Escolar Documentos

Profissional Documentos

Cultura Documentos

2Q10 Income Statement

Enviado por

BVMF_RIDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

2Q10 Income Statement

Enviado por

BVMF_RIDireitos autorais:

Formatos disponíveis

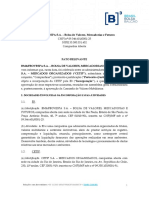

BM&FBOVESPA S.A.

- Bolsa de Valores, Mercadorias e Futuros

Demonstraes de resultados consolidados

(Em milhares de Reais)

Em milhares de Reais

Receita operacional

Neg. e/ou Liq - BM&F

Derivativos

Cmbio

Ativos

Bolsa Brasileira de Mercadorias

Banco

Neg. e/ou Liq. - Bovespa

Negociao - emolumentos de prego

Transaes - compensao e liquidao

Emprstimos de valores mobilirios

Listagem de valores mobilirios

Depositria, custdia e back-office

Acesso dos participantes de negociao

Outras receitas operacionais

Vendors

Taxa de classificao de mercadorias

Outras

Dividendos

Dedues da receita

PIS e Cofins

Impostos sobre servios

Receita operacional liquida

Despesas operacionais

Pessoal

Processamento de dados

Depreciao e amortizao

Servios de terceiros

Manuteno em geral

Comunicaes

Locaes

Materiais de consumo

Promoo e divulgao

Impostos e taxas

Honorrios do conselho

Diversas

Resultado operacional

Resultado financeiro

Receitas financeiras

Despesas financeiras

Resultado antes da tributao sobre o lucro

Imposto de renda e contribuio social

Proviso para imposto de renda

Proviso para contribuio social

Imposto de renda e contribuio social diferidos

Imposto de renda diferido

Contribuio social diferida

Participao minoritria

Lucro lquido do perodo

Margem Lquida

EBITDA

Margem EBITDA

Quantidade de aes em circulao no fim do perodo

Lucro lquido por ao no fim do perodo (R$)

Lucro Lquido Ajustado

Despesas Operacionais Ajustadas

EBITDA Ajustado

Margem EBITDA ajustada

Lucro lquido Ajustado por ao no fim do perodo (R$)

2T10

2T09

526,986

187,902

179,585

5,320

20

1,056

1,921

319,640

189,952

73,582

12,345

10,754

21,386

11,621

19,444

14,574

209

2,177

2,484

(53,365)

(47,325)

(6,040)

473,621

(145,403)

(64,371)

(24,642)

(13,453)

(10,126)

(2,332)

(6,470)

(678)

(764)

(9,870)

(2,340)

(1,830)

(8,527)

328,218

77,546

83,642

(6,096)

405,764

(637)

(396)

(241)

(99,848)

(73,418)

(26,430)

426

305,705

64.5%

341,671

72.1%

2,008,271,970

0.152223

420,581

149,512

140,678

5,463

69

1,250

2,052

247,154

150,752

53,179

7,463

9,332

16,214

10,214

23,915

17,490

1,285

2,681

2,459

(42,339)

(37,967)

(4,372)

378,242

(128,198)

(66,337)

(20,494)

(9,887)

(9,703)

(2,566)

(5,249)

(665)

(580)

(5,475)

(339)

(1,572)

(5,331)

250,044

54,857

67,979

(13,122)

304,901

35,173

25,929

9,244

(152,195)

(112,308)

(39,887)

251

188,130

49.7%

259,931

68.7%

2,002,454,141

0.093950

424,363

(124,418)

348,682

73.6%

0.211308

325,363

(103,303)

