Escolar Documentos

Profissional Documentos

Cultura Documentos

10000026762

Enviado por

Chapter 11 DocketsDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

10000026762

Enviado por

Chapter 11 DocketsDireitos autorais:

Formatos disponíveis

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION IN THE MATTER OF: Collins & Aikman

Corporation, et. al., Bankruptcy Case No. 05-55927 (Jointly Administered) Honorable Steven W. Rhodes Debtors. Chapter 11 / EX-PARTE MOTION FOR ORDER SHORTENING NOTICE PERIOD AND SCHEDULING EXPEDITED HEARING ON: MOTION OF H.P. PELZER AUTOMOTIVE SYSTEMS, INC. PURSUANT TO FEDERAL RULE OF BANKRUPTCY PROCEDURE 3018(a) TO ALLOW CLAIMS FOR PLAN VOTING PURPOSES AND FOR RELIEF FROM AN ORDER PURSUANT TO FEDERAL RULE OF CIVIL PROCEDURE 60(b) NOW COMES H.P. Pelzer Automotive Systems, Inc. ("H.P. Pelzer") by its attorneys, Stevenson & Bullock, P.L.C., and for its Ex-Parte Motion for Order Shortening Notice Period and Scheduling Expedited Hearing its Motion pursuant to Rule 3018(a) of the Federal Rules of Bankruptcy Procedure to allow its claims for the limited purpose of voting on the First Amended Joint Plan of Collins & Aikman Corporation And Its Debtors Subsidiaries (the "Plan") and for relief from an order pursuant to Federal Rule of Civil Procedure 60(b) (the Underlying Motion) and states as follows JURISDICTION 1. 2. 3. This Court has jurisdiction over this matter pursuant to 28 U.S.C. 1334. Venue is proper pursuant 28 U.S.C. 1408 and 1409. The statutory basis for the relief requested herein is F.R.B.P. 9006- 9007 This matter is a core proceeding within the meaning of 28 U.S.C. 157(b)(2).

and L.B.R. 9006-1(b)(E.D.M.). BACKGROUND 4. On May 17, 2005 (the "Filing Date") Debtors filed their voluntary petitions for relief under Chapter 11 of the United States Bankruptcy Code. No trustee or examiner has been appointed in these cases. Previously, the Court entered an order jointly administering these cases pursuant to F.R.Bankr.P. 1015(b).

0W[;'$:

-m

0555927070426000000000013

5.

H.P. Pelzer timely filed a Proof of Claim in the Collins & Aikman

Corporation (Claim No. 5195) and Collins & Aikman Products Co. (Claim No. 7994) cases (collectively, the "Claims"). The Claims asserted secured claims in the amount of $325,814.70. H.P. Pelzer holds rights to, inter alia, setoff and/or recoupment arising from, related to, or in connection with the Claims. 6. 7. On January 26, 2007 the Court entered an Order Approving the Debtors On February 9, 2007 the Court entered an Order Approving Disclosure Motion for Order Approving the Debtors Disclosure Statement and Relief Related Thereto. Statement And Fixing Time For Filing Acceptance Or Rejections Of Plan, Combined With Notice Thereof. This Order provided that the Disclosure Statement that was filed as of January 24, 2007 was approved and established April 9, 2007 as the last day to file written acceptances or rejections of the Plan. 8. Subsequently, on March 30, 2007 the Court entered an Order (A) Extending The Deadline To Vote On And Object To The Debtors' Chapter 11 Plan And (B) Adjourning The Hearing On Confirmation Of Such Plan. This Order extended the deadline to vote on or object to the Plan until May 7, 2007. 9. On Exhibit K to the Motion underlying the Order Approving the Debtors Motion for Order Approving the Debtors Disclosure Statement and Relief Related Thereto, Claim No. 7994 of H.P. Pelzer against Collins & Aikman Products Co. was omitted for voting purposes. See Page 32 of Exhibit K. 10. 11. Currently, there is no pending objection to the Claims. Debtors have informally taken the position that H.P. Pelzer might not have a

fully secured claim. Despite H.P. Pelzers attempt to negotiate an informal resolution of this matter, Debtors did not respond conclusively to H.P. Pelzers requests. Accordingly, H.P. Pelzer has filed this Motion. 12. In accordance with L.B.R. 9006-1(b)(E.D.M.), H.P. Pelzer attempted to conduct a conference with the Debtors to ascertain whether Debtors would contest a shortened notice period and an expedited hearing on the Underlying Motion. 13. Despite attempts at contacting the Debtors' counsel, H.P. Pelzer was unable to conduct a conference.

