Escolar Documentos

Profissional Documentos

Cultura Documentos

FSDFD

Enviado por

Moiz AhmedTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

FSDFD

Enviado por

Moiz AhmedDireitos autorais:

Formatos disponíveis

Marketing of Bank Services in relation to Corporate Customers

Table of Contents

Table of Contents....................................................................................................... 2 Project Title: ............................................................................................................. 3 Introduction................................................................................................................ 3 Aims and Objectives: .................................................................................................5 Questions for the Research:.......................................................................................5 Scope of research:......................................................................................................6 Chapter 2: Literature review:......................................................................................6 Chapter 3: Research Methodology .............................................................................7 Research strategies: ..................................................................................................8 The main study policies are assessment, grounded concept, incident study, testing, action research and ethnography (Saunders, 2009). Both, the qualitative and the quantitative parts of the study are explained in this research approach. According to Kothari, C.R. (1985), the person who is making the study can take the use of primary as well as secondary data evaluation. For the evaluation of the primary information, the study maker can consume the assessment technique, feedback forms, specified group debates, conferences, discussions and various other strategies which are concerned with the unswerving connection (Kumar, R., 2005). The study maker can also take up on the use of secondary information, and used the published and the unpublished information. The information that has been previously published is reliable thats why it can be used to show the secondary information as a basis of the study (Dawson, Catherine, 2002). ...............................8 Data collection Methods.............................................................................................8 Limitation of research...............................................................................................10 SAMPLING TECHNIQUE:............................................................................................11 RELIABILITY: ............................................................................................................. 11 VALIDITY: .................................................................................................................11 ETHICAL ISSUES .......................................................................................................11 Chapter 4: ANALYSIS AND ITS INTERPRETATION:....................................................12 Expected findings: ................................................................................................12 Chapter5 : RECOMMENDATION AND CONCLUSION...................................................13 Recommendations....................................................................................................13

Project Title: Marketing of Bank Services in relation to Corporate Customers

Introduction The first thing that comes to our mind, when we are introducing a bank, is money that we deposited and the interest/profit on it. The topic of this project is related to a banks operations and the banking businesss management of customer relationship. There are a lot of operations that take place in banks, which seem much clocked for an average employee to understand, whereas this research will also prove to be beneficial for the financial company employees also. A bank offers so many products and services, from which we have the find out the best one, and the ones for financial products for the industry. So many banks are utilizing the marketing mix strategies from their respective products. The bank likes having a good relationship with all its customers and clients. For this research is concentrated on the management of customer relation regarding the banks sector and the techniques that a bank uses for the completion of such tasks; whereas, the commercial customers are off keen significance for the bank also due to the fact that they are the care takers of a banks and its products. In the scenario of India, the development of the banks sector seems to be with leaps and bounds and now there are variety of products and services being offered. Researchs Background: The researchs background or the study is entirely dependent upon the nature or type of a research and evaluates whether it will be beneficial with a strong contextual for the research. In India the banking Era took a boost in 1935. For the present era, this has a commercial web with

expended and vast global media universally. The creation of internet has now become the basic source of working and is being acknowledge by many business personnels. There seem to be numerous internet developers like the Amazon, dell and yahoo. Such offers are very quickly adopted and captured by the commercial enterprises and also the general public takes in immense interest for the online business and products. As the academic curriculum is limited and there is likely a short supply of teaching aids. Each website has many features which seem unique to the enterprise and to its customers also. In the section of the literature review we shall be discussing the businesses marketing mix and the try to find a companys best practices. And not just this, we went as step further and discussed regarding the basic requirements, internet and online features for a business. For this investigation we shall also be inclusive off the conventional marketing theorys flow and practices which are already been applied to the current market. Currently the online habits of purchasing for a customer are increasing day in and day out and they are looking for safer and more reliable sites for making business transactions. The great benefit received by the customers is that they dont requirement to go shopping and without requiring and time to waste. The online business works in a way that the order is placed online and the selected/paid product is placed at your doorstep in just a few days time, therefore customers feel like this is a better option rather than shopping. But during this process many customers face many challenges which are very dangerous for them also. All such thoughts were considered in underlying the hypothesis of this researchs study. The entire scope of marketing online and the pros and cons are restricted for the educational narrow scope. A deeper and broader study regarding the marketing online study ought to be an element of an educational database for every college. Such a process is significantly useful and knowledgeable for the process of learning internet marketing plus for the process of transforming the virtual marketing technology. All this will exhibit the businesses real experience for the researchs readers and potential researchers. Rationale for choosing topic Nowadays, marketing is the most important activity out of all other activities of banking sector. All other activities of banks are dependent on the marketing activity of the banking sector. Few years back, people used to choose banks based on their locations but since the Internet has taken over, people can now use services of any bank in the world by remaining in their homes.

