Escolar Documentos

Profissional Documentos

Cultura Documentos

Africa: Ghana - Uganda

Enviado por

ClaudeTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Africa: Ghana - Uganda

Enviado por

ClaudeDireitos autorais:

Formatos disponíveis

The Search For New Emerging Markets

Africa: the next economic tiger?

If you are looking for some good cheer in a pretty gloomy world, consider the growing consensus among some of the worlds smartest money that the next big emerging market may be Africa. Above all, that is great news for Africans: As we have seen across so much of Asia, economic growth has accomplished what decades of well-meaning development efforts failed to do, lifting hundreds of millions out of poverty. If that happens in Africa, the world will be transformed.

This case for Africa as the worlds new economic tiger is made forcefully in The Fastest Billion: The Story Behind Africas Economic Revolution, a data-packed collection of essays published under the aegis of Renaissance Capital, an investment rm with Russian roots and global ambitions. The consensus view among many students of the global economy is that investment decisions are about choosing, in the words of Mohamed A. El-Erian, chief executive of the fund manager Pimco, the cleanest dirty shirt: The United States faces a scal cliff and political gridlock, Europe is tenuously poised between years of painfully slow growth and outright collapse, and even go-go China is slowing.

Lions on the move: The progress and potential of African economies By contrast, Africa is on a tear. It is the only region in the world where growth is accelerating. If you strip out South Africa, the rest of the region is actually growing very, very quickly. Renaissance Jennings says he believes Africa is following the path to economic development that has been trod in recent decades by countries like Brazil, China and India only in Africa the transformation is happening even faster. The chances are this will be like Asia and this will go on for the next 30 years.It is helpful to remember where Asia was in the early 1970s. Then, most of the wars were in Asia, the lowest GDP and life expectancy were in Asia. People thought that was Asias lot. We hold those same prejudices, only more deeply, when it comes to Africa. But, quietly, Africa has been remaking itself. You have this very broad-based, Asia-like process of modernization. Take for instance that Kenya had halved infant mortality in ve years, an improvement it took India 25 years to achieve, predicts that within a generation, Africas place in the world will be utterly changed. By 2050, Nigeria will be the most populous country in the world and the African economy will be bigger than that of the United States and Europe combined. Two years ago, McKinsey, the management consulting rm, put a savanna spin on the emerging market cliche in a report titled, Lions on the move: The progress and potential of African economies. Foreshadowing The Fastest Billion, this report painted a picture of an Africa whose economic pulse has quickened, with gross domestic product rising 4.9 percent per year from 2000 to 2008. While Africas increased economic momentum is widely recognized, less known are its sources and likely staying power, the McKinsey study argued. Our analysis suggests that Africas long-term economic prospects are quite strong. Global businesses cannot afford to ignore the potential. An obvious source of Africas new might is the surge in commodity prices, and both reports acknowledge the impact of natural resources. But they also have a shared conviction that domestic factors are at play. The predictable one is improved governance. Less predictable is the joint celebration of Africas excellent demographics. Not so long ago, Africas tragedy was its children now that is why the global elite think Africa may be a strong bet. This is just the beginning of a revolution in our thinking about babies and the economy: The Industrial Revolution transformed children from a familys labor force to its luxury good. That is still the case; but for the national economy, babies are becoming the most precious resource of all. But it is worth challenging one optimistic assumption, particularly because of its wider implications. That is the view that in Africa, economic growth and democracy will go together. Their synonymity is a comfortable belief. But in Africa, as in other emerging markets like China, Russia and even Turkey, it may not be true. Question Mark ?

We might argue that in countries that are cracking down on freedom of the press, like Ethiopia, economic growth deects attention from growing authoritarianism rather than undermining it. This is the Putin model, or the Beijing model forget about ephemeral concepts like free speech and pluralism in exchange for a swiftly increasing GDP. It is not just impoverished domestic electorates that are tempted by this siren song. Western investors and many Western governments nd it equally convincing. But for the emerging market lions as well as for the tigers and the Siberian bears it is important to ask the question on how long authoritarian growth can be sustained.

