Escolar Documentos

Profissional Documentos

Cultura Documentos

Final Report

Enviado por

Komal DhaliwalDireitos autorais

Formatos disponíveis

Compartilhar este documento

Compartilhar ou incorporar documento

Você considera este documento útil?

Este conteúdo é inapropriado?

Denunciar este documentoDireitos autorais:

Formatos disponíveis

Final Report

Enviado por

Komal DhaliwalDireitos autorais:

Formatos disponíveis

SUMMER TRAINING REPORT SUBMITTED TOWARDS THE PARTIAL FULFILLMENT OF POST GRADUATE DEGREE IN INTERNATIONAL BUSINESS

BUYERS LINE OF CREDIT- TO OPTIMISE THE COST

SUBMITTED BY: ANSHIKA AGARWAL MBA-IB (2010-2012) A1802011249

INDUSTRY GUIDE : ABHISHEK AGARWAL (Vice President)

FACULTY GUIDE: MS. LUVNICA RASTOGI

AMITY INTERNATIONAL BUSINESS SCHOOL AMITY UNIVERSITY, NOIDA

BUYERS LINE OF CREDIT

CERTIFICATE OF ORIGIN

This is to certify that Ms. Anshika Agarwal, a student of Post Graduate Degree in International Business and Finance, Amity International Business School, Noida has worked in the Export-Import, International Business, under the able guidance and supervision of Mr. Abhishek Agarwal ,Vice President, Crystal Crop Protection Ltd. The period for which she was on training was for 8 weeks, starting from 7th May to 29th June. This Summer Internship report has the requisite standard for the partial fulfillment the Post Graduate Degree in International Business. To the best of our knowledge no part of this report has been reproduced from any other report and the contents are based on original research.

Signature (Faculty Guide)

Signature (Student)

AMITY UNIVERSITY

Page 2

BUYERS LINE OF CREDIT

Acknowledgement

Before moving ahead with the report, I would like to show gratitude to our Director Mr. Arun Sachhar sir for including such an informative subject in our course program.

I am vastly obliged to Mr. Abhishek Agarwal, my industry guide and Ms. Luvnica Rastogi, my faculty guide for helping me throughout my project. Their support and approval has instilled the right level of confidence within me. I am also very appreciative to the most widely used search engines that were kind enough to provide me with the information and the photographs for this text. The report would never have been so comprehensive and so much detailed without it.

Not forgetting, thank you Ms-Word, this report would have been unorganized without the power of Ms-Word, from grammar checks to replace alls. It is simple without this software, this report would not be written. Thank you Mr. Bill Gates and Microsoft Corp!

Lastly, I would like to thank the Almighty God for everything. This report would never have been a success without his blessings. I sincerely hope that the readers find our report interesting, informative and enjoyable to read.

-ANSHIKA AGARWAL

Table of contentsAMITY UNIVERSITY Page 3

BUYERS LINE OF CREDIT

CHAPTER TOPIC

1.0 2.0 EXECUTIVE SUMMARY INTRODUCTION a) Objectives b) Assumptions c) Limitations 3.0 RESEARCH METHODOLOGY a) Research problem b) Data Collection 4.0 INDUSTRY BACKGROUND a) Review of literature b) Growth forecasts c) SWOT Analysis 5.0 COMPANY BACKGROUND a) Literature Review b) IB in the Company c) Organisation structure 6.0 LITERATURE REVIEW a) Buyers credit- Current scenario 6.1 INTERNATIONAL PAYMENT MODES a) Telegraphic transfer b) Letter of Credit c) Documentary Collection 7.0 ANALYSIS a) Cost through TT payment b) Cost through L/C c) Cost 8.0 CONCLUSION AND RECOMMENDATIONS

PAGE NO.

6-7 8-9

10

11-15

16-20

21-24

25-41

42-45

46-47

AMITY UNIVERSITY

Page 4

BUYERS LINE OF CREDIT

9.0 10.0 11.0 12.0 13.0

FUTURE PROSPECTS BIBLIOGRAPHY ANNEXURES CASE STUDY SYNOPSIS

48 49-50 51-56 57-61 62-63

1.0 EXECUTIVE SUMMARYAMITY UNIVERSITY Page 5

BUYERS LINE OF CREDIT

Liberalization of the economy, coupled with the significantly lower interest rates prevailing internationally, have thrown up an opportunity to top-notch companies like CRYSTAL CROP PROTECTION Ltd. to source global funds even for their working capital needs. Foreign currency funding options such as buyer's/supplier's credits are being increasingly preferred by companies in India. To simplify the procedure for imports into India, the RBI, in September 2002, permitted the authorised dealers to approve proposals for short-term credit for financing, by way of either suppliers' credit or buyers' credit, of import of goods into India. The conditions to be fulfilled by the ADs are that: the credit is extended for a period of less than three years; the amount of credit does not exceed $20 million, per import transaction;.

Buyers' credits for imports are extended where payment terms can be sight or usance (the term usance refers to payment on deferred terms, as mutually agreed upon by the supplier and the buyer). These credits can be raised irrespective of whether the import takes place under an arrangement of letter of credit (LC) issued by a bank in India or whether the supplier sends the bills on collection basis. Buyers line of credit is a really interesting topic to work upon and helps to know that how it is in organizations and how they use such credit to reduce their cost.

PrefaceAMITY UNIVERSITY Page 6

BUYERS LINE OF CREDIT

This report documents the results of a study and practical experience gained at Crystal Crop Protection Ltd. about the buyers line of credit that was undertaken for the summer internship. This report consists of an Executive Summary and a detailed Overview that present the studys findings and recommendations. It also contains chapters on specific and short appendices like a sample of L/C application and list of exporters in china etc. that expand on points covered in the Overview. The Overview synthesizes the research and functions as a road map pointing the reader toward these additional discussions. The views expressed in this report are those which are being experienced practically and which have been taught in the company.

The main aim of this thesis is to learn and explore much about the company and gain practical experience and thereby learning about the buyers credit.

Foreign currency funding options such as buyer's/supplier's credits are being increasingly preferred by companies in India. To simplify the procedure for imports into India, the RBI, in September 2002, permitted the authorized dealers to approve proposals for short-term credit for financing, by way of either suppliers' credit or buyers' credit, of import of goods into India.

2.0

INTRODUCTION-

AMITY UNIVERSITY

Page 7

BUYERS LINE OF CREDIT

OverviewExporters prefers to sell merchandise on sight terms or a maximum usance period of 180 days from date of shipment. However, importers prefer to buy on a usance terms and at times, beyond 180 days depending on the cash flow position. This cash flow mismatch need can be taken care by the banks through an import buyers credit offering. The local bank through their offshore offices arranges foreign currency financing to pay off the exporter on due date of the transaction.

Definition of Buyers CreditBuyers credit is the credit availed by an Importer (Buyer) from overseas Lenders i.e. Banks and Financial Institutions for payment of his Imports on due date. The overseas Banks usually lend the Importer (Buyer) based on the letter of Credit (a Bank Guarantee) issued by the Importers (Buyers) Bank. In fact the Importers Bank brokers between the Importer and the overseas lender for arranging buyers credit by issuing its Letter of Comfort for a fee.

Buyers credit helps local importers access to cheaper foreign funds close to LIBOR rates as against local sources of funding which are costly compared to LIBOR rates.

a) OBJECTIVE-

To understand the concept as well as the process of buyers credit To know about different modes of international payments.

AMITY UNIVERSITY

Page 8

BUYERS LINE OF CREDIT

To know how companies reduce their costs by using such credit with reference from Crystal Crop Protection Ltd.. To understand how such credit act as an advantage on long term profitability of the firm. To suggest the best possible payment mode to the company. The Future prospects

b) Assumptions-.

