Escolar Documentos

Profissional Documentos

Cultura Documentos

1.5 - Traders Royal Bank Vs Court of Appeals

Enviado por

Elaine Atienza-IllescasDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

1.5 - Traders Royal Bank Vs Court of Appeals

Enviado por

Elaine Atienza-IllescasDireitos autorais:

Formatos disponíveis

Traders Royal Bank vs Court of Appeals TRADERS ROYAL BANK, petitioner, vs.

COURT OF APPEALS, FILRITERS GUARANTY ASSURANCE CORPORATION and CENTRALBANK of the PHILIPPINES, respondents. G.R. No. 93397 March 3, 1997

FACTS: Filriters Guaranty Assurance Corporation (Filriters) is the registered owner of Central Bank Certificates of Indebtedness (CBCI) of PhP500,000.00 with an aggregate value of PhP3,500,000.00. On November 27, 1979, Filriters executed a Detached Assignment transferring, assigning and delivering its title and rights over said CBCI to Philippine Underwriters Finance Corporation (Philfinance). Philfinance then entered into a Repurchase Agreement with Traders Royal Bank (TRB) whereby, for a consideration of PhP500,000.00, the former transferred, assigned and delivered its title and rights over the CBCI with a face value of PhP500,000.00. Pursuant to this Repurchase Agreement, Philfinance promised to repurchase from TRB the CBCI for PhP519,361.11. However, it failed to do so. Due to its default, it executed a Detached Assignment in favor of TRB to enable the latter to have its title completed and registered in the books of Central Bank. When TRB tried to have the CBCI registered in its name in the Central Bank, the latter did not recognize the transfer. Upon these assertions, TRB filed a case with the RTC for the registration by the Central Bank of the CBCI in its name. Filriters, in its defense, claimed that its transfer to Philfinance was a personal act of one of its officers and not a corporate act, and was executed without consideration; thus, it is null and void. Moreover, TRB acted in bad faith for it had knowledge of the illegality and invalidity of transfer. ISSUE(S): WON TRB has a right over the CBCI RULING: No. The title of Filriters over the subject certificate of indebtedness must be upheld over the claimed interest of Traders Royal Bank. RATIO: The CBCI is not a negotiable instrument. The pertinent portions of the subject CBCI:

The Central Bank of the Philippines for value received, hereby promisest o pay bearer, of this Certificate of indebtedness be registered, to FILRITERS GUARANTY ASSURANCE CORPORATION, the registered owner hereof, the principal sum of FIVE HUNDRED THOUSAND PESOS. The instrument provides for a promise to pay the registered owner Filriters. Very clearly, the instrument was only payable to Filriters. It lacked the words of negotiability which should have served as an expression of the consent that the instrument may be transferred by negotiation. The language of negotiability which characterize a negotiable paper as a credit instrument is itsfreedom to circulate as a substitute for money. Hence, freedom of negotiability is the touchtonerelating to the protection of holders in due course, and the freedom of negotiability is the foundationfor the protection which the law throws around a holder in due course. This freedom in negotiability is totally absent in a certificate indebtedness as it merely to pay a sum of money to a specified person or entity for a period of time. The transfer of the instrument from Philfinance to TRB was merely an assignment, and is not governed by the negotiable instruments law.

Você também pode gostar

- 01 - ASJ Corp., Et Al. vs. Sps. Efren and Maura Evangelista, G.R. No. 158086Documento6 páginas01 - ASJ Corp., Et Al. vs. Sps. Efren and Maura Evangelista, G.R. No. 158086Elaine Atienza-IllescasAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- 06 - Allan C. Go vs. Mortimer F. Cordero, G.R. No. 164703Documento11 páginas06 - Allan C. Go vs. Mortimer F. Cordero, G.R. No. 164703Elaine Atienza-IllescasAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- 02 - Gonzales v. Philippine Commercial and International Bank, G.R. No. 180257 (23 February 2011)Documento10 páginas02 - Gonzales v. Philippine Commercial and International Bank, G.R. No. 180257 (23 February 2011)Elaine Atienza-IllescasAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- 05 - Unicapital, Inc. v. Consing, JR., G.R. Nos. 175277, 175285 & 192073Documento9 páginas05 - Unicapital, Inc. v. Consing, JR., G.R. Nos. 175277, 175285 & 192073Elaine Atienza-IllescasAinda não há avaliações

- 12 - Reasonable Expectations v. Implied-In-Fact Contracts - Is The Shareholder Oppression Doctrine NeededDocumento65 páginas12 - Reasonable Expectations v. Implied-In-Fact Contracts - Is The Shareholder Oppression Doctrine NeededElaine Atienza-IllescasAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- SMC vs Kalalo dispute over unpaid beer deliveriesDocumento2 páginasSMC vs Kalalo dispute over unpaid beer deliveriesElaine Atienza-Illescas100% (1)

