Escolar Documentos

Profissional Documentos

Cultura Documentos

Taxation in Bangladesh

Enviado por

Mizbah Uddin SiddiqiTítulo original

Direitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Taxation in Bangladesh

Enviado por

Mizbah Uddin SiddiqiDireitos autorais:

Formatos disponíveis

Taxation in Bangladesh

The Income Tax: Income Tax in Bangladesh (Like many other countries), is levied on the basis of residential status of a taxpayer. It is based on the period of stay, not on the basis of Nationality or citizenship. The income tax ordinance 84 divides taxpayer into two categories: i) Resident and ii) Non resident. Resident is defined in the Income Tax ordinance as follows: (a) an individual who has been in Bangladesh, i. for a period of, or for periods amounting in all to, one hundred and eighty two days or more in that year; or ii. for a period of, or for periods amounting in all to, ninety days or more in that year having previously been in Bangladesh for a period of, or periods amounting in all to, three hundred and sixty five days or more during the four years preceding that year; (b) Hindu undivided family, firm or other association of persons, the control and management of whose affairs is situated wholly or partly in Bangladesh in that year; and (c) A Bangladeshi company or any other company in the control and management of whose affairs is situated wholly in Bangladesh in that year. Assessment Year for income tax is a time span of twelve months beginning on 1st of July every year and includes any such period deemed to be assessment year in respect to any period. Income year is the financial year that immediately precedes the Assessment year. Further refinement & elaboration of Income Year is available in Section 2(35) of the Income tax ordinance 84. Assessee means a person by whom any tax is payable u/s (Under Section) 2(7) of the I. T. O (Income tax ordinance) 84. An assessee for tax purpose includes: a) One against whom I.T proceedings are drawn, b) One who is required to file a return u/s 91 of I.T.O 84, c) One who submits return on his own, d) One who is deemed to be an assessee, or an assessee in default, under provision of I.T.O 84. Person includes an individual, a firm, an association of persons, a Hindu undivided family, a local authority, and a company. Assessees are classified in the following groups for tax calculation: Group-A: (i) Individual (ii) Hindu undivided family (Huf) (iii) Firm

(iv) (v) Group-B

Association of persons Any other artificial juridical person

Companies and local authorities classified into three groups for tax purpose: (i) (ii) (iii) Group-C: Co-operative societies (C.S): Exemption of incomes of co-operative societies are enumerated in section 47 (a to d). Incomes not covered therein stand to be taxed as per schedule of para IV of 3rd schedule of F. A. 1994. The Income Tax Administration The foremost objective of taxation is to provide the government with a source of revenue to finance its activities. However, like most developing countries, taxation is being increasingly used in Bangladesh for achieving other social and economic objectives, such as reduction of inequality of income, reducing concentration of wealth in the hand of a few, control of capital market, incentive for savings and investment and also for industrial and economic development. National Board of Revenue (NBR) is the on the field body to implement the fiscal measures of the government. A Commissioner of taxes receive allocation of revenue budget from the NBR and then distributes it to the IJCTs and DCTs/ACTs/EACTs; who as assessing officers and collection thereof. DCTs includes ACTs & EACTs, the later two are posted in less important circles but they exercise the full power of the DCTs. The Tax administration in Bangladesh as the following nine level organizational structure: 1. National Board of Revenue 2. Director General of Inspection 2A. Commissioner to Taxes (Appeal) 3. Commissioner of Taxes 3A. Additional Commissioner of Taxes who may be either Appellate Joint Additional Commissioner of Taxes or Inspecting Additional Commissioner of Taxes 4. Joint Commissioner of Taxes who may be either Appellate Joint Commissioner of Taxes or Inspecting Joint Commissioner of Taxes (IJCT) 5. Deputy Commissioner of Taxes (DCT) 6. Tax Recovery Officer Publicly traded companies Non publicly traded companies Bank, Insurance, Investment Co. and local authorities.