Therefore, bank needs to do good marketing of their services in order to get customers. The rationale of selecting this topic is to find out new techniques of marketing banking services and resources that would be required in marketing services of a bank. This study is helpful in knowing ways to get competitive advantage in banking industry. Also, it would help in knowing methods to get customer satisfaction within the industry of banking sector.

Aims and Objectives: The objectives and aims for this research have much significance to be attained by utilizing the researchs specific models. For every task that we planned to do, we have some objectives in view, same is here as the research has objectives and aims, plus the researchs objectives and aims are explained as under; Investigate the banking service industry. Investigate and analyze banks marketing mix services. For investigating the banks management of customer relationship in its sector. To investigate the point of view of banks commercial clients in the industry.

Questions for the Research: For the attainment of the objectives and aims that this research holds we have designed a few questions, which are being fulfilled by the industry, and are being experience and taken active part in by the huge players for the past 10 years. The few research questions that shall be discussed through out the research as described as under; 1. Description of the conventional banks marketing strategies in the industry for the products and service? 2. How a bank is able to preserve a relationship with its commercial customers in the long run with mutually agreed benefits? 3. For such a competitive market describe a marketing mix process for banking services? 4. Are normal individual customers really a good choice for business generation of a bank?

Scope of research: The research chiefly focuses on a banks marketing services of facilities and products for the banks commercial customers. For this topic we also have a number of things to debate in the examination. These related topics are also selected to increase the knowledge of our potential students of the examination. Due to the fact the awareness of banking products and facilities tend to remain low. This is the reason for which the opportunity of this research seems to be quite large.

Chapter 2: Literature review: A significant part of the research report is its Literature review. During this section of this paper we shall all the previous research that was completed on this topic and the topics similar to this and what were the conclusions driven from the research by the researchers. This study guides an individual in making a research project with the correct procedures being followed (Elliot, G. 2004). We will study all the previous researches which are connected to the subject of our study in this topic. It is very vital to know about the service promotion of the banking area and the connection of the consumers with the bank. STRUCTURE OF BANK MARKET The banks promotion strategies are reliable on the products of the bank, which are offered by them to their consumers. The structures of the banking situation in the markets and their consequences must be discovered by the banking companies. Bass, F. (1974) tells us that in our present age, most of the marketing is found on the internet and majority of the consumers are using that to discover the finest services offered by the banking firms. The structure of the bank market is very expanded in the view of the internet.

Marketing Mix in the Banking Service Sector While talking about the promotion mix in the service area, the first thing that occurs in ones mind is about the initial component of the mix, which is the product itself but in this scenario, the

service is more of an initial part than the products. The definition of marketing mix given by Bass, F. (2006) is that it is the procedure of the conditions of promoting a product in the market. This research recognizes the influence of all the alterations which affect the marketing conditions and also its impact on the manners of the customers (Elliot, G. 2004). There are four things included in the marketing mix. They are price, place, promotions, and products (Quintana, A. 2004). These all are the marketing mix of products, or the marketing mix of a business is this so as to advertise their company in the markets (Elliot, G. 2004). The initial thing is the product which makes up the total merchandises of a firm, made by the business for the resolution to sell them. As per Quintana, A. (2004) the merchandises and the services of the company are the main vital things for earning profits through selling them and to run the overall business. The staff pay, working capital and other expenses are all made possible because of the products. In fact, the product is also made with the help of the money earned through other products. Another thing is the rates of the products; this is also a vital part for the business and also helps with giving improved clarifications. The rates of the products should be very practicable and rational (Bass, F. 2006). The price regulates the sales of the product; if the price is cheap, then we can say that the product is on a practical price and we can assume that it will lead to incremented sales of the product; if the price of the product is high and the quality doesnt justify the price then many people will not buy it (Elliot, G. 2004). The third thing of the marketing mix is the site of the firm. Many things rely on the site of the products, including the triumph of the business. Nowadays, a lot of the businesses are putting up their products online in their websites, and that many products can be brought online and customers conveniently buy the products online from the companys websites (Quintana, A. 2004). The fourth most vital thing is the promotion in the marketing mix. This defines all the things concerning the product such as retail, returns, and the popularity of the product. For the business to keep on going steadily, the promotion of the merchandise should be very powerful. All these four elements make up the marketing mix (Quintana, A. 2004).

