Escolar Documentos

Profissional Documentos

Cultura Documentos

AIG Autoplus Private Motor

Enviado por

cutiemocha1Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

AIG Autoplus Private Motor

Enviado por

cutiemocha1Direitos autorais:

Formatos disponíveis

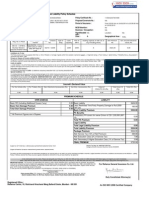

AutoPlus Proposal Form P1.

ai

2/18/08

2:16:34 PM

AutoPlus PROPOSAL FORM

THIS INSURANCE WILL NOT BE VALID IF YOU DO NOT:

Complete all the fields in the Proposal Form Declare truthfully Sign on the Proposal Form

OTHER IMPORTANT NOTES:

If the vehicle you are purchasing is registered under company's name, please endorse the company's stamp on the Proposal Form. An Elderly, Young and/or Inexperienced Driver Excess (EYIDR) of S$2,000 in addition to the Policy Excess applies to You or an Authorised Driver (Named and Un-named) who is above age 65, below age 23 (if applicable) and/or has less than 1 year's driving experience. This policy is subject to drivers age condition. The policy will indemnify the insured or any authorised driver only if he/she meets the age condition. Please refer to policy terms and conditions. For Named-Driver(s)-Only Policies, All Age Condition will not apply. Kindly attach payment with Proposal Form.

Underwritten by

American Home Assurance Company, Singapore

American Home Assurance Company, Singapore (AHAC) is a member company of American International Group, Inc (AIG). Incorporated in the United States with liability limited. American Home Assurance Company Singapore

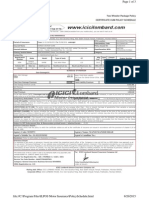

AutoPlus Proposal Form P2-P4.ai

2/13/08

4:31:34 PM

PROPOSAL FORM FOR AutoPlus

(For private car only)

Policy Reference No.

OTHER POLICY OPTIONS (SUBJECT TO CHANGES IN PREMIUM)

To select benefit option, please tick () accordingly: Increase / Reduce excess (below excess subject to prevailing GST) Increase excess to: S$800 S$1,800 Or, reduce excess to: S$400 S$1,000 S$2,000 S$200 S$1,200 S$2,500 S$0 S$1,400 S$3,000 S$1,600

Statement pursuant to the Insurance Act or any amendments thereof: You are to disclose in this Proposal Form, fully and faithfully, all the facts which you know or ought to know, otherwise the Policy issued may be void.

To Producer / Sub-code From Contact No Tel No Fax No Head Office 1 800 419 3000 6835 7408 Alexandra 6373 8023 6276 4846 Changi 6340 0438 6348 2790 Tampines 6587 7231 6787 3645

ABOUT THE PROPOSER

Is this an Insured-Not-Driving policy?

Name

Dr./Mr./Mrs./Ms./Prof.*

10 Days Loss of Use Benefit 1200cc 1300cc (Manual) @ S$72.76 (Inclusive of 7% GST) Fixtures and Accessories (please provide details and attach invoice) NRIC/FIN/ROC No* Others 1500cc 1600cc @ S$94.16 (Inclusive of 7% GST) 1800cc 2000cc @ S$115.56 (Inclusive of 7% GST)

Yes

No

Residential (Block/House No) Address (Street Name) (Building Name) (Singapore) Contact Details (Mobile) (Residential) (Email) Name of Employer Occupation/ Nature of Business

(Level-Unit No)

Passport No.

PAYMENT MODE

Date of Birth Nationality

Cash

Cheque. Please make cheque payable to: American Home Assurance Company

Bank

Cheque No

Singaporean Others:

Permanent Resident

I/We hereby authorise American Home Assurance Company, Singapore (AHAC) to charge the stated annual premium to the following credit card. Where a third party credit card is used, I/we declare that the cardholder has authorised and consented to its use. Credit Card (MasterCard/Visa/American Express) [Please tick () accordingly] 0% Interest Installment Payment with DBS/POSB credit card*** 12 Monthly 0% Interest Installments with DBS/POSB credit card*** 6 Monthly 0% Interest Installments with DBS/POSB credit card*** Name as on card: Card No: Card Expiry Date: Amount:

(Office) (Fax)

Gender Marital Status Driving Exp

Male Single

Female Married (Yrs) Others

Full Annual Payment

(please specify)

(Mths)

(if unemployed, please provide name of previous employer and year of last employment)

M

S$

Job Nature

Mostly Indoor

Mostly Outdoor

* Delete where applicable.

