Escolar Documentos

Profissional Documentos

Cultura Documentos

1 s2.0 036136829500007V Main

Enviado por

Olga GheorghiuDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

1 s2.0 036136829500007V Main

Enviado por

Olga GheorghiuDireitos autorais:

Formatos disponíveis

Pergamon

Accounting, Organlzatfonr and So&q, Vol. 20, No. 6, pp. 423-456, 1995 copyrighr D 1995 Elsevkr Science Ltd Printed in Great Brltaln.AUr&M reserved

0361-3682/95 $9.50+0.00

03613682(95)000074 A MULTI-CASE INVESTIGATION OF A THEORY OF THE TRANSFER PRICING PROCESS*

GARY J. COLBERT Utahem@ of Colorado at Denver and BARRY H. SPICER The UniversZty of Auckland

Abstract Drawing on published work by Williamson Vournal of hw and Economics (October 1979) pp. 233261; The Economic Institutions of Capitalism (New York: Free Press, 1985)], Spicer [Accounting, OrganFzatfons and Society (1988) pp. 302-3221, and Walker [Interfaces (May-June 1988) pp. 62-731 this paper first develops a theory of the sourcing and transfer pricing process from a transaction costs perspective. The paper then reports on an empirical investigation of the theory using a multicase research design involving internal ttansfers in four large, vertically integrated high-technology companies in the electronics industry in the U.S.A. The ways in which these firms manage internal transfers and set transfer prices are found to be positively related to the reported degree of transaction-specific investment (asset specfficity) associated with each transfer and to the strategic importance of the transferred component and the nature of the component divisions production capabilities. Suggestions are made for future research.

The transfer pricing process represents an important and pervasive problem in designing and implementing management information and control systems. There has been considerable academic research published on these related topics, yet it remains a troublesome area for academics and managers alike. Even though significant strategic and behavioural consequences including suboptimal decision making, opportunistic behaviour by subunit managers, and internal friction and disharmony may ensue from the transfer pricing process, we do not understand many of the factors

that condition the way in which managers actually deal with this process. There appear to be two reasons for this, the first being theoretical and the second empirical. Reviews of the transfer pricing literature reveal many normative treatments of the transfer pricing issue (see Abdel-khalik & Lusk, 1974, and Grabski, 1985, for extensive reviews) but fewer attempts such as those made by Eccles (1985) to induce, or Watson & Baumler (1975) and Spicer (1988) to theories of the transfer pricing deduce, process.

The authors would like to thank Jean Cooper, gay King, Terry OKecfe, Frank Selto and Ralph Viator for their helpful comments on earlier dnxfts of this paper. 1 We use the tetm transfer pricing process to refer to all related transfer activity, including the decision to source components internally or externally (make-or-buy), the extent to which senior managers assert control over transfer relationships between subunits, and how tramfer prices are set.

l

423

424

G. J. COLBERT and B. H. SPICER tion describes each of our four cases. The fifth section presents and analyses our case evidence and assesses the support the case evidence provides for the theory of the transfer pricing process laid out in the second section. The final section provides a summary and conclusions which includes a discussion of the limitations of our study and some suggestions for future research.

The second and related reason is that much of the empirical research on actual transfer pricing processes has been done with firm level surveys (e.g Tang, 1979, 1980; Vancil, 1979; Borowski, 1990). We believe that the understanding and insights that have emerged from these types of studies are limited for two important reasons. First, they abstract from both industry and organizational context by choosing samples which span a number of industries, and second, they are directed at the wrong level, i.e. at the level of the firm as a whole rather than at the subunit level where internal transfers actually take place. The approach we adopt in this paper attempts to deal with both of these issues in a meaningful way. The objective of this paper is to report on a theoretically based empirical investigation of factors relevant to the transfer pricing process in high-technology companies. Using a multicase research design we address two research questions: (1) How do the business units of high-technology companies manage the transfer process and why do these practices differ? (2) How do the business units of high-technology companies set transfer prices for particular component transfers and why do the methods used differ? Drawing on work by Williamson (1979, 1985) Spicer (1988) Walker (1988) and Colbet-t (1991) we first set out a theory of the transfer pricing process from a transaction costs perspective. We then report on an empirical investigation of the theory using a multi-case research design in which the pattern of observations made in each case relative to those suggested by the theory is evaluated. Our overriding objective is to assess whether the evidence from multiple cases is consistent or inconsistent with the pattern of observations suggested by theory. Our paper is structured as follows. The second section sets out our theory of the transfer pricing process. The third section presents the details of the multi-case research design we employed to select our cases and collect and analyse evidence from them. The fourth sec-

A THEORY OF THE TRANSFER PRICING PROCESS Starting points There are two starting points for the theory of the transfer pricing process that we develop. The first is a growing body of work that uses the existence of differential transaction costs as an explanation for the existence of variation in the manner in which organizations conduct their economic activity. Generally referred to as transaction costs economics, this framework can be traced to Coase (1937) and Williamson (1975, 1979, 1985). Spicer (1988) draws on transaction costs economics to develop a positive theory of the transfer pricing process in which the strategic and transactional characteristics of specific transfers are related to transfer pricing issues and the organizational processes used to manage transfers within firms. Based on the premise that internal transfers are transactions, he argues that transaction costs economics can be used to consider contracting issues involved with the management of internal transfers and the setting of transfer prices. Although Spicer (1988) argues that firm strategy affects intermediate product design and is related to the dimensions of intra-Iirm transfers he provides few particulars. This missing detail is supplied by Walker (1988) who applies the concepts of Porters (1980, 1985) competitive strategy framework and transaction costs economics to explore the risks associated with a firms sourcing decisions, and the implication of these risks for competitive strategy. Walkers work provides the second starting point for our development of theory.

TRANSFER PRICING PROCESS THEORY -

INVESTIGATION

425

Transaction costs economics Williamson (1985, p. 1) argues that the appropriate level of economic analysis is the transaction which he defines as the transfer of goods or services across a technologically separable interface. Transaction costs economics focuses attention on the relative costs and hazards of conducting transactions within alternative governance structures.2 As the costs of within conducting transactions markets increase it becomes increasingly likely that firms will resort to alternative arrangements such as internalizing the transaction. The level of transaction costs experienced is determined by the dimensions of the transaction. The first of these is asset spec@city3 which is of special importance because without it transaction costs economics would lose much of its significance (Williamson, 1985, p. 52). Asset specificity arises when durable investments are made in relation to a particular transaction and the value of the investment in its next best use is considerably lower. The value of such investments in assets is dependent on the maintenance or continuation of a particular transactional relationship. If the asset cannot be costlessly redeployed from its present use to some other use, the value of the investment can be jeopardized by the opportunistic action of the other party to the transaction. Thus the parties have an incentive to maintain the relationship through the implementation of appropriate contractual or organizational safeguards. As the level of asset specificity increases, the transaction costs associated with firms conducting transactions within markets rise and it becomes increasingly likely that an alternative arrangement such as internalization of the

transaction (vertical integration) transaction costs advantages.