Ghana and Uganda offer promise for brave investor

Political stability, an economy growing at more than 14% the rise of mobile technology, oil discoveries and a growing middle class are piquing the interest of investors. But risks remain. Ghana, however, is located in the western part of Africa, a vast continent often portrayed as troubled and unstable, and therefore the nation has received less attention from investors than its assets might justify.

Ghana and Uganda a landlocked country in East Africa exemplify the seismic changes under way across large parts of sub-Saharan Africa. Extended periods of peace, stable political structures, ubiquitous mobile-phone networks and the rise of mobile technology have transformed their societies. The discovery of oil in both countries holds the promise of huge prots. These changes have helped spark the birth of a middle class eager to spend its hard-earned money on the trappings of modern society.

These economic New Tigers of Africa are poised to grab a bigger share of the continents growth and for some investors offer an alternative to the traditional powerhouses Nigeria, South Africa and Kenya. There are risks. Ugandas president, the aging Yoweri Museveni, has held power for 26 years and shows no signs of loosening his tight grip. A destructive war in Congo rumbles threateningly on the countrys southwestern border. Ghana has just completed an election but the declared loser has refused to concede defeat. Bureaucratic hurdles to investing are high, currency volatility and low liquidity in local stock markets pose signicant barriers. Underappreciated Still, some investors are taking advantage of what they see as underappreciated opportunities in these markets. The biggest theme for all of Africa, including Ghana, is the rise of the middle class. Ghanas stock market is small and relatively illiquid, but opportunities can be seen in the banking and consumer-products sectors. such as Unilever Ghana and there are several banks among them Ghana Commercial is a large local bank, somewhat sleepy but awakening. There are also some foreign global banks that have local subsidiaries such as Standard Chartered. Ghana sees a rapidly growing economy partly fueled by oil discoveries that were made in 2007 and production started in late 2010. The public spending that results from higher oil revenues is creating quite a lot of activity in construction, retail, consumer goods and so on. Look for ways to get exposure to the consumer story, noting that Ghana Commercial Bank and Fan Milk, a producer of milk, yogurt and ice cream, are two attractive equities to achieve that. Buoyed by the beginning of oil production, Ghanas gross domestic product expanded by an estimated 14.4% in 2011, according to the International Monetary Fund. Its projected to exceed 8% this year. Golden opportunities Mark Mobius, the veteran emerging-markets investor, lauded Ghanas golden opportunities in a post on his blog. http://mobius.blog.franklintempleton.com/2012/05/ Ghana has abundant natural resources, including timber, oil, silver and manganese, but perhaps most important are cocoa and gold, two prized commodities for which Ghana is a key producer . Several companies listed in the West offer exposure to Ghanas resources sector. One of them is Tullow Oil PLC, a London-based energy company that operates the Jubilee oil eld with estimated recoverable resources of up to 1 billion barrels located off the coast of Ghana. Tullow is also active in Uganda. In the gold-mining sector, companies with operations in Ghana include AngloGold Ashanti , Gold Fields Ltd. and Newmont Mining Corp .