The company follow the strategies as stated by them and true information has been provided. The bank rates are as they have been stated in the project currently.

c) Limitations-

Lack of time regarding making choices Unable to explore much due to the restrictions laid by the company. Lack of much knowledge about the area of research may lead to certain errors.

3.0 RESEARCH METHODOLOGY-

AMITY UNIVERSITY

Page 9

BUYERS LINE OF CREDIT

Research problem:

To identify the various credit options for importers or the buyers currently applicable to the company and suggesting the best possible method for the company .

Data Collection:

The source of data in my report is basically SECONDARY DATA. The detailed information collected about the buyers credit adopted by such companies in this project is collected through basically secondary research and documentary analysis of annual reports, parliamentary publications and agreements has been used in order to make it complete.

An extent of primary data has also been used. The primary data involves the information collected from colleagues and some senior people in the organization regarding the buyers credit and the various issues while working with the organization and analysis involves calculation of certain costs that is an original piece of work.

4.0 INDUSTRY BACKGROUND

AMITY UNIVERSITY

Page 10

BUYERS LINE OF CREDIT

a) Review of Literature:

A key constituent of the Indian economy that accounts for about five percent of the GDP, the Indian chemical industry has vital associations with several other industries such as automotives, consumer durables, food processing, iron and steel, textiles, paper, and engineering, among others. It is the eighth largest sector in the world and the third largest in Asia by volumes, after China and Japan. This report encompasses an assessment of the chemicals industry in India, within the context of the global industry, and the opportunities and challenges it presents. The countrys chemical industry was estimated at USD 91 billion in 2011 and we believe that it has the potential to reach USD 134 billion by 2015 growing at a CAGR of 10 percent. The growth is expected to be driven by rising demand in end-use segments and expanding exports fuelled by increasing export competitiveness. The dynamics that propel the industry, namely opportunities, competition, infrastructure investment and regulatory policies are also studied in the report. The industry is a multi-product and multi-faceted one that comprises basic chemicals,

pharmaceuticals, petrochemicals, specialty chemicals, agrochemicals and biotechnology and their sub segments. Within the sub segments, the petrochemicals industry is growing the fastest, with a rate of around 15 percent annually. In India, the per-capita consumption of most of the finished products under the chemicals sector is far below the world average, which demonstrates the industrys enormous potential for growth. The government of India plans to invest USD 34 billion in three approved Petroleum, Chemicals and Petrochemicals Investment Regions (PCPIRs); it also plans to establish port-based chemical parks in special economic zones (SEZs) in the next five years.

India is the fourth largest producer of agrochemicals globally, after United States, Japan and China. The agrochemicals industry is a significant industry for the Indian economy. The Indian agrochemicals market grew at a rate of 11% from USD 1.36 billion in FY10 to an estimated USD 1.50 billion in FY11. Indias agrochemicals consumption is one of the lowest in the world with per hectare consumption of just 0.58 Kg compared to US (4.5 Kg/ha) and Japan (11 Kg/ha). In India, paddy accounts for the maximum share of pesticide consumption, around 28%,

AMITY UNIVERSITY

Page 11

BUYERS LINE OF CREDIT

followed by cotton (20%). Indian population is increasing and the per capita size of land decreasing, the use of pesticides in India has to improve further. Besides increasing in domestic consumption, the exports by the Indian Agrochemicals Industry can be doubled in the next four years if proper strategies and sophisticated technologies are adopted by the industry.

India has the potential to become a global chemical manufacturing hub if the government and domestic players rise up to the challenge. It is projected that USD 350 billion of the projected USD 1trillion global specialty chemical industry could move to Asia by 2020. In wake of this, immense growth opportunities coupled with intense competition are acting as major drivers behind the dynamic growth in certain segments.

In India, there are about 125 technical grade manufacturers (10 multinationals), 800 formulators, over 145,000 distributors. 60 technical grade pesticides are being manufactured indigenously. Technical grade manufacturers sell high purity chemicals in bulk (generally in drums of 200-250 Kg) to formulators. Formulators, in turn, prepare formulations by adding inert carriers, solvents, surface active agents, deodorants etc. These formulations are packed for retail sale and bought by the farmers.

The Indian agrochemicals market is characterized by low capacity utilization. The total installed capacity in FY09 was 146,000 tons and total production was 85,000 tons leading to a low capacity utilization of 58%. The industry suffers from high inventory (owing to seasonal & irregular demand on account of monsoons) and long credit periods to farmers, thus making operations working capital intensive.

India's agrochemicals consumption is one of the lowest in the world with per hectare consumption of just 0.58 Kg compared to US (4.5 Kg/ha) and Japan (11 Kg/ha). The key reasons for low usage are low purchasing power of farmers, lack of awareness about crop protection benefits and poor reach and accessibility of crop protection chemicals. The domestic market is expected to grow at 8% annually till FY15. Exports are set to grow at a CAGR of 15% during the same period.

AMITY UNIVERSITY

Page 12

BUYERS LINE OF CREDIT

b) GROWTH FORECAST & DRIVERS

Since the Indian agricultural sector is highly dependent on monsoons, the market for agrochemicals is expected to grow at a conservative growth rate of 7.5% to reach ~ USD 1.95 Bn by FY14. Key market drivers include: Growth in demand for food grains: India has 16% of the worlds population and less than 2% of the total landmass. Increasing population and high emphasis on achieving food grain self-sufficiency as highlighted in the FY10 budget, is expected to drive growth.

Limited farmland availability and growing exports: India has ~190 Mn hectares of gross cultivated area and the scope for bringing new areas under cultivation is severely limited. Available arable land per capita has been reducing globally and is expected to reduce further. The pressure is therefore to increase yield per hectare which can be achieved through increased usage of agrochemicals. Indian agrochemical exports accounted for ~50% of total industry size in 2009.

Growth of horticulture & floriculture: Buoyed by 50% growth experienced by Indian floriculture industry in last 3 years, Government of India has launched a national horticulture mission to double production by 2012. Growing horticulture and floriculture industries will result in increasing demand for agrochemicals, especially fungicides.

Increasing awareness: As per Government of India estimates, total value of crops lost due to non-use of pesticides is around USD 17 Bn every year. Companies are increasingly training farmers regarding the right use of agrochemicals in terms of quantity to be used, the right application methodology and appropriate chemicals to be used for indentified pest problems. With increasing awareness, the use of agrochemicals is expected to increase. c) KEY SEGMENTS

AMITY UNIVERSITY

Page 13

BUYERS LINE OF CREDIT

Insecticides: Insecticides are used to ward off or kill insects. Consumption of insecticides for cotton has come down to 50% from 63% of total volume after introduction of BT cotton.

Fungicides: Fungicides are used to control disease attacks on crops. The growing horticulture market in India owing to the government support has given a boost to fungicide usage. The market share of fungicides has increased from 16% in 2004 to 22% in 2011.

Herbicides: Herbicides are the fastest growing segment of agrochemicals. Their main competition is cheap labor which is employed to manually pull out weeds. Sales are seasonal, owing to the fact that weeds flourish in damp, warm weather and die in cold spells.

Bio-pesticides: Bio-pesticides are pesticides derived from natural substances like animals, plants, bacteria and certain minerals. Currently a small segment, biopesticides market is expectedto grow in the future owing to government support and increasing awareness about use of non-toxic, environment friendly pesticides.

