Escolar Documentos

Profissional Documentos

Cultura Documentos

Cityam 2013-02-05 PDF

Enviado por

City A.M.Título original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Cityam 2013-02-05 PDF

Enviado por

City A.M.Direitos autorais:

Formatos disponíveis

BUSINESS WITH PERSONALITY

S&P agency

faces suit

over ratings

RATINGS giant Standard & Poors

yesterday said it faced a civil

lawsuit from the US Department of

Justice (DOJ) over grades it gave

prior to the credit crunch.

Shares in McGraw-Hill, S&Ps

parent company, collapsed 13.8 per

cent to hit $50.30, their worst fall

since the October 1987 crash.

Shares in rival Moodys also fell 11

per cent yesterday despite no sign it

will be named in the suit.

The DOJ, which may be joined by

several state prosecutors, is

expected to hit S&P with charges

relating to the assessments it gave

mortgage-backed security financial

instruments. This civil lawsuit

comes after talks between S&P and

prosecutors broke down, reportedly

over the size of the payoff.

S&P has maintained that ratings

are effectively opinions, and are

hence protected under the First

Amendment to the US

constitution, which guarantees free

expression.

A DOJ lawsuit would be entirely

without factual or legal merit, S&P

claimed in a statement. The DOJ

would be wrong in contending that

S&P ratings were motivated by

commercial considerations and not

issued in good faith.

It would disregard the central

facts that S&P reviewed the same

subprime mortgage data as the rest

of the market including US

officials who in 2007 publicly

stated that problems in the

subprime market appeared to be

contained and that every security

that the DOJ has cited to us also

independently received the same

rating from another agency.

The DOJ was unavailable for

comment.

Chancellor Angela Merkel gave her backing to Spanish premier Mariano Rajoy after graft allegations

THE EUROZONE crisis returned with

a bang yesterday, with shares sliding

and bond yields soaring, as fresh

political troubles engulfed the bloc.

Yields on Spanish 10-year bonds

rocketed up 23 basis points a 4.42

per cent rise on the day while their

Italian equivalents added some 14

basis points a 3.21 per cent jump.

The euro lost almost a percentage

point versus the dollar, falling from

$1.3648 to $1.3517 and reversing

much of its recent gains. It lost 1.39

per cent against sterling, bringing it

from 0.8692 to 0.8574.

The FTSEurofirst 300 index sank 1.5

per cent and the Euro STOXX 50 dived

3.1 per cent, both erasing all of their

gains for the year. Spains Ibex dipped

some 3.8 per cent, while the Italian

FTSE Mib was down 4.5 per cent. The

FTSE 100 fell 1.58 per cent.

Particularly hard hit were Italian

banks, with five suffering such steep

slides that trading was halted. These

five banks were Unicredit, whose

shares plummeted 8.29 per cent,

along with Intesa Sanpaolo, UBI

Banca, Banca Popolare Milano and

Monti dei Paschi di Siena, which all

lost over five per cent of their value.

These moves came after the German

Chancellor was forced to come out in

favour of embattled Spanish premier

Mariano Rajoy, whose party was hit

with a series of allegations.

Reports had alleged that Rajoys

Peoples Party operated a slush fund

with money donated by construction

www.cityam.com FREE

industry bosses allegations the

Spanish PM flatly denies.

Markets were also spooked by a new

surge in the polls for former Italian

leader Silvio Berlusconi, after the 76-

year old media tycoon promised a

swathe of tax cuts if he was elected.

Recent polls suggest the AC Milan-

owner is five or six percentage points

behind his main centre-left rivals.

But JP Morgans Alex White said in a

note that Berlusconis support tends

to be understated by around three

percentage points. White said the

effect could be even more pro-

nounced in an election cycle with

such heightened tensions. This

would leave the centre-lefts lead

well below the margin of comfort.

Mario Monti slammed Berlusconi

as a snake charmer and said the

former premier was with his tax cut

plans trying to sell a dream more

fantastic than Alice in Wonderland.

BY BEN SOUTHWOOD

FTSE 100 M6,246.84 -100.40 DOWM13,880.08 -129.71 NASDAQM3,131.17 -47.93 /$ 1.58 +0.01 / 1.17 +0.02 /$ M1.35 -0.02

BY BEN SOUTHWOOD

ISSUE 1,812 TUESDAY 5 FEBRUARY 2013

HOW TO SOLVE

THE RBS RIDDLE

Ryan Bourne, The Forum Page 20

Frances Coppola, The Forum Page 20

Certified Distribution

from 26/11/12 to 30/12/12 is 127,678

BY MICHAEL BOW

High street in hedge fund crosshairs after retail meltdown

HEDGE fund managers are betting

millions of pounds on a gloomier

UK high street this year after

figures yesterday showed a sharp

spike in the shorting of some of

Britains biggest retail names.

Hedge fund borrowings are used

as a proxy for bets against

companies those for high street

stalwart WH Smith, electrical

giant Dixons Retail and

department store Debenhams all

leapt in January as investors

digested a torrid start to the year

for the high street, which saw

HMV, Jessops and Blockbuster all

fall into administration.

Short positions against WH

Smith now the most shorted

stock on the FTSE have surged 63

per cent in the past four weeks,

while Dixons increased close to 45

per cent and Halfords almost 90

per cent, according to figures

from data supplier Markit.

The average amount of retail

stocks out on loan among those

listed on the FTSE All Share has

now hit 3.72 per cent more than

three times over the FTSE average.

Further data from the UK

Financial Services Authority

collated last week shows several

hedge funds, including secretive

investor Fest NV, and two New

York firms, Merchants Gate

Capital and Eminence Capital, all

upping their bets against WH

Smith over the last month, with

Fest borrowing almost four per

cent of the firms entire share

capital. Dixons Retail has also seen

increased short interest from Fest

and Lone Pine Capital, according

to the FSA data.

FTSE

4Feb 29Jan 30Jan 31 Jan 1 Feb

6,280

6,300

6,260

6,240

6,320

6,340

6,360

6,246.84

4Feb

Ibex (Spain)

4Feb 29Jan 30Jan 31 Jan 1 Feb

8,300

8,400

8,100

8,000

7,900

8,200

8,500

8,600

8,700

7,919.60

4Feb

FTSE MIB (Italy)

4Feb 29Jan 30Jan 31 Jan 1 Feb

17,000

17,250

16,750

17,500

17,750

18,000

16,539.00

4Feb

MARKETS DIVE ON

EUROZONE FEARS

THE TRUE COST OF SEPARATING BRITAINS BANKS

RINGFENCE MYTHS

MORE HMV: Page 15

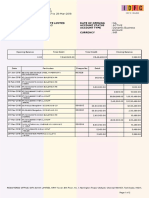

TOP FIVE INCREASES IN

MOST SHORTED RETAIL

STOCKS LAST MONTH

Company %increase (Jan)

Halfords Group 89.90

WH Smith 63.33

Debenhams 50.33

Dixons Retail 44.56

Darty Plc 36.25

allister.heath@cityam.com

Follow me on Twitter: @allisterheath

COMMERZBANK, Germanys

second largest bank, yesterday

posted a surprise net loss of 720m

(617m) for the fourth quarter.

The lender said it booked an

extraordinary depreciation on

deferred tax accruals of 560m

and charges of 185m related to

the sale of its Ukrainian Bank

Forum unit.

According to StarMine, analysts

had on average expected a net loss

of 295m.

The bank further said it expects

restructuring charges of

approximately 500m in the first

quarter of 2013 in connection with

the reduction of 4,000 to 6,000

jobs until 2016.

The negative trend of earnings

disappointments continues, DZ

Bank analyst Christoph Bast said,

adding the large amount of

writedowns was a surprise.

