Escolar Documentos

Profissional Documentos

Cultura Documentos

United States Bankruptcy Court For The District of Colorado: DMWEST #9307475 v1

Enviado por

Chapter 11 DocketsDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

United States Bankruptcy Court For The District of Colorado: DMWEST #9307475 v1

Enviado por

Chapter 11 DocketsDireitos autorais:

Formatos disponíveis

Case:12-24882-ABC Doc#:457 Filed:09/17/12

Entered:09/17/12 14:50:29 Page1 of 4

UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF COLORADO

In re:

)

)

CORDILLERA GOLF CLUB, LLC dba

The Club at Cordillera

EIN: 27-0331317,

Debtor.

Case No. 12-24882 ABC

Chapter 11

)

)

ORDER (A) FURTHER EXTENDING AND INCREASING INTERIM FINANCING AND

(B) FURTHER EXTENDING USE OF CASH COLLATERAL UNDER THE TERMS OF

THE PRIOR ORDER

THIS MATTER comes before the Court with the consent of the parties and by Motion

(the "Motion") of the Debtor made in open court to (A) Further Extend and Increase Interim

Financing and (B) Further Extend Use of Cash Collateral Under the Terms of the Prior Order,

and the Court, being advised in the premises and finding the requested relief reasonable and

supported by just cause, hereby

ORDERS the Motion is hereby GRANTED. The Court's Interim Order Pursuant to 11

U.S.C. 105, 361, 362, 363(c), 364(c), 364(d), and 364(e) and Fed.R.Bankr.P. 2002, 4001, and

9014 (I) Authorizing Debtor to Obtain Post-Petition Secured Financing, (II) Granting Security

Interests and Superpriority Administrative Expense Claims, and (III) Authorizing the Use of

Cash Collateral as Provided Herein [Dkt. No. 270] (the "Interim Order"), as amended by the

Court's Order Granting the Debtor's Motion to (a) Extend and Increase Interim Financing and (B)

Extend Use of Cash Collateral Under the Terms of the Prior Order [Dkt. No. 393], is further

amended as follows:

(a) The expiration date for the authorizations to request advances under the Interim DIP

Loan, and to use the proceeds thereof and to use Cash Collateral under and pursuant

to the Interim Order is extended from September 14, 2012, through and including

September 28, 2012 (the "Extension Period");

(b) The draw limit for the interim financing set forth in paragraph 2 of the Interim Order

is increased from $677,000 to $887,000, and the Budget (as defined in the Interim Order)

is deemed amended to incorporate the additional weeks, as applicable, as reflected on Exhibit

"A" attached hereto; and

DMWEST #9307475 v1

Case:12-24882-ABC Doc#:457 Filed:09/17/12

Entered:09/17/12 14:50:29 Page2 of 4

..

(c) The Interim Cash Collateral Order (as defined in the Interim Order) is hereby

amended to extend the term thereof through and including September 28, 2012.

Dated this _l_Z_day

o~/q q1

2012.

BY THE COURT:

(/t_ __

DMWEST #9307475 v1

Entered:09/17/12 14:50:29 Page3 of 4

"""

Case: 12-24882-ABC Doc#:402-2 Filed:08/30/12

23

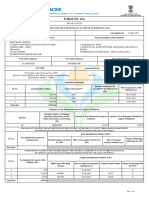

Cordillera Golf Club LLC

Exhibit A

Forecasted Cash Flow Budget

For the Weeks Ended September 7, 2012- February 1, 2013

9/14/12

9/7/12

10/5/12

9/28/12

9/21/12

10/12/12

10/19/12

10/26/12

11/2/12

11/16/12

11/9/12

11/23/12

--

Revenues:

llll_embership Dues Social & Golf

Golf Revenue (greens, cart fees, rental, other)

