Escolar Documentos

Profissional Documentos

Cultura Documentos

Motion of The Debtors For An Order Authorizing The Debtors To (I) Continue All Insurance Policies and Related Agreements and Honor Related Obligations

Enviado por

Chapter 11 Dockets0 notas0% acharam este documento útil (0 voto)

29 visualizações22 páginasIn re UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE Chapter 11 Case No. 09ELECTROGLAS, INC., et al. Debtors move for an order authorizing The Debtors to continue all Insurance Policies and related agreements. The Debtors respectfully represent as follows: 1 The Debtors are Electroglas, INC. (eIN 77-0336101) and ELECTROGLAS International, Inc.

Descrição original:

Título original

10000002248

Direitos autorais

© Attribution Non-Commercial (BY-NC)

Formatos disponíveis

PDF, TXT ou leia online no Scribd

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoIn re UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE Chapter 11 Case No. 09ELECTROGLAS, INC., et al. Debtors move for an order authorizing The Debtors to continue all Insurance Policies and related agreements. The Debtors respectfully represent as follows: 1 The Debtors are Electroglas, INC. (eIN 77-0336101) and ELECTROGLAS International, Inc.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

0 notas0% acharam este documento útil (0 voto)

29 visualizações22 páginasMotion of The Debtors For An Order Authorizing The Debtors To (I) Continue All Insurance Policies and Related Agreements and Honor Related Obligations

Enviado por

Chapter 11 DocketsIn re UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE Chapter 11 Case No. 09ELECTROGLAS, INC., et al. Debtors move for an order authorizing The Debtors to continue all Insurance Policies and related agreements. The Debtors respectfully represent as follows: 1 The Debtors are Electroglas, INC. (eIN 77-0336101) and ELECTROGLAS International, Inc.

Direitos autorais:

Attribution Non-Commercial (BY-NC)

Formatos disponíveis

Baixe no formato PDF, TXT ou leia online no Scribd

Você está na página 1de 22

In re

UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

Chapter 11

Case No. 09-

ELECTROGLAS, INC., et al.,

1

)

)

)

)

)

(Joint Administration Pending)

Debtors.

MOTION OF THE DEBTORS FOR AN ORDER AUTHORIZING

THE DEBTORS TO (I) CONTINUE ALL INSURANCE POLICIES AND

RELATED AGREEMENTS AND (II) HONOR RELATED OBLIGATIONS

The above-captioned debtors and debtors-in-possession (the "Debtors") hereby

respectfully move (the "Motion") for the entry of an order (the "Order")

2

pursuant to sections

105(a) and 363(b) ofTitle 11 ofthe United States Code (as awarded, the "Bankruptcy Code") to:

(a) maintain and continue to make all postpetition payments (including postpetition fees and

premiums) with respect to the Insurance Policies (as defined below) on an uninterrupted basis;

(b) maintain and continue on an uninterrupted basis the Debtors' prepetition practices with

respect to each policy or contract; (c) pay any prepetition premiums related to the Insurance

Policies to the extent that the Debtors determine, in their sole discretion, that such payment is

necessary to avoid cancellation, default, alteration, assignment, attachment, lapse or any form

of impairment to the coverage, benefits or proceeds provided under the Insurance Policies; and

(d) enter into new policies or bonds or assume existing policies or bonds in the ordinary course

of business pursuant to sections 1 OS( a) and 363(b) of the Bankruptcy Code. In support of the

Motion, the Debtors respectfully represent as follows:

1

The Debtors are Electroglas, Inc. (EIN 77-0336101) and Electroglas International, Inc. (EIN 77-0345011).

2

The proposed fonn of Order is attached to this Motion as Exhibit A.

#!1123803 v2

In re

UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

Chapter 11

ELECTROGLAS, INC., et al.,

1

)

)

)

)

)

)

Case No. 09- (__)

(Joint Administration Pending)

Debtors.

MOTION OF THE DEBTORS FOR AN ORDER AUTHORIZING

THE DEBTORS TO (I) CONTINUE ALL INSURANCE POLICIES AND

RELATED AGREEMENTS AND (II) HONOR RELATED OBLIGATIONS

The above-captioned debtors and debtors-in-possession (the "Debtors") hereby

respectfully move (the "Motion") for the entry of an order (the "Order")

2

pursuant to sections

105(a) and 363(b) of Title 11 ofthe United States Code (as awarded, the "Bankruptcy Code") to:

(a) maintain and continue to make all postpetition payments (including postpetition fees and

premiums) with respect to the Insurance Policies (as defined below) on an uninterrupted basis;

(b) maintain and continue on an uninterrupted basis the Debtors' prepetition practices with

respect to each policy or contract; (c) pay any prepetition premiums related to the Insurance

Policies to the extent that the Debtors determine, in their sole discretion, that such payment is

necessary to avoid cancellation, default, alteration, assignment, attachment, lapse or any form

of impairment to the coverage, benefits or proceeds provided under the Insurance Policies; and

(d) enter into new policies or bonds or assume existing policies or bonds in the ordinary course

of business pursuant to sections 105(a) and 363(b) of the Bankruptcy Code. In support ofthe

Motion, the Debtors respectfully represent as follows:

1

The Debtors are Electroglas, Inc. (EIN 77-0336101) and Electroglas International, Inc. (EIN 77-0345011).

2

The proposed fonn of Order is attached to this Motion as Exhibit A.

#11123803 v2

Jurisdiction, Venue & Statutory Predicate

1. The Bankruptcy Court has jurisdiction over this matter pursuant to 28 U.S.C.

1334(b). Venue is proper pursuant to 28 U.S.C. 1408 and 1409. This matter is a core

proceeding within the meaning of28 U.S.C. 157(b)(2).

2. The statutory predicates for the relief requested in this Motion are sections 1 05(a)

and 363(b) ofthe Bankruptcy Code.

Background

3. On the date hereof, the Debtors each filed a voluntary petition for relief under

Chapter 11 of the Bankruptcy Code. The Debtors continue to operate their businesses and

manage their properties as debtors-in-possession pursuant to sections 11 07(a) and 1108 of the

Bankruptcy Code.

4. No creditors' committee has yet been appointed in these cases. No trustee or

examiner has been appointed.