7. Assistant Commissioner of Taxes (ACT) 8. Extra Assistant Commissioner of Taxes (EACT) 9. Inspector of Taxes. Of the above mentioned authorities, the DCTs are the king-pins of taxes administration; they create the tax demand through an assessment order and they remain responsible for colleting it. Approximately 60% of the officers of BCS 9Taxation) Cadre consists of the assessing officers. In Bangladesh the direct taxes administered at the national level are the followings: (a) (b) (c) Income Tax Wealth Tax Gift tax

The Jatiya Shangshad is the authority for imposition of taxes which are administered by the NBR in Bangladesh with its subordinate departments.

Income Tax

Among direct taxes, income tax is one of the main sources of revenue. It is a progressive tax system. Income tax is imposed on the basis of ability to pay. The more he earns the more he pays as income tax. It ensures the equity and social judgment. Definition of Income: There is no Conclusive definition of income. However, under Bangladesh Income Tax Law the following is considerers as income for the purpose of assessing income tax. * Any income, profit or gains, from whatever source derived. * Any income deemed to accrue or arise. * Any unexplained investment or expenditure. Sources of Income: For the purpose charging tax and computation of total income, sources of income can be classified in 8 categories, they are: * * * * * * * Salaries Interest from securities Income from house property Income from agriculture Income from business or profession Capital gains Income from other sources.

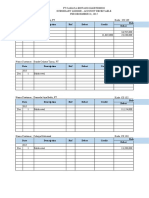

Current Tax Rate:

For Individuals and Other than Company First 1,20,000 Next 2,50,000 Next 3,00,000 Next 3,50,000 Rest Amount For Companies Publicly traded company Non- Publicly traded & private company Bank, Insurance & Financial Company Non-Resident (other than Bangladeshi) If any publicly traded company declares more than 20% dividend 10% rebate on total tax is allowed. Rebate also is allowed for the small and cottage industry in least developed areas. Rebate up to 50% allowed on income from exports Minimum Tax Tk 1,800. 30% 40% 45% 25% Nil 10% 15% 20% 25%

Who is to submit Income Tax Return: If his total income during the income year is Tk 1,20,000 or more. If he was assessed for tax during any of the 3 years immediately preceding the income year. A person who lives in city corporation/paurashava/divisional HQ/district HQ and owns a building of more than 1 story and plinth area exceeds 1,600 sqr feet/motor car/membership of a club registered under VAT Law or Subscribe a telephone. Runs a business or profession having trade license. Any professional registered as doctor, lawyer, Income tax practitioner, Chartered Accountant, Cost & Management Accountant, Engineer, Architect, Surveyor etc. Member of a Chamber of Commerce and Industries or a trade Association. Participates in a tender Has a tax payers Identification number Time to Submit Income Tax Return:

For Company By fifteenth of July or thirty first December but not later than said months after the annual closing of accounts of the company. Other Cases By the Thirtieth day of September next following the income year. Consequences of Non-Submission of Return Penalty - 10% of tax imposed on last assessed income subject to a minimum of Tk. 2,500/ In case of continuing default a further penalty of Tk. 250/- for every day of delay. Assessment Procedures: Self Assessment: for individuals and private Ltd. companies- when income is not less then last year. For foreign and public Ltd. companies: assessment on the basis of auditor's certificate. Assessment after hearing. All returns are however, subject to audit at the discretion of the tax office. Appeal against the order of DCT: Being aggrieved at the total income assessed or on any law point, the assessee may file an appeal against the assessment order of the tax officer. 1. to the Commissioner (Appeals), 2. revision petition to the Commissioner of Tax 3. to the Taxes Appellate Tribunal Major areas for final settlement of tax liability : Tax deduction at source for the following cases is treated as final discharge of tax liabilities and no additional tax or refund is charged or allowed. Supply or contract work Bandrolls of hand made cigarettes Import of goods Transfer of properties Export of manpower Real Estate Business Export value of garments Local shipping business Royalty, technical know-how fee

Tax Recovery System:

For non-payment of income tax demand the following measure can be taken against the assessee for realization of tax. By attachment of bank accounts, Goods, salary or any other payment attachment, As public demand by Magistrate.

