Escolar Documentos

Profissional Documentos

Cultura Documentos

15

Enviado por

sharathk916Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

15

Enviado por

sharathk916Direitos autorais:

Formatos disponíveis

HIGHER SECONDARY MODEL EXAMINATION 2011

COMPUTERISED ACCOUNTING

Maximum Score : 60

HSE II General instructions to candidates There is cool off time of 15 minutes in addition to writing time of 2 hrs. Use the cool off time to get familiar with questions and to plan your answers You are not allowed to write the answer nor to discuss anything with others during the cool off time. All the questions are compulsory to answer and only internal choice is allowed. Time : 2.15 Hrs

PART A 1. Find the odd one and state the reason (a) Admission of a partner (c ) Insolvency of a partner

ACCOUNTING

(b) Retirement of a partner (d) Death of a partner (Score : 1)

2. In the absence of a partnership deed, what is the rule relating to interest on partners capital? (Score : 1)

3. Securities premium account of Supreme Ltd. Shows a credit balance of Rs.5 lakhs. The directors of the company decided to use the amount to distribute it as dividend. Whether the company can do so ? why? (Score : 2)

4. A furniture amounting Rs.12000 was revalued for Rs. 15000 while admitting a new partner. How much amount is recorded in revaluation account ? Give journal entry. (Score : 2)

5. Sigma Co. Ltd forfeits 500 Equity shares of Rs.10 each issued at a discount of Re.1 for non payment of final call of Rs.2. Give journal entry for forfeiture of shares (Score : 3)

6. On 01.01.2010, Arun and Kiran entered into partnership contributing Rs.80000 and Rs.100000 respectively and share profits in the ratio 1:2. Arun is allowed salary of Rs.15000 per month. Interest on capital is to be allowed @ 5% p.a. Kiran is entitled to receive a commission of Rs.7000 p.a. During the year Kiran withdrew Rs.4000 and Arun Rs. 5500. Interest on the same being Rs.200 and Rs.275. Profit for the year after the above adjustments was Rs.40000. You are required to prepare capital accounts of Arun and Kiran. (Score : 4) 7. Ram and Rahim are partners in a firm sharing profits in the ratio of 3:2. On 1 st April 2010, they admit Roy into the firm for a 5 th share in profits. Roy contributed the following in respect of his capital: Machinery Rs.30000 Plant Rs. 40000 Building Rs.60000 Stock Rs.8000

Goodwill has been valued at 2 years purchase of super profit of past 3 years Year Profit 2007 20000 2008 25000 2009 30000

Capital employed is Rs.250000 and normal rate of return is 10% Give journal entries relating to (i) (ii) Capital contributed by Roy Goodwill brought in by Roy (Score : 5)

8. Wipro Ltd. decided to issue shares to its existing shareholders in the ratio of one share for every three shares held. Company made this issue at Rs.125/- per share. The market value of the share is Rs.140/-. Calculate the value of right (Score : 3)

9. Anoop and Pradeep are partners in a firm sharing profits in the ratio 3:2. They admit Chandy as a new partner. Chandy brings Rs.300000 as capital and could not bring any amount for goodwill. The firms goodwill was valued at Rs.200000. Record necessary entry in the books of the firm. (Score : 6)

10. Alex, Andrews and Ahammed are in partnership sharing profits and losses in the ratio 2:2:1. Their balancesheet as on 31st December 2009 was as below:Liabilities Assets

Creditors Capital Alex Andrews Ahammed

45000

Cash at bank Debtors

10000 25000 40000 40000

15000 25000 30000

Stock Plant & Machinery

115000

115000

Alex died on 30th June 2010. Partnership deed provides that in the event of death of a partner, his executor should be entitled to the following: (i) His capital on the date of previous balance sheet. (ii) His proportion of profit up to the date of death on the basis of previous years profit (iii) His share of goodwill calculated on the basis of 3 years purchase of the average profits of the last 4 years The profits of the firm for the past 4 years were : 2006 Rs.22000, 2007 Rs.21000, 2008 Rs.19000, 2009 Rs.18000 Ascertain the amount payable to the executors of the deceased partner. (Score : 5) 11 (a). Following is the balance sheet of Sumesh and Satheesh sharing profits in the ratio of 3:2 on December 31, 2010. Balancesheet as on 31.12.2010 Liabilities Assets

