Escolar Documentos

Profissional Documentos

Cultura Documentos

Chapter 2 Macro Solution

Enviado por

saurabhsaursDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Chapter 2 Macro Solution

Enviado por

saurabhsaursDireitos autorais:

Formatos disponíveis

CHAPTER 7 THE ANATOMY OF INFLATION AND UNEMPLOYMENT Solutions to the Problems in the Textbook: Conceptual Problems: 1.

The rate of unemployment is affected by the frequency, that is, the number of times that workers become unemployed in a period, and by the duration, that is, the length of the period for which workers are unemployed.

1.a. In depressed industries, the duration of unemployment is likely to be long but the frequency is likely to be low. Policies to help unemployed workers from these industries find new jobs may include retraining and education programs to enable them to find work in other industries. 1.b. Unskilled workers tend to be more frequently unemployed, but the duration of their unemployment is usually fairly short. On-the-job training or education programs that provide skills to obtain or maintain jobs are often the best strategy for helping these workers. However, such programs are often costly and difficult to implement. 1.c. Unemployment in depressed geographical areas tends to be of long duration and low frequency and is often concentrated in specific industries (very similar to the situation in 1.a.). Policies to relocate workers to different geographical areas may not be successful since workers are often reluctant to move. Thus policy makers generally prefer programs designed to attract new industries to an area over programs to relocate workers. 1.d. Teenage unemployment is often of high frequency and short duration. Since teenagers tend to have few skills and little or no work experience, programs to facilitate the transition into the adult work force are needed. Programs that offer on-the-job training will provide the highest long-term benefits. These programs tend to be fairly costly, however, which is why some politicians advocate lowering the minimum wage for teenagers instead. 2. The natural unemployment rate is determined by two factors: the duration and frequency of unemployment. While the duration of unemployment depends primarily on the organization and demographic make-up of the labor force, the availability of unemployment benefits, and the desire of the unemployed to look for better jobs, the frequency of unemployment depends largely on the rate at which new workers enter the work force and on the variability of the demand for labor across different employers. 2.a. It is unclear whether the elimination of unions would serve to reduce the natural rate of unemployment. The insider-outsider theory of the labor market suggests that firms bargain with unions (the insiders) and are not much concerned with the unemployed (the outsiders). If unions were eliminated, firms would tend to hire unemployed workers at a lower wage rate, thus reducing the natural unemployment rate. On the other hand, unions tend to preserve stable jobs for their members. Eliminating them may lead not only to a reduction in bargaining power for labor in wage negotiations

but also to an increase in the natural rate of unemployment. The elimination of labor unions could also serve to eliminate the wage differentials between unionized and non-unionized workers and, in the process, redistribute some income. 2.b. Increased labor force participation of teenagers would at least initially increase the natural rate of unemployment, since teenagers have a higher frequency of unemployment than older, more experienced workers. However, as more and more teenagers entered the labor force and more good and stable jobs became available to them, the natural rate of unemployment would start to decline again. But with more people in the labor force, the supply of labor would be higher and wage rates would be driven down, contributing to wage stagnation. 2.c. If aggregate demand fluctuated more, then firms would offer fewer stable jobs and the frequency of unemployment would increase, increasing the natural rate. This would not only lead to a loss in output and an increase in personal hardship, but it would also put more financial strain on the unemployment insurance program. 2.d. An increase in unemployment benefits would make it less urgent for the unemployed to find new jobs. They would have the option of looking longer for jobs after being laid off and would be less likely to accept undesirable job offers. As the length of their unemployment increased, workers might begin to look less desirable to potential employers who might believe that they lacked either the motivation or qualifications to work hard for them. Therefore the natural rate of unemployment would increase. 2.e. Employers who perceive the minimum wage rate to be above the value of the marginal product of low skilled workers will not hire such workers. The elimination of the minimum wage rate might induce some firms to hire more low-skilled workers, thus decreasing the natural rate of unemployment. However, the wage rate that these low skilled workers were offered might be well below the amount that would ensure an adequate standard of living. 2.f. If fluctuation in the composition of aggregate demand increased, workers would have to be shifted from industry to industry more often and this would increase the natural rate of unemployment. However, since skills are not always transferable, resources would have to be devoted to retraining programs. 3. Many unemployed teenagers are new entrants into the labor force and their frequency of unemployment is higher than that of adult workers. Teenagers' frequency of entry into and exit from the labor force indicates that few of them work at jobs with the promise of high job security. They have little or no training and few job skills and thus tend to hold unattractive jobs. This perpetuates the problem since the jobs they can get do not provide the skills needed to gain better jobs in the future. While the frequency of unemployment is lower for adults than teenagers, the duration is often higher. There are fewer entrants and re-entrants into the work force among adults, who are most often unemployed due to layoffs. Overall, the unemployment rate for adults is much lower than the unemployment rate for teenagers.

