Escolar Documentos

Profissional Documentos

Cultura Documentos

Guided Competition in Singapore's Telecommunications Industry

Enviado por

Amit PandeyTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Guided Competition in Singapore's Telecommunications Industry

Enviado por

Amit PandeyDireitos autorais:

Formatos disponíveis

Guided Competition in Singapore's Telecommunications Industry

KULWANT SINGH

(Department of Business Policy, National University of Singapore, Singapore 119260. Email: fbaks@nus.edu.sg)

This paper focuses on the role of competition, defined broadly to encompass both firm-level and internation competition, in the development of telecommunications infrastructure. The context of the paper is Singapore's telecommunications industry. This paper attributes some of the development of Singapore's telecommunications services and infrastructure to actual and potential competition at the market and internation levels. It argues that it is possible to introduce some competitive pressures into a market with few competitors, to ensure close-to-competitive-market outcomes. It also demonstrates the impact of internation competition on within-country telecommunications policies and infrastructure. Finally, the paper discusses how another dimension of internation competitionthe transmission of cultural and social values and practicesimpacts telecommunications policies.

1. Introduction

Analyses of the impact of competition on the development of tele- communications infrastructures have usually focused on the positive value of ~Z, competitive forces at the service provider level. The basic and almost I unchallenged argument is that competitive markets provide better outcomes than non-competitive markets, a position that has been well established in markets that can accommodate competition. However, two related issues g have not drawn adequate attention. to First, how can the benefits of competition be introduced to markets which 0 because of size or other characteristics may not be liberalized to accommodate 1 competition? Economic arguments relating to natural monopolies suggest 0 that in such cases, strong regulatory control is needed to ensure the efficiency . of the service provider but that the likely outcome will still be a relatively 1 high degree of inefficiency. This argument is based in part on the strong

3 Oxford University Press 1998

585

Guided Competition in Singapore's Telecommunications Industry

presumption of inefficiency which characterizes research on government corporations (Sikorski, 1993), a presumption well supported by extensive research demonstrating their poor performance relative to private corporations (Ayub and Hegstad, 1986; Haririan, 1989; Toh, 1991). Second, what is the impact of internation competition on the development of national telecommunications infrastructures? Nations increasingly compete on several dimensions for their share of global trade, foreign direct investment (FDI), technology development and transfer, and economic development. This level of competition has not received much attention in the study of telecommunications development, despite extensive efforts to establish the relationship between telecommunications and economic development. It is likely that competition for FDI, for example, has important impact on telecommunications policies and infrastructure development. This paper focuses on the role of competition, defined broadly to encompass both firm-level and internation competition, in the development of telecommunications infrastructure. The context of the paper is the recent and future development of Singapore's telecommunications industry. This paper attributes some of the development of Singapore's telecommunications services and infrastructure to actual and potential competition at the market level and, importantly, to competition at the internation level. It argues that it is possible to introduce elements of competitive pressures into a market which has limited competition to ensure close-to-competitive-market outcomes. The paper also discusses the impact of internation competition and demonstrates that such competition has strong impact on within-country telecommunications policies and infrastructure. Further, such competition can have some of the same impact on infrastructure development and on efficiency asfirm-levelcompetition. Finally, the paper examines how another dimension of internation competitionthe transmission of cultural and social values and practicesimpacts telecommunications policies.

2. Background

Consistent real economic growth averaging >8% per year between I960 and the mid-1990s transformed Singapore from an underdeveloped nation to having per capita GNP (PPP adjusted) among the ten highest in the world, high standards of living and a physical infrastructure that meets or exceeds world benchmarks (World Economic Forum, 1997). Important reasons for this success include liberal trade and investment policies, heavy investments by multinational companies (MNCs), consistent economic policies and a high priority on national economic growth. The underlying reasons for the success of 586

Guided Competition in Singapore's Telecommunications Industry

these policies and the rapid growth of the economy are the government's industrial policies and its effective management of the economy (Alten, 1995). The high priority placed on economic growth, Singapore's limited national resources, and the small scale of the economy and country encouraged the government to manage the economy to a high degree. This management, however, has not always taken the form of direct intervention or replacement of the market as has been common in many developing countries. On the contrary, the industrial policies of the government have called for direct intervention only if indirect approaches have not worked, in line with the following three levels of participation: 1. Infrastructure. The primary approach is for the government to provide a world-class infrastructure, so as to make it attractive and profitable for businesses to operate in Singapore. 2. Incentivts. In the event that the infrastructure is inadequate to attract the desired levels or types of businesses, direct incentives are offered to attract the required activities. 3. Intervention. If infrastructure and incentives are not sufficient, the government will intervene directly to undertake the activities desired. Intervention is usually through the establishment of a government corporation or by directing an existing government corporation to enter the targeted businesses. As part of its formal plan for long-term development, the government implements comprehensive industrial policies, of which three major strategic thrusts are highlighted here: 1. International hub. This aims to exploit Singapore's strategic location to make it a manufacturing and services hub for Southeast Asia, particularly in communications and information, financial services, trade, logistics, and technology and engineering services. 2. Information technology. The key focus of this effort is to develop a well-integrated and extensive national information infrastructure based on advanced IT. The aims are to facilitate the development of the IT industry in Singapore and to build an infrastructure to facilitate economic development. 3. Regionalization. This strategy encourages Singapore and foreign businesses located there to expand operations into the region to participate in regional growth, to allow the economy to outgrow the constraints imposed by its small size. 587