Others: Plant growth regulators, Nematocides, Rodenticides, Fumigants etc. Rodenticides and plant growth regulators are the stars of this segment.

d) SWOT ANALYSIS

STRENGTHS Low cost manufacturing Availability of process technologies Ample Capacity

WEAKNESSES High R&D expenditure

AMITY UNIVERSITY

Page 14

BUYERS LINE OF CREDIT

Dependence on Monsoons Consumption imbalance Registration Norms Health Hazards

OPPORTUNITIES Focus on Innovative Farming Solutions Export Potential Scope for Increase in Usage Rural Infrastructure & IT Availability of Credit facilities Increase in Minimum Support Price (MSP) Rising Cost of Labor: Blessing in Disguise

THREATS

Integrated Pest Management (IPM) and Rising demand for organic farming Genetically Modified Seeds Spurious Pesticides

5.0 Company profileAMITY UNIVERSITY Page 15

BUYERS LINE OF CREDIT

a) LITERATURE REVIEW

History

Enthused with the noble cause of serving the Indian agriculture, Crystal Phosphates Limited was incepted in the year 1997 by the visionary industrialist Mr. Nand Kishore Aggarwal. Crystal engages in the technical manufacturing, formulation and marketing of agrochemical products Insecticides, Fungicides, Herbicides, PGR (Plant Growth Regulator) & Micronutrients. Under the adept guidance of Mr. Nand Kishore Aggarwal and his 36 years of rich experience, Crystal has evolved as a market leader in the growing agro-chemical industry of India over a period of time.

Vision and Mission

To be a leader in every market we serve with an unsurpassed reputation for excellence that focuses on innovative business practices, high quality, cost effectiveness and high performance standards.

Values

Customer Satisfaction: The Foremost importance in Crystal Phosphates business theory is customer satisfaction. With deep appreciation towards our customers, we will strive to build a reliable and trust worthy partner ship with them behind a mind that all businesses fail to exist without customers.

Maximize & Add Optimal Value: For years Maximize has been core to our strategy because it entails a superior way of doing things. An intelligent management of competencies, high functional efficiency and productivity. The enhanced network of global coalitions and mutual cooperation adds bigger value in the hands of our customers.

AMITY UNIVERSITY

Page 16

BUYERS LINE OF CREDIT

Knowledge & Quality: Knowledge thats been developed through resident expertise and strengths of its global partners and has been honed due to its inherent vast experience of meeting customer needs over three decades across the globe. Our success is based on a total commitment to quality standards that are in line with the most demanding international benchmarks in the industry.

Quality Policy: Quality being the hallmark of Crystals agrochemical products, the company observes highest measures to maintain best quality of its products through various parameters. Again, ultimate quality being integrated in each minuscule work process together has contributed towards ISO 9001:2000 certification, the prestigious accreditation that the enterprise has been awarded with. Beyond maintaining the outstanding quality in its products, Crystal owns a greater concern for environment and reflection of our care is highly endorsed with ISO 14001:2004 certification, which is awarded for sophisticated Environment Management System.

b) International Business (IB IN CCPL):

With a strong R&D and registration department, Crystal Group has various under process registration and an equal number of completed registrations in various countries. We are exporters of Emamectin, Abamectin, Deltamethrin Tech., Cypermethrin Tech., Dichlorvos Tech., Alfacypermethrin Tech., Chlorpyrifos Tech., Triacontanol 0.05% EC, Atrazin 80%WP, Pendimethalin 50% EC, Hexaconazole 5% SC etc. to many countries including Egypt, Nigeria, Saudi Arabia, UAE, Turkey, Philippines, Bangladesh etc. Currently we are also working on expanding our exports to various other countries in South East Asia, Gulf and Africa as our priority focus regions. With various partners in these regions we are undertaking product registration at very rapid pace. We have a large number of dossiers available for various products with complete data of their chemistry, packaging, toxicity etc.

AMITY UNIVERSITY

Page 17

BUYERS LINE OF CREDIT

With a strong research and development department, Crystal is also involved in providing various agricultural solutions to number of countries. Based upon detailed analysis of the countrys climate, soil texture and chemistry, crops and vegetation we develop and provide specific agrochemicals suitable and effective for the countrys crop related problems.

Corporate social responsibility Crystal Phosphates Ltd., organizes various CSR activities from time to time for the upliftment of the society. As a part of its CSR activity the company, has recently organized an award ceremony, Missile of the Year and Crystal of the Year. This award was given to the topper of school for High Schools and to the highest scorers for schools from class first to ninth respectively. Given on the special occasion of Childrens Day, these felicitations specifically cover the village schools. Crystal is also intensely responsive to the loss of those afflicted by different natural disasters. The company has come together with TV 9 & MAA (Movie Artists Association) in the fund-raising mega event Spandana for aiding the flood-stricken population of Andhra Pradesh. Substantial capital contribution has been made as a small gesture of relief for the homeless & hapless.

c) Organization structure-

Head Office AMITY UNIVERSITY Page 18

BUYERS LINE OF CREDIT

Strategy Department

Finance Department

IT Department

Administration

Marketing Department

Public Relation Department

Legal Department

Personnel Department

Sales Department

Research Department

Logistics Department

Production Department

Security Department

This chart above shows the rough idea of the organizational structure that is being followed for reporting etc. the detailed structure is shown later. As observed, in my opinion organsation chart has the following advantages1. Brings clarity to the Organization: The very process of preparing a chart makes the executive think more clearly about the Organisation relationships. 2. Provides dear picture of the Organisation: Once the charts are prepared, they provide lot of information about the Organisation, both to the members of the Organisation as well as to the outsiders. This information relates to number and types of departments, superior subordinate relationships, chain of command and communication and job titles of each employee. 3. Facilitates training of employees: Organisation charts are useful in familiarizing and training new employees. 4. Ensures organizational changes: Organisation charts provide a starting point for planning organizational changes after having discovered the weaknesses of the existing structure.

AMITY UNIVERSITY

Page 19

BUYERS LINE OF CREDIT

5. Provides quick understanding: A chart serves as a better method of visualizing an Organisation than a lengthy written description of it.

Detailed organizational chart-

CEO NandKishore Agarwal

Managing Director Ankur Agrawal

Director Marketing Anil Nirmal

VP Finance S.C Kapoor

GM Account Piyush Jain

General Manager (I.B) Abhishek Agarwal

VP HR S.D Gupta

DGM Logistics Amit Chugh

G M Marketing Pankaj Bora

Finance Manager Prabhat Routry

Manager Account R.K Batra Manager Account Anil Rai

DGM Export Swroop D M B2B Sales Vineet Mudgil

D M B2B Sales Anita Agrawal

DGM HR Rolly Agarwal

6.0 LITERATURE REVIEW

AMITY UNIVERSITY

Page 20

BUYERS LINE OF CREDIT

A) BUYERS CREDIT- CURRENT SCENARIOIN THE wake of various positive developments on the external sector and the domestic front, the Reserve Bank of India (RBI) has been liberalising and rationalising procedures for forex transactions, both on the current and capital accounts. Under the FEMA regime, limits for many current account transactions have been raised to facilitate easier drawal of foreign exchange by residents individuals and corporates in India. On the capital account too, there have been relaxations in respect of foreign currency borrowings, both short and long term. Foreign currency borrowings, which include, inter alia, external assistance, buyers' credit, suppliers' credit, NRI deposits, short-term credit and rupee debt, are a key component of India's overall external debt and its management. The measures taken represent a significant change in the approach of the central bank in the context of overall foreign exchange management. As part of its new approach, the RBI recently came out with comprehensive guidelines on trade credits (hitherto referred to as short-term credits) that include buyers' and suppliers' credits which are extended for periods less than three years. Much clarity is now available on the purpose, cost, and so on. For example, the new guidelines restrict the purpose of the credits for periods exceeding one year (and less than three years) to import capital goods only. The RBI has also reiterated that ADs shall not issue guarantee, letter of undertaking (LoU) or letter of comfort (LoC) in favour of overseas lender on behalf of their importer constituents for trade credits without its (the RBI's) approval. A look at the broad perspective of these credits and a few related issues. A period of six months has long been considered normal settlement time for import payments. Liberalisation of the economy, coupled with significantly lower interest rates prevailing internationally, have thrown an opportunity to the top-notch companies to source global funds even for their working capital needs. Foreign currency funding options such as buyers'/suppliers' credits are being increasingly preferred by the companies in India.