(If you are an American Express Cardholder, please fill up your card number from the second box)

Subject to DBS Card Agreement Terms & Conditions

*** Not applicable for DBS Corporate Card and DBS/AMEX Affinity Card.

DECLARATIONS

Please tick () below where applicable. Otherwise, declarations will be taken as 'NO'.

At fault claims experience in past 3 years (please provide details below) Date of accident (dd/mm/yy) Description of accident Amount of claim ($) Type of claim

(Own Damage/Third Party/Theft/Bodily Injury)

IMPORTANT NOTICE TO PROPOSER

This is an authorised workshop scheme which requires all accident repairs to be done at any Workshops listed in the Certificate of Insurance. An Elderly, Young and/or Inexperienced Driver Excess (EYIDR) of S$2,000 in addition to the Policy Excess applies to You or an Authorised Driver (Named and Un-named) who is above age 65, below age 23 (if applicable) and/or has less than 1 year's driving experience. This policy is subject to drivers age condition. The policy will indemnify the insured or any authorised driver only if he/she meets the age condition. Please refer to policy terms and conditions. If this proposal is accepted or when the cover commences, it is a fundamental and absolute Special Condition of this contract of insurance that for individually-owned policies, the premium due must be paid to the insurer/broker/agent before the inception of the cover. This document is not a contract of insurance. The specific terms, conditions and exclusions applicable to the insurance are set out in the Policy. No insurance is in force until the Company has accepted this Proposal.

Record of revoked/endorsed driving license NCD (%) COM** (5%) Yes (Please attach COM from Traffic Police)

Year: First time owner Others (please specify)

Reason: 2nd or 3rd vehicle Have been driving company's/relatives' vehicles

ACKNOWLEDGED AND DECLARED BY

I/We declare 1. That in respect of any of the risks incurred, no circumstances exists which renders such risks abnormal. 2. That the above particulars to be true and correct and I/we agree that my/our warranties, declarations and disclosures herein shall form the basis of the contract between the Company and myself/ourselves. 3. And agree on behalf of myself/ourselves and any person(s), firm or corporation, that any information collected or held by the Company (whether contained in this Proposal Form or otherwise obtained) may be used and disclosed by the Company, its associated individuals/companies or any independent third parties (within or outside Singapore) for any matter relating to this Proposal Form, any Policy issued and to provide advice or information concerning products and services which the Company believes may be of interest to me/us, and to communicate with me/us for any purpose. 4. That the No Claim Discount (NCD) is as stated and I am/we are aware that I/we have to effect a cancellation of my cover with my existing/ex-insurer in order for the declared NCD to be applied from the inception of this risk proposed. If I/we have opted for the 0% Interest Installments, I/we agree to be bound by DBS Terms and Conditions Governing Installment Payment Plan posted at www.dbs.com.sg

If NCD is nil or 10% with no claims experience, please provide the reason:

Is NCD to be transferred from existing/previous insurer? Previous Insurer: Policy No:

Yes (pls provide details below) Registration No: Expiry/Cancellation Date:

** Subject to 30% NCD or more with submission of the Certificate of Merit (COM) from Traffic Police. The COM can be printed from eCitizen website http://www.ecitizen.gov.sg

ABOUT THE VEHICLE

Period of Insurance From Make & Model Engine No Chassis No Hire Purchase Co Seating Capacity

Signature: Body Type Saloon SUV Registration No Insurance with COE/PARF?*** Off-Peak Car? Yes Yes No No Coupe Others

(please specify)

Company Stamp (if applicable): Date:

D D M M Y Y

to midnight of

D D M M Y Y

Year of Registration Engine Capacity

MPV

Name of Proposer:

PREMIUM DETAILS (FOR OFFICIAL USE)

Basic Premium: Less: % No Claim Discount S$ S$ S$ S$ S$ cc S$ S$ Excess: S$

Insurer's Copy

Less: 5% Certificate of Merit Discount Less: Off-Peak Car Discount Add: Fixtures and Accessories

Total Premium Payable:

S$

*** When insuring without COE/PARF, please inform the financier(s) if vehicle financing is involved. In this instance, in the event of total loss, the Insured will recover the residual value of the COE/PARF from LTA and undertake the financial exposure when disposing the COE/PARF Refund Certificate in the open market.

