Escolar Documentos

Profissional Documentos

Cultura Documentos

10000019856

Enviado por

Chapter 11 DocketsDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

10000019856

Enviado por

Chapter 11 DocketsDireitos autorais:

Formatos disponíveis

11-22820-rdd

Doc 290

Filed 04/20/12 Entered 04/20/12 16:34:53 Pg 1 of 13

Main Document

HEARING DATE: MAY 8, 2012 HEARING TIME: 10:00 A.M. TARTER KRINSKY & DROGIN LLP Attorneys for The Christian Brothers Institute, et al. Debtors and Debtors-in-Possession 1350 Broadway, 11th Floor New York, New York 10018 (212) 216-8000 Scott S. Markowitz, Esq. Eric H. Horn, Esq. UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ------------------------------------------------------------------- x In re: : : THE CHRISTIAN BROTHERS INSTITUTE, et al. : : Debtors. : ------------------------------------------------------------------- x

Chapter 11 Case No.: 11-22820 (RDD) (Jointly Administered)

DEBTORS MOTION FOR ENTRY OF AN ORDER AUTHORIZING THE DEBTOR TO USE CERTAIN PROCEEDS FROM THE SALE OF THE DEBTORS PROPERTY LOCATED AT 74 WEST 124TH STREET, NEW YORK, NEW YORK TO PAY ORDINARY COURSE OBLIGATIONS TO: THE HONORABLE ROBERT D. DRAIN UNITED STATES BANKRUPTCY JUDGE The Christian Brothers Institute (CBI or the Debtor), debtor and debtor-inpossession herein, hereby moves this Court (the Motion) for entry of an order authorizing the Debtor to use a portion of the proceeds from the sale of the Debtors property located at 74 West 124th Street, New York, New York (the Rice Property), to meet its ordinary course obligations. In support of the Motion, CBI relies, in part, upon the declaration of Brother Vincent McNally, Treasurer of CBI (the McNally Declaration). respectfully states as follows: In further support of the Motion, CBI

{Client/001718/BANK376/00478777.DOC;2 }

11-22820-rdd

Doc 290

Filed 04/20/12 Entered 04/20/12 16:34:53 Pg 2 of 13

Main Document

PRELIMINARY STATEMENT 1. The Debtor is at a watershed moment. In or about May 15, 2012, absent the

ability to access some of the monies from the sale of the Rice Property, the Debtor will be unable to fund its ordinary operating expenses. For instance, the Debtor will be unable to provide sustenance for the Brothers who have taken a vow of poverty and have nothing to live on. Without adequate cash and nowhere to go, these Brothers could end up as wards of the state and the Debtors charitable mission, which has been ongoing for over 100 years, will be jeopardized. 2. By this Motion, the Debtor is seeking access to the unencumbered proceeds

generated from the $13 million sale of the Rice Property.1 Importantly, the Debtor is only seeking approximately $1 million to cover its anticipated cash shortfall over the next six (6) months pending the submission of a plan of reorganization. 3. Without access to this money, the Debtor has no means to continue its charitable

mission, good works and provide basic sustenance to the Brothers. The Debtor submits that this is an ordinary course transaction which typically would not require court approval. However, in order to comport with the amended guidelines adopted by General Order M-383, the Debtor agreed not to use the unencumbered sale proceeds without the Committees consent or further order of this Court.2 4. While the Debtor is hopeful that it will reach an accord with the Committee,

because of the anticipated May 15, 2012 cash-shortfall deadline, time is of the essence and the Debtor is filing this Motion in the event that such an accord is not reached.

1

There is currently approximately $6.83 million remaining from the sale proceeds which is being held in a segregated account. 2 Rather than fighting over the use of the sale proceeds at the sale hearing held in January 2012, the Debtor agreed to hold the sale proceeds pending either an agreement with the Committee or a further order of the Court.

{Client/001718/BANK376/00478777.DOC;2 }

11-22820-rdd

Doc 290

Filed 04/20/12 Entered 04/20/12 16:34:53 Pg 3 of 13

Main Document

5.