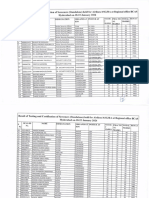

Investing in Ghana certainly comes with risks. One of them is the very low liquidity in the local stock markets, especially compared with the developed world. Average daily turnover in 2011 was only $330,000 in Ghana, while in Nigeria the daily turnover is between $15 and $20 million a day, according to data from Insparo Asset Managements Stock. In Uganda, average equity turnover is $50,000 a day. Aside from liquidity, policy and political unpredictability also poses risks. For foreign investors, this uncertainty is unwelcome and a formal legal challenge of the results by the NPP is likely to keep political tensions elevated. If that happens, economic activity will slump, more forex will be withdrawn from banks, major investment decisions by companies for 2013 companies will be delayed, and the Ghanaian cedi may come under speculative attack. and Ugandas challenges present even more risks. Ugandas appeal for investors is declining, because the policy environment has become very murky. President Museveni has been in power for 26 years and has shown no inclination to even begin to groom a successor, let alone cede any power. Relations between the president and foreign investors in the oil sector have worsened. Museveni is withholding approval of Tullow, Total and Cnoocs development plan due largely to a dispute over whether to export crude or rened products, with the president insisting on developing a petroleum-products industry, while the companies prefer to build a small renery to satisfy local consumption. Total is the French oil major, and Cnooc is an oil company controlled by the Chinese state.

Disputes between the president and parliament have also led to delays in critical oilsector legislation. All these issues mean that oil production will likely be postponed until late 2017 at the earliest. Another issue is that corruption has become increasingly evident and prompted some countries including the United Kingdom to suspend aid. Following allegations of misuse of public funds in Uganda, the World Banks Kampala ofce said in mid-November that it was reviewing its development assistance to the country. -see story http:// www.guardian.co.uk/world/africa-blog/2012/oct/01/uganda-oil These developments come as economic growth has slowed. Facing a difcult outlook in late 2011, Uganda contained rampant ination by tightening monetary policy, but that in turn lowered its growth rate to around 3% in the current scal year from nearly 7% previously. While oil was recently discovered, agriculture especially the production of coffee and tea is the most important economic sector. At a given point the yields can be very high. At one point, one-year T-bills were yielding around 18%. But you only capture that return if the exchange rate is stable. Yields have now come down and we dont see them as particularly attractive right now.

Three Uganda sectors set to benefit from oil boom

With an estimated 3.5 billion barrels of oil lying beneath the lush forests of Ugandas Albertine Rift, the anticipation of wealth hangs heavy in the air of the countrys capital. But speculation is rife about who exactly will benet from this East African countrys black gold, particularly since the oil is slow in coming; the Ugandan Ministry of Energy said in May it could be another three to ve years before commercial production gets under way. Much will depend on how the Ugandan government spends future oil revenues, and so far its intentions have been far from transparent. But, judging from the experiences of other oil rich African nations, there are several sectors in Uganda that are poised to grow. Construction The most obvious comparison is Ghana. Ghana has a new resource boom and it is changing the landscape of the largely rural nation. According to a report by the BBC, expensive new homes and apartments are already transforming the coastal Ghanaian town of Takoradi, rich in offshore oil. Many have been built in anticipation of economic growth, which is projected to more than double. One sure thing is that where there is oil, there is a great need for hotels.Uganda is already tted out with a modest number of these, mostly aimed at tourists, but the legions of oil executives and engineers expected to descend on the country will certainly demand more. Nor will the construction boom stop there. New and better roads will also be needed between the capital and the oil-rich western region. But the main driver of growth will be in overall increase in demand. There shall be an increase in the incomes of people, which will increase aggregate demand for non-tradable goods in the economy. This will include things like new homes, as well as other investment projects including shopping malls.

Leading construction companies in Uganda include closely held National Housing and Construction Company, and Roko Construction, which also operates elsewhere in the region.

