Escolar Documentos

Profissional Documentos

Cultura Documentos

Weekly Foreign Holding Update - 11 01 2013

Enviado por

ran2013Descrição original:

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Weekly Foreign Holding Update - 11 01 2013

Enviado por

ran2013Direitos autorais:

Formatos disponíveis

WEEKLY FOREIGN HOLDING UPDATE

Summary

CAL RESEARCH

Jan-13

A net foreign outflow of LKR116mn was recorded for the week with net foreign selling mainly coming from Asiri Central (LKR558mn) and Dialog (LKR107mn). Actis, an emerging market private equity firm which bought 10% of Asiri Central in August 2012 sold its stake back to Asiri Hospitals Holdings for a consideration of LKR250/share. Foreign participation accounted for 48% of the week's turnover.

Foreign buying and selliing (07-11th January 2012) Trailing12 week average daily net foreign inflow/outflow

Week ended

Rs mn 300

247 100

238

200 100 0 -100

-200 (-23)

195 36

229

154

193 103 40

-300

(-220)

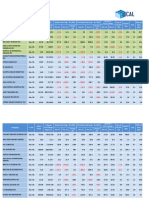

Top 10 stocks with net foreign buying for the week ended 11.01.2013

Top 10 stocks with net foreign selling for the week ended 11.01.2013

NET BUYING

JKH LOLC ASIRI DISTILLERIES CHEVRON RENUKA SHAW SOFTLOGIC COMMERCIAL BANK LMF LION BREWERY

Closing price for the week(Rs)

Value (Rs mn)*

Tot. foreign holding 11.01.13

Tot. foreign holding 04.01.13

% point change

NET SELLING

ASIRI CENTRAL DIALOG CEYLON TOBACCO AITKEN SPENCE AHOT PROPERTIES TEXTURED JERSEY DFCC BANK ACL CENTRAL FINANCE RENUKA AGRI

Closing price for the week(Rs)

Value (Rs mn)*

Tot. foreign Tot. foreign holding holding 11.01.13 04.01.13

% point change

223 60 12 180 215 19 12 105.0 107.9 300

+507 +78 +47 +31 +21 +15 +9.7 +7.7 +2.5 +2.4

54% 31% 27% 20% 29% 3% 4% 36% 2% 32%

54% 30% 26% 20% 29% 2% 4% 36% 2% 32%

0.3% 0.3% 0.4% 0.1% 0.1% 1.8% 0.1% 0.0% 0.1% 0.0%

248 8.3 852 122 75 9 118 69 177 5

(558) (107) (41) (39) (25) (18) (5.4) (5.0) (3.9) (2.9)

0.8% 90.5% 96.2% 45.1% 6.3% 41.2% 23.4% 1.4% 11.7% 19.9%

10.8% 90.6% 96.2% 45.2% 6.4% 41.5% 23.4% 1.6% 11.7% 20.0%

(1-0.1%) (-0.2%) (-0.0%) (-0.1%) (-0.1%) (-0.3%) (-0.0%) (-0.1%) (-0.0%) (-0.1%)

* Value based on weighted avg closing price & not actual traded prices

See page 2 for important disclaimer

Page 1

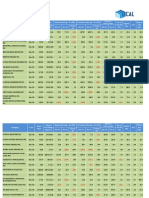

Foreign ownership changes by sector for the week ended 11.01.2013

S&P SL20 foreign holding changes for the week ended 11.01.2013

SECTOR

Sector market Tot. Foreign cap (Rs mn) holding (Rs 11.01.13 mn) 11.01.13

Tot. Foreign holding (Rs mn) 04.01.13

Foreign holding %

S&P SL 20

Closing price for the week(Rs)

Incr/(Decr) in foreign holding value (Rs mn)

Tot. foreign Tot. foreign holding holding 11.01.13 04.01.13

% point change

BANKS FINANCE & INSURANCE BEVERAGE FOOD & TOBACCO CHEMICALS & PHARMACEUTICALS CONSTRUCTION & ENGINEERING DIVERSIFIED HOLDINGS FOOTWEAR & TEXTILES HEALTH CARE HOTELS & TRAVELS INFORMATION TECHNOLOGY INVESTMENT TRUSTS LAND & PROPERTY MANUFACTURING MOTORS OIL PALMS PLANTATIONS POWER & ENERGY SERVICES STORES & SUPPLIES TELECOMMUNICATIONS TRADING

493,000 413,000 20,000 20,000 477,000 12,000 40,000 146,000 2,000 39,000 35,000 99,000 23,000 103,000 26,000 33,000 6,000 6,000 149,000 27,000