Accordingly, for the reasons set forth below, the Debtor respectfully requests that

the Court grant the relief requested herein. JURISDICTION 6. The Court has jurisdiction over this Motion pursuant to 28 U.S.C. 157 and

1334. Venue of this proceeding is proper in this district and before this Court pursuant to 28 U.S.C. 1408 and 1409. This matter is a core proceeding within the meaning of 28 U.S.C. 157(b)(2). 7. The statutory predicate for the relief requested herein is 11 U.S.C. 363(b). The

Debtor additionally relies upon (i) the amended guidelines adopted by General Order M-383 and (ii) this Courts Order pursuant to 11 U.S.C. 105(a) and 363 and Rule 6004 of the Federal Rules of Bankruptcy Procedure (the Bankruptcy Rules) (a) authorizing and approving sale to Harlem Village Academies free and clear of all liens, claims, encumbrances and interests, (b) approving the purchase agreement, and (c) granting related relief, dated January 9, 2012 [Docket No. 200] (the Sale Order). GENERAL BACKGROUND 8. On April 28, 2011 (the Petition Date), CBI and The Christian Brothers of

Ireland, Inc. (CBOI and together with CBI, the Debtors) each commenced their respective Chapter 11 case by filing a voluntary petition for relief under Chapter 11 of Title 11 of the United States Code (the Bankruptcy Code). Pursuant to 1107(a) and 1108 of the

Bankruptcy Code, the Debtors continue to operate as debtors-in-possession. No trustee has been appointed. 9. The Debtors cases were consolidated for administrative purposes only, by order

dated May 2, 2011. Thereafter, by order dated May 18, 2011, the Debtors were authorized to

{Client/001718/BANK376/00478777.DOC;2 }

11-22820-rdd

Doc 290

Filed 04/20/12 Entered 04/20/12 16:34:53 Pg 4 of 13

Main Document

retain Tarter Krinsky & Drogin LLP as bankruptcy counsel. 10. On May 11, 2011, the United States Trustee appointed an Official Committee of

Unsecured Creditors (the Committee). The Committee retained Pachulski Stang Ziehl & Jones LLP as its counsel which was approved by an order of this Court dated July 14, 2011. 11. CBI is a domestic not-for-profit 501(c)(3) corporation organized under

102(a)(5) of the New York Not-for-Profit Corporation Law. CBI was formed in 1906 pursuant to Section 57 of the then existing New York Membership Law. The Not-for-Profit Corporation Law replaced the Membership Law effective September 1, 1970. As a not-for-profit corporation, the assets, and/or income are not distributable to, and do not inure to, the benefit of its directors or officers. CBI depends upon grants and donations to fund a portion of its operating expenses. 12. The cause for the filing of these cases has been extensively detailed in the affidavit

pursuant to Local Bankruptcy Rule 1007-2 filed with the original petitions, and is referred to as if fully set forth herein. In short, the Debtors Chapter 11 cases were filed in an effort to resolve in one forum, an onslaught of litigation and claims asserted by alleged sexual abuse plaintiffs against the Debtors. RELEVANT BACKGROUND A. CBI is Not-for-Profit Entity Focused on Supporting Catholic Education 13. The purpose for which CBI was, and continues to be, formed was to establish,

conduct and support Catholic elementary and secondary schools principally throughout New York State. The focus of their work is on teaching and helping impoverished communities or communities in need, primarily through education. For example, several Brothers teach at All Hallows High School in the Bronx, which is the poorest congressional district in the United States. The Brothers have a substantial presence in Bonita Springs, Florida assisting in the

{Client/001718/BANK376/00478777.DOC;2 }

11-22820-rdd

Doc 290

Filed 04/20/12 Entered 04/20/12 16:34:53 Pg 5 of 13

Main Document

education of migrant farm workers. Brothers have also assisted Operation Helping Hands in rebuilding houses for displaced residents in New Orleans as a result of Hurricane Katrina. Many of the Brothers have full-time teaching positions at educational institutions. B. The Debtors Cash Needs 14. Similar to other not-for-profit organizations, the Debtors ability to continue its

mission and good works is dependent on its ability to fund its operations and its various programs. Because the Brothers take a vow of poverty, a portion of the Debtors funding is also used to support the basic living needs and care of the Brothers many of which are elderly. 15. CBIs cash flow is challenged due to the fact that many of its Brothers are aged

and the difficult economic environment has negatively impacted fundraising and grant giving. Indeed, the Debtor anticipates that funds from grants in the 2013 fiscal year will be substantially less than in prior years. As of the date of this Motion, the Debtors cash position has declined to approximately $258,000. $500,000. C. The Debtors Sale of the Property 16. Understanding the Debtors cash position and going forward needs, prior to the The Debtors monthly operating expenses are approximately