Chapter 3: Research Methodology We should go through a study before selecting methods of data analysis and different approaches as they have their own advantages and disadvantages. These methods and techniques differ with the research topic. The research issues are to be addressed by interviewing employees and

customers who are related to marketing section of banking sector. Surveys would also be carried out to get more and better knowledge related to our research problems.

Research strategies:

The main study policies are assessment, grounded concept, incident study, testing, action research and ethnography (Saunders, 2009). Both, the qualitative and the quantitative parts of the study are explained in this research approach. According to Kothari, C.R. (1985), the person who is making the study can take the use of primary as well as secondary data evaluation. For the evaluation of the primary information, the study maker can consume the assessment technique, feedback forms, specified group debates, conferences, discussions and various other strategies which are concerned with the unswerving connection (Kumar, R., 2005). The study maker can also take up on the use of secondary information, and used the published and the unpublished information. The information that has been previously published is reliable thats why it can be used to show the secondary information as a basis of the study (Dawson, Catherine, 2002). Inclusive of the published and unpublished data, there are two expanded kinds of sources. In the source of published data, it may contain census information which has been published by dominant arithmetical group, financial plan, five year plans of the government, records, balance sheet of the corporations etc. (Kumar, R., 2005). Also, unpublished information can also be used as a sort of data that assists us in the evaluation. But, the secondary information isnt much reliable and so the research can also be called unreliable. Secondary information can do produce a negative conclusion (Kothari, C.R., 1985).

Data collection Methods We are employing the questionnaire technique in order to gather data from the market respondents. One of the most significant elements of the research study is data collection and one have to concentrate over it and take it very earnestly as the entire report contingents on the data collection as well as the research methodology. Any sort of inaccuracy in the data gathering

procedure may directly lead to an inaccurate result in the final research study report. Several researchers employ qualitative as well as quantitative research methodology in the research study. QUALITATIVE RESEARCH: The qualitative data is employed by the researchers for the research study which has been collected by way of the questionnaire technique. And this technique is certainly useful for any research study. This technique is selected to be employed; as the qualitative research methodology is being operated in the research, moreover, this technique makes the research further exploratory and produces more accurate result from the collected data. The qualitative research emphases more upon the subject matter as well as the terminologies of the research, in addition, research methodology for the collection of data is either primary or secondary or both which aid us to gather the pertinent data for finding out the accurate result from the research study. QUANTITATIVE RESEARCH: The research study of quantitative type indicates that it is demonstrated upon the numerous kinds of aspects together with the quantity. This kind of research comprises statistical data up to certain degree; however the ultimate results will derive on the basis of the relevant facts and data. PRIMARY DATA: The basic data which is directly gathered from the research questionnaire respondents or some other different methods is known as primary data. Then in this research study we exploit the data concerning about the communication ethic and the vital marketing of the businesses. Basically primary data is such kind of data which has been collected for the first time and is being used for the first time for any research study, as well as this is extremely factual to the research study as on the basis of this data researchers perform the research and discover solutions (Ellen et al. 2009). Since this data has been gathered from the respondents belonging to diverse age group consequently then we would be able to find more accurate answers of our queries.

SECONDARY DATA:

The data which has already been gathered by other researchers either for the same reason or for some other research study and we utilize that particular data for our own research purpose then this data is our secondary data. (Onkvisit and Shaw 2007.p.216). This type of data can be accumulated from the newspaper, magazines, internet, and books as well as from the website of the company. Hence, such kind of data is known as the Secondary Data.

Limitation of research Each ad everything in this world entails limitations along with it and it is very important to have knowledge about those limitations relating to certain things. Similarly this research study also has few limitations which we have to focus in order to comprehend the result in an appropriate manner. This research study limitations are stated here as under: The data which has been gathered for this research study is based upon primary and

secondary sources only hence the information gained from them could be erroneous up to certain extent and that may lead towards wrong conclusion. The result provided by this research comprises facts and figures but it does not certain

that the result should be believed forever. Collection of primary data obliges more time on the other hand secondary data can be

unreliable for this research. These issues can provoke questions upon reliability and the validity of the data. Among the most significant factors in any research study one of them is the time, the

response of the respondents depends over the time and if they are provided with less time so this can affect the outcome of the research study. Other limitation of this research study can be related to issues in the data and the

theoretical portion.