Creditors Loan by Sumeshs brother Loan by Satheesh Reserve Fund Capital Sumesh Satheesh

19000 5000 7500 1500

Cash at bank Debtors 10000

6000

Less Provision 500 Stock Plant & Machinery

9500 3000 12000 4000 5000 2500 42000

5000 4000

Furniture Investment P/L A/c

42000

The firm was dissolved on 31st December 2010. As a result (a) Sumesh tookover investments at an agreed value of Rs.4000/- and agreed to pay loan taken from his brother (b) Revaluation of assets are as follows:Stock Rs.2000/Debtors Rs.9250/Furniture 4250/Plant & Machinery 10500/(c) Expense on realization were Rs.500/(d) Creditors allowed 3% discount in full settlement Prepare ledger account and close the books. (Score :8) 11 (b). LAL Brothers issued for public subscription 20,000 equity shares of Rs.10 each at a premium of Re.1 per share payable as under. On application Rs.2 On allotment Rs.4 (including premium) On first call Rs.2 On final call Rs.3 Application were received for 30000 shares. Allotment was made prorata to the applicants of 24,000 shares , the remaining applications were rejected. Money overpaid on application was applied towards sums due on allotment. Sri. Dasan to whom 1200 shares were allotted failed to pay the allotment money and Sri. Vijayan , to whom 1500 shares were allotted failed to pay the two calls. These were subsequently forfeited after the final call was made. Pass entries in the books of the company. (Score : 8)

PART B

COMPUTERISED ACCOUNTING (Score : 1) (Score :1)

1. The intersection of row and column in excel is called 2. The function key to create company in Tally is 3. Manoj created a godown at Kollam in Tally. He wants to display godown he had created. Help him to display it

(Score :2)

4. To prepare payroll in MS Excel, Govind entered the basic pay in cell D4. D.A is 64% and professional tax is calculated as 5% on BP+DA. Calculate his NET Salary in G4 (Score :3)

5. Hareesh and Suresh are +2 Commerce students. Suresh argues that manual accounting is better than computerized accounting. What is your opinion?(Score : 4) 6. On 1st January 2010, ABC Ltd purchased a machinery for Rs.1000000. The company decided to write off depreciation at 10% per annum on diminishing value of machinery. You are required to prepare a statement of depreciation for the first 5 years using electronic spread sheet. (Score : 4)

7. Prepare a table consisting of accounts involved, voucher group, function key according to the transactions given below: (a) Starting business with Rs.100000 (b) Opened a current account with Federal Bank Rs.25000 (c) Purchased Machinery Rs.30000 (d) Paid Salary Rs.4000 (e) Received Commission Rs.3000 (f) Purchased goods from R.V Traders Rs.20000 (Score : 5)

Prepared by Mavelikara Cluster (Alappuzha District)

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- 6582 The Australians LLC 20141231Documento2 páginas6582 The Australians LLC 20141231Angelo PuraAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- BIR Rulings On Change of Useful LifeDocumento6 páginasBIR Rulings On Change of Useful LifeCarlota Nicolas VillaromanAinda não há avaliações

- System Mechanism To Regulate The Economy: Higher Secondary Examination March - 2011 EconomicsDocumento6 páginasSystem Mechanism To Regulate The Economy: Higher Secondary Examination March - 2011 Economicssharathk916Ainda não há avaliações

- EconomicsDocumento5 páginasEconomicssharathk916Ainda não há avaliações

- 2 25 EconomicsDocumento3 páginas2 25 Economicssharathk916Ainda não há avaliações