Petition Date, it was determined that the Rice Property should be marketed for sale, where the net proceeds of such sale would enable CBI to continue is charitable mission and good works.3 As described infra, absent use of such funds, the Debtor will be unable to fund its operations come mid-May 2012. 17. As this Court is aware, after a robust marketing process spearheaded by Newmark

The Debtor also intended to utilize a portion of the Rice Property sale proceeds to settle sexual abuse cases pending prior to the Petition Date in Seattle, Washington and Canada.

{Client/001718/BANK376/00478777.DOC;2 }

11-22820-rdd

Doc 290

Filed 04/20/12 Entered 04/20/12 16:34:53 Pg 6 of 13

Main Document

Knight Frank, the Debtor was able to sell the Rice Property for a purchase price of $13 million.4 18. On January 9, 2012, this Court entered the Sale Order approving the sale of the

Rice Property to Harlem Village Academies for a purchase price of $13 million (the Purchase Price). 19. In an effort to comport with the amended guidelines adopted by General Order M-

383, the Debtor agreed to the following language in the Sale Order: [u]nless otherwise agreed to in writing between the Debtor, the Committee and Country Bank, or until otherwise ordered by this Court, all net sale proceeds shall be maintained in a segregated account at a New York money center bank. Sale Order at 5. 20. In early April of this year, the sale of the Rice Property closed and the Purchase

Price was fully funded. With the Committees consent, approximately $5 million owing to Country Bank and certain professional fees were satisfied and the remainder of the sale proceeds (the Segregated Proceeds) were placed in a segregated account at Citibank pursuant to paragraph 5 of the Sale Order.5 It is important to note that the Segregated Proceeds are

unencumbered assets of the Debtor. As noted supra, there is currently approximately $6.83 million is Segregated Proceeds. D. Debtors Negotiation with Committee re: Sale Proceeds 21. Subsequent to the entry of the Sale Order, the Debtor commenced discussion with

the Committee regarding use and application of the sale proceeds from the Rice Property. At the Committees request, during the course of the negotiations, the Debtor provided the Committee

4

It is important to note that the Court has established an August 1, 2012 deadline by which victims of sexual abuse have to file their proofs of claim. Currently, there are only six (6) sexual abuse claims on file, all of which are unliquidated. 5 The Rice Property was encumbered pursuant to a certain mortgage note and related documents between CBI and Country Bank dated as of November 25, 2008 in the principal amount of $5 million.

{Client/001718/BANK376/00478777.DOC;2 }

11-22820-rdd

Doc 290

Filed 04/20/12 Entered 04/20/12 16:34:53 Pg 7 of 13

Main Document

with a budget for the periods of (i) April 1, 2012 through June 30, 2012 (the April-June Budget) and (ii) July 1, 2012 through September 30, 2012 (the July-September Budget and together with the April-June Budget, the Budgets).6 The Budgets provide detail as to the Debtors receivables (including grant monies and monies earned from Brothers teaching) and disbursements (including payroll, administrative costs and Brother support). By way of

example, Saint Josephs is a skilled nursing facility in Westchester County, New York. Certain Brothers requiring assisted living reside there, at a cost of approximately $90,000 per month to the Debtor. 22. As demonstrated in the April-June Budget, the Debtor is projecting a cash The July-September Budget similarly

shortfall of approximately $247,000 for that period.

projects a cash shortfall of approximately $750,000.7 Based on the Debtors current projections, absent access to additional funds, the Debtors will be experience a cash shortfall and will be unable to pay its ordinary operating expenses, such as Brother support and payroll to lay employees as of May 15, 2012. 23. In response to the Debtors Budgets, the Committee informally issued an onerous

request on the Debtor demanding information and documentation relative to certain line items in the Budgets. For instance, the Committee requested that the Debtor provide a 13 week budget (broken down on a weekly basis) as opposed to the 3 month budgets provided. In order to create such a document, the Debtor would have to have its extremely limited financial staff completely rework its financial modeling. Importantly, the line items used and provided in the Budgets are consistent with the Debtors monthly operating reports that have been timely filed in this case

6 7

Copies of the Budgets are attached hereto as Exhibit A. The approximate $500,000 shortfall delta between the two budgets stems mostly from the fact that the Debtor anticipates receiving less in grants than prior years.