5. The Debtors supply semiconductor manufacturing test equipment and software to

the global semiconductor industry, and have been in the semiconductor equipment business for

more than 40 years. The Debtors' installed customer base is one of the largest in the industry, as

the Debtors have sold to date more than 16,500 units of one of their core products, the "wafer

prober" (and its related operating system). The Debtors' other major source of revenue comes

from their business of designing, manufacturing, selling and supporting motion control systems

for advanced technologies.

6. A full description of the Debtors' business operations, corporate structures, capital

structures, and reasons for commencing these cases is set forth in full detail in the Affidavit of

Thomas Brunton in Support of Chapter 11 Petitions and First Day Relief, which was filed

#lll23803 v2

2

contemporaneously herewith and which is respectfully incorporated in this Motion by reference.

Additional facts in support of the specific relief sought in this Motion are set forth below.

Relief Requested

7. Pursuant to sections 105(a) and 363(b) ofthe Bankruptcy Code, the Debtors

request authority to: (a) maintain and continue to make all postpetition payments (including

postpetition fees and premiums) with respect to the Insurance Policies on an uninterrupted basis;

(b) maintain and continue on an uninterrupted basis the Debtors' prepetition practices with

respect to each policy or contract; (c) pay any prepetition premiums related to the Insurance

Policies to the extent that the Debtors determine, in their discretion, that such payment is

necessary to avoid cancellation, default, alteration, assignment, attachment, lapse or any form of

impairment to the coverage, benefits or proceeds provided under the Insurance Policies; and

(d) enter into new policies or bonds or assume existing policies or bonds in the ordinary course

of business.

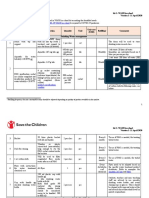

8. In connection with the operation of their businesses, the Debtors maintain

insurance policies (collectively, the "Insurance Policies") through several different insurance

carriers (collectively, the "Insurance Carriers"), which provide coverage for, among other things,

global property, global general liability umbrella, marine cargo, workers compensation,

directors' and officers' liability, crime and fiduciary liability, employers' liability, automobile

liability, electronic data processing, public liability, dental and medical, life or accident and

health. A detailed list of the Debtors' Insurance Policies is attached to this Motion as Exhibit B,

#11123803 v2

3

and it includes the Insurance Carriers, the annual premiums and the expiration dates for each

Insurance Policy.

3

9. The Insurance Policies are critical to the preservation of the Debtors' properties

and assets because, if the Insurance Policies are allowed to lapse without renewal, the Debtors

could be exposed to substantial liability, which could materially affect the Debtors' ability to

complete the sale of all or substantially all assets, reorganize, or liquidate. In many cases, the

insurance coverage is required by regulation, law or contracts that govern the Debtors' business

conduct. Since the Insurance Policies are essential to the Debtors' businesses, it is in the best

interests of the Debtors' estates to permit the Debtors, in their sole discretion, to honor their

obligations under the current insurance contracts.

A. Authority to Pay Insurance Policy Premiums

10. The Debtors seek authorization to pay any prepetition premiums related to the

Insurance Policies to the extent that the Debtors determine, in their sole discretion, that such

payment is necessary to avoid cancellation, default, alteration, assignment, attachment, lapse or

any form of impairment to the coverage, benefits or proceeds provided under the Insurance

Policies.

4

The Debtors are not currently in default on any premium obligations at this time and

seek this authority out of an abundance of caution, in recognition of the critical necessity of

keeping their insurance policies current, and out of concern that, should the Debtors have to

3

The Debtors have made a good-faith effort to identity all of the Debtors' Insurance Policies on Exhibit B. To the

extent that the Debtors identity additional Insurance Policies not listed on the Debtors seek the authority

to continue such Insurance Policies uninterrupted and pay, in the Debtors' discretion, the related insurance

obligations. Upon identifYing Insurance Policies not listed on Exhibit B, the Debtors will promptly file an

amendment to Exhibit Band serve a copy of this Motion and any order approving this Motion on the appropriate

Insurance Carrier. The Debtors request that the order approving this Motion be binding on all Insurance Carriers

and Insurance Policies.

4

The Debtors do not believe that any insurance premiums that became due pre-petition remain unpaid. To the

extent Debtors discover any premium obligations that would constitute a pre-petition claim(s), however, Debtors

request authority to pay same in the ordinary course of business.

#11123803 v2

4

make this type of payment in the future, the passage of time while the Debtors seek and obtain

the Bankruptcy Court's authority for such a payment may have irreversible adverse

consequences for the Debtors' coverage under the Insurance Policies. For instance, a

catastrophic loss during an avoidable lapse in insurance coverage could deplete already limited

estate resources and potentially threaten any proposed sale of assets or prospects for

reorganization, or, in any event, reduce recovery to creditors.

11. Paying the premiums due under the Insurance Policies in the ordinary course of

business will ensure that: (a) the coverage under the Insurance Policies is not interrupted; and

(b) the Debtors are not forced to procure hastily-arranged replacement insurance coverage on

less favorable terms and conditions. Any interruption in insurance coverage would expose the

Debtors to serious risks, including: (v) the possible incurrence of direct liability for the payment

of claims that otherwise would have been payable by the insurance carrier under the Insurance

Policies; (w) the possible incurrence of material costs and other losses that otherwise would have

been reimbursed by the Insurance Carrier under the Insurance Policies; (x) the possible loss of

good-standing certification to conduct business in states that require the Debtors to maintain

certain types and levels of insurance coverage; (y) the possible inability to obtain similar types

and levels of insurance coverage; and (z) the possible incurrence of higher costs for re-

establishing lapsed policies or obtaining new insurance coverage.

B. Authority to Pay Workers' Compensation Deductibles

12. The Debtors are required to maintain workers' compensation liability insurance

under the laws of the states where the Debtors operate. The Debtors have purchased workers'

compensation policies (the "Workers' Compensation Policies"), which are issued by St. Paul

#11123803 v2

5

Fire and Marine and carry estimated annual premiums of approximately $19,873.00. The term of

the Workers' Compensation Policies is one-year and expires on June 1, 2010.

C. Authority to Enter into Additional Insurance Policies

13. Finally, the Debtors seek authority to renew their Insurance Policies or enter into

new Insurance Policies on competitive terms without further Bankruptcy Court approval. These

policies renew at different times throughout the year and the premiums and other amounts due

under them are paid on varying dates as well. This is because the Debtors did not procure the

coverage all at once, and because they pay some of the premiums annually and others monthly.

