Escolar Documentos

Profissional Documentos

Cultura Documentos

Global Retail Scenario

Enviado por

Stavan AjmeraTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Global Retail Scenario

Enviado por

Stavan AjmeraDireitos autorais:

Formatos disponíveis

A ASSIGNMENT ON GLOBAL RETAIL SCENARIO

SUBJECT: RETAILING MANAGEMENT

SUBMITTED BY: AJMERA STAVAN (11MBA043) (201104100710043)

SUBMITTED TO: MR. GAUTAM DONGA

SHRIMAD RAJCHANDRA INSTITUTE OF MANAGEMENT AND COMPUTER APPLICATION

UKA TARSADIA UNIVERSITY (2012-2013)

Growth rate of Global retail sector up to 2011

The Indian retail market, which is the fifth largest retail destination globally, has been ranked as the most attractive emerging market for investment in the retail sector by AT Kearney's eighth annual Global Retail Development Index (GRDI), in 2009. As per a study conducted by the Indian Council for Research on International Economic Relations (ICRIER), the retail sector is expected to contribute to 22 per cent of India's GDP by 2010. With rising consumer demand and greater disposable income, the US$ 400 billion Indian retail sector is clocking an annual growth rate of 30 per cent. It is projected to grow to US$ 700 billion by 2010, according to a report by global consultancy Northbridge Capital. The organised business is expected to be 20 per cent of the total market by then. In 2008, the share of organised retail was 7.5 per cent or US$ 300 million of the total retail market. A McKinsey report, 'The rise of Indian Consumer Market', estimates that the Indian consumer market is likely to grow four times by 2025. Commercial real estate services company, CB Richard Ellis' findings state that India's retail market has moved up to the 39th most preferred retail destination in the world in 2009, up from 44 last year. India continues to be among the most attractive countries for global retailers. Foreign direct investment (FDI) inflows as on September 2009, in single-brand retail trading, stood at approximately US$ 47.43 million, according to the Department of Industrial Policy and Promotion (DIPP). India's overall retail sector is expected to rise to US$ 833 billion by 2013 and to US$ 1.3 trillion by 2018, at a compound annual growth rate (CAGR) of 10 per cent. As a democratic country with high growth rates, consumer spending has risen sharply as the youth population (more than 33 percent of the country is below the age of 15) has seen a significant increase in its disposable income. Consumer spending rose an

impressive 75 per cent in the past four years alone. Also, organised retail, which is pegged at around US$ 8.14 billion, is expected to grow at a CAGR of 40 per cent to touch US$ 107 billion by 2013. The organised retail sector, which currently accounts for around 5 per cent of the Indian retail market, is all set to witness maximum number of large format malls and branded retail stores in South India, followed by North, West and the East in the next two years. Tier II cities like Noida, Amritsar, Kochi and Gurgaon, are emerging as the favoured destinations for the retail sector with their huge growth potential. Further, this sector is expected to invest around US$ 503.2 million in retail technology service solutions in the current financial year. This could go further up to US$ 1.26 billion in the next four to five years, at a CAGR of 40 per cent. Moreover, many new apparel brands such as Zara, the fashion label owned by Inditex SA of Spain, UK garment chain Topshop, the Marc Ecko clothing line promoted by the US entrepreneur of the same name and the Japanese casual wear brand Uniqlo are preparing to open outlets in India.

Buoyed by improved consumer spending, sales of listed retailers increased by 12 per cent in the September 2009 quarter compared with the same period in 2008. Australia's Retail Food Group is planning to enter the Indian market in 2010. It has ambitious

investment plans which aim to clock revenue of US$ 87 million from the country within five years from start of operations. British retail major Marks & Spencer (M&S) is looking at scaling up its India operations and plans to

open at least 50 more outlets in the country over the next few years. Koutons Retail India plans to open 200 stores in FY11 in addition to its existing 1,400. Of the 200 stores, 100 would be family concept stores, which would include women and children's wear. Reliance Footprint, part of Reliance Retail, plans to spend US$ 86.62 million to add 100 outlets

across the country in two years to sell branded footwear. It currently has 16 outlets. Retail chain Suvidhaa Infoserve plans to open 1,000-1,200 new outlets every month across the

country and is eyeing a 100,000 strong network in the next two to three years. At present, the Mumbai-based firm has 18,000 convenient neighbourhood stores called 'Suvidhaa Point' across the country in over 20 states and over 400 cities. Lifestyle International, part of the Dubai-based US$ 1.5 billion Landmark Group, plans to have over

