Escolar Documentos

Profissional Documentos

Cultura Documentos

Chap 01

Enviado por

Tim JamesTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Chap 01

Enviado por

Tim JamesDireitos autorais:

Formatos disponíveis

CHAPTER 1

Introduction

Problem 1 (Basic)

Identify the provision of the Act which deals with each of the following items. Be as specific as possible in citing the reference to the Act (Part, Division, Subdivision, Section, Subsection, etc.). Use of the sectional list at the beginning of the CCH edition of the Act and/or the topical index at the end of the book may be helpful. However, using the CCH CD version of the Act may provide faster search results. (A) (B) (C) (D) (E) (F) (G) (H) (I) (J) (K) (L) (M) (N) (O) Definition of a person. Tax credit for donation made by a Canadian resident individual to a Canadian university. Definition of balance-due day. Taxability of group term life insurance premiums paid by an employer on behalf of an employee. Definition of capital dividend. Computation of income tax instalments for individuals. Definition of a qualified small business corporation share. Prescribed requirement to file an information return for a corporation paying a dividend. Definition of a testamentary trust. The calculation of a benefit associated with an interest-free loan from an employer to an employee. Definition of a disposition of non-depreciable capital property. Limitation on deduction of RRSP administration fees. General limitation on the amount of deductible expenses. Deduction from taxable income for taxable dividends that were received by a Canadian corporation. Tax payable on excess contributions to an RRSP.

2 Solution 1 (Basic)

Introduction to Federal Income Taxation in Canada: Fundamentals

The following summary is discussed in more detail below:

Case (A) (B) (C) (D) (E) (F) (G) (H) (I) (J) (K) (L) (M) (N) (O)

Topic Person...................................................... Donation by individual............................ Balance-due day...................................... Life insurance premiums......................... Capital dividend...................................... Income tax instalments for individual..... Qualified small business corporation share Information return for dividends............. Definition of testamentary trust............... Employee loan......................................... Disposition of non-depreciable capital property................................................... RRSP administration fees........................ Limit on deductible expenses.................. Taxable dividends received by Canadian corporation............................................... RRSP excess contributions......................

Part XVII I XVII I I I I I I XVII I I I X.I

Division E B B I C B B B B C

Subdivision a a h k f b f

Provision subsection 248(1) subsection 118.1(3) subsection 248(1) subsection 6(4) subsection 83(2) subsection 156(1) subsection 110.6(1) Reg. Part II, paragraph 201(1)(a) subsection 108(1) subsection 80.4(1) subsection 248(1) paragraph 18(1)(u) section 67 subsection 112(1) subsection 204.1(1)

(A) Person Part XVII, subsection 248(1): The term is used throughout the Act, so it is likely to be found in the interpretation section. The definition is similar to many in the Act in that it does not tell you exactly what a person is; it tells you what a person includes. (B) Donation by an individual Part I, Division E, Subdivision a, subsection 118.1(3): Tax credits are found in Division E. Credits that are particular to individuals are found in Subdivision a of Division E. (C) Balance-due day Part XVII, subsection 248(1): The term has application to all tax filers and, therefore, should be found in the interpretation section. However, the term has a different meaning depending on the type of tax filer. For trusts and individuals, specific timing is provided. For corporations, the provision refers to section 157. (D) Group term life insurance premiums paid by employer Part I, Division B, Subdivision a, subsection 6(4): Payments made on behalf of an employee by an employer likely result in income from employment. Subdivision a includes the provisions for calculating income from employment. (E) Capital dividend Part XVII, subsection 248(1): The term is found in subsection 248(1) but a definition is not actually provided, only a reference. It refers to another section Part I, Division B, Subdivision h, subsection 83(2): Capital dividends are tax-free distributions by a corporation to its shareholders, so the provision is likely to be found in Part I, Division B, Subdivision h that deals with corporations and their shareholders. (F) Income tax instalments for an individual Part I, Division I, subsection 156(1): The information that is required deals with payments to the CRA; therefore this information should be found in Division I dealing with returns, assessments, payment and appeals. [Some students may also identify subsection 155(1) as dealing with farmers and fishermen.] (G) Qualified small business corporation share Part I, Division C, subsection 110.6(1): The capital gains deduction that is available for qualified small business corporation shares is a deduction that is available in computing taxable income and is therefore found in Division C. (H) Filing information return for dividends paid Regulations Part II, subsection 201(1): The Regulations provide important detail regarding a number of the income tax rules. In order to ensure that individuals are advised of the information required to be reported on their personal tax returns (and to allow the CRA to ensure that the income is reported), corporations are required to file slips such as T5s for dividends paid. (I) Testamentary trust Part I, Division B, Subdivision k, subsection 108(1): The phrase describes a trust so it is likely that the definition will be found in Subdivision k dealing with trusts. Section 108 contains definitions for the subdivision.