will

have

Williamson (1985, p. 55) identifies a number of types of asset specificity which involve investments in the transactions by one or both parties to the transaction. These include: (1) physical asset specificity resulting from investments in tangible assets, e.g. plant, equip ment, tooling, dies, etc. that are more or less unique to this economic relationship; (2) human asset specificity resulting from investments in specialized training or specialized know-how gained through education or experience which is not easily transferred to other transactions; (3) site specificity which results from parties locating their operations in close physical proximity to one another for flow economies; and (4) dedicated asset specificity which arises from investments in generalized (as contrasted to special purpose) productive capacity for the explicit purpose of selling a significant amount of a product to a specific customer and that capacity cannot be costlessly redeployed or otherwise utilized. There is growing interest in the notion of asset specificity as an important explanator of the boundaries of the firm and the related issues of strategy; the make-or-buy decision; and vertical, horizontal and diversification alliances (Alchian, 1984; Alchian & Woodward, 1987; Riordan & Williamson, 1985; Teece, 1986; Jones & Hill, 1988; Klein, 1988; Reve, 1990; Williamson, 1991). There is also a body of empirical research that provides support for the relevance of asset specificity. Of particular pertinence to our study are several papers which uncover a positive relationship between the presence of specialized assets and the

a Transaction costs are the costs of engaging in transactions via a particular institutionaI arrangement or governance stmcturc. They can be separated into exunre and ez-posr transaction costs. Eranfe transaction costs are the costs of drafting, negotiating and safeguardlng contracts. E&r-post transactions include maktdaption and haggling costs when costs transactions get out of alignment, the mnnlng costs of governance structures to resolve disputes, and the bonding costs to secure credible commitments. Spicer & Rallew (1983, p. 88) point out that intemai frictions within iirms arising from contml losses and pIanning difiicuhies can be viewed as the hierarchical counterpart of transaction costs in markets. 3 The terms transaction-specific investment and specialized investments arc also used to refer to asset specificity. We use these terms interchangeably.

426

G. J. COLBERT and B. H. SPICER

extent of vertical integration (Monterverde & Teece, 1982; Walker & Weber, 1984; Masten, 1984; Masten et al., 1989; Levy, 1985).* Transaction costs economics recognizes two other dimensions of transactions: the uncertafnnty to which the transaction is subject and the extent of the transaction. Uncertainty is of a statecontingent kind. When assets cannot be costlessly redeployed and uncertainty is present, efficient adaptations are needed in order to preserve the relationship. Extent refers to the frequency and volume of the transaction and determines whether the cost of specialized governance structures to control the transaction can be recovered. The cost of specialized governance structures (e.g. hierarchy) are easier to recover for large and recurring transactions. Application of transaction costs economics to the internal transfer process As Spicer (1988) points out, the extent to which a Iirm makes internal transfers arises out of a strategic choice between buying components from external sources and making them itself. This is the issue of the appropriate extent of vertical integration. Porter (1980, pp. 303-307) cites the potential benefits of vertical integration as including economies of operations, tapping into technology, assuring sup ply, offsetting bargaining power and input cost distortions in noncompetitive markets, and enhancing ability to differentiate end products. The transaction costs economics framework offers a particular explanation for vertical integration. In this framework the make-or-buy decisions will be made so as to minimize the sum of production and transaction costs. Dimensions of the transactions involved (asset specificity, uncertainty and extent) are thought to be positively related to the decision to integrate vertically into component production.

With low levels of transaction-specific investments (asset specificity) it is likely that economies of scale play an important role in the makeor-buy decision. Suppliers who can aggregate demand for multiple customers, thereby obtaining efficient operating scales, will be the low cost producers. At the same time, with low levels of transaction-specific investments involved, the potential transaction costs associated with buying externally are likely to be low. Given these conditions it is less likely that the firm will source the component internally. As the investments required to produce a particular component become more transaction-specific, the production cost advantages will be less between sellers and buyers but they will face contracting hazards which will result in additional contracting costs. These costs include transaction costs of writing, monitoring and executing contracts. Because production cost advantages of buying externally decrease and the comparative transaction costs of markets increase as assets involved in the transaction increase in specificity, it becomes increasingly likely that the end user will bring the transaction inside the &rn and make the component. It is not only sellers that make transactionspecific investments. Buyers may also make investments where the value of their investment is dependent on the conduct and performance of a particular supplier. For example, investments may be made in equipment, training of personnel or end product and/or component design that are dependent on a component produced exclusively by one sup plier. The presence of these transaction-specific investments by the buyer means that there are potentially high transaction costs involved in contracting to acquire the related component externally.

* Monterverde & Teece (1982) Walker & Weber (1984) and Masten et al. (1989) provide tests of the relevance of asset speciticity in the automobile segment. Masten (1984) provides a test in the aerospace industry, and Levys (1985) tests spans a cross-section of industries. The presence of specialized assets is pmxied by design costs and number of competitors in Monterverde & Teece (1982); by supplier competition in Walker & Weber (1984); by engineering effort, the extent to which components are produced on physical assets specific to an automobile maker, and the closeness of siting of manufacturing stages in Masten et al. (1989); and by research intensive products in Levy (1985).

TRANSFER PRICING PROCESS THEORY -

INVESTIGATION

427

Uncertainty in the presence of transactionspecific investments creates the need for adaptation and co-ordination between the contractlng parties. The greater the extent (frequency and volume) of the transaction the more likely the firm can obtain production economies by manufacturing the component itself and lnternalixing the transaction. However, intemalizatlon of the transaction within the firm does not fully remove the potential transaction costs. Where the firm is highly decentralized, transfers between relatively independent subunits are similar in some contracting aspects to external transactions. In the limit a firm could structure and encourage conduct between subunits that is essentially equivalent to that of external parties transacting in the market-place. Alternatively, firms may arrange their organization structures and control systems so as to encourage more cooperative, interdependent behaviour between subunits. Where the level of transaction-specific investments in internal transfers made by sub units is low, the tirms economic interests will generally be served by allowing external market forces to influence the transfer, including the setting of the transfer price. However, as investments in assets specialized to internal transfers increase, the firm faces a trade-off between the potential efficiencies of trading in a market and its need to protect the value of the specialized investment. As the level of transaction-specitic investment increases, it becomes increasingly important for the firm to protect its economic interests in the transfer relationship by ensuring that conflict and opportunistic actions by subunits are mod-

erated or controlled. Numerous researchers, including Vancil (1979) and Fccles (1985) have noted that relationships between divisionallxed firms can at times involve considerable conflict, especially related to transfer pricing. One possible resolution of this conflict is to seek alternative sources or customers in the market. However, from the tirms perspective, market alternatives are less attractive for the relief or control of disagreements and conflict between subunits when asset specificity is high. The most critical issue in managing the tranfer process is the degree to which the Iirm acts to constrain the actions of the subunits in making sourcing and selling decisions. Where adaptation and coordination of the transfer are important because of transaction-specific investments made by the internal selling unit in an uncertain environment, corporate managers are most likely to protect the firms economic interests by asserting control over the transfer, potentially to the point of mandating the sourcing decision.5 Also, as discussed above, buyers may also make transaction-specific investments where the value is dependent on the conduct and performance of a particular supplier. Consequently, it follows that when a buying units level of transaction-specific investment in the transfer is high, corporate managers are most likely to protect the firms economic interests by asserting control over the transfer by constraining the selling decision. However, when the level of transaction-specific investment made by a buying unit is low, there will be few (if any) reasons associated with the need to protect transaction-specific investments for constraining the selling decision.6

Spicer (1988) suggests that other actions to protect the firms interestsmight Include (1) involvingcorporate management in the arbitration disputes between the subunits,(2) adjustingperformance and Incentivesystems to emphasize of performance measutement and incentives that are tied to higher level or joint performance and de-emphasizing performance measurementsand incentivesthat focus only on individual subunitperformance. However, we conjecture that the importance of these actions is likely to be much less than the decision to control the transferprocess by constraining sourcing and selling decisions.

