Escolar Documentos

Profissional Documentos

Cultura Documentos

FTL 108944881v2

Enviado por

Chapter 11 Dockets0 notas0% acharam este documento útil (0 voto)

19 visualizações5 páginasThe bankruptcy court granted an interim order authorizing Back Yard Burgers and its debtor affiliates to pay prepetition claims of certain critical vendors. The order allows the debtors to pay critical vendors up to $210,000 in the aggregate on an interim basis to ensure continued supply of necessary goods and services. Critical vendors must agree to supply goods and services going forward under the vendors' normal trade terms. The order is effective immediately to avoid harm to the debtors and their restructuring efforts. Objections to a final order are due by November 6, with a hearing scheduled for November [DATE] if any objections are filed.

Descrição original:

Título original

10000000684

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoThe bankruptcy court granted an interim order authorizing Back Yard Burgers and its debtor affiliates to pay prepetition claims of certain critical vendors. The order allows the debtors to pay critical vendors up to $210,000 in the aggregate on an interim basis to ensure continued supply of necessary goods and services. Critical vendors must agree to supply goods and services going forward under the vendors' normal trade terms. The order is effective immediately to avoid harm to the debtors and their restructuring efforts. Objections to a final order are due by November 6, with a hearing scheduled for November [DATE] if any objections are filed.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

19 visualizações5 páginasFTL 108944881v2

Enviado por

Chapter 11 DocketsThe bankruptcy court granted an interim order authorizing Back Yard Burgers and its debtor affiliates to pay prepetition claims of certain critical vendors. The order allows the debtors to pay critical vendors up to $210,000 in the aggregate on an interim basis to ensure continued supply of necessary goods and services. Critical vendors must agree to supply goods and services going forward under the vendors' normal trade terms. The order is effective immediately to avoid harm to the debtors and their restructuring efforts. Objections to a final order are due by November 6, with a hearing scheduled for November [DATE] if any objections are filed.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 5

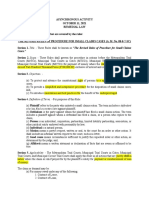

In re

UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

Chapter 11

BACK YARD BURGERS, INC., et a/.

1

Case No. 12-12882 (PJW)

Debtors.

(Joint Administration Pending)

Ref. Docket No. I l

INTERM ORDER (A) AUTHORIZING, BUT NOT DIRECTING, THE DEBTORS TO

PAY ALL OR A PORTION OF THE PREPETITION CLAIMS OF CERTAIN

CRITICAL VENDORS, AND (B) AUTHORIZING FINANCIAL INSTITUTIONS

TO HONOR AND PROCESS RELATED CHECKS AND TRANSFERS

Upon the motion (the "Motion")

2

filed by the above-captioned debtors and debtors-in-

possession (collectively, the "Debtors") pursuant to sections 105(a), 363, 1107, and 1108 oftitle 11

of the United States Code, 11 U.S.C. 101, et seq. (the "Bankruptcy Code") and Rules 6003 and

6004(h) of the Federal Rules of Bankruptcy Procedure (the "Bankruptcy Rules") for entry of an

order: (a) authorizing, but not directing, the Debtors to pay all or a portion of the prepetition claims of

certain Critical Vendors (as defined below), (b) authorizing financial institutions to honor and

process related checks and transfers, and (c) providing any additional relief required in order to

effectuate the foregoing; having reviewed the Motion; and upon the Declaration of James E.

Boyd, Jr. in Support of the Debtors' Chapter 11 Petitions and Requests for First Day Relief (the

"First Day Declaration"); and it appearing that this Court has jurisdiction to consider the

Motion pursuant to 28 U.S.C. 157 and 1334; and it appearing that venue of these cases and

the Motion in this district is proper pursuant to 28 U.S.C. 1408 and 1409; and it appearing

The Debtors in these chapter 11 Cases, along with the last four digits of each Debtor's federal tax

identification number, are: Back Yard Burgers, Inc. (7163), BYB Properties, Inc. (9046), Nashville BYB, LLC (6507)

and Little Rock Back Yard Burgers, Inc. (9133). The mailing address of the Debtors is: St. Clouds Building, 500

Church Street, Suite 200, Nashville, TN 37219.

Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Motion.

FTL 108944881v2

that this matter is a core proceeding pursuant to 28 U.S.C. 157(b); and this Court having

determined that the relief requested in the Motion is in the best interests of the Debtors, their

estates, their creditors and other parties in interest; and it appearing that proper and adequate

notice of the Motion has been given and that no other or further notice is necessary; and after due

deliberation thereon; and good and sufficient cause appearing therefor,

IT IS HEREBY ORDERED THAT:

1. For the reasons set forth on the record, the Motion is GRANTED as set forth

herein on an interim basis.