4.a. Employers would benefit from a lower minimum wage rate, since they would be able to expand production by hiring labor at a lower cost. Since the nominal minimum wage rate might no longer be above the value of the marginal product of low skilled or inexperienced workers, the labor of these workers would be more desirable to employers. Therefore teenagers and low skilled job seekers would also benefit. They would get jobs more easily and gain valuable work experience that they otherwise might not have gotten. Since more people would be hired and more output would be produced at a lower price, the whole economy would benefit from a lower inflation rate and a lower unemployment rate. 4.b. Those workers who would have been working at jobs paying the existing minimum wage rate might lose from a decrease in the minimum wage. With a lower minimum wage rate implemented only during the summer months, employers might lay off current workers and replace them with new entrants at a lower cost. Thus the number of displaced workers might increase. 4.c. Obviously, those who would gain from such a policy measure would support it--teenagers, low skilled workers, and some firms. 5. It is possible to design a restrictive fiscal and monetary policy mix to bring the economy to a long-run equilibrium situation at the natural rate of unemployment and at a zero rate of inflation. However, this cannot be achieved without an increase in the rate of unemployment in the short run. Therefore a choice has to be made among adjustment paths that differ in their inflation-unemployment mix. In considering adjustment paths, the benefits of permanently lower inflation have to be compared with the costs of increased short-term unemployment. The costs of unemployment are loss of output and personal hardship. If inflation can be anticipated only imperfectly, then a redistribution of income and wealth will take place. Some output may be lost as resources are devoted to minimizing a potential loss in purchasing power rather than to actual production. However, the cost of perfectly anticipated inflation is minimal. Thus it probably makes little difference whether we have a zero inflation rate or an inflation rate of 3%, as long as a specific long-run goal is established. A positive rate of inflation may actually help in wage and price adjustments, since it allows real wages to adjust more easily to supply shocks. Most policy makers tend to perceive the cost of inflation as lower than the cost of an increase in unemployment resulting from tough anti-inflation policies. However, the U.S. experience of the early 1980s indicates that tough measures to bring the economy quickly to recovery may be acceptable if inflation reaches the double-digit range. One way to establish a clear inflation goal is for the Fed to follow a monetary growth rule. However, such a rule may not perform well in all situations (for example, in a supply shock). Another option is to maintain discretionary monetary policy along with an independent central bank that has a clear mandate to function as an inflation fighter. The sacrifice ratio is the percentage of output lost for each one- percent reduction in the inflation rate. It is non-zero in the short and medium runs, when output is different from the full-employment level. However, in the long run, unemployment always returns to its natural level and therefore the sacrifice ratio is zero.

6.

7. Okun's law states that a reduction in the unemployment rate of 1 percent will increase the level of output by 2 percent. This relationship allows us to measure the cost to society (in terms of lost production) of a given rate of unemployment. 8. When inflation is perfectly anticipated, then its costs consist primarily of the costs of making price changes (menu costs) and costs related to the holding of currency, which loses purchasing power. If there is only low to moderate inflation, these costs are very low. However, when inflation rates soar, the costs can be substantial. 9. The cost of imperfectly anticipated inflation can be serious. There is a redistribution of wealth among individuals. If actual inflation is higher than expected, debtors profit while creditors lose as real interest rates are lower than expected. Equity holders are also hurt, since the real value of dividends and capital gains is reduced. If there is no tax indexation, people may move into higher tax brackets and suffer financially due to bracket creep. 10. Indexation is designed to make it easier to live with inflation since it eliminates the cost of unanticipated inflation. In practice, however, indexing on a broad basis makes it more complicated to calculate contracts. It also makes it harder for the economy to adjust to shocks if changes in relative prices are needed. This is particularly true for supply shocks. Finally, there is some concern that indexation may weaken political motivation to fight inflation. However, as long as inflation is low to moderate, the benefits of indexation probably outweigh the costs.

Technical Problems: 1.a. The aggregate unemployment rate can be calculated by adding the unemployment rates of different groups weighted by their share of the labor force. The data in the problem indicate that 10% of the labor force are teenagers. The adult work force (the other 90%) is divided into 35% females and 65% males. Thus we get u = (0.1)(0.19) + (0.9)[(0.35)(0.06) + (0.65)(0.07)] = 0.019 + (0.9)(0.021 + 0.0455) = 0.019 + 0.05985 = 0.07885 = 7.9%. 1.b. If the labor force participation rate of teenagers increases to 15%, then the aggregate rate of unemployment changes to: u1 = (0.15)(0.19) + (0.85)[(0.35)(0.06) + (0.65)(0.07)] = 0.0285 + (0.85)(0.021 + 0.0455) = 0.0285 + 0.056525 = 0.085025 = 8.5%. 2. The unemployment figures for each group were taken from the Economic Report of the President, February, 1997. Figures relating to the unemployment rate were taken from Table B-40 and each group's share in the civilian labor force was calculated from Table B-38.