AMITY UNIVERSITY

Page 21

BUYERS LINE OF CREDIT

Suppliers' credits are those short-term loans where the credit for imports into India is extended by the overseas supplier for a period of more than six months but less than three years. In the case of buyers' credits, short-term loans for payment of imports into India are arranged by the importer from a bank or financial institution outside India for maturity of less than three years. Both the arrangements needed specific approval from the RBI till September 2002. To simplify the procedure for imports into India, the RBI, in September 2002, permitted the authorised dealers to approve proposals for short-term credit for financing, by way of either suppliers' credit or buyers' credit, of import of goods into India. The conditions to be fulfilled by the ADs are that:

the credit is extended for a period of less than three years; the amount of credit does not exceed $20 million, per import transaction; the `all-in-cost' per annum, payable for the credit does not exceed Libor +50 basis points for credit up to one year and Libor +125 basis points for credits for periods beyond one year but less than three, for the currency of the credit or applicable benchmark.

Buyers' credits for imports are extended where payment terms can be sight or usance (the term usance refers to payment on deferred terms, as mutually agreed upon by the supplier and the buyer). These credits can be raised irrespective of whether the import takes place under an arrangement of letter of credit (LC) issued by a bank in India or whether the supplier sends the bills on collection basis. The foreign lender, generally a foreign office/correspondent of the importer's bank in India, would raise a loan account in the name of the buyer in its books on the strength of a guarantee, letter of undertaking (LoU) or a letter of comfort (LoC) from the importer's bank in India. Thus, under the arrangement of buyer's credit, the importer company in India need not retire the import bill on the due date; instead it can have the payment deferred to a future date (to a period less than three years from the date of Bill of Lading or the shipment date).

AMITY UNIVERSITY

Page 22

BUYERS LINE OF CREDIT

In the mechanism of supplier's credit, on the other hand, the importer company opens a letter of credit (LC) from a bank in India under usance terms and the supplier company gets its bills (drawn under the LC) discounted from a foreign office/foreign correspondent of the LC opening bank in India. Thus, although according to the original payments terms, the payment is to be received on the expiry of the usance period, the supplier gets cash on the day of presentation of documents to the bank abroad extending the suppliers' credit. For the lending bank, the LC issued by the bank in India becomes the security and payment is assured at the end of the normal usance period. Low-funding cost, the prime motive behind the dependence on buyer's credit, is apparent in the table. The currency of the credit is usually the same as that of the invoice although there are wide differences in interest rates of the four major currencies. Mismatches in Libor (benchmark rate for lendings across the countries) of different currencies are usually negated by market forces through continuous movements in exchange rates between the currencies, propelled by demand/supply position of each currency. The over-all interest cost of buyer's credits is around 2 per cent. Taking into account other pay-outs in the form of handling charges (payable to the bank in India), hedging cost against exchange rate and interest rate risks, the cost would be around 3.5 per cent only. At present, rupee-dollar forward rates are at discount bringing the cost further down to the borrowers. Despite all these benefits, a few obstacles remain in truly popularising the product. One, not every import into India is sizeable for the bank to arrange for a buyers' credit from abroad. Generally, foreign banks/branches of Indian banks look for amounts in excess of $100,000 to give them income of some substance. Two, there is no incentive for the banks in India (other than small amount of commission that they book for issuance of LoUs/LoCs to the foreign lenders) to really push for the buyer's credits as these would eat into their (the banks') existing credit portfolio which is already under severe attack. Even the meagre return of around 5 per cent that the banks are now earning on working capital advances to corporates will be at stake, when the credit off-take is dented by the buyers' credits.

AMITY UNIVERSITY

Page 23

BUYERS LINE OF CREDIT

As per the extant guidelines (as reiterated by the RBI in their circular dated April 17, 2004), ADs shall not issue guarantee in favour of overseas lender on behalf of their importer constituent for trade credit without the approval of the RBI. This requirement necessitates the banks to seek approval from the RBI for every single-credit, thus delaying the whole process and defeating the very essence of liberalisation of rules for import finance in foreign currency. It must be noted here that banks have been issuing commitments of forex payments by way of LC as part of the international trade practice without seeking any approval from the regulatory authorities. Therefore, putting restriction on issuance of guarantee (also in the nature of a commitment) for arranging the buyer's credit would only result in delays which could prove crucial. After all, buyer's credits are a key short-term funding option for the corporates. If the corporates are to become truly global in terms of quality, efficiency, and so on, they should have access to funds at internationally competitive prices. Besides, many of the corporates do have systems in place to monitor the exchange risks and costeffectiveness of the forex loans. Besides, the RBI also has the means and reporting systems in place to effectively monitor foreign currency exposures of the corporates to ensure against anyone going overboard. It is, therefore, hoped the RBI liberalizes the guidelines further, relieving the commercial banks from seeking approvals for the buyer's credits. Banks on their part, would need to take due precautions while popularizing the product to ensure that it will be a win-win situation for all concerned, without any party taking undue risks. Now in order to understand further it is very much essential to learn about letter of credit, about low banks gives LC limits so that it will be easy to carry out the analysis part. So starting with the meaning of letter of credit.

6.1 International Payment Modes-

AMITY UNIVERSITY

Page 24

BUYERS LINE OF CREDIT

To succeed in todays global marketplace and win sales against foreign competitors, exporters must offer their customers attractive sales terms supported by appropriate payment methods. Because getting paid in full and on time is the ultimate goal for each export sale, an appropriate payment method must be chosen carefully to minimize the payment risk while also accommodating the needs of the buyer. During or before contract negotiations, you should consider which method in the figure is mutually desirable for both you and your customer. Points need to be kept in mind while making international payments:

To succeed in todays global marketplace and win sales against International trade presents a spectrum of risk, which causes uncertainty over the timing of payments between the exporter (seller) and importer (foreign buyer).

For exporters, any sale is a gift until payment is received. Therefore, exporters want to receive payment as soon as possible, preferably as soon as an order is placed or before the goods are sent to the importer.

For importers, any payment is a donation until the goods are received. Therefore, importers want to receive the goods as soon as possible but to delay payment as long as possible, preferably until after the goods are resold to generate enough income to pay the exporter.