Tax withholding functions: In Bangladesh withholding taxes are usually termed as Tax deduction and collection at source. This system is considered as an important mechanism of tax collection. Under this system both private and public limited companies are legally authorized and bound to withhold taxes at some point of making payment and deposit the same to the Government Exchequer. The taxpayer receives a certificate from the withholding agent and gets credits of tax against assessed tax demand on production of the certificate. Income Subject to deduction at source: Salary, Interest on Securities, Supply of goods and execution of contract, Indenting commission, Lottery or crossword puzzles, House rent, Export of Manpower, Acting in films, Travel agency, Shipping agency commission, Interest on saving deposits, Insurance commission, Capital gains, Compensation against acquisition of property, Brick field, Services rendered by the doctors, Real estate business, Commission letter of credit, Survey, Commission, remuneration or charges paid to foreign buyer and Income from dividends.

Advance Payment of Tax: Every assessee is required to pay advance tax in four equal installments falling on 15th of September; December; March and June of each year if the latest assessed income exceeds Taka two lakh. For failure to pay any advance installment, penalty may be imposed for such default. Fiscal incentives: Following fiscal incentives are available for the assessee

(a) Tax holiday till 30th June 2008 in fulfillment of certain conditions for newly established industrial undertaking, tourist industry, and physical infrastructure facility such asIndustrial Undertaking: production of textile, textile machinery, high value garments, pharmaceuticals, melamine, plastic products, ceramics, sanitary ware, steel from iron ore, fertilizer, insecticide & pesticide, computer hardware, petro-chemicals, basic raw materials of drugs, chemicals, pharmaceuticals, agricultural machine, ship building, boilers, compressors; Physical Infrastructure: sea or river port, container terminals, internal container depot, container freight station, LNG terminal and transmission line, CNG terminal and transmission line, gas pipe line, flyover, large water treatment plant & supply through pipe line, waste treatment plant, export processing zone. Tourist Industries: residential hotel having facility of three star or more. (b) 100% Accelerated depreciation on cost of machinery is admissible for new industrial undertaking in the first year of commercial production. (c) Initial depreciation allowance for first year on machinery @25% of cost and in respect of factory building @ 10% of cost if the said factory or machinery is constructed or installed in Bangladesh after 30th June, 2002. (d) Industry set up in EPZ is exempt from tax for a period of 10 years from the date of commencement of commercial production. Income from fishery, poultry, cattle breeding, dairy farming, horticulture, floriculture, mushroom cultivation and sericulture are exempt from tax up to 30th June, 2008, subject to investing at least 10% of the exempt income that exceed one lakh Taka. (e) Income derived from export of handicrafts. (f)An amount equal to 50% of the income derived from export business is exempt from tax. (g) Listed companies are entitled to 10% tax rebate if they declare dividend of 20% or more. (h) Income from computer software business up to 30th June, 2008 .

Customs Duty/Import Tax:

Of the three wings of the NBR, Customs Wing is responsible for the collection of customs duties on all imported goods. At present

International trade (Export-Import trade) is conducted through Dhaka, Chittagong, Benapole, and Mongla Custom Houses and a few Land Customs Stations. At the import level Customs Duty, VAT, IDSC, SD, Advance Income Tax, and Advance Trade VAT are imposed. Although law provides for Regulatory Duty, Safeguard Duty and Anti-dumping Duty, these are rarely applied in Bangladesh. Over the past two decades consistent efforts have been made to rationalize the tariff structure with a view to achieving greater trade facilitation. As a result we have now only 4 slabs of customs duty (0%, 6%, 13%, 25%) as against a couple of dozens of them prevalent in the recent past. Customs department is also entrusted with the task of combating smuggling with the support and assistance of all law enforcing agencies of the country including Bangladesh Navy, Bangladesh Coast Guards, Bangladesh Police, Bangladesh Rifles, Bangladesh Ansar and the Narcotics Control Department. There is a special agency in the Customs Department called Customs Intelligence and Investigation Directorate, which plays an important role in anti-smuggling activities. In order to make customs procedures more transparent and achieve more trade facilitation, a number of measures have been taken over the past few years. With the introduction of ASYCUDA++ and DTI (Direct Traders Input) automation in customs clearance has begun. As a result clearance of goods has been accelerated, procedures simplified, lead-time reduced and collection of revenue augmented. The changes that have been undertaken over the past few years have significantly increased revenue collection thereby enhancing NBRs contribution to the national economy. Exemptions from Customs Duty: 1. Capital machinery; 2. Raw materials of Medicine; 3. Poultry Medicine, Feed & machinery; 4. Defense stores; 5. Chemicals of leather and leather goods; 6. Private power generation unit; 7. Textile raw materials and machinery; 8. Solar power equipment; 9. Relief goods; 10.Goods for blind and physically retarded people; and 11.Import by Embassy and UN.