15.

Contemporaneously with the filing of this Motion, H.P. Pelzer filed the

Underlying Motion. RELIEF REQUESTED 16. H.P. Pelzer requests that, pursuant to F.R.Bankr.P. 9006(c) and L.B.R. 90061(b), the Court shorten the Notice for objecting or otherwise responding to the Underlying Motion to April 30, 2007 at 10:00 a.m., and schedule an expedited hearing to be conducted on April 30, 2007 at 3:00 p.m. The Court has previously scheduled a similar hearing on this date at 2:00 p.m. BASIS FOR RELIEF 17. For the reasons set forth in the Underlying Motion, good and sufficient cause exists to consider the Underlying Motion on an expedited basis. Specifically, the Underlying Motion must be heard prior to the May 7, 2007 voting deadline. 18. Pursuant to F.R.Bankr.P. 9007, the Court has the authority to regulate the time, form and the manner in which, notice shall be given, which includes the authority to determine the appropriate notice for conducting a hearing on the matter as presented by the Underlying Motion. WHEREFORE, H.P. Pelzer respectfully requests the entry of an order shortening the period for objecting or otherwise responding to the Underlying Motion to April 30, 2007 at 10:00 a.m.; and schedule an expedited hearing on the Underlying Motion for April 30, 2007 at 3:00 p.m., and grant such other relief as the Court deems appropriate. Respectfully submitted /s/ Charles D. Bullock (P55550) Stevenson & Bullock, P.L.C. Attorneys for H.P. Pelzer 29200 Southfield Rd., Suite 210 Southfield, MI 48076 (248)423-8200 ext. 224 cbullock@gatecom.com Dated: April 26, 2007

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION IN THE MATTER OF: Collins & Aikman Corporation, et. al., Debtors. / ORDER SHORTENING NOTICE PERIOD AND SCHEDULING EXPEDITED HEARING This matter coming before the Court of the Ex-Parte Motion for Order Shortening Notice Period and Scheduling Expedited Hearing its Motion pursuant to Rule 3018(a) of the Federal Rules of Bankruptcy Procedure to allow its claims for the limited purpose of voting on the First Amended Joint Plan of Collins & Aikman Corporation And Its Debtors Subsidiaries (the "Plan") and for relief from an order pursuant to Federal Rule of Civil Procedure 60(b) (the Underlying Motion). ORDERS THAT: a. b. c. The Motion is GRANTED. That the period for objecting or otherwise responding to the Underlying That an expedited hearing on the Underlying Motion shall be held on April Bankruptcy Case No. 05-55927 (Jointly Administered) Honorable Steven W. Rhodes Chapter 11

Motion is April 30, 2007 at 10:00 a.m.; 30, 2007 at 3:00 p.m.

UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION IN THE MATTER OF: Collins & Aikman Corporation, et. al., Bankruptcy Case No. 05-55927 (Jointly Administered) Honorable Steven W. Rhodes Debtors. Chapter 11 / PROOF OF SERVICE Charles D. Bullock certifies that on the 26th day of April, 2007 a copy of Ex-Parte Motion for Order Shortening Notice Period and Scheduling Expedited Hearing On: MOTION OF H.P. PELZER AUTOMOTIVE SYSTEMS, INC. PURSUANT TO FEDERAL RULE OF BANKRUPTCY PROCEDURE 3018(a) TO ALLOW CLAIMS FOR PLAN VOTING PURPOSES AND FOR RELIEF FROM AN ORDER PURSUANT TO FEDERAL RULE OF CIVIL PROCEDURE 60(b) was served upon the Core Service List, the Rule 2002 Service List, including the following parties in accordance with the First Amended Notice, Case Management and Administrative Procedures, either electronically, via facsimile, or by causing a copy to be deposited via First Class U.S. Mail. I declare that the statement above is true to the best of my information, knowledge and belief. Marian J. Mack Carson Fischer, PLC Office of the United States Trustee Attn: Joseph M. Fischer, Esq. 211 W. Fort Street, Suite 700 4111 Andover Rd. Fl. 2W Detroit, MI 48226 Bloomfield Hills, MI 48302-1924 (Facsimile: (248) 644-1832) Kirkland & Ellis, LLP Paul J. Randel, Esq. Office of the United States Trustee Attn: Richard M. Cieri, Esq. 211 W. Fort Street, Suite 700 Citigroup Center rd Detroit, MI 48226 153 East 53 Street New York, NY 10022 (Facsimile: (212) 446-4900) Kirkland & Ellis, LLP Attn: David L Eaton, Esq. Ray C. Schrock, Esq. Marc J. Carmel, Esq. 200 East Randolph Drive Chicago, IL 60601 (Facsimile: (312) 861-2200) /s/ Charles D. Bullock (P55550) Stevenson & Bullock, P.L.C. 29200 Southfield Rd., Suite 210 Southfield, MI 48076 (248)423-8200 ext. 224 cbullock@gatecom.com