Solutions to Chapter 1 Assignment Problems

(J) Interest-free loan benefit Part I, Division B, Subdivision f, subsection 80.4(1): Since the amount relates to an employee, it might be expected that the provision would be found in section 6 (in fact the provision that requires an income inclusion is found in subsection 6(9)). However, the actual calculation of the amount of income is found in Subdivision f which contains rules related to the calculation of income. (K) Disposition of non-depreciable capital property Part XVII, subsection 248(1): The term disposition is used throughout the Act, so it is likely to be found in this definition section. (L) Limit on deduction of RRSP administration fees Part I, Division B, Subdivision b, paragraph 18(1) (u): At one time, when the fees were deductible, they were considered a carrying charge deductible in computing income from property. Therefore, the restriction on the deduction is found in section 18 which provides a list of items that are specifically not deductible in computing income from business or property. (M) Limit on deductible expenses Part I, Division B, Subdivision f, section 67: The restriction on the amount of deductible expenses applies throughout the Act. Therefore, the provision is found in general rules for computing income that are found in Subdivision f. (N) Corporate dividend deduction Part I, Division C, subsection 112(1): The concept deals with a deduction that is available to a corporation. It might be expected to be found in Division B, Subdivision b dealing with the calculation of income from property. However, in this case, the deduction is not considered to reduce income from property but is a general deduction available in computing taxable income. (O) Excess RRSP contributions Part X.I, subsection 204.1(1): This is a special tax that is found in the Act and applies when an individual has contributed more to an RRSP than is allowed by the Act. In this case, the special tax is intended to discourage people from taking advantage of the benefits of an RRSP beyond those that are provided for in the rules.

4 Problem 2 (Advanced)

Introduction to Federal Income Taxation in Canada: Fundamentals

[ITA: Divisions B and C] Ms. Ichbin Verblonget has had a tumultuous year in 2008. She broke her engagement early in the year and quit her job. She moved to a resort area to take a waitress job and to start up a fitness instruction business. She has had the following items correctly calculated and classified as inclusions, deductions or tax credits for the purposes of determining her taxable income and federal tax.

Inclusions

Benefit received from Employment Insurance program......................................

$ 6 0 0

Board and lodging provided by employer during busy season of resort.............. 8, 0 0 0 Bonus from resort employer................................................................................ 5 0 0 Business revenue from fitness instruction fees.................................................... 2, 0 0 0 Gratuities as a waitress......................................................................................... 1 2, 1 0 0 Interest on Canada Savings Bonds....................................................................... 7 7 5 Rental revenue..................................................................................................... 6, 0 0 0 Salary received as a waitress................................................................................ 1 2, 0 0 0 Taxable capital gain............................................................................................. 3, 7 5 0 Retiring allowance from previous employer........................................................ 8 0

Solutions to Chapter 1 Assignment Problems

0

Deductions, Losses or Tax Credits:

Allowable capital loss.......................................................................................... 4, 5 0 0 Capital cost allowance on fitness business equipment......................................... 1, 3 0 0 Capital cost allowance on rental building............................................................ 1, 2 0 0 Charitable gifts tax credit..................................................................................... 2 6 Child care expenses............................................................................................. 1, 8 0 0 Canada Pension Plan contributions tax credits on employment earnings............ 1 6 0 Medical expenses tax credit................................................................................. Business expenses of earning fitness instruction fees.......................................... 9 0 0 Expenses of objection to a tax assessment........................................................... 6 5 Interest on funds borrowed to pay expenses of earning fitness instruction fees...... 7 5 Maintenance on rental property........................................................................... 1, 1 0 0 Mortgage interest on rental property.................................................................... 2, 5 0 0 Moving expenses................................................................................................. 1, 7 0 0 9

Introduction to Federal Income Taxation in Canada: Fundamentals

Non-capital losses from previous year................................................................. 6 0 0 Personal tax credit................................................................................................ 1, 4 4 0 Property tax on rental property............................................................................ 1, 0 0 0 Employment Insurance premiums tax credit........................................................ 7 0 Union dues........................................................................................................... Canada Employment tax credit ........................................................................... 1 0 0 1 5 3

REQUIRED (A) Determine the income, taxable income and basic federal tax based on the above correct information using the ordering rules in sections 3, 111.1, and 118.92 for 2008. Assume federal tax before credits is $4,565 in 2008. (B) Cross-reference each amount to the appropriate section of the Act.

Solutions to Chapter 1 Assignment Problems

Solution 2 (Advanced)

Division B Sec. 3 Par. 3(a) Subdivision a: Employment income Sec. 5 Sec. 5 Sec. 5 Par. 6(1)(a) Less: Par. 8(1)(i) Salary............................................................................... Gratuities.......................................................................... Bonus............................................................................... Board and lodging............................................................ Union dues....................................................................... $ 12,000 12,100 500 8,000 $ 32,600 100 $ 32,500 $ 775 6,000

Subdivision b: Business or property income Par. 12(1)(c) Sec. 9 Less: Sec. 9, par. 18(1)(a) Sec. 9, par. 18(1)(a) Par. 20(1)(a) Maintenance on rental property.................... Property tax on rental property..................... Capital cost allowance.................................. $ 1,100 1,000 1,200 2,500 $ (5,800) 600 800 1,400 $ 34,875 975 Interest on Canada Savings Bonds................................... Rental revenue..................................................................

Par. 20(1)(c) Mortgage interest.......................................... Subdivision d: Miscellaneous sources Par. 56(1)(a) Par. 56(1)(a) Par. 3(b)

Employment insurance..................................................... Retiring allowance...........................................................

Subdivision c: Net taxable capital gains Par. 38(a) Par. 38(b) Taxable capital gains........................................................ Allowable capital losses................................................... $ 3,750 (4,500) Nil $ 34,875

Par. 3(c)

Subdivision e: Miscellaneous deductions Par. 60(o) Sec. 62 Sec. 63 Expense of objection to tax assessment............................ Moving expense............................................................... Child care expense........................................................... $ 65 1,700 1,800 (3,565) $ 31,310

Par. 3(d)

Losses from non-capital sources: Sec. 9 Business: fitness instruction fees.................................. Less: Sec. 9, Business: expenses of earning fitness $ 900 par. 18(1)(a) instruction fees................................... Par. 20(1)(a) Capital cost allowance............................... 1,300 Par. 20(1)(c) Business: Interest on borrowed funds........ 75 Division B income.......................................................................................

$ 2,000

2,275

$ (275) $ 31,035 (600) $ 30,435 $ 4,565 (1,440) (160) (70) (153) (9) (26) $ 2,707

Division C: Deductions Sec 111.1 Par. 111(1)(a) Non-capital losses............................................................................... Taxable income....................................................................................................................................... Division E: Basic federal tax Sec. 118.92 Tax before credits............................................................................................................................ Sec. 118 Personal credits......................................................................................................... Sec. 118.7 CPP contribution credit ............................................................................................ Sec. 118.7 EI premium credit .................................................................................................... Ssec. 118(10) Canada Employment tax credit ................................................................................. Sec. 118.2 Medical expense credit.............................................................................................. Sec. 118.1 Charitable donations credit........................................................................................ Basic federal tax..............................................................................................................................

