Escolar Documentos

Profissional Documentos

Cultura Documentos

Highlights of Direct Tax Code Revise June 2010

Enviado por

stevensrocksDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Highlights of Direct Tax Code Revise June 2010

Enviado por

stevensrocksDireitos autorais:

Formatos disponíveis

MEHUL CHAUHAN(CA FINAL)

chauhanmehulgd@yahoo.com Mobile : 9726868112 Highlights of Direct Tax code New Tax Saving Scheme: Tax saving limit remain same as Rs.100000/- but another Rs.50000 has been added for pure life insurance(Sum insured is atleast 20 time the premium paid), health insurance & tution fees of children. But the Rs.100000/- investment can now only be done in PF, superannuation fund, gratuity fund and new pension scheme. Tax Slabs : Up to Rs.200000/Rs.200000 to Rs.500000/Rs.500000/- to Rs.1000000/Above Rs.1000000/-

NIL 10% 20% 30%

Men & Women treated same and for senior citizen limit goes to Rs.250000/-

Home loan interest: Exemption will remain same as 1.5 lakhs per year for interest on

housing loan for self-occupied property.

Short and long term gains: Only half of Short-term capital gains will be taxed. e.g. if

you gains 50,000, add 25,000 to your taxable income. Long term capital gains (From equities and equity mutual funds, on which STT has been paid) are still exempted from income tax.

Education Cess: Surcharge and education cess are abolished.

Income arising from House Property: Deductions for Rent and Maintenance would be reduced from 30% to 20% of the Gross Rent. Also all interest paid on house loan for a rented house is deductible from rent. Before DTC, if you own more than one property, there was provision for taxing notional rent even if the second house was not put to rent. But, under the Direct Tax Code 2010 , such a concept has been abolished.

LTA (Leave travel allowance): Tax exemption on LTA is abolished.

Education loan: Tax exemption on Education loan to continue.

Medical reimbursement : Max limit for medical reimbursements has been increased

to 50,000 per year from current 15,000 limit.

MEHUL CHAUHAN(CA FINAL)

chauhanmehulgd@yahoo.com Mobile : 9726868112 MAT : it wil be increase from 18.5% to 20 %. There may be other possibility that new concept may be comes to effect and MAT should be calculated on Net asset value @2% for company and this wil be 0.25% for banking company.

News for NRIs : As per the current laws, a NRI is liable to pay tax on global income if

he is in India for a period more than 182 days in a financial year. But in new bill, this duration has been changed to just 60 days. An NRI will be deemed as resident only if he has also resided in India for 365 days or more in the preceding four financial years, together with 60 days in any of these fiscal years. Even if an NRI becomes a resident in any financial year, his global income does not immediately become liable to tax in India. Global income would become taxable only if the person also stayed in India for nine out of 10 precedent years, or 730 days in the preceding seven years. This is very unfair to Seafarers. To avoid any income tax, an Indian sailor employed with a foreign ship will have to stay maximum for 60 days in India.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Form 56Documento2 páginasForm 56Konan Snowden100% (26)

- PLAY - Should They File A Tax ReturnDocumento9 páginasPLAY - Should They File A Tax ReturnAlanna100% (1)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- 26 USC 6033a3Documento2 páginas26 USC 6033a3helpinghandoutreach100% (3)

- IT3 (B) Income Tax Certificate: MR ZL MathunjwaDocumento1 páginaIT3 (B) Income Tax Certificate: MR ZL MathunjwaZakhele MathunjwaAinda não há avaliações

- 1120 & 1120s Corporation Tax Organizer - Long VersionDocumento13 páginas1120 & 1120s Corporation Tax Organizer - Long VersionExactCPAAinda não há avaliações

- NDC v. CIRDocumento2 páginasNDC v. CIRalexis_bea100% (1)

- RemediesDocumento45 páginasRemediesCzarina100% (1)

- AsynchDocumento4 páginasAsyncherickamaeebaloAinda não há avaliações

- Model Question BBS 3rd Taxation in NepalDocumento6 páginasModel Question BBS 3rd Taxation in NepalAsmita BhujelAinda não há avaliações

- 2019 It-511 Individual Income Tax Booklet PDFDocumento52 páginas2019 It-511 Individual Income Tax Booklet PDFvinayak ShedgeAinda não há avaliações

- FR Revision Video Links FinalDocumento2 páginasFR Revision Video Links FinalwipeyourassAinda não há avaliações

- Module 09 - Inclusions in Gross IncomeDocumento15 páginasModule 09 - Inclusions in Gross IncomeRoligen Rose PachicoyAinda não há avaliações

- GST BILL Highlights of Draft Model GST LawDocumento6 páginasGST BILL Highlights of Draft Model GST LawS Sinha RayAinda não há avaliações

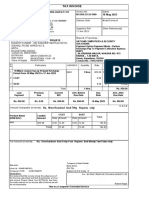

- Form No.16: Page 1 of 2 (SAHTRUGHAN SINGH TOMAR - Asst. Yr.: 2020-2021)Documento2 páginasForm No.16: Page 1 of 2 (SAHTRUGHAN SINGH TOMAR - Asst. Yr.: 2020-2021)Ankit SijariyaAinda não há avaliações

- Government AccountingDocumento2 páginasGovernment AccountingLloyd SonicaAinda não há avaliações

- FMG 401 FinalDocumento342 páginasFMG 401 FinalPratik KolsuneAinda não há avaliações

- 2.1 Purchase Invoice For Leg Rest On Mar2021Documento1 página2.1 Purchase Invoice For Leg Rest On Mar2021Nabajyoti SahaAinda não há avaliações

- Tds Tcs PayrollDocumento4 páginasTds Tcs PayrollGandeti SantoshAinda não há avaliações

- Donor's, Exempt TaxDocumento3 páginasDonor's, Exempt TaxDanna Karen MallariAinda não há avaliações

- Tax 1.1Documento13 páginasTax 1.1Mheryza De Castro PabustanAinda não há avaliações

- Livguard IB Dealers Pricelist May 2019Documento1 páginaLivguard IB Dealers Pricelist May 2019chirag tandonAinda não há avaliações

- Chap # 3 Job Order Costing All ProblemsDocumento4 páginasChap # 3 Job Order Costing All ProblemsDaniyal PervezAinda não há avaliações

- CIR Vs Fortune TobaccoDocumento3 páginasCIR Vs Fortune TobaccoAzrael Cassiel100% (2)

- Tax3701 TL 102Documento80 páginasTax3701 TL 102Jerome ChettyAinda não há avaliações

- SolutionsDocumento24 páginasSolutionsapi-38170720% (1)

- 0 0 0 10000 0 10000 SGST (0006)Documento2 páginas0 0 0 10000 0 10000 SGST (0006)Pruthiv RajAinda não há avaliações

- January 23-February 22, 2019-MGTDocumento10 páginasJanuary 23-February 22, 2019-MGTLaurel BarteAinda não há avaliações

- Invoice SHADOWFAXDocumento1 páginaInvoice SHADOWFAXAinta GaurAinda não há avaliações

- Definitions Residence and Tax LiabilityDocumento23 páginasDefinitions Residence and Tax LiabilityVicky DAinda não há avaliações

- Bantillo - CIR Vs PNBDocumento3 páginasBantillo - CIR Vs PNBAto TejaAinda não há avaliações