DRIVER AGE CONDITION

Important Note: This policy is subject to drivers age condition. The policy will indemnify the insured or any authorised driver only if he/she meets the age condition. Please refer to policy terms and conditions.

Choose from one of the following options: All age condition 30 years old & above age condition

Reference No: PL-PF202-02/08 American Home Assurance Company Singapore

Add: Loss of Use Benefit Add: Others Underwritten by

FOR OFFICIAL USE

AHAC - Underwriter AHAC - CSG

35 years old & above age condition 40 years old & above age condition

American Home Assurance Company, Singapore (AHAC) is a member company of American International Group, Inc (AIG). Incorporated in the United States with liability limited. American Home Assurance Company Singapore

Signature & Date

Signature & Date

Você também pode gostar

- AIG Autoplus Commercial MotorDocumento2 páginasAIG Autoplus Commercial Motorcutiemocha1Ainda não há avaliações

- Smartdrive Private: Application FormDocumento2 páginasSmartdrive Private: Application Formcutiemocha1Ainda não há avaliações

- Application For Motor Insurance: Particulars of Registered OwnerDocumento2 páginasApplication For Motor Insurance: Particulars of Registered Ownercutiemocha1Ainda não há avaliações

- Nstructions: Policy Number Insured Name DateDocumento6 páginasNstructions: Policy Number Insured Name DateChristina PerryAinda não há avaliações

- S M Asloob.Documento2 páginasS M Asloob.saikripa1210% (1)

- 9202532311013275Documento2 páginas9202532311013275arjunkhareAinda não há avaliações

- AXA Commercial MotorDocumento2 páginasAXA Commercial Motorcutiemocha1Ainda não há avaliações

- Extended Manufacturer Warranty Insurance: Proposal & Policy ScheduleDocumento21 páginasExtended Manufacturer Warranty Insurance: Proposal & Policy ScheduleFaizan FarasatAinda não há avaliações

- Extended warranty insuranceDocumento26 páginasExtended warranty insuranceFaizan FarasatAinda não há avaliações

- Innova Ranbir PDFDocumento2 páginasInnova Ranbir PDFNarinder KaurAinda não há avaliações

- Mitsui Sumitomo Insurance (Singapore) Pte LTD: Important Notice To The Proposer (S)Documento2 páginasMitsui Sumitomo Insurance (Singapore) Pte LTD: Important Notice To The Proposer (S)cutiemocha1Ainda não há avaliações

- Extended Manufacturer Warranty Insurance: Proposal & Policy ScheduleDocumento21 páginasExtended Manufacturer Warranty Insurance: Proposal & Policy ScheduleGhulam ShabirAinda não há avaliações

- EXTENDED VEHICLE WARRANTY COVERAGEDocumento26 páginasEXTENDED VEHICLE WARRANTY COVERAGEFaizan FarasatAinda não há avaliações

- Private Vehicle Certificate cum Policy ScheduleDocumento4 páginasPrivate Vehicle Certificate cum Policy ScheduleKambhampati SandilyaAinda não há avaliações

- Extended Manufacturer Warranty Insurance: Proposal & Policy ScheduleDocumento21 páginasExtended Manufacturer Warranty Insurance: Proposal & Policy ScheduleFaizan FarasatAinda não há avaliações

- Reliance Private Car InsuranceDocumento4 páginasReliance Private Car InsuranceMatthew Smith67% (9)

- Two Wheeler PA ProposalDocumento3 páginasTwo Wheeler PA Proposalmurali9026100% (1)

- LifeXL PDFDocumento6 páginasLifeXL PDFJoydeep Kar0% (1)

- Insurance FAQ On Brochure EngDocumento24 páginasInsurance FAQ On Brochure EngAlvin LeungAinda não há avaliações

- Dublicate InsuranceDocumento4 páginasDublicate InsuranceAbubakarsiddiq FruitwalaAinda não há avaliações