273,377

72.3%

0.162482

Variao

2T10/2T09

25.3%

25.7%

27.7%

-2.6%

-71.0%

-15.5%

-6.4%

29.3%

26.0%

38.4%

65.4%

15.2%

31.9%

13.8%

-18.7%

-16.7%

-83.7%

-18.8%

1.0%

26.0%

24.6%

38.2%

25.2%

13.4%

-3.0%

20.2%

36.1%

4.4%

-9.1%

23.3%

2.0%

31.7%

80.3%

590.3%

16.4%

60.0%

31.3%

41.4%

23.0%

-53.5%

33.1%

-101.8%

-101.5%

-102.6%

-34.4%

-34.6%

-33.7%

69.7%

62.5%

14,8 pp

31.4%

3,4 pp

62.0%

30.4%

20.4%

27.5%

1,3 pp

30.0%

1T10

510,660

173,948

166,203

4,704

28

1,114

1,899

314,823

190,930

68,905

10,520

11,511

20,436

12,521

21,889

15,941

277

3,236

2,435

(51,532)

(45,887)

(5,645)

459,128

(136,632)

(63,718)

(21,266)

(12,130)

(9,637)

(2,682)

(5,971)

(665)

(472)

(5,328)

(1,145)

(1,048)

(12,570)

322,496

67,696

72,771

(5,075)

390,192

(495)

(307)

(188)

(107,348)

(78,932)

(28,416)

252

282,601

61.6%

334,626

72.9%

2,007,361,225

0.140782

403,248

(114,582)

343,626

74.8%

0.200885

Variao

2T10/1T10

3.2%

8.0%

8.1%

13.1%

-28.6%

-5.2%

1.2%

1.5%

-0.5%

6.8%

17.3%

-6.6%

4.6%

-7.2%

-11.2%

-8.6%

-24.5%

-32.7%

2.0%

3.6%

3.1%

7.0%

3.2%

6.4%

1.0%

15.9%

10.9%

5.1%

-13.0%

8.4%

2.0%

61.9%

85.2%

104.4%

74.6%

-32.2%

1.8%

14.6%

14.9%

20.1%

4.0%

28.7%

29.0%

28.2%

-7.0%

-7.0%

-7.0%

69.0%

8.2%

3,0 pp

2.1%

-0,7 pp

8.1%

5.2%

8.6%

1.5%

-1,2 pp

5.2%

1S2010

1S2009

1,037,646

361,850

345,788

10,024

48

2,170

3,820

634,463

380,882

142,487

22,865

22,265

41,822

24,142

41,333

30,515

486

5,413

4,919

(104,897)

(93,212)

(11,685)

932,749

(282,035)

(128,089)

(45,908)

(25,583)

(19,763)

(5,014)

(12,441)

(1,343)

(1,236)

(15,198)

(3,485)

(2,878)

(21,097)

650,714

145,242

156,413

(11,171)

795,956

(1,132)

(703)

(429)

(207,196)

(152,350)

(54,846)

678

588,306

63.1%

676,297

72.5%

2,008,271,970

0.292941

772,499

280,059

262,112

11,155

113

2,656

4,023

447,657

264,484

97,643

13,590

19,953

32,298

19,689

44,783

29,011

1,500

6,442

7,830

(77,709)

(69,033)

(8,676)

694,790

(276,958)

(151,799)

(47,177)

(18,838)

(18,822)

(5,392)

(10,240)

(1,490)

(1,057)

(7,767)

(834)

(2,701)

(10,841)

417,832

122,716

142,282

(19,566)

540,548

34,039

25,194

8,845

(159,433)

(118,030)

(41,403)

(44)

415,110

59.7%

436,670

62.8%

2,002,454,141

0.207301

827,611

(239,000)

692,308

74.2%

0.412101

571,102

(204,944)

468,875

67.5%

0.285201

Variao

1S10/1S09

34.3%

29.2%

31.9%

-10.1%

-57.5%

-18.3%

-5.0%

41.7%

44.0%

45.9%

68.2%

11.6%

29.5%

22.6%

-7.7%

5.2%

-67.6%

-16.0%

-37.2%

35.0%

35.0%

34.7%

34.2%

1.8%

-15.6%

-2.7%

35.8%

5.0%

-7.0%

21.5%

-9.9%

16.9%

95.7%

317.9%

6.6%

94.6%

55.7%

18.4%

9.9%

-42.9%

47.2%

-103.3%

-102.8%

-104.9%

30.0%

29.1%

32.5%

-1640.9%

41.7%

3,3 pp

54.9%

9,7 pp

41.3%

44.9%

16.6%

47.7%

6,7 pp

44.5%

BM&FBOVESPA S.A. - Bolsa de Valores, Mercadorias e Futuros

Consolidated Income Statement

(in thousands of BRL)

