Escolar Documentos

Profissional Documentos

Cultura Documentos

MF0015 Set 2

Enviado por

vyasravi24Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

MF0015 Set 2

Enviado por

vyasravi24Direitos autorais:

Formatos disponíveis

MF0015 International Financial Management

Assignment Set-2

ASSIGNMENT

SET 2 NAME: RAVI ARUNKUMAR VYAS

ROLL NUMBER: 511134075 COURSE: MBA SEM: IV EX

SPECIALIZATION: FINANCE LEARNING CENTER CODE: 01535 LEARNING CENTER NAME : COMPRO SOFTECH PVT. LTD. SUBJECT: International Financial Management SUBJECT CODE: MF0015 ASSIGNMENT SET NO: SET - 2 SUBMITTED DATE: 24/11/2012 REGULAR

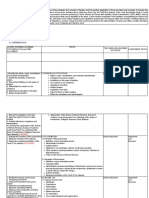

Que.no.

Total

Max. Marks Marks Obtained

10

10

10

10

10

10

60

Signature of Examiner

MF0015 International Financial Management

Assignment Set-2

Q.1 What do you mean by optimum capital structure? What factors affect cost of capital across nations?

Ans:- The objective of capital structure management is to mix the permanent sources of funds in a manner that will maximise the companys common stock price. This will also minimise the firms composite cost of capital. This proper mix of fund sources is referred to as the optimal capital structure. Thus, for each firm, there is a combination of debt, equity and other forms (preferred stock) which maximises the value of the firm while simultaneously minimising the cost of capital. The financial manager is continuously trying to achieve an optimal proportion of debt and equity that will achieve this objective. Cost of Capital across Countries Just like technological or resource differences, there exist differences in the cost of capital across countries. Such differences can be advantageous to MNCs in the following ways: 1. Increased competitive advantage results to the MNC as a result of using low cost capital obtained from international financial markets compared to domestic firms in the foreign country. This, in turn, results in lower costs that can then be translated into higher market shares. 2. MNCs have the ability to adjust international operations to capitalise on cost of capital differences among countries, something not possible for domestic firms. 3. Country differences in the use of debt or equity can be understood and capitalised on by MNCs.

With Lots of Luck 11

We now examine how the costs of each individual source of finance can differ across countries. Country differences in Cost of Debt Before tax cost of debt (Kd) = Rf + Risk Premium This is the prevailing risk free interest rate in the currency borrowed and the risk premium required by creditors. Thus the cost of debt in two countries may differ due to difference in the risk free rate or the risk premium. (a) Differences in risk free rate: Since the risk free rate is a function of supply and demand, any factors affecting the supply and demand will affect the risk free rate. These factors include: Tax laws: Incentives to save may influence the supply of savings and thus the interest rates. The corporate tax laws may also affect interest rates through effects on corporate demand for funds. Demographics: They affect the supply of savings available and the amount of loanable funds demanded depending on the culture and values of a given country. This may affect the interest rates in a country. Monetary policy: It affects interest rates through the supply of loanable funds. Thus a loose monetary policy results in lower interest rates if a low rate of inflation is maintained in the country. Economic conditions: A high expected rate of inflation results in the creditors expecting a high rate of interest which increases the risk free rate. (b) Differences in risk premium: The risk premium on the debt must be large enough to compensate the creditors for the risk of default by the borrowers. The risk varies with the following: Economic conditions: Stable economic conditions result in a low risk of recession. Thus there is a lower probability of default.

MF0015 International Financial Management

Assignment Set-2

Relationships between creditors and corporations: If the relationships are close and the creditors would support the firm in case of financial distress, the risk of illiquidity of the firm is very low. Thus a lower risk premium. Government intervention: If the government is willing to intervene and rescue a firm, the risk of bankruptcy and thus, default is very low, resulting in a low risk premium. Degree of financial leverage: All other factors being the same, highly leveraged firms would have to pay a higher risk premium.

