Escolar Documentos

Profissional Documentos

Cultura Documentos

Relative Resource Manager

Enviado por

Marcus GohDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Relative Resource Manager

Enviado por

Marcus GohDireitos autorais:

Formatos disponíveis

Final Exam 1 (Trial) Suggested Solution Outline

1a) This is a transportation model. Outline of steps: i) ii) iii) iv) State total demand is more than total supply, hence unbalance problem. Decision variable : xij represent number of products from warehouse i to distribution center j. Objective function: Min transportation cost Constraints : note that the supply constraints is = while the demand constraint is <=.

1b) This is an extension of 1a) into a transshipment problem. Let x ij be number of products from location i to location

j , where i 1, 2 ,3, 4 ,5, 6 and i 4 ,5, 6 ,7 ,8,9 . The transshipment nodes A, B and C are

represented by 4, 5 and 6 respectively, and the demand nodes A,B,C are represented by 7,8 and 9 respectively. Note that we are still referring to the same warehouse. The different indexes are meant to differentiate the transshipment point and the demand point.

min 12 x 14 11 x 14 ... 12 x 36 0 x 47 8 x 48 3 x 49 x 57 0 x 58 2 x 59 7 x 67 2 x 68 0 x 69 s .t .

x

j4 6

ij

S i , for i 1, 2 , 3 , and S 1 70 , S 2 80 , S 3 50 D j , for j 7 ,8 , 9 , and D 7 60 , D 8 100 , D 9 50

x

i4 3

ij

3 3

xi4 x i5 xi6

i 1

x

j7 9

4 j

i 1

x

j7 9

5j

i 1

x

j7

6 j

x ij 0 , i 1,..., 6 , j 4 ,..., 9

There are more than one way to do this. The above model is closest to a transshipment model.

2a)

b) Let xij be the flow on branch i-j, for i,j=1,..,7 max x71 s.t. x71-x12-x13-x14=0 x12 x23-x25-x27 =0 x13 -x35=0 x14-x45-x46=0 x25+x35+x45-x57=0 x46-x67=0 x27+ x57+x67-x71=0 x12 10 x13 15 x14 18 x23 12 x25 4 x27 7 x35 12 x45 9 x46 5 x57 10 x67 14 x71 31 xij 0 and integer for all branch i-j.

3) a)

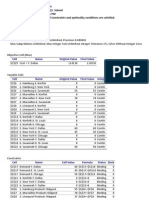

b) You can draw on the AON network using the lecture notations (the one with six box) or present it in table as follows:

c) Critical path = b f j k

Expected project completion time = 28.17 weeks. = 3.00

d)

e) To be discussed in class.

4a) i) Using maximin criterion, choose dealership offer 1 ($150,000). ii) Construct regret table Dealership Offer 1 2 3 EOL(1) = $180,000 EOL(2) = $240,000 EOL(3)=$280,000 Gas Shortage 0.6 $0 $400,000 $180,000 Gas Surplus 0.4 $450,000 $0 $430,000

iii) Using expected value; EV(Offer 1) = 300,000(.6) + 150,000(.4) = $240,000; EV(Offer 2)= 100,000(.6) + 600,000(.4) = $180,000; EV(Offer 3) = 120,000(.6) + 170,000(.4) =$140,000; Hence, select offer 1. OR A FASTER WAY: Using 4a), select the smallest. Hence choose dealership offer 1. iv) EV with perfect info = 0.6(300,000) + 0.4(600,000)=$420,000 EVPI = $420,000-240,000 = $180,000. OR A FASTER WAY: EVPI is exactly equal to smallest EOL. Therefore, EVPI = $180,000. b) Let s- denote the actual shortage. Let S- denote shortage/negative report. Let s+ denote the actual surplus. Let S+ denote surplus/positive report.

Offer 1

Offer 2 Offer 3

Offer 1

Offer 2 Offer 3

ii) If report indicates shortage, then go for offer 1. If report indicates surplus, then go for offer 2.

