Escolar Documentos

Profissional Documentos

Cultura Documentos

Acceptable and Unacceptable Asset

Enviado por

Denicelle BucoyDescrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Acceptable and Unacceptable Asset

Enviado por

Denicelle BucoyDireitos autorais:

Formatos disponíveis

Acceptable and unacceptable asset

a. Acceptable and unacceptable asset classes: In this section of your investment policy, you state which asset classes you will and will not invest in. It is important that you decide which assets you will invest in before you begin investing so that others will not be able to convince you to invest in asset classes that are not suitable for you at your stage in the financial life cycle. Invest where you have a particular expertise or where the odds are in your favor. You should plan to invest in asset classes that have a history of delivering long-term returns, not just high returns over very short periods of time. For example, I recommend that investors invest in stocks, bonds, mutual funds, and cash and cash equivalents; I do not recommend investing in futures, options, foreign currencies, or precious metals. The investments that I have recommended have long-term histories of consistent performance, while the investments that I do not recommend lack a history of consistent performance.

b. Investment benchmarks

b. Investment benchmarks: Investment benchmarks are hypothetical investment portfolios that show how a specific set of assets performed over a specific period of time. These portfolios can help investors evaluate how their investments are performing versus how the benchmark is performing over the same time period. Unless you have a benchmark or standard, by which you can judge your investments performance, you cannot know how your investments are doing. For example, if you invest in a mutual fund of large-capitalization stocks and your annual return is 10 percent for 2009, how do you know if this is a good or bad return? You cannot know if you do not have anything to compare this information with. But if you know that your benchmark for large-capitalization stocks, the Standard and Poors 500 Index, rose only 26.4 percent during 2009, then you know that your investment performed poorly in that year. Investors select benchmarks based on asset classes (equities, bonds, cash), size or capitalization (large-, mid-, and small-capitalization stocks), geography (international, regional, and emerging markets stocks and bonds), issuer (government versus private bonds), and investment style (value versus growth). Investment benchmarks are covered more thoroughly in later sections of this website.

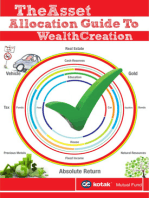

c. Asset allocation

c. Asset Allocation: Asset allocation is the process of determining how much you will invest in each specific asset class in your portfolio. Research has shown that the decision of how to allocate your assets is the most important factor affecting your portfolios performance. Your target asset allocation will probably vary throughout your life. Again, the younger you are, the more likely it is that you will be willing to invest in riskier asset classes. Likewise, the older you are, the less likely it is that you will be willing to invest in riskier asset classes. Younger investors usually have more higher-yield, riskier equity assets (such as small-capitalization stocks and international stocks) and fewer lower-yield, safer assets. Older investors usually have fewer risky equity assets and safer assets (such as government bonds and corporate bonds). In general, the first decision you should make when you are determining your asset allocations is between stocks and bonds. One time-tested way to decide how much you should invest in bonds is to use your age as the percentage for the allocation. The logic behind this starting point is that the older

you are, the more you should invest in bonds because bonds are less risky than other investments. The remainder of your portfolio would be allocated to equities. Once you know the asset classes you want to invest in, it is important that you decide on a minimum allocation, maximum allocation, and target allocation for each asset class. A minimum allocation is the minimum amount you want to have invested in a particular asset class at all times. Having a set minimum allocation preserves diversity in your portfolio. Diversification is an important tool for reducing risk. A maximum allocation is the maximum amount you want to have invested in a particular asset class at any point in time. Since your allocations will change over time, reaching your maximum allocation will be a signal that it is time to rebalance your portfolio back to your target allocation. Finally, your target allocation is your ideal allocation, based on your current expectations and the current market conditions. d. Investment strategy: Your investment strategy describes how you will you invest your money. It clarifies how you will manage, prioritize, and fund your investment; it also describes how you will evaluate new investments. The following paragraphs explain some of the questions you should answer about your investment strategy.

e. Funding strategy

e. Funding strategy: You cannot invest without having the funds to invest, and you should not invest with borrowed money. Where will you get the funds for your investments? In a previous section on Budgeting, I recommended that you always pay the Lord firstthat you pay your tithing and other offerings before anything else and then pay yourself a minimum of 10 percenthopefully more (20 percent for my students). Most financial planners will recommend that you save a minimum of 10 percent when you are young, and they recommend that this amount should increase as you get older. Once you have set aside the recommended 1020 percent each month, I hope that you invest this money wisely according to your personalinvestment plan. How will you manage the funds for your various financial goals? One way to save for different financial goals is to set up different investment vehicles for each of your financial goals. You can use a 401(k) plan to save for retirement, a taxable account to save for your children's missions and weddings, and 529 funds and Education IRAs to save for your childrens educations. You can also set up investment accounts to save for an emergency fund, a house down payment, or a car fund. If you pay yourself at least 10 percent (hopefully more), you can divide this money among your financial goals; for example, you could allocate 5 percent to your 401(k) plan, 4 percent to your investment fund, and 1 percent to your 529 funds.