In November Commerzbank

lowered its 2016 return on equity

target to roughly eight per cent at

group level, setting a goal below

the industrys average cost of

capital of 10-12 per cent.

As a result the bank is now

unable to make full use of losses

carried forward to reduce its tax

bill and had to write down 560m

on deferred tax assets for the

fourth quarter.

Commerzbank

charges lead

to surprise loss

BY CITY A.M. REPORTER

Osbornes bank plan set

to hurt City and economy

THREATENING to split up all banks if

the ringfence does not work will

hurt the economy and hit the value

of the bailed-out banks, analysts and

lawyers claimed yesterday, attacking

George Osbornes plan for the sector.

Individual banks could be broken

up if the authorities fear they are try-

ing to get around the partial separa-

tion of retail and investment

banking, while the whole sector

could be hit if the rules are reviewed

and found wanting in years to come.

As the exact size and location of

the ringfence has yet to be finalised

lobbying is set to intensify, potential-

ly meaning the move to electrify the

ringfence will backfire, as banks try

to shift its foundations. And that

unpredictability is likely to hurt any

sale of the state-owned banks.

The high stakes approach now

being introduced to the ringfence

measures will make it difficult for

the government to decide the opti-

mum time to reduce their holdings

in UK banks, said Pinsent Masons

Tony Anderson. There could be sig-

nificant political fallout for the gov-

ernment from any proximity

between a sell down of shares in a

state owned bank and a full separa-

tion of banking operations following

a breach of the ringfence.

And the UKs economy could lose

Whitehall departments face big cuts

Several government departments will

have lost more than 3 in every 10 they

once had available for spending, by the

time of the next election, according to

Financial Times research.

SGX in talks over LCH.Clearnet stake

SGX, the Singapore stock exchange, is in

discussions about taking a stake in

LCH.Clearnet, the transatlantic clearing

house, as bourses gear up for sweeping

reform of derivatives and equities

markets. The Asian exchange is in talks

with London-based LCH about taking a

separate stake or becoming part of the

deal in which the London Stock Exchange

is set to take a controlling 60 per cent

shareholding, said three people familiar

with the situation.

ECB told to double manpower

The European Central Bank will need to

more than double its manpower and hire

around 2,000 bank supervision staff to

put the Eurozones banking union into

practice, according to a confidential study

for the ECB. The consultancy report was

from Promontory Financial Group.

Boeing faces legal claim

Japans national airline intends to seek

compensation from Boeing over the

grounding of its troubled Dreamliner jets,

which are standing idle on the tarmac

after safety scares.

Gates open at BBC Television Centre

Members of the public will be able to walk

in the footsteps of famous BBC figures

and classic programme characters for the

first time in more than half a century after

a decision by the new owner of Television

Centre, Stanhope, to throw open its gates.

Investor confidence in UK rail low

Investor confidence in the UK rail industry

couldnt get much worse in the wake of

the West Coast rail franchise fiasco,

according to the incoming boss of

Stagecoach, Martin Griffiths.

Harrods shuts lid on piano sections

Harrods has shut its piano department

after 118 years, as sales of the musical

instrument fall across Britain. Today, only

about 4,000 acoustic pianos are sold in

Britain each year compared with 14,000 in

the late 1960s. Hardly any are UK made.

Ryanair offers new concessions

Ryanair has submitted yet another

package of concessions to EU regulators

in a last-ditch attempt to secure approval

for its bid to acquire rival Irish carrier Aer

Lingus, people close to the process said

yesterday.

Ford pouring cash into pensions

Ford expects to spend $5bn this year

shoring up its pension funds, almost as

much as the auto maker spent last year

building plants, buying equipment and

developing new cars.

George Osborne wants banks to face tough punishments if they go against his wishes

2

NEWS

BY TIM WALLACE

To contact the newsdesk email news@cityam.com

I

T is hard to know where to start

with George Osbornes latest

rhetorically fiery foray into bank

regulation. The vast majority of it

was a rehash of previous

announcements, a restatement of

already existing aspirations. As

usual, some of his ideas were

excellent and others awful.

It will now take just a week to

change bank account. The chancellor

is right to want to empower con-

sumers and to seek to reform the pay-

ment system to encourage

competition; let us hope he is more

successful in this pursuit than his

predecessors, who were all defeated

by the challenge. The banks are

wrong to oppose change: we eventual-

ly need to move to full bank account

portability, making it easier to change

bank than it is to change mobile

phone company.

EDITORS

LETTER

ALLISTER HEATH

Ringfencing is the wrong solution to the wrong problem

TUESDAY 5 FEBRUARY 2013

Another positive move is the idea

that we need a new bankruptcy code

to allow even the largest banks to go

bust in a controlled manner, and be

wound down gently, protecting

depositors and taxpayers and avoid-

ing bailouts. It is a myth that some

banks are too big too fail. Lehmans

uncontrolled collapse under the old

system wreaked immense havoc but

the purpose of banking reform

should be to make such bank failures

safe for the rest of us, not to seek to

make banks themselves safe.

Capitalism requires the possibility of

bankruptcy if it is to function effec-

tively. Under the proposed reforms,

bondholders and other creditors

would see their loans turned into new

equity, and shareholders would be

wiped out. Creating a workable reso-

lution mechanism for large universal

banks ought to be the number priori-

ty for regulators; it is a shame, there-

fore, that so many, including

Osborne, are wasting so much of their

time on pointless grandstanding.

One such blind alley is the sort of

ringfencing that Osborne is imposing

on the industry. This will be hugely

costly, reduce efficiency and cut the

supply of credit for no benefit to con-

sumers. The policy is premised on the

myth that retail banking is intrinsi-

cally safe and investment banking

intrinsically dangerous, which is

break up banks that dont follow

these new rules, which doesnt make

sense. Either banks will obey the law

or they should immediately be prose-

cuted; the electrified ring-fence is a

typical case of triangulation, with the

chancellor seeking to have it both

ways. At best, this idea will turn out

to be a useless gimmick; at worst it

will make it harder for the City to

engage in long-term planning and

create yet more uncertainty.

The chancellors demand that exist-

ing RBS staff who are blameless

have their bonuses docked to pay for

Libor fines is unfair and petty.

Osborne is meant to be maximising

RBSs value for the taxpayers that own

it, not using the bank as a political

football. All in all, not a great day.

utter nonsense. A ringfence wouldnt

have stopped the failures of Northern

Rock, HBOS and Bradford and

Bingley, all of which were pure (or

almost pure) retail banks. It was not

trading that caused the crisis, it was

bad lending (such as to subprime bor-

rowers) and then the fact that lots of

financial institutions invested in

these dodgy loans, while simultane-

ously holding very little capital in

reserve. Lending against residential

and commercial property is probably

the most dangerous form of banking.

It is essential to protect depositors

and taxpayers, and banish bailouts for

ever but that can be done with a

proper resolution mechanism and

some other reforms.

Osbornes electrified ringfence

the only new policy will turn out to

be even more damaging. It will give

the authorities reserve powers to

competitiveness as its rules become

tougher than those in other countries.

It is frankly extraordinary that the

British government should be trying to

electrify the regulatory fence for banks

here when in Germany and France

they are busy trying to dig holes under

it, said Ash Saluja from CMS Cameron

McKenna. An uneven playing field is

not what the single market is sup-

posed to be about.

And analysts at the Institute for

Economic Affairs argued the whole

concept of ringfencing is flawed.

We need to make bank failure safe.

We therefore need more focus on how

to wind up failed banks without

recourse to taxpayers money, said

Mark Littlewood. Sadly, Osborne

seems to want to introduce more pre-

scriptive regulations which will make

genuine competition harder and could

exacerbate the too big to fail problem.

The chancellor also argued he is mak-

ing the sector more competitive with

seven-day current account switching.