- Visa Application Form 2012Documento2 páginasVisa Application Form 2012Honey OliverosAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Disini v. Sec. of JusticeDocumento7 páginasDisini v. Sec. of JusticeElaine Atienza-IllescasAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- 03 - Arlegui v. CA, 378 SCRA 322Documento7 páginas03 - Arlegui v. CA, 378 SCRA 322Elaine Atienza-IllescasAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- The Spanish Constitution of 1931 and International LawDocumento5 páginasThe Spanish Constitution of 1931 and International LawElaine Atienza-IllescasAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Visa Application Form 2012Documento2 páginasVisa Application Form 2012Honey OliverosAinda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

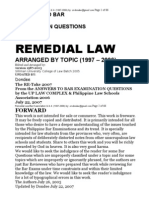

- Remedial Law Suggested Answers (1997-2006), WordDocumento79 páginasRemedial Law Suggested Answers (1997-2006), Wordyumiganda95% (38)

- Us V MilwaukeeDocumento6 páginasUs V MilwaukeeElaine Atienza-Illescas100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- Commercial Law Bar Q&A (1990-2006)Documento107 páginasCommercial Law Bar Q&A (1990-2006)aie03090% (10)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- Civil Code Articles on Carriage of GoodsDocumento6 páginasCivil Code Articles on Carriage of GoodsElaine Atienza-IllescasAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- 23.05 - Republic Vs EquitableDocumento2 páginas23.05 - Republic Vs EquitableElaine Atienza-IllescasAinda não há avaliações

- Answers To Bar Examination Questions in Criminal LawDocumento86 páginasAnswers To Bar Examination Questions in Criminal LawElaine Atienza-Illescas100% (12)

- 66.03 - Gullas V PNBDocumento2 páginas66.03 - Gullas V PNBElaine Atienza-IllescasAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Bank Conservatorsip DigestsDocumento9 páginasBank Conservatorsip DigestsElaine Atienza-IllescasAinda não há avaliações

- Bank Conservatorsip DigestsDocumento9 páginasBank Conservatorsip DigestsElaine Atienza-IllescasAinda não há avaliações

- 23.17 - Associated Bank Vs CA - 1Documento2 páginas23.17 - Associated Bank Vs CA - 1Elaine Atienza-IllescasAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- 17.1 - People Vs RomeroDocumento2 páginas17.1 - People Vs RomeroElaine Atienza-IllescasAinda não há avaliações

- 89.02 - Firestone V CADocumento2 páginas89.02 - Firestone V CAElaine Atienza-IllescasAinda não há avaliações

- 52-59.06 - Banco Atlantico V Auditor GeneralDocumento2 páginas52-59.06 - Banco Atlantico V Auditor GeneralElaine Atienza-IllescasAinda não há avaliações

- 24.03 - Mangahas V BrobioDocumento2 páginas24.03 - Mangahas V BrobioElaine Atienza-IllescasAinda não há avaliações

- 29.11 - Bautista V Auto PlusDocumento2 páginas29.11 - Bautista V Auto PlusElaine Atienza-IllescasAinda não há avaliações

- 12.1 - Pacheco Vs Hon. Court and People of The PhilippinesDocumento3 páginas12.1 - Pacheco Vs Hon. Court and People of The PhilippinesElaine Atienza-IllescasAinda não há avaliações

- 8.3 - GSIS Vs CADocumento2 páginas8.3 - GSIS Vs CAElaine Atienza-Illescas100% (1)

- 9.1 - PNB Vs Rodriguez and RodriguezDocumento2 páginas9.1 - PNB Vs Rodriguez and RodriguezElaine Atienza-IllescasAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Product Datasheet ASSA ABLOY DL6120T enDocumento28 páginasProduct Datasheet ASSA ABLOY DL6120T enAbin RajuAinda não há avaliações

- Variant Configuration Step by Step ConfigDocumento18 páginasVariant Configuration Step by Step Configraghava_83100% (1)

- Manual Centrifugadora - Jouan B4i - 2Documento6 páginasManual Centrifugadora - Jouan B4i - 2Rita RosadoAinda não há avaliações

- Table of Forces For TrussDocumento7 páginasTable of Forces For TrussSohail KakarAinda não há avaliações

- Machine Problem 6 Securing Cloud Services in The IoTDocumento4 páginasMachine Problem 6 Securing Cloud Services in The IoTJohn Karlo KinkitoAinda não há avaliações

