Escolar Documentos

Profissional Documentos

Cultura Documentos

Ecor3800 Assignment2

Enviado por

MaiGetaTirammeesupTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Ecor3800 Assignment2

Enviado por

MaiGetaTirammeesupDireitos autorais:

Formatos disponíveis

ECOR3800-C: Assignment 2

1/3

ECOR 3800C - Assignment #2

Due Date: March 1, 2011 4:00 PM

Learning objective tested: Understand equivalent uniform annual worth and be able to independently develop analytical solutions to this problem.

2-1

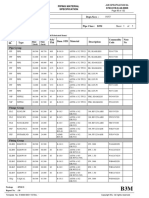

For the following cash flow diagram, calculate the value of R that results in an equivalent uniform annual worth of zero. Assume interest rate of 10%.

R R R R R R R

$1,000

$1,000

$1,000

Learning objective tested: Develop analytical solutions to projects with infinite analysis period.

2-2

For the cash flow diagram presented in problem 2-1, develop an analytical expression of the equivalent uniform annual worth if this 6-year investment cycle is repeatable for infinite number of times.

Learning objective tested: More sophisticated understanding of cash flow diagrams, using equivalent uniform annual worth and incremental analysis for project evaluation.

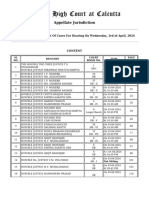

2-3 The City of Sunnyside is contemplating a new highway development. This highway will connect the burgeoning urban centre of Caterpillar to the more established municipality Butterfly. The paths connecting Caterpillar and Butterfly are outlined as follows:

A

Vegetation

Caterpillar

Butterfly

ECOR3800-C: Assignment 2

2/3

Path A is almost the shortest path. It involves vegetation clearance and a 2 km bridge. Total length of Path A is 15 km. Path B circumvents the vegetation area and crosses the nearby river through a 750m bridge. The total length of Path B is 25 km. The highway development was open for bids under a build-own-operate-transfer project financial structure. The awarded contractor will finance the design and the construction of the highway development. Subsequently, the contractor is allowed a 20 year period of limited ownership and operation, after which the highway's ownership will be transferred to the public. Two main contenders emerged: Latso and Woodsie Inc. The cost/benefit estimates of the two companies were as follows:

Latso Inc. (Path A) Item

Earthwork and pavement: Phase 1: Two-lane twoway Part 2 (after 10 years): Two lanes each direction Bridge Toll

Cost

$8 million/km $12 million/km

Woodsie Inc. (Path B) Item Cost

Total construction cost: Phase 1: Transit corridor Part 2 (after 10 years): 1] Parallel two-way two-lane highway 2] Sound barriers Bridge Transit fare $5 million/km $9 million/km

$60 million $5/trip (0--10) $10/trip (10--20)

$5 million $35 million $4/traveler (0--10) $7/traveler (10--20) $10/trip (10--20) 2200 travelers per day to increase by 1300 every 5 years.

Demand forecast:

2000 trips/day to increase by 1000 trips/day for each following 5 years

Highway toll Demand forecast: Transit:

Maintenance: Year 10 Year 20

$2 million/km $4 million/km

Highway (after 10 years): 900 trips/day to increase by 1000 trips/day every 5 years. Operation/maintenance: Transit: Procurement $10 million Operation/maintenance $1 million/yr Highway: Year 20 Cost financing: Cost to the City

Cost financing: Cost to the City

Credit line, 3% interest $450 million

$3 million/km Credit line, 2.5% interest ?

ECOR3800-C: Assignment 2

3/3

You are leading a team to assess the financial feasibility of these two projects from a third-party's perspective. In doing so, the following assumptions are made: 1- Construction costs are concentrated as point costs at time zero and the end of year 10. 2- Revenues during the 20 years after construction are collected by the contractor as uniform annual series. The contractor collects 100% of all revenues during these 20 years. 3- Highway maintenance is conducted every 10 years with costs concentrated at one point. 4- Balance on the project costs is repaid by the contractor to the crediting institution in the form of 20 equal annual instalments distributed over the lifetime of the project. 5- Based on the bidding patterns of Latso and Woodsie, their target interest rate is somewhere in between 5% and 7%. Precisely, the interest rate is Uniformly distributed between the values 0.05 and 0.07. 6- The City will repay the contractor at the end of the operation period the current-dollar project costs. That is, the book value of costs discarding the contractor's discount rate. For example, if the contractor would pay $400 million after 10 years to finance the project at the end, the City would pay the same amount after 20 years. 7- For simplicity, Ignore all other external costs or revenues such as inflation, depreciation, social impact, and corporate taxes. Questions: [2-3-1] Construct the cash flow diagram for both companies. [2-3-2] Calculate the EUAW for both companies, Latso bidding on Path A and Woodsie bidding on Path B, using a discount rate of 6.0% (mean value). [2-3-3] Calculate the Internal Rate of Return (IRR) perceived by both companies. [2-3-4] What is the probabilities that Path A will be feasible for Latso and Path B will be feasible for Woodsie. [2-3-5] From the perspective of a contractor in this profession, other than Latso and Woodsie, find the IRR on the investment increment moving from the project proposed by Woodsie to that proposed by Latso. [2-3-6] Additional information: A committee member raised an objection to Latso's project. The member argued that Latso has externalized all environmental damage due to vegetation clearance. The member argued that Latso's proposal is unconscientious since it ignores the project's impact on the local environment. Advocacy groups estimated that the cost of restoring all existing environmental systems due to vegetation clearance is $1 million/yr for the first 10 years. Question: Including environmental cost, and assuming that the City will not offset this cost, find Lotso's IRR. Comment on the results. --- End of Problems---