Você também pode gostar

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento19 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court Southern District of New YorkDocumento19 páginasUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento21 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court For The District of DelawareDocumento9 páginasUnited States Bankruptcy Court For The District of DelawareChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court Southern District of New YorkDocumento40 páginasUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento8 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento55 páginasUnited States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- In Re Taumoepeau, 523 F.3d 1213, 10th Cir. (2008)Documento13 páginasIn Re Taumoepeau, 523 F.3d 1213, 10th Cir. (2008)Scribd Government DocsAinda não há avaliações

- United States Bankruptcy Court Southern District of New YorkDocumento24 páginasUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsAinda não há avaliações

- In The Matter of Dca Development Corporation, Debtors. Petition of Franchi Construction Co., Inc., 489 F.2d 43, 1st Cir. (1973)Documento7 páginasIn The Matter of Dca Development Corporation, Debtors. Petition of Franchi Construction Co., Inc., 489 F.2d 43, 1st Cir. (1973)Scribd Government DocsAinda não há avaliações

- Ex Parte Motion For Order Shortening Notice Period andDocumento9 páginasEx Parte Motion For Order Shortening Notice Period andChapter 11 DocketsAinda não há avaliações

- Ex Parte Motion For Order Shortening Notice Period andDocumento22 páginasEx Parte Motion For Order Shortening Notice Period andChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court Southern District of New YorkDocumento75 páginasUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsAinda não há avaliações

- Proposed Counsel To The Debtor and Debtor-in-PossessionDocumento5 páginasProposed Counsel To The Debtor and Debtor-in-PossessionChapter 11 DocketsAinda não há avaliações

- Birbari v. United States, 10th Cir. (2012)Documento9 páginasBirbari v. United States, 10th Cir. (2012)Scribd Government DocsAinda não há avaliações

- United States Bankruptcy Court Southern District of New YorkDocumento39 páginasUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court Southern District of New YorkDocumento15 páginasUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsAinda não há avaliações

- Ex ParteDocumento21 páginasEx ParteChapter 11 DocketsAinda não há avaliações

- In Re: Christine Carter Lynch, Debtor. Christine Carter Lynch v. United States of America, Internal Revenue Service, 430 F.3d 600, 2d Cir. (2005)Documento7 páginasIn Re: Christine Carter Lynch, Debtor. Christine Carter Lynch v. United States of America, Internal Revenue Service, 430 F.3d 600, 2d Cir. (2005)Scribd Government DocsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento20 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- Richard H. Greener, Isb # 1191 Monica R. Morrison, Isb #7346 Greener Burke Shoemaker P.ADocumento5 páginasRichard H. Greener, Isb # 1191 Monica R. Morrison, Isb #7346 Greener Burke Shoemaker P.Afng0312Ainda não há avaliações

- In Re R. Eric Peterson Construction Company, Inc., Debtor. R. Eric Peterson Construction Company, Inc. v. Quintek, Inc., 951 F.2d 1175, 10th Cir. (1991)Documento11 páginasIn Re R. Eric Peterson Construction Company, Inc., Debtor. R. Eric Peterson Construction Company, Inc. v. Quintek, Inc., 951 F.2d 1175, 10th Cir. (1991)Scribd Government DocsAinda não há avaliações

- Filed: Patrick FisherDocumento9 páginasFiled: Patrick FisherScribd Government DocsAinda não há avaliações

- Securities and Exchange Commission v. F. C. Dumaine, JR., Koppers Company, Inc. v. Securities and Exchange Commission, 218 F.2d 308, 1st Cir. (1954)Documento9 páginasSecurities and Exchange Commission v. F. C. Dumaine, JR., Koppers Company, Inc. v. Securities and Exchange Commission, 218 F.2d 308, 1st Cir. (1954)Scribd Government DocsAinda não há avaliações