SAMPLING TECHNIQUE: In order to achieve the objectives of the research study, researchers are necessitated to perform a survey. Although to collect data from employees, customers who are related to the marketing of the banking sector is a little difficult thing. The size of the sample for this research study should have to be at optimal degree and it is of about 150 respondents. If the size of sample is raised more, then the result of this research study will become more realistic and will be more near to the truth. But because of the money and time constraints, the sample size is limited.

RELIABILITY: A tool that has been utilized to determine the consistency of the gathered data in known as reliability and is been employed in this research study as well. As researchers gathering information from the primary resources they may have committed some minor errors which can produce difference in the final outcomes. In this research study, the researcher has employed two aspects for testing the reliability and consistency of the collected data; one of them is the repeatability and the other one is inner uniformity of the data. However the data gathered in this research is completely authentic and reliable.

VALIDITY: Validity of the accumulated data is basically the measurement of the data such that if it is valid for this research study or not or it is appropriate for this research or not. This measurement also entails the checking of the validity of different aspects of the data concerning to the research subject. There would be numerous things which would be influencing the ultimate outcome of this research and digress the authenticity of the gathered data. However, this research study is based upon the questionnaire methodology which includes all sort of associated questions, it contains such terminologies which can be easily comprehended by the respondents of this research study.

ETHICAL ISSUES Every single work in our everyday life enlightens ethical issues. The discussed topic is providentially associated to the banking and the marketing services, and in this research study we have considered numerous ethical issues concerning about the communication.

The procedure of collecting data is performed very carefully by the researcher, they properly take every step because as above discussed, and collection of data can be dangerous as this process contains many critical situations. Data first collected initially then from organizations website.

Chapter 4: ANALYSIS AND ITS INTERPRETATION: Collection of data in any research must overcome with an examination and the understanding procedure. It has been noticed then in any research work the main part is the examination of data while collection because it must be clear that the data you have collected is correct otherwise it will be of no use. Krikorian, and Wiener in 1995 said that without the examination of data, this research is nothing. This chapter contains importance and also it must be clear to the researcher that this procedure of collecting data is not so easy because sometimes the tool of examining data can be wrong and can lead the researcher to the wrong path which results failure. Simmons M in 2007 shared his thought by saying that as it is known to the researcher that we use qualitative and quantitative method to collect data so the result of the research must be passed on to different ways of data collection and outcome will be the combination of both techniques. Internet plays excellent role in both servey of research and also in the collection of data. It saves time and money of the researcher and also give accurate result. It is also useful because with net we can apply software of quantitative data. First the techniques of analysing data are selected then the method of research is designed. An statement given by Kucukemiroglu O in 1997 that for the research descriptive data is collected and description work is done by the framework of examination. Expected findings:

world?

Underline the reasons for the success of commercial bank in these viable services of the

Is there mutuality between Banka nod customers and bank? The plans for the products of bank and the realization for the benefits of customer.

Chapter5 : RECOMMENDATION AND CONCLUSION Purposes of this research are obtained the nearby topics and moved it on to the specific field. Marketing communication come after the examination of data in this research paper because many times they face the a situation in which a message should be typed for the customer and it is their responsibility that while advertising they should work very carefully on that message because a single mistake in message will lead the business towards bend. Communication of marketing is primary for this project then the process of marketing is secondary which covers banking operations. In last years internet again played good role in banking operations by providing online facility to the bank. For knowing the best part of advertisement, this discussion is compulsory.

Recommendations For giving the better facility to the corporate customer promotion of banking services is very important. And its natural that customers attracts towards the banks which has better facility for them. So following are the main recommendations for that:

1. Reliable and everlasting relationship should be made with the customer. 2. The service which provides all facilities to the customer and which can fulfill their needs must be provided to the customer by bank. 3. The most important customers are corporate customers, so they deserves more concern and more strong relation then others. 4. Services of bank in marketing should have skills to be appreciated.

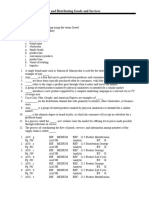

Gantt chart Month Starting in starting March Day 1-15 Activities Research outcome by deep study and collection of proper

Mid May to May end In June July to Mid August Mid August to Mid Sept

15-25 5-25 1-20 18- 28

information. Review of literature and preparation of final draft is completed. Compilation of the collected data. Examination of data and research writing. Finally compile all research work and draw its concluding recommendations and conclusion.