Unless the Bankruptcy Court grants the authority requested in this Motion, the Debtors may not

be able to renew the Insurance Policies on time and could be forced to pay higher rates or

unnecessarily expend limited estate resources to acquire a new provider. Furthermore, the

Insurance Policies have different renewal rates, which means that without having the relief

requested in this Motion, the Debtors would be forced to appear in the Bankruptcy Court

continuously to renew their Insurance Policies-a procedure that would impose an extraordinary

and unnecessary burden on the Debtors' estates and upon restructuring or sale efforts.

14. The Debtors need to continue their Insurance Policies throughout the duration of

these chapter 11 cases, because the discontinuation of the Insurance Policies could frustrate the

ability of the Debtors to complete a sale of all or substantially all assets, reorganize, or liquidate.

The negotiation and renewal of, and the payment of premiums under, these Insurance Policies

falls squarely within the ordinary course of the Debtors' businesses and, but for the constraints of

section 363 of the Bankruptcy Code, the Debtors would not need the Bankruptcy Court's prior

approval to enter into insurance policies. To reduce the administrative burden of these chapter

11 cases, as well as the expense of operating as debtors in possession, the Debtors seek the

lilll23803v2

6

Bankruptcy Court's authority to renew their Insurance Policies or enter into new Insurance

Policies in their sole discretion.

Basis for Relief

15. Section 363(b)(1) ofthe Bankruptcy Code provides that "[t]he trustee, after notice

and a hearing, may use, sell, or lease, other than in the ordinary course of business, property of

the estate .... " 11 U.S.C. 363(b)(l). Section 105(a) of the Bankruptcy Code provides:

The court may issue any order, process, or judgment that is

necessary or appropriate to carry out the provisions of this title.

No provision of this title providing for the raising of an issue by a

party in interest shall be construed to preclude the court from, sua

sponte, taking any action or making any determination necessary

or appropriate to enforce or implement court orders or rules, or to

prevent an abuse of process.

11 U.S.C. 105(a).

16. Section 105(a) ofthe Bankruptcy Code gives bankruptcy courts broad authority

and discretion to enforce the provisions of the Bankruptcy Code either under specific statutory

authority or under equitable common law principles. In re Ionosphere Clubs, Inc., 98 B.R. 174,

175 (Bankr. S.D.N.Y. 1989) ("The ability of a Bankruptcy Court to authorize the payment of

pre-petition debt when such payment is needed to facilitate the rehabilitation of the debtor is not

a novel concept."). This equitable common law principle "was first articulated by the United

States Supreme Court in Miltenberger v. Logansport, 106 U.S. 286 (1882) and is commonly

referred to as either the 'doctrine of necessity' or the 'necessity of payment' rule." In re

Ionosphere Clubs. Inc., 98 B.R. at 175-76; see also In re Just For Feel, Inc., 242 B.R. 821,

825-26 (D. Del. 1999) (recognizing a court's power to authorize the payment ofprepetition

claims when such payment is "necessary for the Debtor's survival during Chapter 11 ").

17. A bankruptcy court may exercise its equitable power to authorize a debtor to pay

critical prepetition claims, even though that type of payment is not explicitly authorized under

1111123803 v2

7

the Bankruptcy Code, under the doctrine of necessity. See In re The Columbia Gas Sys., Inc.,

136 B.R. 930, 939 (Bankr. D. Del. 1992) (recognizing that where payment of a claim is essential

to the continued operation of the debtor, payment of such claim may be authorized).

18. Here, maintaining continued and uninterrupted insurance coverage under the

favorable terms and conditions provided by the Insurance Policies is in the best interests of the

Debtors, their estate and their creditors because, as described above, the failure to do so could

impact the Debtors' ability to complete a sale of all or substantially all assets, liquidate, or

reorganize.

5

As such, maintaining the coverage requests a sound exercise of the Debtors'

business judgment. Accordingly, the Debtors seek authority to: (a) maintain and continue to

make all postpetition payments (including postpetition fees and premiums) with respect to the

Insurance Policies on an uninterrupted basis; (b) to maintain and continue on an uninterrupted

basis the Debtors' prepetition practices with respect to each policy or contract; (c) pay any

prepetition premiums and deductibles related to the Insurance Policies to the extent that the

Debtors determine, in their discretion, that such payment is necessary to avoid cancellation,

default, alteration, assignment, attachment, lapse or any form of impairment to the coverage,

benefits or proceeds provided under the Insurance Policies; and (d) enter into agreements for

additional insurance policies, bonds or premium financing.

19. The Bankruptcy Court has granted similar relief in other chapter 11 cases. See

e.g., In re Norte! Networks Inc., Case No. 09-10138 (Bankr. D. Del. Jan. 15, 2009); In re PPI

The Debtors do not concede that any Insurance Policy is an executory contract under the Bankruptcy Code.

However, to the extent that any Insurance Policy or any other agreement, policy or contract described in this Motion is

deemed an executory contract within the meaning of section 365 of the Bankruptcy Code, the Debtors are not, at this

time, seeking authority to assume such agreement. Bankruptcy Court authorization of payments will not be deemed to

constitute postpetition assumption or adoption of an Insurance Policy or any other agreement subject to this Motion as

an executory contract pursuant to section 365 of the Bankruptcy Code.

#11123803 v2

8

Holdings, Inc., Case No. 08-13289 (Bankr. D. Del., Dec. 15, 2008); In re Broadstripe, LLC,

Case No. 09-10006 (Bankr. D. Del. Jan. 6, 2009).

20. Pursuant to Bankruptcy Rule 6003(b), " ... a motion to pay all or part of a claim

that arose before the filing of the petition" shall not be granted by the Court within 20 days of the

Petition Date "( e ]xcept to the extent that relief is necessary to avoid immediate and irreparable

harm ... ". FED. R. BANKR. P. 6003(b). For the reasons described herein and in the Brunton

Affidavit, the Debtors submit that the requirements of Bankruptcy Rule 6003 have been met and

that the relief requested in this Motion is necessary to avoid immediate and irreparable harm to

the Debtors and their estates.