6 There may be other factors which are not part of our theory which can influencethe extent to which the sellingunit is constrainedfrom sellingoutside the firm. Some of these other factors observed in our case studiesare reported laterin the paper.

428

G. J. COLBERT and B. H. SPICER

Therefore, in our case studies we should observe that the degree to which Iirms constrain subunit managers in sourcing and selling decisions is, in general, positively related to the degree of transaction-specific investment (asset specificity) made by their counterpart(s) to the internal transfer. Strategic sourcing considerations Walker (1988) provides a related perspective by applying the concepts of Porters (1980, 1985) competitive strategy framework to explore the strategic aspects of transaction costs inherent in the sourcing decision. In Porters framework, firms pursue generic strategies such as cost leadership, product differentiation and focus which are sources of competitive advantage. Walker assumes that firms try to order inputs and operations in terms of their value in contributing to competitive advantage. For example, a supplier may supply a custom component that provides important differentiation features in a buyers end product. Walkers Insight is that the risk associated with sourcing relationships can have implications for the value of the firms competitive strategy. His general argument is that inputs that are important to the firms strategy involve greatest risk because supply failure can lead to greater decline in the firms performance than failures with respect to less strategic inputs. Walker identifies two types of sourcing risk with strategic implications. Appropriation risk arises when a supplier owns and sells a factor of intrinsic value to the firms strategy or the Iirm has strategically important assets that are dependent on (i.e. specialized to) aspects of the suppliers goods or services. Firms with suppliers of strategically important components and high switching costs are exposed to the risk of the supplier raising prices or failing to deliver components to specifications thereby reducing the value of

the firms competitive strategy. Appropriation risk can also arise from dependence on the suppliers capabilities necessary for implementing the firms strategy, for example the speed with which a supplier can turn around a pro totype at the design stage may be crucial to gaining advantage by being first to market. Under these conditions, if the buyer has high switching costs, the supplier can opportunistically raise prices or fail to perform adequately, thereby reducing the value of the lirms strategy. Diffuston risk arises when innovative proprietary products or process technology that creates competitive advantage can be replicated or Imitated by competitors. In the design and production of some products suppliers must have access to information about proprietary processes or designs. A supplier external to the firm with important knowledge of the firms important processes and designs may leak this imformation to the firms competitors. To manage or control strategic sourcing risk the firm may decide to Internalize the transactions by investing in facilities to produce the component. Walker concludes that vertical integration will vary directly with the level of strategic sourcing risk and the qualifications of the Iii-ms Internal source relative to those of the best outside supplier. However, the strategic implications of sourcing risk are also applicable to internal transfers in a highly decentralized and divisionalized organization.7 An internal suppliers actions can adversely affect the value of the competitive strategy of end product divisions. For example, by failing to meet contracted delivery schedules on components an internal supplier may cause an end product division to miss a market window. Similarly, an end product division may switch to an external supplier adversely affecting the value of investment in component operations. These are examples of appropriation risk. By selling proprietary com-

Walkers analysis suggests that internal transfers will consist primarily of components where the qualification of the internal source relative to the best external source and the strategic sourcing risk are high.

TRANSFER PRICING PROCESS THEORY -

INVESTIGATION

429

ponents externally, internal suppliers may provide competitors with access to processes, designs and components that are strategically important to end product divisions. This is an illustration of diffusion risk. Therefore, in our case studies we should observe that the degree to which firms constrain subunit managers in sourcing and selling decisions is positively related to the strategic importance of the component and/or the component suppliers capabilities to the firms competitive strategy. Constraints on external sourcing and selling of proprietary components will serve to protect proprietary technology and large specialized investments in strategically Important transfers. In this respect the issues of strategic importance and asset specificity are closely bound together. Transfer price method How transfer prices are set can have important consequences for the tirm as a whole and its subunits through their effects on local decision making and performance measurement. When the level of transaction-specific investment required to support the transfer is low, intermediate products will have a low degree of customization and are most likely to be similar to products available in the market. As Spicer (1988) points out there is no transfer pricing problem in this case. The firms interests will be best served by using external market referents as the primary basis for determining internal terms of trade and to inform decision making. Also, subunit managers are likely to accept market prices as a suitable measure of the value of the internal transfer and for performance measurement. Transfers will typically be negotiated by divisional managers at transfer prices close to market prices with adjustments confined to such things as volume discounts, differences in terms of sale and delivery, and the costs of customization. For the most nart the firms interests are protected by competition amongst internal and external suppliers. As the level of transaction-specific investment in the transfer by the component divi-

sion increases, intermediate components will become increasingly customized and idiosyncratic to the end product division. Consemarket prices will become quently, increasingly less relevant for informing the transfer pricing process and, as noted above, corporate managers are more likely to impose constraints on sourcing decisions by end product divisions. In some mid-range of transaction-specific investment by the component division, it is likely that both costs and market referents in the form of competitive bids and/ or quotations will be used to set internal terms of trade. However, at higher levels of asset specificity in the component division, which results in a considerable degree of customization (idiosyncrasy) in the intermediate product, internal manufacturing costs will become the primary basis for setting transfer prices. As noted above, there will also be strong constraints placed on the sourcing decision. In these circumstances the idiosyncratic nature of the component divisions production process and the intermediate product being transferred will make it extremely difficult for managers to find prices in external markets which are particularly useful for informing the transfer price setting process. With the presence of specialized assets, any market prices that can be obtained are likely to be only crude approximations of the value of the internally transferred component. Forcing the use of external prices as the primary basis for setting internal terms of trade in the presence of specialized assets may be disruptive and counterproductive. This same general point is made strongly by Ball (1989, pp. 19-20) based on his analysis of lirms as specialists in minimizing contracting costs. He writes:

By construction, the more specific the firms factors of production, the less its internal contracts wlII resemble contracts observed in external markets and the less it will find market prices to be informative. For highly specific factors, quasi-prices [which include transfer prices] will bear little resemblance to any observable external market prices. Thus, market prices can provide useful, but not sufficient, information for deter-

430

G. J. COLBERT and B. H. SPICER mining quasi-prices, and their usefulness varies as an inverse function of factor specificity.