He added he wants to open up the

payments system to improve service

and make sure small banks no longer

have to go through rivals systems.

n Banks face being broken up if they try

to undermine the ringfence

n The chancellor said that this is in

response to banks previously pushing

hard to get around regulations

n We are going to arm ourselves in

advance. In the jargon, we will electrify

the ringfence

n He pledged to increase competition in

the sector

n Customers will be allowed to switch

current accounts from one bank to

another in seven days

n They will be able to take all their direct

debits with them seamlessly

n Osborne hopes that will encourage

movement between banks

n The theory is that should put pressure

on institutions to take more care of their

customers

n The chancellor wants to open up

payments services, too

n He said he does not want small banks

to have to rely on bigger rivals for access

to payments systems

n Osborne believes it is unfair that small

firms must wait days for payments when

banks can carry out the transfers in

seconds

n He argued it is wrong and damaging

that it takes several days for cheques to

clear

n The chancellor added he wants to

make sure RBS pays its impending Libor

fine from bonuses, not taxpayer money

n And he told his Bournemouth audience

that Barclays 290m Libor fine is going

to a variety of good causes including

35m to armed forces charities.

OSBORNES SPEECH

The new jobs website for London professionals

CITYAMCAREERS.com

WHAT THE OTHER PAPERS SAY THIS MORNING

THE RETURN on government bonds

has seen a significant slump since the

turn of the year, with data revealing

that investors in UK gilts took the

strongest hit last month.

While riskier assets such as equi-

ties on the FTSE 100 soared in

January, gilts lost two per cent,

while other so called safe haven

assets also suffered.

New figures show German

bunds losing 1.7 per cent last

month, while US Treasuries

were down around one

per cent.

French govern-

ment bonds also

lost 1.5 per cent

in the opening

month of

2013, putting

these forms

of debt

a mo n g

the worst

perform-

ing major

financial

assets.

Risk on as bond

returns slump

at start of year

BY JULIAN HARRIS

Conversely, the FTSE gained 6.43 per

cent during January marking the

best start to a year for the blue chip

index since 1989. And globally, equi-

ties jumped nearly five per cent,

although gains were pared yesterday.

Perceived declines in tail risks and

plentiful liquidity, with more resolute

asset purchase programmes on the

way from Japan, have noticeably

changed investor sentiment

and behaviour away from

risk-off to risk-on mode,

commented the Institute of

International Finance in a

research note.

Investors will also be keeping

an eye on monetary policy

closer to home.

Incoming Bank of

England chief Mark

Carney appears in

front of the Treasury

Select Committee on

Thursday, with mar-

kets looking for any

hints towards a possible

change in direction.

Mark Carney is replacing

Sir Mervyn King (pictured)

NEW market entrants outdid FTSE

100 stalwarts over the past two

years, according to data out

yesterday.

The share price of 10 firms who

joined the main market with an

initial public offering (IPO)

between 2011-12 rose 19.2 per cent

by the end of January 2013,

Deloitte said, while the market as

a whole rose only 8.8 per cent in

the same period.

This marks a reversal of the

story seen in 2010, the accounting

giant said, when the 12 firms

joining the main market did 41.4

per cent worse than the FTSE 100

overall.

Deloitte equities head John

Hammond said a smattering of IPO

horror stories should not drive

investors away from firms listing

publicly for the first time.

There is a misconception that

IPOs are a bad investment and that

it is better to keep your money in

already listed stocks, Hammond

said. 2010s results perpetuated

this view. Our analysis shows that

the picture is changing as recent

IPOs have performed 11 per cent

better than the FTSE.

This data comes at a bad time

for the London IPO market, which

saw just four main market share

issues last year the lowest total

since 2009.

New listings

outdo FTSE in

last two years

BY BEN SOUTHWOOD

THE COALITION government faces

a divisive by-election after Chris

Huhne yesterday admitted

perverting the course of justice and

announced his resignation from

parliament on the day his trial was

due to begin.

The former Lib Dem cabinet

minister faces jail after admitting

handing speeding penalty points to

his then wife Vicky Pryce in 2003.

The trial of Pryce, who pleads not

guilty on the grounds of marital

coercion, will begin today.

Huhnes resignation means a by-

election for his Eastleigh seat, a

Huhne admits perverting justice

and kicks off by-election vote

BY JAMES WATERSON Tory-Lib Dem marginal, must be

held within the next three months.

The Hampshire seat is one of the

constituencies the Conservatives

must win if they want a majority at

the next general election.

Last night Ukip leader Nigel

Farage was considering whether to

stand as a candidate in the poll.

Mark Spragg of Keystone Law

told City A.M. that Huhne is

looking at twelve months behind

bars and a bill of at least 150,000

following a two year legal battle: If

he had pleaded guilty when first

interviewed by police he might just

might have escaped prison with a

suspended sentence or fine.

TUESDAY 5 FEBRUARY 2013

3

NEWS

cityam.com

Chris Huhne lost the 2007 Lib Dem leadership election to Nick Clegg by just 500 votes

PREMIER FOODS new chief

executive Gavin Darby has ousted

the groups chief operating

officer on his first day at the

helm.

The owner of Hovis bread

and Mr Kipling Cakes said

Geoff Eaton will leave the

company with immediate

effect and that the role of

chief operating officer

will cease to exist as

part of a board shake-up.

Eatons departure

follows former chief

executive Michael Clarkes

shock exit last week

Q

What does the government want from

the new nuclear programme?

A

The government wants to secure

long-term energy supply that will

also help its meet its environmental

emissions target.

Q

Who has signed up to the programme so

far?

A

EDF is working on the first new

build nuclear project at Hinkley

Point C in Somerset. Japanese firm

Hitachi got involved last year when it

bought Horizon Nuclear Power,

while questions remain over the

future of a joint venture between

GDF Suez and Iberdrola.

Q

What barriers does

the project face?

A

There are three main barriers to

the new nuclear project: cost,

planning permission for the nuclear

sites and government policy.

Q

Does Centricas exit leave the

governments plan in tatters?

A

Centricas partner EDF Energy

said yesterday that it remains

committed to Hinkley Point. It is

understood that interest in

Centricas 20 per cent stake could

come from China, where a state

energy company has previously

expressed an interest in the venture.

BRITISH GAS owner Centrica yester-

day pulled out of plans to build up to

four new nuclear power stations in

collaboration with EDF, blaming ris-

ing costs and the construction

timetable slipping.

Centrica has spent around 200m

on the project, which will be written

off in this years results. EDF is in dis-

cussions with a number of Chinese

groups with an eye to taking over

Centricas 20 per cent stake in the

joint venture.

The move follows last weeks deci-

sion by Cumbria county council to

reject a new 12bn nuclear waste dis-

posal site in the Lake District, seen as

vital to the UKs nuclear expansion.

Its unfortunate that Centrica is the

first official victim of the councils

vote but the prognosis for new

nuclear builds in the UK remains

extremely strong, Cumbrian MP

Jamie Reed told City A.M. yesterday.

I expect further changes [to outside

investors] as boardrooms get closer to

writing cheques but am assured that

contingencies are in place in case

smaller operators fall by the wayside.

The Department of Energy and

Climate Change (DECC) insisted

Centrica pulls

out of UK new

nuclear plans

BY CATHY ADAMS AND

JAMES WATERSON

Centricas decision did not affect the

case for nuclear expansion: We are

determined to make the UK a leading

global destination for investment in

new nuclear. The decision by Centrica

reflects the companys investment pri-

orities and is not a reflection on UK

government policy.

DECC cited the recent purchase of

Horizon Nuclear Power by Japans

Hitachi which yesterday revised

down its full-year profit forecast as

clear evidence of the attractiveness

of the new nuclear market in the UK.