Golf Shop Sales

2

3

4

5

Food and Beverage

Other Revenue

-$

39,500

11,500 $

34,114

7,500

9,600

90,714

Total Revenues

Cost of Goods: F&B

Food & Beverage Operations

Golf Operations

Golf Course Maintenance

--

Other Amenities/Misc. Expense

General/ Administrative I Management

Utilities, Insurance, POA

Property Taxes

Total Operational Disbursements

r-::-'--~-

Cash Flow Before Capital Expenditures

1,200

4,500

$_

13,625

5,000

8,000

8,626

5,000

4,800

6,585

1,250

4,200

1,965

1,250

4,000

10,000

6,800

26,625

18,426

12,035

7,215

10,000

6,800

(4,000)

(34,059)

(33,886)

(800)

(5,304)

(9,266)

(9,741)

(16,432)

(5,737)

(16,688)

(12,432)

(3,446)

(14,788)

(250)

(6,858)

(10,813)

(800)

(2,577)

(8,783)

(32,659)

(9,750)

(3,446)

(16,688)

(37,715)

(5,615)

(8,671)

(1,000)

(8,041)

(33,886)

(800)

(15,303)

(8,266)

(9,741)

(27,715)

(3,615)

(8,671)

(6,2sii)

(6,858)

(10,813)

(800)

(2,578)

(8,784)

(6,461)

(145,505)

(97,056)

(90,858)

34,639

7,500

9,150

34,114

7,500

9,000

33,939

7,500

10,000

18,125

5,000

8,200

62,!89

51,814

55,939

31,325

14,500

5,000

8,000

27,500

(16,432)

(12,938)

(47,812)

(2,837)

(25,715)

(20,615)

(8,671)

(16,432)

(8,237)

(38,912)

(1,837)

(36,813)

(10,615)

(32,659)

--

--~-

Building Maintenance

Case:12-24882-ABC Doc#:457 Filed:09/17/12

Entered:08/30/12 12:29:46 Page20 of

6

7

8

9

10

11

12

13

Capital Expenditures

Cash Flow From Operations

(26,907) ~4.ooo)

(22,838)

(12,072)

(45,912)

(30,056)

(3,837)

(800)

(36,816)

(21,727)

(5,615)

(9,793)

(40,925)

(41,845)

(182,850)

(120,293)

(135,020)

(6,000)

(36,380)

(30,057)

(800)

(19,727)

(12,793)

(9,741)

(115,498)

(92,136)

(57,504)

(83,206)

(59,559)

(114,180)

(69,556)

(92,136)

(57,504)

(66,000)

(149,206)

(59,559)

(11,000)

(125,180)

(69,556)

14

(77,037)

(26,813)

(3,615)

(6,461)

(431,890)

(499,445)

(62,740)

(69,885)

(42,544)

(64,233)

(58,611)

(487,410)

(55,525)

(59,885)

(35,744)'

(64,233)

(58,611)

(487,410)

(55,525)

(59,885)

(35,744)

Restructuring:

Pre-Petition Interest

DIP Fees

Debtor, legal, Restructuring, & Financial Advisors

UST Fees

Utility Deposits

Capita I Event

Marketing Costs

Principal Payment to DIP Lender and Alpine Bank

Total Restructuring Costs

Total Cash Flow Before DIP

Beginning Cash

Total Cash Flow Before DIP

DIP Interest

DIP Loan Draw

Ending Cash

Printed on 8/21/2012 at 9:28AM

17

23 "$'

_,

15

16

18

19

20

21

24

22

(110,000)

(10,400)

(510,000)

(5,000)

(5,000)

(5,000)

(510,000)

(5,000)

(5,000)

(5,000)

(5,000)

(57,504)

(659,206)

(64,559)

(130,180)

(74,556)

40,000

(57,504)

40,000

(659,206)

40,000

(64,559)

40,000

(74,556)

57,504

40,000

659,206

40,000

64,559

40,000

40,000

(130,180)

(4,954)

135,134

40,000 $

--

(92,136)