1986 Males 16-19 Un.Rt./Share (19.0%)/(.030) Females 16-19 Un.Rt./Share (17.6%)/(.029) Males 20+ Un.Rt./Share (6.1%)/(.525) Females 20+ Un.Rt./Share (6.2%)/(.416)

1991 (19.8%)/(.026) (17.5%)/(.024) (6.4%)/(.520) (5.7%)/(.430)

1996 (18.1%)/(.026) (15.2%)/(.025) (4.6%)/(.512) (4.8%)/(.437)

If the unemployment rate for each group in the two other years was the same as in 1991, then the overall unemployment rate in 1986 or 1996 would have been: u86 = (19.8%)(.030) + (6.4%)(.525) + (17.5%)(.029) + (5.7%)(.416) = 0.594% + 3.360% + 0.508% + 2.371% = 6.83% u96 = (19.8%)(.026) + (6.4%)(.512) + (17.5%)(.025) + (5.7%)(.437) = 0.515% + 3.277% + 0.438% + 2.491% = 6.72% The actual unemployment rates for these years were: u86 = 7.0% u91 = 6.8% u96 = 5.4%

The difference between the unemployment rates calculated above and the unemployment rate in 1986 shows the effects of changes in the composition of the labor force on the rate of unemployment. 3. The data mentioned here were taken from the Economic Report of the President, February, 1997. Table B-42 of the report shows unemployment by duration. In 1991 the average duration was 13.7 weeks, in 1995 it was 16.6 weeks, and in 1996 it was 16.7 weeks. (These numbers reflect the average amount of time that an unemployed worker was out of work in a given year and not the duration of a completed spell of unemployment.) For the years in question, the overall unemployment rates were 6.8% in 1991, 5.6% in 1995, and 5.4% in 1996. Thus the duration of unemployment moved in the opposite direction from the overall unemployment rate. Additional Problems: 1. Why is it possible for the number of unemployed workers to increase at the same time that the overall unemployment rate falls? The unemployment rate is defined as the number of people unemployed divided by the number of people in the labor force. If the labor force grows more than the number of unemployed, the unemployment rate falls.

2.

In the manufacturing sector many workers who have been laid off later return to their original jobs. Does this mean that these workers failed to look for other jobs while they were unemployed?

No. The fact that these workers return to their original jobs simply means that they did not accept other permanent job offers. Very often, laid-off workers actively look for other jobs, but may not find comparable jobs in their geographic area. As the demand for the goods produced by their former firm increases again, they are called back and return to their old jobs. 3. Proposals to raise the minimum wage rate are often opposed with the argument that such a move would not only cause an increase in unemployment but would also hurt the very people it is intended to help. Is there any validity to that argument? The minimum wage rate provides a price floor on nominal wages. If this wage floor is above the marketclearing equilibrium wage rate, then a surplus of labor will be created. The purpose of the minimum wage law is to provide an adequate standard of living for less skilled workers. However, if firms believe that the minimum wage rate is higher than the value of the marginal product of some workers, then those workers will not be hired. As a result, the unemployment rate among less skilled workers may actually increase. Increasing the minimum wage rate raises the cost of production (especially since higher skilled workers may also demand higher wages) and may result in a higher inflation combined with higher unemployment. However, empirical evidence suggests that such effects are fairly small. Whether politicians favor an increase in the minimum wage rate depends on more than just the efficiency and equity arguments. An increase in the minimum wage can be enacted with little cost to the government. Alternative programs (increasing the level of education or training of low skilled workers) may have a higher rate of return but require a greater investment of resources and may therefore be considered unfeasible if budget deficits are a problem. 4. True or false? Why? "When the economy enters a recession, wages tend to adjust only slowly to a market-clearing level, and the resulting unemployment is called frictional."

False. Frictional unemployment is the unemployment that exists when the economy is at its fullemployment level of output. Unemployment in excess of this "natural rate" of unemployment occurs when the economy enters a recession and is called cyclical unemployment. 5. Starting in the early 1990s many U.S. firms downsized their operations. In your opinion, how did this affect the duration of unemployment? Normally after a recession workers either return to their old jobs or find similar jobs. However, since many jobs were completely eliminated in this particular downsizing, workers who lost their jobs in the recession of 1990/91 had a much tougher time finding new and comparable jobs. Therefore, the duration of unemployment increased.

6. Comment on the following statement: "More generous unemployment benefits create a higher unemployment rate." The unemployment rate tends to be higher in countries with more generous unemployment insurance programs. Unemployment benefits significantly reduce the hardships associated with loss of a job. Firms may also be less concerned about laying off their workers if they know that the workers will receive unemployment insurance. At the same time, the benefits decrease the cost of searching for a job and enable those who have lost jobs to at least initially reject unsatisfactory job offers. Finally, since workers have to officially be in the labor force to receive unemployment benefits (even if they do not want a job) they get counted as unemployed, thus increasing the measured unemployment rate. 7. "If wages are rigid, then the government can easily reduce inflation without creating higher unemployment." Comment on this statement.

If wages are rigid, then there is a trade-off between unemployment and inflation. In other words, if policy makers try to reduce inflation by demand management policies (restrictive monetary policy), then unemployment will increase at least in the short run. Only in the long run, when wages become completely flexible, will the unemployment rate return to its natural level. Another way to lower inflation without increasing unemployment would be through supply-side economics, that is, policies designed to shift the AS-curve to the right. According to supply-siders, a decrease in income tax rates will increase the incentive to save, work and invest and this will shift the upward-sloping AS-curve to the right. However, this is easier said than done, since tax cuts generally also affect aggregate demand.