in thousands of BRL

Operational Revenues

Trading / Clearing Systems - BM&F

Derivatives

Foreign Exchange

Securities

Brazilian Commodities Exchange

BM&F Bank

Trading / Clearing Systems-Bovespa

Trading fees

Clearing fees

Securities Lending

Listing

Depositary and custody

Trading access (Brokers)

Other Operational Revenues

Vendors

Commodities classification fees

Others

Dividends

Revenue deductions

PIS and Cofins

Service tax

Net Operational Revenues

Operational Expenses

Personel

Data processing

Deprec. and Amortization

Third Party Services

Maintenance

Communication

Leases

Supplies

Marketing

Taxes

Board Compensation

Sundry

Operating Income

Financial Income

Financial Revenues

Financial Expenses

Income before Taxes

Income Tax and Social Contribution

Income Tax

Social Contribution

Def. Inc.Tax and Soc. Contribution

Deferred income tax

Deferred social contribution

Minority Interest

Net Income

Net Margin

EBITDA

EBITDA Margin

Sharecount

Earnings per share

Adjusted Net Income

2Q10

526,986

187,902

179,585

5,320

20

1,056

1,921

319,640

189,952

73,582

12,345

10,754

21,386

11,621

19,444

14,574

209

2,177

2,484

(53,365)

(47,325)

(6,040)

473,621

(145,403)

(64,371)

(24,642)

(13,453)

(10,126)

(2,332)

(6,470)

(678)

(764)

(9,870)

(2,340)

(1,830)

(8,527)

328,218

77,546

83,642

(6,096)

405,764

(637)

(396)

(241)

(99,848)

(73,418)

(26,430)

426

305,705

64.5%

341,671

72.1%

2,008,271,970

0.15222291

424,363

2Q09

420,581

149,512

140,678

5,463

69

1,250

2,052

247,154

150,752

53,179

7,463

9,332

16,214

10,214

23,915

17,490

1,285

2,681

2,459

(42,339)

(37,967)

(4,372)

378,242

(128,198)

(66,337)

(20,494)

(9,887)

(9,703)

(2,566)

(5,249)

(665)

(580)

(5,475)

(339)

(1,572)

(5,331)

250,044

54,857

67,979

(13,122)

304,901

35,173

25,929

9,244

(152,195)

(112,308)

(39,887)

251

188,130

49.7%

259,931

68.7%

2,002,454,141

0.09394972

325,363

%

2Q10/2Q09

25.3%

25.7%

27.7%

-2.6%

-71.0%

-15.5%

-6.4%

29.3%

26.0%

38.4%

65.4%

15.2%

31.9%

13.8%

-18.7%

-16.7%

-83.7%

-18.8%

1.0%

26.0%

24.6%

38.2%

25.2%

13.4%

-3.0%

20.2%

36.1%

4.4%

-9.1%

23.3%

2.0%

31.7%

80.3%

590.3%

16.4%

60.0%

31.3%

41.4%

23.0%

-53.5%

33.1%

-101.8%

-101.5%

-102.6%

-34.4%

-34.6%

-33.7%

69.7%

62.5%

14,8 pp

31.4%

3,4 pp

62.0%

30.4%

1Q10

510,660

173,948

166,203

4,704

28

1,114

1,899

314,823

190,930

68,905

10,520

11,511

20,436

12,521

21,889

15,941

277

3,236

2,435

(51,532)

(45,887)

(5,645)

459,128

(136,632)

(63,718)

(21,266)

(12,130)

(9,637)

(2,682)

(5,971)

(665)

(472)

(5,328)

(1,145)

(1,048)

(12,570)

322,496

67,696

72,771

(5,075)

390,192

(495)

(307)

(188)

(107,348)