40,000

(92,136)

(2,621)

94,757

40,000 $

1 of 2

74,556

40,000 _1_

(110,000)

(5,000)

(5,000)

(5,000)

(120,400)

(5,000)

(5,000)

(69,233)

(179,011)

(492,410)

(60,525)

(59,885)

40,000

(69,233)

40,000

(179,011)

40,000

(492,410)

(8,014)

500,424

40,000 $

40,000

(60,525)

40,000

(59,885)

69,233

40,000

179,011

40,000

60,525

40,000

(110,000)

59,885

40,000

(145,744)

40,000

-~

$

145,744

40,000

DRAFT- Subject to Change

Case:12-24882-ABC Doc#:457 Filed:09/17/12

Entered:09/17/12 14:50:29 Page4 of 4

Case: 12-24882-ABC Doc#:402-2 Filed:OB/30/12

23

Cordillera Golf Club LLC

Entered:OB/30/12 12:29:46 Page21 of

Forecasted Cash Flow Budget

For the Weeks Ended September 7, 2012- February 1, 2013

11/30/12

--------~---

~--

Revenues:

Membership Dues Social & Golf

Golf Revenue (greens, cart fees, rental, other)

2

3

4

5

Golf Shop Sales

Food and Beverage

Other Revenue

Total Revenues

12/21/12

12/28/12

1/4/13

1/11/13

1/18/13

100,000

1/25/13

100,000

Total

2/1/13

100,000

125,000

6,000

10,800

12,000

12,000

12,000

12,000

6,000

6,000

10,800

12,000

12,000

12,000

112,_000

---

481,700

12,000

12,000

12,000

112,000

112,000

137,000

932,982

(22,182)

(3,445)

(14,788)

(35,713)

(3,615)

(10,191)

(6,250)

(3,671)

(5,374)

(800)

(13,933)

(8,841)

(10,191)

__!8~,~~4)

(49,060)

(262,045)

(216,133)

(434,922)

(17,311)

(490,969)

(169,655)

(356,322)

(431,890)

(2,379,246)

6,000

200,232

52,500

198,550

--~----

6

7

8

9

10

11

12

13

Golf Course Maintenance

Other Amenities/Mise_ Expense

General/ Administrative I Management

Building Maintenance

Utilities, Insurance, POA

Property Taxes

Total Operational Disbursements

Capital Expenditures

15

16

18

19

20

21

24

22

(82,206)

(70,439)

(76,137)

(37,715)

(3,615)

(10,191)

(6,250)

(8,581)

(5,374)

(800)

(15,496)

(8,841)

(10,191)

(43,253)

(91,935)

(55,533)

(31,253)

(79,935)

(43,533)

(22,182)

(3,445)

(14,787)

(22,182)

(3,446)

(14,788)

(6,250)

(8,581)

-(7.275)

(25,715)

(3,615)

(32,659)

{800)

(16,396)

(8,841)

(8,671)

--

(102,405) ----~6,814) _

9,595

55,186

22,066

87,941

(1,446,264)

55,186

22,066

87,941

(97,000)

(1,543,264)

- - - - - - i-(70,439)

(76,137)

(31,253)

(79,935)

(43,533)

9,595

(120,000)

(115,000)

-

--

- --

-~500)

""

'17

23

(86,937)

(32,715)

(3,615)

(10,191)

Total Cash Flow Before DIP

-----~---

(76,439)

(20,000)

(102,206)

14

~---~-

(88,206)

(6,250) - (8,581)

(7,275)

(800)

(2,835)

(8,841)

(8,671)

-~-~-'

Cash Flow From Operations

Restructuring:

Pre-Petition Interest

DIP Fees

gebtor, Legal, Restructuring, & Financial Advisors

UST Fees

Utility Deposits

Capital Event

Marketing Costs

Principal Payment to DIP Lender and Alpine Bank

Total Restructuring Costs

(22,182)

