Escolar Documentos

Profissional Documentos

Cultura Documentos

Internal Evaluation Will Be Based On Seminar Presentation

Enviado por

Vishvjeet SinghDescrição original:

Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Internal Evaluation Will Be Based On Seminar Presentation

Enviado por

Vishvjeet SinghDireitos autorais:

Formatos disponíveis

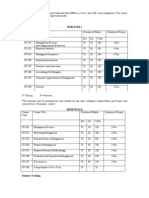

SECOND YEAR: THIRD SEMESTER Compulsory papers Course Code C-3.1 C-3.2 C-3.

3 Business Forecasting International Economics Summer Training Report** Course Title Division of Marks Ext. 70 70 50 Int. 30 30 50* Total 100 100 100 3 Hrs. 3 Hrs. . Duration

** Internal Evaluation will be based on seminar presentation.

LIST OF OPTIONAL PAPERS (COMMON WITH MBA) SPECIALISATION: FINANCIAL MANAGEMENT (FM) Third Semester FM 3.1 FM 3.2 FM 3.3 FM 3.4 FM 3.5 FM 3.6 Security Analysis Financial Markets Corporate Taxation Strategic Financial Management Management of Working Capital Funds Management

SPECIALISATION: MARKETING MANAGEMENT (MM) Third Semester MM 3.1 MM 3.2 MM 3.3 MM 3.4 MM 3.5 Integrated Marketing Communication Consumer Behaviour Service Marketing Marketing Research Brand Management

SPECIALISATION: HUMAN RESOURCE MANAGEMENT (HRM) Third Semester HRM 3.1 HRM 3.2 HRM 3.3 HRM 3.4 HRM 3.5 Management of Industrial Relations Performance Management Compensation Management Human Resource Planning and Development Managing Interpersonal and Group Processes

BUSINESS FORCASTING (C-3.1)

Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course Objective: To give the idea about the various aspect of Business Forecasting. Course Contents: Business forecasting; types and significance of forecasting techniques; Factors affecting the choice of forecasting techniques; forecasting with trend projection, moving averages and exponential smoothening; Barometric methods of forecasting; Predicting business cycles; Qualitative forecasts through surveys and opinion poll methods; Demand analysis: cross-section, time series and panel data, demand function and demand forecasting; Sale forecasting; Econometric forecasting techniques: Simple linear Regression Model, Assumptions and properties of OLS estimators; R2 and adjusted r2, test of significance, Forecasting with Single Equation Regression Model and Standard Error; Econometric Problems: Multicollinearity, Heteroscedascity, Autocorrelation and Dummy Variables: meaning tests, consequences and solutions; Estimation of Cobb-Douglas production and costs functions

Suggested Readings: 1. Gujarati, Damodar N.: Basic Econometrics, McGraw-Hill Co., New York. 2. Intrlligator, M.D.: Econometric Models, Techniques and Applications, Prentice Hall, New Delhi. 3. Johnston, J.: Econometrics Methods, McGraw-Hill Co., New York. 4. Kmenta, J.: Elements of Econometrics, Macmillan, New York. 5. Koutsoyiannis, A.: Theory of Econometrics, Palgrave, New York. 6. Wallis, K.F.: Topics in Applied Econometrics, Basil Blackwell. 7. Pyndyck and Robinfield: Economic models and Economic Forecasts. 8. Klien L R: An Introduction to Econometrics. 9. Koutsoyiannis A:Theory of Econometrics. 10. Hanke and Reitch: Business Forecasting.

The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

International Economics (C- 3.2)

Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course Objective: The course aims at imparting knowledge of formulation, implementation and evaluation of business strategies. Course Contents:

International economics; theories of international trade; terms of trade; foreign trade multiplier; barriers to trade; economic effects of tariffs; Forms of international economic cooperation and integration; trade creating and trade diverting affects of custom union; trade regionalisation in South Asia; international capital movements; alternative approaches to FDI; Analytical structure of balance of payment (bop); bop disequilibrium and approaches to adjustment; macro economic policy for internal and external balance; alternative exchange rate systems; foreign exchange market and exchange rate determination; Working of international institutions in trade and finance (WTO, IMF, UNCTAD and World Bank); problem of international liquidity and indebtedness; analysis of Indias foreign trade and balance of payment in the post reform period. Suggested Readings: 1. 2. 3. 4. Soderston, Bo, International Economics, Macmillan Press, London. Salvatore, D., International Economics, John Wiley, New York. Porter, M.E., The Comparative Advantage of Nation, The Free Press, New York. King, P., International Economics and International Economic Policy: A Reader, McGraw Hill, New York.

The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

SECURITY ANALYSIS (FM 3.1)

Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course objective: The objective of this course is to impart the knowledge to the students regarding the theory and practice of security analysis. Course Contents: Introduction: Basic concepts, Investment Objectives and Investment Process; Investment Opportunities: Fixed and Variable income securities, Non-negotiable Securities, Government Securities, Non-security forms of investment, Tax Sheltered Savings Schemes, Real Assets, Mutual Funds, International Investing; Risk and Return: Risk - Systematic and Unsystematic Risks, Risk Measurement, Minimizing Risk Exposures; Return; Valuation of Securities: Debt and Equity Instruments and their valuation; Fundamental and Technical Analysis; Market Efficiency: Random Walk Theory; Weak, Semi-strong and Strong form of market efficiency; Market inefficiencies. Suggested Readings:

1. Bhalla, V. K., Investment Management: Security Analysis and Portfolio Analysis, S. Chand, New Delhi, 2005. 2. Ranganatham, M. & Madhumathi, R., Investment Analysis and Portfolio Management, Pearson Education, New Delhi, 2008. 3. Pandian, Punithavathy, Security Analysis and Portfolio Management, Vikas Publishing House, New Delhi, 2007. 4. Sharpe, William, F., Alexander, Gordon, J. & Bailley, Jeffery V., Investments, Prentice Hall of India, New Delhi, 2007 5. Chandra, Prasanna, Investment Analysis and Portfolio Management, Tata McGraw Hill, New Delhi, 2008. 6. Bhat, Sudhindra, Security Analysis and Portfolio Management, Excel Books, New Delhi, 2008. 7. Hirschey, Mark & Nofsinger, John, Investments: Analysis and Behaviour, The McGraw Hill Companies, New York, 2008.