Q.2 What is sub-prime lending? Explain the drivers of sub-prime lending? Explain briefly the different exchange rate regime that is prevalent today.

Ans:- Subprime lending is the practice of extending credit to borrowers with certain credit characteristics e.g. a FICO score of less than 620 that disqualify them from loans at the prime

With Lots of Luck 12

rate (hence the term sub-prime). Sub-prime lending covers different types of credit, including mortgages, auto loans, and credit cards. Since sub-prime borrowers often have poor or limited credit histories, they are typically perceived as riskier than prime borrowers. To compensate for this increased risk, lenders charge sub-prime borrowers a premium. For mortgages and other fixed-term loans, this is usually a higher interest rate; for credit cards, higher over-the-limit or late fees are also common. Despite the higher costs associated with sub-prime lending, it does give access to credit to people who might otherwise be denied. For this reason, sub-prime lending is a common first step toward credit repair; by maintaining a good payment record on their sub-prime loans, borrowers can establish their creditworthiness and eventually refinance their loans at lower, prime rates. Sub-prime lending became popular in the U.S. in the mid-1990s, with outstanding debt increasing from $33 billion in 1993 to $332 billion in 2003. As of December 2007, there was an estimated $1.3 trillion in sub-prime mortgages outstanding.20% of all mortgages originated in 2006 were considered to be sub-prime, a rate unthinkable just ten years ago. This substantial increase is attributable to industry enthusiasm: banks and other lenders discovered that they could make hefty profits from origination fees, bundling mortgages into securities, and selling these securities to investors. These banks and lenders believed that the risks of sub-prime loans could be managed, a belief that was fed by constantly rising home prices and the perceived stability of mortgage-backed securities. However, while this logic may have held for a brief period, the gradual decline of home prices in 2006 led to the possibility of real losses. As home values declined, many borrowers realized that the value of their home was exceeded by the amount they owed on their mortgage. These borrowers began to default on their loans, which drove home prices down further and ruined the value of mortgage-backed securities (forcing companies to take write downs and write-offs because the underlying assets behind the securities were now worth less). This downward cycle created a mortgage market meltdown. The practice of sub-prime lending has widespread ramifications for many companies, with direct impact being on lenders, financial institutions and home-building concerns. In the U.S. Housing Market, property values have plummeted as the market is flooded with homes but bereft of buyers. The crisis has also had a major impact on the economy at large, as lenders are hoarding

MF0015 International Financial Management

Assignment Set-2

cash or investing in stable assets like Treasury securities rather than lending money for business growth and consumer spending; this has led to an overall credit crunch in 2007. The sub-prime crisis has also affected the commercial real estate market, but not as significantly as the residential market as properties used for business purposes have retained their long-term value. The International Monetary Fund estimated that large U.S. and European banks lost more than $1 trillion on toxic assets and from bad loans from January 2007 to September 2009. These losses are expected to top $2.8 trillion from 2007-10. U.S. banks losses were forecast to hit $1 trillion and European bank losses will reach $1.6 trillion. The IMF estimated that U.S. banks were about 60 percent through their losses, but British and euro zone banks only 40 percent. Drivers of sub-prime lending Home price appreciation: Home price appreciation seemed an unstoppable trend from the mid-1990s through to today. This "assumption" that real estate would maintain its value in almost all circumstances provided a comfort level to lenders that offset the risk associated with lending in the sub-prime market. Home prices appeared to be growing at annualized rates of 5-10% from the mid-90s forward. In the event of default, a very large percentage of losses could be recouped through foreclosure as the actual value of the underlying asset (the home) would have since appreciated. Lax lending standards Outstanding mortgages and foreclosure starts in 1Q08, by loan type. The reduced rigor in lending standards can be seen as the product of many of the preceding themes. The increased acceptance of securitized products meant that lending institutions were less likely to actually hold on to the risk, thus reducing their incentive to maintain lending standards. Moreover, increasing appetite from investors not only fueled a boom in the lending industry, which had historically been capital constrained and thus unable to meet demand, but also led to increased investor demand for higher-yielding securities, which could only be created through the additional issuance of sub-prime loans. All of this was further enabled by the long-term home price appreciation trends and altered rating agency treatment, which seemed to indicate risk profiles were much lower than they actually were. As standards fell, lenders began to relax their requirements on key loan metrics. Loan-to-value ratios, an indicator of the amount of collateral backing loans, increased markedly, with many lenders even offering loans for 100% of the collateral value. More dangerously, some banks began lending to customers with little effort made to investigate their credit history or even income. Additionally, many of the largest sub-prime lenders in the recent boom were chartered by state, rather than federal, governments. States often have weaker regulations regarding lending practices and fewer resources with which to police lenders. This allowed banks relatively free rein to issue sub-prime mortgages to questionable borrowers. Adjustable-rate mortgages and interest rates Adjustable-rate mortgages (ARMs) became extremely popular in the U.S. mortgage market, particularly the sub-prime sector, toward the end of the 1990s and through the mid-2000s. Instead of having a fixed interest rate, ARMs feature a variable rate that is linked to current prevailing interest rates. In the recent sub-prime boom, lenders began heavily promoting ARMs as alternatives to traditional fixed-rate mortgages. Additionally, many lenders offered low introductory, or teaser, rates aimed at attracting new borrowers. These teaser rates attracted

