Escolar Documentos

Profissional Documentos

Cultura Documentos

Credit Transactions Digest Joven

Enviado por

Claine AvelinoTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Credit Transactions Digest Joven

Enviado por

Claine AvelinoDireitos autorais:

Formatos disponíveis

Dino--- "Candy Claire Fashion Garment" Sio ---part owner and general manager "Universal Toy Master Manufacturing.

"[2]

Dino and Sio, where Sio would manufacture 20,000 pieces of vinyl frogs and 20,000 pieces of vinyl mooseheads to be attached to the shirts of Dino Dino returned to Sio 2 9,772 pieces of frogs and mooseheads for failing to comply with the approved sample . returned on different dates.

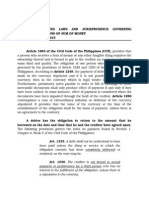

(7) Any indebtedness of the Principal now or hereafter held by the Surety is hereby subordinated to the indebtedness of the Principal to the Creditor; and if the Creditor so requests, such indebtedness Dino demanded return of purchase price of the Principal of the Surety shall be collected, enforced and shall be paid over to the Creditor and ISSUE: WON he can demand return of purchase price shall be paid over to the Creditor and shall be paid over to the Creditor on account of the indebtedness "Art. 1467. A contract for the delivery at a certain price of an article which the to the Creditor but without reducing of the Principal vendor in the ordinary course of his business manufactures or procures for the any manner the liability of the Surety or affecting in under the provisions of this suretyship. general market, whether the same is on hand at the time or not, is a contract of

sale, but if the goods are to be manufactured specially for the customer and upon his special order, and not for the general market, it is a contract for a piece of Trade receivables assigned to Atok PHP125K work." Additional trade "Art. 1713. By the contract for a piece of work the contractor binds himself to rcvbls PHP100K execute a piece of work for the employer, in consideration of a certain price or Sanyu failed to collect and assign the amount due the compensation. The contractor may either employ only his labor or skill, or also trade receivables furnish the material." Filed three months after the 6month period. Gicano doctrine: the action has prescribed, the action may be dismissed even if the defense of prescription was not invoked by the defendant. Respondent--Continuing Suretyship Agreement--Null and void. Accessory contract. Since no pre-existing obligation TC: favoured Atok CA: favoured respondents Although obligations arising from contracts have the force of law between the contracting parties, (Article 1159 of the Civil Code) this does not mean that the law is inferior to it; the terms of the contract could not be enforces if not valid. So, even if, as in this case, the agreement was for a continuing suretyship to include obligations enumerated in paragraph 2 of the agreement, the same could not be enforced. First, because this contract, just like guaranty, cannot exist without a valid obligation (Art. 2052, Civil Code); and, second, although it may be given as security for future debt (Art. 2053, C.C.), the obligation contemplated in the case at bar cannot be considered "future debt" as envisioned by this law.

ATOK ATok Finance. Principal, Sanyo...Sureties would be stockholders halili

1. Joint and several 2. Continunuing Suretyshipsuccessive transactions, heirs, benefits 3. Joint several and independent of principal 4.

Future debts in this case refer to debts already existing but the amount is unknown SC: Art. 2053. A guaranty may also be given as security for future debts, the amount of which is not yet known; there can be no claim against the guarantor until the debt is liquidated. A conditional obligation may also be secured. Continuing Surety Agreements. anticipates entering into a series of credit transactions with a particular company.. projected series of transactions with its creditor... with such surety agreement, there would be no need to execute a separate surety contract or bond for each financing or credit accommodation extended to the principal debtor. As we understand it, this is precisely what happened in the case at bar. In other words, Sanyu Chemical received from Atok Finance the value of its trade receivables it had assigned; Sanyu Chemical obviously benefitted from the assignment. Deed of Assignment: the effect of non-payment by the original trade debtors was breach of warranty of solvency by Sanyu Chemical . In other words, the assignor Sanyu Chemical becomes a solidary debtor under the terms of the receivables covered and transferred by virtue of the Deed of Assignment. And because assignor Sanyu Chemical became, under the terms of the Deed of Assignment, solidary obligor under each of the assigned receivables, the other private respondents (the Arrieta spouses, Pablito Bermundo and Leopoldo Halili), became solidarily liable for that obligation of Sanyu Chemical, by virtue of the operation of the Continuing Suretyship Agreement. Obligations of individual private respondent officers and stockholders of Sanyu Chemical under the Continuing Suretyship Agreement, were activated by the resulting obligations of Sanyu Chemical as solidary obligor under each of the assigned receivables by virtue of the

operation of the Deed of Assignment. That solidary liability of Sanyu Chemical is not subject to the limiting period set out in Article 1629 of the Civil Code.