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (120)

- Oceangoing Ships 2007 PDFDocumento102 páginasOceangoing Ships 2007 PDFaleventAinda não há avaliações

- B5M ElDocumento3 páginasB5M ElBALAKRISHNANAinda não há avaliações

- PPSAS 28 - Financial Instruments - Presentation 3-18-2013Documento3 páginasPPSAS 28 - Financial Instruments - Presentation 3-18-2013Christian Ian LimAinda não há avaliações

- M&A Module 1Documento56 páginasM&A Module 1avinashj8100% (1)

- Capacity Management in Service FirmsDocumento10 páginasCapacity Management in Service FirmsJussie BatistilAinda não há avaliações

- John Deere 6405 and 6605 Tractor Repair Technical ManualDocumento16 páginasJohn Deere 6405 and 6605 Tractor Repair Technical ManualJefferson Carvajal67% (6)

- Pune MetroDocumento11 páginasPune MetroGanesh NichalAinda não há avaliações

- Project ProposalDocumento7 páginasProject Proposalrehmaniaaa100% (3)

- EVALUATION OF BANK OF MAHARASTRA-DevanshuDocumento7 páginasEVALUATION OF BANK OF MAHARASTRA-DevanshuDevanshu sharma100% (2)

- Doku - Pub - Insight-Intermediate-Sbpdf (Dragged)Documento7 páginasDoku - Pub - Insight-Intermediate-Sbpdf (Dragged)henry johnsonAinda não há avaliações

- Rent ReceiptDocumento1 páginaRent ReceiptHarish LakhaniAinda não há avaliações

- Thesis Chapter 1Documento5 páginasThesis Chapter 1Erialc SomarAinda não há avaliações

- Bbob Current AffairsDocumento28 páginasBbob Current AffairsGangwar AnkitAinda não há avaliações

- Notice 11120 02 Apr 2024Documento669 páginasNotice 11120 02 Apr 2024bhattacharya.devangana2Ainda não há avaliações

- Placement Report 2023Documento9 páginasPlacement Report 2023Star WhiteAinda não há avaliações

- Problem 2Documento2 páginasProblem 2Anonymous qiAIfBHnAinda não há avaliações

- Geography in RomaniaDocumento9 páginasGeography in RomaniaJovoMedojevicAinda não há avaliações

- Gmail - Your Booking Confirmation PDFDocumento8 páginasGmail - Your Booking Confirmation PDFvillanuevamarkdAinda não há avaliações

- Business Economics - Neil Harris - Summary Chapter 3Documento2 páginasBusiness Economics - Neil Harris - Summary Chapter 3Nabila HuwaidaAinda não há avaliações

- Indian Real Estate SectorDocumento8 páginasIndian Real Estate SectorSumit VrmaAinda não há avaliações

- Proposal Project AyamDocumento14 páginasProposal Project AyamIrvan PamungkasAinda não há avaliações

- Markets and Commodity Figures: Total Market Turnover StatisticsDocumento6 páginasMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupAinda não há avaliações

- Firth, Raymond (Ed.) (1964) Capital, Savings and Credit in Peasant Societies (Só o Índice!)Documento2 páginasFirth, Raymond (Ed.) (1964) Capital, Savings and Credit in Peasant Societies (Só o Índice!)Felipe SilvaAinda não há avaliações

- Company Profile - Herman Zemel enDocumento17 páginasCompany Profile - Herman Zemel enAlhussein Banuson100% (1)

- Study On The Dynamics of Shifting Cultivation Areas in East Garo HillsDocumento9 páginasStudy On The Dynamics of Shifting Cultivation Areas in East Garo Hillssiljrang mcfaddenAinda não há avaliações

- RPT Sanction EPayment DetailsDocumento4 páginasRPT Sanction EPayment DetailsTYCS35 SIDDHESH PENDURKARAinda não há avaliações

- ASEAN Association of Southeast Asian NationsDocumento3 páginasASEAN Association of Southeast Asian NationsnicolepekkAinda não há avaliações

- Business Economics PPT Chap 1Documento18 páginasBusiness Economics PPT Chap 1david sughapriyaAinda não há avaliações

- Indias Top 50 Best ItDocumento14 páginasIndias Top 50 Best ItAnonymous Nl41INVAinda não há avaliações

- Key Success Factors For The Apparel ManufacturingDocumento6 páginasKey Success Factors For The Apparel ManufacturingMostaqueemAinda não há avaliações