The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

FINANCIAL MARKETS (FM 3.2)

Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course Objective: The aim of the course is to give an idea to the students about the operations of various types of financial markets. Course Contents: Introduction: Overview of financial markets; Products, Participants and functions; Securities Markets and Financial System, Securities Markets and Economic Development; Primary Market: Introduction; New Issue Market - Concept and Role; Primary Market - Issuance and Process; Market Design, Demat Issues, Virtual Debt Portals, Collective Investment Vehicles, ADRs/GDRs, Recent Trends in Primary Market; Secondary Market: Introduction; Market Design; Stock Exchanges - Nature, Functions and Organisational Structure; Membership in NSE and BSE; Regulatory Framework; Listing and Delisting of Securities; Online and Off-line Monitoring; Trading and Settlements; Margin -Meaning and uses; Market Indexes Concept, types and uses of Market Indexes; Understanding S & P CNX NIFTY; Role of NSE and BSE. Government Securities Market: Introduction to Debt Markets; Instruments and Participants; Primary Market Issuance Process - Government Securities and Treasury bills; Secondary Market - Trading of Securities on Stock Exchanges; Repo and Reverse Repo; Negotiated Dealing System; Derivative Market: Introduction; Products, Participants and Functions; Types of Derivatives; Regulatory Framework; Trading Framework; Clearing and Settlement Mechanism; Derivatives Market in India; Regulatory Market: Securities and Exchange Board of India Act 1992; Government Securities Act 2006. Suggested Readings:

8. Bhalla, V. K., Investment Management: Security Analysis and Portfolio Management, S. Chand Publications, New Delhi, 2005. 9. Pandian, Punithavathy, Security Analysis and Portfolio Management, Vikas Publishing House, New Delhi, 2007. 10. Bhole, L. M., Financial Institutions and Markets, Tata McGraw Hill, New Delhi, 2006. 11. Saunders, Anthony and Millon Cornett, Marcia, Financial Markets and Institutions, Tata McGraw Hill, New Delhi, 2007.

The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

CORPORATE TAXATION (FM 3.3)

Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course objective: The objective of this course is to acquaint the participants with the implications of tax structure and corporate tax planning in operational as well as strategic terms. Course Contents: Introduction: Basic concepts of Income Tax, Residential status of a company; Computation of Income: Computation of income under the different heads of income; Set off and Carry forward of losses; Deductions and exemptions; Tax Planning-I: Meaning and scope of tax planning; Tax planning, Tax avoidance and Tax evasion, Tax planning regarding location of undertaking and dividend policy, inter corporate dividends and transfers; Tax Planning-II: Tax considerations in respect of specific managerial decisions like Make or Buy, Own or Lease, Close or Continue, Sale in Domestic Markets or Exports, Replacements and Capital Budgeting Decisions and Managerial Remuneration etc. Suggested Readings: 1. Ranina, H. P., Corporate Taxation: A Handbook, Oriental Law House, New Delhi. 2. Singhania, V. K.., Direct Taxes: Planning and Management, Taxman, New Delhi. 3. Srinivas, E. A., Handbook of Corporate Tax Planning, Tata McGraw Hill, New Delhi. 4. Ahuja, G K & Gupta Ravi, Systematic Approach to Income Tax, Bharat Law House Allahabad. 5. Iyengar, A C., Sampat, Law of Income Tax, Bharat House, Allahabad. The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

STRATEGIC FINANCIAL MANAGEMENT (FM 3.4)

Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course objective: The course aims at discussing the issues related to venture capitals, corporate control and corporate restructuring etc. Course Contents: Corporate Restructuring: Meaning and objectives, Mergers - reasons for merger, legal procedure for merger and benefits and cost of merger; Determination of swap ratios, Evaluation of merger proposal; corporate and distress restructuring, Legal accounting and tax issues in merger and acquisitions; Recent developments in mergers and acquisitions process in India; Corporate Control: Mechanism, Share repurchase and exchange, Buyback of shares, Non-voting shares, Disinvestment of Public Sector Undertakings; Leasing: Concept, Classification, Accounting, Legal and Tax Aspects of Leasing; Financial Evaluation of Leasing from lessor and lessee point of view; Lease vs. owned decision; Venture Capital: Concept and developments in India; Process and methods of financing; Fiscal incentives; Corporate Strategy: Financial Policy and shareholder value creation; Linkage between corporate strategy and financial strategy; Shareholder value-creation; Measurement and management. Suggested Readings: 1. Jakhotiya, G. P., Strategic Financial Management, Vikas Publishing House, New Delhi. 2. Allen, D., An Introduction to Strategic Financial Management, Kogan page, London. 3. Hampton, John, Financial Decision Making Englewood Cliffs, Prentice Hall Inc., New Jersey 1997. 4. Khan, M. Y. and Jain, P. K., Financial Management,, Tata McGraw Hill, New Delhi 2001. 5. Prasanna Chandra, Financial Management, Tata McGraw Hill, New Delhi, 2002. 6. Pandey, l. M., Financial Management, Vikas Publishing House, New Delhi, 2000. 7. Van Horne & James C., Financial Management and Policy, Prentice Hall of India, New Delhi 1997. The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

MANAGEMENT OF WORKING CAPITAL (FM 3.5)

Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course objectives: The objective of this course is to acquaint the students with the importance of the working capital and the techniques use for effective working capital management. Course Contents: Working Capital: Concept of Working Capital; Importance of Working Capital Management; Kinds of Working Capital; Factors determining Working Capital; Estimating Working Capital Requirements; Management of Cash: Motives for Holding Cash and Marketable Securities; Managing the Cash Flows; Types of Cash Flows; Types of Collection Systems; Cash concentration strategies; Disbursement Tools; Investment in Marketable Securities; Forecasting Cash Flows; Managing Corporate Liquidity and Financial Flexibility; Measures of Liquidity, Determining the Optimum Level of Cash Balance Baumol Model, Beranek Model, Millr-Orr Model and Stone Model; Management of Receivables: Determining Appropriate Receivable Policy; Marginal Analysis; Credit Analysis and Decision; Heuristic Approach, Discriminant Analysis; Sequential Decision Analysis; Management of Inventory: Kinds of Inventories; Benefits and Costs of holding Inventories; Inventory Management and Valuation; Inventory Control Models; Short-term Financing; Programming Working Capital Management; Integrating Working Capital and Capital Investment Processes. Suggested Readings:

1. Bhalla, V. K., Working Capital Management: Text and Cases, Anmol Publications, New Delhi, 2001. 2. Hampton, John J. and Wagner, C. L., Working Capital Management, John Willey and Sons, New York, 1989. 3. Mannes, T. S. and Zietlow, J. T., Short-term Financial Management, West Publishing Company, New York, 1992. 4. Scherr, F. C., Modern Working Capital Management, Prentice Hall of India, New Delhi, 1989.