While asset specificity may not be the only factor which affects the setting of transfer prices in divisionalized firms, our theory leads us to expect that it will exert a systematic and powerful in8uence.s Therefore, in our case studies we expect to observe that the weight given to manufacturing costs in setting transfer prices is positively associated with the extent of asset specificity related to the transfer in the component division.

MULTI-CASE STUDY DESIGN To investigate the case questions and the theoretical propositions developed above we use a multi-case research design with multiple (embedded) units to collect evidence. This multi-case design is the most sophisticated of the four case designs discussed by Yin (1989, pp. 46-60).9 Yin (1989) was selected because this book is a standard reference for case research design and provides the clearest, most coherent and comprehensive approach to designing, carrying out and presenting mutli-case explanatory case research (as opposed to descriptive or exploratory case studies) that we were able to find. However, we also found work by Bisenhardt (1989), McKinnon (1988) Bruns & Kaplan (1987) Merchant (1987) Maher (1987), Palepu (1987) Hertenstem (1987) and Merchant & Manzoni (1989) helpful to our thinking about how to approach, design and write up the results of our study. We chose to use a case research design

because this method is appropriate to the manner in which we have framed the research questions and our desire to understand which factors are important in the design and implementation of transfer processes and the setting of transfer prices In specific organizational contexts. As our theory suggests that the proper level of analysis is the transfers which occur within each firm, a number of selected transfers of intermediate products (components) were studied in each of four large, vertically integrated high-technology companies in the electronics industry in the U.S.A. The firms are treated as the cases, the embedded units are the divisions between which the specific transfers take place. Using a multi-case research method makes it possible to study particular transfers within each of these firms.

Case selection We targeted firms in the electronics industry because we believed different degrees of asset specificity would characterize h-ma-firm trans fers in this industry. As discussed above, we expected this factor to be a principal determinant of how these firms manage their internal transfer pricing processes. Our analysis of internal transfers in the targeted Iirms focuses primarily upon asset specificity and related strategic considerations. We ensure that uncertainty is present by selecting our cases from an industry which is acknowledged to be volatile and continuously changing. In addition, within each selected firm, we focus on significant transfers from large component divisions. By definition these

s Other Erm-specific factors affecting the setting of transfer prices observed in the course of our cast studies are reported later in the paper. 9 Types of case research designs arc (1) singlecase design with a single unit of analysis, (2) multiplecase design with a single unit of analysis, (3) singlecase design with multiple (embedded) units of analysis, and (4) a multiple-case design with multiple (embedded) units of analysis. Recent case research in management accounting has mostly used either designs of type 1 or type 2. We are not aware of other contemporary case research in management accounting that uses a type 4 design. The closest is a field study by Merchant & Manzooi (1989) which is conducted at the level of profits centres in multiple firms (cases). However, their study does not follow case research methods which requires that the data for each embedded unit (profit centre) be first analyzed for each firm before patterns are analysed and compared across cases.

TRANSFER PRICING PROCESS THEORY -

INVESTIGATION

431

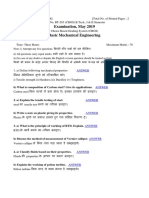

Involve each firms largest component transfers which are big enough to attract management attention. However, throughout the cases we also discuss some transfers of lesser extent. General descriptive information about the cases selected for study and the nature of embedded units (i.e. the types of transfers from component divisions studied) are given in Table 1. The identity of each of the four firms has been disguised but it can be seen from the data in the table that they are all large, highly divisionalized firms in the electronics industry. The attribute common to these firms is that each transfers electronic components between component and end product divisions. The types of component transfers we focus on are transfers shown at the bottom of Table 1. These include the most important and largest transfers in these companies. It can be seen that there are overlaps between the types of transfer studied in each case. This was done deliberately to provide us with a strong basis for comparison. Our focus is on the transfers of similar types of components in each case, i.e. integrated circuits and circuit boards. The com-

ponent units making these transfers vary in terms of their strategic roles and the degree of asset specificity involved. Data collection Gaining high level access to the companies that agreed to participate in this study required considerable time and effort. We first sent letters of inquiry to corporate level finance or accounting managers. We followed up our letters with numerous telephone calls to the companies involved. Our objective was to gain access to at least four large, vertically integrated, divisionalized, high-technology companies. The number of cases was determined by cost, the desire to provide the potential for replication and, most important of all in case research, the ability to obtain access. Not all the firms we approached agreed to participate. We initially approached nine firms which we believed would meet our criteria. One firm was dropped from further consideration when we discovered that it contracted out most of its manufacturing. Of the eight companies remaining, one company wished us to

divisions) Southern Defense and Aerospace Defence and aerospace systems $10-15 > 20

TABLE 1. Descriptive data on cases and embedded units (component High-Tech Inc. General Primary end products Sales (in billions) Number of product divisions Instruments $1-5 > 20 World-Wide Inc. Test, measurement and computing $10-15 > 20

Continental Communications Telecommunications systems $5-10 > 10

Embedded units (component divisions) Component transfer Custom Electronic Integrated circuits or Circuit Technology (CT) hybrids division and Packaging Circuit (CEC) division St Interconnect (P&l) division Printed Circuit Board circuit boards Circuit Board (CB) division (PCB) division

Integrated Circuit (IC) division

Electronic Circuit (EC) division

Printed Circuit @CD) division

lo Many telephone calls to each company were necessary to reach the appropriate corporate level executive. The primary difficulty we encountered was getting past secretaries and administrative assistants (gate-keepers) who protected their bosses from what they considered to be unnecessary intrusions. With some companies we logged over 25 telephone calls before we were able to reach the appropriate executive. In some cases we only started to make progess when we discovered that many top level executives answer their own telephones early in the morning before their secretaries arrive.

432

G. J. COLBERT and B. H. SPICER

defer access until some unspecified time in the future, and three others decided not to participate for various reasons. The numbers of sites and interviews involved in the course of the research are shown in Table 2. Our investigation required considerable cooperation from participants and was financially costly. It took us to 21 selling and buying divisions spread over seven states dispersed widely across the U.S.A. Because of scheduling difficulties this required 15 separate interstate trips over an 18 month period. Interviews were conducted with accounting and functional managers in these divisions. Forty-six managers were interviewed in the course of the study with some individuals being interviewed on more than one occasion when we judged there was something more to be learnt. Interviews ranged between ti and 3 hours in length. A tape recorder was used in almost all of the interviews and transcripts were prepared for later analysis. In some cases follow-up discussions took place by telephone to clarify gaps in our understanding that were discovered during the analysis phase. We also toured manufacturing facilities. Data collection took place in two phases. Initial interviews took place with corporate and/or group level accounting personnel who were generally familiar with the management of the transfer pricing process and ,transfer pricing within each of the selected firms. In these

interviews we did two things. First, we gathered general information about the firms orgaperformance nization structure, its measurement system, and its sourcing and transfer pricing policies. Second, and most important, we identified particular component transfers to study and identified the buying and selling divisions involved. Those selected are shown in the bottom half of Table 1. The second phase of interviewing involved visits to selling and buying divisions on either side of the selected transfers. The theory of the transfer pricing process discussed above determined the data to be collected. To improve the reliability and comparability of the data collected, a structured questionnaire was used to guide our interviews and was filled out during the interview by each interviewee. However, during the interviews we queried informants for detail and asked them to comment on matters they deemed to be important but which were not adequately captured in our questionnaire. It also allowed us to ask informants to compare and contrast the particular transfer under study with others they were knowledgeable about. At the divisional level we focused on interviewing divisional controllers and divisional managers. The information gathered during these interviews included the descriptive data about the subunit, dimensions or characteristics of the transfer(s) under investigation, the sourcing

TABLE 2. Number of sites and interviews Corporate Number of interviews 2 2 1 1 6 Selling divisions Number of interviews 8 5 2 4 19 Buying divisions Number of interviews 5 9 3 4 21

Firm High-Tech World-Wide Continental Communications Southern Defense and Aerospace Total

Number of sites 3 2 2 1 8

Number of sites 3 5 3 2 13

I1 One lirm would not allow us to tape interviews for security reasons. In this instance we were restricted to note taking.