f. New investment strategy

f. New investment strategy: How will you handle new investments? You need to decide the maximum percentage you will allocate to any new investment. Most experts advise that this amount should not generally be more than 10 percent of an investors assets. Too often, people lose a great deal of money by putting all of their investments into one company or product that they think is a sure thing. There are no sure things. To avoid falling into this trap, decide now on the maximum amount you are willing to invest with a single investment: in other words, decide how much you would be willing to lose with a single investment. You should also decide on the maximum amount of your companys stock that you will include in your 401(k) or other retirement account. For most people, this amount should not be more than 5 to 10 percent of the funds in their retirement account. Remember the principle of diversification. If your company does well, your job is secure and your retirement portfolio is strong. If your company does poorly, you may loose your job and your retirement portfolio may be reduced substantially as well.

Io lng te yan type..im not sure c correct pero based na kosa io ya leeste me yan gets. How are they related to acceptable and unacceptable assets? Before making and investment policy you have to take into consideration which assets are useable. You have to be able to determine what you will and will not invest in, how you will allocate your

investments, and how you will distribute your assets. So your investment policy is divided into 6 sections. Ese 6 sections amo ya se ese 6 tali ariba..man refer ylg..

Você também pode gostar

- The Asset Allocation Guide to Wealth CreationNo EverandThe Asset Allocation Guide to Wealth CreationNota: 4 de 5 estrelas4/5 (2)

- How to Make Money in the Stock Market: Investing for BeginnersNo EverandHow to Make Money in the Stock Market: Investing for BeginnersAinda não há avaliações

- Bwi-Cfq-2013 Portfolio Management QuestionnaireDocumento11 páginasBwi-Cfq-2013 Portfolio Management QuestionnaireShravani Kanagala100% (1)

- What Is InvestmentsDocumento9 páginasWhat Is InvestmentsRidwan RamdassAinda não há avaliações

- Four Steps To Building A Profitable PortfolioDocumento6 páginasFour Steps To Building A Profitable Portfoliojojie dadorAinda não há avaliações

- Wealth CreationDocumento28 páginasWealth CreationMike RobertsonAinda não há avaliações

- PortfolioConstruction & RealEstateDocumento18 páginasPortfolioConstruction & RealEstateVamsi TarunAinda não há avaliações

- Understanding Investment ObjectivesDocumento5 páginasUnderstanding Investment ObjectivesDas RandhirAinda não há avaliações

- Things To Consider Before You Make Investing DecisionsDocumento3 páginasThings To Consider Before You Make Investing DecisionsJoel AttariAinda não há avaliações

- Asset AllocationDocumento8 páginasAsset AllocationAnonymous Hw6a6BYS3DAinda não há avaliações

- A Battle Strategy For Your Financial Future: by Thomas Collimore, CFA, Director, Investor EducationDocumento2 páginasA Battle Strategy For Your Financial Future: by Thomas Collimore, CFA, Director, Investor EducationkautiAinda não há avaliações

- Unit6: Investment ManagementDocumento48 páginasUnit6: Investment ManagementaksAinda não há avaliações

- New To Mutual FundsDocumento46 páginasNew To Mutual FundssandeepkakAinda não há avaliações

- 4 Steps To Building A Profitable Portfolio: Chris Gallant Portfolio Asset AllocationDocumento5 páginas4 Steps To Building A Profitable Portfolio: Chris Gallant Portfolio Asset AllocationRuhulAminAinda não há avaliações

- How To Invest in Stocks: A Beginner's Guide For Getting StartedDocumento4 páginasHow To Invest in Stocks: A Beginner's Guide For Getting StartedMarko Zero FourAinda não há avaliações

- 4 Steps To Building A Profitable PortfolioDocumento4 páginas4 Steps To Building A Profitable PortfolioZaki KhateebAinda não há avaliações

- Investment QuestionnaireDocumento6 páginasInvestment QuestionnaireRohit AggarwalAinda não há avaliações

- Sequrity Analysis and Portfolio ManagementDocumento55 páginasSequrity Analysis and Portfolio ManagementMohit PalAinda não há avaliações

- NavDocumento2 páginasNavFaisal ZaheerAinda não há avaliações

- Low Risk InvestmentsDocumento6 páginasLow Risk Investmentsmyschool90Ainda não há avaliações

- Fidelity's: Top TipsDocumento24 páginasFidelity's: Top Tipsmandar LawandeAinda não há avaliações