The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

FUNDS MANAGEMENT (FM 3.6)

Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course objectives: The main objective of this course is to make students to learn the various aspects of funds management. Course Contents: Introduction to funds management: Different types of funds and their characteristics- conventional funds, pension funds, mutual funds and unit trusts, collective investment schemes (OEICS), tracker/index funds, hedge funds, money market funds; Examining investment products and their applications- equities domestic and overseas, bonds, commodities, derivatives futures. Fund management process: Theory behind fund management; Role and responsibilities of fund managers; Planning for optimal portfolio returns- setting investment objectives, the constraints of the fund manager, strategic asset allocation to enhance portfolio performance; Strategies to maximize fund performance: The mandate definition, how and why benchmarks must be specified; Effective management for ultimate results- tactical asset allocation, securities selection; Controlling the process- performance measurement, attribution analysis; Investment strategies of funds managers: Asset class and geographic diversification, active strategies, passive strategies, top down approach, bottom up approach, sector rotation style, growth investing, value investing, momentum style, small capitalization style, comparing fund management styles; Fixed income fund management and Equity fund management: Asset allocation within the investment decision making process- Determining clients aims and objectives, Asset / liability management, Strategic and tactical asset allocation, the decision making levels. Suggested Readings: 1. Portfolio Management in Practice by Christing Brentani, Elsevier 2. Investments by Bodie, Kane and Marcus, 6th Ed., Tata McGraw Hills, N.D 3. Financial Market Analysis by David Blake 4. Bond Markets Analysis & Strategies by frank J. Fabozzi, 5th ed., Pearson Delhi The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

INTEGRATED MARKETING COMMUNICATION (MM-3.1)

Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course objective: The objective of this course is to make the students to understand the intricate process of marketing communication and to know the contribution of each tool of communication in overall communication strategy. Course Contents:

Campaign planning; IMC planning process; Message and profitability targeting; Digitization of brand information; Customer database; Developing creative message strategy; Process of developing IMC message strategy; Methods of getting creative ideas; Brand-message execution; Copywriting; Writing for point and electronic media; Print layout and design; Executional and strategic consistency; Media: Classification strength and weakness; Integrating online brand communication; Media planning; Sales promotion tools; Strength and limitations, Trade promotion (for new products and existing brands); Trade promotional strategies; Integrated marketing communication: Types of advertising agencies; Media partners and their role; compensating the advertising agencies; Agency evaluation; Brands- Meaning; Creating and maintaining the brand; Selecting desired brand position; Developing brand identification; Creating a brand image; Creating and maintaining brand relationship with customers; Brandcustomer touch points; Prospects and customers; AIDA model; Think/feel/do models; Brand decision making process; Attitude formation and Attitude change; Personal selling: Objectives and strategies; Personal selling process; Defining public relations; Limitation of brand publicity; Brand publicity tools; Corporate image and reputation; Mission and cause marketing; Crisis communication; Interactive and personal dimension of direct marketing; Event marketing; Trade shows and other participation events; Sponsorships; Objectives and strategies of customer service; Social, economic and ethical issues in IMC; Evaluation and measurement of brand message measurement and evaluation methods.

Suggested Readings: 1. Duncan, Tom, Principles of Advertising and IMC, Tata McGraw Hill, New Delhi. 2. Clow, Kenneth & Back, Donald, Integrated Advertising, Promotion and Marketing Communication, Pearson Education, New Delhi. 3. Belch, George and Belch, Michael, Advertising and Promotion, Tata McGraw Hill, New Delhi. 4. Wells, William, Burnett, John and Moriarty, Sandra, Advertising Principles and Practice, Pearson Education, New Delhi. 5. Jethwaney, Jaishree and Jain, Shruti, Advertising Management, Oxford University Press, New Delhi.

The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

CONSUMER BEHAVIOUR (MM 3.2)

Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course Objective: The subject explores the mysterious world of the consumers psyche and helps the students to understand what makes consumers to purchase a particular product or avail a particular service. Course Contents: Consumer behaviour and consumer research; Evolution of consumer behaviour; Methods of studying consumer behaviour; Customer centric organizations; Consumer decision process model, Types of decision process; Factors influencing the extent of problem solving; Pre-purchase processes; Need recognition; Internal and external search; Pre-purchase evaluation; Different types of purchase situations; Retailing and the purchase process; Determinants of retail success or failure; Point of purchase materials; Consumer logistics; Location based retailing; Direct marketing, Consumption behaviours; Consumption experiences; Importance of customer satisfaction; Factors affecting, satisfaction level; Demographics and consumer behaviour; Economic resources and consumer behaviour; Personality and consumer behaviour; Personal values; Lifestyle, Motivational conflict and need priorities; Motivational intensity; Motivating consumer; Importance of consumer knowledge; Types of consumer knowledge; Sources of consumer knowledge; Benefits of understanding consumer knowledge; Consumer beliefs; Consumer feelings; Consumer attitudes; Consumer intentions; Culture and changing values and its effect on consumer behaviour and marketing; Social class and consumer behaviour; Importance of families and households on consumer behaviour, Role behaviour and its influence on the decision process; Family life cycles; Changing roles of women; Children and household consumer behaviour. Suggested Readings: 1. Blackwell, Roger, Miniard, Paul & Engel, James; Consumer Behaviour, Thomson Learning, New Delhi. 2. Loudon, David L. & Dellabitta, Albert, Consumer Behaviour, Tata McGraw Hill; New Delhi. 3. Schiffman, Leon G., & Kanuk, Leslie Lazar, Consumer Behaviour; Pearson Education, New Delhi. 4. Soloman, Michael R., Consumer Behaviour - Buying Having and Being, Pearson Education; New Delhi. 5. Nair, Suja R., Consumer Behaviour in Indian Perspective, Himalaya Publishing House, New Delhi.

The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

SERVICE MARKETING (MM 3.3)

Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course Objective: To understand the service product and key elements of services marketing mix; and how to deal with managing the service delivery process and the implementation of services marketing. Course Contents: Introduction to Service Marketing: Role of services marketing; Consumer behaviour in service encounters; Customer interaction, Purchase process, Needs and expectations of customers; Positioning services in competitive markets; Search for competitive advantages; Market segmentation, Positioning vis--vis competitors; Creating the Service Product: Identifying and classifying supplementary services, Planning and branding service-products, New service development; Designing communication mix; Branding and communication; Effective pricing objectives and foundations for setting prices; Distributing services; Options for service delivery, Place and time decisions, Delivery in cyberspace, Role of intermediaries; Managing relationship and building loyalty; Customer-firm relationship; Analyzing and managing customer base; Customer management relationship system in services marketing; Customer feedback and service recovery; Customer complaining behaviour, Principles and responses to effective service recovery, Service quality and the gap model, Measuring and improving service quality, Defining, measuring and improving service productivity; Organizing for service leadership; Search for synergy in service management, Creating a leading service organization. Suggested Readings: 1. Lovelock, Christopher, Wirtz, Jocken and chatterjee, Jayanta, Services Marketing People, Technology, Strategy, Pearson Education, New Delhi. 2. Zeithaml, Valarie A. & Bitner, Mary Jo, Services Marketing Integrating Customer Focus Across the Firm, Tata McGraw Hill, New Delhi. 3. Rao, K., Rama Mohana, Services marketing, Person Education, New Delhi. 4. Hoffman & Bateson, Essentials of services marketing, Thomson Asia Pvt. Ltd. New Delhi. 5. Rampal, M.K. & Gupta, S.L., Services Marketing, Galgotia Publications, New Delhi. 6. Shanker Ravi, Services Marketing The Indian Perspective, Excel Books, New Delhi. The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