Guided Competition in Singapore's Telecommunications Industry

The success of these policies depends greatly on the existenceand will contribute to the developmentof a high quality physical infrastructure, one that is particularly strong in telecommunications and IT. Consequently, the government has placed a high priority on developing the telecommunications infrastructure ahead of actual need and on investing early in the exploitation of leading-edge but tested technologies (Sisodia, 1992; Ng, 1997).

3. Competition in Singapore's Telecommunications Industry Competition and Telecommunications

There has been a clear trend among developing countries towards deregulation, liberalization and the introduction of competition in their telecommunications markets to improve infrastructure while conserving scarce public funds. This trend has occurred despite the belief that key infrastructure should be owned and managed by governments for reasons of national development and security. Reflecting this view, many Asian countries have introduced competition in their telecommunications sectors without fully privatizing state operators and with only partial market liberalization. Entry has generally been restricted for foreign firms, who have only been allowed to participate through minority stakes in partnerships with domestic firms. Although Singapore has implemented policies broadly consistent with these trends, it has been acutely aware of the potential impact of competition on its telecommunications infrastructure and of this infrastructure on economic development (Mah, 1997). Singapore's telecommunications infrastructure and services have often been identified as among the most effective and cost efficient in the world, matching or exceeding the standards of advanced countries in many areas (Telecom Strategy and Research, 1990; Carrel, 1991; Pyramid Research, 1994; IMD, 1997; World Economic Forum, 1997; Centre for Telemedia Studies, 1998). This position has been achieved despite two characteristics that are commonly believed to create less efficient outcomes: the absence of free competition and government ownership of telecommunications services providers. Singapore's small size, dense population and heavily built-up nature severely limit its market size and the number of service providers that can operate there efficiently and profitably. Although privatization and liberalization in the early 1990s reduced government ownership of the telecommunications service provider (SingTel) to 80% and removed some 588

Guided Competition in Singapore's Telecommunications Industry

constraints, Singapore had only one service provider until 1997. Despite having monopoly control, SingTel achieved considerable success in developing a high-quality infrastructure and providing services at prices rated among the lowest in Asia {Asian Wall Street Journal, June 2, 1998; Centre for Telemedia Studies, 1998), while achieving high profitability (Singh, 1995). SingTel's performance, which is unusual for public monopolies, has been partly attributed to its effective strategy and to efficient supervision by the telecommunications regulator, Telecommunications Authority of Singapore (TAS) (Toh and Low, 1990; Singh, 1995). Key elements of this management involve benchmarking global service providers to establish operating and pricing standards for SingTel, establishing high profitability and performance targets, and placing high demands on the core of carefully selected senior executives running telecommunications and other government operations (Singh, 1995; Singh and Ang, 1997).' Corporatization and partial privatization by listing SingTel on the Singapore Stock Exchange further increased external pressures for performance. Finally, expansion of operations outside Singapore into competitive markets further pressured SingTel to improve its operations.2 Less deliberately, though perhaps more significantly, the entry of callback services into the market placed great pressure on SingTel to reduce its international direct dialling (FDD) rates. 3 All of these forces partially introduced the pressures of competition on the monopoly service provider without the entry of direct competitors. While these pressures were clearly less than those of a competitive market, they represented an intermediate stage which SingTel benefited from, in preparation for liberalization and increased competition. SingTel's performance subsequent to its 1992 privatization suggests that the managed, phased introduction of competition is a useful part of the privatization and liberalization processes.

Guided Competition

In 1995, the government issued a license for a second mobile phone provider to commence services in 1997. This decision reflected global trends of

1 The high pressure to succeed and strong competition among this carefully selected core of senior executives essentially replicates some of the pressures of competition among the firms they lead. Since many of these firms do not actually face strong competition, competition among chief executives creates competition across industries, with positive impact on firm performance. 1 By mid-1997, SingTel had investments in 52 telecommunications ventures in 21 countries. With few exceptions, these ventures have not been profitable.

* Callback services cannot be promoted or provided in Singapore, though they are not illegal. However, even limited advertising by foreign providers in foreign publications sold in Singapore have attracted many users. This was a major factor in SingTel's reduction of IDD prices. Average IDD charge declined by 42% between 1993 and 1998 (SingTel advertisement), much faster than in preceding years.