TANEDO Cheng to pay Tanedo 2m 14% pa penalty of 1% pmonth 7 PN s P10,000,000.00, from defendants Alfredo Ching and Emilio Taedo under a Continuing Guaranty providing for joint and several liability relative to the said promissory notes Bank branded security as worthless security ISSUE (a) whether the execution by the respondent Bank of the Fourth Amendatory Agreement extinguished petitioners obligations as surety---NO (b) whether the continuing guarantee executed by the petitioner is a contract of (surety) adhesion.--NO Bank and cheng extended the maturity of the promissory notes without notice or consent of the petitioner as surety of the obligations. However, the continuing guarantee thus surety not releasesd. BAYLON Baylon introduced private respondent Leonila Tomacruz, the co-manager of her husband at PLDT, to Rosita B. Luanzon. Petitioner told private respondent that Luanzon has been engaged in business as a contractor for twenty years..... invited private respondent to lend Luanzon money at a monthly interest rate of five percent (5%), to be used as capital for the latter's business. Private respondent, persuaded by the assurances of petitioner that Luanzon's business was stable and by the high interest rate, agreed to lend Luanzon money in the amount of P150,000. Luanzon issued PN for PHP150K Baylon instituted claim for sum of money

Baylon claimed it was investment not loan. That properties of debtor not yet exhausted. TC: for Tomacruz. Evidence of issuance of checks and 5% p.a ISSUE: Won Baylon is still liable despite non exhaustion SC: The clear terms of the promissory note establish a creditor-debtor relationship between Luanzon and private respondent. The transaction at bench is therefore a loan, not an investment. It is axiomatic that the liability of the guarantor is only subsidiary.[20] All the properties of the principal debtor must first be exhausted before his own is levied upon. Thus, the creditor may hold the guarantor liable only after judgment has been obtained against the principal debtor and the latter is unable to pay, for obviously the exhaustion of the principals property - the benefit of which the guarantor claims - cannot even begin to take place before judgment has been obtained.*21+ This rule is embodied in article 2062 of the Civil Code which provides that the action brought by the creditor must be filed against the principal debtor alone, except in some instances when the action may be brought against both the debtor and the principal debtor.[22]

Você também pode gostar

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Grant Application GuideDocumento2 páginasGrant Application GuideMunish Dogra100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- Wealth DynamicsDocumento32 páginasWealth Dynamicsmauve08Ainda não há avaliações

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- Photography Session ContractDocumento5 páginasPhotography Session Contractapi-24913181367% (3)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- 96 Fix-Notice To Bank of Canada GovernorDocumento3 páginas96 Fix-Notice To Bank of Canada Governorashley_kos8020100% (3)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- FM09-CH 27Documento6 páginasFM09-CH 27Kritika SwaminathanAinda não há avaliações

- Darshan Gandhi - Sem 6 - Roll No-052 - Sec-C - CORPORATE LAWDocumento19 páginasDarshan Gandhi - Sem 6 - Roll No-052 - Sec-C - CORPORATE LAWSounak VermaAinda não há avaliações

- Hire Purchase ExplainedDocumento25 páginasHire Purchase ExplainedReet SalariaAinda não há avaliações

- Legal Memo - Collection of Sum of MoneyDocumento9 páginasLegal Memo - Collection of Sum of MoneyArnold Cavalida Bucoy100% (3)

- SEx 9Documento24 páginasSEx 9Amir Madani100% (1)

- Sunga-Chan v.CADocumento2 páginasSunga-Chan v.CAHanna Quiambao0% (1)

- TPA Act Introduction and Key DefinitionsDocumento41 páginasTPA Act Introduction and Key DefinitionsakhilAinda não há avaliações

- Business CorrespondentDocumento22 páginasBusiness CorrespondentdivyangAinda não há avaliações

- Letter To Maeves Lawyer (House)Documento2 páginasLetter To Maeves Lawyer (House)Daniel CooperAinda não há avaliações

- MNE 202-V Slides2Documento178 páginasMNE 202-V Slides2carla32wehrleAinda não há avaliações

- IDBI Bank Operations Management ProjectDocumento20 páginasIDBI Bank Operations Management ProjectriznasifAinda não há avaliações

- Meezan Bank Report FinalDocumento61 páginasMeezan Bank Report FinalMuhammad JamilAinda não há avaliações

- CommScope2016 Brochure FinalDocumento8 páginasCommScope2016 Brochure FinalsteveAinda não há avaliações

- Terms of Reference (Tor) Post: Vacancies: 1 Post Type: Full Time Reporting To: Finance ManagerDocumento2 páginasTerms of Reference (Tor) Post: Vacancies: 1 Post Type: Full Time Reporting To: Finance ManagerMohamed LammahAinda não há avaliações

- History of BankingDocumento6 páginasHistory of Bankinglianna marieAinda não há avaliações

- Writing Inequalities From Word ProblemsDocumento28 páginasWriting Inequalities From Word Problemsapi-379755793Ainda não há avaliações

- Outline 2006-07Documento196 páginasOutline 2006-07Manish BokdiaAinda não há avaliações

- ICICI Bank Ltd. Versus Official Liquidator of APS StarDocumento17 páginasICICI Bank Ltd. Versus Official Liquidator of APS StarAman Kumar YadavAinda não há avaliações

- What Is A MortgageDocumento6 páginasWhat Is A MortgagekrishnaAinda não há avaliações

- Rules of The Law Society of NamibiaDocumento26 páginasRules of The Law Society of NamibiaAndré Le Roux100% (2)

- Micro Finance BankDocumento15 páginasMicro Finance BankSarwar KhanAinda não há avaliações

- Online Class1Documento36 páginasOnline Class1Marie Thelma Benolirao RomarateAinda não há avaliações

- Investment Agreement 321066534330728Documento24 páginasInvestment Agreement 321066534330728Pankaj KumarAinda não há avaliações

- Contracts IIDocumento8 páginasContracts IISushmaSuresh100% (1)

- Asset Quality Report Deutche Bank and BNPDocumento5 páginasAsset Quality Report Deutche Bank and BNPblazivica999Ainda não há avaliações

- Landlord Tenant Handbok Montgomery County MDDocumento80 páginasLandlord Tenant Handbok Montgomery County MDkitty_chan_19Ainda não há avaliações