--"

(3,446)

(14,788)

(37,715)

(3,615)

(6,461)

(6,250)

(8,581)

(5,375)

(800)

(13,933)

(8,841)

(32,659)

(22,182)

(3,446)

(14,787)

Cash Flow Before Capital Expenditures

Printed on 8/21/2012 at 9:28AM

12/14/12

--

Cost of Goods: F&B

Food & Beverage Operations

Golf Operations

Beginning Cash

Total Cash Flow Before DIP

DIP Interest

DIP Loan Draw

Ending Cash

12/7/12

-----

(965,000)

(16,900)

(30,000)

(102,206)

(70,439)

(76,137)

(151,253)

(79,935)

(43,533)

9,595

55,186

(99,434)

87,941

(2,555,164)

40,000

(102,206)

40,000

(70,439)

(14,927)

85,366

c-o40,000 $

40,000

(76,137)

40,000

(151,253)

40,000

(79,935)

40,000

9,595

49,595

55,186

104,781

(99,434)

5,347

87,941

(18,708)

76,137

40,000

151,253

40,000

79,935

40,000

40,000

(43,533)

(13,988)

57,521

40,000

40,000

(2,555,164)

(63,212)

2,652,955

$ 74,579

102,206

40,000

(120,000)

2 of 2

(1,011,900)

(121,500)

49,595

104,781

5,347

74,579

DRAFT- Subject to Change

Você também pode gostar

- Cordillera Golf Club, LLC Dba The Club at CordilleraDocumento7 páginasCordillera Golf Club, LLC Dba The Club at CordilleraChapter 11 DocketsAinda não há avaliações

- Stamford Water Distribution Replacement ProjectDocumento81 páginasStamford Water Distribution Replacement ProjectChris BrazellAinda não há avaliações

- Interim Order in The Matter of Sunshine Hi-Tech Infracon LimitedDocumento17 páginasInterim Order in The Matter of Sunshine Hi-Tech Infracon LimitedShyam Sunder100% (1)

- Attorneys For Secured Creditor, Capital One, NADocumento9 páginasAttorneys For Secured Creditor, Capital One, NAChapter 11 DocketsAinda não há avaliações

- Erhard V C I R Docket Nos 39473-85, 46712-86, 39532-87, 137-88 1992Documento9 páginasErhard V C I R Docket Nos 39473-85, 46712-86, 39532-87, 137-88 1992Frederick BismarkAinda não há avaliações

- Objections Due: March 5, 2012 at 4:00 P.M. (Prevailing Eastern Time)Documento14 páginasObjections Due: March 5, 2012 at 4:00 P.M. (Prevailing Eastern Time)Chapter 11 DocketsAinda não há avaliações

- Hearing Date: TBD If Necessary Objection Deadline: February 12, 2009 at 4:00 P.MDocumento101 páginasHearing Date: TBD If Necessary Objection Deadline: February 12, 2009 at 4:00 P.MChapter 11 DocketsAinda não há avaliações

- Cordillera Golf Club, LLC Dba The Club at Cordillera, Tax ID / EIN: 27-0331317Documento11 páginasCordillera Golf Club, LLC Dba The Club at Cordillera, Tax ID / EIN: 27-0331317Chapter 11 DocketsAinda não há avaliações

- Cordillera Golf Club, LLC Club at Cordillera,: "Motion") "Debtor")Documento49 páginasCordillera Golf Club, LLC Club at Cordillera,: "Motion") "Debtor")Chapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court For The District of ColoradoDocumento92 páginasUnited States Bankruptcy Court For The District of ColoradoChapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court For The District of DelawareDocumento20 páginasIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court For The District of ColoradoDocumento4 páginasUnited States Bankruptcy Court For The District of ColoradoChapter 11 DocketsAinda não há avaliações

- WWW Ecf Nysb Uscourts GovDocumento3 páginasWWW Ecf Nysb Uscourts GovChapter 11 DocketsAinda não há avaliações