589

Guided Competition in Singapore's Telecommunications Industry

deregulation and increased competition, growth of the mobile phone market in Singapore, rapid emergence of mobile phone technologies, and the government's intention to increase competitive pressures on SingTel in preparation for increased international competition and expansion (Leong, 1993). MobileOne's entry in April 1997 had the usual dramatic results associated with the introduction of competition in a previously protected market.4 MobileOne captured ~30% of the market, prices declined by 50-70% within a year, the range and quality of services improved significantly, and the market expanded rapidly. In the process, the mobile phone penetration rate rose from 14% at the start of 1997 to 25% at year-end and approached 30% by the end of 1998. In 1998, two additional licenses were awarded for mobile phone services and one for fixed line services, while a further license for full domestic and international operations will be considered in 1999- Each license winner was led by two government-linked corporations. The primary factor driving liberalization was the recognition that competition would bring the same positive benefits to the fixed line market as it did in the mobile phone market (Hu, 1997; TAS, 1998). Failure to do this would, on the other hand, handicap the country with higher telecommunications costs and older technology than in competitor economies with more competitive telecommunications industries (Ng, 1997). Recognizing the national interest in not duplicating existing networks, the regulatory authority indicated that it would mandate access to existing local access networks for the new service provider. While trying to prevent redundant investments, the TAS also encouraged proposals based on new and innovative technologies that would compete with or advance the existing infrastructure on the basis of significant new investments. This again illustrates Singapore's pragmatic approach to managing competition in the telecommunications industry, which provides a framework for competition while allowing for cooperation if this is perceived to be beneficial. The winner of the license chose to lay its own island-wide fiber backbone, which will duplicate SingTel's network. Though this may be viewed as a surprising outcome in light of the aim of avoiding duplication and overinvestment, it may have been driven by the national IT plan which envisages an extensive fiber-based infrastructure. The choice was also restricted by the inability to adopt more direct or satellite-based alternatives, as discussed below. The growth of the mobile phone market is consistent with the view that

* MobileOne is a consortium of two local firms (the diversified, government-linked Keppel Corporation and Singapore's sole newspaper publisher, SPH) and two foreign firms (UK's Cable & Wireless and i a partially owned subsidiary, HongKoag Telecoms).

590

Guided Competition in Singapore's Telecommunications Industry

FIXED UNE TELEPHONY tWOA PORE TELECOM TAIIHUB {fnm l o w ) WtOAPORI TECHNO LOOK*

MAJOR PLAYERS

MHOAPORE POWER

wUu BX,SH

WIRELESS COMMUNICATIONS 1WOTP. cbn t ITAflHUB (Hob!*; traai 1000) i t t : fll JUT H P (Hat**; w n I n l u i i l l t o n 1000) HUTCHiaOH IHTHAPAOE

TV MAT8TEEL KEPPEL CORP

OeUOU *!* M

INTERNET ACCeSS PROVIDERS 8 IN OA PORE PRESS 8EMBAWANS " COflP

HOLDmaa

PACIFIC MTERNET

CABLE T.V. SMOAPOU CABLIVtUON tOu lOJ BROADCAST T.V. SWOAPORG

ITL

MEDIA

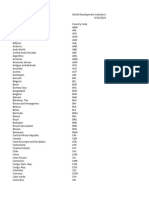

FIGURE 1. The major players in Singapore's telecommunications and IT industry. Firms underlined and in italics are not owned wholly or in part by the government. (Source: Straits Time, April 25, 1998.)

competition plays an important part in matket expansion and that no matter how efficient a monopolist is, it is unlikely to achieve the efficient outcomes of competitive markets. However, it is noteworthy that improvements in market growth and efficiency were achieved with one service provider being 80% owned by the government and the other being minority-owned by a government-linked corporation. This approach continues to be adopted, with all existing or prospective service providers in 1998 being at least partially publicly owned. Figure 1 charts the major players in Singapore's telecommunications and IT industry. Government ownership does not appear to have constrained the players, who compete directly and intensely. Regulation and policies appear to encourage competition while ensuring that the providers remain viable and profitable, and that the integrity of the national telecommunications network is not jeopardized. Policies on number portability and interconnect charges, for example, appeared to be finely balanced so as not to offer excessive advantage to either player (TAS, 1997). This approach to guided competition is illustrated by the following: The need for Singapore to liberalise and harness market forces to achieve our goal is dear. However, our liberalisation approach is not aimed at introducing competition for competition's sake. Instead, to ensure that 591

Guided Competition in Singapore's Telecommunications Industry

competition benefits are sustainable for the telecommunications industry in the long run, we have adopted a managed competition approach, that is a deliberate and phased approach, towards liberalisation of the industry. While we recognise that a fully competitive and open market environment may be ideal and desirable in the long term, we are mindful of the possible negative effects of an overly rapid liberalisation process. We believe that unorderly and unstructured liberalisation could lead to usage of scarce resources that is not optimal; results in unintentional duplication of infrastructure; and give disincentive to invest long term. (Ng, 1997) One of the key challenges for TAS will be how to make sure that all of these competitive forces happen in a systematic and orderly manner. Not just for orderliness' sake. But I think the implication would be that if you have systematic competition it would lead to long-term benefits for consumers as opposed to a very laissez faire and unsystematic manner.