MARKETING RESEARCH (MM 3.4)

Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course Objective: To enable students to learn the process, tools and techniques of marketing research

Course Contents:

Marketing Research (MR): Introduction, Importance, Nature and scope, Marketing research, MR process, Organization of MR Department, Ethical issues in MR, MR in India, Role of MR Agencies; Problem Identification & Research Design: Development of Research Proposal, Types of Research Designs; Data Collection: Primary and Secondary Data Resources, Online Data Sources, Primary Data Collection Methods- Questioning Techniques, Online surveys, Observation method, Preparation of questionnaire; Aptitude Measurement and scaling Techniques: Elementary Introduction to measurement scales; Sampling Plan: Universe, Sample frame and sampling unit, Sampling techniques, Sample size determination; Data Collection: Organization of field work and survey errors-Sampling and nonsampling errors; Research Report: Preparation and Presentation; Market Research Application: Product Research, Advertising Research, Sales and Marketing Research, International Marketing Research. Suggested Readings: 1. Beri, G.C., Marketing Research, Tata McGraw Hill, New Delhi 2. Luck, D.J., Marketing Research, Prentice Hall of India, New Delhi 3. Chisnall, Peter M, The Essence of Marketing Research, Prentice Hall of India, New Delhi. 4. Churchill, Gilbert A., Basic Marketing Research, Dryden press, Boston. 5. Tull, Donald and Hawkin, Del, Marketing Research: Measurement and Methods, Prentice Hall of India, New Delhi. The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

BRAND MANAGEMENT (MM 3.5)

Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course objective: To impart in depth knowledge to the students regarding the branding and brand management for developing and managing brand equity.

Course Contents:

Branding: Concept, challenges and opportunities, Brand equity, Strategic brand management, Brand positioning, Brand values, Brand personality, Brand image, Brand identity, Brand revitalization, Brand portfolio; Building Brand Equity: Role of Integrated Marketing Communication, Brand Product Matrix, Brand Hierarchy, Brand Extension, Co-branding, Managing Brands over Geographical boundaries and market segments, Managing brands over time; Brand Equity Measurement: Capturing changing customer mindset, Qualitative and Quantitative Research Techniques, Measuring outcomes of Brand Equity, Capturing Market Performance. Suggested Readings: 1. Keller, Kevin Lane, Strategic Brand Management, Pearson Education, New Delhi. 2. Sengupta, Subroto, Brand Positioning: Strategies for Competitive Advantage, Tata McGraw Hil, New Delhi. 3. Kapoor, Jagdeep, 24 Brand Mantras, Safe Publications, New Delhi. 4. Kapferer, Jean Noel, Strategic Brand Management, Kagan Page, New Delhi. 5. Cowley, Den, Understanding Brand, Kegan Page, New Delhi. The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages

MANAGEMENT OF INDUSTRIAL RELATIONS (HRM 3.1) Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course Objective: To sensitize and expose the students to critical tasks, functions and issues of industrial relations and to gain insight into the dynamics of employees relations with the management on the different job situations. Course Contents:

Industrial Relations: Concept, Scope, Importance, Factors affecting industrial relations; Approaches to industrial relations; Impact of technological change on industrial relations; Role of state in managing industrial relations; Ethical codes and industrial relations; Recent trends in industrial relations; ILO and Trade Unions: Objectives and Impact of ILO on the Indian labor scene; Trade Unions: Objectives, Functions, Determinants, Problems, Trade Union Movement in India, Types and Structure of Union, Trade Union Act 1926; Trade unions and Industrial relations; Industrial Conflicts: Concept, Classification, Causes, Impact of industrial disputes, Strikes; Resolution of Industrial Disputes: Discipline and Grievance Management, Collective Bargaining, Conciliation, Arbitration and Adjudication; Management of Strikes and Lockouts; Participative Management: Concept, Forms, Objectives, Levels; Empowerment: Concept, Role, Quality management, Quality of work life.

Suggested Readings: 1. Mamoria, Mamoria, Gankar, Dynamics of Industrial Relations, Himalaya Publishing House, New Delhi, 2008 2. Megia, Balkin, Cardy, Managing Human Resources, Prentice Hall of India, New Delhi, 2003. 3. Sen, Ratna, Industrial Relations in India- Shifting Paradigms, Macmillan India Ltd., 2003. 4. Monappa, A. Industrial Relations, Tata McGraw Hill, New Delhi, 2004. 5. Sinha, Sinha, Shekhar, Industrial Relations, Trade Unions and Labour Legislations, Pearson Education, New Delhi, 2004. 6. Ramaswamy, E. Managing Human Resources, Oxford University Press, New Delhi. 7. Monappa, A. Industrial Relation, Tata McGraw Hill, New Delhi. 8. Singh, B. D., Industrial relations and Labour Laws, Excel Books, New Delhi, 2008. The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages

PERFORMANCE MANAGEMENT (HRM 3.2) Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30

Course Objective: This course is designed to develop the skills essential for designing and instituting effective performance management system. Course Contents: Performance Management: Concept, Characteristics, Role and Significance of Performance, Performance Appraisal vis--vis Performance Management, Process of Performance Management; Performance Management and Strategic Planning Linkages; Establishing and Operationalsing Performance Management System, Measuring Performance- Results and Behaviour, Conducting Performance Review Discussions, Harnessing Performance Management System for Performance Improvement.; Performance Management Strategies and Interventions: Reward Based Performance Management, Career Based Performance Management, Team Based Performance Management, Culture Based Performance Management; Measurement Based Performance Management, Competency Based Performance Management, Leadership Based Performance Management. Suggested Readings: 1. Aguinis, Herman, Performance Management, Pearson Education, Inc., New Delhi. 2. Kandula, Srinivas R., Performance Management, Prentice Hall of India, New Delhi. 3. Rao, T.V., Performance Management and Appraisal Systems, Response Book, New Delhi. 4. Cardy, Robert L., Performance Management: Concepts, Skills and Exercise, PHI, New Delhi. 5. Sahu, R. K., Performance Management System, Excel Books, New Delhi. 6. Kohli, A. S. and Tapomoy Deb, Performance Management, Oxford University Press, New Delhi, 2008. The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

COMPENSATION MANAGEMENT (HRM 3.3)

Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course Objective: This course is designed to promote understanding of the issues related to compensation in corporate sector and impart skills in designing, analyzing and restructuring compensation management systems, policies and strategies. Course Contents: Compensation: Concept, Importance, Components, Economic and Behavioural Theories, Determinants, Strategies for Managerial Compensation, Challenges in Compensation, Recent Trends in Managerial Compensation, Compensation Policies; Compensation Practices of MNC; Managing Employee Compensation: Determination of Inter and Intra Industry Compensation differentials; Determining the worth of Jobs, Internal and External Equity in Compensation Package, Understanding various Components of Compensation Package like Fringe Benefits, Incentives and Retirement Plans, Pay for Performance Based Plans, VRS, Employee Stock Option Plan; Compensation of Special Groups: CEOs, Senior Managers, R and D staff, Sales Compensation Plan, Compensation of Professionals and Knowledge Workers; Statutory Provisions governing different Components of Reward System; Working of different institutions related to Reward System like Wage Boards, Pay Commissions, Role of Trade Unions in Compensation Management. Suggested Readings: 1. Milkovich, George, T. and Newman, J.M., Compensation, Tata McGraw Hill, New Delhi, 2005. 2. Noe, Hollenback, Gerhart, Wright, Patrich, Fundamentals of Human Resource Management, Tata McGraw Hill, New Delhi, 2007 3. Bhatia, S. K., New Management in Changing Environment, Deep and Deep Publications, New Delhi, 2008. 4. Aswathapa, K., Human Resource Management-Text and Cases, Tata McGraw Hill, New Delhi, 2008. 5. Bernarden, John H., Human Resource Management- An Experiential Approach, Tata McGraw Hill, New Delhi, 2003. 6. Goel, Dewakar, Performance Appraisal and Compensation Management, Prentice Hall of India, New Delhi. 7. Henderson, R. O., Compensation Management, Pearson Education, New Delhi. 8. Martocchio, J. J., Strategic Compensation, Pearson Education, New Delhi. 9. Armstong, M and Murlis H, Reward Management, Kogan Page, UK. 10. Singh, B. D., Compensation Reward Management, Excel Books, New Delhi.

The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

HUMAN RESOURCE PLANNING AND DEVELOPMENT (HRM 3.4) Time Allowed: Three Hours Total Marks: 100 External: 70

Internal: 30

Course Objective: To develop a conceptual as well as a practical understanding of Human Resource Planning, Deployment and Development in Organizations. Course Contents: Human Resource Planning: Concept, Importance, Factors, Role, Process, Prerequisites, Barriers; Levels of Human Resource Planning: Macro Level and Organizational Level, HR Planning, Models and Techniques of Manpower, Demand and Supply Forecasting; Behavioural Factors in Human Resource Planning: Wastage Analysis, Retention, Redeployment and Exit Strategies; Career Management: Career Planning, Performance Planning, Potential Appraisal, Career Development, Succession Planning; Human Resource Development: Concepts, Goals, Challenges, HRD Climate, Culture, HRD Strategies, HRD Approaches for coping Organizational Change; Emerging Trends and Issues in HRPD: Balanced Scorecard, Six Sigma, Quality of work life, Human Resource Information System, Human Resource Valuation, Human Resource Audit, Multi-skilling, Total Quality Management. Suggested Readings: 1. Bhattacharya, Kumar, Dipak, Human Resource Planning, Excel Books, New Delhi, 2006 2. Patanayak, Biswajeet, Human Resource Management, PHI, New Delhi, 2003. 3. Aswathapa, K., Human Resource Management-Text and Cases, Tata McGraw Hill, New Delhi, 2008. 4. Thomson, R. and Mabey, C., Developing Human Resources, Oxford, Butterworth, Heinemann, 1994. The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

MANAGING INTERPERSONAL AND GROUP PROCESSES (HRM 3.5) Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course Objective: To create understanding regarding interpersonal and group processes and help the students to examine and develop process facilitation skills mainly through laboratory and other experience based methods of learning. Course Contents: Groups and Teams: Nature, Types, Stages, Characteristics, Structure, Groups vs. Teams; Group Synergy, Group cohesiveness, Team Building, Group Decision-Making; Influencing Processes: Interpersonal Communication; Power; Politics. Interpersonal awareness and feedback process; Interpersonal trust; Fundamental interpersonal relations orientation (FIRO); Group Conflicts and Negotiation: Inter-group Conflicts, Reasons of Conflicts, Consequences, Managing Inter-group Conflicts, Negotiation, Competition and co-operation. Suggested Readings: 1. Ivanclvich, Konopaske, Matteson, Organizational Behaviour and Management, Tata McGraw Hill, New Delhi, 2006. 2. Luthans, Fred, Organizational Behaviour, Tata McGraw Hill, New Delhi, 2005. 3. Green Berg Jerald, Bason Robert, Behaviour in Organization, Prentice Hall of India, New Delhi, 2003. 4. Worley and Cummings, Organisational Development and Change, Thomson, New Delhi, 2007. 5. Robbins, S. P., Organizational Behaviour, Pearson Education, New Delhi, 2004. The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

INTERNATIONAL BUSINESS ENVIRONMENT (IB 3.1)

Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course Objectives: The primary objective of this course is to acquaint the students to emerging global trends. Course Contents: International Business: Concept, Types of International Business; Types of Environment- Economic, Political, Human, Social, Financial, Technological, Cultural Environment; Recent World Trade and Foreign Investment; Trade Theories: Absolute Advantage Theory; Comparative Cost Theory; CrossNational Co-operation and Agreements; Tariff and Non Tariff Barriers; Regional Blocks; Multilateral Economic Institutions - IMF, World Bank, WTO, UNCTAD, Euro-Currency Market; Global Competitiveness; Technology and Global Competition; Globalization; Licensing; Joint Ventures; FDI (Foreign Direct Investment) and MNCs; Contemporary Issues in International Business Environment: Negotiating an International Business; Multilateral Settlements, External Relations Approach and World Financial Environment. Suggested Readings: 1. Black and Sundaram, International Business Environment, Excel Books, New Delhi, 2000. 2. Daniels, John and Lee H., Globalisation and Business, Prentice Hall of India, New Delhi, 2002. 3. Daniels, John and Redebaugh, Lee, International Business Environment and Operations, 2000. 4. Charles W. Hill, International Business, Tata McGraw Hill, New Delhi, 2000. 5. Bhalla, V. K., and Shivaram, International Business Environment and Business, Anmol Publications Private Limited, New Delhi, 2000. The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

EXPORT IMPORT PROCEDURES AND DOCUMENTATION (IB 3.2)