Centrica will launch a 500m share

buyback programme to return capital

to shareholders, having previously

undertaken a 2.2bn rights issue to

fund its stake in the construction of

new power stations at Hinkley Point in

Somerset and Sizewell in East Anglia.

TUESDAY 5 FEBRUARY 2013

4

NEWS

cityam.com

Premier Foods new boss ousts

chief operating officer Eaton

BY KASMIRA JEFFORD

just 18 months after he joined the

group.

Shares have fallen more than 25

per cent in the week since the

announcement.

Darby, the former Cable and

Wireless Worldwide boss who

succeeded Clarke as chief

executive, yesterday said he

wanted a flatter executive

management structure...

that will enable

commercial and

functional management to

report directly to him.

Q

A

and Whats next for UK nuclear power?

Centrica PLC

4Feb 29Jan 30Jan 31 Jan 1 Feb

350.0

352.5

347.5

355.0

357.5

360.0

349.00

4Feb

ITALIAN prosecutors in the town

of Trani are investigating five

foreign banks for possible

manipulation of Euribor, the euro-

priced counterpart of scandal-hit

Libor bank-to-bank lending rates,

court sources said yesterday.

The five banks are said to be

Deutsche Bank, Barclays, Royal

Bank of Scotland, HSBC and Societe

Generale, according to the court

sources.

The probe was opened in July

after complaints from consumer

groups.

The Libor investigation in the UK

has rocked many of the top banks.

Italy probe on

Euribor claims

BY CITY A.M. REPORTER

SWISS watchmaker Swatch yesterday posted a 26 per cent rise in net income to

SFr1.61bn (1.12bn), smashing analyst expectations. The groups operating margin rose

to 25.4 per cent, versus 23.9 per cent a year ago, giving hope to other luxury goods

firms aiming for an uptick in demand from China.

SWATCH SALES TICK UP

Geoff Eaton joined the

firm in October

Lloyds chairman Sir Win

Bischoff also gave evidence

THE HEAD of Chinas central bank

Zhou Xiaochuan will step down next

month after 11 years, according to a

report in a state-run newspaper, the

China Securities Journal.

Zhous departure was signalled at

the end of last year when he was

excluded from the Communist

Partys central committee.

Zhou, 65, gained the nickname Mr

RMB when he oversaw the loosening

of the states exchange rate regime

for the renminbi in 2005.

Mooted successors include the

head of Chinas banking regulator

Shang Fulin and Guo Shuqing the

chief securities regulator.

Mr RMB to bow

out this March

BY CITY A.M. REPORTER

LLOYDS chief executive may not

receive this years bonus until the gov-

ernments stake in the bank is above

the level it put into the institution, it

emerged yesterday.

The banks remuneration commit-

tee is thought to be considering hold-

ing back the payment of Antonio

Horta-Osorios bonus until the share

price recovers beyond its bailout

level.

They have not yet decided the

level of that bonus.

The chief declined to com-

ment on his likely payout, but

told the Parliamentary

Commission on Banking

Standards he is aware

of public anger over

pay.

We are very

mindful of the gen-

eral environment

in financial servic-

es, he said.

At the hearing

Ho r t a - Os o r i o

revealed he dis-

agrees with the

British Bankers

Lloyds bonuses

may face new

bailout target

BY TIM WALLACE

Association on ringfencing. Lloyds

favours tough rules to enforce the par-

tial separation of retail and invest-

ment banking, but the industry body

opposes the plan.

We are the only bank to publicly

support the ringfence, and we support

electrification, he said. It is absolute-

ly correct that for society as a whole it

is better for financial stability and

from a cultural perspective to have a

ringfence with strong enforcement

and incentives.

But the bank is not entirely in

conflict with the BBA Lloyds

chairman Sir Winfried Bischoff

called for a standards body to be

set up with the powers to strike

off errant bankers in the same

way as bad doctors are

banned from the profes-

sion, in line with pro-

posals the lobby group

is considering.

Horta-Osorio also

said he wants a cut off

date for PPI claims,

arguing it would

speed up the process,

cut the costs from

bogus applications

from claims compa-

nies, and help the

industry move on from

the scandal.

Chief executive of Lloyds Antonio Horta-Osorio was hired to clean up the bank

STARBUCKS tax arrangements are

perfectly legitimate under

international tax rules and do not

represent abuses of the system, tax

heads from HM Revenue and

Customs (HMRC) and the Treasury

said yesterday.

The coffee chain had come in for

criticism for recording no UK

profits and so not paying

corporation tax in Britain, despite

large sales in the country.

But that is the result of the firm

abiding by international

agreements, not of abusive

arrangements according to the

Treasurys corporation tax head.

BY TIM WALLACE

TUESDAY 5 FEBRUARY 2013

7

NEWS

cityam.com

NATIONAL regulators across the

European Union must show by the

end of the month they are not

damaging the single market by

being too heavyhanded with banks

from elsewhere in the bloc, the EC

said yesterday.

Britain has lobbied for more

wriggle room as its regulators

discourage foreign branches and

put pressure on lenders to set up

subsidiaries that are required to

have their own capital and

liquidity buffers to withstand

market shocks.

BY HARRY BANKS

EC deadline for

bank regulators

The media debate has

fundamentally been about taxing

rights allocated between countries

something determined in

accordance with international

principles and not something the

general anti-abuse rule (GAAR)

could rewrite, Mike Williams told

the House of Lords economic

affairs committee.

Multinationals adopt a range of

tax structures and when they are

abusive the GAAR will apply to

multinationals.

Meanwhile HMRCs Judith Knott

argued the GAAR will cut down on

legal bills by creating a simple

smell test for tax schemes, rather

than needing expensive advice.

Tax bosses say Starbucks has

not been abusing the system

THE GERMAN government is

considering a new law to imprison

bank executives for up to five years if

they are found guilty of reckless

behaviour that puts a bank at risk.

Weve found a regulatory gap

here that we want to close, a senior

government official in Berlin said

yesterday. According to the draft

banking law amendment, which

the cabinet discussed yesterday, a

manager may face a jail sentence if

he deliberately ignored risk rules

and thereby risked the collapse of a

financial institution.

German plans

to jail bankers

BY CITY A.M. REPORTER

BRITAINS accountants have

enjoyed a seven per cent pay rise in

the last year, marking three years

of solid wage growth, research

showed yesterday.

The average salary rose five per

cent to 64,022, according to a

survey conducted by financial

services recruiter Marks Sattin.

But it was a bigger-than-expected

bonus pool that boosted bean

counters pay packets, with the

average bonus jumping from just

over 9,500 to more than 11,000

in 2012/13.

Around 47 per cent received a

bonus this year, up from 45 per

cent a year ago.

Obviously accountants are not

immune from the gloomy

economic news, hence their

understated bonus expectations,

said Dave Way, deputy managing

director of Marks Sattin.

But the news is actually very

good for them these figures

represent the third year in a row of

solid, above inflation, pay growth,

Sattin added.

Accountants

enjoy fresh

rises in pay

BY AMY-JO CROWLEY

UK listed companies returned twice as

much money to shareholders

through share buybacks in 2012 as

they raised in new capital, according

to figures released today.

Last year businesses spent 12.4bn

buying back and cancelling their own

shares compared to the 5.9bn they

raised from the stock market through

IPOs and rights issues.

The imbalance suggests that com-

panies do not see enough investment

opportunities to justify keeping hold

of cash let alone raising new cash

from shareholders, said Laurence

Sacker of accountancy group UHY

Hacker Young.

A narrowing of that gap would be

an important indicator that the mar-

ket is starting to fire on all cylinders

and returning to its crucial function

Stock buybacks

twice as likely

as new issues

BY JAMES WATERSON of funding future growth.

The British IPO market was stagnant

for most of last year, with Direct Lines

successful float in October accounting

for more than a tenth of total annual

funds raised through share issues.