Services One stark example of how a sudden oil boom can affect a poor countrys service sector can be seen, in Angola. Damaged by decades of poverty and conict, Angola has been focusing on oil since the end of its civil war in 2002, though commercial production in the area dates back to the 1950s. Today the Angolan capital, Luanda, is consistently ranked among the most expensive cities in the world. With the resource boom, demand for ofces, accommodation and international restaurants shot up, and all were in short supply. The result was stratospheric ination and prices that, in the eyes of new arrivals, can seem obscenely high. Uganda is coming into its oil after a decade of strong economic growth, so the rise in demand, and in prices, isn't likely to be as precipitous. But the service sector will boom. There shall be a need for hotel services and restaurants in the oil areas, but all over the country such things will come up because of revenues from the oil. In Uganda, the service sector already leads the economy, and it is growing. There is even a danger that with the advent of oil, services and construction could undermine other mainstays of the Ugandan economy, such as agriculture and sheries, as capital and labor are concentrated elsewhere. The agricultural industry is already experiencing labor shortages as young people choose the quick returns of work in the service sector. With oil revenues and rising demand for services, this problem could well be compounded. Growth in construction and services nontraded goods could eventually damage the countrys manufacturing sector as well, according to a paper published last year by the Bank of Uganda. Because traded goods can be imported, paid for by the oil-induced ood of foreign exchange, the structure of production in the Ugandan economy will shift toward nontraded goods with potentially damaging long term consequences, including unemployment and poverty.

At the moment, the luxury hotel industry in Uganda is dominated by international chains like Starwood Hotels & Resorts Worldwides,Sheraton and TPS Eastern Africas Serena Hotels, which trades on the Nairobi Stock Exchange under the symbol TPSE. More are expected to pour in to accommodate wealthy executives once the oil begins to ow. Other players in the sector include telecom companies, such as France Tlcoms Orange, South Africas MTN and Uganda Telecom, which is jointly owned by the Libyan governments investment fund and the Ugandan government.

Hydropower One question looming over Ugandas nascent oil industry is what effect it will have on the critical power situation in the country itself. There are no easy answers to this; how the sector fares will depend on how the government chooses to invest its revenues. But if past promises are anything to go by, one sector that should receive a badly needed cash injection is hydropower. According to the World Bank, a hefty chunk of the royalties so far paid by foreign oil companies to the Ugandan government totaling around $400 million have been earmarked for future investment in energy generation, most of which, in Uganda, comes from dams. Chief among these is the long-anticipated Karuma Dam, whose projected 600 megawatt capacity should be a boon both to the energy sector and to an economy groaning under the strain of power cuts. Hydropower companies in Uganda include South Africas Eskom, which currently operates the Nalubaale Hydroelectric Station near Jinja, and Bujagali Energy Company, which runs the newly opened Bujagali Dam. The Karuma Dam is still in the early stages of construction, and it remains to be seen which company will be charged with its operation. It is anticipated that Uganda should benet from oil, but only if it is managed properly. With the countrys oil projected to last only 30 years, a frenzy of spending and an overreliance on oil revenues could leave Uganda with nothing. But investment in industries like hydropower could provide a sustainable boost to power supplies not only in Uganda, but in the region as a whole.

Você também pode gostar

- Finance in Africa: Uncertain times, resilient banks: African finance at a crossroadsNo EverandFinance in Africa: Uncertain times, resilient banks: African finance at a crossroadsAinda não há avaliações

- MCK On Sub Saharan Africa June 1 2010Documento6 páginasMCK On Sub Saharan Africa June 1 2010mlaw_21Ainda não há avaliações

- Shaping The Future of Africa: Markets and Opportunities For Private InvestorsDocumento36 páginasShaping The Future of Africa: Markets and Opportunities For Private Investorssade consultantAinda não há avaliações

- Summary: Stephen Roach on the Next Asia: Review and Analysis of Stephen S. Roach's BookNo EverandSummary: Stephen Roach on the Next Asia: Review and Analysis of Stephen S. Roach's BookAinda não há avaliações

- Southern Innovator in A World of Innovation 2015 VersionDocumento24 páginasSouthern Innovator in A World of Innovation 2015 VersionSouthern Innovator MagazineAinda não há avaliações

- Is Africa The New Market of The Future?Documento5 páginasIs Africa The New Market of The Future?Himanshu Rajesh PatnekarAinda não há avaliações

- The Next Great Globalization: How Disadvantaged Nations Can Harness Their Financial Systems to Get RichNo EverandThe Next Great Globalization: How Disadvantaged Nations Can Harness Their Financial Systems to Get RichAinda não há avaliações

