Escolar Documentos

Profissional Documentos

Cultura Documentos

Balance of Payment Introduction

Enviado por

vmktptDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Balance of Payment Introduction

Enviado por

vmktptDireitos autorais:

Formatos disponíveis

Balance of Payment (BOP) - Concept & Definition Most of exports and imports involve finance i.e.

. receipts and payments in money. An account of all receipts and payments is termed as Balance of Payments (BOP). According to Kindle berger, "The balance of payments of a country is a systematic record of all economic transactions between the residents of the reporting country and residents of foreign countries during a given yeriod of time". The balance of payment record is maintained in a standard double-entry book-keeping method. International transactions enter in to the record as credit or debit. The payments received from foreign countries enter as credit and payments made to other countries as debit. Balance of Payment is a record pertaining to a period of time; usually it is all annual statement. All the transactions entering the balance of payments can be grouped under three broad accounts; (1) Current Account, (2) Capital Account. Structure of Balance of Payment (BOP)

1. Trade Account Balance: It is the difference between exports and imports of goods, usually referred as visible or tangible items. Till recently goods dominated international trade. Trade account balance tells as whether a country enjoys a surplus or deficit on that account. An industrial country with its industrial products comprising consumer and capital goods always had an advantageous position. Developing countries with its export of primary goods had most of the time suffered from a deficit in their balance of payments. Most of the OPEC countries are in better position on trade account balance. The Balance of Trade is also referred as the 'Balance of Visible Trade' or 'Balance of Merchandise Trade'. 2. Current Account Balance: It is difference between the receipts and payments on account of current account which includes trade balance. The current account includes export of services, interests, profits, dividends and unilateral receipts from abroad, and the import of services, interests, profits, dividends and unilateral Payments to abroad. There can be either surplus or deficit in current account. The deficit will take place when the debits are more than credits or when payments are more than receipts and the current account surplus will take place when the credits are more than debits. 3. Capital Account Balance: It is difference between the receipts and payments on account of capital account. The capital account involves inflows and outflows relating to investments, short tern borrowings/lending, and medium term to long term borrowing/lending. There can be surplus or deficit in capital account. The surplus will take place when the credits are more than debits and the deficit will take place when the debits are more than credits. 4. Foreign Exchange Reserves: Foreign exchange reserves (Check item No.9 in above figure) shows the reserves which are held in the form of foreign currencies usually in hard currencies like dollar, pound etc., gold and Special Drawing Rights (SDRs). Foreign exchange reserves are analogous to an individual's holding of cash. They increase when the individual has a surplus in his transactions and decrease when he has a deficit. When a country enjoys a net surplus both in current account & capital account, it increases foreign exchange reserves. Whenever current account deficit exceeds the inflow in capital account, foreign exchange from the reserve accounts is used to meet the deficit If a country's foreign exchange reserves rise, that transaction is shown as minus in that country's balance of payments accounts because money is been transferred to the foreign exchange reserves.

Foreign exchange reserves (forex) are used to meet the deficit in the balance of payments. The entry is in the receipt side as we receive the forex for the particular year by reducing the balance from the reserves. When surplus is transferred to the foreign exchange reserve, it is shown as minus in that particular year's balance of payment account. The minus sign (-) indicates an increase in forex and plus sign (+) shows the borrowing of foreign exchange from the forex account to meet the deficit. 5. Errors and Omission: The errors may be due to statistical discrepancies & omission may be due to certain transactions may not be recorded. For eg: A remittance by an Indian working abroad to India may not yet recorded, or a payment of dividend abroad by an MNC operating in India may not yet recorded or so on. The errors and omissions amount equals to the amount necessary to balance both the sides. The Balance of Payments Meaning and Components Introduction The balance of payments is merely a way of listing receipts and payments in international transactions for a nation. It shows the nations trading positions variations in its net position as a foreign lender or borrower and variations in its official reserve holding. Structure of Balance of Payments Accounts The balance of payments account of a nation is assembled on the doctrine of double entry book keeping. Every transaction is entered on the credit and debit side of the Income Statement and assets and liabilities on the balance sheet. However balance of payments accounting varies from the business accounting in one aspect. In business accounting debits (minus) are presented on the left side and credits (plus) are represented on the right side of the income statements. Whereas in the balance of payments accounting the practice is to present credits on the left side and debits on the right side of the balance of payments sheet. Principles 1. If a payment is received from overseas account, it is a credit transaction. 2. While if payment made to overseas account it is a debit transaction. 3. The chief items presented on the credit side (plus) are exports of goods and services, transferred receipts in the form of gifts, subscription etc from overseas account, borrowings from overseas account investments by overseas account in the nation and official sale of reserve assets incorporating gold to overseas account and abroad agencies. 4. The principal items on the debit side (minus) are imports of goods and services, unrequited payments to overseas account as gifts, subscriptions etc, lending to overseas account investments by residents to overseas account and official purchase of reserve assets or gold from overseas account and overseas agencies. 5. These credits and debits are presented vertically in the balance of payments sheet of a nation as per the principle of double entry book keeping. 6. Horizontally they are classified under three categories: the current account, the capital account and the official settlements accounts or the official reserve assets account. Now let us see the structure of Balance of Payments Sheet and the items incorporated there with: Balance of Payments (BOP) Account of a Country