50 stores across India by 201213. These will include 35 Lifestyle stores for retailing apparel, cosmetics and footwear, besides 15 Home Centres that sell home furnishing goods. Watch maker, Timex India, is looking at increasing its presence in the country by adding another 52

stores by March 2011 at an investment of US$ 1.3 million taking its total store count to 120. Wills Lifestyle plans to expand its operations by opening 100 new stores in the next three years. It

also plans to concentrate on online buyers. Pantaloon Retail India (PRIL) is planning to invest US$ 77.88 million this fiscal to add up to 2.4

million sq ft retail space at its existing operations. Pantaloon Retail is also looking to hive off its value retail chain, Big Bazaar, into a separate subsidiary, which may eventually go for an initial public offer (IPO). PRIL proposes to open 155 Big Bazaar stores by 2014, increasing its total network to 275 stores.

Top Retail Companies in India

The retail industry in India is one of the quick growing sectors in India and this sector has seen very good progress in the past two years. Initially, the retail sector in India was unorganized, but nowadays with the growing preferences of consumers, the sector is becoming one of the organized sectors in India.

Unorganized retails industry includes paan shops, kirana stores, subzi mandi, medicine stores and medium & small grocery stores. The names of some of the top players in the retail sector in India are given below:

Key players in Indian retail sector in 2011

AV Birla Group has a strong presence in apparel retail and owns renowned brands like Allen Solly, Louis Phillipe, Trouser Town, Van Heusen and Peter England. The company has investment plans to the tune of Rs 8000 9000 crores till 2010. Trent is a subsidiary of the Tata group; it operates lifestyle retail chain, book and music retail chain, consumer electronic chain etc. Westside, the lifestyle retail chain registered a turnover of Rs 3.58 mn in 2006 Landmark Group invested Rs. 300 crores to expand Max chain, and Rs 100 crores on Citymax 3 star hotel chain. Lifestyle International is their international brand business. K Raheja Corp Group has a turnover of Rs 6.75 billion which is expected to cross US$100 million mark by 2010. Segments include books, music and gifts, apparel, entertainment etc. Reliance has more than 300 Reliance Fresh stores; they have multiple formats and their sale is expected to be Rs 90,000 crores ($20 billion) by 2009-10. Pantaloon Retail has 450 stores across the country and revenue of over Rs. 20 billion and is expected to touch 30 million by 2010. Segments include Food & grocery, e-tailing, home solutions, consumer electronics, entertainment, shoes, books, music & gifts, health & beauty care services.

Key players in Global retail sector in 2011

United States Top Global Retail Ranking #1 - Wal-Mart Stores Cash and Carry/Warehouse Club, Discount Department Store, Hypermarket/ Supercenter/ Superstore, Supermarket Australia Top Global Retail Ranking #20 - Woolworths Ltd. Convenience/ Forecourt Store, Discount Department Store, Electronics Specialty, Other Specialty, Supermarket Austria Top Global Retail Ranking #72 - SPAR Oster-reichische Warenhandels-AG Hypermarket/Supercenter/Superstore, Other Specialty, Supermarket Belgium Top Global Retail Ranking #32 -

Cash & Carry/Warehouse Club, Convenience/Forecourt Store, Drug Store/Pharmacy, Hypermarket/Supercenter/Superstore, Other Specialty Supermarket

Brazil Top Global Retail Ranking #75 - Grupo Pao De Acucar Convenience/Forecourt Store, Electronics Specialty, Hypermarket/Supercenter/Superstore, Supermarket Canada Top Global Retail Ranking #40 Cash & Carry/Warehouse Club, Discount Store, Hypermarket/Supercenter/Superstore, Supermarket

Chile Top Global Retail Ranking #90 Cencosud S.A. Supermarket China Top Global Retail Ranking #70 Bailian (Brilliance) Group Supermarket Denmark Top Global Retail Ranking #79 - Dansk Supermarket A/S Apparel/Footwear Specialty, Department Store, Discount Store, Hypermarket/Supercenter/Superstore