Introduction to Federal Income Taxation in Canada: Fundamentals

Solutions to Chapter 1 Assignment Problems

Problem 3 (Basic)

[ITA: 2] Many words and terms used in the Act have very specific interpretations. Awareness of these interpretations is fundamental to understanding the scheme and application of the Act. These interpretations come from various sources. The primary source is statutory definition; that is, the term is explicitly defined in the Act. Common law principles also determine interpretations for terms. Many court cases have centred on the interpretation of specific words or phrases which were not explicitly defined in the statute. Once such terms are interpreted by the Courts, that interpretation becomes standard for that term. If a term is neither defined in the statute, nor the subject of a common law definition, the word or term must be assigned the meaning provided by everyday language. The definition is often that which can be found in a common dictionary. Division A of Part I of the Act outlines who is liable for tax. This Division is a fundamental building block for the Act as it defines to whom the Act will apply. Therefore, it is essential that the terms used in this Division are clearly understood. REQUIRED Identify and define those words and terms found in section 2 of the Act, in the order of their use, which you believe require definition. Indicate the references in the Act to the source of the definition for those words or terms which you have so identified. If you use the CCH CD version of the Act the words that are defined elsewhere in the Act are highlighted in red.

10 Solution 3 (Basic)

Introduction to Federal Income Taxation in Canada: Fundamentals

Division A of Part I of the Act consists of section 2 of the Act. Section 2 consists of three subsections.

Subsection 2(1):

taxable income This is defined in subsection 2(2). taxation year Subsection 249(1) contains the definition of a taxation year. For corporations, the taxation year is the fiscal period of the corporation; for individuals, the taxation year is the calendar year. fiscal period This is also a defined term, found in subsection 249.1(1). corporation This word is part of a defined term in subsection 248(1), corporation incorporated in Canada. individual Subsection 248(1) defines individual as a person, other than a corporation, person This is also defined in subsection 248(1). This is expanded below. calendar year This is not defined in the Act. However, the Interpretation Act defines the term in paragraph 37(1)(a) to mean a period of twelve consecutive months commencing on January 1. person The definition of person is found in subsection 248(1). Section 248 is an interpretation section and many of the words and terms used in the Act, which require definition, are found in this section. Person is defined to include any body corporate and politic, and the heirs, executors, administrators or other legal representatives of such body. resident Although the Act includes a definition of deemed residents (subsections 250(1) and (4)), the word resident is not itself defined in the Act. Canadian residents are taxed on their worldwide income. As this term is fundamental to establishing a liability for Canadian tax, there have been many court cases centred on the issue of residency. The common law principles which have evolved from these cases are the basis for the interpretation of this word. Residency is more fully discussed in Chapter 2. Canada Section 255 defines Canada to include certain sea beds adjacent to the coasts, as well as the airspace above the geographic boundaries of Canada.

Subsection 2(2):

As mentioned above, subsection 2(2) is itself a definition. This subsection is for the purpose of defining taxable income. taxpayer is found in subsection 248(1). This is any person, whether or not liable to pay tax. income for the year Section 3 contains the blueprint for the calculation of income. The term income, however, is not defined. Section 3 states: The income of a taxpayer for a taxation year for the purposes of this Part is his income determined by the following rules ... In order to determine income under section 3, one has to first know what income is. As income is not defined, we again must turn to jurisprudence and common language. Again, there are numerous court cases over the issue of what constitutes income.

Subsection 2(3):

employed Subsection 248(1) defines this word as performing the duties of an office or employment. business Subsection 248(1) defines this word to include a profession, calling, trade, manufacture, or undertaking of any kind whatever, and an adventure or concern in the nature of trade. The definition excludes an office or employment. carrying on a business in Canada Section 253 provides an extended meaning of this term, as it applies to non-residents. This provides a number of criteria to expand when a business will be considered to be conducted in Canada. However, the term carrying on a business is not, itself, defined. Therefore, although we have an extended meaning of this term legislated by the Act, we will not find a legislated definition of the term itself. Again, there have been numerous cases disputing whether a business was carried on. disposed Although the term disposed is not itself defined, disposition is defined in subsection 248(1) to be, in paragraph (a), any event or transaction which entitles the taxpayer to proceeds of disposition. Proceeds of disposition is, itself, a defined term found in subsection 13(21) and section 54. taxable Canadian property This is defined in subsection 248(1)and is quite a lengthy definition. Taxable Canadian property includes, among other items, real property situated in Canada, shares of private Canadian companies, and certain partnership interests and trust interests which derive their value principally from these former two types of property. taxable income earned in Canada Subsection 248(1) defines this term to mean taxable income determined in accordance with Division D of Part I, but in no case can this ever be less than nil.