- This Repod Is Be Sebmined Forehl Om Rcoseoity N.isioh,,d by The DebtorDocumento2 páginasThis Repod Is Be Sebmined Forehl Om Rcoseoity N.isioh,,d by The DebtorChapter 11 DocketsAinda não há avaliações

- Journal entries for city general fundDocumento3 páginasJournal entries for city general fundEkta Saraswat VigAinda não há avaliações

- 3424 Carson Street, Suite 350: " Central District of CaliforniaDocumento76 páginas3424 Carson Street, Suite 350: " Central District of CaliforniaChapter 11 DocketsAinda não há avaliações

- Cordillera Golf Club, LLC Dba The Club at CordilleraDocumento26 páginasCordillera Golf Club, LLC Dba The Club at CordilleraChapter 11 DocketsAinda não há avaliações

- In Re:) : Debtors.)Documento24 páginasIn Re:) : Debtors.)Chapter 11 DocketsAinda não há avaliações

- Attorneys For Midland Loan Services, IncDocumento41 páginasAttorneys For Midland Loan Services, IncChapter 11 DocketsAinda não há avaliações

- Blockbuster's Agreement To $290 Million SaleDocumento194 páginasBlockbuster's Agreement To $290 Million SaleDealBookAinda não há avaliações

- Ex Parte Motion For Order Shortening Notice Period andDocumento22 páginasEx Parte Motion For Order Shortening Notice Period andChapter 11 DocketsAinda não há avaliações

- Court Review of BIR Assessment of Bank's FCDU TransactionsDocumento16 páginasCourt Review of BIR Assessment of Bank's FCDU TransactionsAramea BaneraAinda não há avaliações

- In Re:) : Debtors.)Documento9 páginasIn Re:) : Debtors.)Chapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court District of ColoradoDocumento7 páginasUnited States Bankruptcy Court District of ColoradoChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court Southern District of New YorkDocumento88 páginasUnited States Bankruptcy Court Southern District of New YorkandyAinda não há avaliações

- Ch6 SolutionsDocumento9 páginasCh6 SolutionsKiều Thảo AnhAinda não há avaliações

- LM2 2014Documento52 páginasLM2 2014Latisha WalkerAinda não há avaliações

- DW Loan Amendment 4 Fully ExecutedDocumento5 páginasDW Loan Amendment 4 Fully Executeds88831139Ainda não há avaliações

- This Repel Is To Be Sub LSSD Fur .5 Boa .Suuw, Tu 00W.Pr - Sodjy Isui, Suinsd by A. Pest. Us D.BboDocumento2 páginasThis Repel Is To Be Sub LSSD Fur .5 Boa .Suuw, Tu 00W.Pr - Sodjy Isui, Suinsd by A. Pest. Us D.BboChapter 11 DocketsAinda não há avaliações

- Plano Hall Farm Land DealDocumento36 páginasPlano Hall Farm Land DealDallas Morning News Plano BlogAinda não há avaliações

- Best BudgetDocumento31 páginasBest BudgetSyed Muhammad Ali SadiqAinda não há avaliações

- Commissioner of Internal Revenue vs. Burmeister and Wain Scandinavian Contractor Mindanao, Inc. (January 22, 2007)Documento13 páginasCommissioner of Internal Revenue vs. Burmeister and Wain Scandinavian Contractor Mindanao, Inc. (January 22, 2007)Vince LeidoAinda não há avaliações

- A.M. No. P-17-3746Documento6 páginasA.M. No. P-17-3746Sheraina GonzalesAinda não há avaliações

- Filed & Entered: Clerk U.S. Bankruptcy Court Central District of California by Deputy ClerkDocumento7 páginasFiled & Entered: Clerk U.S. Bankruptcy Court Central District of California by Deputy ClerkChapter 11 Dockets100% (1)