Finland Top Global Retail Ranking #68 S Group Supermarket France Top Global Retail Ranking #2 - Carrefour Cash and Carry/Warehouse Club, Discount Department Store, Hypermarket/Supercenter/Superstore, Supermarket, convenience/forecourt store Germany Top Global Retail Ranking #3 - Metro AG Apparel/Footwear Specialty, Cash & Carry/Warehouse Club, Department Store, Electronics, Specialty, Hypermarket/Supercenter/Superstore, Other Specialty, Supermarket

Hong Kong SAR Top Global Retail Ranking #55 - AS Watson & Company Ltd. Discount Store, Drug Store/Pharmacy, Electronics Specialty, Hypermarket/Supercenter/Superstore, Other Specialty, Supermarket Italy Top Global Retail Ranking #47 - Coop Italia Discount Store, Hypermarket/Supercenter/Superstore, Supermarket, Hypermarket/Supercenter/Superstore

Share of retailing in India in 2011

Retailing in India is one of the pillars of its economy and accounts for 14 to 15 percent of its GDP. The Indian retail market is estimated to be US$450 billion and one of the top five retail markets in the world by economic value. India is one of the fastest growing retail market in the world, with 1.2 billion people. India's retailing industry is essentially owner manned small shops. In 2010, larger format convenience stores and supermarkets accounted for about 4 percent of the industry, and these were present only in large urban centers. India's retail and logistics industry employs about 40 million Indians (3.3% of Indian population). Until 2011, Indian central government denied foreign direct investment (FDI) in multi-brand retail, forbidding foreign groups from any ownership in supermarkets, convenience stores or any retail outlets. Even single-brand retail was limited to 51% ownership and a bureaucratic process. In November 2011, India's central government announced retail reforms for both multi-brand stores and single-brand stores. These market reforms paved the way for retail innovation and competition with multibrand retailers such as Walmart, Carrefour and Tesco, as well single brand majors such as IKEA,Nike, and Apple. The announcement sparked intense activism, both in opposition and in support of the reforms. In December 2011, under pressure from the opposition, Indian government placed the retail reforms on hold till it reaches a consensus. In January 2012, India approved reforms for single-brand stores welcoming anyone in the world to innovate in Indian retail market with 100% ownership, but imposed the requirement that the single brand retailer source 30 percent of its goods from India. Indian government continues the hold on retail reforms for multibrand stores. In June 2012, IKEA announced it has applied for permission to invest $1.9 billion in India and set up 25 retail stores. Fitch believes that the 30 percent requirement is likely to significantly delay if not prevent most single brand majors from Europe, USA and Japan from opening stores and creating associated jobs in India.

Você também pode gostar

- Indian Retail ScenarioDocumento10 páginasIndian Retail ScenarioSubodh KantAinda não há avaliações

- India Is in The Mark of Developed CountryDocumento8 páginasIndia Is in The Mark of Developed CountryGargi ChawlaAinda não há avaliações

- Industry ProfileDocumento10 páginasIndustry Profilewhisky86Ainda não há avaliações

- Final Report OSDDocumento25 páginasFinal Report OSDNikita GuptaAinda não há avaliações

- Retailing Industry in IndiaDocumento16 páginasRetailing Industry in IndiaPratik Ahluwalia100% (1)

- Ndian Etail Ndustry: May - 2010 Industry OverviewDocumento7 páginasNdian Etail Ndustry: May - 2010 Industry OverviewUmesh SalekarAinda não há avaliações

- SIP ON BRAND FACTORY ReportDocumento79 páginasSIP ON BRAND FACTORY Reportvikas lakshettyAinda não há avaliações

- Final Globus - ProjectDocumento72 páginasFinal Globus - Projectravi_sms001Ainda não há avaliações

- Ishan Capstone FinalDocumento18 páginasIshan Capstone FinalManjinder SandhuAinda não há avaliações

- introduction:: Watches TitanDocumento15 páginasintroduction:: Watches TitanThirumalesh MkAinda não há avaliações

- Growth Drivers of Retail in IndiaDocumento10 páginasGrowth Drivers of Retail in IndiaRajshreeAinda não há avaliações

- Retail IndiaDocumento32 páginasRetail IndiaKrunal DhawasAinda não há avaliações

- Project On Growth of Retail Sector in IndiaDocumento46 páginasProject On Growth of Retail Sector in IndiasharadAinda não há avaliações

- Customer Satisfaction Towards Big BazarDocumento56 páginasCustomer Satisfaction Towards Big BazarAnsh100% (2)

- Private Lebel Mini ProjectDocumento24 páginasPrivate Lebel Mini ProjectVijit GhoshAinda não há avaliações