(78,932)

(28,416)

252

282,601

61.6%

334,626

72.9%

2,007,361,225

0.14078233

403,248

%

2Q10/1Q10

3.2%

8.0%

8.1%

13.1%

-28.6%

-5.2%

1.2%

1.5%

-0.5%

6.8%

17.3%

-6.6%

4.6%

-7.2%

-11.2%

-8.6%

-24.5%

-32.7%

2.0%

3.6%

3.1%

7.0%

3.2%

6.4%

1.0%

15.9%

10.9%

5.1%

-13.0%

8.4%

2.0%

61.9%

85.2%

104.4%

74.6%

-32.2%

1.8%

14.6%

14.9%

20.1%

4.0%

28.7%

29.0%

28.2%

-7.0%

-7.0%

-7.0%

69.0%

8.2%

3,0 pp

2.1%

-0,7 pp

8.1%

5.2%

1H2010

1,037,646

361,850

345,788

10,024

48

2,170

3,820

634,463

380,882

142,487

22,865

22,265

41,822

24,142

41,333

30,515

486

5,413

4,919

(104,897)

(93,212)

(11,685)

932,749

(282,035)

(128,089)

(45,908)

(25,583)

(19,763)

(5,014)

(12,441)

(1,343)

(1,236)

(15,198)

(3,485)

(2,878)

(21,097)

650,714

145,242

156,413

(11,171)

795,956

(1,132)

(703)

(429)

(207,196)

(152,350)

(54,846)

678

588,306

63.1%

676,297

72.5%

2,008,271,970

0.29294140

827,611

1H2009

772,499

280,059

262,112

11,155

113

2,656

4,023

447,657

264,484

97,643

13,590

19,953

32,298

19,689

44,783

29,011

1,500

6,442

7,830

(77,709)

(69,033)

(8,676)

694,790

(276,958)

(151,799)

(47,177)

(18,838)

(18,822)

(5,392)

(10,240)

(1,490)

(1,057)

(7,767)

(834)

(2,701)

(10,841)

417,832

122,716

142,282

(19,566)

540,548

34,039

25,194

8,845

(159,433)

(118,030)

(41,403)

(44)

415,110

59.7%

436,670

62.8%

2,002,454,141

0.20730063

571,102

%

1H2010/1H2009

34.3%

29.2%

31.9%

-10.1%

-57.5%

-18.3%

-5.0%

41.7%

44.0%

45.9%

68.2%

11.6%

29.5%

22.6%

-7.7%

5.2%

-67.6%

-16.0%

-37.2%

35.0%

35.0%

34.7%

34.2%

1.8%

-15.6%

-2.7%

35.8%

5.0%

-7.0%

21.5%

-9.9%

16.9%

95.7%

317.9%

6.6%

94.6%

55.7%

18.4%

9.9%

-42.9%

47.2%

-103.3%

-102.8%

-104.9%

30.0%

29.1%

32.5%

-1640.9%

41.7%

3,3 pp

54.9%

9,7 pp

41.3%

44.9%

Você também pode gostar

- AGE Incorporacao - Boletim de VotoDocumento5 páginasAGE Incorporacao - Boletim de VotoBVMF_RIAinda não há avaliações

- PROPOSTA CONSOLIDADA ReduzidaDocumento359 páginasPROPOSTA CONSOLIDADA ReduzidaBVMF_RIAinda não há avaliações

- Julgamento CARF 2010-2011 Sem Julgamento PTDocumento1 páginaJulgamento CARF 2010-2011 Sem Julgamento PTBVMF_RIAinda não há avaliações

- B3 - Edital de Convocacao (AGE de Incorporacao CETIP)Documento2 páginasB3 - Edital de Convocacao (AGE de Incorporacao CETIP)BVMF_RIAinda não há avaliações

- B3 AGE Incorporacao Proposta Da AdministracaoDocumento15 páginasB3 AGE Incorporacao Proposta Da AdministracaoBVMF_RIAinda não há avaliações