References

Anderson, J.C. and Narus, J.A. (1990): A model of distributor firm and manufacturer firm working partnerships, Journal of Marketing Research, Vol. 54, No. 1, pp. 42-58; Athanassopoulos and Labroukos (1999): Corporate customer behavior towards financial services: empirical results from emerging market of Greece, International Journal of Bank Marketing, 17/6, pp. 274-285; Azjen, I. and Fishbein, M. (1980): Understanding Attitudes and Predicting Social Behaviour, Prentice Hall, Englewood Cliffs, NJ; Bahia, K. and Nantel, J. (2000):A reliable and valid measurement scale for perceived service quality of banks, International Journal of Bank Marketing, Vol. 18, No. 2, pp. 84-91; Ball, D., Coelho, P. and Machs, A. (2003): The role of communication and trust in explaining customer loyalty. An extension to the ECSI Model, European Journal of Marketing, Vol. 38, N 9/10, pp. 1272-1293; Barsky, J. (1994):World-Class Satisfactin, Irwin Professional Publishing, Burr Ridge, IL; Bass, F. (1974):The theory of stochastic, preference and brand switching, Journal of Marketing Research, Vol. 11, pp. 178-202; Baumann, C. , Burton, S. and Elliot, G. (2004): Determinants of customer loyalty and share of wallet in retail banking, Journal of Financial Services Marketing, Vol. 9, pp. 231-248; Beerli, A. Martin, J. and Quintana, A. (2004):A model of customer loyalty in the retail banking market, European Journal of Marketing, Vol. 38, N , pp. 253-275;

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Index: S.No Date Page# Topic Remarks SignDocumento4 páginasIndex: S.No Date Page# Topic Remarks SignMoiz AhmedAinda não há avaliações

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- Ce-312 Data Communication 6th Semester Computer Engineering (Batch 2007) Section C Sessional MarksDocumento4 páginasCe-312 Data Communication 6th Semester Computer Engineering (Batch 2007) Section C Sessional MarksMoiz AhmedAinda não há avaliações

- Currency Converter: Enter Amount in Rs 1000Documento1 páginaCurrency Converter: Enter Amount in Rs 1000Moiz AhmedAinda não há avaliações

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Calculator: Object: Make A Calculator Using Ms ExcelDocumento1 páginaCalculator: Object: Make A Calculator Using Ms ExcelMoiz AhmedAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- CH 12Documento26 páginasCH 12Moiz AhmedAinda não há avaliações

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Data Com Outline 2011Documento3 páginasData Com Outline 2011Moiz AhmedAinda não há avaliações

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- PrinterDocumento2 páginasPrinterMoiz AhmedAinda não há avaliações

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Overview of Data Communications and NetworkingDocumento18 páginasOverview of Data Communications and NetworkingMoiz AhmedAinda não há avaliações

- CH 10Documento48 páginasCH 10Moiz AhmedAinda não há avaliações

- CH 04Documento46 páginasCH 04Moiz AhmedAinda não há avaliações

- CH 04Documento46 páginasCH 04Moiz AhmedAinda não há avaliações

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Overview of Data Communications and NetworkingDocumento18 páginasOverview of Data Communications and NetworkingMoiz AhmedAinda não há avaliações

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- MFRP KjlkjassignmentDocumento23 páginasMFRP KjlkjassignmentMoiz AhmedAinda não há avaliações

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- SasDocumento14 páginasSasMoiz AhmedAinda não há avaliações

- New Microsoft Word DocumentDocumento1 páginaNew Microsoft Word DocumentMoiz AhmedAinda não há avaliações

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- MIS Chapter 01Documento29 páginasMIS Chapter 01Moiz Ahmed100% (1)

- DC Front PageDocumento2 páginasDC Front PageMoiz AhmedAinda não há avaliações

- Sirsyed University Ofengineering & Technology (Ssuet) Computerengineering DepartmentDocumento3 páginasSirsyed University Ofengineering & Technology (Ssuet) Computerengineering DepartmentMoiz AhmedAinda não há avaliações

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- All ProgsDocumento3 páginasAll ProgsMoiz AhmedAinda não há avaliações

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- 1Documento2 páginas1Moiz AhmedAinda não há avaliações