84,700 258,600 1,000 11,600 165,200 3,100 6,100 9,800 100 6,900 14,500 19,800 4,100 46,000 1,500 10,400 400 600 97,500 11,600

84,600 258,600 1,000 11,600 164,700 3,100 6,600 9,800 100 6,900 14,500 19,800 4,100 46,000 1,500 10,400 400 600 97,600 11,600

17.2% 62.6% 5.0% 58.0% 34.6% 25.8% 15.3% 6.7% 5.0% 17.7% 41.4% 20.0% 17.8% 44.7% 5.8% 31.5% 6.7% 10.0% 65.4% 43.0%

JKH CEYLON TOBACCO CARSONS CUMBERBATCH COMMERCIAL BANK SRI LANKA TELECOM THE BUKIT DARAH PLC NESTLE LANKA DIALOG AXIATA AITKEN SPENCE HATTON NATIONAL BANK DISTILLERIES ASIAN HOTELS & PROPERTIES DFCC BANK CARGILLS SAMPATH BANK AITKEN SPENCE HOTEL HOLDINGS C T HOLDINGS HAYLEYS CHEVRON LUBRICANTS NDB

223.0 852 439 105 45 685 1,600 8.3 122 147 180 75 118 147 203 73 135 300 215 140

+507 (41.1) (0.6) +7.7 (0.0) (0.4) (107.3) (38.6) (1.9) +30.6 (25.2) (5.4) +0.1 (1) +0.0 +21 +0.4

54.3% 96.2% 17.8% 36.2% 44.8% 21.5% 94.6% 90.5% 45.1% 22.2% 19.9% 6.3% 23.4% 3.6% 5.7% 2.3% 7.8% 2.5% 29.1% 36.5%

54.0% 96.2% 17.8% 36.1% 44.8% 21.5% 94.6% 90.6% 45.2% 22.2% 19.9% 6.4% 23.4% 3.6% 5.7% 2.3% 7.8% 2.5% 29.0% 36.5%

0.3% (-0.0%) (-0.0%) 0.0% (-0.0%) (-0.0%) (-0.2%) (-0.1%) (-0.0%) 0.1% (-0.1%) (-0.0%) 0.0% (-0.0%) 0.0% 0.1% 0.0%

* Values based on weighted avg closing price & not actual traded prices

This document has been prepared and issued on the basis of publicly available information, internally developed data and other sources, believed to be reliable. Capital Alliance Securities (Private) Limited however does not warrant its completeness or accuracy. Opinions and estimates given constitute a judgment as of the date of the material and are subject to change without notice. This report is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The recipient of this report must make their own independent decision regarding any securities, investments or financial instruments mentioned herein. Securities or financial instruments mentioned may not be suitable to all investors. Capital Alliance Securities (Private) Limited its directors, officers, consultants, employees, outsourced research providers associates or business partner, will not be responsible, for any claims damages, compensation, suits, damages, loss, costs, charges, expenses, outgoing or payments including attorneys fees which recipients of the reports suffers or incurs directly or indirectly arising out actions taken as a result of this report. This report is for the use of the intended recipient only. Access, disclosure, copying, distribution or reliance on any of it by anyone else is prohibited and may be a criminal offence.

Page 2

Você também pode gostar

- Weekly Foreign Holding Update - 21 12 2012Documento2 páginasWeekly Foreign Holding Update - 21 12 2012ran2013Ainda não há avaliações

- Weekly Foreign Holding & Block Trade - Update - 07 02 2014Documento4 páginasWeekly Foreign Holding & Block Trade - Update - 07 02 2014Randora LkAinda não há avaliações

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDocumento4 páginasWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkAinda não há avaliações

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDocumento4 páginasWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkAinda não há avaliações

- Weekly Foreign Holding & Block Trade - Update - 13 02 2014Documento4 páginasWeekly Foreign Holding & Block Trade - Update - 13 02 2014Randora LkAinda não há avaliações

- Weekly Foreign Holding & Block Trade - Update - 21 02 2014Documento4 páginasWeekly Foreign Holding & Block Trade - Update - 21 02 2014Randora Lk100% (1)

- Market Outlook 19th August 2011Documento3 páginasMarket Outlook 19th August 2011Angel BrokingAinda não há avaliações

- Daily Technical Report, 10.06.2013Documento4 páginasDaily Technical Report, 10.06.2013Angel BrokingAinda não há avaliações

- Brs-Ipo Document Peoples Leasing Company LimitedDocumento13 páginasBrs-Ipo Document Peoples Leasing Company LimitedLBTodayAinda não há avaliações