MF0015 International Financial Management

Assignment Set-2

droves of sub-prime borrowers, who took out mortgages in record numbers. While ARMs can be beneficial for borrowers if prevailing interest rates fall after the loan origination, rising interest rates can substantially increase both loan rates and monthly payments. In the sub-prime bust, this is precisely what happened. The target federal funds rate (FFR) bottomed out at 1.0% in 2003, but it began hiking steadily upward in 2004. As of mid-2007, the FFR stood at 5.25%, where it had remained for over one year. This 4.25% increase in interest rates over a three-year period left borrowers with steadily rising payments, which many found to be unaffordable. The expiration of teaser rates didnt help either; as these artificially low rates are replaced by rates linked to prevailing interest rates, sub-prime borrowers are seeing their monthly payments jump by as much as 50%, further driving the increasing number of delinquencies and defaults. Between September of 2007 and January 2009, however, the U.S. Federal Reserve slashed rates from 5.25% to 0-.25% in hopes of curbing losses. Though many sub-prime mortgages continue to reset from fixed to floating, rates have fallen so much that in many circumstances the fully indexed reset rate is below the pre-existing fixed rate; thus, a boon for some sub-prime borrowers. The exchange rate is an important price in the economy and some governments like to control it, manage it or influence it. Others prefer to leave the exchange rate to be determined only by market forces. This decision is the choice of exchange rate regime. Many alternative regimes exist: Floating Exchange Rate (Flexible) Regimes: A flexible exchange rate system is one where the value of the currency is not officially fixed but varies according to the supply and demand for the currency in the foreign exchange market. In this system, currencies are allowed to: Appreciate when the currency becomes more valuable relative to others. Depreciate when the currency becomes less valuable relative to others. Fixed Exchange Rate Regimes: A Fixed exchange rate system is one where the value of the currency is set by official government policy. The exchange rate is determined by government actions designed to keep rates the same over time. The currencies are altered by the government: Revaluation Government action to increase the value of domestic currency relative to others. Devaluation Government action to decrease the value of domestic currency. After the transition period of 1971-73, the major currencies started to float. Flexible exchange rates were declared acceptable to the IMF members. Gold was abandoned as an international reserve asset. Since 1973, most major exchange rates have been floating against each other. However, there are countries which have fixed exchange rate regimes.

Q.3 What is covered interest rate arbitrage? Assume spot rate of = $ 1.60 180 day forward rate = $ 1.56 180 day interest rate in U.K. = 4% 180 day U.S interest rate = 3% Is covered interest arbitrage by U.S investor feasible?