- The Shadow Market: How a Group of Wealthy Nations and Powerful Investors Secretly Dominate the WorldNo EverandThe Shadow Market: How a Group of Wealthy Nations and Powerful Investors Secretly Dominate the WorldNota: 4 de 5 estrelas4/5 (2)

- Five Pillars For Doing Business in Africa: A Road Map To OpportunitiesDocumento10 páginasFive Pillars For Doing Business in Africa: A Road Map To OpportunitiesAndzani NdhukwaniAinda não há avaliações

- Finance in Africa: Navigating the financial landscape in turbulent timesNo EverandFinance in Africa: Navigating the financial landscape in turbulent timesAinda não há avaliações

- The Deloitte Consumer Review: Africa: A 21st Century ViewDocumento32 páginasThe Deloitte Consumer Review: Africa: A 21st Century Vieweugene123Ainda não há avaliações

- Global Perspectives October 2016: Update On AfricaDocumento8 páginasGlobal Perspectives October 2016: Update On AfricaNational Association of REALTORS®100% (1)

- Renaissance in Sub-Saharan Africa: (2nd Edition)Documento36 páginasRenaissance in Sub-Saharan Africa: (2nd Edition)Kagnew WoldeAinda não há avaliações

- Economic and Monetary Sovereignty in 21st Century AfricaNo EverandEconomic and Monetary Sovereignty in 21st Century AfricaMaha Ben GadhaAinda não há avaliações

- Planet, People and Profit: Strike a Balance: Strike a balanceNo EverandPlanet, People and Profit: Strike a Balance: Strike a balanceAinda não há avaliações

- Grow Rich in the New Africa: Navigating Business Opportunities on the ContinentNo EverandGrow Rich in the New Africa: Navigating Business Opportunities on the ContinentAinda não há avaliações

- Africa's Economic GrowthDocumento28 páginasAfrica's Economic GrowthAlex McPettersonAinda não há avaliações

- Economic Transformation and Job Creation: The Caribbean ExperienceNo EverandEconomic Transformation and Job Creation: The Caribbean ExperienceAinda não há avaliações

- Georges ProjectDocumento29 páginasGeorges ProjectGeorge Baffour AwuahAinda não há avaliações

- Revolutionizing World Trade: How Disruptive Technologies Open Opportunities for AllNo EverandRevolutionizing World Trade: How Disruptive Technologies Open Opportunities for AllAinda não há avaliações

- Ataberk Güngör - 24155 - Negative Effects of Globalization On South AfricaDocumento7 páginasAtaberk Güngör - 24155 - Negative Effects of Globalization On South AfricaUlaş TuraAinda não há avaliações

- InvestAD EIU Africa Report 2012 enDocumento30 páginasInvestAD EIU Africa Report 2012 enashraf187Ainda não há avaliações

- Review Questions: 1. Cite Five (5) Major Issues of Economic Development in The World Today. A. Growing Income InequalityDocumento7 páginasReview Questions: 1. Cite Five (5) Major Issues of Economic Development in The World Today. A. Growing Income InequalityRozaine Arevalo ReyesAinda não há avaliações

- Capital Budgeting and Economic Development in The Third World: The Case of NigeriaDocumento26 páginasCapital Budgeting and Economic Development in The Third World: The Case of NigeriaAdeyeye davidAinda não há avaliações

- Development Asia—Can Asia Unite to Weather the Storm?: April 2009No EverandDevelopment Asia—Can Asia Unite to Weather the Storm?: April 2009Nota: 5 de 5 estrelas5/5 (1)

- Speech Kofi Annan enDocumento7 páginasSpeech Kofi Annan enAmaboh ShepardAinda não há avaliações

- Latin America and the Caribbean as Tailwinds Recede: In Search of Higher Growth (LAC Semiannual Report, April 2013)No EverandLatin America and the Caribbean as Tailwinds Recede: In Search of Higher Growth (LAC Semiannual Report, April 2013)Ainda não há avaliações