- Retail MarketingDocumento19 páginasRetail MarketingLuv PrakashAinda não há avaliações

- Future Prospects of Organized Retail Sector in IndiaDocumento2 páginasFuture Prospects of Organized Retail Sector in IndiaMamatha KerpudeAinda não há avaliações

- Grand Project On Retail Management: Submitted To: Submitted By: Prof. Roopa Rao Jiten Khandor Roll No. 17 (PGP-1)Documento33 páginasGrand Project On Retail Management: Submitted To: Submitted By: Prof. Roopa Rao Jiten Khandor Roll No. 17 (PGP-1)Piyush GaurAinda não há avaliações

- Evolution of Indian Retail IndustryDocumento8 páginasEvolution of Indian Retail IndustryVenkata Pratap Reddy MAinda não há avaliações

- Shoppers Stop Campus Guru CaseDocument PDFDocumento9 páginasShoppers Stop Campus Guru CaseDocument PDFHardik GuptaAinda não há avaliações

- India Retail IndustryDocumento9 páginasIndia Retail IndustrysunnygauravscribdAinda não há avaliações

- Wal MartDocumento76 páginasWal MartVishal PatelAinda não há avaliações

- Introduction To Retail Industry in IndiaDocumento16 páginasIntroduction To Retail Industry in Indiatejas.waghuldeAinda não há avaliações

- Indian Retail ScenarioDocumento26 páginasIndian Retail ScenarioPreet Kamal0% (1)

- Organised Retail Industry in IndiaDocumento4 páginasOrganised Retail Industry in IndiavartikakukrejaAinda não há avaliações

- Introduction To Retail Industry in IndiaDocumento14 páginasIntroduction To Retail Industry in Indiamynameismhasan100% (1)

- Retail DistributionDocumento68 páginasRetail DistributionMba ProjectsAinda não há avaliações

- New Mock AssignDocumento76 páginasNew Mock AssignsnehaAinda não há avaliações

- Retail! Retail! Retail! Why Is There So Much Talk About This Industry, Which Is ProbablyDocumento127 páginasRetail! Retail! Retail! Why Is There So Much Talk About This Industry, Which Is ProbablySanjay RamaniAinda não há avaliações

- Introduction and Company Profile: Retail in IndiaDocumento60 páginasIntroduction and Company Profile: Retail in IndiaAbhinav Bansal0% (1)

- CCCCCCCCCCCCCCCCCCCCCCCC C C C: CCCC 'Documento12 páginasCCCCCCCCCCCCCCCCCCCCCCCC C C C: CCCC 'binow89Ainda não há avaliações

- Assignment On Retail IndustryDocumento16 páginasAssignment On Retail Industryvinodhategirls100% (1)

- Retail Industry On Global EnvironmentDocumento50 páginasRetail Industry On Global EnvironmentPriyanka KhannaAinda não há avaliações

- Consumer Perception of 3 Retail Chains in BangaloreDocumento73 páginasConsumer Perception of 3 Retail Chains in BangaloreVincent LalooAinda não há avaliações

- Thesis 2Documento5 páginasThesis 2Ripunjay GoswamiAinda não há avaliações

- Retail DownloadedDocumento6 páginasRetail DownloadedpavanAinda não há avaliações

- Dmart and The Retail IndustryDocumento29 páginasDmart and The Retail IndustryVansh JainAinda não há avaliações

- PHD ThesisDocumento332 páginasPHD ThesisManpreet Singh50% (2)

- Aknowledgement: Tina Dubey Ms. Sarita Dubey Mr. Sameer ThakurDocumento23 páginasAknowledgement: Tina Dubey Ms. Sarita Dubey Mr. Sameer ThakurPrachi TiwariAinda não há avaliações

- Retail Scenario in India Cii ReportDocumento21 páginasRetail Scenario in India Cii Reportapi-3823513100% (1)

- Bibi L OgraphyDocumento51 páginasBibi L Ographydivyaa76Ainda não há avaliações

- India Retail Industry: Growth of Indian RetailDocumento5 páginasIndia Retail Industry: Growth of Indian Retailswapnild7Ainda não há avaliações

- Retail Market Opportunity and ThreatsDocumento30 páginasRetail Market Opportunity and ThreatsRashed55Ainda não há avaliações