Solutions to Chapter 1 Assignment Problems

11

A review of section 2 clearly emphasizes the importance of understanding the terms used throughout the Act. In many examples, the Act will expand upon terms or provide computational rules for certain terms, but does not extend to providing a statutory definition of the term itself. This is one of many reasons why interpretation of the statute remains, at times, an imprecise practice. It also demonstrates that, while the Act is the cornerstone for the taxation system, it cannot be studied in isolation as it draws meaning from other external sources.

12 Problem 4 (Advanced)

Introduction to Federal Income Taxation in Canada: Fundamentals

Over the past two years, your client, a lawyer in sole practice, has developed several software packages for the preparation of legal contracts. At a recent small-business seminar, your client learned that she could pay her spouse and children a salary. By doing so, your clients total tax paid as a family unit would drop substantially. REQUIRED If tax is avoided, how would the general anti-avoidance rule affect the transactions?

Solutions to Chapter 1 Assignment Problems

13

Solution 4 (Advanced)

The general anti-avoidance rule allows for transactions or a series of transactions to be disregarded if they are without a bona fide purpose. If your clients spouse and children are not providing any services to her business, it is obvious that the transactions were arranged primarily to obtain a tax benefit with no bona fide purpose, and they will be disregarded by the CRA. Any tax benefit derived from the transactions will be eliminated. If there is some service being provided to justify a salary, the amount of salary must be reasonable in the circumstance or the transactions can be ignored.

Você também pode gostar

- Chapter 01 - PowerPoint - Introduction To Taxation in Canada - 2013Documento32 páginasChapter 01 - PowerPoint - Introduction To Taxation in Canada - 2013melsun007Ainda não há avaliações

- BUS345 Midterm 1 NotesDocumento31 páginasBUS345 Midterm 1 NotesՄարիա ՄինասեանAinda não há avaliações

- Hilton6e SM08Documento70 páginasHilton6e SM08Eych MendozaAinda não há avaliações

- BU 357 Wilfrid Laurier HomeworkDocumento35 páginasBU 357 Wilfrid Laurier HomeworkNia ニア MulyaningsihAinda não há avaliações

- Tax Answers 2Documento280 páginasTax Answers 2Don83% (6)

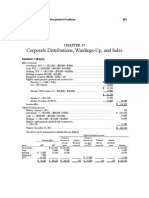

- Corporate Distributions, Windings-Up, and Sales: Solutions To Chapter 15 Assignment ProblemsDocumento21 páginasCorporate Distributions, Windings-Up, and Sales: Solutions To Chapter 15 Assignment ProblemsKiều Thảo AnhAinda não há avaliações

- Computation of Taxable Income and Tax After General Reductions For CorporationsDocumento20 páginasComputation of Taxable Income and Tax After General Reductions For CorporationsKiều Thảo Anh100% (1)

- Test Bank For Modern Advanced Accounting in Canada Canadian 7th Edition by HiltonDocumento6 páginasTest Bank For Modern Advanced Accounting in Canada Canadian 7th Edition by Hiltonhezodyvar80% (5)

- Koya Institute of Technology Homework AssignmentDocumento21 páginasKoya Institute of Technology Homework AssignmentmaastrichtpieAinda não há avaliações

- Controls at The Bellagio Casino ResortDocumento2 páginasControls at The Bellagio Casino ResortFareeha Anwar0% (1)

- Introduction to Federal Taxation in CanadaDocumento40 páginasIntroduction to Federal Taxation in CanadaDonna So100% (2)