- African Pespectives On MarketDocumento4 páginasAfrican Pespectives On MarketcloviseAinda não há avaliações

- 10 Reasons Why You Should Invest in AfricaDocumento16 páginas10 Reasons Why You Should Invest in AfricaOlivier LumenganesoAinda não há avaliações

- Amazing Africa, Where Is Your Spirit Of Common Good Gone,No EverandAmazing Africa, Where Is Your Spirit Of Common Good Gone,Ainda não há avaliações

- The Future of Economic ConvergenceDocumento50 páginasThe Future of Economic ConvergenceScott N. ChinAinda não há avaliações

- Eco AssignmentDocumento30 páginasEco AssignmentMitali ChatterjeeAinda não há avaliações

- Africa's Economic Boom PDFDocumento8 páginasAfrica's Economic Boom PDFflashed12Ainda não há avaliações

- Future Economic ConvergenceDocumento50 páginasFuture Economic ConvergenceSKSAinda não há avaliações

- Africa's Economic Pulse Has Quickened, Infusing The Continent With ADocumento11 páginasAfrica's Economic Pulse Has Quickened, Infusing The Continent With AT-kash EverlastingAinda não há avaliações

- Africa's Future and The World Bank's Role in ItDocumento18 páginasAfrica's Future and The World Bank's Role in ItGoutham Kumar ReddyAinda não há avaliações

- Strong Globalisation ThesisDocumento6 páginasStrong Globalisation ThesisBuyCustomPapersOnlineChicago100% (2)

- The Emergence of The Asian TigersDocumento4 páginasThe Emergence of The Asian TigersShepherd Cha'abataAinda não há avaliações

- Asian RegionalismDocumento26 páginasAsian RegionalismChesca Marie Arenal PeñarandaAinda não há avaliações

- A Time To Invest in AfricaDocumento18 páginasA Time To Invest in AfricaTony AwimboAinda não há avaliações

- Success in Africa: CEO Insights from a Continent on the RiseNo EverandSuccess in Africa: CEO Insights from a Continent on the RiseNota: 5 de 5 estrelas5/5 (3)

- Izbor Tekstova Iz The Economist 15 OktobarDocumento11 páginasIzbor Tekstova Iz The Economist 15 OktobarNiksa KosuticAinda não há avaliações

- Stiglitz Glob and GrowthDocumento20 páginasStiglitz Glob and GrowthAngelica MansillaAinda não há avaliações

- Post Asian CrisisDocumento11 páginasPost Asian CrisisSahil BundelaAinda não há avaliações

- Increasing Revenues Generated From ExportsDocumento8 páginasIncreasing Revenues Generated From Exportsparamita tuladhar100% (1)

- Introduction Zahir 3Documento10 páginasIntroduction Zahir 37rdw2kc7gmAinda não há avaliações

- F&D Sep'13Documento60 páginasF&D Sep'13Venkatesh GorurAinda não há avaliações

- Africa Rising (1)Documento2 páginasAfrica Rising (1)Priyanka RajaniAinda não há avaliações

- Thunderroad Report Q4 PDFDocumento40 páginasThunderroad Report Q4 PDFabcabc123123xyzxyxAinda não há avaliações

- How To Play RussiaDocumento3 páginasHow To Play RussiaClaudeAinda não há avaliações

- Morgan The Global Macro Analyst Macro Surprises For 2014Documento21 páginasMorgan The Global Macro Analyst Macro Surprises For 2014Claude100% (1)

- Thunder Road Report: The New New Great GameDocumento39 páginasThunder Road Report: The New New Great GameGold Silver WorldsAinda não há avaliações

- WGC Q2 Demand TrendsDocumento12 páginasWGC Q2 Demand TrendsClaudeAinda não há avaliações

- LombardOdier 2014 Outlook : A Slow and Fragile Healing Process To SafeguardDocumento52 páginasLombardOdier 2014 Outlook : A Slow and Fragile Healing Process To SafeguardClaudeAinda não há avaliações