With reference to the project, 3 types of international payments have been discussed in detail, namely: Telegraphic Transfer Letter of Credit Documentary collection

6.1.1 Telegraphic Transfer:

AMITY UNIVERSITY

Page 25

BUYERS LINE OF CREDIT

First type of payment method that the company has opted is TT payment mode, i.e. Telegraphic Transfer. T/T means telegraphic transfer, or simply wire transfer. It's the simplest and easiest payment method to use. T/T payment in advance is usually used when the sample and small quantity shipments are transported by air or ship. The reason why is that the documents like air waybill, commercial invoice and packing list are also sent along with the shipment by the same plane. As soon as the shipment arrives, you can clear the customs and pick up the goods with the documents. As it's acknowledged, T/T payment in advance presents risk to the importer if the supplier is not an honest one. Bank transfers (also known as telegraphic transfers or T/T) is one of the simplest forms of international transfers. In traditional international trade, its risky for buyers to pay using bank transfers because their money goes into the suppliers bank account directly - before they are able to receive their order. It takes 3-4 days for us to received the wire transfer made from anywhere in the world. The importer makes payment to a local bank in home currency which arranges for payment to the payee abroad in the currency of his country either through the branch of the local bank or a foreign bank with which the local bank has arrangements for all such payments.It is the process of transmitting money from one entity to another. A bank transfer can be made from one bank account to another bank account. Bank Transfer can also be done by transferring cash from one account to another at a cash administrative center.

Procedure for Bank Transfer:

If an individual wants to make a bank transfer, he visits a bank and the bank provides a form which a person is required to submit with proper details to his bank. While making a bank transfer you need to have the following details: Bank Name: Payee Name: Sort Code: Account Number: IBAN:

AMITY UNIVERSITY

Page 26

BUYERS LINE OF CREDIT

SWIFT:

Bank Transfer usually takes 3-4 days to reflect amount in the payees account. However, some banks have a fast processing system and the amount is transferred the same day. While making a bank transfer, one should always enter a proper reference number to help the Payee locate the account. Sort Code: Sort Code is a number assigned for internal purpose to a particular branch of a bank. Sort Code is used because it is not always feasible to write down the banks full address. Sort Code differs from branch to branch. A Sort Code is made up of 6 characters with three pairs and hyphens in between. A Sort Code looks like this: 4567-89 IBAN: IBAN stands for "International Bank Account Number". It is required while making an international bank transfer. IBAN is a mixture of Swift Code, Sort Code, and Account Number. If you are making an electronic funds transfer, then there should be no spaces in the IBAN. United Kingdom accounts usually contain 22 characters in an IBAN. Swift Code: SWIFT term stands for "Society for Worldwide Interbank Financial Telecommunication"ISO approves the Swift Code which is a standard format of Bank Identifier Codes. Swift Code is the unique code for a particular bank. Swift Code contains first four letters of the bank name, two letters of the Country name and other unique numbers provided by ISO.

Advantages:

Payment is sent directly from one recognized bank account to another account. Immediate and convenient. Payment is deposited directly into the seller's account.

Disadvantages:

Payment is difficult to recover in cases of fraud.

6.1.2 Letter of creditAMITY UNIVERSITY Page 27

BUYERS LINE OF CREDIT

Letter of Credit L/c also known as Documentary Credit is a widely used term to make payment secure in domestic and international trade. The document is issued by a financial organization at the buyer request. Buyers also provide the necessary instructions in preparing the document. The International Chamber of Commerce (ICC) in the Uniform Custom and Practice for Documentary Credit (UCPDC) defines L/C as: "An arrangement, however named or described, whereby a bank (the Issuing bank) acting at the request and on the instructions of a customer (the Applicant) or on its own behalf : 1. Is to make a payment to or to the order third party ( the beneficiary ) or is to accept bills of exchange (drafts) drawn by the beneficiary. 2. Authorised another bank to effect such payments or to accept and pay such bills of exchange (draft). 3. Authorised another bank to negotiate against stipulated documents provided that the terms are complied with. A key principle underlying letter of credit (L/C) is that banks deal only in documents and not in goods. The decision to pay under a letter of credit will be based entirely on whether the documents presented to the bank appear on their face to be in accordance with the terms and conditions of the letter of credit.

Parties to Letters of Credit

Applicant (Opener): Applicant which is also referred to as account party is normally a buyer or customer of the goods, who has to make payment to beneficiary. LC is initiated and issued at his request and on the basis of his instructions.

Issuing Bank (Opening Bank) : The issuing bank is the one which create a letter of credit and takes the responsibility to make the payments on receipt of the documents from the beneficiary or through their banker. The payments has to be made to the beneficiary within seven working days from the date of receipt of documents at their end, provided the documents are in accordance with the terms and conditions of the letter of credit. If

AMITY UNIVERSITY

Page 28

BUYERS LINE OF CREDIT

the documents are discrepant one, the rejection thereof to be communicated within seven working days from the date of of receipt of documents at their end.

Beneficiary : Beneficiary is normally stands for a seller of the goods, who has to receive payment from the applicant. A credit is issued in his favour to enable him or his agent to obtain payment on surrender of stipulated document and comply with the term and conditions of the L/c. If L/c is a transferable one and he transfers the credit to another party, then he is referred to as the first or original beneficiary.

Advising Bank : An Advising Bank provides advice to the beneficiary and takes the responsibility for sending the documents to the issuing bank and is normally located in the country of the beneficiary.

Confirming Bank : Confirming bank adds its guarantee to the credit opened by another bank, thereby undertaking the responsibility of payment/negotiation acceptance under the credit, in additional to that of the issuing bank. Confirming bank play an important role where the exporter is not satisfied with the undertaking of only the issuing bank.

Negotiating Bank: The Negotiating Bank is the bank who negotiates the documents submitted to them by the beneficiary under the credit either advised through them or restricted to them for negotiation. On negotiation of the documents they will claim the reimbursement under the credit and makes the payment to the beneficiary provided the documents submitted are in accordance with the terms and conditions of the letters of credit.

. Second Beneficiary : Second Beneficiary is the person who represent the first or original Beneficiary of credit in his absence. In this case, the credits belonging to the original beneficiary is transferable. The rights of the transferee are subject to terms of transfer.

Types of Letter of Credit

AMITY UNIVERSITY

Page 29

BUYERS LINE OF CREDIT

1. Revocable Letter of Credit L/c A revocable letter of credit may be revoked or modified for any reason, at any time by the issuing bank without notification. It is rarely used in international trade and not considered satisfactory for the exporters but has an advantage over that of the importers and the issuing bank.

There is no provision for confirming revocable credits as per terms of UCPDC, Hence they cannot be confirmed. It should be indicated in LC that the credit is revocable. if there is no such indication the credit will be deemed as irrevocable. 2. Irrevocable Letter of CreditL/c In this case it is not possible to revoked or amended a credit without the agreement of the issuing bank, the confirming bank, and the beneficiary. Form an exporters point of view it is believed to be more beneficial. An irrevocable letter of credit from the issuing bank insures the beneficiary that if the required documents are presented and the terms and conditions are complied with, payment will be made. 3. Confirmed Letter of Credit L/c Confirmed Letter of Credit is a special type of L/c in which another bank apart from the issuing bank has added its guarantee. Although, the cost of confirming by two banks makes it costlier, this type of L/c is more beneficial for the beneficiary as it doubles the guarantee. 4. Sight Credit and Usance Credit L/c Sight credit states that the payments would be made by the issuing bank at sight, on demand or on presentation. In case of usance credit, draft are drawn on the issuing bank or the correspondent bank at specified usance period. The credit will indicate whether the usance draft are to be drawn on the issuing bank or in the case of confirmed credit on the confirming bank.

AMITY UNIVERSITY

Page 30

BUYERS LINE OF CREDIT

5. Back to Back Letter of Credit L/c Back to Back Letter of Credit is also termed as Countervailing Credit. A credit is known as back to back credit when a L/c is opened with security of another L/c. A back to back credit which can also be referred as credit and counter credit is actually a method of financing both sides of a transaction in which a middleman buys goods from one customer and sells them to another. The practical use of this Credit is seen when L/c is opened by the ultimate buyer in favour of a particular beneficiary, who may not be the actual supplier/ manufacturer offering the main credit with near identical terms in favour as security and will be able to obtain reimbursement by presenting the documents received under back to back credit under the main L/c.