- PROPOSTA CONSOLIDADA ReduzidaDocumento359 páginasPROPOSTA CONSOLIDADA ReduzidaBVMF_RIAinda não há avaliações

- AGE Incorporacao - Boletim de VotoDocumento5 páginasAGE Incorporacao - Boletim de VotoBVMF_RIAinda não há avaliações

- Apresenta??o MensalDocumento48 páginasApresenta??o MensalBVMF_RIAinda não há avaliações

- Fato RelevanteDocumento2 páginasFato RelevanteBVMF_RIAinda não há avaliações

- 1T17 - Apresentao de ResultadosDocumento23 páginas1T17 - Apresentao de ResultadosBVMF_RIAinda não há avaliações

- Apresenta??o MensalDocumento48 páginasApresenta??o MensalBVMF_RIAinda não há avaliações

- B3 - Brasil, Bolsa, Balcão: Demonstração Do Resultado (Consolidado) / Income Statement (Consolidated)Documento1 páginaB3 - Brasil, Bolsa, Balcão: Demonstração Do Resultado (Consolidado) / Income Statement (Consolidated)BVMF_RIAinda não há avaliações

- 1T17 - Apresentacao de ResultadosDocumento23 páginas1T17 - Apresentacao de ResultadosBVMF_RIAinda não há avaliações

- BVMF 1T17 Earnings Release PORT 2017 05 12Documento13 páginasBVMF 1T17 Earnings Release PORT 2017 05 12BVMF_RIAinda não há avaliações

- 1T17 - Apresentacao de ResultadosDocumento23 páginas1T17 - Apresentacao de ResultadosBVMF_RIAinda não há avaliações

- BVMF 1T17Documento79 páginasBVMF 1T17BVMF_RIAinda não há avaliações

- Fato RelevanteDocumento4 páginasFato RelevanteBVMF_RIAinda não há avaliações

- B3 - Brasil, Bolsa, Balcão: Demonstração Do Resultado (Consolidado) / Income Statement (Consolidated)Documento1 páginaB3 - Brasil, Bolsa, Balcão: Demonstração Do Resultado (Consolidado) / Income Statement (Consolidated)BVMF_RIAinda não há avaliações

- CVM 358 Companhia - Abril 2017Documento3 páginasCVM 358 Companhia - Abril 2017BVMF_RIAinda não há avaliações

- BVMF 1T17 Earnings Release PORT 2017 05 12Documento13 páginasBVMF 1T17 Earnings Release PORT 2017 05 12BVMF_RIAinda não há avaliações

- BVMF 1T17Documento79 páginasBVMF 1T17BVMF_RIAinda não há avaliações

- CVM 358 ConsolidadaDocumento2 páginasCVM 358 ConsolidadaBVMF_RIAinda não há avaliações

- UntitledDocumento174 páginasUntitledBVMF_RIAinda não há avaliações

- BVMF 1T17 Earnings Release PORT 2017 05 12Documento13 páginasBVMF 1T17 Earnings Release PORT 2017 05 12BVMF_RIAinda não há avaliações

- Ata Da RCA de 12/05/2017 13:00Documento3 páginasAta Da RCA de 12/05/2017 13:00BVMF_RIAinda não há avaliações

- DFPDocumento79 páginasDFPBVMF_RIAinda não há avaliações

- AG Mapa Final de Votacao 2017 05 10 ANEXODocumento3 páginasAG Mapa Final de Votacao 2017 05 10 ANEXOBVMF_RIAinda não há avaliações

- BMFBOVESPA - Calendrio Anual 2017 v3Documento2 páginasBMFBOVESPA - Calendrio Anual 2017 v3BVMF_RIAinda não há avaliações

- CVM 358 Individual (Companhia) - 04 2017Documento3 páginasCVM 358 Individual (Companhia) - 04 2017BVMF_RIAinda não há avaliações

- 2017 05 04 Comunicado Ao Mercado - Balanco Operacional - Abr2017Documento4 páginas2017 05 04 Comunicado Ao Mercado - Balanco Operacional - Abr2017BVMF_RIAinda não há avaliações