- Macroeconomic Developments Likely To Influence Gold in 2013-World Gold CouncilDocumento14 páginasMacroeconomic Developments Likely To Influence Gold in 2013-World Gold CouncilClaudeAinda não há avaliações

- Zermatt Summit About The Common GoodDocumento45 páginasZermatt Summit About The Common GoodClaudeAinda não há avaliações

- Russia Are You Contrarian Enough ?Documento40 páginasRussia Are You Contrarian Enough ?ClaudeAinda não há avaliações

- JP Morgan Q3 Guide To The MarketDocumento70 páginasJP Morgan Q3 Guide To The MarketClaudeAinda não há avaliações

- The World of GoldDocumento50 páginasThe World of GoldClaudeAinda não há avaliações

- Media 2 GoDocumento24 páginasMedia 2 GoClaudeAinda não há avaliações

- Inflationary Deflation Thunder Road Report December 2012Documento75 páginasInflationary Deflation Thunder Road Report December 2012Gold Silver WorldsAinda não há avaliações

- There Will Be HaircutsDocumento7 páginasThere Will Be HaircutsClaudeAinda não há avaliações

- Europe - Poland-Turkey - The Search For New Emerging MarketsDocumento7 páginasEurope - Poland-Turkey - The Search For New Emerging MarketsClaudeAinda não há avaliações

- Commodities Outlook, LBBWDocumento25 páginasCommodities Outlook, LBBWClaudeAinda não há avaliações

- Currencies, Interest Rates and Market (Citi)Documento18 páginasCurrencies, Interest Rates and Market (Citi)ClaudeAinda não há avaliações

- Asia - Indonesia-Philippines - The Search For New Emerging MarketsDocumento9 páginasAsia - Indonesia-Philippines - The Search For New Emerging MarketsClaudeAinda não há avaliações

- Emerging Markets OutlookDocumento13 páginasEmerging Markets OutlookClaudeAinda não há avaliações

- Commodities Outlook, LBBWDocumento25 páginasCommodities Outlook, LBBWClaudeAinda não há avaliações

- Chicago Fed PaperDocumento4 páginasChicago Fed Paperrichardck61Ainda não há avaliações

- Asian Bonds Exposure - ETFDocumento20 páginasAsian Bonds Exposure - ETFClaudeAinda não há avaliações

- RUSSIA CALLING! Forum Diary President Putin's Keynote AddressDocumento4 páginasRUSSIA CALLING! Forum Diary President Putin's Keynote AddressClaudeAinda não há avaliações

- 121101latin America - Peru - Colombia - The Search For New Emerging MarketsDocumento11 páginas121101latin America - Peru - Colombia - The Search For New Emerging MarketsClaudeAinda não há avaliações

- Eoliennes - Girouettes PresentationDocumento29 páginasEoliennes - Girouettes PresentationClaudeAinda não há avaliações

- Thunder Road Report 26Documento57 páginasThunder Road Report 26TFMetalsAinda não há avaliações

- AET Assignment C Kate ThomsonDocumento12 páginasAET Assignment C Kate ThomsonaymenmoatazAinda não há avaliações

- TIP - IPBT M - E For MentorsDocumento3 páginasTIP - IPBT M - E For Mentorsallan galdianoAinda não há avaliações

- HyderabadDocumento3 páginasHyderabadChristoAinda não há avaliações

- New York State - NclexDocumento5 páginasNew York State - NclexBia KriaAinda não há avaliações

- Astm A 478 - 97Documento2 páginasAstm A 478 - 97neno2405Ainda não há avaliações

- Unit 8 - Week 7: Assignment 7Documento3 páginasUnit 8 - Week 7: Assignment 7Nitin MoreAinda não há avaliações

- A Study On Impact of Smartphone AddictioDocumento4 páginasA Study On Impact of Smartphone AddictiotansuoragotAinda não há avaliações