By contrast, in 2009 just 593m was

returned to investors through buy-

back schemes, while companies raised

76.7bn.

Shareissuanceandrepayment amongUKlistedcompanies

2012 2011 2010 2009 2008 2007

40

50

30

20

10

0

60

70

80 bn Issuance

16.5

28.4

54

17.2

76.7

18.1

4.9 5.9

0.6

4.1

14.4

12.4

Repayment

MORE than half of UK finance

directors have no succession plan

in place according to research

released today.

The survey of 200 finance

directors by recruitment

consultancy Robert Half found 55

per cent of respondents had no

plans to ensure a smooth

transition at their business,

Yesterday Barclays confirmed

that group finance director Chris

Half of finance directors have

no succession plan at their firm

BY JAMES WATERSON Lucas was leaving the business but

said it would take a considerable

time to find a replacement,

highlighting the difficulties

associated with finding suitable

top-level executives.

With a raft of high profile

senior resignations over the past

year, it is surprising to see such a

large proportion of financial

directors without a chosen

successor, or indeed the pool to

choose from, said Phil Sheridan,

of Robert Half.

TUESDAY 5 FEBRUARY 2013

8

NEWS

cityam.com

Barclays group finance director Chris Lucas is leaving the bank after six years in the role

IN BRIEF

FORMER JP Morgan dealmaker

Ian Hannam, one of the Citys

most prolific M&A bankers, is

in the early throes of setting up

a new investment boutique

advising companies in the

mining, oil and gas sectors, it

emerged yesterday.

Hannam, who stepped down

from his role at the bank last

April to contest a 450,000 fine

handed to him by City

regulators, is understood to be

lining up City grandee John

Manser as chairman of the

prospective business, which is

in the very early stages of

applying for regulatory

approval,

Manser was

chair of

legendary City

merchant bank

Robert Fleming

until its eventual

merger into JP

Morgan

Cazenove,

Hannams

former

Top dealmaker Hannam gets

set for new advisory venture

BY MICHAEL BOW

stomping ground. Manser is

currently chairman of

Shaftesbury and deputy

chairman of SABMiller.

A spokesman for Hannam

declined to comment on

speculation about a new

venture yesterday but referred

to an earlier statement which

said: Ian Hannam has said he

intends to set up his own FSA-

registered business.

However, the plans are still

evolving and until they are

finalised and ready to be

announced publicly, it is

inappropriate to comment on

details which may be subject to

change and which should

remain confidential.

Before his resignation,

Hannam was one of the Citys

busiest dealmakers clocking up

hundreds of floats and

mergers. He had a hand in the

early stages of the Xstrata and

Glencore mega merger which

closed last year.

PETER Cruddas, executive chairman

of CMC Markets and former co-treas-

urer of the Conservative Party, was

yesterday awarded libel damages of

45,000 in the High Court against

Mark Adams, the political lobbyist.

Cruddas stepped down from his

post in the Conservative Party after a

series of allegations about his role in

Tory party funding.

At a previous court hearing in

November 2012, judgment had been

entered against Adams with dam-

ages to be assessed. Adams is also

required to pay the costs of the

action, more than 120,000, and has

undertaken to the court not to pub-

lish in future the defamatory allega-

tions he had posted about Cruddas

on his standup4lobbying website

and via his Twitter account.

Commenting, Jeremy Clarke-

Williams, a lawyer at Slater &

Gordon who represents Cruddas,

said: The very serious nature of the

defamatory campaign pursued by

Adams left Cruddas with no option

but to accept his invitation to sue

him for libel. .....There now remains

his ongoing libel action against The

Sunday Times.

Cruddas gets

45,000 win

BY DAVID HELLIER

Top rainmaker Ian

Hannam is prolific

M&C Saatchi heads claim shares

n Advertising giant M&C Saatchi has

awarded shares worth more than

7m to four directors, including co-

founder Lord Saatchi, as it

announced profits in line with

expectations. In an interim

statement, the agency network said

it was awarding 886,733 shares each

to Lord Saatchi, chief executive David

Kershaw, executive director Bill

Muirhead and chairman Jeremy

Sinclair. The shares are worth just

over 7m based on yesterdays

closing price of 198.5p. The firms

year-end report will be on 18 March.

LondonMetric starts spending

n LondonMetric Property has moved

quickly to boost its property portfolio

following the merger of London &

Stamford and Metric Property

Investment last month. In its first

interim management statement, the

firm said that between 1 October last

year and 1 February it has exchanged

contracts for six retail warehouses

worth 92.4m, as well as further sales

and lettings. Chief executive Andrew

Jones said: We are excited to have

announced the 92.4m portfolio

acquisition so soon after completing

the merger.

Banco de Valencia posts loss

n Spains Banco de Valencia, which

was bought by Spains third-largest

lender Caixabank last year, reported a

loss of 3.6bn (3.1bn) for 2012, the

bank restructuring fund (FROB) said

yesterday. While Banco de Valencia is

still technically held by the FROB,

CaixaBank bought the smaller lender

for 1 with the benefit of a

government-funded programme to

protect it against future losses on

assets. A Caixabank spokesperson

said the loss has not been

consolidated into the larger banks

results.

THE WORLDS MOST EXPENSIVE CITIES

#1 TOKYO

#2 OSAKA

#12 FRANKFURT

#46 MOSCOW

#3 SYDNEY

#6 SINGAPORE

#4= MELBOURNE

#4= OSLO

#7 ZURICH

#10 GENEVA

#8 PARIS

#16 LONDON

#47 MANCHESTER

#9 CARACAS

LONDON will gain its own TV station

next year, after the race to operate the

channel was awarded to Russian

billionaire Alexander Lebedev, the

owner of the Evening Standard and

Independent newspapers.

Communications regulator Ofcom

announced that Lebedevs London

Live bid had beaten four competitors

to win the rights to the contract.

London is one of 21 areas which will

switch on a local TV station from late

2013, although following delays to the

awarding process, London Live is

unlikely to be switched on before this

time next year.

The station will focus on news and

current affairs with programming

created by staff at the Standard.

It will also present live politics cover-

age with space for drama and sports.

Standard owner

wins London TV

BY JAMES TITCOMB The race to win the 12-year licence

for the London channel was the most

hotly contested in the UK, with the

ability to reach four million viewers a

big advertising opportunity.

Launching a TV station could turn

Lebedevs British media holdings into

a profitable enterprise for the first

time since he bought the Independent

and a majority share of the Standard

in 2009.

The most recent figures available for

parent company Lebedev Holdings

showed a 27.4m loss in 2011.

It is controlled by Alexanders son,

Evgeny, who will be chairman of the

TV company, ESTV.

Other bidders for the London TV

licence included London8, led by for-

mer Channel 4 chairman Luke

Johnson, and LondonTV, fronted by

former ITV News editor David

Mannion.

DO YOU THINK IT IS EXPENSIVE TO

LIVE IN LONDON?Interviews by Amy-Jo Crowley

Food kills me. Things like Pret are totally over-

rated - 3.50 for a sandwich is extortionate and

youre lucky to get a proper meal for 10. If I was to eat

out every day, I think Id easily spend 40-60 a week.

These views are those of the individuals above andnot necessarily those of their company

TOBY WILLIAMS

JP MORGAN

Its difcult for young people who have left Uni

or starting out on their rst job. But there is

denitely a lot of things to do the galleries and muse-

ums are free which can help keep you active and busy.

JEMIMA HARRIS

CLARKSONS

Our company is based out of different cities

and in different places such as Norwich for

about 400, you get your own one-bedroom at per

month. Here you have to pay at least twice as much.