- Reliable Electric Co., Inc. v. Olson Construction Company, 726 F.2d 620, 10th Cir. (1984)Documento7 páginasReliable Electric Co., Inc. v. Olson Construction Company, 726 F.2d 620, 10th Cir. (1984)Scribd Government DocsAinda não há avaliações

- 10000004873Documento11 páginas10000004873Chapter 11 DocketsAinda não há avaliações

- Peterson v. Saperstein, 10th Cir. (2008)Documento7 páginasPeterson v. Saperstein, 10th Cir. (2008)Scribd Government DocsAinda não há avaliações

- United States Bankruptcy Court Southern District of New YorkDocumento14 páginasUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsAinda não há avaliações

- United States v. Bryan Winfred Smith, 416 F.3d 1350, 11th Cir. (2005)Documento7 páginasUnited States v. Bryan Winfred Smith, 416 F.3d 1350, 11th Cir. (2005)Scribd Government DocsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento14 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- Filed: Patrick FisherDocumento5 páginasFiled: Patrick FisherScribd Government DocsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento9 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- First American Bank & Trust Company v. G. W. Ellwein, Commissioner, Etc., 520 F.2d 1309, 1st Cir. (1975)Documento4 páginasFirst American Bank & Trust Company v. G. W. Ellwein, Commissioner, Etc., 520 F.2d 1309, 1st Cir. (1975)Scribd Government DocsAinda não há avaliações

- United States Court of Appeals, Eighth CircuitDocumento7 páginasUnited States Court of Appeals, Eighth CircuitScribd Government DocsAinda não há avaliações

- United States Bankruptcy Court District of NevadaDocumento17 páginasUnited States Bankruptcy Court District of NevadaNevadaGadflyAinda não há avaliações

- Baby C v. Price, 10th Cir. (2005)Documento8 páginasBaby C v. Price, 10th Cir. (2005)Scribd Government DocsAinda não há avaliações

- Krim Ballentine V., 3rd Cir. (2015)Documento5 páginasKrim Ballentine V., 3rd Cir. (2015)Scribd Government DocsAinda não há avaliações

- Spreitzer v. Woodall, 10th Cir. (2015)Documento13 páginasSpreitzer v. Woodall, 10th Cir. (2015)Scribd Government DocsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento9 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- United States v. Pech-Aboytes, 562 F.3d 1234, 10th Cir. (2009)Documento12 páginasUnited States v. Pech-Aboytes, 562 F.3d 1234, 10th Cir. (2009)Scribd Government DocsAinda não há avaliações

- Related To Docket No. 1713Documento26 páginasRelated To Docket No. 1713Chapter 11 DocketsAinda não há avaliações

- Nichols v. Long Island Lighting Co., 207 F.2d 931, 2d Cir. (1953)Documento5 páginasNichols v. Long Island Lighting Co., 207 F.2d 931, 2d Cir. (1953)Scribd Government DocsAinda não há avaliações

- In Re Savers Federal Savings & Loan Assoc., The Federal Savings and Loan Ins. Corp., 872 F.2d 963, 11th Cir. (1989)Documento5 páginasIn Re Savers Federal Savings & Loan Assoc., The Federal Savings and Loan Ins. Corp., 872 F.2d 963, 11th Cir. (1989)Scribd Government DocsAinda não há avaliações

- Hearing Date: June 3, 2009 at 1:00 P.M. (ET)Documento8 páginasHearing Date: June 3, 2009 at 1:00 P.M. (ET)Chapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court For The District of DelawareDocumento5 páginasIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsAinda não há avaliações

- Order Shortening Notice Period and Scheduling Expedited HearingDocumento2 páginasOrder Shortening Notice Period and Scheduling Expedited HearingChapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento8 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- Maury Rosenberg v. DVI Receivables XIV, LLC, 11th Cir. (2016)Documento21 páginasMaury Rosenberg v. DVI Receivables XIV, LLC, 11th Cir. (2016)Scribd Government DocsAinda não há avaliações

- Director of Revenue, State of Colorado v. United States, 392 F.2d 307, 10th Cir. (1968)Documento8 páginasDirector of Revenue, State of Colorado v. United States, 392 F.2d 307, 10th Cir. (1968)Scribd Government DocsAinda não há avaliações