{Client/001718/BANK376/00478777.DOC;2 }

11-22820-rdd

Doc 290

Filed 04/20/12 Entered 04/20/12 16:34:53 Pg 8 of 13

Main Document

since inception. Similarly, the Budgets comport with the Debtors internal accounting systems, customarily utilized by not-for-profits, as well as its historical accounting. The Debtor is in the process of converting its funding from a decentralized model to centralized model, similar to CBOIs model. 24. By letter dated April 19, 2012, the Debtor responded to the Committees request.

A copy of the response is annexed hereto as Exhibit B. 25. While the Debtor is continuing to work with the Committee towards reaching an

agreement, because of the soon approaching cash shortfall, the Debtor is filing this Motion for authorization to use the Segregated Proceeds up to an amount sufficient to cover its projected cash shortfall (approximately $1 million) for the six (6) month period covered by the Budgets. While the Debtor is hopeful that it will be able to reach a consensus with the Committee prior to that time, it is filing this Motion in the event that such an accord is not reached. 26. The Debtor stresses that this is a watershed moment and without the funding

requested herein, the Debtor will be unable to fund its operations leaving the Brothers without any sustenance and possibly leaving them wards of the state, and seriously jeopardizing the Debtors good works, which have been a vital part of various communities for decades. RELIEF REQUESTED 27. By this Motion, CBI requests entry of an order authorizing the Debtor to use the

Segregated Proceeds, in an amount not to exceed the projected cash shortfall (approximately $1 million) for the six (6) month period covered by the Budgets, in order to fund the Debtors operations, including provision of sustenance for the Brothers.

{Client/001718/BANK376/00478777.DOC;2 }

11-22820-rdd

Doc 290

Filed 04/20/12 Entered 04/20/12 16:34:53 Pg 9 of 13

Main Document

BASES FOR REQUESTED RELIEF A. Use of Segregated Proceeds Ordinary Course Transaction 28. As noted above and further demonstrated in the Budgets, the Debtor is proposing

to use certain of the Segregated Proceeds to satisfy its cash shortfall needed to fund its programs and to pay ordinary and necessary operating expenses. For instance, as set forth in the Budgets, some of the disbursement line items include payroll, taxes, insurance, administrative costs, program expenses and sustenance for the Brothers. These items are ordinary course obligations which typically would not require court approval. However, in order to comport with the amended guidelines adopted by General Order M-383, the Debtor agreed to insert language in the Sale Order which required the Committees consent or further order of this Court prior to distribution of the Segregated Proceeds. Additionally, the line-item disbursements set forth in the Budgets are consistent with those listed in the monthly operating reports filed in this case. 29. Absent satisfaction of those obligations particularly the support for the Brothers

the Debtor will be unable to continue program funding and worse yet, pay for the basic needs and care of the Brothers. 30. The Debtor simply cannot ignore those obligations and are, in fact, bound by

fiduciary duty to ensure that they are satisfied to the best of its ability. Indeed, as recognized by the New Jersey District Court, officers and directors of a non-profit organization are charged with the fiduciary obligation to act in furtherance of the organizations charitable mission. In re United Healthcare Sys., Inc., Civil Action No. 97-1159, 1997 WL 176574, *5 (D.N.J. March 26, 1997); see also In the Matter of Brethren Care of South Bend, Inc., 98 B.R. 927, 935 (Bankr. N.D. Ind. 1989) (finding that the continuing satisfaction and ongoing beneficial treatment of the residents of the . . . facility is a good business justification for the sale of assets); Manhattan