- Derivatives Report, 22 February 2013Documento3 páginasDerivatives Report, 22 February 2013Angel BrokingAinda não há avaliações

- Deirvatives Report 27th DecDocumento3 páginasDeirvatives Report 27th DecAngel BrokingAinda não há avaliações

- Weekly Foreign Holding & Block Trade - Update - 28 02 2014Documento4 páginasWeekly Foreign Holding & Block Trade - Update - 28 02 2014Randora LkAinda não há avaliações

- Market Outlook 26th September 2011Documento3 páginasMarket Outlook 26th September 2011Angel BrokingAinda não há avaliações

- Daily Technical Report, 22.07.2013Documento4 páginasDaily Technical Report, 22.07.2013Angel BrokingAinda não há avaliações

- Daily Technical Report, 15.07.2013Documento4 páginasDaily Technical Report, 15.07.2013Angel BrokingAinda não há avaliações

- Daily Technical Report, 29.05.2013Documento4 páginasDaily Technical Report, 29.05.2013Angel BrokingAinda não há avaliações

- Weekly Foreign Holding & Block Trade Update - 01 11 2013Documento4 páginasWeekly Foreign Holding & Block Trade Update - 01 11 2013Randora LkAinda não há avaliações

- Market Outlook 25th August 2011Documento3 páginasMarket Outlook 25th August 2011Angel BrokingAinda não há avaliações

- Technical Format With Stock 09.11.2012Documento4 páginasTechnical Format With Stock 09.11.2012Angel BrokingAinda não há avaliações

- Weekly Foreign Holding & Block Trade - Update - 27 09 2013Documento4 páginasWeekly Foreign Holding & Block Trade - Update - 27 09 2013Randora LkAinda não há avaliações

- Derivatives Report 2nd April 2012Documento3 páginasDerivatives Report 2nd April 2012Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Documento4 páginasDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingAinda não há avaliações

- Technical Report, 24 January 2013Documento4 páginasTechnical Report, 24 January 2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (16950) / NIFTY (5139)Documento4 páginasDaily Technical Report: Sensex (16950) / NIFTY (5139)Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (16668) / NIFTY (5054)Documento4 páginasDaily Technical Report: Sensex (16668) / NIFTY (5054)Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (16846) / NIFTY (5110)Documento4 páginasDaily Technical Report: Sensex (16846) / NIFTY (5110)Angel BrokingAinda não há avaliações

- Derivative Report: Nifty Vs OIDocumento3 páginasDerivative Report: Nifty Vs OIAngel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (16640) / NIFTY (5043)Documento4 páginasDaily Technical Report: Sensex (16640) / NIFTY (5043)Angel BrokingAinda não há avaliações

- Technical Format With Stock 06.11.2012Documento4 páginasTechnical Format With Stock 06.11.2012Angel BrokingAinda não há avaliações

- Daily Technical Report, 18.07.2013Documento4 páginasDaily Technical Report, 18.07.2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (16877) / NIFTY (5118)Documento4 páginasDaily Technical Report: Sensex (16877) / NIFTY (5118)angelbrokingAinda não há avaliações

- Daily Technical Report: Sensex (16219) / NIFTY (4924)Documento4 páginasDaily Technical Report: Sensex (16219) / NIFTY (4924)Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (16454) / NIFTY (4997)Documento4 páginasDaily Technical Report: Sensex (16454) / NIFTY (4997)Angel BrokingAinda não há avaliações

- Technical Format With Stock 19.10Documento4 páginasTechnical Format With Stock 19.10Angel BrokingAinda não há avaliações

- Derivatives Report 27th September 2011Documento3 páginasDerivatives Report 27th September 2011Angel BrokingAinda não há avaliações

- Derivative Report: Nifty Vs OIDocumento3 páginasDerivative Report: Nifty Vs OIAngel BrokingAinda não há avaliações

- Technical Format With Stock 05.10Documento4 páginasTechnical Format With Stock 05.10Angel BrokingAinda não há avaliações

- Daringderivatives-Jul05 11Documento3 páginasDaringderivatives-Jul05 11Vamsi BhargavaAinda não há avaliações

- Price To Book Value Stocks 161008Documento2 páginasPrice To Book Value Stocks 161008Adil HarianawalaAinda não há avaliações

- Daily Technical Report: Sensex (16706) / NIFTY (5064)Documento4 páginasDaily Technical Report: Sensex (16706) / NIFTY (5064)Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (16897) / NIFTY (5121)Documento4 páginasDaily Technical Report: Sensex (16897) / NIFTY (5121)Angel BrokingAinda não há avaliações