- United States Bankruptcy Court Southern District of New YorkDocumento24 páginasUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento33 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Ashland Chemical, IncDocumento16 páginasDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Ashland Chemical, IncChapter 11 DocketsAinda não há avaliações

- Hearing Date: November 10, 2010 at 10:00 A.M. (Prevailing Eastern Time) Objection Deadline: November 3, 2010 at 4:00 P.M. (Prevailing Eastern Time)Documento39 páginasHearing Date: November 10, 2010 at 10:00 A.M. (Prevailing Eastern Time) Objection Deadline: November 3, 2010 at 4:00 P.M. (Prevailing Eastern Time)Chapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento9 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento8 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocumento10 páginasIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsAinda não há avaliações

- United States Court of Appeals, Third CircuitDocumento10 páginasUnited States Court of Appeals, Third CircuitScribd Government DocsAinda não há avaliações

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionNo EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionAinda não há avaliações

- Filed: Patrick FisherDocumento8 páginasFiled: Patrick FisherScribd Government DocsAinda não há avaliações

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Documento28 páginasAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsAinda não há avaliações

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Documento69 páginasAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsAinda não há avaliações

- Republic Late Filed Rejection Damages OpinionDocumento13 páginasRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- City Sports GIft Card Claim Priority OpinionDocumento25 páginasCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsAinda não há avaliações

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Documento47 páginasAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsAinda não há avaliações

- PopExpert PetitionDocumento79 páginasPopExpert PetitionChapter 11 DocketsAinda não há avaliações

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Documento38 páginasAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsAinda não há avaliações

- SEC Vs MUSKDocumento23 páginasSEC Vs MUSKZerohedge100% (1)

- Wochos V Tesla OpinionDocumento13 páginasWochos V Tesla OpinionChapter 11 DocketsAinda não há avaliações

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocumento22 páginasUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsAinda não há avaliações

- Zohar 2017 ComplaintDocumento84 páginasZohar 2017 ComplaintChapter 11 DocketsAinda não há avaliações

- Roman Catholic Bishop of Great Falls MTDocumento57 páginasRoman Catholic Bishop of Great Falls MTChapter 11 DocketsAinda não há avaliações

- Energy Future Interest OpinionDocumento38 páginasEnergy Future Interest OpinionChapter 11 DocketsAinda não há avaliações

- National Bank of Anguilla DeclDocumento10 páginasNational Bank of Anguilla DeclChapter 11 DocketsAinda não há avaliações

- Kalobios Pharmaceuticals IncDocumento81 páginasKalobios Pharmaceuticals IncChapter 11 DocketsAinda não há avaliações

- NQ LetterDocumento2 páginasNQ LetterChapter 11 DocketsAinda não há avaliações

- Home JoyDocumento30 páginasHome JoyChapter 11 DocketsAinda não há avaliações

- NQ Letter 1Documento3 páginasNQ Letter 1Chapter 11 DocketsAinda não há avaliações

- Zohar AnswerDocumento18 páginasZohar AnswerChapter 11 DocketsAinda não há avaliações

- Quirky Auction NoticeDocumento2 páginasQuirky Auction NoticeChapter 11 DocketsAinda não há avaliações

- APP CredDocumento7 páginasAPP CredChapter 11 DocketsAinda não há avaliações

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocumento4 páginasUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsAinda não há avaliações

- Farb PetitionDocumento12 páginasFarb PetitionChapter 11 DocketsAinda não há avaliações

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocumento5 páginasDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsAinda não há avaliações

- GT Advanced KEIP Denial OpinionDocumento24 páginasGT Advanced KEIP Denial OpinionChapter 11 DocketsAinda não há avaliações

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocumento1 páginaSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsAinda não há avaliações

- APP ResDocumento7 páginasAPP ResChapter 11 DocketsAinda não há avaliações

- Licking River Mining Employment OpinionDocumento22 páginasLicking River Mining Employment OpinionChapter 11 DocketsAinda não há avaliações

- Fletcher Appeal of Disgorgement DenialDocumento21 páginasFletcher Appeal of Disgorgement DenialChapter 11 DocketsAinda não há avaliações

- Rapport DharaviDocumento23 páginasRapport DharaviUrbanistes du MondeAinda não há avaliações