RAGAV SAWHNEY

AVIVA

CITYVIEWS

TUESDAY 5 FEBRUARY 2013

9

NEWS

cityam.com

TOKYO has regained its position as

the most expensive major city in

the world, according to figures

released today, while the ongoing

financial crisis has pushed down

the relative cost of living in the

Eurozone.

Research by the Economist

Intelligence Unit shows uncertainty

surrounding the single currency

has made it relatively cheaper to

live in cities such as Frankfurt,

Brussels and Dublin. London rose

one position to joint 16th place.

Asian cities have also been rising

on the back of wage growth and

economic optimism, said the

Tokyo tops cost of living table

but London rises to 16th place

BY JAMES WATERSON

reports editor Jon Copestake. This

means that over half of the 20 most

expensive cities now hail from Asia

and Australasia.

The report considers more than

160 items in large cities, including

the price of a litre of petrol, a loaf

of bread and a bottle of table wine.

The cost of these items are then

converted into US dollars and

weighted in order to achieve

comparative indices.

Caracas makes the top ten most

expensive currency due to

substantial price volatility and a

fixed exchange rate between the

Venezuelan bolvar and the dollar.

Karachi in Pakistan is the

cheapest major city on the list.

MOSCOWS stock exchange will be

valued at up to $4.6bn in its

planned stock market flotation,

which will raise around $500m for

the company and selling

shareholders, according to a price

range published yesterday.

The Moscow Exchange, Russias

main venue for trading in stocks,

bonds, currencies and derivatives,

is to float on its own platform in

an attempt to revitalise Russias

capital markets and convince

companies to list domestically.

Russian stock exchange priced

BY CITY A.M. REPORTER

Promoting Moscow's markets

has been backed by the Kremlin in

a bid to transform the Russian

capital into a global financial

centre. President Vladimir Putin

recently called for upcoming

privatisations of state assets to be

held in Russia.

The exchange, formed in 2011

through the merger of Moscows

two largest stock exchanges

MICEX and RTS set an

indicative price range for its initial

public offering (IPO) of between 55

(1.15) and 63 roubles.

Etihad triples

its net profits

BY CITY A.M. REPORTER

ROYAL Caribbean Cruises, the

worlds second-largest cruise

operator, yesterday said that strong

US demand and a jump in bookings

so far this year would help mitigate

lingering weakness in Europe in

2013.

The firm reported a fourth-

quarter net loss of $392.8m

(249m), on revenue of $1.81bn,

compared with a profit of $36.6m

on revenue of $1.78bn a year earlier.

The loss stemmed from a $413.9m

impairment charge related to its

Spanish cruise line Pullmantur,

which has been hit by austerity

measures in that country.

The company said it has seen a

significant deterioration in

demand in Spain, and sales across

the industry have been hit by the

sinking of the Costa Concordia.

Choppy waters

for cruise firm

BY CITY A.M. REPORTER

SCRAPPING air passenger duty (APD)

would end up benefiting the public

purse, according to research

conducted by PwC and

commissioned by airlines.

If the government ended the

controversial levy on air travellers

entering or leaving the UK, the

subsequent boost to businesses

could lift GDP by 0.46 per cent this

year, the study by PwC claimed

yesterday.

The rise in business activity would

more than offset the amount raised

by APD each year, leading to a net

gain of 500m a year in the first two

years for the exchequer, it adds.

The Treasury expects to take

2.9bn in air passenger duty in

2012/13, rising to 3.9bn by 2017/18.

PwCs report, which comes just

over a month ahead of George

Osbornes next Budget, was

commissioned by four of the UKs

biggest airlines.

British Airways, Virgin Atlantic,

Axe tax and lift

growth, airlines

urge Osborne

BY MARION DAKERS

Ryanair and EasyJet put aside

rivalries in 2011 to jointly lobby for

the end of APD through their Axe

the Tax campaign.

The levy has long been a bugbear

of the travel industry, and sparked a

fresh wave of criticism when it rose

by eight per cent last April.

APD costs between 13 per

passenger on a short-haul flight and

92 for long-haul journeys.

The government must urgently

review the reports

recommendations ahead of the

upcoming Budget, said Mark

Tanzer, chief executive of the

Association of Britsh Travel Agents.

The four airlines said in a

statement: Should APD be abolished

the aviation industry would be able

to move quickly to add new flights in

and out of the UK, or invest in new

products and services, creating new

opportunities for businesses and

much needed jobs across the UK.

The report claims that 60,000 jobs

would be created if the tax gets the

chop in the Budget.

EasyJet boss Carolyn McCall New Virgin Atlantic boss Craig Kreeger

Ryanairs Michael OLeary Willie Walsh of British Airways parent IAG

TUESDAY 5 FEBRUARY 2013

10

NEWS

cityam.com

fixed

grin

for ve years

5 Year Fixed Rate

Limited Edition

Repayment Mortgage

2.89%

Fixed for 5 years, changing to our Standard

Variable Rate for the rest of the term, currently

3.69%

The overall cost for comparison is

3.6% APR

A non-refundable booking fee of 1,999

applies. Maximum loan to value (LTV) is 65%.

An early repayment charge applies during the

xed rate period.

With a competitive 5 Year

Fixed Rate Mortgage

Looking for a fixed rate mortgage deal?

Thisll make you happy. Fix for five years

with first direct and you can count on

your repayments staying the same until

2018. And if that wasnt enough, we were

named the UKs Most Trusted Mortgage

Provider by Moneywise*. Smiles all round.

Other fees and charges may apply.

Mortgage funding for this offer is limited

and the offer may be withdrawn at any

time without notice. You must hold or open

a 1st Account to qualify. We have a range

of mortgages with and without fees. For

our full range, please call or check online.

Your home may be repossessed if you do not keep up repayments on your mortgage.

* Awarded Most Trusted Mortgage Provider at Moneywise Customer Service Awards in July 2012. first direct

credit facilities are subject to status. Because we want to make sure were doing a good job, we may monitor and/

or record our calls. HSBC Bank plc 2013. All Rights Reserved. first direct 40 Wakefield Road, Leeds LS98 1FD. A

C

2

0

8

6

3

US computer giant Dell gets

closer to $24bn buyout deal

DELL was last night moving closer

to a near $24bn (15.2bn) buyout

deal, with price negotiations

narrowing to $13.50 to $13.75 a

share in what would be the

biggest leveraged buyout since the

financial crisis.

Talks between Dell, the worlds

third biggest computer maker,

and a consortium led by its

founder and chief executive,

Michael Dell, to take the company

private were in the final stages

yesterday, a person familiar with

BY CITY A.M. REPORTER

the matter said.

An outcome is expected soon,

the person said, cautioning that

no final agreement had been

reached and negotiations could

still break down.

Dell shares fell almost three per

cent yesterday.

Microsoft, which provides its

Windows software for Dell

computers and is also part of the

investment consortium, is

expected to invest around $2bn in

the deal, while private equity firm

Silver Lake is expected to put in

about $1bn, the source said.

Michael Dell is expected to roll

over his roughly 16 per cent stake

and put in some of his own money

so he has control of the company,

the source added.

Dell and Silver Lake declined to

comment and Microsoft did not

immediately respond to a request

for a comment.

The $13.75 per share is a

premium of about 23 per cent to

the average of $11 per share Dell

traded before news of the deal

talks broke, but is far below the

$17.61 that the shares were trading

a year ago.

ETIHAD Airways yesterday said its

net profit tripled in 2012 as its

fast-expanding global network

attracted more passengers.

Etihad which has stakes in Air

Berlin and Virgin Australia and is

close to taking a stake in Indias

Jet Airways earned a net profit of

$42m (26.6m) in 2012, compared

with $14m in the previous year.

Revenue rose 17 per cent to

$4.8bn, the airline said in a

statement.

The eight-year old carrier made

its first profit in 2011.

The UAE carrier competes with

key Gulf rivals like Emirates and

Qatar Airways.