MF0015 International Financial Management

Assignment Set-2

Q.4 Explain double taxation avoidance agreement in detail ANS:

Double Taxation Avoidance Agreements Double taxation relief Double taxation means taxation of same income of a person in more than one country. This results due to countries following different rules for income taxation. There are two main rules of income taxation (a) source of income rule and (b) residence rule. As per source of income rule, the income may be subject to tax in the country where the source of such income exists (i.e. where the business establishment is situated or where the asset/property is located) whether the income earner is a resident in that country or not. On the other hand, the income earner may be taxed on the basis of his residential status in that country. For example if a person is resident of a country, he may have to pay tax on any income earned outside that country as well. Further some countries may follow a mixture of the above two rules. Thus problem of double taxation arises if a person is taxed in respect of any income on the basis of source of income rule in one country and on the basis of residence in another country or on the basis of mixture of above two rules. Relief against such hardship can be provided mainly in two ways Bilateral relief Unilateral relief. Bilateral Relief The governments of two countries can enter into agreement to provide relief against double taxation, worked out on the basis of mutual agreement between the two concerned sovereign states. This may be called a scheme of bilateral relief as both concerned powers agree as to the basis of the relief to be granted by either of them. Unilateral Relief The above procedure for granting relief will not be sufficient to meet all cases. No country will be in a position to arrive at such agreement as envisaged above with all the countries of the world for all time. The hardship of the taxpayer, however, is a crippling one in all such cases. Some relief can be provided even in such cases by home country irrespective of whether the other country concerned has any agreement with India or has otherwise provided for any relief at all in respect of such double taxation. This relief is known as unilateral relief. Types of Agreements Agreements can be divided into two main categories: 1. Limited agreements 2. Comprehensive agreements Limited agreements are generally entered into to avoid double taxation relating to income derived from operation of aircraft, ships, carriage of cargo and freight. Comprehensive agreements, on the other hand, are very elaborate documents which lay down in detail how incomes under various heads may be dealt with. Countries with which no agreement exists [section 91] [unilateral relief] If any person who is resident in India in any previous year proves that, in respect of his income which accrued or arose during that previous year outside India (and which is not deemed to accrue or arise in India), he has paid in any country with which there is no agreement under

MF0015 International Financial Management

Assignment Set-2

section 90 for the relief or avoidance of double taxation, income-tax, by deduction or otherwise, under the law in force in that country, he shall be entitled to the deduction from the Indian income-tax payable by him of a sum calculated on such doubly taxed income at the Indian rate of tax or the rate of tax of the said country, whichever is the lower, or at the Indian rate of tax if both the rates are equal. In other words, unilateral relief will be available, if the following conditions are satisfied: 1. The assessee in question must have been resident in the taxable territories. 2. That some income must have accrued or arisen to him outside the taxable territory during the previous year and it should also be received outside India. 3. In respect of that income, the assessee must have paid by deduction or otherwise tax under the law in force in the foreign country in question in which the income outside India has arisen. 4. There should be no reciprocal arrangement for relief or avoidance from double taxation with the country where income has accrued or arisen. India has agreements for avoidance of double taxation with over 60 countries. If all the above conditions are satisfied, such person shall be entitled to deduction from the Indian income-tax payable by him of a sum calculated on such doubly taxed income At the average Indian rate of tax or the average rate of tax of the said country, whichever is the lower, or At the Indian rate of tax if both the rates are equal. Average rate of tax means the tax payable on total income divided by the total income. Steps for calculating relief under this section: Step I: Calculate tax on total income inclusive of the foreign income on which relief is available. Claim relief if available under sections 88, 88B and 88C. Step II: Calculate average rate of tax by dividing the tax computed under Step I with the total income (inclusive of such foreign income). Step III: Calculate average rate of tax of the foreign country by dividing income-tax actually paid in the said country after deduction of all relief due but before deduction of any relief due in the said country in respect of double taxation by the whole amount of the income as assessed in the said country. Step IV: Claim the relief from the tax payable in India at the rate calculated at Step II or Step III whichever is less