- Price List PPM TerbaruDocumento7 páginasPrice List PPM TerbaruAvip HidayatAinda não há avaliações

- Joining Instruction 4 Years 22 23Documento11 páginasJoining Instruction 4 Years 22 23Salmini ShamteAinda não há avaliações

- Why Choose Medicine As A CareerDocumento25 páginasWhy Choose Medicine As A CareerVinod KumarAinda não há avaliações

- Paper SizeDocumento22 páginasPaper SizeAlfred Jimmy UchaAinda não há avaliações

- Key Fact Sheet (HBL FreedomAccount) - July 2019 PDFDocumento1 páginaKey Fact Sheet (HBL FreedomAccount) - July 2019 PDFBaD cHaUhDrYAinda não há avaliações

- Returnable Goods Register: STR/4/005 Issue 1 Page1Of1Documento1 páginaReturnable Goods Register: STR/4/005 Issue 1 Page1Of1Zohaib QasimAinda não há avaliações

- Gabinete STS Activity1Documento2 páginasGabinete STS Activity1Anthony GabineteAinda não há avaliações

- Technical Specification of Heat Pumps ElectroluxDocumento9 páginasTechnical Specification of Heat Pumps ElectroluxAnonymous LDJnXeAinda não há avaliações

- BIT 4107 Mobile Application DevelopmentDocumento136 páginasBIT 4107 Mobile Application DevelopmentVictor NyanumbaAinda não há avaliações

- 3d Control Sphere Edge and Face StudyDocumento4 páginas3d Control Sphere Edge and Face Studydjbroussard100% (2)

- EN 12449 CuNi Pipe-2012Documento47 páginasEN 12449 CuNi Pipe-2012DARYONO sudaryonoAinda não há avaliações

- Unr Ece R046Documento74 páginasUnr Ece R046rianteri1125Ainda não há avaliações

- Build A Program Remote Control IR Transmitter Using HT6221Documento2 páginasBuild A Program Remote Control IR Transmitter Using HT6221rudraAinda não há avaliações

- Assignment - Final TestDocumento3 páginasAssignment - Final TestbahilashAinda não há avaliações

- Certification Presently EnrolledDocumento15 páginasCertification Presently EnrolledMaymay AuauAinda não há avaliações

- Copula and Multivariate Dependencies: Eric MarsdenDocumento48 páginasCopula and Multivariate Dependencies: Eric MarsdenJeampierr Jiménez CheroAinda não há avaliações

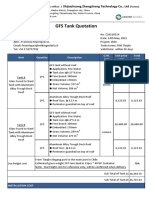

- GFS Tank Quotation C20210514Documento4 páginasGFS Tank Quotation C20210514Francisco ManriquezAinda não há avaliações

- Arta Kelmendi's resume highlighting education and work experienceDocumento2 páginasArta Kelmendi's resume highlighting education and work experienceArta KelmendiAinda não há avaliações

- SiloDocumento7 páginasSiloMayr - GeroldingerAinda não há avaliações

- Ratio Analysis of PIADocumento16 páginasRatio Analysis of PIAMalik Saad Noman100% (5)

- Assembly ModelingDocumento222 páginasAssembly ModelingjdfdfererAinda não há avaliações

- Ecc Part 2Documento25 páginasEcc Part 2Shivansh PundirAinda não há avaliações

- Baobab MenuDocumento4 páginasBaobab Menuperseverence mahlamvanaAinda não há avaliações

- Endangered EcosystemDocumento11 páginasEndangered EcosystemNur SyahirahAinda não há avaliações

- Listening Exercise 1Documento1 páginaListening Exercise 1Ma. Luiggie Teresita PerezAinda não há avaliações

- Extrajudicial Settlement of Estate Rule 74, Section 1 ChecklistDocumento8 páginasExtrajudicial Settlement of Estate Rule 74, Section 1 ChecklistMsyang Ann Corbo DiazAinda não há avaliações

- Ielts Practice Tests: ListeningDocumento19 páginasIelts Practice Tests: ListeningKadek Santiari DewiAinda não há avaliações

- MQC Lab Manual 2021-2022-AutonomyDocumento39 páginasMQC Lab Manual 2021-2022-AutonomyAniket YadavAinda não há avaliações

- Ultra Slimpak G448-0002: Bridge Input Field Configurable IsolatorDocumento4 páginasUltra Slimpak G448-0002: Bridge Input Field Configurable IsolatorVladimirAinda não há avaliações