E(Strategy) = $342,094 EVSI = $342,094 - 240,000 = $102,094

Você também pode gostar

- CATS Web User Guide For TempStaff StudentDocumento27 páginasCATS Web User Guide For TempStaff StudentMarcus GohAinda não há avaliações

- Brochure Statistics 2011 enDocumento24 páginasBrochure Statistics 2011 enMarcus GohAinda não há avaliações

- MS Lecture023 Solving LP Using Excel Sem2 2011Documento21 páginasMS Lecture023 Solving LP Using Excel Sem2 2011Marcus GohAinda não há avaliações

- 10 Edition Chapter 5, 33, 9 Edition Chapter 5, 23: Solutions To Supplementary ProblemsDocumento1 página10 Edition Chapter 5, 33, 9 Edition Chapter 5, 23: Solutions To Supplementary ProblemsMarcus GohAinda não há avaliações

- Solutions To Supplementary Problems - LPDocumento11 páginasSolutions To Supplementary Problems - LPMarcus GohAinda não há avaliações

- Supplementary Problems LPDocumento2 páginasSupplementary Problems LPMarcus GohAinda não há avaliações

- Supplementary Problems LPDocumento2 páginasSupplementary Problems LPMarcus GohAinda não há avaliações

- Ms Assignment 1Documento9 páginasMs Assignment 1Marcus Goh100% (1)

- Assignment 3 DecisionAnalysis Project Sem3B 2010Documento4 páginasAssignment 3 DecisionAnalysis Project Sem3B 2010Marcus GohAinda não há avaliações

- Finalexam Trial Sem1 2011-1Documento11 páginasFinalexam Trial Sem1 2011-1Marcus GohAinda não há avaliações

- OPIM 101 FAQ Sem 2 2010Documento14 páginasOPIM 101 FAQ Sem 2 2010Marcus GohAinda não há avaliações

- Sensitivity Analysis of Objective Function Coefficients (Part IDocumento22 páginasSensitivity Analysis of Objective Function Coefficients (Part IMarcus GohAinda não há avaliações

- Assignment 2Documento5 páginasAssignment 2Marcus GohAinda não há avaliações

- MS Assignment 4Documento1 páginaMS Assignment 4Marcus GohAinda não há avaliações

- OPIM101 - Marcus Ang - Sem2 - 2011 - 12 - 24Documento2 páginasOPIM101 - Marcus Ang - Sem2 - 2011 - 12 - 24Marcus GohAinda não há avaliações

- MS Lecture00 Outline Sem2 2011Documento26 páginasMS Lecture00 Outline Sem2 2011Marcus GohAinda não há avaliações

- MS Lecture010 Introduction To Modeling Sem2 2011Documento23 páginasMS Lecture010 Introduction To Modeling Sem2 2011Marcus GohAinda não há avaliações

- MS Lecture011 LP FormulationDocumento13 páginasMS Lecture011 LP FormulationMarcus GohAinda não há avaliações

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (119)

- JETIR1906666Documento17 páginasJETIR1906666ssrana26Ainda não há avaliações

- Business ManagementDocumento13 páginasBusiness ManagementCatherine WijayaAinda não há avaliações

- A Comparative Study of Professional Attitude of M.ed. Students Studying in Government-Aided and Self-Financed InstitutionsDocumento6 páginasA Comparative Study of Professional Attitude of M.ed. Students Studying in Government-Aided and Self-Financed InstitutionsAnonymous CwJeBCAXpAinda não há avaliações

- Paediatric Sequential Organ Failure Assessment (pSOFA) Score: A New Mortality Prediction Score in The Paediatric Intensive Care UnitDocumento9 páginasPaediatric Sequential Organ Failure Assessment (pSOFA) Score: A New Mortality Prediction Score in The Paediatric Intensive Care UnitNico DwikiAinda não há avaliações

- OREM'S SELF-CARE DEFICIT THEORYDocumento29 páginasOREM'S SELF-CARE DEFICIT THEORYCarl SolivaAinda não há avaliações