2. Pursuant to sections 105(a), 363(b), 1107 and 1108 of the Bankruptcy Code, the

Debtors are authorized, but not directed, in the reasonable exercise of their business judgment, to

pay each Critical Vendor in the ordinary course of business.

3. The Debtors shall only make payment on account of Critical Vendor Claims to

Critical Vendors who agree to continue to supply goods or services to the Debtors on such

Critical Vendor's Governing Trade Terms. As used herein, "Governing Trade Terms" means,

with respect to a Critical Vendor: (a) the normal and customary trade terms, practices and

programs (including, but not limited to, credit limits, pricing, cash discounts, timing of

payments, allowances, rebates, coupon reconciliation, normal product mix and availability, and

other applicable terms and programs), that were most favorable to the Debtors and in effect

between such Critical Vend or and the Debtors prior to the Petition Date; or (b) such other trade

terms that are agreed to by the Debtors and such Critical Vendor.

4. The Debtors shall maintain a matrix summarizing (a) the name of each Critical

Vendor paid on account of Critical Vendor Claims, (b) the amount paid to each Critical Vendor

on account of its Critical Vendor Claim and (c) the goods or services provided by such Critical

Vendor. This matrix will periodically be provided to the following parties (together, the "Notice

FTL 108944881v2

2

Parties"): the United States Trustee for the District of Delaware (the "U.S. Trustee"),

professionals retained by the official committee of unsecured creditors appointed in these cases

(the "Committee"), if any, and counsel to the Debtors' postpetition lenders, provided, however,

that the Notice Parties shall keep the matrix confidential and shall not disclose any of the

information in the matrix to anyone, including, but not limited to, any member of the Committee,

without prior written consent from the Debtors.

5. The Debtors shall undertake all appropriate efforts to cause Critical Vendors to

enter into an agreement (the "Vendor Agreement") including provisions substantially similar to

the form attached to the Motion as Exhibit "A".

6. The Debtors are authorized, but not directed, to enter into Vendor Agreements

when the Debtors determine, in the exercise of their reasonable business judgment, that it is

appropriate to do so. However, the Debtors' inability to enter into a Vendor Agreement shall not

preclude them from paying a Critical Vendor Claim when, in the exercise of their reasonable

business judgment, such payment is necessary to the Debtors' operations.

7. If a Critical Vendor that has received payment of a prepetition claim later refuses

to continue to supply goods or services for the applicable period in compliance with the Vendor

Agreement or this Order, then (a) the Debtors may, in their discretion, declare that the payment

of the creditor's Critical Vendor Claim is a voidable postpetition transfer pursuant to section

549(a) of the Bankruptcy Code that the Debtors may recover in cash or in goods from such

Critical Vendor, (b) the Debtors may then take any and all appropriate steps to cause such

Critical Vendor to repay payments made to it on account of its prepetition trade claims to the

extent that such payments exceed the postpetition amounts then owing to such Critical Vendor

without giving effect to alleged setoff rights, recoupment rights, adjustments, or offsets of any

FTL 108944881v2

3

type whatsoever, and (c) the Critical Vendor Claim shall be reinstated in such an amount so as to

restore the Debtors and the Critical Vendor to their original positions as if the Vendor Agreement

had never been entered into and no payment of the Critical Vendor Claim had been made.

8. Each of the banks and financial institutions at which the Debtors maintain their

accounts relating to the payment of the claims that the Debtors request authority to pay in the

Motion are authorized to receive, process, honor and pay all checks presented for payment and to

honor all fund transfer requests made by the Debtors related thereto, to the extent that sufficient

funds are on deposit in those accounts, and are authorized to rely on the Debtors designation of

any particular check as approved by this Order.

9. Notwithstanding anything to the contrary contained herein any payment to be

made, or authorization contained, hereunder shall be subject to the requirements imposed on the

Debtors under any approved debtor-in-possession financing facility, or any order regarding the

Debtors' postpetition financing or use of cash collateral.

10. During the interim period, the Debtors will not make payments to Critical

Vendors in excess of $210,000 in the aggregate.

11. Rule 6003(b) of the Federal Rules of Bankruptcy Procedure (the "Bankruptcy

Rules") has been satisfied because the relief requested in the Motion is necessary to avoid

immediate and irreparable harm to the Debtors.