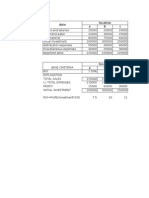

The items 1 to 7 show the total receipts from all sources. These receipts amount to Rs. 1000 Crores. The items 1(a) to 7(a) Show the total payments on all accounts. These payments amount to Rs. 990 Crores. When item 8 included, the total payment is Rs. 1000 Crores, hence the total credit is equal to the total debit. Thus the current account and capital account Balance each other. Thus surplus in the current account is equal to the deficit in the capital account. A deficit in the current account is equal to the surplus in the capital account. In the above given table, the balance of current account shows a deficit of Rs. 200 crores But there is a corresponding surplus of Rs. 200 crores in the balance of capital account. Hence the credit and debit sides balance & the balance of payments is in equilibrium. The balance of trade of a country may not balance. For instance, if exports exceed imports, here is a surplus and a favourable balance of trade and vice-versa. Only if the value of exports is equal to the value of imports, the balance of trade is said to be in equilibrium. But the balance of payments always balances because every transaction must be settled. Hence total debits must be equal to the total credits.

Balance of Payments Account 1. Current Account 1. The current account of a nation incorporates all transactions associating to business in merchandise and services and unrequited transfers. 2. 3. 4. Service transactions comprise of costs of travel and transportation, insurance, earnings and imbursements of overseas investments etc. Transfer payments associate to gifts, subscriptions, overseas aid, remittance made by private etc. received from overseas individuals account and government to overseas individuals. In current account goods exports and imports are the most significant items. Merchandise exports are presented as the plus item and are computed free on board which means that cost of transportation, insurance etc. are eliminated. On the right side imports are presented as a minus item and are computed based on costs, insurance and freight and are incorporated. The deviation among exports and imports of a nation is its balance of visible imports; the balance of trade is likely. In the contra crate, when imports surpasses exports it is not likely transaction. It is but services, transfer payments or invisible items of the current account that reproduce the actual picture of the balance of payments account. The balance of exports and imports of services and transfer payments is termed as the balance of hidden trade. The hidden items along with perceptible item ascertain the real present account position. If exports of merchandise and services surpass imports of merchandise and services, the balance of payments is said to be likely transaction or vice versa it is not likely transaction. In current account, exports of merchandise and services and the receipts of transfer payments are shown in the credit side or left hand side as they depict receipts from overseas individuals. Alternatively, the imports of merchandise and services and subscriptions imbursements to overseas individuals are shown on the debits or right hand side as they depict the imbursements to overseas individuals. The net value of these perceptible items balances is the balance on the current account.

5. 6. 7. 8. 9. 10.

11. 12.

13.