- Islamic Branding and Marketing: Creating A Global Islamic BusinessNo EverandIslamic Branding and Marketing: Creating A Global Islamic BusinessNota: 5 de 5 estrelas5/5 (1)

- India's Store Wars: Retail Revolution and the Battle for the Next 500 Million ShoppersNo EverandIndia's Store Wars: Retail Revolution and the Battle for the Next 500 Million ShoppersAinda não há avaliações

- Entrepreneurship: Model Assignment answer with theory and practicalityNo EverandEntrepreneurship: Model Assignment answer with theory and practicalityAinda não há avaliações

- Store Wars: The Worldwide Battle for Mindspace and Shelfspace, Online and In-storeNo EverandStore Wars: The Worldwide Battle for Mindspace and Shelfspace, Online and In-storeAinda não há avaliações

- The Online Marketplace Advantage: Sell More, Scale Faster, and Create a World-Class Digital Customer ExperienceNo EverandThe Online Marketplace Advantage: Sell More, Scale Faster, and Create a World-Class Digital Customer ExperienceAinda não há avaliações

- Marketing 3.0: From Products to Customers to the Human SpiritNo EverandMarketing 3.0: From Products to Customers to the Human SpiritNota: 4.5 de 5 estrelas4.5/5 (29)

- Vending Machine Business: How to Start Making Money from Vending MachinesNo EverandVending Machine Business: How to Start Making Money from Vending MachinesAinda não há avaliações

- Branding a Store: How To Build Successful Retail Brands In A Changing MarketplaceNo EverandBranding a Store: How To Build Successful Retail Brands In A Changing MarketplaceNota: 3 de 5 estrelas3/5 (2)

- A Practical Approach to the Study of Indian Capital MarketsNo EverandA Practical Approach to the Study of Indian Capital MarketsAinda não há avaliações

- Top Stocks 2019: A Sharebuyer's Guide to Leading Australian CompaniesNo EverandTop Stocks 2019: A Sharebuyer's Guide to Leading Australian CompaniesAinda não há avaliações

- Brand New World: How Paupers, Pirates, and Oligarchs are Reshaping BusinessNo EverandBrand New World: How Paupers, Pirates, and Oligarchs are Reshaping BusinessAinda não há avaliações

- The Small Business Guide to Apps: How your business can use apps to increase market share and retain more customersNo EverandThe Small Business Guide to Apps: How your business can use apps to increase market share and retain more customersAinda não há avaliações

- Be a Millionaire Shopkeeper: How Your Independent Shop Can Compete with the Big GuysNo EverandBe a Millionaire Shopkeeper: How Your Independent Shop Can Compete with the Big GuysAinda não há avaliações

- Case StudyDocumento8 páginasCase StudyStavan AjmeraAinda não há avaliações

- Coca Cola PDFDocumento30 páginasCoca Cola PDFAmit YadavAinda não há avaliações

- B.R. Jornal of Management EducationDocumento14 páginasB.R. Jornal of Management EducationStavan AjmeraAinda não há avaliações

- HRM Institutional Change in JapanDocumento35 páginasHRM Institutional Change in JapanStavan AjmeraAinda não há avaliações

- Reebok Case StudyDocumento17 páginasReebok Case StudyStavan Ajmera100% (2)

- Pestle Analysis of SingaporeDocumento14 páginasPestle Analysis of SingaporeStavan Ajmera60% (5)

- Questionnaire On Customer Perception Towards Bajaj BikesDocumento3 páginasQuestionnaire On Customer Perception Towards Bajaj BikesStavan Ajmera61% (18)

- 01-Jul-2021Documento2 páginas01-Jul-2021Baseerat KhanAinda não há avaliações

- Economics: Number Key Number KeyDocumento6 páginasEconomics: Number Key Number Keymstudy123456Ainda não há avaliações

- Quotation: Customer Code: 10008260 Information VAT Number - 300055945410003Documento1 páginaQuotation: Customer Code: 10008260 Information VAT Number - 300055945410003Marcial MilitanteAinda não há avaliações

- Wade Timmerson, Suzanne Caplan, - Building Big Profit in REDocumento273 páginasWade Timmerson, Suzanne Caplan, - Building Big Profit in REkafes51427Ainda não há avaliações

- East Godavari District Officers Phone Numbers-Mobile Numbers Andhra Pradesh StateDocumento7 páginasEast Godavari District Officers Phone Numbers-Mobile Numbers Andhra Pradesh StateSRINIVASARAO JONNALAAinda não há avaliações