12. Notwithstanding any applicability of Bankruptcy Rule 6004(h), the terms and

conditions of this Order shall be immediately effective and enforceable upon its entry.

13. This Court shall retain jurisdiction with respect to all matters arising from or

relating to the interpretation or implementation of this Order.

FTL 108944881v2

4

1. Any objections to entry of a final order granting the relief requested in the Motion

shall be filed and served upon counsel for the Debtors by 5:00p.m. (Prevailing Eastern Time) on

No J , 6, 2012. In the event no objections are filed, a final order shall be entered without

further notice or a hearing. In the event that any objection is timely filed, a hearing will be held

on Nov. 2012 at I Eastern Time).

Dated: Octobe{-f 2012

UNITED STATES BANKRUPTCY JUDGE

FTL 108944881v2

5

Você também pode gostar

- Introduction to Negotiable Instruments: As per Indian LawsNo EverandIntroduction to Negotiable Instruments: As per Indian LawsNota: 5 de 5 estrelas5/5 (1)

- Debt Validation Letter 2020Documento6 páginasDebt Validation Letter 2020Nat Williams97% (29)

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Documento28 páginasAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsAinda não há avaliações

- Sample Information For Attempted MurderDocumento3 páginasSample Information For Attempted MurderIrin200Ainda não há avaliações

- 10000009535Documento528 páginas10000009535Chapter 11 Dockets67% (3)

- Week 1Documento34 páginasWeek 1Mitchie Faustino100% (1)

- Cases Torts 7-29-17 DigestDocumento1 páginaCases Torts 7-29-17 Digestczabina fatima delicaAinda não há avaliações

- сестр главы9 PDFDocumento333 páginasсестр главы9 PDFYamikAinda não há avaliações

- Insolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (Fria) of 2010Documento10 páginasInsolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (Fria) of 2010Benedict AlvarezAinda não há avaliações

- Interim Rules of Procedure On Corporate RehabDocumento21 páginasInterim Rules of Procedure On Corporate RehabSharmen Dizon GalleneroAinda não há avaliações

- FTL 108944862v2Documento3 páginasFTL 108944862v2Chapter 11 DocketsAinda não há avaliações

- Boyd, Jr. in Support of The Debtors' Chapter 11 Petitions and Requests For First Day ReliefDocumento3 páginasBoyd, Jr. in Support of The Debtors' Chapter 11 Petitions and Requests For First Day ReliefChapter 11 DocketsAinda não há avaliações

- Boyd, Jr. in Support of The Debtors' Chapter 11 Petitions and Requests For First Day Relief (The "First Day Declaration")Documento3 páginasBoyd, Jr. in Support of The Debtors' Chapter 11 Petitions and Requests For First Day Relief (The "First Day Declaration")Chapter 11 DocketsAinda não há avaliações

- Et Al.,t: Re: Docket Nos. 74, 106, 122, 149, 154 &Documento3 páginasEt Al.,t: Re: Docket Nos. 74, 106, 122, 149, 154 &Chapter 11 DocketsAinda não há avaliações

- FTL 108944861v2Documento6 páginasFTL 108944861v2Chapter 11 DocketsAinda não há avaliações

- Capitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Motion. The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Documento10 páginasCapitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Motion. The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsAinda não há avaliações

- OriginalDocumento7 páginasOriginalChapter 11 DocketsAinda não há avaliações

- Et Al.Documento9 páginasEt Al.Chapter 11 DocketsAinda não há avaliações

- Original: Et AlDocumento3 páginasOriginal: Et AlChapter 11 DocketsAinda não há avaliações

- Ref. Docket No. 6Documento3 páginasRef. Docket No. 6Chapter 11 DocketsAinda não há avaliações

- Requirements For Information To Include in The Combined Plan and Disclosure Statement (Judge Phillip J. Shefferly)Documento10 páginasRequirements For Information To Include in The Combined Plan and Disclosure Statement (Judge Phillip J. Shefferly)jarabboAinda não há avaliações

- Edward J. Cheetham, Debtor v. Universal C. I. T. Credit Corp., (In The Matter of Edward J. Cheetham, Debtor), 390 F.2d 234, 1st Cir. (1968)Documento7 páginasEdward J. Cheetham, Debtor v. Universal C. I. T. Credit Corp., (In The Matter of Edward J. Cheetham, Debtor), 390 F.2d 234, 1st Cir. (1968)Scribd Government DocsAinda não há avaliações