(Business Times, October 1, 1997)

The alternative of full market competition and complete devolution of public ownership has not been adopted for two main reasons. First, the relatively weak institutional, information, technological and market infrastructures and the small size of the market may not ensure competitive market outcomes or outcomes that are positive from the national perspective (Ng, 1997; TAS, 1998). In the latter respect, the policies of nurturing local firms to succeed in high-technology and IT industries would not have been facilitated by an industry dominated by foreign firms. The involvement of the government through its corporations was therefore necessary to ensure close-to-competitive but favorable market outcomes. Second, telecommunications is part of the strategic infrastructure and is central to the nation's industrial policies (Mah, 1997). Government involvement is therefore viewed as necessary to ensure close direction and the development of supporting and complementary industries. Although neither of these two factors necessarily requires the participation of the government or government-linked corporations, the ability of these corporations to approach or match private sector benchmarks (Singh and Ang, 1997; Sikorski, 1989) appears to justify their participation. The outcomes of rapid market expansion, declining prices and a high-quality infrastructure suggest that the guided competition approach is a feasible one in Singapore. This is further supported by Singapore being rated ahead of all but four countries in having a competitive telecommunications market (British Telecom, 1998), despite the fact that by the criteria of common government ownership, it may not have a competitive industry at all. 592

Guided Competition in Singapore's Telecommunications Industry

4. Internation Competition Economic Competition

Policymakers in Southeast Asia, particularly in Singapore, appear to accept that the telecommunications infrastructure significantly impacts economic growth (Jussawalla, 1995; Mah, 1997; Ng, 1997; TAS, 1998) despite researchers' disagreements on causality. This is reflected in the importance accorded by governments in the region, particularly in Singapore, to the development of the IT and telecommunications infrastructures. This priority and the strategy of targeting IT and related sectors as growth industries for Singapore largely account for the heavy investment in the telecommunications infrastructure. While this position is not unusual among developing countries, Singapore has perhaps placed more importance on targeting and developing these sectors than most countries. More unusually, Singapore places a high degree of importance on possessing an infrastructure that is superior to that of 'competitor nations' (Far Eastern Economic Review, June 4, 1998), so as to be able to attract greater FDI, grow foreign trade faster, achieve greater economic growth and development, and emerge as the IT hub for the region. This long-term priority on the IT infrastructure is well illustrated by the impact on Singapore of Malaysia's launch of its 'Multimedia Super Corridor' (MSQ. The MSC is essentially a national effort to build a large-scale, purposedesigned, highly integrated broadband IT infrastructure to serve as the basis for new business, government, health, social and education institutions, and industries in Malaysia. Although perhaps not conceptually novel, this effort was well marketed, well supported by Malaysia's top leaders, and drew the support of leading IT firms when launched in 1995. Although Singapore had commenced implementation of its Strategic IT Plan (National Computer Board, 1992) which envisaged a similar infrastructure, the announcement of the MSC was widely perceived as a threat to Singapore's continued status as the region's leading candidate for IT and MNC investments and as the communications and economic hub for the region. This led Singapore to review and relaunch its IT strategy, and to increase and focus investment in this effort. This level of competition is not unique, being common among the countries in East Asia for example, as they compete for foreign investments and for their share of world trade and economic growth (Far Eastern Economic Review, June 4, 1998). The pressure to stay ahead of'competitor countries' in the economic development race plays a big part in infrastructure decisions, with the drive for growth translating into expenditure on telecommunications 593

Guided Competition in Singapore's Telecommunications Industry

infrastructure, in the belief that this will directly impact economic growth.'