8. Distinguish between frictional, search, seasonal, and cyclical unemployment. Frictional unemployment exists, because labor markets do not work perfectly. At any given time, some workers are always between jobs and therefore temporarily unemployed. Search unemployment exists because some workers who are offered a job wait for a better opportunity; they can do this for some time because they receive unemployment insurance benefits. Seasonal unemployment occurs, since workers are needed at different times in different areas. (Ski instructors are only needed in winter; and college students tend to enter the labor force temporarily during the summer time.) Cyclical unemployment refers to the unemployment that occurs as the economy enters a downturn. 9. What kinds of policies would you suggest to reduce the natural rate of unemployment?

The answer to this question is student specific. Policies to reduce the natural rate of unemployment must reduce the frequency or duration of unemployment and affect the composition or demographic make-up of the labor force. Policies that make workers more mobile, make information regarding job vacancies more accessible to the public, or reduce the variability of the demand for labor across industries can also be considered. Some people may favor a reduction in the minimum wage rate or a reduction in unemployment benefits, but such proposals are more controversial.

10. "Restrictive monetary policy will help to decrease inflation; the resulting increase in the natural unemployment rate is a small price to pay." Comment on this statement. In your answer, explain what policies the government should design to lower the natural rate of unemployment. Restrictive monetary policy lowers the rate of inflation but at the cost of increasing the actual rate of unemployment. However, in the long run the economy will adjust back to the natural rate of unemployment. This natural unemployment rate is not affected by monetary policy, but only by employment policies or changes in the composition of the labor force. Employment policies involve educating workers or increasing their skills to make them more mobile, making information about job opportunities more readily available to them, or reducing discrimination to allow certain groups to find jobs faster. 11. "Unemployment hysteresis generally exists when the economy is entering a deep recession and workers fear lay-offs." Comment on this statement. The term unemployment hysteresis is used to describe a situation in which long periods of high unemployment lead to an increase in the natural rate of unemployment. This phenomenon arises since workers who are out of a job may either take advantage of unemployment benefits while doing odd jobs or get discouraged and put less effort into finding a new job. Thus they stay unemployed longer. Since firms may perceive long periods of unemployment as a signal that these workers are less qualified or motivated, they may not want to hire them. Therefore, the longer the spell of unemployment, the harder it is to get out of the unemployment pool. 12. Assume the unemployment rate among different groups in the labor force is as follows: adult males 5%, adult females 4.5%, teenagers 12%. Teenagers account for 15% of the work force and, among adults, women workers account for 40%. What is the actual nation-wide unemployment rate? The aggregate unemployment rate can be calculated by adding the unemployment rates of the different groups weighted by their share of the labor force. Therefore we get u = (0.15)(0.12) + (0.85)[(0.6)(0.05) + (0.4)(0.045)] = 0.018 + (0.85)(0.03 + 0.018) = 0.018 + 0.0408 = 0.0588 = 5.8%. 13. Demographic studies show that the proportion of teenagers and minorities in the U.S. population is likely to increase in the near future. In your opinion, what implications, if any, would this trend have on the natural rate of unemployment? Teenagers and minorities tend to have a greater frequency of unemployment than the general population. If the proportion of teenagers and minorities in the labor force increases, then we should expect an increase in the natural rate of unemployment.

14. In Japan, a large part of a worker's annual salary comes in the form of bonuses. In your opinion, what are the implications of this for the unemployment rate in Japan? The fact that these bonuses can be easily reduced when a firm experiences a tough time makes wages much more flexible. The Japanese economy can therefore adjust more easily to full employment. In bad economic times Japanese workers are not laid off as easily as workers in the U.S., where wages are more rigid. The implication is that the Japanese unemployment rate should, on average, be lower. 15. Given that inflation cannot be perfectly anticipated, how can lending institutions protect themselves against the loss of purchasing power? If inflation cannot be perfectly anticipated, then lending institutions have great uncertainty about the real value of the nominal payments they receive on loans. For example, if a long-term mortgage has a fixed interest rate, then the lending institution that issued the loan will lose purchasing power if the rate of inflation is higher than expected. The homeowner, on the other hand, is better off since the real interest rate of the mortgage loan has been effectively reduced. Variable mortgage rates (which are generally dependent on short-term interest rates) protect the lending institution against rising inflation, since they are adjusted periodically as inflation, and thus shortterm interest rates, increase. The unanticipated capital gains accrued by borrowers due to higher inflation are therefore much smaller since the mortgage rate is adjusted soon after short-term interest rates increase. Thus the lending institution's purchasing power is essentially protected. 16. "Perfectly anticipated inflation should not affect currency holders." Comment. Whenever there is inflation, currency becomes more costly to hold because of the loss in purchasing power. The higher the rate of inflation, the larger the incentive for individuals to put their funds into interest earning accounts with yields higher than the expected rate of inflation 17. "Unanticipated inflation benefits debtors." Comment on this statement. Assume you get a 30-year fixed-rate mortgage from your local savings and loan institution. The terms of the contract will specify the nominal interest rate for your loan, which contains a premium for expected inflation over the term of the contract. If the actual inflation rate is greater than was anticipated at the time the contract was signed, then you (as the debtor) are better off. In this case, you will be able to pay back the loan with "cheaper" dollars since money has lost some of its purchasing power. The lending institution, on the other hand, will be hurt by the higher than anticipated interest rates. Naturally, if the actual inflation rate is less than was anticipated, the lending institution will benefit. 18. "Wage indexation can lead to an inflation spiral." Comment on this statement. If material prices rise and the price increases are passed on to consumers in the form of higher product prices, then the rate of inflation will increase. If wages are indexed for inflation, then workers' nominal wages will increase as soon as new labor contracts go into effect. But firms will again pass the higher wage costs on to consumers in the form of higher product prices and inflation will increase even more. This process (the so-called wage-price spiral) may continue until decisive action is taken to stop it.