TRANSFER PRICING PROCESS THEORY -

INVESTIGATION

433

and transfer pricing process as it related to the transfer(s) under study, and the performance measurement system. The method we used to obtain information on the key construct of asset specificity associated with internal transfers is discussed in the Appendix. Because of the heavy cost of data collection, the most extensive interviewing took place in those companies with divisions which were the least expensive for us to access. These companies were High-Tech and World-Wide. We started our study at High-Tech. We visited this company many times over a 6 month period. This helped us to refine our questions and approach in order to obtain comparable information from the other companies in the study with divisions which were more widely scattered, further away and more expensive to visit. Consquently, we conducted fewer interviews and spent less time at Continental Communications and Southern Defense and Aerospace than we did at High-Tech and World-Wide.

factors appear to bear on the theoretical relationship? It is important to note that it was our theory which influenced not only the data to be collected but also provided the template against which the data were analysed. l2 Having analysed the data on individual trans fers within the context of the firm involved, we then focused on a cross-case analysis and comparison of results. Results from each case were considered to be findings that were subject to replication by the other individual cases. If the findings obtained in subsequent cases also were consistent with the theory, we concluded that the viability of the theory was strengthened. Thus, if the pattern observed in the second case was similar to the pattern observed in the first case, we would interpret this as a replication. If the patterns were not similar we tried to understand why the patterns observed did not match those predicted by the theory. Our data collection efforts were designed to provide sufficient additional information about the tirm, the divisions and the selected transfers to allow us to take this additional step.

Analysis and interpretation Analysis and interpretation of our data were conducted in two stages. First, the data collected for specific transfers within each of the firms were analysed and interpreted within the context of that firm. For each individual case our analysis concentrates on how and why the pattern of observations and information about each case is consistent or inconsistent with our theory. The mode of analysis is referred to by Yin (1989, p. 109) as pattern matching. The importance of context in case research requires that the data be analysed as a pattern relative to theory, in this instance our theory of the transfer process. For example, where do hypothesized relationships line up with the theory and where do they not? What other

DESCRIPTION OF CASES In this section we flesh out the descriptions of our four cases and embedded units identified in Table 1. We focus on providing some relevant background about each company and information about the independent variables; that is the degree of transaction-specific investment by each component (selling) and end product (buying) division, and the strategic role of each of the component units. This information is summarized in Table 3 for each firm and component division we studied. We also outline each lirms decentralization policy as it relates to the divisions involved

Our research method included Yins (1989) recommended methods for dealing with issues involving construct validity, internal validity, external validity, and reliability in the design of our data collection efforts. Construct validity was addressed through use of multiple sources of evidence, internal validity through use of a pattern matching approach, external validity through the use of replication logic (using multiple cases), and reliability through the use of questionnaires and interview transcripts.

TABLE 3. Summary of information of interest by embedded units (divisions)

Component divisions role in tirms competitive strategy Organization stmcture Reported constraint Repotted weight Reported level of on buying divisions given to asset specificity by decision to buy mantltacturhlg cost component division in transfer price externally

Reported level Reported constraint of asset on selling divisions speciticity by decision to sell buying division enmrmnfy significant Significant for CT when it involves new technology, significant for P&f to assureservice Minor None

Panel A: HigbTecb PCwithBE objective on internal safes. PC on external sales Significant for transfers to largest internal customer, minor otherwise Signfkant for the largest internal customer, minor otherwise Signikant, costbased

Circuit Technology Source of advanced (CT) and Packaging proprietary & Interconnect technology critical (P&f) divisions to the end product divisions PC on internal and external safes Minor None Minor, market-based

~ ; n 9

Circuit Board (CB) division

First, as a source of external profits; second, supports strategy by providing superior service

Panel B: Worldwide PCwithBE objective on internal sales, PC on external safes Significant for its largest transfers Signitkant when capacity utilization is an issue Signikant, costbased Minor

Custom Electronic Cimuit (CEC) division

Secure source of important technofogy that provides differentiation to end products PCwithBE objective Moderate for its largest transfers, minor otherwise

Printed Circuit

Minor

Board (PCB) division

Supports strategy by providing superior service

Signilicant, costbased

Minor

very signiticant

TABLE 3. Cont. 4 5 5 Reported constraint Reported weight Repotted level of on buyirqg divisions given to asset specificity by decision to buy mantlkNring cost component division in transfer price extemaRy

Component divisions role in hrms competitive Organization structure

strategy

Reported level Reported constraint of asset on sclliag divisions specificity by decision to sell buying division extetnaRY

Panel C: COtlti?W?lkd Communications si@liticant Signiticant on hi& volume transfers

Minor

Integrated Circuit (IC) division

Secure source of

Very significant

g ; 8 Minor Very s&niBcant !! 2 8 2

ProPdetary technology PC expected to BE or make a modest profit Minor Minor

PC expected to BE or make a modest profit

S&nificant, but sigriticant weight is also given to market Minor, market-based

printed Circuit @CD) division

Supports strategy by providing superior service

Panel D: Soutbem Defence atki

I signi6cant,costbased Moderate

A-pace Significant for hybrids Significant for hybrids, moderate for integrated circuits Si@kant for those with high technology needs

Secure source of PCwithaBE objective on internal sales, PC on external sales

Ekctronic circuits @C) division

2dVZUlCCd

tccbnology not readily available

e--W

3 9 ij 5 ij

PC means profit centre and BE means breakeven.

436

G. J. COLBERT and B. H. SPICER

under the heading organization structure. Our findings are then discussed in the following section. High-Tech Inc. High-Tech Inc. is a large, divisionalized company that makes a wide variety of sophisticated electronic products including display and measurement devices. The company has over 20 divisions that are organized into a small number of product groupings. Component divisions are located in the different end product groups. Since it started up in the 194Os, the companys corporate strategy has been to be a differentiated producer of high-technology, highperformance, state-of-the-art electronic products; a producer that sets the standards for the rest of the industry. One divisional controller commented:

Our corporate strategy is to produce products that offer cost-effective proprietary performance. We have to be cost-effective, but products have to have a proprietary performance because we are a technology driven company-we are not a low cost manufacturer. It is proprietary technology that we need.