Notice

21. Notice ofthis Motion has been provided to: (a) the Office of the United States

Trustee for the District of Delaware; (b) the creditors holding the 20 largest unsecured claims

against the Debtors, as identified in the Debtors' respective chapter 11 petitions; (c) Lovells, 590

Madison Avenue, New York, NY 10022 (Attn: Christopher R. Donoho III, Esq.), counsel to

bondholder group for the 6.25% Convertible Senior Subordinated Secured Notes due 2027; and

(d) the Internal Revenue Service. As this Motion is seeking first day relief, notice of this Motion

and any related Order will be served as required by Local Rule 9013-1 (m). In light of the relief

requested in this Motion, no other or further notice need be provided.

22. This Motion does not contain any novel issues of law requiring briefing.

Therefore, pursuant to Rule 7 .1.2 of the Local Rules of Civil Practice of the United States

District Court for the District of Delaware, as amended from time to time (the "Local District

Court Rules"), as incorporated by reference into Local Rule 1 001-1 (b), the Debtors respectfully

#11123803 v2

9

request that the Bankruptcy Court set aside the briefing schedule set forth in Rule 7 .1.2( a) of the

Local District Court Rules.

No Prior Request

23. No prior motion for the relief requested in this Motion has been made to this or

any other court.

#11123803 v2

10

WHEREFORE, the Debtors respectfully request that the Bankruptcy Court enter an

order, substantially in the form attached to this Motion as Exhibit A, granting the relief requested

in this Motion and such other further relief the Bankruptcy Court deems just and proper.

Dated: July 9, 2009

Wilmington, Delaware

!;11123803 \2

11

Respectfully submitted,

Proposed Attorneys for the Debtors

EXHIBIT A

#11123803 v2

In re

UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

Chapter 11

Case No. 09- (__J

ELECTROGLAS, INC., et al.,

1

)

)

)

)

)

(Joint Administration Pending)

Debtors.

ORDER AUTHORIZING THE DEBTORS TO (I) CONTINUE

ALL INSURANCE POLICIES AND RELATED AGREEMENTS

AND (II) HONOR RELATED OBLIGATIONS

THIS MATTER having come before the Bankruptcy Court upon the Debtors' motion

(the "Motion")

2

for an order authorizing the Debtors to: (a) continue all insurance policies and

related agreements; and (b) honor related obligations, and the Bankruptcy Court having found

that: (a) it has jurisdiction over the matters raised in the Motion pursuant to 28 U.S.C. 157

and 1334(b); (b) this is a core proceeding pursuant to 28 U.S.C. 157(b)(2); (c) venue is lying

pro peri y with the Bankruptcy Court; (d) the relief requested in the Motion is in the best interests

of the Debtors, their estates and their creditors; (e) proper and adequate notice of the Motion and

the hearing has been given and that no other or further notice is necessary; and (f) upon the

record and after due deliberation, good and sufficient cause exists for the granting of the relief as

set forth in this Order; it is hereby

ORDERED, that the Motion is granted in its entirety; and it is further

ORDERED, that the Debtors are authorized, but not directed, to maintain and continue to

make all postpetition payments (including postpetition fees and premiums) with respect to the

Insurance Policies on an uninterrupted basis; and it is further

ORDERED, that the Debtors are authorized, but not directed, to maintain and continue on

1

The Debtors are Electroglas, Inc. (EIN 77-0336101) and Electroglas International, Inc. (EIN 77-0345011).

2

Capitalized terms used but not otherwise defined in this Order shall have the meanings ascribed to them in the

Motion.

#11123803 v2

an uninterrupted basis the Debtors' prepetition practices with respect to each policy or contract;

and it is further

ORDERED, that the Debtors are authorized, but not directed, to pay any prepetition

premiums and deductibles related to the Insurance Policies to the extent that the Debtors

determine, in their discretion, that such payment is necessary to avoid cancellation, default,

alteration, assignment, attachment, lapse or any form of impairment to the coverage, benefits or

proceeds provided under the Insurance Policies, or to avoid any other loss to the estates; and it is

further

ORDERED, that the Debtors are authorized, but not directed, to enter into new policies

or bonds or assume existing policies or bonds in the ordinary course of business; and it is further

ORDERED, that, to the extent that the Insurance Policies, or any related contract or

agreement, are deemed executory contracts, the relief granted by this Order shall not be deemed

an assumption of any contract pursuant to section 365 of the Bankruptcy Code, and all of the

Debtors' rights pursuant to section 365 of the Bankruptcy Code are expressly reserved; and it is

further

ORDERED, that the Debtors, their officers, employees and agents are authorized to take

or refrain from taking such acts as are necessary and appropriate to implement and effectuate the

relief granted in this Order without further order of the Bankruptcy Court; and it is further

ORDERED, that the requirements of Bankruptcy Rule 6003 have been satisfied; and it is

further

ORDERED, that the Bankruptcy Court shall retain jurisdiction over any matters arising

from or related to the implementation or interpretation of this Order.

Dated: July_, 2009

Wilmington, Delaware

iilll23803 v2

UNITED STATES BANKRUPTCY JUDGE

2

EXHIBITB

ny-870958

Schedule 1.2( d)(ii)

Specified Policies

Insurance

Carrier Premium Exoiration Limit

$491.30

C, Employee

Medical

\ Anthem Blue \

OK) spouse $1,028.60 8/1/2008 7/31/2009

$5 million per insured

PPO-CA Cross Employee+

covered expenses) *limit

1132JS (MA)

child(ren) $926.32 8/112008 7/3!12009

per type of procedure

ll32JQ (Other)

I

Employee

family $1,472.79 I 8/l/2008 I 7/3112009

Employee only $479.43 8/1/2008 7/31/2009

Employee

2121 N.

Medical

Anthem Blue 1132JA

spouse $1,003.75 811/2008 7/31/2009

California

$5 million per insured (if

PPO- Out of

Shield

Employee

Blvd, 7th

covered expenses) *limit

CA

child(ren) $903.99 8/112008 7/31/2009

Floor, Walnut

per type of procedure

Employee

Creek, CA

$1,437.20 8/l/2008 7/31/2009

94596

$391.61 8/l/2008 7/3112009

Employee+

Medical

I Anthem Blue I

I

spouse $82!.93 811/2008 7/31/2009 unlimited (if covered

HMO-CA Cross

59Pl2A

Employee+

expenses) *limit per type

child(ren) $741.32 8/l/2008 7/31/2009

of procedure

Employee

$1,174.51 8/1/2008 7/31/2009

Employee only $410.59 8/1/2008 7/31/2009

Employee+

1900 s.