- Attorneys For Midland Loan Services, IncDocumento27 páginasAttorneys For Midland Loan Services, IncChapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento4 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- NRE ASE O BK Hapter Elta Roduce Ointly Dministered EbtorDocumento5 páginasNRE ASE O BK Hapter Elta Roduce Ointly Dministered EbtorChapter 11 DocketsAinda não há avaliações

- Public Warehousing Company, K.S.C., A.S.B.C.A. (2016)Documento16 páginasPublic Warehousing Company, K.S.C., A.S.B.C.A. (2016)Scribd Government DocsAinda não há avaliações

- Nunc Pro Tunc To The Petition DateDocumento12 páginasNunc Pro Tunc To The Petition DateChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court Southern District of New YorkDocumento18 páginasUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsAinda não há avaliações

- 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Date: June 10, 2008 Time: 9:30 A.M. in ReDocumento70 páginas1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 Date: June 10, 2008 Time: 9:30 A.M. in ReChapter 11 DocketsAinda não há avaliações

- 2.7.2014 Retiree Committee Expense ClaimDocumento35 páginas2.7.2014 Retiree Committee Expense ClaimWDET 101.9 FMAinda não há avaliações

- I T U S B C F T D O C: N HE Nited Tates Ankruptcy Ourt OR HE Istrict F OloradoDocumento14 páginasI T U S B C F T D O C: N HE Nited Tates Ankruptcy Ourt OR HE Istrict F OloradoChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court District of Delaware: Corporate Montfily Operating ReportDocumento17 páginasUnited States Bankruptcy Court District of Delaware: Corporate Montfily Operating ReportChapter 11 DocketsAinda não há avaliações

- MT760 HSBC PLC LondonDocumento2 páginasMT760 HSBC PLC LondonEdwin W Ng87% (15)

- BUS 251 - Homework SolutionsDocumento46 páginasBUS 251 - Homework SolutionsJerry He0% (2)

- Advance AccountingDocumento16 páginasAdvance AccountingMicro MaxxAinda não há avaliações

- CDC Citizen's Charter PDFDocumento41 páginasCDC Citizen's Charter PDFammendAinda não há avaliações

- Contabilidad de Coberturas - PWCDocumento11 páginasContabilidad de Coberturas - PWCalvaroAinda não há avaliações

- Inre: Chapterll Delta Produce, L.P. CASE NO. 12-50073-LMC Debtors Jointly AdministeredDocumento11 páginasInre: Chapterll Delta Produce, L.P. CASE NO. 12-50073-LMC Debtors Jointly AdministeredChapter 11 DocketsAinda não há avaliações

- Mstrict of Uela Ware: Attached AttachedDocumento11 páginasMstrict of Uela Ware: Attached AttachedChapter 11 DocketsAinda não há avaliações

- Long Arm LC-2-135121020010Documento3 páginasLong Arm LC-2-135121020010yAinda não há avaliações

- Income Tax Savings Declaration Form EngDocumento2 páginasIncome Tax Savings Declaration Form EngDedyTo'tedongAinda não há avaliações

- United States Bankruptcy Court District of New Jersey Caption in Compliance With D.N.J. LBR 9004-1 (B) Cole Schotz P.CDocumento17 páginasUnited States Bankruptcy Court District of New Jersey Caption in Compliance With D.N.J. LBR 9004-1 (B) Cole Schotz P.CAxon eduardo Guerra guzmanAinda não há avaliações

- Balaji Waghmare-2Documento11 páginasBalaji Waghmare-2ca.bandewarAinda não há avaliações

- Bank Reconciliation Solution - Uhuru Sacco LTD V1Documento9 páginasBank Reconciliation Solution - Uhuru Sacco LTD V1Daniel Dayan SabilaAinda não há avaliações

- Small Smiles Bankruptcy DocumentsDocumento340 páginasSmall Smiles Bankruptcy DocumentsGlennKesslerWPAinda não há avaliações