Time Allowed: Three Hours Total Marks: 100 External: 70

Internal: 30

Course Objectives: The aim of the course is to acquaint the students with the export-import procedures, documentation and logistics. Course Contents: Introduction: Meaning, Nature and Significance of Export Import Procedures and Documentation in International Trade; Procedures and Documentation as Trade Barriers; Export Strategy; Import Strategy; Third Party Intermediaries; Official Machinery for Trade Procedures and Documentation; Export Order Processing: Registration of Exporters; Export Contract; Export Price Quotations; Main Export Documents; Role of Forwarding Agents; Cargo Insurance and Claim Procedure; Import Order Processing: Registration of Importers; Import Contract; Import Price Quotations; Main Import Documents; Role of Forwarding Agents; Cargo Insurance and Claim Procedure; Methods of Payment in International Trade: Collection of Export Bills; UCPDC Guidelines; Realization of Export Proceeds; Provisions of RBIs Exchange Control Manual; Pre-shipment and Post- Shipment Finance; Major Export Promotion Schemes in India: EPCG, Duty Exemption Scheme; DPEB Scheme; SIL; Facility for Deemed Exports; EPC; Commodity Boards; Role of EXIM Bank and ECGC; WTO Provisions regarding Export Import. Suggested Readings: 1. Daniel and Radebaugh, International Business, Pearson Education, New Delhi, 2003. 2. Jitendra, M. D., Export Procedures and Documentations, Rajat Publications, New Delhi, 2000. 3. Shukla, Shyam, International Business, Excel Books, New Delhi, 2001. 4. Bhalla, V. K., International Business Management, Anmol Publication Private Limited, New Delhi. 5. Nabhis Exporters Manual and Documentation. The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

FOREIGN EXCHANGE MANAGEMENT (IB 3.3)

Time Allowed: Three Hours Total Marks: 100 External: 70 Internal: 30 Course Objectives: The aim of this paper is to expose the students to the functions and operations of foreign exchange market and the intricacies of the risks involved. Course Contents: Introduction: Meaning and Significance of Foreign Exchange, Foreign Exchange Markets- Meaning, Types, Functions and Working of Foreign Exchange Markets; Institutions of Foreign exchange markets; Foreign Exchange Rate Systems; Exchange Rate Forecasting; Exchange Rate: Structural Models of Exchange Rate Determination; Mechanics of Currency Trading; Exchange Rate Regimes; Futures and Options: Meaning, Types and Determination of their Market Value; Over the Counter Trade Options; Fisher Blacks Optional Pricing Model; SWAPS: Meaning, Types- Currency, Interest Rate Swaps; Credit Risk of Swaps, Forward Exchange Rate in India; Forward Rate as Risk Adjusted Future Spot Rate; Management of Currency Exposure: Risk Management Process, Objectives of Hedging Policy and its Measurement, Managing Transactions Exposure, Invoicing, Quantity Inertia and Operating Exposure. Suggested Readings 1. Apte,P.G., International Finance, Tata McGill, New Delhi, 2003. 2. Wild, John J. and Kenneth, L., International Business Prentice Hall of India, New Delhi, 2000. 3. Daniels and Radebaugh , International Business, Pearson Education, New Delhi, 2003. 4. Levich, Richard M., International Financial Markets, Tata McGraw Hill, New Delhi, 2000. The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

MULTI NATIONAL BANKING (IB 3.4)

Time Allowed: Three Hours Total Marks: 100 External: 70

Internal: 30

Course Objectives: The objective of the course is to acquaint the students with the institutional operational aspects of multinational banking. Course Contents: Introduction: Meaning, Characteristics, Organization and Factors of Multinational Banking; Bank Lending and Macro Economic Vulnerability; Bank Lending and Financial Sector Vulnerability; Lending Booms and Banking Sector vulnerabilities; Cost of Banking Crisis; International Banking Market: Meaning and Recent Trends; International Capital Market: Forces, Main Components of the International Capital Market; Investment Banks; Eurocurrency Market; Exchange Bank; Role of Banks in International Money and Capital Markets, and International Banking - Mergers and Acquisitions; International Payments System; International Asset Liability Management; Strategies for Managing Non-Performing Assets, and International Credit Appraisal Techniques. Suggested Readings: 1. Bhalla, V.K., International Business Management, Anmol Publications Private Limited, New Delhi, 2000. 2. Wild, John J. and Wild, Kenneth, International Business, Prentice Hall of India, New Delhi, 2001. 3. Valdez, Stephan, International to Global Financial Markets, Palgrave Macmillan Publications, New York, 1998. 4. Robinson, Stuart W., Multinational Banking, Sigthoff International, Luiden. 5. Fabozzi, Frank J., Foundations of Financial Markets and Institutions, Pearson Education, New Delhi, 2000. The list of cases and specific references including recent articles will be announced in the class at the time of launching of the course. Note: Question paper will be divided into three sections. Section A (10 marks) will consist of five questions having two marks each. Candidates will be required to attempt all the parts. Answer to any part should not exceed half page. Section B (40 marks) will consist of twelve questions. Candidates will be required to attempt eight questions, each question carrying five marks. Answer to any of the questions should not exceed three pages. Section C (20 marks) will consist of four questions. Candidates will be required to attempt two questions, each question carrying ten marks. Answer to any questions should not exceed six pages.

Você também pode gostar

- Sem 4Documento15 páginasSem 4GorishsharmaAinda não há avaliações

- K.U.K-M.B.A-3rd Sem SyllabusDocumento16 páginasK.U.K-M.B.A-3rd Sem SyllabusvivekatriAinda não há avaliações

- Entrepreneurship Development Programme MBA 4th Semester SyllabusDocumento11 páginasEntrepreneurship Development Programme MBA 4th Semester SyllabusomkaravarunAinda não há avaliações

- B Com I (Business - Economics)Documento5 páginasB Com I (Business - Economics)Pooja RajputAinda não há avaliações

- 23 Investment ManagementDocumento40 páginas23 Investment Managementvarun_deppAinda não há avaliações

- Value Investing With Legends (Santos, Greenwald, Eveillard) SP2015Documento6 páginasValue Investing With Legends (Santos, Greenwald, Eveillard) SP2015ascentcommerce100% (1)

- Accounting For Manangement: Course Code: MBAFN10101 Course ObjectiveDocumento21 páginasAccounting For Manangement: Course Code: MBAFN10101 Course ObjectiveShiva DuttaAinda não há avaliações

- McKENNA Market Positioning in High TechnologyDocumento8 páginasMcKENNA Market Positioning in High TechnologyAmigos Al CougarAinda não há avaliações

- PGDM EBIZ - 2010 - 12 & 2011 - 13 Batches - SyllabusDocumento66 páginasPGDM EBIZ - 2010 - 12 & 2011 - 13 Batches - SyllabusPriyank PiyushAinda não há avaliações

- M.B.A Sem I NewDocumento25 páginasM.B.A Sem I NewManish PariharAinda não há avaliações

- 18 MBA 201 Corporate Finance Credit: 3, Class Hours: 35Documento15 páginas18 MBA 201 Corporate Finance Credit: 3, Class Hours: 35sid misraAinda não há avaliações