The need for such credits arise mainly when : 1. The ultimate buyer not ready for a transferable credit 2. The Beneficiary do not want to disclose the source of supply to the openers. 3. The manufacturer demands on payment against documents for goods but the beneficiary of credit is short of the funds 6. Transferable Letter of Credit L/c A transferable documentary credit is a type of credit under which the first beneficiary which is usually a middleman may request the nominated bank to transfer credit in whole or in part to the second beneficiary. The L/c does state clearly mentions the margins of the first beneficiary and unless it is specified the L/c cannot be treated as transferable. It can only be used when the company is selling the product of a third party and the proper care has to be taken about the exit policy for the money transactions that take place.

AMITY UNIVERSITY

Page 31

BUYERS LINE OF CREDIT

This type of L/c is used in the companies that act as a middle man during the transaction but dont have large limit. In the transferable L/c there is a right to substitute the invoice and the whole value can be transferred to a second beneficiary. The first beneficiary or middleman has rights to change the following terms and conditions of the letter of credit: 1. Reduce the amount of the credit. 2. Reduce unit price if it is stated 3. Make shorter the expiry date of the letter of credit. 4. Make shorter the last date for presentation of documents. 5. Make shorter the period for shipment of goods. 6. Increase the amount of the cover or percentage for which insurance cover must be effected. 7. Substitute the name of the applicant (the middleman) for that of the first beneficiary (the buyer).

Standby Letter of Credit L/c Initially used by the banks in the United States, the standby letter of credit is very much similar in nature to a bank guarantee. The main objective of issuing such a credit is to secure bank loans. Standby credits are usually issued by the applicants bank in the applicants country and advised to the beneficiary by a bank in the beneficiarys country. Unlike a traditional letter of credit where the beneficiary obtains payment against documents evidencing performance, the standby letter of credit allow a beneficiary to obtains payment from a bank even when the applicant for the credit has failed to perform as per bond.

A standby letter of credit is subject to "Uniform Customs and Practice for Documentary Credit" (UCP), International Chamber of Commerce Publication No 500, 1993 Revision, or

AMITY UNIVERSITY

Page 32

BUYERS LINE OF CREDIT

"International Standby Practices" (ISP), International Chamber of Commerce Publication No 590, 1998. Now after learning about the letter of credit and its types it is crucial to know about THE IMPORT OPERATIONS(as buyers credit emphasizes on both import and export credit but only import credit has been taken into consideration in the whole project) under letter of credit, RISK INVOLVED and various CHARGES under letter of credit.

Import Operations Under L/cThe Import Letter of Credit guarantees an exporter payment for goods or services, provided the terms of the letter of credit have been met. A bank issue an import letter of credit on the behalf of an importer or buyer under the following Circumstances

When a importer is importing goods within its own country. When a trader is buying good from his own country and sell it to the another country for the purpose of merchandizing trade.

When an Indian exporter who is executing a contract outside his own country requires importing goods from a third country to the country where he is executing the contract.

Fees And ReimbursementsThe different charges/fees payable under import L/c is briefly as follows

1. The issuing bank charges the applicant fees for opening the letter of credit. The fee charged depends on the credit of the applicant, and primarily comprises of : (a) Opening Charges : This would comprise commitment charges and usance charged to be charged upfront for the period of the L/c.

AMITY UNIVERSITY

Page 33

BUYERS LINE OF CREDIT

The fee charged by the L/c opening bank during the commitment period is referred to as commitment fees. Commitment period is the period from the opening of the letter of credit until the last date of negotiation of documents under the L/c or the expiry of the L/c, whichever is later. Usance is the credit period agreed between the buyer and the seller under the letter of credit. This may vary from 7 days usance (sight) to 90/180 days. The fee charged by bank for the usance period is referred to as usance charges. (b)Retirement Charges: 1. This would be payable at the time of retirement of LCs. LC opening bank scrutinizes the bills under the LCs according to UCPDC guidelines , and levies charges based on value of goods. 2. The advising bank charges an advising fee to the beneficiary unless stated otherwise The fees could vary depending on the country of the beneficiary. The advising bank charges may be eventually borne by the issuing bank or reimbursed from the applicant. 3. The applicant is bounded and liable to indemnify banks against all obligations and responsibilities imposed by foreign laws and usage. 4. The confirming bank's fee depends on the credit of the issuing bank and would be borne by the beneficiary or the issuing bank (applicant eventually) depending on the terms of contract. 5. The reimbursing bank charges are to the account of the issuing bank.

Risk Associated with Opening Imports L/cs:

The basic risk associated with an issuing bank while opening an import L/c are : 1. The financial standing of the importer: As the bank is responsible to pay the money on the behalf of the importer, thereby the bank should make sure that it has the proper funds to pay.

AMITY UNIVERSITY

Page 34

BUYERS LINE OF CREDIT

2. The goods: Bankers need to do a detail analysis against the risks associated with perishability of the goods, possible obsolescence, import regulations packing and storage, etc. Price risk is the another crucial factor associated with all modes of international trade. 3. Exporter Risk: There is always the risk of exporting inferior quality goods. Banks need to be protective by finding out as much possible about the exporter using status report and other confidential information. 4. Country Risk: These types of risks are mainly associated with the political and economic scenario of a country. To solve this issue, most banks have specialized unit which control the level of exposure that that the bank will assumes for each country. 5. Foreign exchange risk: Foreign exchange risk is another most sensitive risk associated with the banks. As the transaction is done in foreign currency, the traders depend a lot on exchange rate fluctuations.

AMITY UNIVERSITY

Page 35

BUYERS LINE OF CREDIT

Documents required for Import Credit

1. Intimation letter 2. Application for buyer credit 3. Form A1(Attached) 4. ECB Form 5. FEMA Declaration 6. OGL (Open General Licence) 7. Commercial Invoice 8. Bill of Lading( Format given below) 9. IEC copy

Form A1

Applications by persons, firms and companies for making payments towards imports into India must be made on form A1. Variants of this form have been devised in different colours to be used for remittance in foreign currency, transfer of rupees to non-resident bank accounts, and Remittance through Asian Clearing Union

Care should be taken to see that appropriate form A1 is used. Care should also be taken to fill in correctly the various details relating to the import as required on the form and to furnish necessary declarations/undertakings thereon.

External Commercial Borrowings (ECB)

External Commercial Borrowings (ECBs) include bank loans, suppliers' and buyers' credits, fixed and floating rate bonds (without convertibility) and borrowings from private sector

AMITY UNIVERSITY

Page 36

BUYERS LINE OF CREDIT

windows of multilateral Financial Institutions such as International Finance Corporation. Euroissues include Euro-convertible bonds and GDRs.

In India, External Commercial Borrowings are being permitted by the Government for providing an additional source of funds toIndian corporates and PSUs for financing expansion of existing capacity and as well as for fresh investment, to augment theresources available domestically. ECBs can be used for any purpose (rupee-related expenditure as well as imports) except for investment in stock market and speculation in real estate. External Commercial Borrowings (ECB) are defined to include commercial bank loans, buyers credit, suppliers credit, securitised instruments such as floating rate notes, fixed rate bonds etc. credit from official export credit agencies, commercial borrowings from the private sector window of multilateral financial institutions such as IFC, ADB, AFIC, CDC etc. and Investment by Foreign Institutional Investors (FIIs) in dedicated debt funds .

Applicants are free to raise ECB from any internationally recognised source like banks, export credit agencies, suppliers of equipment, foreign collaborations, foreign equity - holders, international capital markets etc.