- Et Al./: These CasesDocumento34 páginasEt Al./: These CasesChapter 11 DocketsAinda não há avaliações

- 10000003244Documento11 páginas10000003244Chapter 11 DocketsAinda não há avaliações

- Et Al./: (LL) (Ill)Documento32 páginasEt Al./: (LL) (Ill)Chapter 11 DocketsAinda não há avaliações

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Documento24 páginasThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Chapter 11 DocketsAinda não há avaliações

- Am No.00!8!10-Sc (Rehab Corporate)Documento14 páginasAm No.00!8!10-Sc (Rehab Corporate)Jose BonifacioAinda não há avaliações

- United States Bankruptcy Court Southern District of New YorkDocumento13 páginasUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsAinda não há avaliações

- Interim Rules of Procedure On Corporate Rehabilitation: en BancDocumento5 páginasInterim Rules of Procedure On Corporate Rehabilitation: en BancarloAinda não há avaliações

- Ref. Docket No. 7Documento3 páginasRef. Docket No. 7Chapter 11 DocketsAinda não há avaliações

- ORDERED in The Southern District of Florida On May 14, 2010Documento14 páginasORDERED in The Southern District of Florida On May 14, 2010Chapter 11 DocketsAinda não há avaliações

- Original: Et Al.Documento15 páginasOriginal: Et Al.Chapter 11 DocketsAinda não há avaliações

- Original: For The District of DelawareDocumento2 páginasOriginal: For The District of DelawareChapter 11 DocketsAinda não há avaliações

- Not PrecedentialDocumento8 páginasNot PrecedentialScribd Government DocsAinda não há avaliações

- Insolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (FRIA) of 2010Documento22 páginasInsolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (FRIA) of 2010Kobe BullmastiffAinda não há avaliações

- Premium Finance Agreement An GratingDocumento18 páginasPremium Finance Agreement An GratingChapter 11 DocketsAinda não há avaliações

- Joint Plan of Liquidation of The Debtors and The Official Committee of Unsecured Creditors Pursuant To Chapter 11 of The Bankruptcy CodeDocumento24 páginasJoint Plan of Liquidation of The Debtors and The Official Committee of Unsecured Creditors Pursuant To Chapter 11 of The Bankruptcy CodeChapter 11 DocketsAinda não há avaliações

- Original: Et Al,'Documento3 páginasOriginal: Et Al,'Chapter 11 DocketsAinda não há avaliações

- Honorable Carol A. DoyleDocumento3 páginasHonorable Carol A. DoyleChapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court For The District of DelawareDocumento9 páginasIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court Southern District of New YorkDocumento3 páginasUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsAinda não há avaliações

- (Ii) (Iii) (Iv)Documento55 páginas(Ii) (Iii) (Iv)Chapter 11 DocketsAinda não há avaliações

- Re: Docket Nos. 5, 37Documento25 páginasRe: Docket Nos. 5, 37Chapter 11 DocketsAinda não há avaliações

- Et Al.Documento32 páginasEt Al.Chapter 11 DocketsAinda não há avaliações

- CBTEQ Commonwealth Biotech Disclosure StatementDocumento59 páginasCBTEQ Commonwealth Biotech Disclosure StatementstockenfraudAinda não há avaliações

- Ref. Docket Nos. 117 and 174Documento7 páginasRef. Docket Nos. 117 and 174Chapter 11 DocketsAinda não há avaliações

- BAY:01512259 VLDocumento15 páginasBAY:01512259 VLChapter 11 DocketsAinda não há avaliações

- "Motion") "Debtors") ,: FTL 108944922v1Documento38 páginas"Motion") "Debtors") ,: FTL 108944922v1Chapter 11 DocketsAinda não há avaliações

- For The District of Colorado: TedstatesbankruptcycourtDocumento2 páginasFor The District of Colorado: TedstatesbankruptcycourtChapter 11 DocketsAinda não há avaliações

- 10000005315Documento62 páginas10000005315Chapter 11 DocketsAinda não há avaliações

- 10000005755Documento5 páginas10000005755Chapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court Southern District of New YorkDocumento2 páginasUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsAinda não há avaliações

- Green Tree Settlement OrderDocumento67 páginasGreen Tree Settlement OrderJimHammerandAinda não há avaliações

- Order Approving Debtors' Motion For Order Establishing Deadlines For Filing Proofs of Claim and Approving Form and Manner of Notice ThereofDocumento36 páginasOrder Approving Debtors' Motion For Order Establishing Deadlines For Filing Proofs of Claim and Approving Form and Manner of Notice ThereofChapter 11 DocketsAinda não há avaliações