- XCD InsuranceDocumento3 páginasXCD Insuranceabhiin4Ainda não há avaliações

- Iwyze Quote - Jan 2012Documento6 páginasIwyze Quote - Jan 2012Moloko RamatsuiAinda não há avaliações

- 4 24 20145 07 53PM PDFDocumento2 páginas4 24 20145 07 53PM PDFpawarkamal5Ainda não há avaliações

- 51aa388a6152e91b828df530ca0e0cab (3)Documento5 páginas51aa388a6152e91b828df530ca0e0cab (3)Aakash ShishodiaAinda não há avaliações

- HLA Income Builder GuideDocumento3 páginasHLA Income Builder GuideFarrahAbdullahAinda não há avaliações

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocumento3 páginasIffco-Tokio General Insurance Co - LTD: Servicing OfficeAnonymous pKsr5vAinda não há avaliações

- Vehicle Insurance Policy FormatDocumento4 páginasVehicle Insurance Policy Formatarunavonline_947835049% (59)

- Basic Own DamageDocumento3 páginasBasic Own DamageHarsh PriyaAinda não há avaliações

- Magallanes Broker AgreementDocumento15 páginasMagallanes Broker AgreementKyle LampetAinda não há avaliações

- Takaful MyMotor Motor PDS ENGDocumento4 páginasTakaful MyMotor Motor PDS ENGNamirahMujahidahSyahidahAinda não há avaliações

- Iffco TokioDocumento2 páginasIffco Tokioneel55% (11)

- Short Term Motor Insurance TermsDocumento3 páginasShort Term Motor Insurance TermslleimicojonAinda não há avaliações

- Important Policy Notice for PRATHAMESH PRAKASH NAIKDocumento6 páginasImportant Policy Notice for PRATHAMESH PRAKASH NAIKPrathamesh NaikAinda não há avaliações

- CSC Private Car Eng Ver 1.1 10.04.19 06.01.2020Documento8 páginasCSC Private Car Eng Ver 1.1 10.04.19 06.01.2020Haikal MashkovAinda não há avaliações

- Guaranteed Return PlanDocumento2 páginasGuaranteed Return PlanShikha ShuklaAinda não há avaliações

- InsuranceDocumento3 páginasInsurancePinakin Puranik0% (2)

- mh43x8786 Xylo E6Documento4 páginasmh43x8786 Xylo E6Asif ShaikhAinda não há avaliações

- QuotationDocumento2 páginasQuotationRohit ModiAinda não há avaliações

- Two Wheeler Insurance Policy SummaryDocumento3 páginasTwo Wheeler Insurance Policy SummaryMukesh ManwaniAinda não há avaliações

- CSC Motorcycle Eng Ver 1.1 10.04.19 06.01.2020Documento8 páginasCSC Motorcycle Eng Ver 1.1 10.04.19 06.01.2020Haikal MashkovAinda não há avaliações

- Thunderbird Twinspark Insurance2014Documento4 páginasThunderbird Twinspark Insurance2014vijaybk73Ainda não há avaliações

- Car InsuranceDocumento34 páginasCar InsurancesuithinkAinda não há avaliações

- Motor Private Car ENGDocumento4 páginasMotor Private Car ENGascap77Ainda não há avaliações

- Car Scheme FAQDocumento14 páginasCar Scheme FAQdipenkhandhediya100% (1)

- AXA ProposalDocumento2 páginasAXA Proposalcutiemocha1Ainda não há avaliações

- Third Party Fire and Theft - Product Dislosure Sheet - EnglishDocumento4 páginasThird Party Fire and Theft - Product Dislosure Sheet - EnglishhishamhamdanAinda não há avaliações

- Reliance's Guaranteed Money Back PlanDocumento2 páginasReliance's Guaranteed Money Back PlantrskaranAinda não há avaliações

- MOTOR INSURANCE CERTIFICATEDocumento3 páginasMOTOR INSURANCE CERTIFICATEJagateeswaran KanagarajAinda não há avaliações

- Installment Sales Contract GAP WaiverDocumento2 páginasInstallment Sales Contract GAP Waiverkyle2fitzgeraldAinda não há avaliações