spouse $815.02 8/112008 7/31/2009

Norfolk unlimited (if covered

Medical

I

Kaiser

I I

Street, Suite expenses) *limit per type

HMO

5475-0001 Employee

1 "1 1/

$680.76 8/l/2008 7/31/2009

290, San of procedure

Mateo, CA

Employee+

I

94403

,240.39 8/112008 7/31/2009

#11123803 v2

2

Insurance

Contracts

Dental

Vision

Basic

Life/AD&D

Voluntary

Life/AD&D

Global

Medical

Policy

# lll23803 v2

Insurance

Carrief

CIGNA

Vision Service

Plan

SunLife

ACE USA

3329699

12051846

007-5107-00

007-5107-0 l

GLM N00064877

'-

Coverage

level

Employee only

Employee

spouse

Employee

child(ren)

Employee+

family

Employee only

Employee+

spouse

Employee

child(ren)

Employee

family

Premium

$39.17

$74.90

$129.99

$129.99

'*

$7.05

$12.08

$12.34

$19.89

*Based on

Salary

Employee

Paid

$2,703

3

Address Insurance Limit

811/2008 7/31/2009

One Front

8/l/2008 7/31/2009 Street, 7th

annual'maximum'

Floor, San

8/1/2008 7/31/2009 Francisco, CA

benefit per person

94111

8/l/2008 7/31/2009

8/1/2008 7/31/2009

3333 Quality

811/2008 7/31/2009 Drive,

Rancho

based on usage

8/l/2008 7/31/2009

Cordova, CA

frequency allowance

95670

8/112008 7/3112009

2121 N.

8/l/2008 7/31/2009 Califomia

Blvd, Suite benefit coverage is the

840, Walnut limit

Creek, CA

811/2008 7/3112009

94596

All full time non-United

States salaried employees

who are in Active service.

436 Walnut

Medical expense coverage

Street,

up to $50,000 per person,

8/1/2009 7/31/2010 WA09D,

per occurence. Deductible

Philadelphia,

is $250 per person, per

PA 19106

occurence. Accidental

death &

coverage included, at

$300,000

Insurance

\./; _!

li' :'

. .

2

>

7

contracts Carrier ... ' Polley Number Effective Expiration

_ ..

All U.S. salaried

employees traveling on

behalf of the employer,

436 Walnut

who are in Active

World Class service.

Travel

Street,

Accidental Death &

Protection

ACE USA ADD N01062712 $2,500 8/l/2009 7/31/2010 WA09D,

Dismemberment

Policy

Philadelphia,

coverage is 5 timex

PA 19106

annaul salary or

$500,000, whichever is

Less. Aggregate limit is

$2,500,000 per Accident.

Global

I 00 California

Property

St STE 300

St Paul Fire & San

Policy

Marine

TT094004277 $46,948.00 6/1/2009 5/3l/201-

Francisco, CA

$7,500,000

(Master

Policy)

94111

$1,000,000 Each

I

Occurrence

$I ,000,000 Personal &

Advertising Limit

$1,000,000 Premises

Damage Limit

$2,000,000 General

I 00 California Aggregate

Global Included in St STE 300 $2,000,000

General St Paul Fire &

TT094004277

Global

6/!/2009 5/3112010

San Products/Comp Ops

Liability+ Marine Property Francisco, CA Aggregate

Umbrella Policy 94111 $5,000,000 Tech Errors

& Omissions Limit

$3,000,000 Employee

Benefits Liability

Aggregate

$1,000,000 Hired &

Non-owned autos Limit

$10,000,000 Umbrella

Limit

#Ill 23803 v2

4

Insunuu::e

<::on tracts

International

Package

(Master

Policy)

Marine

Cargo

Domestic &

International

Workers

Compensatio

n (USA)

Directors &

Officers

Primary $5M

Coverage

Directors &

Officers

$5M Side A

DIC

#11123803 v2

Travelers

Continental

Insurance

Travelers

Navigators

Insurance

XL Specialty

Insurance Co.

TT09404279

OC7lll96

WC277Ml54

UB

NY08DOL602033

IV

ELU1730708

Coverage

level Premiunr Effective

$13,723 6/1/2009

$2,500.00 6/1/2009

$19,159.00 6/1/2009

$47,700.00 9/30/2008

$40,500.00 9/30/2008

5

5/3112010

5/31/2010

5/31/2010

9/30/2009

9/30/2009

100 California

St STE 300

San

Francisco, CA

94111

406 Howard

St. #600

San

Francisco, CA

94105

100 California

St STE 300

San

Francisco, CA

94111

One Penn

Plaza, 55th

FL

New York,

NY 10! 19

70 Seaview

Avenue

Stamford, CT

06902

$1 ,000,000 Each

Occurrence

$! ,000,000 Personal &

Advertising Limit

,000,000 Premises

Damage Limit

$2,000,000 General

Aggregate

$2,000,000

Products/Camp Ops

Aggregate

$1 ,000,000 Any one loss

By Accident $1,000,000

Each Accident

By Disease $1,000,000

Each Employee

By Disease $1,000,000

Aggregate

$5,000,000 Aggregate

$5,000,000 Aggregate

"'>' 'i:tc;:/ ,.

Insurance ,

.\ < r.

i; '

I ,. : .."' :,i,

r; Carrier PolicyN r

'

ili'P'

Exuiration

h.J:r..,nran<>.r;> Linlit

1 :t;OlttractS';'

Directors &

4600

Touchton Rd

Officers Carolina

East, Bldg

$5M excess Casualty 1848607 $32,400.00 9/30/2008 9/30/2009 $5,000,000 Aggregate

of$5M Side Insurance Co.

100, Ste 400

ADIC

Jacksonville,

FL 32246

15 Mountain

Crime & Chubb

81736791 $21,349.00 11/1/2008 9/30/2009

ViewRd $3,000,000 Each Claim

Fiduciary Insurance

Warren, New $3,000,000 Aggregate

Jersey 07059

I

UK Head

I

Office

UK

Zurich 054/9LON/60 120

Zurich House,

Employers

Insurance 834/0

1,050 7/1/2008 6/30/2009 Stanhope Rd 10,000,000

Liability

Portsmouth,

Hampshire

POl lDU

UK

2-8 Colmore

Personal

Royal Sun &

89-RKJ900495 717.19 7/1/2008 6/30/2009

Row

Comprehensive

Alliance Birmingham

Auto Policy

B32BT

Master Policy:

100 California

France

St Paul

St STE 300

GL&Emp.

