake in ACEM in 2005. In India, the Holcim Group currently controls one-fifth of the total cement capacity through ACEM and ACC. On a standalone basis, ACEM is the third largest cement player in India with total capacity of 27mtpa. The company majorly focuses on northern and western India, with no plants in southern India. Of its current total capacity, 40% capacity is in the western, 38% in northern, 16% in eastern and northeastern and 6% in central region.

October 19, 2012

Ambuja Cements | 3QCY2012 Result Update

Profit & loss statement (Standalone)

Y/E Dec. (` cr) Total operating income % chg Total Expenditure Net Raw Materials Other Mfg costs Personnel Other EBITDA % chg (% of Net Sales) Depreciation & Amortization EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of PBT) Recurring PBT % chg Extraordinary Expense/(Inc.) PBT (reported) Tax (% of PBT) PAT (reported) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg CY08

6,168 9.5 4,461 519 1,326 266 2,350 1,707 (16.5) 27.7 260 1,447 (20.0) 23.5 32 246 15 1,662 (13.7) (308) 1,970 568 28.8 1,402 1,183 (5.9) 19.2 7.8 7.8 (5.9)

CY09

7,181 16.4 5,210 1,014 1,423 273 2,501 1,971 15.5 27.9 297 1,674 15.7 23.7 22 151 8 1,803 8.5 1,803 585 32.4 1,218 1,218 3.0 17.2 8.0 8.0 2.9

CY10

7,518 4.7 5,567 542 1,697 344 2,984 1,951 (1.0) 26.4 387 1,564 (6.6) 21.2 49 120 7 1,635 (9.3) (27) 1,662 398 24.0 1,264 1,237 1.5 16.7 8.1 8.1 1.1

CY11

8,603 14.4 6,608 634 2,006 433 3,535 1,994 2.2 23.4 445 1,549 (0.9) 18.2 53 230 13 1,727 5.6 24 1,703 474 27.8 1,229 1,253 1.3 14.7 8.2 8.2 1.0

CY12E

10,272 19.4 7,585 593 2,418 477 4,097 2,687 34.7 26.4 496 2,192 41.5 21.5 40 301 12 2,452 42.0 279 2,173 695 32.0 1,478 1,757 40.2 17.3 11.5 11.5 40.2

CY13E

11,884 15.7 8,815 716 2,766 529 4,804 3,069 14.2 26.1 507 2,562 16.9 21.8 35 386 13 2,912 18.7 2,912 932 32.0 1,980 1,980 12.7 16.8 12.9 12.9 12.7

October 19, 2012

Ambuja Cements | 3QCY2012 Result Update

Balance sheet (Standalone)

Y/E Dec. (` cr) SOURCES OF FUNDS Equity Share Capital Preference Capital Reserves & Surplus Shareholders Funds Total Loans Deferred Tax Liability Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Goodwill Investments Current Assets Cash Loans & Advances Other Current liabilities Net Current Assets Misc. Exp. not written off Total Assets

5,707 2,514 3,193 1,947 332 2,339 852 300 1,188 1,474 865 4 6,342 6,224 2,784 3,440 2,714 727 1,979 881 253 846 1,741 238 3 7,122 8,779 3,151 5,628 931 626 3,135 1,648 441 1,047 2,394 741 0 7,926 9,702 3,516 6,186 532 864 3,874 2,116 568 1,189 2,694 1,179 0 8,762 9,934 4,011 5,923 785 914 5,054 2,989 619 1,446 3,122 1,932 0 9,555 10,169 4,519 5,651 1,543 914 6,061 3,636 688 1,737 3,553 2,508 0 10,617 305 5,368 5,673 289 381 6,342 305 6,166 6,471 166 486 7,122 307 7,023 7,330 65 531 7,926 339 7,730 8,069 49 644 8,762 339 8,523 8,862 49 644 9,555 339 9,585 9,924 49 644 10,617

CY08

CY09

CY10

CY11E

CY12E

CY13E

October 19, 2012

Ambuja Cements | 3QCY2012 Result Update

Cash flow statement (Standalone)

Y/E Dec. (` cr) Profit before tax Depreciation Change in WC Interest expenses Less: Other income Direct taxes paid Cash Flow from Operations (Inc)/ Dec in Fixed Assets (Inc)/ Dec in Investments Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances CY08 1,970 260 (252) 32 246 568 1,196 (1,726) 957 246 (523) 1 (42) 390 32 (463) 209 643 852 CY09 1,803 297 698 22 151 585 2,085 (1,284) (395) 151 (1,528) 8 (123) 390 22 (528) 29 852 881 CY10 1,662 387 257 49 120 398 1,836 (771) 101 120 (550) 55 (101) 425 49 (519) 767 881 1,648 CY11E 1,703 445 (51) 53 230 474 1,445 (525) (238) 230 (533) 30 (16) 570 (111) (444) 468 1,648 2,116 CY12E 2,173 496 119 40 301 695 1,832 (485) (50) 301 (234) 685 40 (725) 872 2,116 2,989 CY13E 2,912 507 71 35 386 932 2,208 (993) 386 (607) 918 35 (953) 648 2,989 3,636

October 19, 2012

Ambuja Cements | 3QCY2012 Result Update

Key ratios

Y/E Dec. Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value DuPont Analysis (%) EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Int.)