{Client/001718/BANK376/00478777.DOC;2 }

11-22820-rdd

Doc 290

Filed 04/20/12 Entered 04/20/12 16:34:53 Pg 10 of 13

Main Document

Eye, Ear & Throat Hosp. v. Spitzer, 715 N.Y.S.2d 575, 593 (N.Y. Sup. Ct. 1999) (noting that [i]t is axiomatic that the board of directors is charged with the duty to ensure that the mission of the charitable corporation is carried out); Summers v. Cherokee Children & Family Servs., 112 S.W.3d 486, 504 (Tenn. Ct. App. 2002) (noting that [t]he central purpose of fiduciary duties of officers and directors of not-for-profit corporations is the pursuit of the charitable purpose or public benefit which is the mission of the corporation and to ensure that a corporations resources are used to achieve the corporations purposes) (internal citations omitted). 31. Because the Segregated Proceeds are unencumbered funds, and the proposed

usage for same is without a doubt ordinary course, there is simply no reason for the Committee to hold the monies hostage and as a leverage point. Such is essentially tantamount to a prejudgment attachment without the necessary procedures.8 Accordingly, the Debtor respectfully submits that relief requested herein is more than warranted. B. Use of the Segregated Proceeds is an Exercise of Sound Business Judgment 32. Even if this Court were to find that the Debtors proposed use of the Segregated

Proceeds is outside of the ordinary course, the Debtor would still have the right to use such proceeds pursuant to Bankruptcy Code 363(b)(1). Bankruptcy Code 363(b)(1) provides that [t]he trustee, after notice and a hearing, may use, sell, or lease, other than in the ordinary course of business, property of the estate. 11 U.S.C. 363(b)(1). Although Bankruptcy Code 363(b) does not specify a standard for determining when it is appropriate for a court to authorize the use, sale or lease of property of the estate, courts have required that such use, sale or lease be based

8

This was expressly rejected by the Supreme Court in Grupo Mexicano de Desarrollo, S.A. v. Alliance Bond Fund, 527 U.S. 308, 319, 119 S.Ct. 1961, 1968 (1999) (noting that [i]t is well established . . . that, as a general rule, a creditors bill could be brought only by a creditor who had already obtained a judgment establishing the debt). Here, no such judgment exists. Instead, unliquidated sexual abuse claims are being filed against the estate (there are approximately six (6) on file as of the date hereof).

{Client/001718/BANK376/00478777.DOC;2 }

10

11-22820-rdd

Doc 290

Filed 04/20/12 Entered 04/20/12 16:34:53 Pg 11 of 13

Main Document

upon the sound business judgment of the debtor. See, e.g., In re Ionosphere Clubs, Inc., 98 B.R. 174, 175 (Bankr. S.D.N.Y. 1989) (noting that debtor must articulate some business justification for expending funds outside of ordinary course of business); In re Martin, 91 F.3d 389, 394-95 (3d Cir. 1996) (same); see also In re Simasko Production Co., 47 B.R. 444, 449 (Bankr. D. Colo. 1985 (noting that [b]usiness judgments should be left to the board room and not to this Court); In re Curlew Valley Assocs., 14 B.R. 506, 513-14 (Bankr. D. Utah 1981) (noting that decisions made in good faith on a reasonable basis should not be second guessed). 33. There is more than adequate business justification for the Debtor to use a portion Indeed, if the Debtor is unable to access such funds, it will

of the Segregated Proceeds.

experience a cash shortfall come May 15th and will not be able to make payroll or even provide basic sustenance for Brothers many of which are elderly. Such would open the door to a parade of horribles possibly resulting in the Brothers becoming wards of the state and jeopardizing the Debtors viability to continue its good works. C. Debtors Organization is a Going Concern 34. It is axiomatic that a debtor-in-possession has broad discretion in conducting its

operations. As noted throughout, absent use of the Segregated Proceeds, the Debtor will not have the means to fund its mission and thwart any progress made in this case. Indeed, without use of the proceeds, the Debtor questions whether it will be able to emerge as a viable entity continuing its charitable mission or even continue as a Chapter 11 debtor. That is after all one of the primary objectives of Chapter 11. See NLRB v. Bildisco and Bildisco, 465 U.S. 513, 527, 104 S. Ct. 1188, 1196 (1984) (noting that the policy of Chapter 11 is to permit successful

{Client/001718/BANK376/00478777.DOC;2 }

11

11-22820-rdd

Doc 290

Filed 04/20/12 Entered 04/20/12 16:34:53 Pg 12 of 13

Main Document

rehabilitation of the debtors).9 35. It is important to note, that if the Court authorizes the Debtor to use

approximately $1 million of the Segregated Proceeds to cover the Debtors anticipated cash shortfall, there will still be in excess of $5.8 million of Segregated Proceeds remaining prior to payment of Chapter 11 administrative costs, and it is expected that from other property sales scheduled to close in the next several months, an additional $5 million of unencumbered proceeds should be available. As such, the Debtor submits that access to the Segregated

Proceeds to cover the approximate $1 million shortfall demonstrated in the Budgets is necessary and warranted. NO PRIOR REQUEST 36. Court. NOTICE 37. Notice of this Motion has been given to (i) the United States Trustee for the No previous request for the relief sought herein has been made to this or any other

Southern District of New York; (ii) counsel for the Committee; and (iii) all parties who have filed a notice of appearance pursuant to Bankruptcy Rule 2002 in these cases. In light of the nature of the relief requested herein, the Debtor submits that no other or further notice is required.

