Escolar Documentos

Profissional Documentos

Cultura Documentos

Chapter 07

Enviado por

Suzanna RamizovaDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Chapter 07

Enviado por

Suzanna RamizovaDireitos autorais:

Formatos disponíveis

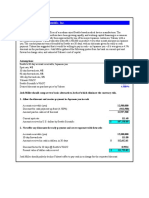

Problem 7.

6 Argentine Peso and PPP

The Argentine peso was fixed through a currency board at Ps1.00/$ throughout the 1990s. In January 2002 the Argentine peso was floated. On January 29, 2003 it was trading at Ps3.20/$. During that one year period Argentina's inflation rate was 20% on an annualized basis. Inflation in the United States during that same period was 2.2% annualized. Assumptions Spot exchange rate, fixed peg, early January 2002 (Ps/$) Spot exchange rate, January 29, 2003 (Ps/$) US inflation for year (per annum) Argentine inflation for year (per annum) a. What should have been the exchange rate in January 2003 if PPP held? Beginning spot rate (Ps/$) Argentine inflation US inflation PPP exchange rate b. By what percentage was the Argentine peso undervalued? Actual exchange rate (Ps/$) PPP exchange rate (Ps/$) Percentage overvaluation (positive) or undervaluation (negative) c. What were the probable causes of undervaluation? The rapid decline in the value of the Argentine peso was a result of not only inflation, but also a severe crisis in the balance of payments (see Chapter 4). 3.20 1.17 -63.307% 1.00 20.00% 2.20% 1.17 Value 1.0000 3.2000 2.20% 20.00%

Problem 7.10 XTerra exports and Pass-Through

Assume that the export price of a Nissan XTerra from Osaka, Japan is 3,250,000. The exchange rate is 115.20/$. The forecast rate of inflation in the United States is 2.2% per year and is 0.0% per year in Japan. Use this data to answer the following questions on exchange rate pass through. Steps Initial spot exchange rate (/$) Initial price of a Nissan Xterra () Expected US dollar inflation rate for the coming year Expected Japanese yen inflation rate for the coming year Desired rate of pass through by Nissan Value 115.20 3,250,000 2.200% 0.000% 75.000%

a) What is the export price for the XTerra at the beginning of the year expressed in U.S. Dollars? Year-beginning price of an XTerra () 3,250,000 Spot exchange rate (/$) 115.20 Year-beginning price of a XTerra ($) $ 28,211.81 b) Assuming PPP holds, what should the exchange rate be at the end of the year? Initial spot rate (/$) Expected US$ inflation Expected Japanese yen inflation Expected exchange rate at end of year assuming PPP (/$)

115.20 2.20% 0.00% 112.72

c) Assuming 100% pass-through, what should be the dollar price of an Xterra at the end one year? Price of XTerra at beginning of year () 3,250,000 Japanese yen inflation over the year 0.000% Price of XTerra at end of year () 3,250,000 Expected spot rate one year from now assuming PPP (/$) 112.72 Price of XTerra at end of one year in ($) $ 28,832.47 d) Assuming 75% pass-through, what should be the dollar price of an Xterra at the end one year? Price of XTerra at end of year () 3,250,000 Amount of expected exchange rate change, in percent (from PPP) 2.200% Proportion of exchange rate change passed through by Nissan 75.000% Proportional percentage change 1.650% Effective exchange rate used by Nissan to price in US$ for end of year 113.330 Price of XTerra at end of one year in ($) $ 28,677.30

Problem 7.15 Luis Pinzon -- 30 Days Later

One month after the events described in the previous question, Luis Pinzon once again has $1 million (or its Swiss franc equivalent) to invest for three months. He now faces the following rates. Should he again ener into a covered interest arbitrage (CIA) investment? Assumptions Arbitrage funds available Spot exchange rate (SFr./$) 3-month forward rate (SFr./$) U.S. dollar 3-month interest rate Swiss franc3-month interest rate Value $1,000,000 1.3392 1.3286 4.750% 3.625% SFr. Equivalent SFr. 1,339,200

Arbitrage Rule of Thumb: If the difference in interest rates is greater than the forward premium/discount, or expected change in the spot rate for UIA, invest in the higher interest yielding currency. If the difference in interest rates is less than the forward premium (or expected change in the spot rate), invest in the lower yielding currency. Difference in interest rates ( i SFr. - i $) Forward premium on the Swiss france CIA profit -1.125% 3.191% 2.066%

This tells Luis Pinzon he should borrow U.S. dollars and invest in the LOWER yielding currency, the Swiss franc, and then sell the Swiss franc principal and interest forward three months locking in a CIA profit.