Q.5 Explain American depository receipt sponsored programme and unsponsored programme. ANS:

When a company establishes an American Depositary Receipt program, it must decide what exactly it wants out of the program, and how much time, effort and resources they are willing to commit. For this reason, there are different types of programs that a company can choose. ADRs may be sponsored or unsponsored; however, unsponsored ADRs are increasingly rare and cannot be listed on the major American stock exchanges because they are not registered with the SEC, and lack other necessary qualifications. An unsponsored ADR is created by a U.S. investment bank or brokerage that buys the shares in the country where the shares trade, deposits

MF0015 International Financial Management

Assignment Set-2

them in a local bankthe custodian bank, which is often a branch of a U.S. bank, called the depositary bank (aka depository bank). The depositary bank then issues shares that represent an interest in the stocks and handles most of the transactions with the American investors, serving both as transfer agent and registrar for the ADR. The shares of the foreign stock that are held in the custodian bank are called American Depositary Shares (ADS), although this term is sometimes used as a synonym for ADRs. Most often, the company will sponsor the creation of its own ADR, in which case it is a sponsored ADR. There are 3 levels of sponsorship. A Level 1 sponsored ADR is created by the company to extend the market for its securities to this country, but without needing to register with the SEC, or conforming to generally accepted accounting principles (GAAP). Consequently, this ADR can only be traded in the OTC Bulletin Board or Pink Sheets trading systems, usually by institutional investors. These ADRs have more risk, and it is more difficult to compare a Level I ADR with other investments, because of the differences in accounting. Level 2 and Level 3 sponsored ADRs must register with the SEC, and financial statements must be reconciled to generally accepted accounting principles. A Level 2 ADR requires partial compliance with GAAP, while a Level 3 ADR requires complete compliance. A Level 3 sponsorship is required, if the ADR is a primary offering and is used to raise capital for the company. Only Level 2 and Level 3 sponsored ADRs can be listed on the New York Stock Exchange, the American Stock Exchange, or NASDAQ.

Q.6 Explain (a) Parallel Loans (b) Back to- Back loans

Ans;Parallel loan: The forerunner of a swap; a method of raising capital in a foreign country to finance assets there without a cross-border movement of capital. For example, a $US loan would be made to an Australian company to finance its factory in the US; at the same time the US party which made the loan would borrow $A in Australia from the Australian company's parent to finance a project in Australia. Parallel loans enjoyed considerable popularity in the 1970s in the UK when they were frequently used to circumvent strict exchange controls. Back-to-back loan: A Back-to-back loan is a loan agreement between entities in two countries in which the currencies remain separate but the maturity dates remain fixed. The gross interest rates of the loan are separate as well and are set on the basis of the commercial rates in place when the agreement is signed. Most back-to-back loans come due within 10 years, due to their inherent risks. Initiated as a way of avoiding currency regulations, the practice had, by the mid-1990s, largely been replaced by currency swaps.

Você também pode gostar

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Pepsi Cola Bottling Company Vs Municipality of TanauanDocumento1 páginaPepsi Cola Bottling Company Vs Municipality of TanauanAlfonso Miguel LopezAinda não há avaliações

- Taxation 1Documento17 páginasTaxation 1Michelle Valdez Alvaro100% (1)

- Slides On Taxes and Corporate Decision MakingDocumento21 páginasSlides On Taxes and Corporate Decision Makingyebegashet100% (1)

- FinalDocumento1.200 páginasFinalRahulAinda não há avaliações

- Slides International Taxation 1Documento19 páginasSlides International Taxation 1yebegashetAinda não há avaliações

- Taxation I Cases: Taxation Vis-À-Vis TaxDocumento9 páginasTaxation I Cases: Taxation Vis-À-Vis TaxKitel YbañezAinda não há avaliações

- CIR vs. S.C. Johnson and Sons, Inc., GR No. 127105 Dated June 25, 1999Documento13 páginasCIR vs. S.C. Johnson and Sons, Inc., GR No. 127105 Dated June 25, 1999Abbey Agno PerezAinda não há avaliações