It is important to note that in the context of a not-for-profit, courts have held that the absolute priority rule embodied by Bankruptcy Code 1129 does not prevent a not-for-profit debtor from retaining ownership and continuing operations even where senior creditors have not been paid. See, e.g., In re Wabash Valley Power Assn, Inc., 72 F.3d 1305 (7th Cir. 1995). Any argument to the contrary should be rejected by this Court.

{Client/001718/BANK376/00478777.DOC;2 }

12

11-22820-rdd

Doc 290

Filed 04/20/12 Entered 04/20/12 16:34:53 Pg 13 of 13

Main Document

CONCLUSION WHEREFORE, CBI respectfully requests that this Court grant the relief requested herein and such other and further relief as is just and proper. Dated: New York, New York April 20, 2012 TARTER KRINSKY & DROGIN LLP Attorneys for The Christian Brothers Institute, et al. Debtors and Debtors-in-Possession By: /s/ Scott S. Markowitz Scott S. Markowitz Eric H. Horn 1350 Broadway, 11th Floor New York, New York 10018 (212) 216-8000

{Client/001718/BANK376/00478777.DOC;2 }

13

11-22820-rdd

Doc 290-1

Filed 04/20/12 Entered 04/20/12 16:34:53 of Br. Vincent McNally Pg 1 of 2

Declaration

UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK ------------------------------------------------------------------- x In re: : : THE CHRISTIAN BROTHERS INSTITUTE, et al. : : Debtors. : ------------------------------------------------------------------- x

Chapter 11 Case No.: 11-22820 (RDD) (Jointly Administered)

DECLARATION OF BROTHER VINCENT MCNALLY IN SUPPORT OF DEBTORS MOTION FOR ENTRY OF AN ORDER AUTHORIZING THE DEBTORS USE OF A PORTION OF THE PROCEEDS GENERATED BY THE SALE OF PROPERTY LOCATED AT 74 WEST 124TH STREET, NEW YORK, NEW YORK TO PAY ORDINARY COURSE OBLIGATIONS I, Br. Vincent McNally, do hereby declare, under penalty of perjury, as follows: 1. I am the Treasurer for The Christian Brothers Institute (CBI or the Debtor),

and have served in such capacity for the past 9 years. 2. I am authorized to make and submit this declaration (the Declaration) on behalf

of the Debtor in support of the Debtors motion (the Motion) for entry of an order authorizing the Debtor to use a portion of the proceeds from the sale of the Debtors property located at 74 West 124th Street, New York, New York, to pay ordinary course obligations. I have read and agree with the facts and assertions set forth in the Motion. 3. Except as otherwise indicated, all facts set forth in this Declaration are based on

my personal knowledge. If called upon to testify, I can and will testify competently to the facts set forth herein. 4. on hand. 5. In my capacity as the Treasurer for CBI, I participate in financial decisions and In particular, I As of the date of this Declaration, the Debtor has approximately $258,000 in cash

assist in preparation of the monthly operating reports as well as budgets.

{Client/001718/BANK376/00479460.DOCX;1 }

11-22820-rdd

Doc 290-1

Filed 04/20/12 Entered 04/20/12 16:34:53 of Br. Vincent McNally Pg 2 of 2

Declaration

reviewed the budgets prepared by Sara E. Barber, CBIs Director of Finance, and have personal knowledge with respect to same, for the periods of (i) April 1, 2012 through June 30, 2012 (the April-June Budget) and (ii) July 1, 2012 through September 30, 2012 (the July-September Budget, and together with the April-June Budget, the Budgets). The Budgets provide detail as to the Debtors receivables (including grant monies and monies resulting from Brothers teaching) and disbursements (including payroll, administrative costs and Brother support). Copies of the Budgets are attached as Exhibit A to the Motion. 6. As demonstrated in the April-June Budget, the Debtor is projecting a cash

shortfall of approximately $247,000. The July-September Budget similarly projects a cash shortfall of approximately $750,000. The approximate $500,000 in additional cash shortfall for the three month period of July September 2012 (as compared to the April-June Budget) stems mostly from the fact that the Debtor anticipates receiving less grant money than in prior years. 7. Based on the Debtors current projections, absent access to additional funds, the