- Motor Insurance PDS PDFDocumento4 páginasMotor Insurance PDS PDFalister kellenAinda não há avaliações

- Reliance Two Wheeler Insurance Policy DetailsDocumento2 páginasReliance Two Wheeler Insurance Policy DetailsRoopesh KumarAinda não há avaliações

- PDSMotor FormDocumento3 páginasPDSMotor FormAkoo MeraAinda não há avaliações

- Authorized Signatory For THE NEW INDIA ASSURANCE CO LTDDocumento5 páginasAuthorized Signatory For THE NEW INDIA ASSURANCE CO LTDnaman singhAinda não há avaliações

- PRUcash premier: 15-Year Endowment PlanDocumento14 páginasPRUcash premier: 15-Year Endowment PlanJaboh LabohAinda não há avaliações

- Terms & Conditions: Product Name: Tata Aia Life Insurance Sampoorna Raksha Supreme - Non Pos LP/RP UIN: 110N160V02Documento3 páginasTerms & Conditions: Product Name: Tata Aia Life Insurance Sampoorna Raksha Supreme - Non Pos LP/RP UIN: 110N160V02Himanshi ChauhanAinda não há avaliações

- CoverPlus $100 ExcessDocumento12 páginasCoverPlus $100 ExcessPerhan LauAinda não há avaliações

- TWP 87187353Documento2 páginasTWP 87187353Abilon Smith100% (2)

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsAinda não há avaliações

- CDL Study Guide: Guide on hazardous materials, chamber vehicles and basic vehicle control skillsNo EverandCDL Study Guide: Guide on hazardous materials, chamber vehicles and basic vehicle control skillsAinda não há avaliações

- R03Documento2 páginasR03cutiemocha1Ainda não há avaliações

- R01ADocumento2 páginasR01Acutiemocha1Ainda não há avaliações

- R01Documento2 páginasR01cutiemocha1100% (1)

- Chartis ProposalDocumento2 páginasChartis Proposalcutiemocha1Ainda não há avaliações

- SHC Private MotorDocumento2 páginasSHC Private Motorcutiemocha1Ainda não há avaliações

- Q01Documento2 páginasQ01cutiemocha1Ainda não há avaliações

- M19Documento2 páginasM19cutiemocha1Ainda não há avaliações

- ES04Documento2 páginasES04cutiemocha1Ainda não há avaliações

- AXA ProposalDocumento2 páginasAXA Proposalcutiemocha1Ainda não há avaliações

- RSA Private MotorDocumento1 páginaRSA Private Motorcutiemocha1Ainda não há avaliações

- SHC Commercial MotorDocumento2 páginasSHC Commercial Motorcutiemocha1Ainda não há avaliações

- Motor Proposal Form: Particulars of Proposer Particulars of VehicleDocumento1 páginaMotor Proposal Form: Particulars of Proposer Particulars of Vehiclecutiemocha1Ainda não há avaliações

- Mitsui Sumitomo Insurance (Singapore) Pte LTD: Important Notice To The Proposer (S)Documento2 páginasMitsui Sumitomo Insurance (Singapore) Pte LTD: Important Notice To The Proposer (S)cutiemocha1Ainda não há avaliações

- SCB FormDocumento2 páginasSCB Formcutiemocha1Ainda não há avaliações

- Mayban MotorDocumento2 páginasMayban Motorcutiemocha1Ainda não há avaliações

- Liberty Motor ProposalDocumento3 páginasLiberty Motor Proposalcutiemocha1Ainda não há avaliações

- AXA Commercial MotorDocumento2 páginasAXA Commercial Motorcutiemocha1Ainda não há avaliações

- Benito Mussolini - English (Auto-Generated)Documento35 páginasBenito Mussolini - English (Auto-Generated)FJ MacaleAinda não há avaliações

- 2Nd Regional Conference of Amarc Asia PacificDocumento9 páginas2Nd Regional Conference of Amarc Asia PacificAMARC - Association mondiale des radiodiffuseurs communautairesAinda não há avaliações

- Biosphere Reserves of IndiaDocumento4 páginasBiosphere Reserves of IndiaSrinivas PillaAinda não há avaliações

- The Miracle - Fantasy FictionDocumento2 páginasThe Miracle - Fantasy FictionAanya ThakkarAinda não há avaliações