Travelers

TBD $2,750.00 6/1/2008 5/3112010 San Included above

Liab.

Local Policy:

Francisco, CA

COVEA

94111

RISKS

France

Motor

SWISSLIFE nll099532 999.99 l/1/2009 12/3112009

Contingent

Liability

#11!23803 v2

6

Insurance >I' -'";/

. .JJ;,

I

Limit

Contracts 1 ) . Policy Premium

. . >

Address /y '

:'.!

cllUVIl

France

Motor Fleet SWISSLIFE nll09953l 3,659.99 1/l/2009 12/31/2009

Master Policy:

St Paul I 00 California

Taiwan Travelers

No. 1400-

St STE 300

GL I Public Local Policy:

972220038

$2,500.00 6/1/2009 5/3112010 San Included above

Liability South China Francisco, CA

Insurance Co. 94111

Ltd

Master Policy: 2 Rincon

AIG Center

Taiwan Local Policy: 0952- 121 Spear St

Property AIG General 0661001335- $1,500.00 6/l/2009 5/31/2010 5th Floor Included above

Policy Insurance 000000 San

(Taiwan) Co., Francisco, CA

Ltd. 94105

100

Directors &

Constitution

Officers

XL Specialty

TBD

Primary/Run

$185.000.00 9/30/2009 9/30/2015

Plaza;l7

1

h

$15,000,000

Liability

Insurance Co. off Floor;

Hartford CT

06103

100

Directors &

Constitution

Officers

XL Specialty

TBD

Primary/Go-

$34,000.00 9/30/2009 9/30/2015

Plaza;l7

1

h

$3,000,000

Liability

Insurance Co. Forward Floor;

Hartford CT

06103

'

#11123803 v2

7

Você também pode gostar

- 10000001776Documento16 páginas10000001776Chapter 11 DocketsAinda não há avaliações

- Et Al./: (LL) (Ill)Documento32 páginasEt Al./: (LL) (Ill)Chapter 11 DocketsAinda não há avaliações

- Motion of The Debtors For Interim and Final Orders: (I) Prohibiting Utilities From Interrupting Service and (Ii) Determining That The Debtors Provided Adequate Assurance of PaymentDocumento21 páginasMotion of The Debtors For Interim and Final Orders: (I) Prohibiting Utilities From Interrupting Service and (Ii) Determining That The Debtors Provided Adequate Assurance of PaymentChapter 11 DocketsAinda não há avaliações

- 10000024360Documento86 páginas10000024360Chapter 11 DocketsAinda não há avaliações

- Re: Docket Nos. 78, 110, 124Documento4 páginasRe: Docket Nos. 78, 110, 124Chapter 11 DocketsAinda não há avaliações

- Broadview EE MotionDocumento40 páginasBroadview EE MotionChapter 11 DocketsAinda não há avaliações

- Otelco Disclosure StatementDocumento363 páginasOtelco Disclosure StatementChapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento5 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- Premium Finance Agreement An GratingDocumento18 páginasPremium Finance Agreement An GratingChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court Southern District of New YorkDocumento9 páginasUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento5 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- How BK Affects 4closureDocumento21 páginasHow BK Affects 4closureGene Johnson100% (1)

- Requirements For Information To Include in The Combined Plan and Disclosure Statement (Judge Phillip J. Shefferly)Documento10 páginasRequirements For Information To Include in The Combined Plan and Disclosure Statement (Judge Phillip J. Shefferly)jarabboAinda não há avaliações

- Pro Se Movant - Motion For Appointment of Ch. 11 TrusteeDocumento120 páginasPro Se Movant - Motion For Appointment of Ch. 11 TrusteeSAinda não há avaliações

- In Re:) Chapter 11) Collins & Aikman Corporation, Et Al.1) Case No. 05-55927 (SWR) ) (Jointly Administered) Debtors.) ) (Tax Identification #13-3489233) ) ) Honorable Steven W. RhodesDocumento37 páginasIn Re:) Chapter 11) Collins & Aikman Corporation, Et Al.1) Case No. 05-55927 (SWR) ) (Jointly Administered) Debtors.) ) (Tax Identification #13-3489233) ) ) Honorable Steven W. RhodesChapter 11 DocketsAinda não há avaliações

- Et Al.Documento4 páginasEt Al.Chapter 11 DocketsAinda não há avaliações

- Declaration of Daniell. Fitchett in Support of Chapter 11Documento21 páginasDeclaration of Daniell. Fitchett in Support of Chapter 11Chapter 11 DocketsAinda não há avaliações

- (15-00293 258-9) Ex. F Title Ins. Gary MillerDocumento6 páginas(15-00293 258-9) Ex. F Title Ins. Gary Millerlarry-612445Ainda não há avaliações

- Secured Transactions - ZinnickerDocumento97 páginasSecured Transactions - ZinnickerGreg BealAinda não há avaliações

- Capitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Motion. The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Documento10 páginasCapitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Motion. The Last Four Digits of The Debtor's Federal Tax Identification Number Are 3507Chapter 11 DocketsAinda não há avaliações

- Maremont Draft Disclosure As of Jan 2019Documento84 páginasMaremont Draft Disclosure As of Jan 2019Kirk HartleyAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento5 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento7 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- Attorneys For Flextronics Industrial, LTD.: United States Bankruptcy Court For The District of DelawareDocumento9 páginasAttorneys For Flextronics Industrial, LTD.: United States Bankruptcy Court For The District of DelawareChapter 11 DocketsAinda não há avaliações

- Joint Liquidating Second Amended Plan of Fastship, Inc. and Its Subsidiaries Pursuant To Chapter 11 of The United States Bankruptcy Code (The "Plan") Filed On June 27, 2012, PursuantDocumento39 páginasJoint Liquidating Second Amended Plan of Fastship, Inc. and Its Subsidiaries Pursuant To Chapter 11 of The United States Bankruptcy Code (The "Plan") Filed On June 27, 2012, PursuantChapter 11 DocketsAinda não há avaliações

- OriginalDocumento7 páginasOriginalChapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento41 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- Ou"ofu, 2oos: I) MtedDocumento6 páginasOu"ofu, 2oos: I) MtedChapter 11 DocketsAinda não há avaliações