- MFC Part-I (Semester I & II)Documento11 páginasMFC Part-I (Semester I & II)angelagarwalAinda não há avaliações

- LO & LP of Cost Accounting 23-05-2012Documento3 páginasLO & LP of Cost Accounting 23-05-2012Amit Kumar NagAinda não há avaliações

- Syllabus MBA (IB) 2010 3rd SemDocumento29 páginasSyllabus MBA (IB) 2010 3rd SemVipul AroraAinda não há avaliações

- HS200 Business Economics PDFDocumento3 páginasHS200 Business Economics PDFsethuAinda não há avaliações

- MBA Scheme and SyllabusDocumento60 páginasMBA Scheme and SyllabusSushil SainiAinda não há avaliações

- 3COMDE0603Documento3 páginas3COMDE0603Deepak BaloriaAinda não há avaliações

- MBA (FA) - I Sem Indian Financial System Course Objective: ND STDocumento26 páginasMBA (FA) - I Sem Indian Financial System Course Objective: ND STRiddhi SagoreAinda não há avaliações

- K.U.K-M.B.A 4th Sem SyllabusDocumento12 páginasK.U.K-M.B.A 4th Sem Syllabusvivekatri100% (1)

- Mba-Ms-Iii 2Documento9 páginasMba-Ms-Iii 2nainaniharshita03Ainda não há avaliações

- Bba 6 (2017)Documento3 páginasBba 6 (2017)ali.amarmaqboolAinda não há avaliações

- MBA FM Syllabus FinalDocumento14 páginasMBA FM Syllabus FinalShivanshKatochAinda não há avaliações

- Bba III Sem SyllabusDocumento13 páginasBba III Sem SyllabusaromoishaAinda não há avaliações

- Semester-Ii CP - 2O1: Management ScienceDocumento8 páginasSemester-Ii CP - 2O1: Management Sciencecoolanmol14Ainda não há avaliações

- MM - 403 Service MarketingDocumento4 páginasMM - 403 Service MarketingpoojasethiAinda não há avaliações

- M.ComDocumento33 páginasM.ComAmit PrajapatiAinda não há avaliações

- New SyllabusDocumento377 páginasNew Syllabuslishpa123Ainda não há avaliações

- Cusat Mba Second Semester SyllabusDocumento12 páginasCusat Mba Second Semester SyllabusGabriel Belmonte100% (1)

- Syllabus Applied MicroeconomicsDocumento11 páginasSyllabus Applied Microeconomicstramnguyen.31221026352Ainda não há avaliações

- B. Tech Sem - I SUBJECT-Engineering Economics and Principles of Management (AM110) Teaching Scheme (Hr/week) Exam Scheme (Marks)Documento3 páginasB. Tech Sem - I SUBJECT-Engineering Economics and Principles of Management (AM110) Teaching Scheme (Hr/week) Exam Scheme (Marks)jay bhagatAinda não há avaliações

- CMT Reading List 02Documento10 páginasCMT Reading List 02Tanvir Ahmed100% (2)

- Sylllabus 2nd SemDocumento13 páginasSylllabus 2nd SemVinay DuggalAinda não há avaliações

- To Develop An Understanding of The Strategic Management Process in A Dynamic andDocumento6 páginasTo Develop An Understanding of The Strategic Management Process in A Dynamic andManish RanaAinda não há avaliações

- MBA-Financial AdministrationDocumento38 páginasMBA-Financial Administrationanjalibhopale1169Ainda não há avaliações

- 1st Sem SyllabusDocumento11 páginas1st Sem SyllabusharrydeepakAinda não há avaliações

- MBA Business EconomicsDocumento24 páginasMBA Business EconomicsLokesh BaghelAinda não há avaliações

- Financial MarketsDocumento54 páginasFinancial Marketsdurga_319Ainda não há avaliações

- Mba - FT & PTDocumento7 páginasMba - FT & PTNawin KumarAinda não há avaliações

- BSc3 Financial Intermediation 2020-2021Documento12 páginasBSc3 Financial Intermediation 2020-2021AndrewAinda não há avaliações

- Bba SyllabusDocumento21 páginasBba SyllabusAditi BhardwajAinda não há avaliações

- Economics For Managers PDFDocumento4 páginasEconomics For Managers PDFHiren MoradiyaAinda não há avaliações

- Course Syllabus: MBA 135 Managerial Economics 2 Credits Course DescriptionDocumento3 páginasCourse Syllabus: MBA 135 Managerial Economics 2 Credits Course DescriptionMathew JoseAinda não há avaliações

- Course Overview: 101 Management Practices & Organizational BehaviorDocumento7 páginasCourse Overview: 101 Management Practices & Organizational Behaviorreepu12345Ainda não há avaliações

- MGT 412 Strategic Management BBA, 8 SemesterDocumento6 páginasMGT 412 Strategic Management BBA, 8 SemesterFalling stonesAinda não há avaliações

- AGBS BBA Syllabus-1st, 2nd, 3rd, 4th SemDocumento98 páginasAGBS BBA Syllabus-1st, 2nd, 3rd, 4th SemSrinath Sundareswaran100% (2)

- Engineering Economics & Accountancy :Managerial EconomicsNo EverandEngineering Economics & Accountancy :Managerial EconomicsAinda não há avaliações

- Finding Value in the Market - The Fundamentals of Fundamental AnalysisNo EverandFinding Value in the Market - The Fundamentals of Fundamental AnalysisAinda não há avaliações

- Rethinking Valuation and Pricing Models: Lessons Learned from the Crisis and Future ChallengesNo EverandRethinking Valuation and Pricing Models: Lessons Learned from the Crisis and Future ChallengesCarsten WehnAinda não há avaliações

- ECON 101 Notes + Study Guide - Standard: Introduction to MicroeconomicsNo EverandECON 101 Notes + Study Guide - Standard: Introduction to MicroeconomicsAinda não há avaliações

- Multi-Asset Risk Modeling: Techniques for a Global Economy in an Electronic and Algorithmic Trading EraNo EverandMulti-Asset Risk Modeling: Techniques for a Global Economy in an Electronic and Algorithmic Trading EraNota: 4.5 de 5 estrelas4.5/5 (2)

- Market Microstructure: Confronting Many ViewpointsNo EverandMarket Microstructure: Confronting Many ViewpointsFrédéric AbergelAinda não há avaliações

- Financial Statistics and Mathematical Finance: Methods, Models and ApplicationsNo EverandFinancial Statistics and Mathematical Finance: Methods, Models and ApplicationsNota: 3 de 5 estrelas3/5 (1)

- Investment Management: A Modern Guide to Security Analysis and Stock SelectionNo EverandInvestment Management: A Modern Guide to Security Analysis and Stock SelectionAinda não há avaliações