(0.1) (0.3) 45.1 (0.1) (0.4) 74.7 (0.2) (0.8) 32.1 (0.3) (1.0) 29.4 (0.3) (1.1) 55.0 (0.4) (1.2) 72.3 1.1 45 11 108 (6) 1.2 41 10 113 (16) 1.0 38 7 136 (38) 0.9 39 8 141 (39) 1.0 36 10 140 (35) 1.2 37 11 138 (34) 24.7 38.2 22.9 24.9 47.4 20.1 20.8 35.2 17.9 18.6 27.0 16.3 23.9 36.8 20.8 25.4 45.7 21.1 23.5 71.2 1.2 20.2 23.3 67.6 1.2 19.3 20.8 76.0 1.2 19.0 18.0 72.2 1.3 17.3 21.3 68.0 1.6 22.6 21.6 68.0 1.8 25.7 7.8 7.8 10.9 2.2 37.3 8.0 8.0 9.9 2.4 42.4 8.1 8.1 10.7 2.6 47.7 8.2 8.2 9.9 3.2 47.6 11.5 11.5 11.6 3.8 52.3 12.9 12.9 14.7 5.2 58.6 26.6 18.9 5.5 1.1 4.7 17.0 4.6 25.8 20.8 4.9 1.2 3.9 14.1 3.9 25.5 19.2 4.3 1.3 3.9 14.9 3.7 25.3 20.9 4.3 1.6 3.4 14.5 3.3 18.0 17.7 3.9 1.9 2.7 10.3 2.9 16.0 14.1 3.5 2.5 2.2 8.6 2.5

CY08

CY09

CY10

CY11E

CY12E

CY13E

October 19, 2012

Ambuja Cements | 3QCY2012 Result Update

Research Team Tel: 022 - 3935 7800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Ambuja Cements No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors.

Ratings (Returns) :

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

October 19, 2012

10

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Oilseeds and Edible Oil UpdateDocumento9 páginasOilseeds and Edible Oil UpdateAngel BrokingAinda não há avaliações

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocumento4 páginasRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingAinda não há avaliações

- WPIInflation August2013Documento5 páginasWPIInflation August2013Angel BrokingAinda não há avaliações

- Daily Agri Report September 16 2013Documento9 páginasDaily Agri Report September 16 2013Angel BrokingAinda não há avaliações

- Daily Agri Tech Report September 16 2013Documento2 páginasDaily Agri Tech Report September 16 2013Angel BrokingAinda não há avaliações

- Daily Metals and Energy Report September 16 2013Documento6 páginasDaily Metals and Energy Report September 16 2013Angel BrokingAinda não há avaliações

- International Commodities Evening Update September 16 2013Documento3 páginasInternational Commodities Evening Update September 16 2013Angel BrokingAinda não há avaliações

- Derivatives Report 8th JanDocumento3 páginasDerivatives Report 8th JanAngel BrokingAinda não há avaliações

- Daily Agri Tech Report September 14 2013Documento2 páginasDaily Agri Tech Report September 14 2013Angel BrokingAinda não há avaliações

- Market Outlook: Dealer's DiaryDocumento13 páginasMarket Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Metal and Energy Tech Report Sept 13Documento2 páginasMetal and Energy Tech Report Sept 13Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Documento4 páginasDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingAinda não há avaliações

- Currency Daily Report September 16 2013Documento4 páginasCurrency Daily Report September 16 2013Angel BrokingAinda não há avaliações

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocumento1 páginaPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingAinda não há avaliações

- Market Outlook: Dealer's DiaryDocumento12 páginasMarket Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Currency Daily Report September 13 2013Documento4 páginasCurrency Daily Report September 13 2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Documento4 páginasDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocumento6 páginasTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingAinda não há avaliações

- Daily Metals and Energy Report September 12 2013Documento6 páginasDaily Metals and Energy Report September 12 2013Angel BrokingAinda não há avaliações

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocumento4 páginasJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Documento4 páginasDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingAinda não há avaliações

- Daily Agri Tech Report September 12 2013Documento2 páginasDaily Agri Tech Report September 12 2013Angel BrokingAinda não há avaliações

- Market Outlook: Dealer's DiaryDocumento13 páginasMarket Outlook: Dealer's DiaryAngel BrokingAinda não há avaliações

- Metal and Energy Tech Report Sept 12Documento2 páginasMetal and Energy Tech Report Sept 12Angel BrokingAinda não há avaliações