VAT in Bangladesh

Value Added Tax (VAT) a percentage tax on the value added of a commodity or service as each constituent stage of its production and distribution is completed. Brief History of VAT In Bangladesh: In April 1979, the Taxation Enquiry Commission (TEC) officially took up the issue of introducing VAT in Bangladesh as an alternate to sales tax. Until 1982, sales tax was being

collected under the Sales Tax Act 1951, which was replaced by the Sales Tax Ordinance 1982 with effect from 1 July 1982. The World Bank played the pioneering role in introduction of VAT in Bangladesh. A World Bank Mission visited Bangladesh for preparing an agenda for tax reform in Bangladesh in December 1986. The mission submitted its final report on 15 October 1989. The report recommended the introduction of a manufacturing-cum-import stage VAT at a single standard rate within three years. Thereafter, a Bangladesh Tax Mission visited India, Indonesia, the Philippines and Thailand during 13 November - 04 December 1989. The Mission submitted its report in January 1990. The government discussed the issues relating to introduction of VAT with all related private and public agencies including the various leading Chambers of Commerce and Industry from time to time. The government prepared the Value Added Tax Act 1990 (Draft) in June 1990. Final version of the Value Added Tax Act was promulgated 31 May 1991 as a Presidential Ordinance with eight sections (relating to registration under VAT system and the appointment and powers of VAT authorities). It was made effective from 2 June 1991. The Value Added Tax Bill 1991 was introduced in the Parliament on 1 July 1991 and the Parliament passed it on 9 July 1991. With the Presidential assent to the bill on the next day it came into effect as The Value Added Tax Act 1991. The VAT Act 1991 replaced the Business Turnover Tax Ordinance 1982 and the Sales Tax Ordinance 1982 with effect from 1 July 1991. It imposed VAT @ 15% on importer or supplier (producer) of taxable goods and provider of taxable services having annual turnover of Tk 1.5 million or more. It imposed Turnover Tax (TT) @ 2% (currently 4%) on supplier of taxable goods and provider of taxable services having annual turnover of less than Tk 1.5 million (Tk 2 million at present). The new law imposed VAT at zero-rate on export sales of any goods and services, brought excise duties on most goods under the VAT net, and imposed Supplementary Duty (SD) @ 10% to 85% on goods and services which are luxurious and non-essential and are socially undesirable. The objectives behind introducing VAT in Bangladesh were to (a) bring transparency in the taxation system; (b) prohibit cascading taxation at different stages of production; (c) consolidate the tax administration; (d) activate the overall economy by mobilizing more internal resources; and (e) bring a consistency in the tax-GDP ratio. VAT introduced in Bangladesh in its initial form was a sort of consumption tax (by allowing purchase of capital goods as input), which extended its coverage up to the level of import, production or manufacture and service-rendering but not to export (which is zero-rated), wholesale or retail level. Since the financial year 1996-97, VAT in Bangladesh has become a broad-based consumption expenditure tax by covering the wholesale and retail levels. VAT is imposed on the following goods and services: all goods imported in Bangladesh except those mentioned in the First Schedule of the VAT Act; all goods supplied except those mentioned in the First Schedule of the VAT Act; and all services provided in Bangladesh except those mentioned in the Second Schedule of the VAT Act.