Historically, because of the technology driven nature and culture of the company (sometimes described as a company of engineers producing products for engineers) High-Tech had practised backwards vertical integration to assure a continuous flow of components to its end product divisions. Large scale component fabrication and assembly facilities were built to produce a diverse set of proprietary and nonproprietary components to end product divisions. More recently, High-Tech had experienced financial performance difficulties owing primarily to increasing product competition and unsuccessful forays into new product areas. Two other factors disrupted the companys ver._

tical integration strategy. First, commodity type components (e.g. plastics and metal fabrication) which provide its end products little or no differentiation advantage became readily available from external suppliers at lower cost. Second, expected growth for end pro ducts failed to materialize, creating serious excess capacity problems in its important electronic component operations. These problems forced High-Tech to change. At the time we conducted our study High-Tech was attempting to build a stronger market and customer focus and to improve the companys rate of return. As part of this change process top management divested some facilities producing commodity type components, reorganized and made related changes to sourcing and transfer pricing policies. Some of these changes are discussed later in the paper. Current corporate policy is to allow divisions to negotiate over internal transfers and related transfer prices. In general, division and group managers are expected to work things out without calling in top management to arbitrate disputes. High-Tech has three primary component divisions which vary in their strategic roles in the company and the degree of asset specificity and proprietary content of internal transfers. Panel A of Table 3 summarizes information about these roles and the reported levels of asset specificity of these component divisions and their customers. The following sections describe their operations. Circuit Technology (CD and Packaging C Interconnect (PM) divisions. The CT division produces a wide range of customized integrated circuits while the P&I division produces many custom circuit modules called hybrids.i3 Because they share many common attributes these two divisions are discussed together. There is a consensus among the managers we interviewed that these two divisions are

Hybrids have been described as circuits in a can. They are fully tested circuit modules which provide a way of dealing with problems of limited space, complex interconnects and heat build-up in electronic circuits. A single hybrid can functionally replace a fully loaded circuit board in a compact module form. P&I hybrids incorporate custom integrated circuits supplied by the CT division.

TRANSFER PRICING PROCESS THEORY -

INVESTIGATION

437

critical to the companys competitive strategy because they supply the proprietary technology that imparts cutting edge performance and features for the companys end products. A significant portion of each divisions sales are internal although both have acted recently to build an external customer base as well. However, their external business is seen primarily as a way to increase capacity utilization rather than as a separate source of profits per se. Both divisions report moderate amounts of unused capacity. Both divisions are evaluated as profit centres with a break-even objective on internal transfers and a positive profit objective for external sales. Both divisions report specialized investments of two types. The first are investments specialized to the production of a type of component, i.e. integrated circuits or hybrids. These consist primarily of equipment and training of personnel. The fabrication processes employ certain machines that are very expensive and unique. Although these machines were purchased with the primary intent of supporting internal demand, they can be used to produce a range of different components. Both CTs and P&Is managers report that there would be moderate difficulty in redeploying these assets to serve new external or internal business. Because of relatively long lead times, curtailment of existing production owing to lost internal business would result in lost revenue while capacity is backfilled with new business. The second type of specialized investment is in those assets which are specialized to the production of particular customized components. These investments consist primarily of engineering design work and software used to run automated equipment to fabricate and test each particular component. For example, the P&I divisions controller comments:

There is no portability with respect to a lot of investment that we have made here. It is specific to a custom application. In the custom hybrid business a significant amount of your investment is your engineering assets and your process development assets to get a custom product going. If we were to replace this internal business we would have to reincur all that cost over again.

Internal transfers to one end product division account for over one-half of the total volume of both the CT and P&I divisions. For each component division, a significant level of asset specificity was reported to be present for these internal transfers. Both of these component divisions report that if transfers to this one end product division were halted there would be at least a moderate decline in the value of the investments in tangible assets and personnel specialized to the production of component types, i.e. integrated circuits and hybrids, and a significant decline in the value of investments in design work and training which are specialized to unique components. Lower volume transfers involve lower levels of specialized investments and a minor decline in investment values if these transfers were halted. End product divisions, which are internal customers of these two buying divisions, also report a significant level of investment specialized to the components sources from these two divisions. These consist primarily of investments in design work and training of personnel. These internal customers report that there would be a significant decline in the value of these investments if the internal transfers were halted and they were forced to switch to external supply. They attribute this to the significant difficulty in buying these advanced components externally, particularly when the individual volumes of specific components are relatively low. There was also some doubt expressed about whether they would receive the same level of service, for example responsive engineering support, from an external vendor. Circuit Board (CB) division. Although the CB division manufactures a diverse range of custom circuit boards, it specializes in highend, multi-layer circuit boards. The division is noted for delivering these types of boards quickly and efficiently even in relatively low volumes. This capability is valuable to external and internal customers who have low volumes and fast time-to-market requirements. Because circuit boards are regarded as something of a

438

G. J. COLBERT and B. H. SPICER

commodity available from external sources, service in the form of quick turn around, consistent high quallty, reliable delivery times, etc., rather than proprietary technology is regarded as the key to providing competitive advantage to customers. The divisions controller comments on the service features they offer: Allof those things [quick turn around, electronic design

transfer, close working relationships to the customer, etc.] make it easy to do business with us as opposed to someone else. Circuit boards are on the critical path of time-tomarket. If you screw up and miss getting the right board in the prototype phase you could completely miss the market window.

sourced from CB. However, even those with a need for high-end, high-technology boards report that there would be only a minor decline ln the value of investments if the lnternal transfer were halted because even these boards could be obtained from external sources, albeit with some difficulty. The comments of a controller of an end product division that is a major customer of the CB division reflects this point:

I could find another vendor pretty easily, and I could get my design tapes and film work from CB. I might have to put a little bit of effort into reformatting the design tapes for a different process. My estimate is this would only involve a minor decline in investment value though I would have to scramble around a bit.

In marked contrast to the CT and P&I component divisions, the CB division has a successful and extensive external business and is viewed as a direct source of profits to the company somewhat like High-Techs end product divisions. Interestingly, the division views itself as a stand alone business and is evaluated as a full profit centre on both internal and external sales. At the time the study was conducted the division reported it was operating with moderately constrained capacity. The CB division reports a very significant level of investment specialized to the fabrication of circuit boards in general, but only a minor level of investment specialized to the production of particular circuit boards whether for internal or external sale. CB reports that there would only be minor losses involved if individual internal transfers were halted. The reason given is that assets used to fabricate circuit boards can readily be redeployed to produce other boards. Furthermore, they have a backlog of orders which they could use to backlill any volume lost. The biggest issue is the time needed to bring in a new customer and develop tooling for that customers boards. Tooling in this case is analogous to a blueprint or map that indicates how to build a particular board and is unique to that board. End product divisions that are internal customers of CB report moderate to significant levels of investment specialized to the components

World- Wtde Inc.