- ECON 101 Notes + Study Guide - Gold Version: Introduction to Microeconomics at the University of AlbertaNo EverandECON 101 Notes + Study Guide - Gold Version: Introduction to Microeconomics at the University of AlbertaAinda não há avaliações

- A Pragmatist’s Guide to Leveraged Finance: Credit Analysis for Below-Investment-Grade Bonds and LoansNo EverandA Pragmatist’s Guide to Leveraged Finance: Credit Analysis for Below-Investment-Grade Bonds and LoansNota: 5 de 5 estrelas5/5 (1)

- Competitive Strategy: Techniques for Analyzing Industries and CompetitorsNo EverandCompetitive Strategy: Techniques for Analyzing Industries and CompetitorsNota: 4.5 de 5 estrelas4.5/5 (31)

- Empowerment:: Sharing Varying Degrees of Power With Lower-Level Employees To Better Serve The CustomerDocumento13 páginasEmpowerment:: Sharing Varying Degrees of Power With Lower-Level Employees To Better Serve The CustomerVishvjeet SinghAinda não há avaliações

- Not at All Stressful 0 1 2 3 4 Extremely StressfulDocumento1 páginaNot at All Stressful 0 1 2 3 4 Extremely StressfulVishvjeet SinghAinda não há avaliações

- Inter-Personel Awareness & Feedback Process: Presented by Binay & SanjeevDocumento19 páginasInter-Personel Awareness & Feedback Process: Presented by Binay & SanjeevVishvjeet SinghAinda não há avaliações

- Segmenting and Targeting: For Use Only With Duncan Texts. © 2005 Mcgraw-Hill Companies, Inc. Mcgraw-Hill/IrwinDocumento26 páginasSegmenting and Targeting: For Use Only With Duncan Texts. © 2005 Mcgraw-Hill Companies, Inc. Mcgraw-Hill/IrwinVishvjeet Singh0% (1)

- Campaign Planning GuideDocumento10 páginasCampaign Planning GuideVishvjeet SinghAinda não há avaliações

- Library Management SystemDocumento4 páginasLibrary Management SystemVishvjeet SinghAinda não há avaliações

- Project FormatDocumento15 páginasProject FormatVishvjeet SinghAinda não há avaliações

- Chemical KineticsDocumento47 páginasChemical KineticsVishvjeet SinghAinda não há avaliações

- Creative LeadershipDocumento6 páginasCreative LeadershipRaffy Lacsina BerinaAinda não há avaliações

- Instrumentation. Between Science, State and IndustryDocumento271 páginasInstrumentation. Between Science, State and IndustryMichel GautamaAinda não há avaliações

- How To Write A ThesisDocumento14 páginasHow To Write A ThesisPiyushAinda não há avaliações

- Calderon de La Barca - Life Is A DreamDocumento121 páginasCalderon de La Barca - Life Is A DreamAlexandra PopoviciAinda não há avaliações

- Introduction PDFDocumento7 páginasIntroduction PDFJalal NhediyodathAinda não há avaliações

- Meralco v. CastilloDocumento2 páginasMeralco v. CastilloJoven CamusAinda não há avaliações

- ComeniusDocumento38 páginasComeniusDora ElenaAinda não há avaliações

- Firewatch in The History of Walking SimsDocumento5 páginasFirewatch in The History of Walking SimsZarahbeth Claire G. ArcederaAinda não há avaliações

- Constitutional Law Sem 5Documento5 páginasConstitutional Law Sem 5Ichchhit SrivastavaAinda não há avaliações

- 007-Student Council NominationDocumento2 páginas007-Student Council NominationrimsnibmAinda não há avaliações

- TENSES ExerciseDocumento28 páginasTENSES ExerciseKhanh PhamAinda não há avaliações

- Cranial Deformity in The Pueblo AreaDocumento3 páginasCranial Deformity in The Pueblo AreaSlavica JovanovicAinda não há avaliações

- Hayat e Imam Abu Hanifa by Sheikh Muhammad Abu ZohraDocumento383 páginasHayat e Imam Abu Hanifa by Sheikh Muhammad Abu ZohraShahood AhmedAinda não há avaliações

- Marketing Plan For Optimo InternationalDocumento47 páginasMarketing Plan For Optimo InternationalNiña Alfonso100% (1)

- Renal CalculiDocumento12 páginasRenal CalculiArieAinda não há avaliações

- Research Design1 USED 6Documento14 páginasResearch Design1 USED 6Joselle RuizAinda não há avaliações

- Financial Management - Risk and Return Assignment 2 - Abdullah Bin Amir - Section ADocumento3 páginasFinancial Management - Risk and Return Assignment 2 - Abdullah Bin Amir - Section AAbdullah AmirAinda não há avaliações

- Impact of Diabetic Ketoacidosis Management in The Medical Intensive Care Unit After Order Set ImplementationDocumento6 páginasImpact of Diabetic Ketoacidosis Management in The Medical Intensive Care Unit After Order Set ImplementationFrancisco Sampedro0% (1)

- RUBEEEEDocumento44 páginasRUBEEEEAhlyssa de JorgeAinda não há avaliações

- Lesson Plan Tower of LondonDocumento5 páginasLesson Plan Tower of Londonmacrinabratu4458Ainda não há avaliações

- Revision 5 - OnlineDocumento5 páginasRevision 5 - OnlineThu HaAinda não há avaliações

- Filters SlideDocumento17 páginasFilters SlideEmmanuel OkoroAinda não há avaliações

- Maria Da Piedade Ferreira - Embodied Emotions - Observations and Experiments in Architecture and Corporeality - Chapter 11Documento21 páginasMaria Da Piedade Ferreira - Embodied Emotions - Observations and Experiments in Architecture and Corporeality - Chapter 11Maria Da Piedade FerreiraAinda não há avaliações

- ESSAYDocumento1 páginaESSAYJunalie GregoreAinda não há avaliações

- ResumeDocumento2 páginasResumeKeannosuke SabusapAinda não há avaliações

- Child Development Assessment Tools in Low-Income and Middle-Income CountriesDocumento9 páginasChild Development Assessment Tools in Low-Income and Middle-Income Countriesalibaba1888Ainda não há avaliações

- Who Should Take Cholesterol-Lowering StatinsDocumento6 páginasWho Should Take Cholesterol-Lowering StatinsStill RageAinda não há avaliações

- Precision Nutrition. Nutrient TimingDocumento21 páginasPrecision Nutrition. Nutrient TimingPaolo AltoéAinda não há avaliações

- Call Me by Your Name-SemioticsDocumento2 páginasCall Me by Your Name-SemioticsJoevic FranciaAinda não há avaliações

- Background Essay LSA Skills (Speaking)Documento12 páginasBackground Essay LSA Skills (Speaking)Zeynep BeydeşAinda não há avaliações