- 10000006242Documento31 páginas10000006242Chapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento38 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- 10000000736Documento94 páginas10000000736Chapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento24 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento5 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- 811-1 Small Smiles Dental Centers Settlement and Release Agreement - File May 6, 2015Documento64 páginas811-1 Small Smiles Dental Centers Settlement and Release Agreement - File May 6, 2015Dentist The MenaceAinda não há avaliações

- United States Bankruptcy Court Southern District of New YorkDocumento6 páginasUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsAinda não há avaliações

- Original: Et AlDocumento3 páginasOriginal: Et AlChapter 11 DocketsAinda não há avaliações

- FTL 108944862v2Documento3 páginasFTL 108944862v2Chapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento27 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- Cash Collateral AgreementDocumento11 páginasCash Collateral AgreementJudge ReinholdAinda não há avaliações

- FTL 108944881v2Documento5 páginasFTL 108944881v2Chapter 11 DocketsAinda não há avaliações

- Consent Order Encore Capital Group, Inc., Midland Funding, LLC, Midland Credit Management, Inc. and Asset Acceptance Capital Corp.Documento63 páginasConsent Order Encore Capital Group, Inc., Midland Funding, LLC, Midland Credit Management, Inc. and Asset Acceptance Capital Corp.Juan Viche100% (1)

- Lawsky Disaster ProtocolDocumento4 páginasLawsky Disaster ProtocolCeleste KatzAinda não há avaliações

- The Debtors Are Electroglas, Inc. ("Electroglas") and Electroglas International, Inc. ("Electroglas International")Documento135 páginasThe Debtors Are Electroglas, Inc. ("Electroglas") and Electroglas International, Inc. ("Electroglas International")Chapter 11 DocketsAinda não há avaliações

- Petition For Declaratory ReliefDocumento5 páginasPetition For Declaratory ReliefLen Harris100% (2)

- Golf LLC ID: Cordillera Club, Dba The Club at Cordillera, Tax EIN: 27-0331317Documento2 páginasGolf LLC ID: Cordillera Club, Dba The Club at Cordillera, Tax EIN: 27-0331317Chapter 11 DocketsAinda não há avaliações

- In Re:) Chapter 11) Collins & Aikman Corporation, Et Al.1) Case No. 05-55927 (SWR) ) (Jointly Administered) Debtors.) ) (Tax Identification #13-3489233) ) ) Honorable Steven W. RhodesDocumento35 páginasIn Re:) Chapter 11) Collins & Aikman Corporation, Et Al.1) Case No. 05-55927 (SWR) ) (Jointly Administered) Debtors.) ) (Tax Identification #13-3489233) ) ) Honorable Steven W. RhodesChapter 11 DocketsAinda não há avaliações

- "Motion") "Debtors") ,: FTL 108944922v1Documento38 páginas"Motion") "Debtors") ,: FTL 108944922v1Chapter 11 DocketsAinda não há avaliações

- PACIFIC EMPLOYERS INSURANCE COMPANY v. ADVANCED CLINICAL EMPLOYMENT STAFFING LLC Complaint For Breach of ContractDocumento12 páginasPACIFIC EMPLOYERS INSURANCE COMPANY v. ADVANCED CLINICAL EMPLOYMENT STAFFING LLC Complaint For Breach of ContractACELitigationWatchAinda não há avaliações

- United States Bankruptcy Court For The District of ColoradoDocumento4 páginasUnited States Bankruptcy Court For The District of ColoradoChapter 11 DocketsAinda não há avaliações

- FDIC v. Ally FinancialDocumento10 páginasFDIC v. Ally FinancialJoseph VillarosaAinda não há avaliações

- Capitalized Terms Not Defined Herein Shall Have The Meaning Ascribed To Such Terms in The Designation Rights OrderDocumento16 páginasCapitalized Terms Not Defined Herein Shall Have The Meaning Ascribed To Such Terms in The Designation Rights OrderChapter 11 DocketsAinda não há avaliações

- R.A. 3765 Truth in Lending Act PDFDocumento5 páginasR.A. 3765 Truth in Lending Act PDFsunthatburns00Ainda não há avaliações

- Cordillera Golf Club, LLC Dba The Club at Cordillera, Tax ID / EIN: 27-0331317Documento11 páginasCordillera Golf Club, LLC Dba The Club at Cordillera, Tax ID / EIN: 27-0331317Chapter 11 DocketsAinda não há avaliações

- United States Court of Appeals, Ninth CircuitDocumento5 páginasUnited States Court of Appeals, Ninth CircuitScribd Government DocsAinda não há avaliações

- Stone Panels Inc Bankruptcy FilingDocumento4 páginasStone Panels Inc Bankruptcy FilingespanolalAinda não há avaliações

- 10000018182Documento665 páginas10000018182Chapter 11 DocketsAinda não há avaliações

- PDFDocumento284 páginasPDFChapter 11 DocketsAinda não há avaliações

- 10000017641Documento507 páginas10000017641Chapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court For The District of DelawareDocumento29 páginasIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsAinda não há avaliações

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Documento38 páginasAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsAinda não há avaliações

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Documento28 páginasAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsAinda não há avaliações

- Wochos V Tesla OpinionDocumento13 páginasWochos V Tesla OpinionChapter 11 DocketsAinda não há avaliações

- SEC Vs MUSKDocumento23 páginasSEC Vs MUSKZerohedge100% (1)

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Documento47 páginasAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsAinda não há avaliações

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Documento69 páginasAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsAinda não há avaliações

- PopExpert PetitionDocumento79 páginasPopExpert PetitionChapter 11 DocketsAinda não há avaliações

- Roman Catholic Bishop of Great Falls MTDocumento57 páginasRoman Catholic Bishop of Great Falls MTChapter 11 DocketsAinda não há avaliações

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocumento22 páginasUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsAinda não há avaliações

- City Sports GIft Card Claim Priority OpinionDocumento25 páginasCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsAinda não há avaliações

- Zohar 2017 ComplaintDocumento84 páginasZohar 2017 ComplaintChapter 11 DocketsAinda não há avaliações

- GT Advanced KEIP Denial OpinionDocumento24 páginasGT Advanced KEIP Denial OpinionChapter 11 DocketsAinda não há avaliações