Cultural and Social Competition

From a different perspective, the challenges of minimizing foreign social and cultural influences can also significantly influence infrastructure decisions. These influences can be evaluated as a different dimension of internation competition, that for cultural influence and independence. The significant concern among developing Asian countries about foreign cultural influences almost uniformly translates into attempts by authorities to control, regulate or monitor information and telecommunications content. An example is provided by Singapore's selection of a fiber-optic cable network as the primary basis for its future telecommunications and IT networks. Many issues and uncertainties make the choice between satellite and fiber difficult, with the answer dependent on many context-specific factors and emerging technologies. Although satellite transmission may offer the faster, more cost effective and more mobile means for providing increased television, multimedia services and telecommunications services for a small and urbanized environment like Singapore, this option was not selected. One of the important factors in this decision was that satellite-based transmission was likely to lead to unrestricted access to content. This was viewed as undesirable, as the population would be vulnerable to foreign cultural and social influences, a significant threat to what is viewed as an immature society and emerging nation (Mah, 1997). The decision was therefore made to use optical fiber as the backbone for the country's future telecommunications, cable and information networks.6 Singapore's national IT strategy is based on the concept of a country-wide optical fiber-based broadband infrastructure of high-capacity networks and switches providing advanced applications and services. To implement the network, known as Singapore One, every business, home and institution in the country will be linked by an optical fiber network to provide access to cable television, cable-based telecommunications and other broadband multimedia applications. Although it has been argued that the nation has made a costly investment in a fixed asset that may be

5 At a different level, pressure from external organizations has also impacted Singapore's plans for liberalizing its telecommunications market. In April 1996, Singapore announced that it would bring forward the end of SingTel's exclusive fixed line and international services licenses by 5 years, to 2002 (later brought further forward to 2000). This was widely interpreted as a retction to liberalization pressures from the VCfcrld Trade Organization, which was to hold its first conference in Singapore at the end of 1996. 6 Recognizing that satellites will be important for telecommunications in future, SingTel launched its own satellite in mid-1998. It offers several services to customers in the region, including VSAT, satellite uplinking, direct-to-home video, broadcast and fixed-line restoration services.

594

Guided Competition in Singapore's Telecommunications Industry

leapfrogged by cheaper and more flexible technologies, the fiber option was viewed as superior for offering lower total financial and social costs. Optical fiber cables had been laid 'kerbside'" by the early 1990s for the telecommunications network and were owned by SingTel. The partially government-owned cable television provider, Singapore Cable Vision, laid and owns the links from there into homes. By early 1998, > 8 5 % of all homes in Singapore had been wired and it is expected that all will be by the end of 1999. Potentially, almost the entire country will have access to fiber-based broadband IT applications before the year 2000, possibly a decade before larger developed countries. The integration of the cable and telephone networks on the same backbone is a central aspect of the government's plan to have a nation-wide broadband infrastructure providing a wide range of interactive multimedia services to all homes, offices and institutions in the country. This network is being developed with a combination of government direction, ownership of the backbone network and regulation of content, and private sector development of content and services. The government's intervention in and guidance of the industry has been essential to ensure that the various elements of the infrastructure are integrated, and are consistent with planned capabilities and intended uses. Although directly involved in the establishment and management of the network, the government has been minimally involved in content development, probably in recognition of its limitations in this area. Given the uncertain viability of the venture, government subsidies were offered to attract private content developers. This level of government involvement is justified on the basis that the Singapore One network will enhance Singapore's competitiveness and help it develop new technologies for its IT industry. A similar approach was taken in the provision of internet services. The strategy of making Singapore an intelligent island and a leader in IT suggested the need to maximize internet access and utilization. However, the need to minimize the potentially negative social and cultural influences of the internet required some measure of control. The strategy adopted was to allow several service providers (all of which are government-linked corporations) easy access while introducing strict new regulations to discourage uses that were viewed as undesirable. The competing interests in this and the examples discussed above are the need to establish a modern infrastructure to aid the nation's development at minimum cost, which requires openness and competition, against the need to avoid negative external cultural influences, which suggests a more guarded and closed approach.

595

Guided Competition in Singapore's Telecommunications Industry

5. Discussion and Conclusion

This paper has discussed Singapore's approach to introducing and managing competition in its telecommunications industry. The approach is essentially pragmatic, recognizing both the benefits and costs of competition for telecommunications within Singapore. The gains from competition include more rapid development of the market, industry and technology, greater efficiency, lower costs, and positive spillover effects for the economy. Against these benefits, competition is associated with the risk of the market being dominated by foreign firms, thus hindering the emergence of a local industry, with competitors placing priority on profitability ahead of national considerations, and with wastage from unnecessary competition and duplication of infrastructure. The solution is to encourage competition, but to provide close guidance through the use of incentives and regulation, and to drive the industry by encouraging government-linked corporations to compete in the industry. A similar perspective applies at the internation level, with the government viewing the national telecommunications infrastructure as a key resource for competitive advantage, one that needs to be nurtured to ensure national success. This suggests a need to adopt a broader perspective of the sources and nature of competition. At a very basic level, the concept of competition must be broadened to include indirect competitors. The nature of telecommunications is such that some competitive pressures can be transmitted even without the direct participation of firms in the specific market. Evaluation of the competitiveness of markets must factor the impact of these indirect forces. This is consistent with the basic premise of one of the most widely used models in strategy, which argues that competition in an industry comprises current competitors in the industry, and other forces that constrain the flexibility of these competitors (Porter, 1980). It is also possible to transmit some of the effects of competition through the establishment of competitive performance benchmarks. Supervision of service providers has often focused on pricing of services, capping rates of returns, and the approval process for price changes. It may be more effective for supervision to focus on setting competitive benchmarks for minimum rates of return, maximum prices and minimum service standards. This approach, which partly reverses the procedures adopted by some telecommunications regulators, allows service providers the flexibility to deal with rapidly changing telecommunications and IT technologies and industries, while providing incentives for performance. Investment and technology decisions based on firms' evaluation of the best use of their resources are more likely to be efficient in rapidly changing environments than regulators' guidelines. 596