Open export license

instead of going to a process to acquire a export license on each export for the identical goods repeatedly, this open general license allows exporting continuously for fixed period when qualified for ceratin requirement. For the exports acquired this license, the collection of export earning must be executed within the fixed period as per each reported exportation.

Bills of lading

The bill of lading (in ocean transport), waybill or consignment note (in air, road, rail or sea transport), and receipt (in postal or courier delivery) are collectively known as the transport documents.

AMITY UNIVERSITY

Page 37

BUYERS LINE OF CREDIT

The B/L must indicate that the goods have been loaded on board or shipped on a named vessel, and it must be signed or authenticated by the carrier or the master, or the agent on behalf of the carrier or the master. The signature or authentication must be identified as carrier or master, and in the case of agent signing or authenticating, the name and capacity of the carrier or the master on whose behalf such agent signs or authenticates must be indicated. Unless otherwise stipulated in the letter of credit (L/C), a bill of lading containing an indication that it is subject to a charter party and/or that the vessel is propelled by sail only is not acceptable.

CLIENTS BENEFITThis type of financing allows the exporter: to be paid in cash as and when the commercial contract is executed; to be exempt from the entire credit risk, the risk being taken on by the lending Bank or

Banks (the exporter remaining only responsible of the execution of the commercial contract); to lighten the make-up of his balance sheet; to present the buyer with an attractive offer (up to 100 % of the commercial contract if commercial loan is granted) devoid of provisions for risks and costs. For his part, the buyer can benefit of: a financing with better conditions that the market may offer, specially in term of duration and/or interest rate; a financing tool specially adapted for major projects.

AMITY UNIVERSITY

Page 38

BUYERS LINE OF CREDIT

6.1.3 Documentary collection:

A documentary collection is a payment mechanism in which a seller uses a bank as his/her "agent" in collecting payment from a buyer located overseas. After shipping the goods, the seller submits a draft (a demand for payment) and the relevant shipping documents to the bank. The draft will include instructions to release the documents to the buyer upon the buyers payment or acceptance of the draft. The sellers bank sends the documents, draft, and collection instructions to a branch or correspondent bank in the buyers country. This bank carries out the sellers collection instructions and, upon receipt of payment from the buyer, remits payment to the sellers bank for the credit of the seller.

Description: (1) D/P(document against payment) method:

- This method is for a collection bank to present at sight documentary bill and the shipping documents to a importer, and exchange importer's cash to shipping documents.

- Usance D/P(Usance D/P) - In principle, D/P is sight bill term in general but if a importer wants to concord payment period with goods obtain period, there is usually "D/P, 20days after B/L date" indication. At this pont, a collection bank only notifies to a importer of the shipping documents arrival and keep the documents itself. When the due date arrives, the bank reimburse the documents and cash to collection.

(2) D/A (document against acceptance) method:

An importer indicates "acceptance" on the bill of change document usance bill presented by a collection bank and hand over the shipping documents to a collection bank by signing the documents and collect cash on the maturity date. In the process of collection procedures, only the bill of change is received from a importer and hand over documents to a importer and receive payment on the D/A maturity date is the different process from D/P method. If a importer refuse a collection request of a collection bank, a collection bank should prepare

AMITY UNIVERSITY

Page 39

BUYERS LINE OF CREDIT

a certificate of refusal and send it to a collection requested bank or deliver a collection refusal purpose to a collection requested bank.

Procedure:

Documentary collection procedures are uncomplicated. After shipping the goods, the exporter submits to the bank:

shipping documents, including the bill of lading conveying title to the goods, as well as other documents related to the shipment.

a draft, also called a bill of exchange, demanding payment from a buyer. Depending on the agreed terms of sale, this may be a sight draft, demanding payment on presentation, or a time draft, demanding payment at some stated future time after presentation or after the bill of lading date.

instructions to the bank as to how to handle the transaction. Note that a documentary collection requiring payment before the release of documents may sometimes be transacted without a sight draft. Under cash against documents (CAD) terms, the documents are released to a buyer against receipt of payment. These terms are generally used when the government of the importing country requires tax stamps affixed to drafts; by eliminating the draft, both buyer and seller avoid stamp taxes.

Release documents to a buyer upon payment of the sight draft, which is known as a documents against payment, or D/P collection; or release documents to a buyer upon acceptance of the time draft, a documents against acceptance, or D/A collection.

The sellers bank, called the remitting bank, sends the documents, draft, and instructions to one of its branches or correspondent banks in the buyers country. This bank, called the collecting or presenting bank, contacts the buyer and informs him/her that the documents have arrived and can be obtained when he/she complies with the payment terms, which may be documents against payment or documents against acceptance.

AMITY UNIVERSITY

Page 40

BUYERS LINE OF CREDIT

Things to be cautious when concluding a contract:

(1) Thorough credit research of a importer: Since D/A, D/P are the transaction that grants credit to a importer without the payment guarantee of a bank, they require detail and through investigation about a importer's credit in advance.

(2) Loss prevention Export draft insurance coverage

- Since the credit limit is fixed per each countries, it needs to be checked in advance. Request to importer to provide security.

7.0 Analysis (results and discussions)AMITY UNIVERSITY Page 41

BUYERS LINE OF CREDIT

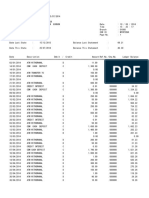

Starting from the beginning Crystal Crop Protection Pvt. Ltd. (CCPL) is a company of 800 crores and have 28 branches all over India. Import of company is majorly from china which is equal to around 165crores. CCPL has a chain of 3 factories out of which 2 of them are located in Jammu and the remaining one in Nathupur, Haryana. Material is supplied from these factories to all over India. Hence today company has around 4500 distributors and company supply to these distributors. In manufacturing plants the tankers and vessels blend the Raw materials and raw material is being formulated in liquid, granular form. Packed and sold through distributors to farmers. The main strength of CCPL is its import from China. CCPL has taken exclusive registrations from China and the registration is worth 2crores, being expensive so that only CCPL becomes the core and single importer of India for those company. As already stated the core business of CCPL is to import goods from China. It takes around 10-15 days for chinas exporter in production of goods and roughly after 20-30 days the goods are being dispatched. After that it takes around 20 days to reach Nava Siva port from Shanghai port and then the goods are being dispatched to Delhi dry port through trains which takes 5 days and then CCPL has to pay clearance charges. Now CCPL has three options to make payment. TT payment (payment before shipment) L/C 180 days and, Buyers line of credit payment (Documents against presentation).

Now below is the detailed analysis of all the three showing the cost from all the three sources.

7.1 CALCULATION OF COSTS:

AMITY UNIVERSITY Page 42

BUYERS LINE OF CREDIT

*costing is calculated based on 180 days purchase cost to Crystal Crop Protection Pvt. Ltd. *for the analysis 1 USD = Rs. 55 has been taken

7.1.1 (Cost through TT PAYMENT MODE)

Now according to the current scenario bank interest rate = 13% p.a. Now considering the fact that Crystal Crop Protection Ltd. makes payment to Chinese supplier, then to arrive at 180 days cost at bank rate we need 6.5% as interest rate for the period of 180 days (considering bank rate @ 13%p.a.). So for a product of 1000USD , it can quoted = Rs. 55000 So for 180 days the cost will be (1000+(1000*6.5%)) = 1065 USD or say 55000*6.5% = Rs. 58,575. Now considering 160crores of import from china the cost to Crystal Phosphates Ltd. will be = Rs. 160crores*6.5% = Rs.170.4crores Now once Crystal makes TT payment, then the Chinese manufacturer will take 20 days to make goods and 20 days as transit period from Shanghai to Nava Shiva and further 10 days for goods to reach ICD Tughlaqabad by train to Nathupur, Haryana to the Crystal Phosphates Ltd. factory. So in total it takes around 50 days for the total material to reach the factory.