Debtor will experience a cash shortfall as of May 15, 2012, and will be unable to satisfy its obligations set forth in the Budgets, including, but not limited to, Brother support/sustenance, and other ordinary and necessary operating expenses. I declare under penalty of perjury, pursuant to 28 U.S.C. 1746, that based on my knowledge, information and belief as set forth in this declaration, the foregoing is true and correct. Dated: New Rochelle, New York April 20, 2012 /s/ Vincent McNally Brother Vincent McNally

{Client/001718/BANK376/00479460.DOCX;1 }

11-22820-rdd

Doc 290-2

Filed 04/20/12 Entered 04/20/12 16:34:53 Budgets Pg 1 of 3

Exhibit A -

11-22820-rdd

Doc 290-2

Filed 04/20/12 Entered 04/20/12 16:34:53 Budgets Pg 2 of 3

Exhibit A -

11-22820-rdd

Doc 290-2

Filed 04/20/12 Entered 04/20/12 16:34:53 Budgets Pg 3 of 3

Exhibit A -

11-22820-rdd

Doc 290-3 Filed 04/20/12 Entered 04/20/12 16:34:53 Letter Response to Committee Request Pg 1 of 5

Exhibit B -

11-22820-rdd

Doc 290-3 Filed 04/20/12 Entered 04/20/12 16:34:53 Letter Response to Committee Request Pg 2 of 5

Exhibit B -

11-22820-rdd

Doc 290-3 Filed 04/20/12 Entered 04/20/12 16:34:53 Letter Response to Committee Request Pg 3 of 5

Exhibit B -

11-22820-rdd

Doc 290-3 Filed 04/20/12 Entered 04/20/12 16:34:53 Letter Response to Committee Request Pg 4 of 5

Exhibit B -

11-22820-rdd

Doc 290-3 Filed 04/20/12 Entered 04/20/12 16:34:53 Letter Response to Committee Request Pg 5 of 5

Exhibit B -

Você também pode gostar

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Documento28 páginasAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsAinda não há avaliações

- Wochos V Tesla OpinionDocumento13 páginasWochos V Tesla OpinionChapter 11 DocketsAinda não há avaliações

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Documento47 páginasAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsAinda não há avaliações

- SEC Vs MUSKDocumento23 páginasSEC Vs MUSKZerohedge100% (1)

- Zohar 2017 ComplaintDocumento84 páginasZohar 2017 ComplaintChapter 11 DocketsAinda não há avaliações

- National Bank of Anguilla DeclDocumento10 páginasNational Bank of Anguilla DeclChapter 11 DocketsAinda não há avaliações

- PopExpert PetitionDocumento79 páginasPopExpert PetitionChapter 11 DocketsAinda não há avaliações

- Kalobios Pharmaceuticals IncDocumento81 páginasKalobios Pharmaceuticals IncChapter 11 DocketsAinda não há avaliações

- NQ LetterDocumento2 páginasNQ LetterChapter 11 DocketsAinda não há avaliações

- Energy Future Interest OpinionDocumento38 páginasEnergy Future Interest OpinionChapter 11 DocketsAinda não há avaliações

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocumento5 páginasDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsAinda não há avaliações

- Home JoyDocumento30 páginasHome JoyChapter 11 DocketsAinda não há avaliações

- Zohar AnswerDocumento18 páginasZohar AnswerChapter 11 DocketsAinda não há avaliações

- Quirky Auction NoticeDocumento2 páginasQuirky Auction NoticeChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocumento4 páginasUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Shareholding Pattern of Force MotorsDocumento5 páginasShareholding Pattern of Force MotorsImran KhanAinda não há avaliações

- MetDocumento2 páginasMetTiff DizonAinda não há avaliações

- Munro, Victoria - Hate Crime in The MediaDocumento260 páginasMunro, Victoria - Hate Crime in The MediaMallatAinda não há avaliações