World-Wide is a major manufacturer of precision electronic equipment used for measurement, analysis and computation. The company makes thousands of products that cover a broad range. Operations are concentrated in the U.S.A., but the company has other research and manufacturing facilities throughout the world. World-Wides competitive strategy has a strong marketing emphasis which is based on understanding customer needs and then developing solutions through technological innovation. At the time we conducted our study the company had been experiencing strong growth which was attributed to both its innovative capabilities and the success of its end product divisions in introducing new products and new generations of existing products to the market-place. The companys products and businesses are very diverse. Some businesses operate in large, very competitive markets where they compete against world-class competitors. Other businesses operate in narrow markets where volumes are relatively low and technology and performance demands are such that customers are not as price sensitive. Unsurprisingly, it is the former businesses which appear to be most sensitive to transfer pricing issues. The company is organized into groups on the

TRANSFER PRICING PROCESS THEORY -

INVESTIGATION

439

basis of major business segments. The groups are further decentralized Into divisions. Component operations are primarily located in a separate group. Historically, managements strategy has been to utilize its large internal volume requirements to drive down the cost of component supply by fully utilizing the capacity of its Internal component divisions. The internal component divisions are expected to meet the needs of a diverse set of internal customers and the company has typically operated its component operations as captive suppliers. However, considerable negotiation over transfers and transfer prices takes place between component and end product divisions but disputes are rarely elevated to the group or corporate level. Business units within the groups that sell end products are operated as profit centres (divisions) that operate very autonomously. The corporate policy and culture has been to encourage responsibility and innovation, and end product divisions, in particular, have been encouraged to run their own businesses to the greatest extent possible. This has caused some difficulties when divisions must cooperate and share resources to provide Integrated solutions to customer requirements. Over time, World-Wide has experimented with changes in responsibilities and reporting relationships to Improve co-ordination. With World-Wide we focused on two component manufacturing units that internally transfer the same or similar types of components to those studied in the High-Tech case. Like HighTech these units vary in terms of their strategic roles in the company and the characteristics or dimensions of component transfers to product divisions. These divisions are located within the same group and represent the primary source of components transferred internally within World-Wide. Panel B of Table 3 summarizes information about the roles these two component divisions play in World-Wides competitive strategy, their reported levels of asset specificity, and that of their internal customers. The following

sections detail.

describe

their

operations

in more

Custom Electronic Circuit (CEC) division.

World-Wides CEC division is similar to HighTechs Circuit Technology (Cl) division. CEC manufactures custom integrated circuits. The division is regarded as strategically important to many of World-Wides end product divisions because it serves as a secure source of customized advanced circuits that provide differentiation features for the companys end products. The divisions origins are rooted in the belief that at one time the only way to have access to custom Integrated circuits was to manufacture them internally. Internal customers now cite the divisions design capability, availability of particular manufacturing processes, quality, responsiveness, and security of unique proprietary designs and technology as advantages of doing business with CEC over external vendors. Although it is not intended to be a low cost producer of components (internal customers rate CEC as having no price advantage), to remain economically viable CEC has had to obtain higher volumes by producing some circuitry that is less unique and not as advanced technologically. Like High-Techs CT division, CEC has increasingly pursued external sales to fill capacity and meet performance objectives. CEC is evaluated as a profit centre with a breakeven objective on internal sales and a positive profit objective on external sales. At the time our study was conducted, CEC reported moderately constrained capacity. CECs managers report a very sign&ant investment in the facility and its workforce devoted exclusively to the production of custom integrated circuits. Although in principle this Investment could be redeployed, CECs managers report that there would be at least a moderate decline in investment value if its largest internal transfers were halted owing to difficulties in quickly backfilling capacity with external business. Most importantly, CECs managers report significant investments specialized to particular internal transfers. For example, in the case of its largest internal customer,

440

G. J. COLBERT and B. H. SPICER and redesign of boards since some products have life cycles as short as a year and a half. Attempting to stay on the front edge of the market with each generation of product, end product divisions make frequent changes to board layout, etc. Thus the ability to co-ordinate designs and provide quick turnaround are crucial to obtaining time-to-market advantages. PCB reports very significant levels of investment in tangible assets and training specialized to the production of circuit boards. The decline in the value of these investments that would occur if individual internal transfers were halted is reported to vary from minor to moderate depending on the size of the transfer. Potentially, specialized assets resulting from these investments could be switched to producing boards for external customers. However, PCB has no external marketing capability and to establish this would involve substantial costs. PCB also reports a minor level of investment in design work related to specific circuit boards as this is borne primarily by the buying unit. Hence, there would be only a minor decline in value if an individual transfer were halted. Internal customers report a significant level of investment in design work that is specialized to internal transfers of particular circuit boards from PCB. They report that the decline in investment value would be minor should the internal transfer be halted, as the design work could be shifted easily to an external vendor. As one manager pointed out the technology isnt that terribly unique that we couldnt fmd alternative sources. Continental Communications Continental Communications is a leading manufacturer of digital telecommunications systems. The companys products are focused on a small number of applications in the telecommunications market. In each of these product lines Continental is one of the few major suppliers in the North American market where its operations are concentrated. With the break up of AT&T and the dereg-

CEC has invested in an expensive piece of equipment that is used only to assemble pro ducts for that customer. In addition there are significant investments in design work and specialized training to produce a particular component. It is reported that there would be a significant decline in the value of these investments if large internal transfers were halted. Internal customers report moderate levels of investment consisting of design work and training and minor levels of tangible assets that are specialized to components transferred from CEC. However, they also report that only a minor decline in the value of these investments would occur if the internal transfer were halted. Any decline would be due to the developing new relationships, cost of exchange of information about designs and fabrication processes, and perhaps some redesign effort. For example, the controller of the largest customer division comments:

We had to automate a lot of things to use that [internally transferred] integrated circuit. The dollar value is high but the investment is fairly transferable to outside vendors.

Printed Circuit Board (PCB) division. Similar to the Circuit Board (CB) division at HighTech, this division also manufactures circuit boards which are not regarded as strategically important. However, in contrast to the HighTech CB division, which is operated very much as a stand-alone business, World-Wides PCB division is operated exclusively as a cap tive supplier and is several times larger involving multiple plants. It is evaluated as a profit centre with a break-even objective. At the time of the study it was operating at or near capacity. PCBs strategic role is to support end product divisions strategy by providing superior service including flexible delivery and quick design turnaround. Internal customers cite design capability, quality, responsiveness, delivery and cost as PCBs advantages over external suppliers. World-Wides product divisions have very demanding needs for design

TRANSFER PRICING PROCESS THEORY -

INVESTIGATION

441

ulation of the telecommunications industry, the company underwent a period of strong growth but more recently has come under increasing pressure from competitors vying for market share and from customers seeking increasingly sophisticated, higher quality products. At the time we conducted our study Continentals competitive strategy centred on increasing customer satisfaction at the same time as it reduced costs and increased throughput in its manufacturing facilities. The company is divisionalized based on its major product lines. Component fabrication and research and development are organized as separate business units apart from end pro duct operations. Historically, the company required its end product divisions to source components internally but more recently has given greater latitude to end product divisions to source some components externally. The company has streamlined its operations through closure and consolidation of some of its manufacturing facilities as it shifted towards external sourcing of some components such as low-technology circuit boards. Virtually all components except custom integrated circuits and circuit boards and closely related components are now sourced from outside vendors. Owing to competitive pressures, end product divisions have placed considerable pressure on component divisions to reduce their transfer prices. In our study we looked at transfers from the companys two primary component divisions that supply integrated circuits and circuit boards. While internal sourcing is in principle mandated and there is a corporate transfer pricing policy of standard manufacturing cost plus a set percentage mark-up, the transfers that we studied are exempted from this policy as a result of attempts by end product divisions to reduce costs by forcing internal component divisions to price against potential external .

vendors whenever possible. Negotiation and disagreements over transfer prices occur but we were told that most disputes are resolved at the divisional level. Panel C of Table 3 summarizes information about the strategic roles these divisions play in Continentals competitive strategy and the reported levels of asset specificity of these component divisions and their customers. The following sections describe their operations.