- Chapter 7 Federal Taxation Textbook SolutionsDocumento26 páginasChapter 7 Federal Taxation Textbook SolutionsReese Parker0% (1)

- Chap 06Documento30 páginasChap 06Tim JamesAinda não há avaliações

- Chap 02Documento25 páginasChap 02Tim JamesAinda não há avaliações

- Solution Manual For Accounting Tools For Business Decision Makers 4th Edition by KimmelDocumento18 páginasSolution Manual For Accounting Tools For Business Decision Makers 4th Edition by KimmelKristine AstilleroAinda não há avaliações

- Chapter 16 Sol 2020 WKDocumento53 páginasChapter 16 Sol 2020 WKVu Khanh LeAinda não há avaliações

- Chap03 Sol OddDocumento19 páginasChap03 Sol OddRussell WilsonAinda não há avaliações

- Chapter 11 Question Answer KeyDocumento91 páginasChapter 11 Question Answer KeyBrian Schweinsteiger Fok100% (1)

- Bellagio Case - Owais RafiqDocumento6 páginasBellagio Case - Owais Rafiqowaisra67% (3)

- CH 7 Answer KeyDocumento88 páginasCH 7 Answer KeyT m100% (1)

- Income Deferral Rollover PitfallsDocumento31 páginasIncome Deferral Rollover PitfallsKevin Tee100% (3)

- Tax QuestionsDocumento261 páginasTax QuestionsPocaGuri100% (1)

- Chapter Fifteen SolutionsDocumento21 páginasChapter Fifteen Solutionsapi-3705855Ainda não há avaliações

- Kinko'solutinDocumento5 páginasKinko'solutintmalkawiAinda não há avaliações

- Chapter 4 Question Answer KeyDocumento63 páginasChapter 4 Question Answer KeyBrian Schweinsteiger Fok100% (2)

- Business Combinations: 2005 Mcgraw-Hill Ryerson Limited. All Rights Reserved. 52Documento37 páginasBusiness Combinations: 2005 Mcgraw-Hill Ryerson Limited. All Rights Reserved. 52cpscbd9Ainda não há avaliações

- Depreciable Property and Eligible Capital Property: Solutions To Chapter 5 Assignment ProblemsDocumento27 páginasDepreciable Property and Eligible Capital Property: Solutions To Chapter 5 Assignment ProblemsOktariadie RamadhianAinda não há avaliações

- Consolidation Subsequent To Acquisition Date: Solutions Manual, Chapter 5Documento86 páginasConsolidation Subsequent To Acquisition Date: Solutions Manual, Chapter 5olivia caoAinda não há avaliações

- Chapter Two SolutionsDocumento9 páginasChapter Two Solutionsapi-3705855Ainda não há avaliações

- Chapter 3Documento8 páginasChapter 3lijijiw23Ainda não há avaliações

- ACCO320Midterm Fall2013FNDocumento14 páginasACCO320Midterm Fall2013FNzzAinda não há avaliações

- Download: Acc 307 Final Exam Part 1Documento2 páginasDownload: Acc 307 Final Exam Part 1AlexAinda não há avaliações

- Buckwold12e Solutions Ch11Documento40 páginasBuckwold12e Solutions Ch11Fang YanAinda não há avaliações

- Buckwold12e Solutions Ch07Documento41 páginasBuckwold12e Solutions Ch07awerweasd100% (1)

- Chapter 5 Question Answer KeyDocumento83 páginasChapter 5 Question Answer KeyBrian Schweinsteiger FokAinda não há avaliações

- Chapter 11 - Computation of Taxable Income and TaxDocumento22 páginasChapter 11 - Computation of Taxable Income and TaxMichelle Tan100% (1)

- Ch02 SolutionDocumento6 páginasCh02 SolutionMalekAinda não há avaliações

- Chapter 9Documento18 páginasChapter 9Rubén ZúñigaAinda não há avaliações

- Property Plant Equipment: Sukhpreet KaurDocumento79 páginasProperty Plant Equipment: Sukhpreet KaurJeryl AlfantaAinda não há avaliações