- Objections Due: September 6, 2011 at 4:00 P.M. (Prevailing Eastern Time)Documento27 páginasObjections Due: September 6, 2011 at 4:00 P.M. (Prevailing Eastern Time)Chapter 11 DocketsAinda não há avaliações

- Minutes of Board of Directors Meeting 12 12 2014Documento4 páginasMinutes of Board of Directors Meeting 12 12 2014LightRIAinda não há avaliações

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Documento28 páginasAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsAinda não há avaliações

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Documento69 páginasAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsAinda não há avaliações

- Republic Late Filed Rejection Damages OpinionDocumento13 páginasRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- City Sports GIft Card Claim Priority OpinionDocumento25 páginasCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsAinda não há avaliações

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Documento47 páginasAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsAinda não há avaliações

- PopExpert PetitionDocumento79 páginasPopExpert PetitionChapter 11 DocketsAinda não há avaliações

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Documento38 páginasAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsAinda não há avaliações

- SEC Vs MUSKDocumento23 páginasSEC Vs MUSKZerohedge100% (1)

- Wochos V Tesla OpinionDocumento13 páginasWochos V Tesla OpinionChapter 11 DocketsAinda não há avaliações

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocumento22 páginasUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsAinda não há avaliações

- Zohar 2017 ComplaintDocumento84 páginasZohar 2017 ComplaintChapter 11 DocketsAinda não há avaliações

- Roman Catholic Bishop of Great Falls MTDocumento57 páginasRoman Catholic Bishop of Great Falls MTChapter 11 DocketsAinda não há avaliações

- Energy Future Interest OpinionDocumento38 páginasEnergy Future Interest OpinionChapter 11 DocketsAinda não há avaliações

- National Bank of Anguilla DeclDocumento10 páginasNational Bank of Anguilla DeclChapter 11 DocketsAinda não há avaliações

- Kalobios Pharmaceuticals IncDocumento81 páginasKalobios Pharmaceuticals IncChapter 11 DocketsAinda não há avaliações

- NQ LetterDocumento2 páginasNQ LetterChapter 11 DocketsAinda não há avaliações

- Home JoyDocumento30 páginasHome JoyChapter 11 DocketsAinda não há avaliações

- NQ Letter 1Documento3 páginasNQ Letter 1Chapter 11 DocketsAinda não há avaliações

- Zohar AnswerDocumento18 páginasZohar AnswerChapter 11 DocketsAinda não há avaliações

- Quirky Auction NoticeDocumento2 páginasQuirky Auction NoticeChapter 11 DocketsAinda não há avaliações

- APP CredDocumento7 páginasAPP CredChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocumento4 páginasUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsAinda não há avaliações

- Farb PetitionDocumento12 páginasFarb PetitionChapter 11 DocketsAinda não há avaliações

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocumento5 páginasDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsAinda não há avaliações

- GT Advanced KEIP Denial OpinionDocumento24 páginasGT Advanced KEIP Denial OpinionChapter 11 DocketsAinda não há avaliações

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocumento1 páginaSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsAinda não há avaliações

- APP ResDocumento7 páginasAPP ResChapter 11 DocketsAinda não há avaliações

- Licking River Mining Employment OpinionDocumento22 páginasLicking River Mining Employment OpinionChapter 11 DocketsAinda não há avaliações

- Fletcher Appeal of Disgorgement DenialDocumento21 páginasFletcher Appeal of Disgorgement DenialChapter 11 DocketsAinda não há avaliações

- Kohinoor Chemicals Balance Sheet Analysis 2016-2019Documento37 páginasKohinoor Chemicals Balance Sheet Analysis 2016-2019Sharif KhanAinda não há avaliações

- AFAR QuestionsDocumento6 páginasAFAR QuestionsTerence Jeff TamondongAinda não há avaliações