Guided Competition in Singapore's Telecommunications Industry

The rapid spread of privatization and liberalization of telecommunications markets suggest that free markets are a much superior alternative. However, the results of privatization have often been mixed (Harper, 1993). This paper proposes that governments can play positive roles in the development of telecommunications infrastructures. In most countries, governments, deliberately or otherwise, guide the nature of competition in the telecommunications industry. If effective, this guidance can balance or reconcile national development needs against the more efficient outcomes offered by competitive markets. Major innovations and changes in public administration in several countries are viewed as heralding the rise of a 'New Public Administration', which sees the potential for governments and their agencies to approach private sector performance (Kaul, 1997). From the strategy and policy perspectives, these factors suggest a need to question the presumption of public sector inefficiency that appears to characterize research of public enterprises and government participation in telecommunications. Competition among government-linked firms is potentially as effective as among profit-oriented firms (Kaul, 1997; Singh and Ang, 1997), suggesting that under appropriate conditions it is possible for the government to introduce competition into markets without necessarily allowing unlimited competition. Competition among government-linked corporations may represent a phase in the evolution of markets towards free competition, which may be useful for developing economies. These steps are likely to be more effective in preparing public monopolies for competition than exhortations for increased efficiency which often characterize devolution of public ownership. One possible conclusion is that a focus on competition is more productive than a focus on ownership when evaluating changes to industry structure and devolution of public ownership. Privatization in the absence of competition may not be better than the public retention of ownership with the introduction of competition. The "ideal state' of competition and total devolution of government ownership may not be politically feasible for emerging economies or may contradict industrial policies. It is important to recognize that competition among countries has a major impact on telecommunication and IT infrastructure decisions. For many developing countries, this factor may be as important a driver of infrastructure decisions as service provider efficiency and availability of resources for investment, for example. While consistent with the long-established argument that telecommunications and economic growth are closely related, the impact of internation competition is somewhat different and needs to be further studied. Such competition can significantly promote investment in telecommunications and IT infrastructure, while constraining the nature of 597

Guided Competition in Singapore's Telecommunications Industry

the investment. More generally, this suggests that in many developing countries, telecommunications policies represent an important element of macroeconomic policies, so that decisions on liberalization, for example, are dependent on multiple national considerations. For these countries, policies and regulation will continue to play as important roles in the development of the industry as competition and technology, despite privatization, liberalization and deregulation. It is also clear that non-technological or financial factors can be important influences on telecommunications. Social and cultural considerations may directly impact infrastructure decisions. Although these circumstances may not be typical of the large US market, they are common in the smaller and developing countries, where the free transmission of information is associated with the free importation of negative social and cultural influences. The example of Singapore demonstrates that even in these conditions, a relatively efficient solution can be obtained. Economic and other types of competition at the internation level are identified as having critical impact on telecommunications firms' performances and on the type and level of infrastructure investments undertaken. This paper suggests that government involvement and direction will not necessarily lead to negative outcomes, and may be necessary to ensure that non-competitive markets operate with some measure of efficiency. The arguments presented here are consistent with the view that guided competition can be effective under some circumstances.

Acknowledgements

A previous version of this paper was presented at the Fourth Annual Conference of the Consortium for Research on Telecommunications Policy and Strategy, held at the University of Michigan, Ann Arbor, June 1998.

References

Alten, F. von (1995), Tbt RtU ef Gomvunt Asian Ukli StnttJamuKJune in ibt Singtport Eanumy. Peter Lang: Franfuit. 2, 1998), 'Aiin Telecommunications'.

Ayub, M. A. and S. O. Hegstad (1986), Public Industrial Enterprises: Determinants of Performance. The World Bank: Washington, D C British Telecom (1998), World Communications Report 1998/99. BT: London. Btamas Taut (October 1, 1997), "Win-Win for Everyone in Mobile Paging Markets'. Carrel, H. (1991), Asiajlbd/u TUeammmietitims MMTJOS. Northern Business Information: NY