Online Live Tutor Structure of Balance of Payments Accounts: We have the best tutors in Economics in the industry. Our tutors can break down a complex Structure of Balance of Payments Accounts problem into its sub parts and explain to you in detail how each step is performed. This approach of breaking down a problem has been appreciated by majority of our students for learning Structure of Balance of Payments Accounts concepts. You will get one-to-one personalized attention through our online tutoring which will make learning fun and easy. Our tutors are highly qualified and hold advanced degrees. Please do send us a request for Structure of Balance of Payments Accounts tutoring and experience the quality yourself. Online Balance of Payments Meaning and Components Help: If you are stuck with an Balance of Payments Meaning and Components Homework problem and need help, we have excellent tutors who can provide you with Homework Help. Our tutors who provide Balance of Payments Meaning and Components help are highly qualified. Our tutors have many years of industry experience and have had years of experience providing Balance of Payments Meaning and Components Homework Help. Please do send us the Balance of Payments Meaning and Components problems on which you need help and we will forward then to our tutors for review. Adjustment Mechanisms of Balance of Payments Introduction When there is a shortfall or excess in balance of payments in a nation, it is adjusted through the succeeding apparatus: 1. Mechanical regulation through price and earnings variations. Price variations are analysed under supple or buoyant exchange rates and under the Gold Standard. 2. 3. 4. 5. Earnings variations are described in terms of the overseas trade multiplier. Regulation strategies are incorporated variations to correct dissymmetry in balance of payments by the government of a nation. They comprise of imbursements variation and imbursements toggle strategies, maintaining external and internal balance, direct controls etc.

There are also approaches to balance of payments which form part of strategy evaluations but normally explained separately as Elasticity, Absorption and Monetary Approaches. Mechanical Price Regulation Under Gold Standard 1. In this method, the currency in use was made of gold or was negotiable into gold at a definite rate. 2. The central bank of the nation was always ready to buy and sell gold at the definite cost. 3. The rate at which the standard money of the nation was exchangeable to gold termed as mint price of gold. 4. This rate was called the mint equality or mint nominal exchange for the reason that it depends on the mint cost of gold. 5. However the real rate of exchange could change above and below the mint equality by the rate of shipping gold amidst the two countries. 6. To illustrate this, presume the Canada had a short fall in its balance of payments with Britain. The deviation amidst the value of imports surpassed the supply of pounds. 7. But the transhipment of gold integrated conveyance cost and other usage charges, insurance etc. 8. Presume the shipping rate of gold from Canada to Scotland is 6 cents. So the Canadian importers would have to expend $12.06 i.e. ($12 + 0.06c) for obtaining 2. 9. This could be the convertible rate which was the Canadian gold export point or upper specie point. 10. No Canadian importer would pay more than $12.06 to get 2 for the reason that he could buy $12 worth of gold from Canada treasury and ship it to Scotland at a cost of 6 cents per ounce. 11. Likewise, the convertible rate of the pound could not drop beneath $12.94 to a pound in the crate of a excess in the Canadian balance of payments. 12. Therefore, the convertible rate of $12.94 to a pound was the Canadian gold import point or lesser specie point. 13. The convertible rate under the gold standard was ascertained by the influence of demand and supply amidst the gold points and was prevented from moving outside the gold points by shipments of gold. 14. The main aim was to keep balance of payments in symmetry. 15. A shortfall or excess in balance in payments under the gold standard was mechanically regulated by the price specie flow of mechanism.

16. For example a balance of payments shortfall of a nation implied a drop in its overseas convertible reserves due to an outflow of its gold to an excess nation. 17. This diminished the nations finance supply thus fetching a drop in the general price level. 18. This in turn, would enhance its exports and diminish its imports. This regulation procedure in balance of payments was surrogated by a hike in interest rates as a consequent of deduction in finance supply. 19. This tended to the inflow of short term capital from the excess nation. 20. Therefore, the inflow of short term capital from the excess nation helped in restoring balance of payments symmetry. Online Live Tutor Mechanical Price Regulation Under Gold Standard: We have the best tutors in Economics in the industry. Our tutors can break down a complex Mechanical Price Regulation under Gold Standard problem into its sub parts and explain to you in detail how each step is performed. This approach of breaking down a problem has been appreciated by majority of our students for learning Mechanical Price Regulation under Gold Standard concepts. You will get one-to-one personalized attention through our online tutoring which will make learning fun and easy. Our tutors are highly qualified and hold advanced degrees. Please do send us a request for Mechanical Price Regulation under Gold Standard tutoring and experience the quality yourself. Online Adjustment Mechanisms of Balance of Payments Help: If you are stuck with an Adjustment Mechanisms of Balance of Payments Homework problem and need help, we have excellent tutors who can provide you with Homework Help. Our tutors who provide Adjustment Mechanisms of Balance of Payments help are highly qualified. Our tutors have many years of industry experience and have had years of experience providing Adjustment Mechanisms of Balance of Payments Homework Help. Please do send us the Adjustment Mechanisms of Balance of Payments problems on which you need help and we will forward then to our tutors for review.