- Acco 2033 Income TaxationDocumento284 páginasAcco 2033 Income TaxationRita Daniela100% (1)

- Basic Principles - Taxn01bDocumento28 páginasBasic Principles - Taxn01bJericho PedragosaAinda não há avaliações

- Chapter 1 - Introduction To TaxationDocumento43 páginasChapter 1 - Introduction To TaxationGladysAinda não há avaliações

- Taxation Law Society 2012 Taxation Law Multiple Choice QuestionsDocumento8 páginasTaxation Law Society 2012 Taxation Law Multiple Choice QuestionsEubs Cape-onAinda não há avaliações

- TDS On Sale of Property by NRI in 2022 Complete GuideDocumento7 páginasTDS On Sale of Property by NRI in 2022 Complete Guideoffice201 207Ainda não há avaliações

- Topic: Tax On Non-Resident and Double Taxation AgreementDocumento23 páginasTopic: Tax On Non-Resident and Double Taxation AgreementpuvillanAinda não há avaliações

- Case Doctrines Tax 2Documento22 páginasCase Doctrines Tax 2NingClaudioAinda não há avaliações

- Deutsche Bank AG Manila Branch Versus Commissioner of Internal RevenueDocumento1 páginaDeutsche Bank AG Manila Branch Versus Commissioner of Internal RevenueCheng AyaAinda não há avaliações

- DTC Agreement Between United Arab Emirates and PhilippinesDocumento26 páginasDTC Agreement Between United Arab Emirates and PhilippinesOECD: Organisation for Economic Co-operation and Development100% (1)

- Expats Working in IndiaDocumento17 páginasExpats Working in IndiaPratap ReddyAinda não há avaliações

- Sound Tax System, Inherent Limitations of Taxation, Situs of Taxation and Double TaxationDocumento6 páginasSound Tax System, Inherent Limitations of Taxation, Situs of Taxation and Double TaxationJohn Emmanuel TulayAinda não há avaliações

- ICAB Professional Level Syllabus Weight Based Tax Planning & Compliance QUESTION & ANSWER BANKDocumento206 páginasICAB Professional Level Syllabus Weight Based Tax Planning & Compliance QUESTION & ANSWER BANKSaiful Islam MozumderAinda não há avaliações

- Bar QA Taxation 2010-2015Documento238 páginasBar QA Taxation 2010-2015poontin rilakkuma100% (2)

- Paper 16 PDFDocumento433 páginasPaper 16 PDFPravin ThoratAinda não há avaliações

- Supplemental Note #1 - General Principles of Taxation, Intro To Income TaxationDocumento9 páginasSupplemental Note #1 - General Principles of Taxation, Intro To Income TaxationRicojay FernandezAinda não há avaliações

- Income Tax ProjectDocumento14 páginasIncome Tax ProjectBharat JoshiAinda não há avaliações

- 2014-2017 Bar TaxationDocumento41 páginas2014-2017 Bar TaxationLR F0% (1)

- En Banc: Taxation I Case Digest CompilationDocumento1 páginaEn Banc: Taxation I Case Digest CompilationPraisah Marjorey PicotAinda não há avaliações

- International Double Taxation Content Consequences and AvoidanceDocumento11 páginasInternational Double Taxation Content Consequences and AvoidanceMstefAinda não há avaliações

- 66 CIR Vs LednickyDocumento9 páginas66 CIR Vs LednickyYaz CarlomanAinda não há avaliações

- Special Topics & Updates TaxationDocumento7 páginasSpecial Topics & Updates TaxationMhadzBornalesMpAinda não há avaliações

- Analysis - Germany - Individual Taxation - IBFDDocumento56 páginasAnalysis - Germany - Individual Taxation - IBFDbilgintalhaAinda não há avaliações

- Tax LawDocumento171 páginasTax LawAlexis Von TeAinda não há avaliações