- Republic Late Filed Rejection Damages OpinionDocumento13 páginasRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- National Bank of Anguilla DeclDocumento10 páginasNational Bank of Anguilla DeclChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocumento4 páginasUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsAinda não há avaliações

- NQ Letter 1Documento3 páginasNQ Letter 1Chapter 11 DocketsAinda não há avaliações

- Energy Future Interest OpinionDocumento38 páginasEnergy Future Interest OpinionChapter 11 DocketsAinda não há avaliações

- Zohar AnswerDocumento18 páginasZohar AnswerChapter 11 DocketsAinda não há avaliações

- Home JoyDocumento30 páginasHome JoyChapter 11 DocketsAinda não há avaliações

- Kalobios Pharmaceuticals IncDocumento81 páginasKalobios Pharmaceuticals IncChapter 11 DocketsAinda não há avaliações

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocumento5 páginasDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsAinda não há avaliações

- APP ResDocumento7 páginasAPP ResChapter 11 DocketsAinda não há avaliações

- APP CredDocumento7 páginasAPP CredChapter 11 DocketsAinda não há avaliações

- NQ LetterDocumento2 páginasNQ LetterChapter 11 DocketsAinda não há avaliações

- Quirky Auction NoticeDocumento2 páginasQuirky Auction NoticeChapter 11 DocketsAinda não há avaliações

- Farb PetitionDocumento12 páginasFarb PetitionChapter 11 DocketsAinda não há avaliações

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocumento1 páginaSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsAinda não há avaliações

- Licking River Mining Employment OpinionDocumento22 páginasLicking River Mining Employment OpinionChapter 11 DocketsAinda não há avaliações

- Fletcher Appeal of Disgorgement DenialDocumento21 páginasFletcher Appeal of Disgorgement DenialChapter 11 DocketsAinda não há avaliações

- CNS Manual Vol III Version 2.0Documento54 páginasCNS Manual Vol III Version 2.0rono9796Ainda não há avaliações

- Unit List MUZAFFARPUR - Feb 18 PDFDocumento28 páginasUnit List MUZAFFARPUR - Feb 18 PDFPawan Kumar100% (1)

- IIBA Academic Membership Info-Sheet 2013Documento1 páginaIIBA Academic Membership Info-Sheet 2013civanusAinda não há avaliações

- Barangay Tanods and The Barangay Peace and OrderDocumento25 páginasBarangay Tanods and The Barangay Peace and OrderKarla Mir74% (42)

- Mathematics 2 First Quarter - Module 5 "Recognizing Money and Counting The Value of Money"Documento6 páginasMathematics 2 First Quarter - Module 5 "Recognizing Money and Counting The Value of Money"Kenneth NuñezAinda não há avaliações

- Ril Competitive AdvantageDocumento7 páginasRil Competitive AdvantageMohitAinda não há avaliações

- Kit 2: Essential COVID-19 WASH in SchoolDocumento8 páginasKit 2: Essential COVID-19 WASH in SchooltamanimoAinda não há avaliações

- ASM INTERNATIONAL Carburizing Microstructures and Properties by Geoffrey ParrishDocumento222 páginasASM INTERNATIONAL Carburizing Microstructures and Properties by Geoffrey ParrishAdheith South NgalamAinda não há avaliações

- Corporation Law Review Test Midterms 2019Documento4 páginasCorporation Law Review Test Midterms 2019Van NessaAinda não há avaliações

- Midterm Exam StatconDocumento4 páginasMidterm Exam Statconlhemnaval100% (4)

- Fire and Life Safety Assessment ReportDocumento5 páginasFire and Life Safety Assessment ReportJune CostalesAinda não há avaliações

- Ucbackup Faq - Commvault: GeneralDocumento8 páginasUcbackup Faq - Commvault: GeneralhherAinda não há avaliações

- AN610 - Using 24lc21Documento9 páginasAN610 - Using 24lc21aurelioewane2022Ainda não há avaliações

- 7933-Article Text-35363-1-10-20230724Documento8 páginas7933-Article Text-35363-1-10-20230724Ridho HidayatAinda não há avaliações

- Tecplot 360 2013 Scripting ManualDocumento306 páginasTecplot 360 2013 Scripting ManualThomas KinseyAinda não há avaliações

- Sem 4 - Minor 2Documento6 páginasSem 4 - Minor 2Shashank Mani TripathiAinda não há avaliações

- Freqinv 3g3fv Ds 01oct2000Documento20 páginasFreqinv 3g3fv Ds 01oct2000Mohd Abu AjajAinda não há avaliações

- Standard Cost EstimatesDocumento12 páginasStandard Cost EstimatesMasroon ẨśầŕAinda não há avaliações

- Solved - in Capital Budgeting, Should The Following Be Ignored, ...Documento3 páginasSolved - in Capital Budgeting, Should The Following Be Ignored, ...rifa hanaAinda não há avaliações

- SVPWM PDFDocumento5 páginasSVPWM PDFmauricetappaAinda não há avaliações

- VRIODocumento3 páginasVRIOJane Apple BulanadiAinda não há avaliações

- Qualifi Level 6 Diploma in Occupational Health and Safety Management Specification October 2019Documento23 páginasQualifi Level 6 Diploma in Occupational Health and Safety Management Specification October 2019Saqlain Siddiquie100% (1)

- Pharaoh TextDocumento143 páginasPharaoh Textanon_31362848Ainda não há avaliações

- Journalism Cover Letter TemplateDocumento6 páginasJournalism Cover Letter Templateafaydebwo100% (2)

- Idmt Curve CalulationDocumento5 páginasIdmt Curve CalulationHimesh NairAinda não há avaliações

- Ground Vibration1Documento15 páginasGround Vibration1MezamMohammedCherifAinda não há avaliações

- Resources and Courses: Moocs (Massive Open Online Courses)Documento8 páginasResources and Courses: Moocs (Massive Open Online Courses)Jump SkillAinda não há avaliações

- Mix Cases UploadDocumento4 páginasMix Cases UploadLu CasAinda não há avaliações

- Sena BrochureDocumento5 páginasSena BrochureNICOLAS GUERRERO ARANGOAinda não há avaliações

- Bs en 1991-1-5 2003 + 2009 Thermal Actions (Unsecured)Documento52 páginasBs en 1991-1-5 2003 + 2009 Thermal Actions (Unsecured)Tan Gui SongAinda não há avaliações