Você também pode gostar

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Impact of Intrest Rate On Profitbility of BanksDocumento26 páginasImpact of Intrest Rate On Profitbility of Bankschashfaq15178% (9)

- Monetary Tools of The Bangko Sentral NG PilipinasDocumento13 páginasMonetary Tools of The Bangko Sentral NG PilipinasBenj Lucio100% (4)

- Macro Economic TheoryDocumento1 páginaMacro Economic TheoryvmktptAinda não há avaliações

- Amdocs PPT FinalDocumento14 páginasAmdocs PPT FinalvmktptAinda não há avaliações

- Cooperative BankingDocumento8 páginasCooperative BankingvmktptAinda não há avaliações

- EmiDocumento6 páginasEmivmktptAinda não há avaliações

- A Study On Financial Inclusion Initiation by State Bank of IndiaDocumento5 páginasA Study On Financial Inclusion Initiation by State Bank of IndiavmktptAinda não há avaliações

- Credit Rating Agency CraDocumento46 páginasCredit Rating Agency CravmktptAinda não há avaliações

- Surveying Professor Bharat Lohani Department of Civil Engineering Indian Institute of Technology, KanpurDocumento25 páginasSurveying Professor Bharat Lohani Department of Civil Engineering Indian Institute of Technology, KanpurvmktptAinda não há avaliações

- National IncomeDocumento14 páginasNational Incomevmktpt100% (1)

- Surveying Professor Bharat Lohani Department of Civil Engineering Indian Institute of Technology, KanpurDocumento25 páginasSurveying Professor Bharat Lohani Department of Civil Engineering Indian Institute of Technology, KanpurvmktptAinda não há avaliações

- International Development AssociationDocumento8 páginasInternational Development AssociationvmktptAinda não há avaliações

- Mutual Fund: Concept, Organisation Structure, Advantages and TypesDocumento10 páginasMutual Fund: Concept, Organisation Structure, Advantages and TypesvmktptAinda não há avaliações

- MF History: First Phase - 1964-1987Documento3 páginasMF History: First Phase - 1964-1987vmktptAinda não há avaliações

- International Bank For Reconstruction and DevelopmentDocumento4 páginasInternational Bank For Reconstruction and DevelopmentvmktptAinda não há avaliações

- 13mba 224a IfmDocumento3 páginas13mba 224a IfmvmktptAinda não há avaliações

- Pom Q & AnsDocumento1 páginaPom Q & AnsvmktptAinda não há avaliações

- Bhaskar - POWERDocumento35 páginasBhaskar - POWERvmktptAinda não há avaliações

- Friday Activities: QM: Prajwal SDocumento23 páginasFriday Activities: QM: Prajwal SvmktptAinda não há avaliações

- Types of LayoutsDocumento3 páginasTypes of LayoutsvmktptAinda não há avaliações

- Aggregate Planning and ForecastingDocumento7 páginasAggregate Planning and ForecastingvmktptAinda não há avaliações

- Accounting For Managers. 1pdfDocumento168 páginasAccounting For Managers. 1pdfAkash TiwariAinda não há avaliações

- I 22 P100 1 2013Documento1 páginaI 22 P100 1 2013Casian GosaAinda não há avaliações

- Workers Insurance - Schedule of Insurance 2017Documento3 páginasWorkers Insurance - Schedule of Insurance 2017Michael FarnellAinda não há avaliações