- Derivatives Report 31st DecDocumento3 páginasDerivatives Report 31st DecAngel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (16839) / NIFTY (5100)Documento4 páginasDaily Technical Report: Sensex (16839) / NIFTY (5100)angelbrokingAinda não há avaliações

- Market Outlook 17.11.11Documento3 páginasMarket Outlook 17.11.11Angel BrokingAinda não há avaliações

- Weekly Foreign Holding & Block Trade Update - 31 01 2014Documento4 páginasWeekly Foreign Holding & Block Trade Update - 31 01 2014Randora LkAinda não há avaliações

- Weekly Foreign Holding & Block Trade - Update - 04 04 2014Documento4 páginasWeekly Foreign Holding & Block Trade - Update - 04 04 2014Randora LkAinda não há avaliações

- Technical Format With Stock 11.10Documento4 páginasTechnical Format With Stock 11.10Angel BrokingAinda não há avaliações

- Derivative Report: Nifty Vs OIDocumento3 páginasDerivative Report: Nifty Vs OIAngel BrokingAinda não há avaliações

- Technical Format With Stock 05.12.2012Documento4 páginasTechnical Format With Stock 05.12.2012Angel BrokingAinda não há avaliações

- Technical Format With Stock 05.11.2012Documento4 páginasTechnical Format With Stock 05.11.2012Angel BrokingAinda não há avaliações

- Market Outlook 20th December 2011Documento4 páginasMarket Outlook 20th December 2011Angel BrokingAinda não há avaliações

- Derivatives Report 13th September 2011Documento3 páginasDerivatives Report 13th September 2011Angel BrokingAinda não há avaliações

- Astra Agro Lestari: Strong Jan 11 ProductionDocumento6 páginasAstra Agro Lestari: Strong Jan 11 ProductionerlanggaherpAinda não há avaliações

- Daily Technical Report: Sensex (16863) / NIFTY (5116)Documento4 páginasDaily Technical Report: Sensex (16863) / NIFTY (5116)Angel BrokingAinda não há avaliações

- Daily Technical Report, 26.07.2013Documento4 páginasDaily Technical Report, 26.07.2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (16070) / NIFTY (4870)Documento4 páginasDaily Technical Report: Sensex (16070) / NIFTY (4870)Angel BrokingAinda não há avaliações

- Daily Technical Report, 23.07.2013Documento4 páginasDaily Technical Report, 23.07.2013Angel BrokingAinda não há avaliações

- Daily Technical Report: Sensex (16021) / NIFTY (4863)Documento4 páginasDaily Technical Report: Sensex (16021) / NIFTY (4863)Angel BrokingAinda não há avaliações

- Technical Format With Stock 29.10.2012Documento4 páginasTechnical Format With Stock 29.10.2012Angel BrokingAinda não há avaliações

- Daily Trade Journal - 05.03Documento7 páginasDaily Trade Journal - 05.03ran2013Ainda não há avaliações

- CCPI Feb 2013Documento2 páginasCCPI Feb 2013ran2013Ainda não há avaliações

- Daily Trade Journal - 04.03Documento7 páginasDaily Trade Journal - 04.03ran2013Ainda não há avaliações

- Daily Trade Journal - 21.02Documento12 páginasDaily Trade Journal - 21.02ran2013Ainda não há avaliações

- Daily Trade Journal - 22.02Documento12 páginasDaily Trade Journal - 22.02ran2013Ainda não há avaliações

- Daily Market Update 18.02Documento1 páginaDaily Market Update 18.02ran2013Ainda não há avaliações

- Results Update - Dec 2012 20.02Documento15 páginasResults Update - Dec 2012 20.02ran2013Ainda não há avaliações

- Weekly Plus - 2013 Issue 07 (15.02.2013)Documento14 páginasWeekly Plus - 2013 Issue 07 (15.02.2013)ran2013Ainda não há avaliações

- Results Update - Dec 2012 15.02Documento10 páginasResults Update - Dec 2012 15.02ran2013Ainda não há avaliações

- Dialog Records Rs 6.0Bn Net Profit For FY 2012: 18 February, 2013. ColomboDocumento3 páginasDialog Records Rs 6.0Bn Net Profit For FY 2012: 18 February, 2013. Colomboran2013Ainda não há avaliações

- CBWeeklyReport 13.02Documento1 páginaCBWeeklyReport 13.02ran2013Ainda não há avaliações

- Press Release - EnglishDocumento1 páginaPress Release - Englishran2013Ainda não há avaliações