- Objection Deadline: September 13, 2012 at 4:00 P.M. (ET) Hearing Date: September 20, 2012 at 2:00 P.M. (ET)Documento12 páginasObjection Deadline: September 13, 2012 at 4:00 P.M. (ET) Hearing Date: September 20, 2012 at 2:00 P.M. (ET)Chapter 11 DocketsAinda não há avaliações

- Objection Deadline: January 20, 2012 at 4:00 P.M. (ET) Hearing Date: February 7, 2012 at 3:00 P.M. (ET)Documento12 páginasObjection Deadline: January 20, 2012 at 4:00 P.M. (ET) Hearing Date: February 7, 2012 at 3:00 P.M. (ET)Chapter 11 DocketsAinda não há avaliações

- Re: Docket Nos. 78, 110, 124Documento4 páginasRe: Docket Nos. 78, 110, 124Chapter 11 DocketsAinda não há avaliações

- Bankr. L. Rep. P 69,989 in Re Eugene C. Mullendore and Kathleen Boren Mullendore, Debtors. Kathleen Boren Mullendore and Katsy Mullendore Mecom v. United States, 741 F.2d 306, 10th Cir. (1984)Documento10 páginasBankr. L. Rep. P 69,989 in Re Eugene C. Mullendore and Kathleen Boren Mullendore, Debtors. Kathleen Boren Mullendore and Katsy Mullendore Mecom v. United States, 741 F.2d 306, 10th Cir. (1984)Scribd Government DocsAinda não há avaliações

- In Re:) : Debtors.)Documento16 páginasIn Re:) : Debtors.)Chapter 11 DocketsAinda não há avaliações

- Objection Deadline: May 21, 2012 at 4:00 P.M. (ET) Hearing Date: June 15, 2012 at 10:00 A.M. (ET)Documento13 páginasObjection Deadline: May 21, 2012 at 4:00 P.M. (ET) Hearing Date: June 15, 2012 at 10:00 A.M. (ET)Chapter 11 DocketsAinda não há avaliações

- Moreno, Ma. Christela M. (BLN1Ar) - BALM105 Asynchronous (October 11)Documento12 páginasMoreno, Ma. Christela M. (BLN1Ar) - BALM105 Asynchronous (October 11)Christela MorenoAinda não há avaliações

- Objection of Visteon Corporation To Debtors' Motion For Order Deeming Reclamation Claims To Be General Unsecured Claims Against The DebtorsDocumento8 páginasObjection of Visteon Corporation To Debtors' Motion For Order Deeming Reclamation Claims To Be General Unsecured Claims Against The DebtorsChapter 11 DocketsAinda não há avaliações

- Bank of America Mortgage Settlement DocumentsDocumento317 páginasBank of America Mortgage Settlement DocumentsFindLaw100% (1)

- Counsel For F&G Mechanical Corporation and Meadowlands Fire ProtectionDocumento10 páginasCounsel For F&G Mechanical Corporation and Meadowlands Fire ProtectionChapter 11 DocketsAinda não há avaliações

- Hearing Date: March 23, 2011 at 11:00 A.M. Eastern Time Objections Due: March 18, 2011 at 4:00 P.M. Eastern TimeDocumento8 páginasHearing Date: March 23, 2011 at 11:00 A.M. Eastern Time Objections Due: March 18, 2011 at 4:00 P.M. Eastern TimeChapter 11 DocketsAinda não há avaliações

- SEC Vs MUSKDocumento23 páginasSEC Vs MUSKZerohedge100% (1)

- Wochos V Tesla OpinionDocumento13 páginasWochos V Tesla OpinionChapter 11 DocketsAinda não há avaliações

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Documento47 páginasAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsAinda não há avaliações

- Zohar 2017 ComplaintDocumento84 páginasZohar 2017 ComplaintChapter 11 DocketsAinda não há avaliações

- PopExpert PetitionDocumento79 páginasPopExpert PetitionChapter 11 DocketsAinda não há avaliações

- National Bank of Anguilla DeclDocumento10 páginasNational Bank of Anguilla DeclChapter 11 DocketsAinda não há avaliações

- Zohar AnswerDocumento18 páginasZohar AnswerChapter 11 DocketsAinda não há avaliações

- Energy Future Interest OpinionDocumento38 páginasEnergy Future Interest OpinionChapter 11 DocketsAinda não há avaliações