- Flexible Pavement: National Institute of Technology, HamirpurDocumento127 páginasFlexible Pavement: National Institute of Technology, HamirpurArchan ChakrabortyAinda não há avaliações

- Legislative IssuesDocumento323 páginasLegislative IssuesOur CompassAinda não há avaliações

- Nietzsche and The Origins of ChristianityDocumento20 páginasNietzsche and The Origins of ChristianityElianMAinda não há avaliações

- Chapter 5Documento27 páginasChapter 5Devansh GoelAinda não há avaliações

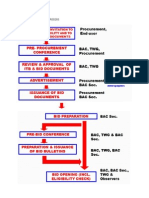

- Bidding Process For Procurement Process and DPWHPDFDocumento9 páginasBidding Process For Procurement Process and DPWHPDFGerardoAinda não há avaliações

- Galt 500Documento2 páginasGalt 500satishAinda não há avaliações

- Lecture 2 Partnership FormationDocumento58 páginasLecture 2 Partnership FormationSherwin Benedict SebastianAinda não há avaliações

- Schlage Price Book July 2013Documento398 páginasSchlage Price Book July 2013Security Lock DistributorsAinda não há avaliações

- Important Tables in Payables ModuleDocumento4 páginasImportant Tables in Payables ModuleunnikallikattuAinda não há avaliações

- PersonsDocumento134 páginasPersonsIkkinAinda não há avaliações

- Kurn Hattin Vermont Senate Hearing Testimony - Bill GorskyDocumento2 páginasKurn Hattin Vermont Senate Hearing Testimony - Bill GorskydocumentapublicaAinda não há avaliações

- HKN MSC - V.24 (Non Well)Documento77 páginasHKN MSC - V.24 (Non Well)أحمد خيرالدين عليAinda não há avaliações

- Bunker HedgingDocumento30 páginasBunker Hedgingukhalanthar100% (6)

- Booking Details Fares and Payment: E-Ticket and Tax Invoice - ExpressDocumento2 páginasBooking Details Fares and Payment: E-Ticket and Tax Invoice - ExpressWidodo MuisAinda não há avaliações

- Labor BreakfastDocumento1 páginaLabor BreakfastSunlight FoundationAinda não há avaliações

- ( (Sig1 Es :signer1:signature) )Documento8 páginas( (Sig1 Es :signer1:signature) )SUNNY SINGHAinda não há avaliações

- BPI Payment ProcedureDocumento2 páginasBPI Payment ProcedureSarina Asuncion Gutierrez100% (1)

- The Role of The Maguindanao SultanateDocumento4 páginasThe Role of The Maguindanao SultanateGeo TemblorAinda não há avaliações

- Laws of Malaysia: Offenders Compulsory Attendance Act 1954Documento12 páginasLaws of Malaysia: Offenders Compulsory Attendance Act 1954Syafiq SulaimanAinda não há avaliações

- Safety Data Sheet: Magnafloc LT25Documento9 páginasSafety Data Sheet: Magnafloc LT25alang_businessAinda não há avaliações

- DiffusionDocumento15 páginasDiffusionRochie DiezAinda não há avaliações

- TERGITOLTM TMN-100X 90% Surfactant PDFDocumento4 páginasTERGITOLTM TMN-100X 90% Surfactant PDFOnesany TecnologiasAinda não há avaliações

- Karnataka Act No. 26 of 2020 The Karnataka Epidemic Diseases Act, 2020Documento9 páginasKarnataka Act No. 26 of 2020 The Karnataka Epidemic Diseases Act, 2020Rajendra PAinda não há avaliações

- The Science of Cop Watching Volume 008Documento433 páginasThe Science of Cop Watching Volume 008fuckoffanddie23579Ainda não há avaliações

- OSG Reply - Republic V SerenoDocumento64 páginasOSG Reply - Republic V SerenoOffice of the Solicitor General - Republic of the Philippines100% (2)

- Santos V NLRC, G.R. No. 115795. March 6, 1998Documento3 páginasSantos V NLRC, G.R. No. 115795. March 6, 1998Bernz Velo Tumaru100% (1)

- Professional Ethics and EtiquetteDocumento14 páginasProfessional Ethics and EtiquetteArunshenbaga ManiAinda não há avaliações