START $1,000,000 Spot (SFr./$) 1.3392 SFr. 1,339,200.00

U.S. dollar interest rate (3-month) 4.750% 1.011875 $

END 1,011,875.00 1,017,113.13 $ 5,238.13 F-90 (SFr./$) 1.3286 SFr. 1,351,336.50

---------------> 90 days ---------------->

1.0090625

3.625% Swiss franc interest rate (3-month)

Yes, Luis should undertake the covered interest arbitrage transaction, as it would yield a risk-less profit (exchange rate risk is eliminated with the forward contract, but counterparty risk still exists if one of his counterparties failed to actually make good on their contractual commitments to deliver the forward or pay the interest) of $5,238.13 on each $1 million invested.

Você também pode gostar

- Federal Reserve Directors: A Study of Corporate and Banking Influence. Staff Report, Committee On Banking, Currency and Housing, House of Representatives, 94th Congress, 2nd Session, August 1976.Documento127 páginasFederal Reserve Directors: A Study of Corporate and Banking Influence. Staff Report, Committee On Banking, Currency and Housing, House of Representatives, 94th Congress, 2nd Session, August 1976.babstar99967% (3)

- Bank Statement PDFDocumento5 páginasBank Statement PDFIrfanLoneAinda não há avaliações

- FX IV PracticeDocumento10 páginasFX IV PracticeFinanceman4100% (4)

- Blades Inc. Case, Assessment of Risk Exposure, (Jeff Madura, International Financial Management)Documento8 páginasBlades Inc. Case, Assessment of Risk Exposure, (Jeff Madura, International Financial Management)raihans_dhk337894% (18)

- Blades PLC: International Flow of Funds: A Case StudyDocumento10 páginasBlades PLC: International Flow of Funds: A Case StudyKristelle Brooke Dianne Jarabelo100% (2)

- Problem 11.3Documento1 páginaProblem 11.3SamerAinda não há avaliações

- MBF14e Chap02 Monetary System PbmsDocumento13 páginasMBF14e Chap02 Monetary System PbmsKarlAinda não há avaliações

- MBF14e Chap05 FX MarketsDocumento20 páginasMBF14e Chap05 FX Marketskk50% (2)

- HUD Settlement Statement - 221-1993Documento4 páginasHUD Settlement Statement - 221-1993Paul GombergAinda não há avaliações

- Case StudyDocumento7 páginasCase StudyTasnova Haque Trisha100% (1)

- Mckinsey & Company: AboutDocumento10 páginasMckinsey & Company: AboutRamkumarArumugapandiAinda não há avaliações

- Blades IFMDocumento2 páginasBlades IFMtikanath100% (2)

- IlliquidDocumento3 páginasIlliquidyến lêAinda não há avaliações

- MBF13e Chap07 Pbms - FinalDocumento21 páginasMBF13e Chap07 Pbms - FinalMatthew Stojkov100% (6)

- MBF13e Chap08 Pbms - FinalDocumento25 páginasMBF13e Chap08 Pbms - FinalBrandon Steven Miranda100% (4)

- Blades Inc Case of IFMDocumento3 páginasBlades Inc Case of IFMimaal86% (7)

- Chap07 Pbms MBF12eDocumento22 páginasChap07 Pbms MBF12eBeatrice Ballabio100% (1)

- Tata Consultancy Services Ltd. Company AnalysisDocumento70 páginasTata Consultancy Services Ltd. Company AnalysisPiyush ThakarAinda não há avaliações

- Final ExamDocumento18 páginasFinal ExamHarryAinda não há avaliações

- International Financial Management - Geert Bekaert Robert Hodrick - Chap 02 - SolutionDocumento4 páginasInternational Financial Management - Geert Bekaert Robert Hodrick - Chap 02 - SolutionFagbola Oluwatobi OmolajaAinda não há avaliações

- MBF14e Chap06 Parity Condition PbmsDocumento23 páginasMBF14e Chap06 Parity Condition PbmsKarl100% (18)

- Blade Inc CaseDocumento11 páginasBlade Inc Caserasha_fayez60% (5)

- Chap12 Pbms MBF12eDocumento10 páginasChap12 Pbms MBF12eBeatrice BallabioAinda não há avaliações

- Fund 4e Chap07 PbmsDocumento14 páginasFund 4e Chap07 Pbmsjordi92500100% (1)

- MBF14e Chap05 FX MarketsDocumento20 páginasMBF14e Chap05 FX MarketsHaniyah Nadhira100% (1)

- BladesDocumento7 páginasBladestausif080604Ainda não há avaliações

- Blades CasesDocumento22 páginasBlades CasesShEen AraInAinda não há avaliações

- MBF14e Chap04 Governance PbmsDocumento16 páginasMBF14e Chap04 Governance PbmsKarl60% (5)