- NQ LetterDocumento2 páginasNQ LetterChapter 11 DocketsAinda não há avaliações

- Kalobios Pharmaceuticals IncDocumento81 páginasKalobios Pharmaceuticals IncChapter 11 DocketsAinda não há avaliações

- Home JoyDocumento30 páginasHome JoyChapter 11 DocketsAinda não há avaliações

- Quirky Auction NoticeDocumento2 páginasQuirky Auction NoticeChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocumento4 páginasUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsAinda não há avaliações

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocumento5 páginasDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsAinda não há avaliações

- Thermoplastics Are Defined As Polymers That Can Be Melted and Recast AlmostDocumento5 páginasThermoplastics Are Defined As Polymers That Can Be Melted and Recast AlmostMnemosyneAinda não há avaliações

- Public Utility Accounting Manual 2018Documento115 páginasPublic Utility Accounting Manual 2018effieladureAinda não há avaliações

- Catalogue 2015-16Documento72 páginasCatalogue 2015-16PopokasAinda não há avaliações

- Problem+Set+ 3+ Spring+2014,+0930Documento8 páginasProblem+Set+ 3+ Spring+2014,+0930jessica_1292Ainda não há avaliações

- James Burt HistoryDocumento9 páginasJames Burt HistoryJan GarbettAinda não há avaliações

- Factor Affecting Child Dental Behaviour PedoDocumento19 páginasFactor Affecting Child Dental Behaviour PedoFourthMolar.comAinda não há avaliações

- MSPM Clark UniversityDocumento27 páginasMSPM Clark Universitytushar gargAinda não há avaliações

- Mouth Tongue and Salivary GlandsDocumento52 páginasMouth Tongue and Salivary GlandsIrfan FalahAinda não há avaliações

- International Banking & Foreign Exchange ManagementDocumento4 páginasInternational Banking & Foreign Exchange ManagementAnupriya HiranwalAinda não há avaliações

- Intj MbtiDocumento17 páginasIntj Mbti1985 productionAinda não há avaliações

- Department of Education: Weekly Learning PlanDocumento4 páginasDepartment of Education: Weekly Learning PlanJanine Galas DulacaAinda não há avaliações

- Educational Institutions: Santos, Sofia Anne PDocumento11 páginasEducational Institutions: Santos, Sofia Anne PApril ManjaresAinda não há avaliações

- RMK Akl 2 Bab 5Documento2 páginasRMK Akl 2 Bab 5ElineAinda não há avaliações

- Youth Policy Manual: How To Develop A National Youth StrategyDocumento94 páginasYouth Policy Manual: How To Develop A National Youth StrategyCristinaDumitriuAxyAinda não há avaliações

- Modelling The Relationship Between Hotel Perceived Value, CustomerDocumento11 páginasModelling The Relationship Between Hotel Perceived Value, Customerzoe_zoeAinda não há avaliações

- A Proposed Approach To Handling Unbounded Dependencies in Automatic ParsersDocumento149 páginasA Proposed Approach To Handling Unbounded Dependencies in Automatic ParsersRamy Al-GamalAinda não há avaliações

- Case Study: Direct Selling ConceptDocumento20 páginasCase Study: Direct Selling Conceptbansi2kk0% (1)

- Eastwoods: College of Science and Technology, IncDocumento2 páginasEastwoods: College of Science and Technology, IncMichael AustriaAinda não há avaliações

- IEEE 802.1adDocumento7 páginasIEEE 802.1adLe Viet HaAinda não há avaliações

- WK5 SR MOD001074 Grundy 2006 PDFDocumento18 páginasWK5 SR MOD001074 Grundy 2006 PDFadwiyahAinda não há avaliações

- Maths-Term End Examination-2020-2021 (2020-2021, MATHS)Documento6 páginasMaths-Term End Examination-2020-2021 (2020-2021, MATHS)Venkat Balaji0% (1)

- Digital Image Processing Unit-8Documento4 páginasDigital Image Processing Unit-8Kpsteja TejaAinda não há avaliações

- Vocab Money HeistDocumento62 páginasVocab Money HeistCivil EngineeringAinda não há avaliações

- Abdukes App PaoerDocumento49 páginasAbdukes App PaoerAbdulkerim ReferaAinda não há avaliações

- 12-List of U.C. Booked in NGZ Upto 31032017Documento588 páginas12-List of U.C. Booked in NGZ Upto 31032017avi67% (3)

- Sustainable Cities:: Why They MatterDocumento2 páginasSustainable Cities:: Why They MatterbokugairuAinda não há avaliações