19. Broad-based indexation is a good idea, since it eliminates the hardships associated with inflation." Comment on this statement. Broad-based indexation eliminates the cost of unanticipated inflation, which is primarily the redistribution of wealth. Long-term loan contracts, such as mortgages, government bonds, or wage contracts are especially affected by imperfectly anticipated inflation since lenders and workers cannot be certain about the real value of the nominal payments they receive. Since inflation is less predictable when it is high than when it is low, indexation is more prevalent in countries with high inflation than in those with low inflation. The advantage of indexation is that it keeps nominal and real rates of return (or wages) in line, while avoiding frequent costly contract renegotiations. However, indexation is often complicated and may weaken policy makers' will to fight inflation. Furthermore, indexation prevents real wages from falling after a supply shock, preventing an adjustment back to full employment. 20. Briefly explain how and why each of the following changes would affect the natural rate of unemployment: (i) a decrease in unemployment benefits; (ii) an increase in the minimum wage; (iii) a higher number of teenagers in the work force. A decrease in unemployment benefits would make it more urgent for the unemployed to find new jobs. They would be more likely to accept early job offers and the length of unemployment would be reduced. Therefore the natural rate of unemployment would decrease. Employers who believe the minimum wage rate to be above the value of the marginal product of lowskilled workers will not hire such workers. A higher minimum wage rate might make some firms less likely to hire low-skilled workers, increasing the natural rate of unemployment. However, low-skilled workers who continue to be employed would receive a higher wage rate, ensuring them more spending power and this could create jobs elsewhere. Increased labor force participation of teenagers would at least initially increase the natural rate of unemployment, sine teenagers have a higher frequency of unemployment than older, more experienced workers do. But as more teenagers entered the labor force and more stable jobs became available to them, then the natural rate of unemployment would decrease again. 21. Comment on the following statement: "An incumbent president can always ensure his re-election simply by using all policy measures at his disposal to ensure low inflation and high growth in an election year." This statement relates to the political business cycle theory, which asserts that politicians will use those economic policies that have high voter approval to guarantee reelection. The Fair equation, which is based on the inflation rate and per-capita growth in an election year, has been fairly successful in predicting the outcome of presidential elections. However, there are some other factors that work against this hypothesis. External shocks cannot be predicted but they can influence voter behavior. The president also has no control over the actions of the Fed nor can he use fiscal policy measures that would serve his own purposes too openly. Finally, if expectations are indeed rational, then policy measures designed to stimulate the economy before an election should have negligible effects. Empirical evidence in support of the political business cycle theory is mixed.

10

22. "The natural rate of unemployment is a very helpful guide for policy makers, since most inflation is driven by wage increases." Comment on this statement. The true value of the natural rate of unemployment is not known for sure. So is policy makers assume this rate is lower than it actually is, they will try to stimulate the economy through expansionary policies as soon as unemployment rises above this assumed rate. But this will reduce the actual unemployment rate only temporarily, since the economy has a tendency to go back to the true natural rate. Policy makers will have to stimulate the economy again and again and this creates inflationary pressure. Since inflation reduces real wages, workers will ask for wage increases and we will enter a wage-price spiral. The assertion that most inflation is driven by wage increases also does not hold. Instead, global competition has broken down the relationship between wage increases and increases in inflation. In the long urn, inflation can only persist if monetary growth is excessive. 23. "Structural unemployment is in excess of the natural rate of unemployment and can therefore be easily lowered by expansionary fiscal policy." Comment on t his statement. In your answer, list the different types of unemployment. Expansionary fiscal policy will result in a temporary decrease in the actual unemployment rate, but in the long run the economy will adjust back to the natural unemployment rate. This natural rate can only be reduced through policies geared towards improving education, skills, information about jobs, and job mobility. Structural unemployment (the mismatch of job openings and available skills) is part of the natural unemployment rate. Frictional unemployment always exists since labor markets don't work perfectly and some people are always between jobs. Search unemployment exists when people who are offered jobs decide not to take them in hopes of getting better jobs. Only cyclical unemployment is in excess of this natural rate and can be reduced through expansionary fiscal policy.