- InvoiceDocumento2 páginasInvoiceJovelyn MaskitAinda não há avaliações

- S STRATEGIES FOR EFFECTIVE NPA RECOVERIEStrategies For Effective Npa RecoveriesDocumento12 páginasS STRATEGIES FOR EFFECTIVE NPA RECOVERIEStrategies For Effective Npa RecoveriesambujchinuAinda não há avaliações

- Exercise For Week 5 v5Documento27 páginasExercise For Week 5 v5Mayur GBAinda não há avaliações

- Banking Awareness by Disha PublicationDocumento293 páginasBanking Awareness by Disha PublicationBalachandarMahadevan100% (1)

- 04 v1 2016cfa一级强化班 固定收益Documento88 páginas04 v1 2016cfa一级强化班 固定收益Mario XieAinda não há avaliações

- SOF DL en Brand V15 - tcm41 180545 PDFDocumento11 páginasSOF DL en Brand V15 - tcm41 180545 PDFAnkur GargAinda não há avaliações

- Friedman v. Union Bank of SwitzerlandDocumento14 páginasFriedman v. Union Bank of SwitzerlandJon McFarlaneAinda não há avaliações

- Importance of Banking in IndiaDocumento2 páginasImportance of Banking in IndiaNimalanAinda não há avaliações

- Monthly Current Affairs PDF For FreeDocumento2 páginasMonthly Current Affairs PDF For FreeKaran SinghaniaAinda não há avaliações

- Bwbb3053 Past Years Questions A151Documento38 páginasBwbb3053 Past Years Questions A151trevorsum123Ainda não há avaliações

- Accenture IT Blueprint For The Everyday BankDocumento12 páginasAccenture IT Blueprint For The Everyday BankCristian RoscaAinda não há avaliações

- Chapter 1Documento14 páginasChapter 1wondwosen mengistuAinda não há avaliações

- Https Emarketing - Pwc.com ReAction Images NYM StamfordtaxforumfinalpresentationDocumento205 páginasHttps Emarketing - Pwc.com ReAction Images NYM StamfordtaxforumfinalpresentationResearch and Development Tax Credit Magazine; David Greenberg PhD, MSA, EA, CPA; TGI; 646-705-2910Ainda não há avaliações

- CIS - BUHAGIAR - Approval LetterDocumento3 páginasCIS - BUHAGIAR - Approval LetterДенис КопотиенкоAinda não há avaliações

- Hons AdmitCard 2022 2023 HONS 5320778Documento1 páginaHons AdmitCard 2022 2023 HONS 5320778MR EMON YTAinda não há avaliações

- Account StatementDocumento2 páginasAccount StatementGaurav mishraAinda não há avaliações

- Snack Vending Machines Gens40vmDocumento2 páginasSnack Vending Machines Gens40vmapi-372274970Ainda não há avaliações

- Choose Australian Super Nomination FormDocumento1 páginaChoose Australian Super Nomination Formmax_zaid7801Ainda não há avaliações

- Paper On Risk ManagementDocumento8 páginasPaper On Risk ManagementSANTOSHAinda não há avaliações

- Lecture Credit and Collection Chapter 1Documento7 páginasLecture Credit and Collection Chapter 1Celso I. MendozaAinda não há avaliações

- Account Statement PDFDocumento12 páginasAccount Statement PDFRizwan AkhtarAinda não há avaliações

- Indusind Bank and Bharat Financial Inclusion Merger Update: Building A Sustainable Platform For Financing LivelihoodsDocumento29 páginasIndusind Bank and Bharat Financial Inclusion Merger Update: Building A Sustainable Platform For Financing LivelihoodsShubham VermaAinda não há avaliações

- MFC 2nd SEMESTER FM Assignment 1 FMDocumento6 páginasMFC 2nd SEMESTER FM Assignment 1 FMSumayaAinda não há avaliações

- Bispap 117Documento63 páginasBispap 117Ayeshas KhanAinda não há avaliações

- Angie M Lopez or Juan L Lopez 8591 SW 159TH PL MIAMI FL33193-3076Documento4 páginasAngie M Lopez or Juan L Lopez 8591 SW 159TH PL MIAMI FL33193-3076Шеф Отрисовка100% (1)