- 2 25 EconomicsDocumento3 páginas2 25 Economicssharathk916Ainda não há avaliações

- 2 25 EcosyrDocumento5 páginas2 25 Ecosyrsharathk916Ainda não há avaliações

- Model Question Paper: EconomicsDocumento3 páginasModel Question Paper: Economicssharathk916Ainda não há avaliações

- 4Documento4 páginas4sharathk916Ainda não há avaliações

- Higher Secondary Model Examination-February 2011: EconomicsDocumento5 páginasHigher Secondary Model Examination-February 2011: Economicssharathk916Ainda não há avaliações

- Accountancy With Accountancy With Accountancy With Accountancy With (Afs and Ca) (Afs and Ca) (Afs and Ca) (Afs and Ca)Documento43 páginasAccountancy With Accountancy With Accountancy With Accountancy With (Afs and Ca) (Afs and Ca) (Afs and Ca) (Afs and Ca)sharathk916Ainda não há avaliações

- 29Documento3 páginas29sharathk916Ainda não há avaliações

- 1Documento6 páginas1sharathk916Ainda não há avaliações

- 30Documento4 páginas30sharathk916Ainda não há avaliações

- 1Documento62 páginas1sharathk916Ainda não há avaliações

- Higher Secondary Examination March 2011: Accoutancy With Computerised AccountingDocumento2 páginasHigher Secondary Examination March 2011: Accoutancy With Computerised Accountingsharathk916Ainda não há avaliações

- Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised AccountingDocumento3 páginasGhss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accountingsharathk916Ainda não há avaliações

- Model Evaluation February 2011 AccountingDocumento4 páginasModel Evaluation February 2011 Accountingsharathk916Ainda não há avaliações

- 25Documento6 páginas25sharathk916Ainda não há avaliações

- 24Documento4 páginas24sharathk916Ainda não há avaliações

- 16Documento4 páginas16sharathk916Ainda não há avaliações

- 26Documento4 páginas26sharathk916Ainda não há avaliações

- TH TH STDocumento3 páginasTH TH STsharathk916Ainda não há avaliações

- 20Documento7 páginas20sharathk916Ainda não há avaliações

- 22Documento5 páginas22sharathk916Ainda não há avaliações

- 17Documento3 páginas17sharathk916Ainda não há avaliações

- 12Documento3 páginas12sharathk916Ainda não há avaliações

- 11Documento2 páginas11sharathk916Ainda não há avaliações

- 8Documento2 páginas8sharathk916Ainda não há avaliações

- Cluster Centre MGM HSS: Prepared byDocumento6 páginasCluster Centre MGM HSS: Prepared bysharathk916Ainda não há avaliações

- Model Examination Feb 2010-2011: Computerised AccountingDocumento3 páginasModel Examination Feb 2010-2011: Computerised Accountingsharathk916Ainda não há avaliações

- Ali FikriDocumento3 páginasAli FikriIntan WidyawatiAinda não há avaliações

- Axitrader Product ScheduleDocumento12 páginasAxitrader Product Schedulesiaufa hahaAinda não há avaliações

- Financial Statement Analysis As A Tool For Investment Decisions and Assessment of Companies' PerformanceDocumento18 páginasFinancial Statement Analysis As A Tool For Investment Decisions and Assessment of Companies' PerformanceCinta Rizkia Zahra LubisAinda não há avaliações

- Takaful Ikhlas Family Berhad (593075-U) : Takaful Participant Azan Age 35 Gender Female 1 0Documento1 páginaTakaful Ikhlas Family Berhad (593075-U) : Takaful Participant Azan Age 35 Gender Female 1 0Mohd Hafiz ZakiuddinAinda não há avaliações

- Income Tax Study PackDocumento68 páginasIncome Tax Study PackKempton MurimiAinda não há avaliações