- Python Lecture PSBCDocumento83 páginasPython Lecture PSBCPedro RodriguezAinda não há avaliações

- Motion For Bill of ParticularsDocumento3 páginasMotion For Bill of ParticularsPaulo Villarin67% (3)

- Basic Concept of Process Validation in Solid Dosage Form (Tablet) : A ReviewDocumento10 páginasBasic Concept of Process Validation in Solid Dosage Form (Tablet) : A Reviewqc jawaAinda não há avaliações

- Kinds of ObligationDocumento50 páginasKinds of ObligationKIM GABRIEL PAMITTANAinda não há avaliações

- 341 BDocumento4 páginas341 BHomero Ruiz Hernandez0% (3)

- Nº SSR-1 NS-R-3 Draf R1 Site Evaluation For Nuclear Installations FRDocumento33 páginasNº SSR-1 NS-R-3 Draf R1 Site Evaluation For Nuclear Installations FRdaniel addeAinda não há avaliações

- RAMA - 54201 - 05011381320003 - 0025065101 - 0040225403 - 01 - Front - RefDocumento26 páginasRAMA - 54201 - 05011381320003 - 0025065101 - 0040225403 - 01 - Front - RefMardiana MardianaAinda não há avaliações

- 2012 NAPTIN DocumentDocumento48 páginas2012 NAPTIN DocumentbenaikodonAinda não há avaliações

- Activity Problem Set G4Documento5 páginasActivity Problem Set G4Cloister CapananAinda não há avaliações

- Sierra Wireless firmware versions for cellular modulesDocumento20 páginasSierra Wireless firmware versions for cellular modulesjacobbowserAinda não há avaliações

- Which Delivery Method Is Best Suitable For Your Construction Project?Documento13 páginasWhich Delivery Method Is Best Suitable For Your Construction Project?H-Tex EnterprisesAinda não há avaliações

- An-7004 IGBT Driver Calculation Rev00Documento8 páginasAn-7004 IGBT Driver Calculation Rev00Raghuram YaramatiAinda não há avaliações

- Rodriguez, Joseph Lorenz Ceit-08-402ADocumento7 páginasRodriguez, Joseph Lorenz Ceit-08-402AJOSEPH LORENZ RODRIGUEZAinda não há avaliações

- BIM and AM to digitally transform critical water utility assetsDocumento20 páginasBIM and AM to digitally transform critical water utility assetsJUAN EYAEL MEDRANO CARRILOAinda não há avaliações

- GFRDDocumento9 páginasGFRDLalit NagarAinda não há avaliações

- Safety in Manufacturing: Ergonomics: Awkward PosturesDocumento2 páginasSafety in Manufacturing: Ergonomics: Awkward PosturesprashanthAinda não há avaliações

- 91 SOC Interview Question BankDocumento3 páginas91 SOC Interview Question Bankeswar kumarAinda não há avaliações

- Restructuring The Circular Economy Into The Resource Based Economy (Michaux, 2021)Documento126 páginasRestructuring The Circular Economy Into The Resource Based Economy (Michaux, 2021)CliffhangerAinda não há avaliações

- Naoh Storage Tank Design Description:: Calculations For Tank VolumeDocumento6 páginasNaoh Storage Tank Design Description:: Calculations For Tank VolumeMaria Eloisa Angelie ArellanoAinda não há avaliações

- MockupDocumento1 páginaMockupJonathan Parra100% (1)

- Relationship Between Effective Pain Management and Patient RecoveryDocumento4 páginasRelationship Between Effective Pain Management and Patient RecoveryAkinyiAinda não há avaliações

- WebquestDocumento3 páginasWebquestapi-501133650Ainda não há avaliações

- CSCI5273 PS3 KiranJojareDocumento11 páginasCSCI5273 PS3 KiranJojareSales TeamAinda não há avaliações

- Black Box Components and FunctionsDocumento9 páginasBlack Box Components and FunctionsSaifAinda não há avaliações

- Brochure of H1 Series Compact InverterDocumento10 páginasBrochure of H1 Series Compact InverterEnzo LizziAinda não há avaliações

- Introduction to Negotiable Instruments: As per Indian LawsNo EverandIntroduction to Negotiable Instruments: As per Indian LawsNota: 5 de 5 estrelas5/5 (1)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorNo EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorNota: 4.5 de 5 estrelas4.5/5 (63)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpNo EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpNota: 4 de 5 estrelas4/5 (214)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorNo EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorNota: 4.5 de 5 estrelas4.5/5 (132)

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesNo EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesNota: 4 de 5 estrelas4/5 (1)