- Currency Daily Report September 12 2013Documento4 páginasCurrency Daily Report September 12 2013Angel BrokingAinda não há avaliações

- Daily Agri Report September 12 2013Documento9 páginasDaily Agri Report September 12 2013Angel BrokingAinda não há avaliações

- Company Law - Unit IDocumento61 páginasCompany Law - Unit IHarsh ThakurAinda não há avaliações

- CH - 04 Dissolution of Partnership FirmDocumento10 páginasCH - 04 Dissolution of Partnership FirmMahathi AmudhanAinda não há avaliações

- MAS-42E (Budgeting With Probability Analysis)Documento10 páginasMAS-42E (Budgeting With Probability Analysis)Fella GultianoAinda não há avaliações

- Acc414 Fin43 mgt45 Midterm-ExamDocumento11 páginasAcc414 Fin43 mgt45 Midterm-ExamNicole Athena CruzAinda não há avaliações

- Dutch-Bangla Bank Limited: Account StatementDocumento1 páginaDutch-Bangla Bank Limited: Account StatementMohammad AminurAinda não há avaliações

- ch12 SolutionsDocumento49 páginasch12 Solutionsaboodyuae2000Ainda não há avaliações

- Kinross Q1 2023 Results Webcast Deck VF CLEANDocumento27 páginasKinross Q1 2023 Results Webcast Deck VF CLEANMatheusAinda não há avaliações

- Tutorial Week 3 Questions 1Documento6 páginasTutorial Week 3 Questions 1Shermaine WanAinda não há avaliações

- ICAEW 2021 Chapter 15: Sole Trader and Partnership Financial Statements Under UK GAAPDocumento28 páginasICAEW 2021 Chapter 15: Sole Trader and Partnership Financial Statements Under UK GAAPHankhnilAinda não há avaliações

- SMDocumento84 páginasSMKapil JainAinda não há avaliações

- Avoiding-Business-Failure A Guide For SMEDocumento37 páginasAvoiding-Business-Failure A Guide For SMETeferi BiruAinda não há avaliações

- Capital Budgeting and Basic Appraisal Techniques: Margarita KouloumbriDocumento23 páginasCapital Budgeting and Basic Appraisal Techniques: Margarita KouloumbriInga ȚîgaiAinda não há avaliações

- Group 7 - Excel Solution For 7 QuestionsDocumento8 páginasGroup 7 - Excel Solution For 7 QuestionsJESWIN BENNY 1928517Ainda não há avaliações

- Stock Valuation: A Second LookDocumento116 páginasStock Valuation: A Second LookHuy PanhaAinda não há avaliações

- Highland Malt Accounting Project PDFDocumento12 páginasHighland Malt Accounting Project PDFEng Chee Liang100% (1)

- Corporate Finance Asia Global 1st Edition Ross Test BankDocumento22 páginasCorporate Finance Asia Global 1st Edition Ross Test Bankburke.bedrugi2878100% (25)

- Cap StructureDocumento4 páginasCap StructureInvisible CionAinda não há avaliações

- Unit Iii Assessment ProblemsDocumento8 páginasUnit Iii Assessment ProblemsWindie SisodAinda não há avaliações

- FM Course Outline & Materials-Thappar UnivDocumento74 páginasFM Course Outline & Materials-Thappar Univharsimranjitsidhu661Ainda não há avaliações

- Abakkus Emering Opp PPT September 2023Documento24 páginasAbakkus Emering Opp PPT September 2023nuthan.10986Ainda não há avaliações

- Preparing and Using Financial StatementsDocumento33 páginasPreparing and Using Financial StatementsMuhammad Imran50% (2)

- African Bank 13/03/2023 Branch Code 430000: StatementDocumento23 páginasAfrican Bank 13/03/2023 Branch Code 430000: StatementKosie Smith100% (1)

- Problem Sheet 2 - Common Size Statements & Trend AnalysisDocumento3 páginasProblem Sheet 2 - Common Size Statements & Trend AnalysisAkshita KapoorAinda não há avaliações

- F9 Question Bank Answers-BeckerDocumento153 páginasF9 Question Bank Answers-BeckerRanjisi chimbanguAinda não há avaliações

- Act. 5 Terminos de PatrimonioDocumento3 páginasAct. 5 Terminos de PatrimonioYaritza Ileany ROMERO RODRIGUEZAinda não há avaliações

- Depreciation and Fixed AssetsDocumento10 páginasDepreciation and Fixed AssetssiddharthdileepkamatAinda não há avaliações

- Bcel 2019Q1Documento1 páginaBcel 2019Q1Dương NguyễnAinda não há avaliações

- Done 5Documento12 páginasDone 5jefrinjabezchristianAinda não há avaliações

- Project in Business FinanceDocumento10 páginasProject in Business FinanceKOUJI N. MARQUEZAinda não há avaliações

- Reverse Charge Mechanism in VATDocumento22 páginasReverse Charge Mechanism in VATbinuAinda não há avaliações