- Compilation Notes On Journal Ledger and Trial BalanceDocumento14 páginasCompilation Notes On Journal Ledger and Trial BalanceAB12P1 Sanchez Krisly AngelAinda não há avaliações

- ReviewerDocumento34 páginasReviewerBABY JOY SEGUIAinda não há avaliações

- Công TH CDocumento9 páginasCông TH CLê Hồng ThuỷAinda não há avaliações

- 2023 - Q1 Press Release BAM - FDocumento9 páginas2023 - Q1 Press Release BAM - FJ Pierre RicherAinda não há avaliações

- CiMB Research Report On REITDocumento6 páginasCiMB Research Report On REITAnonymous DJrec2Ainda não há avaliações

- May 2019 Professional Examinations Public Sector Accounting & Finance (Paper 2.5) Chief Examiner'S Report, Questions and Marking SchemeDocumento24 páginasMay 2019 Professional Examinations Public Sector Accounting & Finance (Paper 2.5) Chief Examiner'S Report, Questions and Marking SchemeMahama JinaporAinda não há avaliações

- Materi Kusumaningsih Angkawidjaja - Improving Audit Quality and Culture During COVID-19 and Beyond - IAPI - ICAEWDocumento10 páginasMateri Kusumaningsih Angkawidjaja - Improving Audit Quality and Culture During COVID-19 and Beyond - IAPI - ICAEWMarsya CikitaAinda não há avaliações

- RosewoodDocumento5 páginasRosewoodkyleplattner100% (2)

- Commercial BankCommercial Bank Address - Bank Sentral Republik Indonesia Address - Bank Sentral Republik IndonesiaDocumento5 páginasCommercial BankCommercial Bank Address - Bank Sentral Republik Indonesia Address - Bank Sentral Republik IndonesiaAndang We SAinda não há avaliações

- 2023 CFA Level 1 Curriculum Changes Summary (300hours)Documento2 páginas2023 CFA Level 1 Curriculum Changes Summary (300hours)johnAinda não há avaliações

- Taxation Law Mamalateo PDFDocumento99 páginasTaxation Law Mamalateo PDFErmawooAinda não há avaliações

- Cost Cia 3RD SemDocumento30 páginasCost Cia 3RD SemSaloni Jain 1820343Ainda não há avaliações

- 2 - AccentForex Competitive Analysis No ScreenshotsDocumento1 página2 - AccentForex Competitive Analysis No ScreenshotsTanveer HussainAinda não há avaliações

- Annotated 3.1 Q3 PPT Adjusting Entries Accruals and DeferralsDocumento36 páginasAnnotated 3.1 Q3 PPT Adjusting Entries Accruals and DeferralsenzobarnaoAinda não há avaliações

- AFAR 3 AnswersDocumento5 páginasAFAR 3 AnswersTyrelle Dela CruzAinda não há avaliações

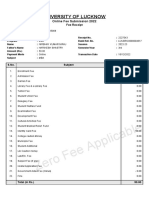

- Fee Receipt - Lucknow UniversityDocumento3 páginasFee Receipt - Lucknow UniversityNirbhay NirajAinda não há avaliações

- Pas 7Documento11 páginasPas 7Princess Jullyn ClaudioAinda não há avaliações

- Syallabus Corporate Finance 2 ModuleDocumento1 páginaSyallabus Corporate Finance 2 ModuleDharamveer SharmaAinda não há avaliações

- E-Way Bill - 7Documento2 páginasE-Way Bill - 7AshishTrivediAinda não há avaliações

- Capital Mortgage Insurance - Position PaperDocumento4 páginasCapital Mortgage Insurance - Position Papersouthern2011100% (1)

- Bharatiya Mahila BankDocumento5 páginasBharatiya Mahila Bankbharatparyani0% (1)

- Zoya ProjectDocumento60 páginasZoya Projectanas khanAinda não há avaliações

- Hire Purchase Excel TemplateDocumento6 páginasHire Purchase Excel TemplateShreeamar SinghAinda não há avaliações