- Lab 08 OopDocumento6 páginasLab 08 OopMoiz Ahmed100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Strategic Management Analysis - Tesco PLCDocumento13 páginasStrategic Management Analysis - Tesco PLCbhrAinda não há avaliações

- AIMS Institute of Management StudiesDocumento20 páginasAIMS Institute of Management StudiesTechnical Tech TalksAinda não há avaliações

- CH 12Documento27 páginasCH 12alslmaniabdoAinda não há avaliações

- (En) MR Jeff - EcosystemDocumento20 páginas(En) MR Jeff - EcosystemABDOPORSAinda não há avaliações

- Schiffman Chapter 1.Documento3 páginasSchiffman Chapter 1.Taiba NaseerAinda não há avaliações

- Impact of Personal Selling in Super MarketsDocumento12 páginasImpact of Personal Selling in Super MarketsvanshitaAinda não há avaliações

- Group 8 - Case #4 - Starbucks - SMDocumento6 páginasGroup 8 - Case #4 - Starbucks - SMSiddhi GodeAinda não há avaliações

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- Presentation On 4 P's of Marketing.Documento6 páginasPresentation On 4 P's of Marketing.ananyaAinda não há avaliações

- EconomicsDocumento107 páginasEconomicsWala LangAinda não há avaliações

- Marketing Strategy of Mcdonalds: MarouaneDocumento30 páginasMarketing Strategy of Mcdonalds: MarouanepseAinda não há avaliações

- Marketing PlanDocumento35 páginasMarketing PlanWensen ChuAinda não há avaliações

- A Project Report On Supply Cahin Management atDocumento39 páginasA Project Report On Supply Cahin Management atjizozorAinda não há avaliações

- Title: Marketing Practices of Street Food Vendors in Roxas Avenue, Davao CityDocumento25 páginasTitle: Marketing Practices of Street Food Vendors in Roxas Avenue, Davao CityJhayann Ramirez100% (1)

- Sample Marketing Plan Green Eggs v2Documento41 páginasSample Marketing Plan Green Eggs v2Syed Noordeen100% (4)

- Chapter 5Documento17 páginasChapter 5Cuitlahuac TogoAinda não há avaliações

- Chapter 3Documento8 páginasChapter 3Nigussie BerhanuAinda não há avaliações

- A Aravind Bharathi - Resume - 21Documento2 páginasA Aravind Bharathi - Resume - 21Aravind BharathiAinda não há avaliações

- The Positioning in Practice Research ReportDocumento30 páginasThe Positioning in Practice Research ReportPat McLoughlinAinda não há avaliações

- Victoria SecretDocumento50 páginasVictoria SecretStan Alice0% (1)

- Ch02-Managing Industry Competition - Global StrategyDocumento54 páginasCh02-Managing Industry Competition - Global StrategyNguyễn Phương ThảoAinda não há avaliações

- Scorpio - Developing Brand IdentityDocumento9 páginasScorpio - Developing Brand IdentityVarun JainAinda não há avaliações

- In Terms of Market GeographyDocumento17 páginasIn Terms of Market GeographyAnu MathewsAinda não há avaliações

- Chapter 1Documento26 páginasChapter 1Sachi DhanandamAinda não há avaliações

- Call For Papers GBATA 2018Documento9 páginasCall For Papers GBATA 2018Emilia VásquezAinda não há avaliações

- Five Minds For The FutureDocumento4 páginasFive Minds For The Futurejgiorgi_1Ainda não há avaliações

- WM Morrison Supermarkets PLCDocumento6 páginasWM Morrison Supermarkets PLCabdul2017Ainda não há avaliações

- Ebook PDF The Well Managed Healthcare Organization 9th Edition PDFDocumento41 páginasEbook PDF The Well Managed Healthcare Organization 9th Edition PDFclyde.garner99997% (37)

- 08jun201610060713 Ranjita Gupta 225-231Documento7 páginas08jun201610060713 Ranjita Gupta 225-231Abhishek MitraAinda não há avaliações

- Assigment 2 Advertising Planning and Decision MakingDocumento2 páginasAssigment 2 Advertising Planning and Decision MakingamirAinda não há avaliações

- Candied Nails Attributes Growth To Affordability, Choices and Stylist ProgramDocumento2 páginasCandied Nails Attributes Growth To Affordability, Choices and Stylist ProgramPR.comAinda não há avaliações