598

Guided Competition in Singapore's Telecommunications Industry

Centre for Tekmedia Studio (1998), "Asia-Pacific Telecommunications Index 1998", unpubliihed repon, National Univetiity of Singapore. Far Eastern Economic Rtview (June 4, 1998), Telecommunications in Alia'. Haririan, M. (1989), State-owned Enterprises in a Mixtd Economy. Westview Press: San Francitco. Harper, J. (1993), 'Shot in the Foot,' in M. Christofferjen and S. Henten (edi), TUtammtaicatioas: Limits u Deregulation. IOS Press: Washington, DC, pp. 25-36. Hu, R- (1997), '1997 Budget Statement,' Ministry of Finance, Singapore. 1MD (1997), WMd Compelilnmss Mariooi 1997. International Institute for Management Development: I. m i a n t . Jussawalla, M. (1995), 'Deregulation Sparks a Telecommunications Explosion in the Asia Pacific Region,' IndustrialandCorporate Change, 4, 703-710. Kaul, M. (1997), T h e New Public Administration: Management Innovations in Government,' Public Administration and Development, 17, 13-26. Leong, K. T. (1993), 'Lessons of Regulatory Changes for Asian Needs,' in Proatdings of Special Session on Effeaivt Transition through Rtgulation, World Telecommunications Forum, Singapore. ITU, pp. 113116. Mah, B. T. (1997), 'Competitiveness through Multimedia and Wireless Technology in the Global Information Society,' presented to Asia Pacific Telecom 1997: A New Era in Telecommunications (http://2O3.127.83.132/tas/sea2ysO11297.html). National Computer Board (1992), A Vtsim of an Intelligent Island: Tbt IT2000 Ripen. National Computer Board: Singapore. N g , C K. (1997), 'Competition in Telecommunications: The Regulators' Challenge,' presented to Asia Telecom 1997 (http://203.127.83.132/tas/sea2/slOO697.html). Porter, M. (1980), Competitive Strategy. Free Press: New York. Pyramid Research (1994), Telecom Markets in Southeast Asia. Pyramid Research: Cambridge, MA. Sikorski, D. J. (1993), 'A General Critique of the Theory on Public Enterprise: Part I,' InternationalJournal of Public Sector Mjmagemtnt, 6(2), 17-40. Singh, K. (1995), 'Corporate Strategy in the Intelligent Island: The Case of Singapore Telecom,' Industrial and Corporate Change, 4, 691-702. Singh, K. and S. H. Ang (1997), The Strategies and Success of Government Linked Corporations in Singapore,' National University of Singapore, Faculty of Business Administration Working Paper. Sisodia, R- (1992), 'Singapore Invests in the Nation-Corporation,' Harvard Business Rtvitw, May, 40-50. Straits Tinas (April 25, 1998), 'Cabling to Begin by September'. TAS (1997), Information rhekage Rtlating to the Tcndtd for Public Basic TUtamrnunication Service Liana. TAS: Singapore. TAS (1998), Successful Tenderers for One Public Basic Telecommunication Services and Two Public Cellular Mobile Telephone Services Licences (http://203.127.83.132/tas/sea2/p23O498.htmD. Telecom Strategy and Research (1990), Singapore Tilewrnmimications. TRC: Chichester. Tbh, K. W (1991), The Role of the State in Southeast Asia,' In C X Ng and N. Wagner (eds), Markttizatitn in ASEAN. Institute of Southeast Asian Studies: Singapore. Tbh, M. H. and L Low (1990), 'Privatization of Telecommunications Services in Singapore,' in J. Pelkmans and N. Wagner (eds), Priuatizalion and Deregulation in Anon and EG Making Mortals More Effictwt. Institute of Southeast Asian Studies: Singapore, pp. 82-93World Economic Forum (1997), XCtrld Competithmuss Report. WEE Davos.

599

Você também pode gostar

- Unit II Strategy Formulation Value Chain AnalysisDocumento19 páginasUnit II Strategy Formulation Value Chain AnalysisAmit Pandey100% (1)

- Coal Scam Final With NameDocumento29 páginasCoal Scam Final With NameAmit PandeyAinda não há avaliações

- Managerial Roles and SkillsDocumento2 páginasManagerial Roles and SkillsAmit Pandey50% (2)

- Project Report, HDFC BANKDocumento43 páginasProject Report, HDFC BANKsinharitwik90% (52)

- Dividend and Determinants of Dividend PolicyDocumento3 páginasDividend and Determinants of Dividend PolicyAmit PandeyAinda não há avaliações

- Advanced Advertising Consumer BehaviorDocumento45 páginasAdvanced Advertising Consumer BehaviorAmit PandeyAinda não há avaliações

- International Market Entry Model for Business GrowthDocumento1 páginaInternational Market Entry Model for Business GrowthAmit PandeyAinda não há avaliações

- SamDocumento11 páginasSamAmit PandeyAinda não há avaliações

- Elm04 04Documento3 páginasElm04 04Amit PandeyAinda não há avaliações

- Mib AssignmentDocumento2 páginasMib AssignmentManpal SinghAinda não há avaliações

- Component MatrixaDocumento3 páginasComponent MatrixaAmit PandeyAinda não há avaliações