The standard tax rate for VAT has been fixed all along at 15% (for taxable goods and services). The adoption of truncated value-bases caused multiplicity of practical tax rates, but VAT rate is a single, flat or uniform one. The rate of turnover tax (TT) is also uniform at 4% (2% up to 11 June 1997). But the rates of supplementary duty (SD) are multiple. At the beginning (FY 1991-92), there were five different rates which ranged from 10% to 85%. Next rates were eleven in number and ranged from 5% to 350%. For FY 2000-01, there are 31 different rates that ranged from 2.5% as on coffee to 350% as on cigarettes. The computation of actual value-addition requires detailed recording of payments for goods/services bought, which is not properly done in Bangladesh. To ease the administrative steps for taxation of services, in specified cases, a 'truncated value-base' was fixed with the option of waiving 'input tax credit'. Under the VAT system, tax points depend on the stage of production and distribution. For goods imported by any importer, VAT is to be paid at the time of paying import duty under the Customs Act 1969. For goods produced or manufactured or imported, purchased, acquired, or otherwise collected by any registered persons in the course of business operation or expansion, VAT is to be paid at the time of one of the following activities whichever occurs first: (a) when the goods are delivered or supplied; (b) when an invoice relating to the supply of goods is given; (c) when any goods are used personally or given for use to another person; and (d) when the price is received in part or full. For services rendered by any registered persons in the course of business operation or expansion, VAT is to be paid at the time of one of the following activities whichever occurs first: (a) when the services are rendered; (b) when an invoice relating to the rendering of service is given; and (c) when the price is received in part or full. For goods or class of goods for which the national board of revenue has ordered through the official Gazette notification to use stamp or banderole or special sign or mark having security system of specified value on package or carrier or container of the goods, VAT is to be considered as paid equivalent to the value of the stamp or banderole or special sign or mark used. For services rendered by construction firms, indenting firms, travel agencies, motor garages and workshops, and dockyards and other services determined by the official Gazette notification, VAT is to be paid as withholding tax and VAT is collected, deducted and deposited by the receiver of the services or the persons paying the price or commission as the case may be. For any other goods and class of goods or services, VAT is to be paid at the time as indicated in the NBR rule. VAT was introduced in Bangladesh as a consumption tax and allowed the full deduction of 'machinery' as an input from the 'output value' (sale proceeds of taxable goods and services) to compute the tax-base (i.e., value added). Although the initial coverage was up to import and production stages, the VAT-net is now expanded to wholesale and retail stages. Initially, the number of VAT taxable services were 25 (under 21

Heading numbers), but now the number is theoretically unlimited, although for practical purposes this number is kept limited to 70 services under 57 heading numbers for which the scope is defined. Goods other than primary unprocessed agricultural products and food items listed in the First Schedule of the VAT Act (live animals or poultry, human or animal hair, parts of animal body or animal products, parts of plant, green or dried vegetables, fruits, unprocessed spices, food items, oil seeds, natural gums or like products, wood, uncarded wool or cotton, and raw jute, etc) are subject to VAT. Thus almost the whole economy falls under the VAT-net and as a consumption tax, VAT is supposed to streamline the economic activities with corrective measures by applying supplementary duty. Main Features of VAT 1. VAT is imposed on goods and services manufacturing, wholesale and retails levels; at import stage,

2. A uniform VAT rate of 15 percent is applicable for both goods and services; 3. 15 percent VAT is applicable for all business or industrial units with an annual turnover of Taka 2 million and above; 4. Turnover tax at the rate of 4 percent is leviable where annual turnover is less than Taka 2 million; 5. VAT is applicable to all domestic products and services with some exemptions; 6. VAT is payable at the time of supply of goods and services; 7. Tax paid on inputs is creditable/adjustable against output tax; 8. Export is exempt; 9. Cottage industries (defined as a unit with an annual turnover of less than Taka 2 million and with a capital machinery valued up to Taka 3,00,000) are exempt from VAT; 10.Tax returns are to be submitted on monthly or quarterly or half yearly basis as notified by the Government. 11.Supplementary Duty (SD) is imposed at local and import stage under the VAT Act, 1991. Existing statutory SD rates are as follows: a. On goods: 20%, 35%, 65%, 100%, 250% & 350% b. On services: 10%, 15% & 35%. Tax Base for VAT: Import Stage:

Customs Assessable Value + Customs duty + Supplementary Duty Domestic/Local Stage: a) Goods (manufacturing): [Production cost + Profit and Commission (if any) + Supplementary duty (if any)] b) Services: [total receipts excluding VAT but including supplementary duty (if any)] Truncated Base / Fixed Value Addition: In some of the cases of goods and services producers and sellers face difficulties in availing VAT credit/adjustment facilities due to non availability of invoices from the sellers of input. In order to remove this operational difficulty fixed bases such as 10%, 25%, 30%, and 60% value addition is taken into account for calculation of VAT for a number of goods and services. In such circumstances net VAT rate for different rates of value addition comes to 1.5%, 2.25%, 4.5% and 9%. VAT at the wholesale and retail stage: In case of wholesalers and retailers, there is a special provision for a 1.5% percent VAT known as Trade VAT on the total sale, provided that the wholesaler/retailer do not avail the facility of input credit/adjustment. Such tax is also collected at the import stage from importers of finished goods as an advance trade VAT. Tariff Value for imposition of VAT: Under the VAT Law, the government is empowered to fix Tariff Value for some items for the collection of VAT. Example: tariff value for mild-steel products produced from imported/locally procured re-rollable scraps is TK 4000.00 per MT. Normal VAT input credit is also not available under this system. Deduction of VAT at source: case of VAT on certain Autonomous Bodies, NGOs, Companies are authorized by the services at source. As deduction at source is also practiced in services, Government, Semi-Government, Banks, Insurance Companies and Limited the government to deduct applicable VAT on

Excise Duty: At present excise duty applies to only two items: bank deposits and domestic air ticket (Tk. 250 per journey). Sources: 1. NBR Website http://www.nbr-bd.org/ 2. Banglapedia website www.banglapedia.org 3. Direct Taxes in Bangladesh, A Study of Income Tax, Wealth Tax Gift Tax by Mustafa Tariq Hasan

Você também pode gostar

- Assignment On BrandingDocumento7 páginasAssignment On BrandingMizbah Uddin SiddiqiAinda não há avaliações

- Almighty Allah: in The Name ofDocumento44 páginasAlmighty Allah: in The Name ofSarfraz KhalilAinda não há avaliações

- Assignment: Course TitleDocumento1 páginaAssignment: Course TitleMizbah Uddin SiddiqiAinda não há avaliações

- Sample Resume 1Documento6 páginasSample Resume 1Mizbah Uddin SiddiqiAinda não há avaliações

- The Yellow House: A Memoir (2019 National Book Award Winner)No EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Nota: 4 de 5 estrelas4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNo EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeNota: 4 de 5 estrelas4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNo EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureNota: 4.5 de 5 estrelas4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNo EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryNota: 3.5 de 5 estrelas3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNo EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceNota: 4 de 5 estrelas4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItNo EverandNever Split the Difference: Negotiating As If Your Life Depended On ItNota: 4.5 de 5 estrelas4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingNo EverandThe Little Book of Hygge: Danish Secrets to Happy LivingNota: 3.5 de 5 estrelas3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNo EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersNota: 4.5 de 5 estrelas4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaNo EverandThe Unwinding: An Inner History of the New AmericaNota: 4 de 5 estrelas4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnNo EverandTeam of Rivals: The Political Genius of Abraham LincolnNota: 4.5 de 5 estrelas4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyNo EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyNota: 3.5 de 5 estrelas3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNo EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaNota: 4.5 de 5 estrelas4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerNo EverandThe Emperor of All Maladies: A Biography of CancerNota: 4.5 de 5 estrelas4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNo EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreNota: 4 de 5 estrelas4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)No EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Nota: 4.5 de 5 estrelas4.5/5 (121)