- Chapter 6 Excel - CIA1Documento10 páginasChapter 6 Excel - CIA1tableroof100% (1)

- Practice Questions - International FinanceDocumento18 páginasPractice Questions - International Financekyle7377Ainda não há avaliações

- SS 04partDocumento4 páginasSS 04partJanice Lan100% (1)

- International Finance Homework SolutionDocumento33 páginasInternational Finance Homework Solutionenporio7978% (9)

- MBF13e Chap10 Pbms - FinalDocumento17 páginasMBF13e Chap10 Pbms - FinalYee Cheng80% (5)

- Chapter 2 Shipyard-Layout Lecture Notes From South Hampton UniversityDocumento10 páginasChapter 2 Shipyard-Layout Lecture Notes From South Hampton UniversityJonnada KumarAinda não há avaliações

- Chapter 11Documento2 páginasChapter 11atuanaini0% (1)

- Joseph Nye, Soft PowerDocumento24 páginasJoseph Nye, Soft Powerpeter_yoon_14Ainda não há avaliações

- BUS322Tutorial5 SolutionDocumento20 páginasBUS322Tutorial5 Solutionjacklee191825% (4)

- Exchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%Documento11 páginasExchange Rate Determination: SOLUTION: ($0.73 - $0.69) /$0.69 5.80%rufik der100% (2)

- Solutions Manual For Multinational Financial Management 10th Edition by ShapiroDocumento6 páginasSolutions Manual For Multinational Financial Management 10th Edition by Shapirohezodyvar63% (8)

- Exchange Rate Determination: Answers To End of Chapter QuestionsDocumento14 páginasExchange Rate Determination: Answers To End of Chapter QuestionsMichael Rongo0% (1)

- Chapter 2 - Part 2 - Problems - AnswersDocumento3 páginasChapter 2 - Part 2 - Problems - Answersyenlth940% (2)

- MBF14e Chap10 Transaction PbmsDocumento19 páginasMBF14e Chap10 Transaction PbmsQurratul Asmawi100% (2)

- Week 3 Tutorial ProblemsDocumento6 páginasWeek 3 Tutorial ProblemsWOP INVESTAinda não há avaliações

- Tiffany and CoDocumento2 páginasTiffany and Comitesh_ojha0% (2)

- Ex - TransExposure SOLDocumento5 páginasEx - TransExposure SOLAlexisAinda não há avaliações

- FX II PracticeDocumento10 páginasFX II PracticeFinanceman4Ainda não há avaliações

- Ch07 SSolDocumento7 páginasCh07 SSolvenkeeeee100% (1)

- Finance - Module 7Documento3 páginasFinance - Module 7luckybella100% (1)

- Chap08 Pbms SolutionsDocumento25 páginasChap08 Pbms SolutionsDouglas Estrada100% (1)

- Chapter 13 - Class Notes PDFDocumento33 páginasChapter 13 - Class Notes PDFJilynn SeahAinda não há avaliações

- Pbm7 2Documento1 páginaPbm7 2jordi92500Ainda não há avaliações

- BladesDocumento1 páginaBladesWulandari Pramithasari50% (2)

- Assignment #2 Exchange Rate BehaviorDocumento7 páginasAssignment #2 Exchange Rate BehaviorjosephblinkAinda não há avaliações

- UntitledDocumento5 páginasUntitledsuperorbitalAinda não há avaliações

- Bus 322 Tutorial 5-SolutionDocumento20 páginasBus 322 Tutorial 5-Solutionbvni50% (2)

- Chap 10 IfmDocumento17 páginasChap 10 IfmNguyễn Gia Phương Anh100% (1)

- BladesDocumento19 páginasBladescristianofoni100% (1)

- Blades Inc CaseDocumento3 páginasBlades Inc Casemasskillz33% (3)

- Growth of Corporation Occurs Through 1. Internal Expansion That Is Growth 2. MergersDocumento8 páginasGrowth of Corporation Occurs Through 1. Internal Expansion That Is Growth 2. MergersFazul Rehman100% (1)

- Summer 2021 FIN 6055 New Test 2Documento2 páginasSummer 2021 FIN 6055 New Test 2Michael Pirone0% (1)

- Chap 6 ProblemsDocumento5 páginasChap 6 ProblemsCecilia Ooi Shu QingAinda não há avaliações

- Fund 4e Chap07 PbmsDocumento14 páginasFund 4e Chap07 PbmsChu Minh LanAinda não há avaliações

- FinanceDocumento2 páginasFinanceALLISSON ANAHI ZU�IGA ALBANAinda não há avaliações