- Midas Safety Term Report - Procurement & Inventory ManagementDocumento21 páginasMidas Safety Term Report - Procurement & Inventory ManagementChaudhary Hassan Arain100% (2)

- Unit 11 - Money and Its FunctionsDocumento2 páginasUnit 11 - Money and Its FunctionsĐỗ Tuấn AnAinda não há avaliações

- Principle of Macro-Economics Mcq'sDocumento6 páginasPrinciple of Macro-Economics Mcq'sSafiullah mirzaAinda não há avaliações

- Commerce 11Documento12 páginasCommerce 11Abu IbrahimAinda não há avaliações

- Coremacroeconomics 3rd Edition Chiang Solutions ManualDocumento11 páginasCoremacroeconomics 3rd Edition Chiang Solutions Manualphenicboxironicu9100% (27)

- Agricultural Master PlanDocumento92 páginasAgricultural Master PlanKhalifa Mahmoud InuwaAinda não há avaliações

- Guide Buying Gold SilverDocumento7 páginasGuide Buying Gold SilverTahafut At-TahafutAinda não há avaliações

- Lesson 1 PDFDocumento30 páginasLesson 1 PDFJanna GunioAinda não há avaliações

- Inter Factory Demand: IfifdDocumento56 páginasInter Factory Demand: IfifdSATYENDRA KUMARAinda não há avaliações

- Materi Front Office Kelas Xi & Xii Perhotelan-1Documento8 páginasMateri Front Office Kelas Xi & Xii Perhotelan-1DAYANA PUTRIAinda não há avaliações

- Elias N. Stebek, WTO Accesion in The Ethiopian Context - A Bittersweet ParadoxDocumento29 páginasElias N. Stebek, WTO Accesion in The Ethiopian Context - A Bittersweet ParadoxLex BekAinda não há avaliações

- Import RegulationsDocumento8 páginasImport RegulationsAfaa NkamaAinda não há avaliações

- ROZY MAM If & MarketingDocumento41 páginasROZY MAM If & Marketingraj rmnAinda não há avaliações

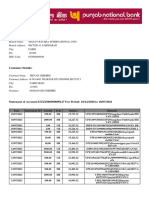

- PNBONE Mpassbook 18-12-2020 18-7-2021 XXXX006900009127Documento9 páginasPNBONE Mpassbook 18-12-2020 18-7-2021 XXXX006900009127jeevan GhimireAinda não há avaliações

- College Accounting Chapters 1-24-11th Edition Nobles Test BankDocumento28 páginasCollege Accounting Chapters 1-24-11th Edition Nobles Test Bankthomasgillespiesbenrgxcow100% (20)

- Question Bank by CA P.S. BeniwalDocumento497 páginasQuestion Bank by CA P.S. BeniwalTushar MittalAinda não há avaliações

- Advantages and Drawbacks of ContainerizationDocumento2 páginasAdvantages and Drawbacks of ContainerizationPortAinda não há avaliações

- Opportunities Within Belt and Road Initiative Development of Railway ServicesDocumento11 páginasOpportunities Within Belt and Road Initiative Development of Railway ServicesDuska VuletaAinda não há avaliações

- ListDocumento6 páginasListRoshelleAinda não há avaliações

- Estimates of Global E-Commerce 2019 and Preliminary Assessment of Covid-19 Impact On Online Retail 2020Documento12 páginasEstimates of Global E-Commerce 2019 and Preliminary Assessment of Covid-19 Impact On Online Retail 2020lamia lebharAinda não há avaliações

- Walmart in India - Challenges and OpportunitiesDocumento2 páginasWalmart in India - Challenges and Opportunitiesabhijeet1505Ainda não há avaliações

- Credit Creation ProcessDocumento5 páginasCredit Creation ProcessHarshad NagreAinda não há avaliações

- Module - 2 Banking System and Operations: Rajneesh MishraDocumento51 páginasModule - 2 Banking System and Operations: Rajneesh MishramarianmadhurAinda não há avaliações

- (N - A) Rob Dix - The Complete Guide To Property InvestmentDocumento247 páginas(N - A) Rob Dix - The Complete Guide To Property InvestmentNguyen Cuong100% (2)

- Internship Report Mastercopy-1111Documento52 páginasInternship Report Mastercopy-1111Nishant GauravAinda não há avaliações