- Preserving & Growing Your Savings: The Karachi Stock ExchangeDocumento2 páginasPreserving & Growing Your Savings: The Karachi Stock ExchangeAyeshaJangdaAinda não há avaliações

- Research Report Financial PlanningDocumento43 páginasResearch Report Financial PlanningManasi KalgutkarAinda não há avaliações

- Module 3 IP MDocumento11 páginasModule 3 IP MJane Carla BorromeoAinda não há avaliações

- Financial Planning: I Need A Plan?Documento6 páginasFinancial Planning: I Need A Plan?Karim Boupalmier100% (1)

- Investing !! What's That?Documento37 páginasInvesting !! What's That?sandeep_953Ainda não há avaliações

- Risk and Return AnalysisDocumento38 páginasRisk and Return AnalysisAshwini Pawar100% (1)

- Top Tips For Choosing InvestmentsDocumento6 páginasTop Tips For Choosing InvestmentsBey Bi NingAinda não há avaliações

- Client Risk ProfileDocumento21 páginasClient Risk ProfileShinchan NoharaAinda não há avaliações

- 18U61E0027 - INVESTMENT DECISION ANALYSIS - Indiabulls - NewDocumento36 páginas18U61E0027 - INVESTMENT DECISION ANALYSIS - Indiabulls - NewMohmmedKhayyumAinda não há avaliações

- Investing Conservatively in Retirement: Make Your Money Work for You (For the Middle Class)No EverandInvesting Conservatively in Retirement: Make Your Money Work for You (For the Middle Class)Ainda não há avaliações

- TT05B - Investment Plan Example InstructionsDocumento12 páginasTT05B - Investment Plan Example InstructionsRana HaiderAinda não há avaliações

- How It Works To Make Better Financial LifeDocumento16 páginasHow It Works To Make Better Financial LifeSunilAinda não há avaliações

- Market Secrets: Step-By-Step Guide to Develop Your Financial Freedom - Best Stock Trading Strategies, Complete Explanations, Tips and Finished InstructionsNo EverandMarket Secrets: Step-By-Step Guide to Develop Your Financial Freedom - Best Stock Trading Strategies, Complete Explanations, Tips and Finished InstructionsAinda não há avaliações

- Investing Your Money: o o o o oDocumento8 páginasInvesting Your Money: o o o o oAnna Lina LimosAinda não há avaliações

- TUA - Investment and Portfolio Management Insights - Activity 4Documento4 páginasTUA - Investment and Portfolio Management Insights - Activity 4Angelica Arceno0% (1)

- Investing For Dummies (Artikel)Documento22 páginasInvesting For Dummies (Artikel)Riska KurniaAinda não há avaliações

- Stocks GuruDocumento11 páginasStocks GuruTrue 2 lifeAinda não há avaliações

- Unit 1Documento6 páginasUnit 1malarastogi611Ainda não há avaliações

- FPTM Unit-2Documento69 páginasFPTM Unit-2Avneesh RajputAinda não há avaliações

- How To Make Money In Stocks Value Investing StrategiesNo EverandHow To Make Money In Stocks Value Investing StrategiesAinda não há avaliações

- Introduction to Index Funds and ETF's - Passive Investing for BeginnersNo EverandIntroduction to Index Funds and ETF's - Passive Investing for BeginnersNota: 4.5 de 5 estrelas4.5/5 (7)

- Why Most Investors FailDocumento2 páginasWhy Most Investors FailIAinda não há avaliações

- 1.1 Introduction To The TopicDocumento92 páginas1.1 Introduction To The TopicNithya Devi AAinda não há avaliações

- For A Rich Future: Owning A Car, A HouseDocumento11 páginasFor A Rich Future: Owning A Car, A Housedbsmba2015Ainda não há avaliações

- 10 Golden Rules of Investing: How To Secure Your Financial FutureDocumento21 páginas10 Golden Rules of Investing: How To Secure Your Financial FutureAmbar PurohitAinda não há avaliações

- UntitledDocumento13 páginasUntitledMr.TraderAinda não há avaliações

- Guide To Investing PDFDocumento25 páginasGuide To Investing PDFmuralyyAinda não há avaliações

- Dissertarion Preject ReportDocumento64 páginasDissertarion Preject ReportSaurabh RathoreAinda não há avaliações

- Chapter - 13 2Documento35 páginasChapter - 13 2陈皮乌鸡Ainda não há avaliações

- How To Invest in A Mutual FundDocumento4 páginasHow To Invest in A Mutual FundPritesh BhanushaliAinda não há avaliações

- Economics NotesDocumento2 páginasEconomics NotesKaleb GreenAinda não há avaliações

- DiversificationDocumento2 páginasDiversificationking_neuAinda não há avaliações