- HW2 Q 1Documento6 páginasHW2 Q 1Paul NdegAinda não há avaliações

- Ps1 AnswerDocumento6 páginasPs1 AnswerChan Kong Yan AnnieAinda não há avaliações

- Sample QuestionDocumento9 páginasSample QuestionYussone Sir'YussAinda não há avaliações

- HW 3Documento3 páginasHW 3chocolatedoggy12100% (1)

- Chapter 05Documento1 páginaChapter 05Suzanna RamizovaAinda não há avaliações

- Inventory ExampleDocumento3 páginasInventory ExampleSuzanna RamizovaAinda não há avaliações

- Chap 004 To PresentDocumento46 páginasChap 004 To PresentSuzanna RamizovaAinda não há avaliações

- Ch3 ProjectManDocumento30 páginasCh3 ProjectManSuzanna RamizovaAinda não há avaliações

- Lecture 1Documento84 páginasLecture 1Suzanna RamizovaAinda não há avaliações

- ProjectManagement 1Documento37 páginasProjectManagement 1Suzanna RamizovaAinda não há avaliações

- Marketing Process: Analysis of The Opportunities in The MarketDocumento7 páginasMarketing Process: Analysis of The Opportunities in The Marketlekz reAinda não há avaliações

- The Kerala Account Code Vol IIIDocumento207 páginasThe Kerala Account Code Vol IIINripen MiliAinda não há avaliações

- Sbi Po - Mock Test - QuestionsDocumento15 páginasSbi Po - Mock Test - QuestionsVishwanath SomaAinda não há avaliações

- Trade Me ProspectusDocumento257 páginasTrade Me Prospectusbernardchickey100% (1)

- Banking Awareness October Set 2Documento7 páginasBanking Awareness October Set 2Madhav MishraAinda não há avaliações

- SSDCourse Curriculum PUCDocumento5 páginasSSDCourse Curriculum PUCBDT Visa PaymentAinda não há avaliações

- CIR vs. ALGUE INC. G.R. No. L 28896. February 17 1988 PDFDocumento10 páginasCIR vs. ALGUE INC. G.R. No. L 28896. February 17 1988 PDFZenith EuropaAinda não há avaliações

- ASEAN - Civil Society:: A People-Centred ASEAN'?Documento10 páginasASEAN - Civil Society:: A People-Centred ASEAN'?andi adnanAinda não há avaliações

- Bead Making UnitDocumento20 páginasBead Making Unithamza tariqAinda não há avaliações

- 5S Hybrid Management Model For Increasing Productivity in A Textile Company in LimaDocumento7 páginas5S Hybrid Management Model For Increasing Productivity in A Textile Company in Limaruhaina malikAinda não há avaliações

- Noor Arfa BatikDocumento14 páginasNoor Arfa BatikCkyn Rahman25% (4)

- Reforms Claimed by Provincial BOIs - Oct 219, 2020Documento37 páginasReforms Claimed by Provincial BOIs - Oct 219, 2020Naeem AhmedAinda não há avaliações

- Project Template Comparing Tootsie Roll & HersheyDocumento37 páginasProject Template Comparing Tootsie Roll & HersheyMichael WilsonAinda não há avaliações

- Agreement 2006 Bank of AmericaDocumento19 páginasAgreement 2006 Bank of AmericaNora WellerAinda não há avaliações

- PDFDocumento10 páginasPDFsakethAinda não há avaliações

- B.Voc II (Fundamentals in Accouting and Technology (Computer Skill) - IIDocumento165 páginasB.Voc II (Fundamentals in Accouting and Technology (Computer Skill) - IIsharmarohtashAinda não há avaliações

- Solution:: Purchases, Cash Basis P 2,850,000Documento2 páginasSolution:: Purchases, Cash Basis P 2,850,000Jen Deloy50% (2)

- Customer Relationship and Wealth ManagementDocumento65 páginasCustomer Relationship and Wealth ManagementbistamasterAinda não há avaliações

- Fco GCV Adb 55-53 Nie-RrpDocumento3 páginasFco GCV Adb 55-53 Nie-RrpZamri MahfudzAinda não há avaliações

- Sales Training Manual - Part 1Documento48 páginasSales Training Manual - Part 15th07nov3mb2rAinda não há avaliações

- Solutions-Chapter 2Documento5 páginasSolutions-Chapter 2Saurabh SinghAinda não há avaliações

- Annual Report 2015-2016: Our MissionDocumento219 páginasAnnual Report 2015-2016: Our MissionImtiaz ChowdhuryAinda não há avaliações

- Bus 5111 Discussion Assignment Unit 7Documento3 páginasBus 5111 Discussion Assignment Unit 7Sheu Abdulkadir BasharuAinda não há avaliações