11

Você também pode gostar

- L A R G e - S C A L e M e T H A M P H e T A M I N e M A N U F A C T U R eDocumento21 páginasL A R G e - S C A L e M e T H A M P H e T A M I N e M A N U F A C T U R eDaria Schka100% (1)

- Organizational Behavior Test Bank Robbins Chapter 1Documento48 páginasOrganizational Behavior Test Bank Robbins Chapter 1salamonilandish89% (36)

- Macro Chap 01Documento4 páginasMacro Chap 01saurabhsaurs100% (2)

- Macro Chap 01Documento4 páginasMacro Chap 01saurabhsaurs100% (2)

- IS-LM FrameworkDocumento54 páginasIS-LM FrameworkLakshmi NairAinda não há avaliações

- Intoduction To WeldingDocumento334 páginasIntoduction To WeldingAsad Bin Ala QatariAinda não há avaliações

- Toy World CaseDocumento9 páginasToy World Casesaurabhsaurs100% (1)

- Acid Chemical CaseDocumento13 páginasAcid Chemical Casesaurabhsaurs100% (2)

- INTP Parents - 16personalitiesDocumento4 páginasINTP Parents - 16personalitiescelinelbAinda não há avaliações

- Chapter 2 Macro SolutionDocumento11 páginasChapter 2 Macro Solutionsaurabhsaurs100% (1)

- Chapter 2 Macro SolutionDocumento11 páginasChapter 2 Macro Solutionsaurabhsaurs100% (1)

- Energy Optimization of A Large Central Plant Chilled Water SystemDocumento24 páginasEnergy Optimization of A Large Central Plant Chilled Water Systemmuoi2002Ainda não há avaliações

- Case: Manzana InsuranceDocumento4 páginasCase: Manzana InsurancesaurabhsaursAinda não há avaliações

- Indian Fiscal PolicyDocumento2 páginasIndian Fiscal PolicyBhavya Choudhary100% (1)

- Prof. Madhavan - Ancient Wisdom of HealthDocumento25 páginasProf. Madhavan - Ancient Wisdom of HealthProf. Madhavan100% (2)

- Managerial Economics Question BankDocumento21 páginasManagerial Economics Question BankM.Satyendra kumarAinda não há avaliações

- PPC Production PlantDocumento106 páginasPPC Production PlantAljay Neeson Imperial100% (1)

- Reverse Osmosis Desalination: Our Global Expertise To Address Water ScarcityDocumento16 páginasReverse Osmosis Desalination: Our Global Expertise To Address Water Scarcitynice guyAinda não há avaliações

- Standerdised Tools of EducationDocumento25 páginasStanderdised Tools of Educationeskays30100% (11)

- Econometrics Notes PDFDocumento8 páginasEconometrics Notes PDFumamaheswariAinda não há avaliações

- Chapter 2 Macro SolutionDocumento11 páginasChapter 2 Macro Solutionsaurabhsaurs100% (1)

- Mid TestDocumento8 páginasMid Testseven_jason_guo0% (1)

- MacroeconomicsDocumento43 páginasMacroeconomicsNikkiprincessAinda não há avaliações

- Dornbusch - Preguntas Capitulo 1Documento3 páginasDornbusch - Preguntas Capitulo 1Diego Dolby0% (1)

- Macro FinalDocumento198 páginasMacro FinalpitimayAinda não há avaliações

- Macro Cheat SheetDocumento3 páginasMacro Cheat SheetMei SongAinda não há avaliações

- 19001Documento2 páginas19001Naresh HollaAinda não há avaliações

- Chapter 03 Productivity, Output and EmploymentDocumento44 páginasChapter 03 Productivity, Output and EmploymentSaranjam BeygAinda não há avaliações

- Sickness in Small EnterprisesDocumento15 páginasSickness in Small EnterprisesRajesh KumarAinda não há avaliações

- Rate of Return Payoff Investment: + 1+discount 0Documento10 páginasRate of Return Payoff Investment: + 1+discount 0Jair Azevedo JúniorAinda não há avaliações

- Minicase On Supply DemandDocumento4 páginasMinicase On Supply DemandRohan Sahni0% (1)

- Chapter 2 Macro SolutionDocumento14 páginasChapter 2 Macro Solutionsaurabhsaurs100% (1)

- 1-Value at Risk (Var) Models, Methods & Metrics - Excel Spreadsheet Walk Through Calculating Value at Risk (Var) - Comparing Var Models, Methods & MetricsDocumento65 páginas1-Value at Risk (Var) Models, Methods & Metrics - Excel Spreadsheet Walk Through Calculating Value at Risk (Var) - Comparing Var Models, Methods & MetricsVaibhav KharadeAinda não há avaliações

- Change of Origin and ScaleDocumento11 páginasChange of Origin and ScaleSanjana PrabhuAinda não há avaliações

- Kaldor Model - Group 3Documento12 páginasKaldor Model - Group 3Dairy Of PeaceAinda não há avaliações

- 2a1f7d8b61dd52f01454b9fc2ffa8fc1Documento17 páginas2a1f7d8b61dd52f01454b9fc2ffa8fc1Qarsam Ilyas100% (1)

- Week 1 Practice QuizDocumento7 páginasWeek 1 Practice QuizDonald112100% (1)

- Econometrics Project PDFDocumento10 páginasEconometrics Project PDFharshika mahakalAinda não há avaliações

- Nechyba 2e CH 16ABDocumento47 páginasNechyba 2e CH 16ABsnazrulAinda não há avaliações

- ABC 8e Answer Key CH 6Documento10 páginasABC 8e Answer Key CH 6Paul LeeAinda não há avaliações

- Liquidity Preference As Behavior Towards Risk Review of Economic StudiesDocumento23 páginasLiquidity Preference As Behavior Towards Risk Review of Economic StudiesCuenta EliminadaAinda não há avaliações