- Auditors' responsibilities and ethicsDocumento12 páginasAuditors' responsibilities and ethicsscribdtea100% (1)

- Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions ManualDocumento9 páginasByrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1st Edition Byrd Solutions Manuallemon787100% (5)

- Murphy 2019 SM CH01Documento55 páginasMurphy 2019 SM CH01kevin ChenAinda não há avaliações

- Case Notes EcoPakDocumento8 páginasCase Notes EcoPakGajan SelvaAinda não há avaliações

- CH 12 NotesDocumento23 páginasCH 12 NotesBec barronAinda não há avaliações

- Solution To Mid-Term Exam ADM4348M Winter 2011Documento17 páginasSolution To Mid-Term Exam ADM4348M Winter 2011SKAinda não há avaliações

- Chapter c4Documento44 páginasChapter c4bobAinda não há avaliações

- PROG8520 - Week 10 - SlidesDocumento96 páginasPROG8520 - Week 10 - Slidessimran sidhuAinda não há avaliações

- Tax Notes 5Documento29 páginasTax Notes 5spiotrowskiAinda não há avaliações

- Managerial Accounting Solutions Manual Chapter 3Documento3 páginasManagerial Accounting Solutions Manual Chapter 3Peeyush Pareek0% (2)

- CH 10 TBDocumento18 páginasCH 10 TBjhaydn100% (1)

- Assignment 3 (f5) 10341Documento8 páginasAssignment 3 (f5) 10341Minhaj AlbeezAinda não há avaliações

- Make or BuyDocumento51 páginasMake or BuySitaramanjaneyulu ManthaAinda não há avaliações

- Solutions Manual, Chapter 10: 2005 Mcgraw-Hill Ryerson Limited. All Rights Reserved. 416Documento60 páginasSolutions Manual, Chapter 10: 2005 Mcgraw-Hill Ryerson Limited. All Rights Reserved. 416salehin1969Ainda não há avaliações

- CH 2-3-4 Exam SolutionsDocumento6 páginasCH 2-3-4 Exam SolutionsadlkfjAinda não há avaliações

- Chapter c3Documento47 páginasChapter c3bobAinda não há avaliações

- 2511 Practice Final Exam AnswersDocumento7 páginas2511 Practice Final Exam AnswersMarco A HenriquezAinda não há avaliações

- Payout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Documento4 páginasPayout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Gian RandangAinda não há avaliações

- Chapter 1 - Sol - 2023 Introduction To Federal Income Taxation in Canada, 44th EditionDocumento5 páginasChapter 1 - Sol - 2023 Introduction To Federal Income Taxation in Canada, 44th Editionfullgradestore2023Ainda não há avaliações

- Practice Exam For PensionDocumento10 páginasPractice Exam For PensionDiandra Aditya KusumawardhaniAinda não há avaliações

- Employee Benefits and Retirement PlanningDocumento20 páginasEmployee Benefits and Retirement PlanningchiposityAinda não há avaliações

- Solution Manual For South Western Federal Taxation 2021 Comprehensive 44th Edition David M Maloney William H Hoffman JR James C Young Annette Nellen William A Raabe Mark PersellinDocumento24 páginasSolution Manual For South Western Federal Taxation 2021 Comprehensive 44th Edition David M Maloney William H Hoffman JR James C Young Annette Nellen William A Raabe Mark PersellinJohnValenciaajgq100% (40)

- Smart Communications v. City of Davao resolution on franchise tax exemptionDocumento2 páginasSmart Communications v. City of Davao resolution on franchise tax exemptionDom Robinson BaggayanAinda não há avaliações

- Tax Handbook PDFDocumento48 páginasTax Handbook PDFMahmoud Mohamedali RehmtullaAinda não há avaliações

- New York-Presbyterian Q1 2020 Financial StatementsDocumento57 páginasNew York-Presbyterian Q1 2020 Financial StatementsJonathan LaMantia100% (1)

- 8% Income Tax OptionDocumento14 páginas8% Income Tax OptionZaaavnn VannnnnAinda não há avaliações