- Alfa Laval Plate Heat Exchangers: A Product Catalogue For Comfort Heating and CoolingDocumento8 páginasAlfa Laval Plate Heat Exchangers: A Product Catalogue For Comfort Heating and CoolingvictoryanezAinda não há avaliações

- Design of Accurate Steering Gear MechanismDocumento12 páginasDesign of Accurate Steering Gear Mechanismtarik RymAinda não há avaliações

- Pavement Design - (Rigid Flexible) DPWHDocumento25 páginasPavement Design - (Rigid Flexible) DPWHrekcah ehtAinda não há avaliações

- Legal Environment of Business 7th Edition Kubasek Solutions Manual Full Chapter PDFDocumento34 páginasLegal Environment of Business 7th Edition Kubasek Solutions Manual Full Chapter PDFlongchadudz100% (12)

- Induction-Llgd 2022Documento11 páginasInduction-Llgd 2022Phạm Trúc QuỳnhAinda não há avaliações

- Subsistence and Travel FormsDocumento3 páginasSubsistence and Travel FormsAnonymous YRLhQY6G6jAinda não há avaliações

- EE FlowchartDocumento1 páginaEE Flowchartgoogley71Ainda não há avaliações

- Project Cost ContingencyDocumento9 páginasProject Cost ContingencyniroshniroshAinda não há avaliações

- Data MiningDocumento721 páginasData MiningAuly Natijatul AinAinda não há avaliações

- BGD Country en Excel v2Documento2.681 páginasBGD Country en Excel v2Taskin SadmanAinda não há avaliações

- Cost Volume Profit AnalysisDocumento7 páginasCost Volume Profit AnalysisMatinChris KisomboAinda não há avaliações

- Factors Affecting The Implementation of Green Procurement: Empirical Evidence From Indonesian Educational InstitutionDocumento12 páginasFactors Affecting The Implementation of Green Procurement: Empirical Evidence From Indonesian Educational InstitutionYeni Saro ManaluAinda não há avaliações

- Grant Miller Resume-ColliersDocumento3 páginasGrant Miller Resume-ColliersDeven GriffinAinda não há avaliações

- LG+32LX330C Ga LG5CBDocumento55 páginasLG+32LX330C Ga LG5CBjampcarlosAinda não há avaliações

- Mercantile Law Zaragoza Vs Tan GR. No. 225544Documento3 páginasMercantile Law Zaragoza Vs Tan GR. No. 225544Ceasar Antonio100% (1)

- 2 Players The One With Steam BaronsDocumento1 página2 Players The One With Steam BaronsBrad RoseAinda não há avaliações

- Problems of Spun Concrete Piles Constructed in Soft Soil in HCMC and Mekong Delta - VietnamDocumento6 páginasProblems of Spun Concrete Piles Constructed in Soft Soil in HCMC and Mekong Delta - VietnamThaoAinda não há avaliações

- Wheel CylindersDocumento2 páginasWheel Cylindersparahu ariefAinda não há avaliações

- San Francisco Chinese Christian Union, Et Al. v. City and County of San Francisco, Et Al. ComplaintDocumento25 páginasSan Francisco Chinese Christian Union, Et Al. v. City and County of San Francisco, Et Al. ComplaintFindLawAinda não há avaliações

- Median FilteringDocumento30 páginasMedian FilteringK.R.RaguramAinda não há avaliações

- Energia Eolica Nordex N90 2500 enDocumento20 páginasEnergia Eolica Nordex N90 2500 enNardo Antonio Llanos MatusAinda não há avaliações

- RFBT - Law On Sales Cont. Week 11Documento1 páginaRFBT - Law On Sales Cont. Week 11Jennela VeraAinda não há avaliações

- Wilo49608 Wilo Ge LeafletDocumento46 páginasWilo49608 Wilo Ge LeafletJair Jimenez HerreraAinda não há avaliações