- Bilg Il I Soy Filiz 2018Documento28 páginasBilg Il I Soy Filiz 2018QuiroprácticaParaTodosAinda não há avaliações

- Reading and Writing Position Paper PDFDocumento15 páginasReading and Writing Position Paper PDFJian Francisco100% (1)

- L-1production & Operations ManagementDocumento31 páginasL-1production & Operations ManagementSanket GangalAinda não há avaliações

- 1 Toke 2019Documento9 páginas1 Toke 2019jasvinder singhAinda não há avaliações

- Reflective Teaching PracticeDocumento24 páginasReflective Teaching Practicejoycepeter100% (3)

- Evidence Based Practice FinalDocumento22 páginasEvidence Based Practice Finalgopscharan100% (1)

- Set+1 Descriptive+Statistics+Probability+Documento5 páginasSet+1 Descriptive+Statistics+Probability+nikita rautAinda não há avaliações

- Report Vs Research PaperDocumento8 páginasReport Vs Research Paperiiaxjkwgf100% (1)

- Journal of Cleaner Production: Kannan Govindan, Marina BouzonDocumento20 páginasJournal of Cleaner Production: Kannan Govindan, Marina BouzonKhawar AliAinda não há avaliações

- Psychological Factors Affecting EFL Students' Speaking PerformanceDocumento12 páginasPsychological Factors Affecting EFL Students' Speaking PerformanceadamcomAinda não há avaliações

- Mathematical Studies Project-IaDocumento32 páginasMathematical Studies Project-Iamadhu_angel20018484Ainda não há avaliações

- A Critical Analysis of The Techniques For Data Gathering in Legal ResearchDocumento9 páginasA Critical Analysis of The Techniques For Data Gathering in Legal ResearchTran QuyetAinda não há avaliações

- Rhetorical AnalysisDocumento7 páginasRhetorical Analysisapi-302721513Ainda não há avaliações

- Efficacy of Clear Aligners in Controlling Orthodontic Tooth MovementDocumento9 páginasEfficacy of Clear Aligners in Controlling Orthodontic Tooth MovementMirnaLizAinda não há avaliações

- Maine Alumnus Volume 12 Number 9 June 1931Documento33 páginasMaine Alumnus Volume 12 Number 9 June 1931isaac mensageiroAinda não há avaliações

- Introduction of Internship ReportDocumento6 páginasIntroduction of Internship ReportKazi Jakir Hossain17% (6)

- CH 6 Transforming DataDocumento12 páginasCH 6 Transforming Datazeina.samara213Ainda não há avaliações

- Eticality in NegotiationDocumento26 páginasEticality in NegotiationRita MyroshnychenkoAinda não há avaliações

- Pavement DesignDocumento17 páginasPavement DesignDhanushka Manjula100% (1)

- Lesson 2 ResearchDocumento18 páginasLesson 2 ResearchGrant Hill AtienzaAinda não há avaliações

- Historical Knowledge and Historical Skills A Distracting DichotomyDocumento29 páginasHistorical Knowledge and Historical Skills A Distracting DichotomyLasse Arguck0% (1)

- Lab Topic 3: Enzymes: Principles of Biology Lab IDocumento13 páginasLab Topic 3: Enzymes: Principles of Biology Lab IDahiana BakalianAinda não há avaliações

- SAS - Session-25-Research 1Documento6 páginasSAS - Session-25-Research 1ella retizaAinda não há avaliações

- Peran Sektor Pemerintah Dan Swasta Dalam Perkembangan Destinasi Wisata Di Kabupaten Pulau MorotaiDocumento15 páginasPeran Sektor Pemerintah Dan Swasta Dalam Perkembangan Destinasi Wisata Di Kabupaten Pulau MorotaiHargiyantiAinda não há avaliações

- Chapter 2 Target SettingDocumento24 páginasChapter 2 Target SettingAthea SalvadorAinda não há avaliações