- Corporate Accounting MCQDocumento11 páginasCorporate Accounting MCQsharrine60% (5)

- Financial Report of HotelDocumento28 páginasFinancial Report of HotelShandya MaharaniAinda não há avaliações

- Solution Manual For South Western Federal Taxation 2020 Comprehensive 43rd Edition David M MaloneyDocumento36 páginasSolution Manual For South Western Federal Taxation 2020 Comprehensive 43rd Edition David M Maloneyamyparkrf9v7100% (26)

- Student HandbookDocumento26 páginasStudent HandbookNadyusha NavrucAinda não há avaliações

- Anexa 1 Solicitation W917bk 09 R 0035 AL DAMOOK LDocumento151 páginasAnexa 1 Solicitation W917bk 09 R 0035 AL DAMOOK LSima ViorelAinda não há avaliações

- Solution Manual For Personal Finance 12th Edition by GarmanDocumento7 páginasSolution Manual For Personal Finance 12th Edition by Garmana719435805Ainda não há avaliações

- Chapter 10 Test Bank Subsidiary Preferred Stock, Cosolidated Earnings Per Share, and Consolidated Income TaxationDocumento27 páginasChapter 10 Test Bank Subsidiary Preferred Stock, Cosolidated Earnings Per Share, and Consolidated Income TaxationSteven Andrian GunawanAinda não há avaliações

- Final Withholding Tax: BIR Quarterly, Monthly or Annually DeadlineDocumento2 páginasFinal Withholding Tax: BIR Quarterly, Monthly or Annually DeadlineMary Christine Formiloza MacalinaoAinda não há avaliações

- G.R. No. L-9692Documento10 páginasG.R. No. L-9692mar corAinda não há avaliações

- Grayscale Bitcoin Trust BTC 2019 Tax Information - FinalDocumento17 páginasGrayscale Bitcoin Trust BTC 2019 Tax Information - FinalEjikeume DennisAinda não há avaliações

- FRS 8 Guidance on Accounting Policies ChangesDocumento4 páginasFRS 8 Guidance on Accounting Policies ChangesDavid LeeAinda não há avaliações

- Get Out of The System Letter Pre-Tax CourtDocumento14 páginasGet Out of The System Letter Pre-Tax CourtPublic Knowledge100% (9)

- Prep2012 Pack1 CR PDFDocumento31 páginasPrep2012 Pack1 CR PDFPraveen whatsappAinda não há avaliações

- Revocation of ElectionDocumento15 páginasRevocation of ElectionTitle IV-D Man with a plan100% (24)

- Katrina Pierce IndictmentDocumento29 páginasKatrina Pierce IndictmentTodd FeurerAinda não há avaliações

- Income TaxationDocumento211 páginasIncome Taxationfritz100% (5)

- F 8308Documento2 páginasF 8308IRSAinda não há avaliações

- Legal Basics For Small BusinessDocumento349 páginasLegal Basics For Small BusinessMohammad Abd Alrahim Shaar100% (1)

- South Korea REITsDocumento2 páginasSouth Korea REITsRoyce ZhanAinda não há avaliações

- FABM2 Module 09 (Q2-W3-5)Documento9 páginasFABM2 Module 09 (Q2-W3-5)Christian Zebua50% (4)

- IRS Publication 4220 - Applying For 501 (C) (3) Tax-Exempt StatusDocumento16 páginasIRS Publication 4220 - Applying For 501 (C) (3) Tax-Exempt StatusgeneisaacAinda não há avaliações

- Class 26 - Depreciation and Income TaxesDocumento19 páginasClass 26 - Depreciation and Income TaxesPruthvi PrakashaAinda não há avaliações

- 1701A Annual Income Tax Return: (Add More... )Documento1 página1701A Annual Income Tax Return: (Add More... )Karen Faye TorrecampoAinda não há avaliações

- fw4v PDFDocumento2 páginasfw4v PDFAnonymous KmCLdfNShbAinda não há avaliações

- Reception For Mitt RomneyDocumento2 páginasReception For Mitt RomneySunlight FoundationAinda não há avaliações