Etihad said it carried 10.3m

passengers last year, up 23 per cent

over 2011. The average seat factor

was 78.2 per cent.

T

HE strike that hit Lonmins

Marikana platinum mine in

South Africa last summer is the

one that sticks most tragically

in the memory, thanks to the

appalling violence which broke out,

ending with 34 strikers dead at the

hands of the police on a single day

the bloodiest security incident in

the troubled nation since the end of

apartheid.

Yet Lonmin was not the only firm

affected. Platinum miner Amplats,

part of the FTSE 100 mining and

natural resources group Anglo

American, endured problems on an

enormous scale as the year wore

on, at one point sacking 12,000

miners at a swoop.

It is hardly surprising that these

damaging disputes, costly in

human life and to corporate

bottom lines, were reflected in the

disappointing numbers reported by

Anglo and Amplats yesterday.

Amplats, which is the worlds

biggest platinum producer, saw a

headline loss of $170m (108m)

over the 2012 calendar year, down

from a profit of $527m the year

before. For Anglo American, this

translated into a $225m loss to

underlying earnings, down from a

$410m contribution to the same

measure of earnings in 2011. Shares

fell 1.51 per cent on the news.

Such shocking losses are in line

with the shocking scale of the

problem. Of more concern for

investors today is how intractable

the situation in South Africa still

appears. Amplats has already

announced this year a fresh round

of job cuts, with 14,000 intended to

be axed, as it mothballs some

mines in order to reduce platinum

output a plan that was predicted

to reduce the worlds total

platinum production by seven per

cent.

However, these plans met with

an unsurprisingly frosty reception

and the threat of further strikes.

Amplats has subsequently delayed

implementing the radical scheme

while it negotiates further with the

unions.

Part of the problem is the

generosity of Lonmin, which

buckled in the face of the dreadful

escalation at Marikana and offered

its workers a 22 per cent wage hike.

As a result, other platinum miners

find themselves faced with the

option of following suit or being

threatened with more labour

disruption until they offer similar

concessions. It is hardly surprising

that laying off 14,000 miners looks

unacceptable by comparison.

And yet both Anglo and Lonmin

are in their different ways trying to

adjust to some tough new market

realities. The price of platinum fell

off a cliff in 2008 and is still

trading below its pre-crisis trend

price.

Platinum suffers from being a

useful metal. Important for

catalystic converters in cars, the

slowdown in Europes automobile

market has hit demand very hard

and prices have been depressed as a

result. The stoppages last year, with

all the uncertainty they brought

and their constraining effect on

production, failed to make prices

for the white metal spike up even

to match the recent highs of early

2011. Anglos 2012 losses are bad

but worse still is the reality that

there is no imminent gleam at the

end of this tunnel except the lamp

of an angry miner.

MINER Anglo American will take a

$225m (143m) hit in this years

results for its interest in its platinum

operations, following violent strikes

last summer.

Anglo American, which is due to

report its annual results next week,

said it will take the $225m as an

underlying loss in respect of majori-

ty-owned subsidiary Anglo American

Platinum.

Separately, Amplats, which is 80

per cent owned by its London-listed

parent, yesterday posted an operat-

ing loss of ZAR6.3bn (451m) for

2012, a drop of 180 per cent from a

profit of almost ZAR8bn last year.

Lower sales volumes due to the two-

month long strike that erupted in

August last year, higher mining costs

and lower platinum costs all

weighed on the miners results.

Amplats said it produced eight per

cent less refined platinum year on

year, hit by the industrial action that

erupted last summer that plagued

Anglo warns of

$225m loss on

back of strikes

BY CATHY ADAMS

many of its peers working across

South Africas platinum belt.

Amplats chief executive Chris

Griffith yesterday labelled 2012 a

challenging year for the company

and the platinum industry as a

whole, adding that it was charac-

terised by increasingly volatile

markets.

Last month, Amplats unveiled a rad-

ical overhaul of its South African

operations, involving the sale of a

mine complex and the closure of sev-

eral shafts. The restructuring could

lead to the loss of up to 14,000 jobs.

BOTTOM

LINE

MARC SIDWELL

Anglo American PLC

4Feb 29Jan 30Jan 31 Jan 1 Feb

1,900

1,920

1,880

1,940

1,960

1,980 p

1,924.50

4Feb

TUESDAY 5 FEBRUARY 2013

12

NEWS

cityam.com

Making flying better from London.

Fares are one way including taxes and charges, only available online, subject to availability. Avaliable for travel on or before 25.10.13.

No debit card fees apply, credit card fee of 11 per booking may apply. Flybe operate from London Gatwick.

Book now!

Discover the

wonderful

Isle of Man.

Fly from

99

36

one way

Up to

4 flights a day.

Hard choices ahead as platinum prices fail to brighten

WITH just over two weeks to go

before Bumis boardroom battle

on 21 February, senior

independent non-executive

director Julian Horn-Smith has

called on co-founder Nat

Rothschild to give up more than

16m bonus shares.

Rothschild was granted the

shares when his acquisition

vehicle Vallar bought Bumi assets

in 2011.

It is now clear that the deal and

deal structure which Nat proposed

and championed for Vallar has

resulted in considerable losses for

many shareholders, Horn-Smith

said in a statement.

Following meetings with

shareholders over the past few

weeks there is growing pressure

Bumi director urges Rothschild

to return his 16m bonus shares

BY CATHY ADAMS

from them for Nat to return these

shares, he added.

The board believes it is unjust

that Nat should be able to

continue to own and vote these

shares which he received as the

result of a flawed transaction. It is

wrong for failure to be rewarded

and this bonus should be clawed

back.

Rothschild responded: These

shares were awarded because I and

my associates put up 20m in cash

ahead of the IPO of Vallar; this

20m would have been lost,

without any compensation to me,

had we failed to execute the IPO.

In a letter to shareholders

yesterday, the financier urged

them to save Bumi and vote for

his radical board overhaul at the

meeting in a little over two weeks

time.

IN BRIEF

EnQuest hits output targets

nProducer EnQuest hit its production

targets for 2012, it said yesterday,

producing an average 22,802 barrels a

day. The FTSE 250 explorer, which last

month became the first oil company

to launch a retail bond, had given

guidance of between 20,000 and

24,000 barrels of oil equivalent a day.

EnQuest added that the first oil was

expected from its Alma/Galia project

in the North Sea in the fourth quarter

of this year. Separately, the London-

listed explorer said its bond offer

period would close this Friday, and the

offer would be at least 100m.

Rolls-Royce wins Air Lease order

nRolls-Royce has netted an order for

its Trent XWB engines worth $1.1bn

(699m) at list prices from leasing

company Air Lease Corporation. The

engines will be used to power 25 of

Air Leases Airbus aircraft.

Additionally, Air Lease has an option

for an extra five aircraft. The Trent

XWB engine specially designed for

the Airbus A350 is the fastest selling

Trent engine ever, Rolls-Royce said

yesterday, with more than 1,200

already sold. Shares in the FTSE 100

power systems company closed up

0.05 per cent yesterday at 971.5p.

Sumitomo buys Surrey water

nJapanese trading house Sumitomo

has agreed to spend 164.5m on

buying Sutton and East Surrey Water

Group from Aqueduct, which is

owned by investors including Icon

Infrastructure. The utility firm, which

serves around 655,000 water

customers in south east England,

had attracted bid interest from CVC

and Beijing Water Company.

Sumitomo was advised by Nomura,

while Aqueduct and Icon took advice

from Citigroup and law firm

Freshfields.

GOLD miner Randgold Resources yes-

terday posted record production and

profits for last year, despite a tough

time at some of its African operations.

The FTSE 100 miner logged profits of

$511m (325m) over the year, up 16

per cent. Production was up 14 per

cent, at 794,844 ounces of gold.