- Lecture Law On Negotiable InstrumentDocumento27 páginasLecture Law On Negotiable InstrumentDarryl Pagpagitan100% (3)

- Case Study 2, Domino?s Sizzles With Pizza TrackerDocumento3 páginasCase Study 2, Domino?s Sizzles With Pizza TrackerAman GoelAinda não há avaliações

- Afi11 214Documento3 páginasAfi11 214amenendezamAinda não há avaliações

- MkgandhiDocumento220 páginasMkgandhiDebarpit TripathyAinda não há avaliações

- Shareholding Agreement PFLDocumento3 páginasShareholding Agreement PFLHitesh SainiAinda não há avaliações

- Amadioha the Igbo Traditional God of ThunderDocumento4 páginasAmadioha the Igbo Traditional God of ThunderJoshua Tobi100% (2)

- Regio v. ComelecDocumento3 páginasRegio v. ComelecHudson CeeAinda não há avaliações

- PHILIP MORRIS Vs FORTUNE TOBACCODocumento2 páginasPHILIP MORRIS Vs FORTUNE TOBACCOPatricia Blanca SDVRAinda não há avaliações

- Weekly Mass Toolbox Talk - 23rd Feb' 20Documento3 páginasWeekly Mass Toolbox Talk - 23rd Feb' 20AnwarulAinda não há avaliações

- United Nations Industrial Development Organization (Unido)Documento11 páginasUnited Nations Industrial Development Organization (Unido)Ayesha RaoAinda não há avaliações

- Lawrkhawm: Kum 2014 Branch Kumtir Com-Mittee Neih A NiDocumento4 páginasLawrkhawm: Kum 2014 Branch Kumtir Com-Mittee Neih A NibawihpuiapaAinda não há avaliações

- The Boy in PajamasDocumento6 páginasThe Boy in PajamasKennedy NgAinda não há avaliações

- IBS AssignmentDocumento4 páginasIBS AssignmentAnand KVAinda não há avaliações

- MEP Civil Clearance 15-July-2017Documento4 páginasMEP Civil Clearance 15-July-2017Mario R. KallabAinda não há avaliações

- Build - Companion - HarrimiDocumento3 páginasBuild - Companion - HarrimiandrechapettaAinda não há avaliações

- Listof Licenced Security Agencies Tamil NaduDocumento98 páginasListof Licenced Security Agencies Tamil NadudineshmarineAinda não há avaliações

- Joyce Flickinger Self Assessment GuidanceDocumento5 páginasJoyce Flickinger Self Assessment Guidanceapi-548033745Ainda não há avaliações

- 3 Macondray - Co. - Inc. - v. - Sellner20170131-898-N79m2kDocumento8 páginas3 Macondray - Co. - Inc. - v. - Sellner20170131-898-N79m2kKobe Lawrence VeneracionAinda não há avaliações

- National University's Guide to Negligence PrinciplesDocumento35 páginasNational University's Guide to Negligence PrinciplesSebin JamesAinda não há avaliações

- The 5000 Year Leap Study Guide-THE MIRACLE THAT CHANGED THE WORLDDocumento25 páginasThe 5000 Year Leap Study Guide-THE MIRACLE THAT CHANGED THE WORLDMichele Austin100% (5)

- VA-25 Grammar 5 With SolutionsDocumento11 páginasVA-25 Grammar 5 With SolutionsSOURAV LOHIAAinda não há avaliações

- Boundary computation detailsDocumento6 páginasBoundary computation detailsJomar FrogosoAinda não há avaliações

- Instant Download Statistics For Business and Economics Revised 12th Edition Anderson Test Bank PDF Full ChapterDocumento32 páginasInstant Download Statistics For Business and Economics Revised 12th Edition Anderson Test Bank PDF Full Chapteralicenhan5bzm2z100% (3)

- Da Vinci CodeDocumento2 páginasDa Vinci CodeUnmay Lad0% (2)

- Gramatyka Test 14Documento1 páginaGramatyka Test 14lolmem100% (1)

- Lecture 4 The Seven Years' War, 1756-1763Documento3 páginasLecture 4 The Seven Years' War, 1756-1763Aek FeghoulAinda não há avaliações