- GrowingleadersDocumento16 páginasGrowingleadersBasudebAinda não há avaliações

- Macroeconomics Final Exam NotesDocumento24 páginasMacroeconomics Final Exam NotesThomas Bryant100% (1)

- Mundell-Fleming ModelDocumento32 páginasMundell-Fleming ModelMarce Tabares Herrera100% (1)

- Goods and Money Market InteractionsDocumento25 páginasGoods and Money Market Interactionsparivesh_kmr0% (1)

- Unit1-Topic2 Handout-Ten Principles of EconomicsDocumento4 páginasUnit1-Topic2 Handout-Ten Principles of EconomicsRudolph FelipeAinda não há avaliações

- Managerial Economics:: According To Spencer and SiegelmanDocumento10 páginasManagerial Economics:: According To Spencer and SiegelmankwyncleAinda não há avaliações

- Balanced ScorecardDocumento27 páginasBalanced ScorecardJimsy AntuAinda não há avaliações

- Chapter 2 Macro SolutionDocumento14 páginasChapter 2 Macro Solutionsaurabhsaurs100% (2)

- Health Status of Fishing Communities - by Dr. Rajan R PatilDocumento45 páginasHealth Status of Fishing Communities - by Dr. Rajan R PatilDr. Rajan R Patil100% (3)

- Paper III For NABARD Grade B: The Answers Along With Explanations Are Given at The End of The Question PaperDocumento52 páginasPaper III For NABARD Grade B: The Answers Along With Explanations Are Given at The End of The Question PaperDhaval patelAinda não há avaliações

- FSAV3eModules 5-8Documento26 páginasFSAV3eModules 5-8bobdoleAinda não há avaliações

- 0000001635-Macroeconomics For ManagersDocumento19 páginas0000001635-Macroeconomics For ManagersVigneshVardharajanAinda não há avaliações

- Managerial Economics Notes 13Documento25 páginasManagerial Economics Notes 13bevinj100% (4)

- Did United Technologies Overpay For Rockwell CollinsDocumento2 páginasDid United Technologies Overpay For Rockwell CollinsRadAinda não há avaliações

- Chap 17Documento46 páginasChap 17Chevalier ChevalierAinda não há avaliações

- Financial Ratios AnalysisDocumento17 páginasFinancial Ratios AnalysisRamneet ParmarAinda não há avaliações

- Econ Assignment AnswersDocumento4 páginasEcon Assignment AnswersKazımAinda não há avaliações

- ch02 AnsDocumento11 páginasch02 AnsAmarjargal NorovAinda não há avaliações

- Macro 95 Ex 4Documento18 páginasMacro 95 Ex 4Nimra Pervaiz100% (1)

- Conceptually-Based Financial Reporting Quality Assessment. An Empirical Analysis On Quality Differences Between UK Annual Reports and US 10-K ReportsDocumento35 páginasConceptually-Based Financial Reporting Quality Assessment. An Empirical Analysis On Quality Differences Between UK Annual Reports and US 10-K ReportsAbdulAzeemAinda não há avaliações

- SahilJaswal MRIIRSDocumento14 páginasSahilJaswal MRIIRSmannumannu08439Ainda não há avaliações

- Difference Between Balance of Trade (BOT) & Balance of Payment (BOP)Documento2 páginasDifference Between Balance of Trade (BOT) & Balance of Payment (BOP)Bhaskar KabadwalAinda não há avaliações

- Introduction To Managerial EconomicsDocumento70 páginasIntroduction To Managerial EconomicsSavantAinda não há avaliações

- Solution Question 2 Quiz 2005 PDFDocumento3 páginasSolution Question 2 Quiz 2005 PDFsaurabhsaurs100% (1)

- Chap 009Documento22 páginasChap 009Yarlagadda GayathriAinda não há avaliações

- Theory of Production 1 0Documento22 páginasTheory of Production 1 0Suthan Dinho సుతాన్ దళినైడుAinda não há avaliações

- Competitive Analysis of RelianceDocumento15 páginasCompetitive Analysis of Reliancearka85Ainda não há avaliações

- Chapter 6 The Open EconomyDocumento11 páginasChapter 6 The Open EconomyJoana Marie CalderonAinda não há avaliações

- BFF2140 - Practice Questions For Final Exam - With - SolutionsDocumento15 páginasBFF2140 - Practice Questions For Final Exam - With - SolutionsFarah PatelAinda não há avaliações

- IE 1 - Topic 4 - Dreze and Sen - India in Comparative Perspective - Ch.4 of Uncertain GloryDocumento27 páginasIE 1 - Topic 4 - Dreze and Sen - India in Comparative Perspective - Ch.4 of Uncertain GloryKeshav AroraAinda não há avaliações

- Types of Unemployment in Zambia (Macro Economics)Documento8 páginasTypes of Unemployment in Zambia (Macro Economics)Peter Mbanga ShankayaAinda não há avaliações

- Chapter 8 SolutionsDocumento9 páginasChapter 8 SolutionsMohit KapoorAinda não há avaliações

- Shocking Secrets Every Worker Needs to Know: How to Future-Proof Your Job, Increase Your Income, Protect Your Wealth in Today's Digital AgeNo EverandShocking Secrets Every Worker Needs to Know: How to Future-Proof Your Job, Increase Your Income, Protect Your Wealth in Today's Digital AgeAinda não há avaliações