Quarter on quarter, profit in the

three months to September was up 18

per cent and production rose by five

per cent.

On the back of soaring profits,

Randgold which has operations in

Mali, the Congo and the Ivory Coast in

Africa has proposed a 25 per cent

hike in the annual dividend to $0.50.

On an operational level, its flagship

Loulo-Gounkoto complex in Mali

exceeded its output target for the

year, producing more than 500,000

ounces of gold, on

the back of devel-

opment of the

Yalea and Gara

unde r g r o und

mines.

Gold output at

Randgolds Tongon

Randgold tops

FTSE 100 risers

on record profit

BY CATHY ADAMS

mine in the Ivory Coast inched down

from 250,390 ounces in 2011 to

210,615 ounces last year.

Randgold blamed frequent outages

in the grid power supply leading to

plant stoppages for the fall in pro-

duction.

It's been a particularly eventful year

but the team once again rose to the

challenges, chief executive Mark

Bristow said yesterday.

Not only did we achieve very cred-

itable results for 2012 but we start

2013 in good shape and with a

renewed focus on growing our produc-

tion and managing our costs.

Bristow reiterated Randgolds annu-

al production target of 1.2m ounces of

gold by 2015. This year, he said the

company was focussed on pouring the

first gold at its Kibali mine, getting

Tongon back on target and maintain

the strong performance at Loulo and

Morila.

Randgold was the biggest blue chip

riser yesterday.

Salamander soars as it strikes oil at

the North Kutei basin off Indonesia

SHARES in explorer Salamander Energy

soared yesterday as it said it had discovered

oil at a well offshore Indonesia.

The London-listed explorer said

yesterday that it had discovered 40 metres

of net oil and gas in sandstones in the

North Kutei basin part of Salamanders

multi-well drilling programme off the

coast of Indonesia.

The well was drilled to a depth of more

than 2,000 metres, and was flowing at

6,000 barrels of light oil and 8m cubic feet

of gas per day during tests, Salamander

said in an operational update.

BY CATHY ADAMS The well, known technically as the South

Kecapi-1 DIR/ST exploration well, has been

plugged and abandoned as an oil and gas

discovery.

Work is now underway to confirm the

resources. Salamander said that the gas

resources are not commercial on a

standalone basis.

We are very encouraged by these results

and are now moving on to drill one of the

largest structures in the basin at the North

Kendang location, chief executive James

Menzies said yesterday.

Phil Corbett, analyst from Deutsche

Bank, hailed the FTSE 250 explorers

discovery yesterday, adding that it could be

transformational for Salamanders

investment case.

Shares closed up 11.83 per cent at 208p.

Randgolds gold production hit record highs in 2012

Salamander Energy PLC

4Feb 29Jan 30Jan 31 Jan 1 Feb

195

200

185

190

180

205

210

215 p

208.00

4Feb

TUESDAY 5 FEBRUARY 2013

13

NEWS

cityam.com

Chief exec

Mark Bristow

Randgold guided production in a range of 900-950,000 ounces,

representing a 13-19 per cent increase over 2012, based on more conservative

guidance for Tongon and Morila than our forecast of 950,000 ounces. We

maintain our buy rating.

ANALYST VIEWS

2012 production was broadly in line with our numbers. Cash costs were

up at both Loulo and Tongon due to issues with recoveries that we expect will

run into the rst quarter of this year. Kibali capital expenditure overrun

was only six per cent which is better than our estimation of 10 per cent.

Given that the share price falls since October have arguably factored in

the uncertainty over Mali conict, the reassurance from Bristow and his team

that Randgold Resources is on target to produce 1.2m ounces of gold by

2015 is good enough for us.

WHAT SHOULD INVESTORS

WATCH OUT FOR IN

RANDGOLDS RESULTS? Interviews by Cathy Adams

TIM DUDLEY CANACCORD GENUITY

KATE CRAIG LIBERUM CAPITAL

RICHARD CURR PRIME MARKETS

ANADARKO yesterday reported

fourth-quarter net income of

$203m (128.8m) a big

improvement on the $358m

loss at the same time last year.

Adjusted net income for the

quarter was $457m, or 91 cents

a share, compared to $423m or

85 cents a share at the same

time last year. Analysts had

Anadarko moves back into

black for 2012 fourth quarter

BY CITY A.M. REPORTER forecast the company to report

earnings of 72 cents per share

for the quarter.

Total revenues for the oil and

gas producer fell to $3.41bn

from $3.84bn last year.

However that was still above

analysts consensus revenue of

$3.38bn for the period in 2012.

Shares fell 0.8 per cent to

$80.50 at the close of New York

trading.

KFC parent Yum Brands

yesterday warned it expects

2013 per-share earnings to

shrink rather than grow, as it

grapples with a food safety

scare that ensnared some of its

chicken suppliers in its top

market.

The company, which gets

more than half of its overall

KFC poultry probe leaves

bad taste for Yum Brands

BY CITY A.M. REPORTER

Randgold Resources Ltd

4Feb 29Jan 30Jan 31 Jan 1 Feb

6,100

6,200

6,000

6,300

6,400

6,500 p

6,275.00

4Feb

sales and operating profit from

China, reported a six per cent

drop in fourth-quarter sales at

established restaurants in

China due to adverse

publicity regarding its

poultry supply.

As a result, Yum forecast a

mid-single digit percentage

decline in earnings per share

for 2013.

L

A

U

R

A

L

E

A

N

/

C

I

T

Y

A

.

M

.

FORMER Morgan Stanley investment

banker Emmett Kilduff has

left the firm to become a

social media guru.

Eagle Intel, which

launches fully next

month, aims to capture

stock intelligence from the

likes of Twitter to assist

institutional investors. The

Capitalist hears that fund man-

ager Tim Steer from Artemis is

one of 15 City clients already

signed up.

My father was a successful technol-

ogy entrepreneur and I grew up

wanting to launch my own business,

Kilduff told The Capitalist. He appears

to not only be following in his

parental footsteps, but also those of

DCM Capital, which offers a similar

analytics service.

This is not his first foray into web

entrepreneurship. Kilduff founded

cmypitch.com in 2008 after

eight years at Credit Suisse,

but returned to invest-

ment banking after his

first web venture ended.

Ex-banker Emmett Kilduff

Good news for City thespians:

there are two new financial sector-

inspired productions on the horizon. The

first by Anders Lustgarten If You Dont

Let us Dream, We Wont Let You Sleep

looks at what life might be like in a

privatised world where hedge fund

managers can hedge on social issues

like crime and healthcare. The play,

starring The Kumars actress Meera Syal

(pictured), runs at the Royal Court

Theatre from 15 February to 9 March.

For a more playful take on the financial

sector, the Bush Theatre is offering up

Money: The Game Show by playwright

Clare Duffy. The production involves

10,000 of hard cash

being gratuitously

flashed on-stage

while the audience is

invited to play a

series of high

stake games

that explore

how the worlds

economic

system came to

the brink of

collapse. From

now until

2 March.

Twitter power

harnessesed

by ex-banker

14

cityam.com

TUESDAY 5 FEBRUARY 2013

cityam.com/the-capitalist

THECAPITALIST

EDITED BY CALLY SQUIRES

Got A Story? Email

thecapitalist@cityam.com

The new

jobs website

for London

professionals

C

I

T

Y

A

M

C

A

R

E

E

R

S

.

c

o

m

The Bishop of Durham, Reverend Justin Welby, returned to the City yesterday when he was

confirmed as the 105th Archbishop of Canterbury at St Pauls Cathedral. No stranger to the

Square Mile, the new Archbishop worked in corporate finance for two oil companies before

he retrained as an Anglican priest in his mid-30s. Tweeting to his online followers after the