- Abm 1 - Module Part 1Documento7 páginasAbm 1 - Module Part 1Alvin Ryan CaballeroAinda não há avaliações

- Pinto Pm2 Ch03Documento22 páginasPinto Pm2 Ch03Focus ArthamediaAinda não há avaliações

- AIS ReviewerDocumento20 páginasAIS ReviewerkimmibanezAinda não há avaliações

- Solved Ashley Company Uses A Perpetual Inventory System From The Following PDFDocumento1 páginaSolved Ashley Company Uses A Perpetual Inventory System From The Following PDFAnbu jaromiaAinda não há avaliações

- All About Inflation: Club of Economics and Finance IIT (BHU), VaranasiDocumento16 páginasAll About Inflation: Club of Economics and Finance IIT (BHU), VaranasiShashank_PardhikarAinda não há avaliações

- Maf 630 Chapter 1Documento3 páginasMaf 630 Chapter 1Pablo EkskobaAinda não há avaliações

- Module 13 Regular Deductions 3Documento16 páginasModule 13 Regular Deductions 3Donna Mae FernandezAinda não há avaliações

- Dow's Answer To Rohm & Haas's LawsuitDocumento62 páginasDow's Answer To Rohm & Haas's LawsuitDealBook90% (10)

- Retirement and Dissolution of Firm Class TestDocumento2 páginasRetirement and Dissolution of Firm Class TestHarish RajputAinda não há avaliações

- Guide To Starting A Small BusinessDocumento66 páginasGuide To Starting A Small Businesssandaya100% (2)

- Bu Mba Syllabus Full Time 1 Sem All Subjects PDFDocumento6 páginasBu Mba Syllabus Full Time 1 Sem All Subjects PDFShubham PalAinda não há avaliações

- Capital and Return On CapitalDocumento38 páginasCapital and Return On CapitalThái NguyễnAinda não há avaliações

- Business TaxationDocumento3 páginasBusiness TaxationRaJa50% (2)

- Triveni TurbineDocumento14 páginasTriveni Turbinecanaryhill100% (1)

- A. Background of The StudyDocumento10 páginasA. Background of The StudyRamil dela CruzAinda não há avaliações

- Buying and SellingDocumento19 páginasBuying and SellingNeri SangalangAinda não há avaliações

- Corporate Finance: Topic: Company Analysis "Infosys"Documento6 páginasCorporate Finance: Topic: Company Analysis "Infosys"Anuradha SinghAinda não há avaliações

- Clarkson QuestionsDocumento5 páginasClarkson QuestionssharonulyssesAinda não há avaliações

- Jawaban Soal ExerciseDocumento13 páginasJawaban Soal Exerciseqinthara alfarisiAinda não há avaliações

- Interview Question Senior AuditorDocumento4 páginasInterview Question Senior AuditorSalman LeghariAinda não há avaliações

- Report Audit PT Greenwood Sejahtera TBK 2020Documento100 páginasReport Audit PT Greenwood Sejahtera TBK 2020NYansyahAinda não há avaliações

- Case Incident 1 Motivation Concepts-300713 - 085437Documento3 páginasCase Incident 1 Motivation Concepts-300713 - 085437Azie100% (1)

- TDS CertificateDocumento2 páginasTDS Certificatetauqeer25Ainda não há avaliações

- Benchmarking Cost Savings and Cost Avoidance PDFDocumento41 páginasBenchmarking Cost Savings and Cost Avoidance PDFlsaishankarAinda não há avaliações

- Inherent Powers of The StateDocumento15 páginasInherent Powers of The StateCyris Aquino NgAinda não há avaliações

- 9781337913201.112 Warren Acct28e ch11Documento81 páginas9781337913201.112 Warren Acct28e ch11cielocastanedaAinda não há avaliações

- Government Accounting: (Unified Account Code Structure)Documento13 páginasGovernment Accounting: (Unified Account Code Structure)Mariella AngobAinda não há avaliações