Integrated Circuit (rC) division. The IC

division, in contrast to other integrated circuit plants in this study, specializes in producing high-volume, mature, custom integrated circuits.* The division is evaluated as a profit centre with a modest profit objective or at minimum a breakeven objective. Internal customers cite proprietary designs, assured supply and responsiveness as Ks primary competitive advantages over external suppliers. Neither IC nor its internal customers regard price as one of the IC divisions competitive advantages. The IC division reports a very significant level of investments in tangible assets, design work and training specialized to the production of integrated circuits. IC produces a limited number of high-volume components which are transferred to more than one end product division. Loss of an individual transfer would impact on the division through a decline in capacity utilization. Hence, ICs managers report that there would be a significant decline in the value of these investments if an individual transfer were halted. ICs controller explains: Thisis a highly leveraged business. Because of all the

expensive specialized equipment we have a fairly high breakeven point. If you pull volume below our break even point then we are left with a fixed chunk of cost without volume to cover it. That is the risk you run in letting buyers redeploy elsewhere.

* The company actually has two integrated circuit facilities. The facility we studied focuses on the production of mature components ln high volumes. The other facility focuses on prototype and advanced technology custom circuits. Transfers from this division, which is located In the same facility as the companys research operations, were not studied.

442

G. J. COLBERT and B. H. SPICER

Internal customers report only minor amounts of investments specialized to internal transfers from the IC division and that the potential decline in investment value would be minor if internal transfers were halted. They believe that although there would be some short- to medium-term difficulties their component requirements could be met by switching to external sources. Printed Circuit division (PCD). A large portion of Continentals board needs are sourced externally. The boards produced by the PCD division differ from those sourced externally as they typically involve more advanced technology, are more difficult to make and are lower ln volume. However, PCDs managers recognize that their only real advantage over external suppliers is not cost or quality but rather superior service and their ability to work closely with the end product divisions and the companys R&D unit to bring new boards or revisions of old boards into production. Internal customers concur with this assessment. PCD is evaluated as a profit centre with a modest profit objective or at a minimum a break-even objective. The PCD division reports significant investments in assets specialized to circuit boards generally but only minor investments that are specialized to particular internal transfers. They further report only a minor potential decline in investment value if individual internal transfers were halted. Internal customers report that although they have significant investments in design work related to internally sourced circuit boards, this investment could be redeployed to outside vendors; hence, they report that there would only be a minor decline in investment value if internal transfers were halted. This is particularly the case for the least complex boards that are required in large volumes. Southern Defense and Aerospace Southern Defense and Aerospace is a major manufacturer of high-technology electronic systems for military, commercial and scientific use. The company produces several thousand

products and services that often involve longterm programmes or projects. Southerns strategy is to be considered as a technology leader and it is regarded as a pacesetter in applying advanced electronics in the defence and aerospace industry. The companys growth and reputation resulted from the post World War II boom in high-technology applications in defence and aerospace. The company is organized into a number of product groups each of which have several divisions that involve similar technology and applications. The company is operated on a highly decentralized basis which allows each group to respond to its segment of the electronics market with a total capability from research to sales. One exception to this is intracompany activity that relates to some centralized component technology and fabrication. Most of Southerns internal transfers involve transfers from the Electronic Circuit division and it is on these transfers that we focus. Much of the companys external business is conducted through prime contracts (as opposed to subcontracts) with government entities. These contracts may span several years and involve hundreds of millions of dollars. Both cost-plus and fixed-cost contracts are used with the latter being most common and increas ing in frequency. Because of its high exposure to declines in defence budgets, management is attempting to decrease the companys dependence on defence-related business. Achieving this requires changing a rather bureaucratic organizational infrastructure that has been long established to service defence contracts. At the time of our study the company was beglnning to explore how to make these changes. Panel D of Table 3 summarizes information about the strategic role the Electronic Circuit division plays in Southerns competitive strategy and the reported levels of asset specificity of this component division and its customers. The following sections describe its operations. Electronic Circuit (EC) divfsion. The majority of Southerns internal transfers of components comes from the EC division. This division produces custom integrated circuits

TRANSFER PRICING PROCESS THEORY -

INVESTIGATION

443

and hybrid packaging of these circuits. The divisions primary mission is to provide end product divisions with a secure source of advanced technology components that are not readily available from external sources. This component capability, and in particular their hybrid technology, l5 is crucial to the company given its markets and strategy to be a technology leader. In particular it is seen as giving them control over the interface between R&D and production in advanced applications. Given that defence contracts often include penalties for late delivery, internal customers also require an assured and reliable source of supply and tight security with respect to designs. At the time of the study the division had significant excess integrated circuit capacity relative to internal volume requirements. In an attempt to offset the cost of this capacity the division has aggressively pursued external sales of Integrated circuits. Hybrid capacity could be increased with some additional investment but is presently profitable with only a minor amount of external sales. EC is evaluated as a profit centre with a breakeven objective on internal sales and a positive profit objective on external sales. The EC division reports a very sign&ant level of investment specialized to the production of the two component types, integrated circuits and hybrids. For example, its fabrication areas require the highest level of clean rooms in the industry and are extremely expensive. The division also reports a significant level of investment specialized to individual trans fers. To illustrate, EC recently purchased an expensive piece of test equipment specifically to support one product divisions programme. The division reports that there would be a significant decline in both the value of invest._

ments in capacity and investments specialized to individual transfers of integrated circuits and hybrids if internal transfers were halted. Internal customers with advanced technology needs report a signiticant level of investments specialized to internal transfers from EC. These would involve a significant decline in investment values if internal transfers were halted. For example, an end product division indicates that it is tied by technology and design decisions to buy certain components from the EC division. The end product division has designed these components for fabrication on uncommon processes owned and operated by the EC division. Cfrcuft boar&. Unlike the other companies in our study, Southern sources all of its circuit boards externally. However, the company has recently reconsidered this issue and has decided to invest in an internal circuit board facility. In addition to internal sourcing the company plans to continue sourcing some boards externally with a few highquality sup pliers with whom it will develop a long-term relationship. l6 The anticipated benefits of an internal board supplier cited by Southerns management include lower cost through economies of scale in production and adminis nation of the supplier interface, improved quality and quicker turnaround.