- How To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDocumento148 páginasHow To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDavid ChalkerAinda não há avaliações

- BS 6206-1981 PDFDocumento24 páginasBS 6206-1981 PDFwepverro100% (2)

- Presentation On " ": Human Resource Practices OF BRAC BANKDocumento14 páginasPresentation On " ": Human Resource Practices OF BRAC BANKTanvir KaziAinda não há avaliações

- Fatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournDocumento13 páginasFatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournSunny SinghAinda não há avaliações

- Trade Confirmation: Pt. Danareksa SekuritasDocumento1 páginaTrade Confirmation: Pt. Danareksa SekuritashendricAinda não há avaliações

- BIR Form 1707Documento3 páginasBIR Form 1707catherine joy sangilAinda não há avaliações

- Use CaseDocumento4 páginasUse CasemeriiAinda não há avaliações

- Part 1Documento122 páginasPart 1Astha MalikAinda não há avaliações

- Latihan Soal PT CahayaDocumento20 páginasLatihan Soal PT CahayaAisyah Sakinah PutriAinda não há avaliações

- Business Plan SampleDocumento14 páginasBusiness Plan SampleGwyneth MuegaAinda não há avaliações

- Project On SurveyorsDocumento40 páginasProject On SurveyorsamitAinda não há avaliações

- Exim BankDocumento79 páginasExim Banklaxmi sambre0% (1)

- StatementsDocumento2 páginasStatementsFIRST FIRSAinda não há avaliações

- TIPS As An Asset Class: Final ApprovalDocumento9 páginasTIPS As An Asset Class: Final ApprovalMJTerrienAinda não há avaliações

- Guide To Accounting For Income Taxes NewDocumento620 páginasGuide To Accounting For Income Taxes NewRahul Modi100% (1)

- Monsoon 2023 Registration NoticeDocumento2 páginasMonsoon 2023 Registration NoticeAbhinav AbhiAinda não há avaliações

- NaftaDocumento18 páginasNaftaShabla MohamedAinda não há avaliações

- BCG Executive Perspectives CEOs DilemmaDocumento30 páginasBCG Executive Perspectives CEOs DilemmaageAinda não há avaliações

- Aptdc Tirupati Tour PDFDocumento1 páginaAptdc Tirupati Tour PDFAfrid Afrid ShaikAinda não há avaliações

- 002016-2017 S2S TRAINING PROPOSAL SLAC On THE DEVT OF SCHOOL MRFDocumento7 páginas002016-2017 S2S TRAINING PROPOSAL SLAC On THE DEVT OF SCHOOL MRFBenjamin MartinezAinda não há avaliações

- Ifland Engineers, Inc.-Civil Engineers - RedactedDocumento18 páginasIfland Engineers, Inc.-Civil Engineers - RedactedL. A. PatersonAinda não há avaliações

- Kennedy 11 Day Pre GeneralDocumento16 páginasKennedy 11 Day Pre GeneralRiverheadLOCALAinda não há avaliações

- Healthpro Vs MedbuyDocumento3 páginasHealthpro Vs MedbuyTim RosenbergAinda não há avaliações

- Financial Astrology by Mahendra SharmaDocumento9 páginasFinancial Astrology by Mahendra SharmaMahendra Prophecy33% (3)

- TCW Act #4 EdoraDocumento5 páginasTCW Act #4 EdoraMon RamAinda não há avaliações

- Approaches To Industrial RelationsDocumento39 páginasApproaches To Industrial Relationslovebassi86% (14)

- E Money PDFDocumento41 páginasE Money PDFCPMMAinda não há avaliações

- Packing List PDFDocumento1 páginaPacking List PDFKatherine SalamancaAinda não há avaliações

- Levacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesDocumento14 páginasLevacic, Rebmann - Macroeconomics. An I... o Keynesian-Neoclassical ControversiesAlvaro MedinaAinda não há avaliações

- Arithmetic of EquitiesDocumento5 páginasArithmetic of Equitiesrwmortell3580Ainda não há avaliações