- Economy (Base Fare)Documento3 páginasEconomy (Base Fare)saurabhsaursAinda não há avaliações

- Chapter 2 Macro SolutionDocumento16 páginasChapter 2 Macro Solutionsaurabhsaurs80% (10)

- Need of Machine LearningDocumento1 páginaNeed of Machine LearningsaurabhsaursAinda não há avaliações

- Chapter 2 Macro SolutionDocumento14 páginasChapter 2 Macro Solutionsaurabhsaurs100% (1)

- Chapter 2 Macro SolutionDocumento14 páginasChapter 2 Macro Solutionsaurabhsaurs100% (2)

- Ob13 Tif19Documento23 páginasOb13 Tif19biaamin100% (1)

- Chapter 2 Macro SolutionDocumento12 páginasChapter 2 Macro Solutionsaurabhsaurs100% (1)

- Solution Question 2 Quiz 2005 PDFDocumento3 páginasSolution Question 2 Quiz 2005 PDFsaurabhsaurs100% (1)

- Ob13 Tif06Documento29 páginasOb13 Tif06Nguyễn Hoàng Nam100% (1)

- Warner LambertDocumento21 páginasWarner LambertsaurabhsaursAinda não há avaliações

- BGS SummaryDocumento50 páginasBGS SummarysaurabhsaursAinda não há avaliações

- Mariott CaseDocumento3 páginasMariott CasesaurabhsaursAinda não há avaliações

- Beckhoff Service Tool - USB StickDocumento7 páginasBeckhoff Service Tool - USB StickGustavo VélizAinda não há avaliações

- Thai Guava Production PDF by VNRDocumento29 páginasThai Guava Production PDF by VNRDatta100% (2)

- Test On QuantifiersDocumento1 páginaTest On Quantifiersvassoula35Ainda não há avaliações

- Tractor Price and Speci Cations: Tractors in IndiaDocumento4 páginasTractor Price and Speci Cations: Tractors in Indiatrupti kadamAinda não há avaliações

- Mdp36 The EndDocumento42 páginasMdp36 The Endnanog36Ainda não há avaliações

- NTJN, Full Conference Program - FINALDocumento60 páginasNTJN, Full Conference Program - FINALtjprogramsAinda não há avaliações

- Bioplan Nieto Nahum)Documento6 páginasBioplan Nieto Nahum)Claudia Morales UlloaAinda não há avaliações

- Calao Deliquente Diadi River SystemDocumento15 páginasCalao Deliquente Diadi River SystemJason MalamugAinda não há avaliações

- Course Guide Pe1 PDFDocumento4 páginasCourse Guide Pe1 PDFrahskkAinda não há avaliações

- TCJ Series: TCJ Series - Standard and Low Profile - J-LeadDocumento14 páginasTCJ Series: TCJ Series - Standard and Low Profile - J-LeadgpremkiranAinda não há avaliações

- Hmo Details November 2022 1Documento6 páginasHmo Details November 2022 1Saad BelloAinda não há avaliações

- EM2U60CLP 115-127 V 60 HZ 1Documento4 páginasEM2U60CLP 115-127 V 60 HZ 1armagedrumAinda não há avaliações

- Sebaran Populasi Dan Klasifikasi Resistensi Eleusine Indica Terhadap Glifosat Pada Perkebunan Kelapa Sawit Di Kabupaten Deli SerdangDocumento7 páginasSebaran Populasi Dan Klasifikasi Resistensi Eleusine Indica Terhadap Glifosat Pada Perkebunan Kelapa Sawit Di Kabupaten Deli SerdangRiyo RiyoAinda não há avaliações

- The Impact Behaviour of Composite MaterialsDocumento6 páginasThe Impact Behaviour of Composite MaterialsVíctor Fer100% (1)

- My Public Self My Hidden Self My Blind Spots My Unknown SelfDocumento2 páginasMy Public Self My Hidden Self My Blind Spots My Unknown SelfMaria Hosanna PalorAinda não há avaliações

- BKM 10e Ch07 Two Security ModelDocumento2 páginasBKM 10e Ch07 Two Security ModelJoe IammarinoAinda não há avaliações

- E10b MERCHANT NAVY CODE OF CONDUCTDocumento1 páginaE10b MERCHANT NAVY CODE OF CONDUCTssabih75Ainda não há avaliações

- Case Report 3 MukokelDocumento3 páginasCase Report 3 MukokelWidychii GadiestchhetyaAinda não há avaliações

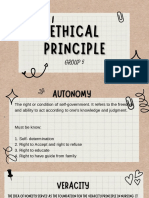

- Group 5 - Ethical PrinciplesDocumento11 páginasGroup 5 - Ethical Principlesvirgo paigeAinda não há avaliações

- Remote Control Unit Manual BookDocumento21 páginasRemote Control Unit Manual BookIgor Ungur100% (1)

- DR K.M.NAIR - GEOSCIENTIST EXEMPLARDocumento4 páginasDR K.M.NAIR - GEOSCIENTIST EXEMPLARDrThrivikramji KythAinda não há avaliações

- Key ScientificDocumento4 páginasKey ScientificGarrettAinda não há avaliações