- UN Report On Sri LankaDocumento18 páginasUN Report On Sri LankaSri Lanka GuardianAinda não há avaliações

- List of All CompaniesDocumento86 páginasList of All CompaniesRaj Sa100% (2)

- Audit of LiabsDocumento2 páginasAudit of LiabsRommel Royce CadapanAinda não há avaliações

- Ex - Scenario and Sensitifity AnalysisDocumento3 páginasEx - Scenario and Sensitifity AnalysisSakura Rosella100% (1)

- Project On Human RightsDocumento2 páginasProject On Human RightsRahul sawadiaAinda não há avaliações

- Bullish India: Rs. 25/-12 Dark HorseDocumento12 páginasBullish India: Rs. 25/-12 Dark Horsecca neevkAinda não há avaliações

- Microsoft Corp. 4,2 1535 Bond A1Z9YR US594918BK99 PriceDocumento1 páginaMicrosoft Corp. 4,2 1535 Bond A1Z9YR US594918BK99 Pricejose linaresAinda não há avaliações

- Brochure Internacional Ene2018 (v.2)Documento27 páginasBrochure Internacional Ene2018 (v.2)Darío Guiñez ArenasAinda não há avaliações

- Skew GuideDocumento18 páginasSkew Guidezippolo100% (2)

- AR Len 2017 PDFDocumento476 páginasAR Len 2017 PDFdennysAinda não há avaliações

- Rangers CvaDocumento60 páginasRangers CvaSteven Burns50% (2)

- Merchant Banking in IndiaDocumento66 páginasMerchant Banking in IndiaNitishMarathe80% (40)

- Financial Statement AnalysisDocumento77 páginasFinancial Statement AnalysisJebin Jacob100% (1)

- MBIA v. Credit Suisse, DLJ & SPSDocumento36 páginasMBIA v. Credit Suisse, DLJ & SPS83jjmackAinda não há avaliações

- Toa Q3Documento13 páginasToa Q3Rachel Leachon100% (1)

- AlphaDocumento18 páginasAlphaOrganic NutsAinda não há avaliações

- Brand Equity MeasurementDocumento13 páginasBrand Equity MeasurementMehal VichhivoraAinda não há avaliações

- NCFM Mutual Fund Begginer ModuleDocumento71 páginasNCFM Mutual Fund Begginer ModuleIshpreet SinghAinda não há avaliações

- Finance Case StudyDocumento66 páginasFinance Case StudyDevika Verma50% (2)

- Real Estate Mortgage: Annex "A"Documento3 páginasReal Estate Mortgage: Annex "A"Eduardo AnerdezAinda não há avaliações

- Iglesia Evangelica Metodista en Las IslasDocumento5 páginasIglesia Evangelica Metodista en Las IslasChoi ChoiAinda não há avaliações

- MGT 201 Financial Management Grand QuizDocumento5 páginasMGT 201 Financial Management Grand Quizعباس ناناAinda não há avaliações

- Relative Strength Index (RSI)Documento2 páginasRelative Strength Index (RSI)Raj RathodAinda não há avaliações

- Original Research Paper: Prof. Parameshwar H.S. Manish Soni Utkarsh Pandey Jayant Singh Bhadoria Pranjul BajpayeeDocumento4 páginasOriginal Research Paper: Prof. Parameshwar H.S. Manish Soni Utkarsh Pandey Jayant Singh Bhadoria Pranjul BajpayeeSourav PaulAinda não há avaliações

- Comparative Study of Mutual Fund Returns and Insurance ReturnsDocumento3 páginasComparative Study of Mutual Fund Returns and Insurance Returnskkdeepak sal0% (1)

- Nike, Inc Cost of CapitalDocumento6 páginasNike, Inc Cost of CapitalSilvia Regina100% (1)

- Prakas On Accreditation of Professional Accounting Firm Providing... EnglishDocumento12 páginasPrakas On Accreditation of Professional Accounting Firm Providing... EnglishChou ChantraAinda não há avaliações

- Investments - Chap. 6Documento31 páginasInvestments - Chap. 6AndreaAinda não há avaliações

- EOI - AUCTION NOTICE SALE - SIS - Final PDFDocumento36 páginasEOI - AUCTION NOTICE SALE - SIS - Final PDFRaviAinda não há avaliações

- All Schemes Monthly Portfolio - As On 31 August 2018Documento759 páginasAll Schemes Monthly Portfolio - As On 31 August 2018brijsingAinda não há avaliações

- Amg - TRM - BBP - V2.0.Documento43 páginasAmg - TRM - BBP - V2.0.Molli Deva83% (6)