- Claculating PV and FV of AnnuitiesDocumento5 páginasClaculating PV and FV of AnnuitiesAmit PandeyAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Re-Thinking Town and Country Planning Practice in ZambiaDocumento11 páginasRe-Thinking Town and Country Planning Practice in ZambiaLushimba Chileya100% (1)

- The World Bank and Its CriticsDocumento14 páginasThe World Bank and Its CriticsNayana SinghAinda não há avaliações

- Microlending: Stephen Vogel Microlending: Andrea Lerace: Executive Director: Jose Garza Microlending: Irwin DayanDocumento3 páginasMicrolending: Stephen Vogel Microlending: Andrea Lerace: Executive Director: Jose Garza Microlending: Irwin DayanAdiya Ariagiaberete GivaAinda não há avaliações

- Ephor of Capitalism SchumpeterDocumento46 páginasEphor of Capitalism Schumpeterfrancoacebey100% (1)

- Energy AssignmentDocumento2 páginasEnergy AssignmentAamir MukhtarAinda não há avaliações

- Prob of OverpopulationDocumento12 páginasProb of OverpopulationPratham YadavAinda não há avaliações

- API BX - Klt.dinv - CD.WD Ds2 en Excel v2 5872141Documento74 páginasAPI BX - Klt.dinv - CD.WD Ds2 en Excel v2 5872141Mihalciuc VladAinda não há avaliações

- The Scope and Method of EconomicsDocumento16 páginasThe Scope and Method of Economicskay datinguinooAinda não há avaliações

- MoPIC 2017 Annual Progress ReportDocumento27 páginasMoPIC 2017 Annual Progress ReportkunciilAinda não há avaliações

- Dairy Lessons Learned Publication FINALDocumento187 páginasDairy Lessons Learned Publication FINALsubhendujenaAinda não há avaliações

- Ethiopia - National Urban ProfileDocumento36 páginasEthiopia - National Urban ProfileUnited Nations Human Settlements Programme (UN-HABITAT)100% (1)

- Mat Clark Essay WritingDocumento150 páginasMat Clark Essay WritingadelekeyusufAinda não há avaliações

- Introduction To Employee WelfareDocumento92 páginasIntroduction To Employee WelfareRAJESHAinda não há avaliações

- CV Isabel Ortiz Sep 2016 PDFDocumento12 páginasCV Isabel Ortiz Sep 2016 PDFAnna Sophia YorkAinda não há avaliações

- A History of Ikorodu From Earliest TimesDocumento84 páginasA History of Ikorodu From Earliest TimesAbimbola Oyarinu100% (3)

- General Studies Vision IasDocumento12 páginasGeneral Studies Vision IasnitinjamesbondAinda não há avaliações

- UN (United Nations) : BranchesDocumento1 páginaUN (United Nations) : Branchesapi-3779442Ainda não há avaliações

- Privatization of Education - 1Documento16 páginasPrivatization of Education - 1Jee MusaAinda não há avaliações

- The Economic Consequences of The Spanish Reconquest - Oto-Peralías-Romero-Ávila (2016)Documento56 páginasThe Economic Consequences of The Spanish Reconquest - Oto-Peralías-Romero-Ávila (2016)Ces PortaAinda não há avaliações

- Aontú Election 2020 ManifestoDocumento69 páginasAontú Election 2020 ManifestoBusinessPost100% (1)

- Roadmap On Volunteering For Development in The PhilippinesDocumento90 páginasRoadmap On Volunteering For Development in The Philippines--100% (2)

- Keeping Teachers Happy: Job Satisfaction Among Primary School Teachers in Rural ChinaDocumento33 páginasKeeping Teachers Happy: Job Satisfaction Among Primary School Teachers in Rural ChinaRana SabaAinda não há avaliações

- From Urban Renewal To Urban RegenerationDocumento2 páginasFrom Urban Renewal To Urban RegenerationJerico Dizon NamoroAinda não há avaliações

- Openness and The Market Friendly ApproachDocumento27 páginasOpenness and The Market Friendly Approachmirzatouseefahmed100% (2)

- Entrepreneurship and Economic DevelopmentDocumento7 páginasEntrepreneurship and Economic DevelopmentBirendra MahatAinda não há avaliações

- City of Saratoga Springs: 2015 Comprehensive PlanDocumento76 páginasCity of Saratoga Springs: 2015 Comprehensive PlanWendy LiberatoreAinda não há avaliações

- Project On Co-Operative Banks and Rural DevelopmentDocumento52 páginasProject On Co-Operative Banks and Rural DevelopmentDileep94% (17)

- Devcom 202Documento209 páginasDevcom 202Den Santiago100% (2)

- Tourism Master Plan Sri LankaDocumento40 páginasTourism Master Plan Sri LankaOds Guys100% (7)