- How To Build A Mutual Fund Portfolio: The Debt-Equity RatioDocumento10 páginasHow To Build A Mutual Fund Portfolio: The Debt-Equity Ratioparry5000Ainda não há avaliações

- Investing 50s Guide FINALDocumento32 páginasInvesting 50s Guide FINALmickxxsAinda não há avaliações

- How To InvestDocumento13 páginasHow To InvestwritetoevvAinda não há avaliações

- Analysis of Investment DecisionsDocumento55 páginasAnalysis of Investment DecisionscityAinda não há avaliações

- HCL ProjectDocumento130 páginasHCL ProjectAbhishek Tiku100% (1)

- Resume - Daniel Liu Aug 2019 3Documento1 páginaResume - Daniel Liu Aug 2019 3Daniel LiuAinda não há avaliações

- Audit of PpeDocumento6 páginasAudit of PpeJonailyn YR Peralta0% (1)

- JSW Energy Valuation 2022Documento40 páginasJSW Energy Valuation 2022ShresthAinda não há avaliações

- Navy ERP For SailorsDocumento4 páginasNavy ERP For SailorsUday.mahindrakarAinda não há avaliações

- Strategic Management and Business Policy Global 15th Edition Hunger Test BankDocumento29 páginasStrategic Management and Business Policy Global 15th Edition Hunger Test Bankkiethanh0na91100% (31)

- Kolej Vokasional - Jabatan Teknologi Mekanikal Dan PembuatanDocumento6 páginasKolej Vokasional - Jabatan Teknologi Mekanikal Dan PembuatanAnuar SallehAinda não há avaliações

- Toyota Strategy MarketingDocumento19 páginasToyota Strategy Marketingashwin balajiAinda não há avaliações

- The Business Research Process: An OverviewDocumento24 páginasThe Business Research Process: An OverviewsatahAinda não há avaliações

- GeraDocumento2 páginasGeraAnonymousAinda não há avaliações

- Anchor of Asset ManagementDocumento2 páginasAnchor of Asset ManagementLaammeem NoonAinda não há avaliações

- Marketing Research NotesDocumento8 páginasMarketing Research NotesEmily100% (1)

- WFDSA Annual Report 112718Documento17 páginasWFDSA Annual Report 112718Oscar Rojas GuerreroAinda não há avaliações

- 603-Article Text-1225-1-10-20200203Documento16 páginas603-Article Text-1225-1-10-20200203ABAYNEGETAHUN getahunAinda não há avaliações

- Determinants of Exchange Rate ThesisDocumento6 páginasDeterminants of Exchange Rate Thesisgloriamoorepeoria100% (1)

- 116INTDocumento4 páginas116INTAnonymous rOv67R100% (1)

- Integrated Logistics: JF Hillebrand's Approach To Tailored Beverage LogisticsDocumento7 páginasIntegrated Logistics: JF Hillebrand's Approach To Tailored Beverage Logisticsvivin vesAinda não há avaliações

- 2C00531Documento1.159 páginas2C00531Pranali ThombeAinda não há avaliações

- Marketing Project 2Documento37 páginasMarketing Project 2Hetik PatelAinda não há avaliações

- Sample TestDocumento15 páginasSample TestSoofeng LokAinda não há avaliações

- Ar & Ap Task ListDocumento2 páginasAr & Ap Task Listmari bellogaAinda não há avaliações

- Pratap Mehta CaseDocumento13 páginasPratap Mehta CaseMyrna ChristyAinda não há avaliações

- Unilever (Strategy & Policy)Documento10 páginasUnilever (Strategy & Policy)Joshua BerkAinda não há avaliações

- Implementing Total Quality Management at WiproDocumento4 páginasImplementing Total Quality Management at WiproDullStar MOTOAinda não há avaliações

- ADFINAPDocumento2 páginasADFINAPKenneth Bryan Tegerero TegioAinda não há avaliações

- Case Study Data Analytics by RevoU 1659413996Documento11 páginasCase Study Data Analytics by RevoU 1659413996Vicky NopatAinda não há avaliações

- Income Taxation - Ampongan (SolMan)Documento56 páginasIncome Taxation - Ampongan (SolMan)John Dale Mondejar75% (12)

- I. Financial Accounting & Reporting (FAR) Code Course Description Topics Based On CPALE Syllabus (2019)Documento2 páginasI. Financial Accounting & Reporting (FAR) Code Course Description Topics Based On CPALE Syllabus (2019)LuiAinda não há avaliações

- Account Statement From 10 Aug 2021 To 9 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocumento15 páginasAccount Statement From 10 Aug 2021 To 9 Aug 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAsheera AishwaryaAinda não há avaliações

- Nitya Reddy ResumeDocumento1 páginaNitya Reddy Resumeapi-506368271Ainda não há avaliações