7.1.2 (Cost through L/C MODE):

*The problem in this was that many suppliers wanted either TT payment or L/C sight.

AMITY UNIVERSITY

Page 43

BUYERS LINE OF CREDIT

The second available option for Crystal Crop Protection Pvt. Ltd. can be called as CCPL is to open L/C 180 days to the supplier. The Chinese bank and in turn the Chinese supplier charge interest @ 6.5% p.a., so the final cost in China is cheaper by 6.5% (because in India the bank rate is assumed to be 13%) as compared to the Indian banks. Now considering the fact that CPL opens 180 days to L/C supplier, the cost will be as belowSo for a product of $1000 the cost will be = Rs. 55000+(55000*3.25%) = Rs. 56,787.5 Now again similarly considering 160crores of import the cost to CPL will be = Rs.160crores*3.25% = Rs. 165.2crores. However in this case, CPL has to give 15% margin money to bank in India ( State Bank of India) as security to open L/C to the supplier. However the bank may give interest on this amount but it should be noted that CPLs capital money gets blocked out here which could have been utilized in some other more profitable business or project. And taking the time constraint in consideration it will take 30 days as the time when the goods are being produced is not considered in this case as there is no advance payment. So during my training at CPL in consultation with the finance department, I came to the conclusion that we should go for Buyers Line of Credit after negotiating with the other banks and the State Bank of India.

7.1.3 (Cost through Documentary collection)-

AMITY UNIVERSITY

Page 44

BUYERS LINE OF CREDIT

Now the third case could be when CCPL did a contract with the Chinese supplier on DP at sight basis (Documents against presentation). Under this case, the Chinese supplier will get the payment once the documents are being presented in Indian Bank by the Chinese bank. CCPL has to make payment and then take the negotiable documents by which clearance of goods can be done. Cost Now on DP Sight basis Chinese supplier can get the payment easily and immediately from the bank once the contract has been signed. Another advantage could be that company gets much time to make payment. Payment is made only once the goods are about to reach Nava Shiva in order to take negotiable documents from bank so as to clear goods. Here the cost of finance is 3.5%p.a. only

So again for a product of $1000 the cost will be = Rs. 55000*1.75% (for 180 days of trade) = Rs. 55,962.50 Now again similarly considering 160crores of import the cost to CPL will be = Rs.160crores*1.75% = Rs. 162.8crores.

8.0 Conclusion and recommendations-

AMITY UNIVERSITY

Page 45

BUYERS LINE OF CREDIT

Buyers credit is the best possible alternative for CCPL amongst the three discussed above. Hence the report can be concluded as-

COST BENEFIT:

So from the analysis it has been discovered that in terms of cost Buyers Line of Credit is cheaper than TP payment by 7.6crores (as from the above data TP payment cost was coming to be Rs. 170.4crores as compared to Buyers Line of credit payment which was only Rs.162.8crores) and 2.4crores cheaper than L/C (as from the above data the L/C cost was coming out to be Rs. 165.2crores as compared to Buyers Line of credit payment which was only Rs.162.8crores). Further the advantage of using Buyers Line of Credit is that it is been discovered that it is the best possible way to reduce cost that CPL can make.

MARGIN MONEY BENEFIT:

Other than this no margin money of 15% has to be paid in this case as compared to L/C 180 days. So this is another advantage that the company has by opting D/P payment mode and in long term profitability increases due to this.

NO TRANSIT LOSS:

Hence transit time loss is being saved and the companys negotiation power will increase. Because advance payment has not been done.

ENOUGH TIME TO MAKE PAYMENT:

AMITY UNIVERSITY

Page 46

BUYERS LINE OF CREDIT

Another advantage could be that company gets much time to make payment. Payment is made only once the goods are about to reach Nava Shiva in order to take negotiable documents from bank so as to clear goods.

BENEFIT TO THE EXPORTER:

DP Sight basis Chinese supplier can get the payment easily and immediately from the bank once the contract has been signed. Hence with the buyer, the exporters are also willing to agree upon such kinds of payment because they get the payment immediately, therefore situation of negotiation occurs.

WORKING CAPITAL BENEFIT:

D/P payment also prevents the working capital from blocking. As the payment is madeonce the goods reach Nava Shiva port, till then the amount of payment can be invested in other profitable projects and because the working capital doesnt get blocked in D/P Payment.

9.0 Future prospects-

AMITY UNIVERSITY

Page 47

BUYERS LINE OF CREDIT

As Crystal Phosphates Ltd. is basically dealing with China in its exports and had also taken certain exclusive registrations from certain companies (name of these companies being attached in annexure: 2) worth Rs.2crores and this is interesting to know that in last 10 years the company had already spent 44crores on the same. Therefore there are a lot of opportunities for CPL to get engaged with certain more companies in China and worldwide (as it has a very strong customer and supplier base.) These exclusive registrations could even help CPL to be worldwide known and earn goodwill in this field. CPL has even many chances to open its branches globally and serve as one of the leading companies in future if it continues making huge profits as now using buyers line of credit as it has already been stated that company has had a profit of 7.6crores using the same. This will further help company increase its number of contacts and thereby its export-import and hence earn huge profits. Currently the company has also acquired a pesticide Luphos-36 from Mumbai-based Cheminova India Ltd. Buyers credit saves money and thereby that amount can be invested in some profitable deal that could not have been possible if CPL has used L/C 180 days or TT payment mode. The company has huge prospects and is dying to promote the brand in major states including Punjab, Haryana, A.P., Maharashtra, Gujrat , Rajasthan, MP, Assam, W.B. also. And some offers from Japan are also coming forth.

10.0 BIBLIOGRAPHY

AMITY UNIVERSITY Page 48

BUYERS LINE OF CREDIT

Websiteshttp://www.crystalcropprotection.com/ http://www.businessdictionary.com/definition/documents-against-payment-D-P.html http://www.infodriveindia.com/Exim/Guides/ExportFinance/Ch_14_Foreign_Exchange_Management_Act.aspx#Buyerss_/Suppliers_Credit http://www.ftb.ca.gov/forms/2010/10_3549a.pdf http://escrow.aliexpress.com/escrow-faq/payment/how-do-i-pay-using-bank-transfers.html http://webarchive.nationalarchives.gov.uk/tna/+/http://www.ecgd.gov.uk/guide-buyer-credi_sept_2008__v3-2.pdf/ http://letterofcreditforum.com/content/mode-shipment-sea-mode-payment-lc-mode-payment-tt-modeshipment-lc http://www.pfc.gov.in/writereaddata/userfiles/file/Financial/8_loc_buyers.pdf http://www.scribd.com/doc/15427657/International-Trade-Importance-of-Letter-of-Credit http://english.cmbchina.com/corporate+business/domestic/trade/trade7.htm http://www.ec-finance.com/site/about_lcs/letter_of_credit_process.htm http://www.just4uloan.com/business/non_fund_limits/buyer_credit.htm http://www.exim.gov/pub/ins/pdf/eib92-18.pdf http://en.allexperts.com/q/Exporting-Importing-Goods-2032/2010/12/LC-CAD-T-T.htm

BooksAnupam publishers (paras ram), 2008-09 Edward G. Hinkelman, 3rd edition, 2009 Rupnarayan bose, 2006

AMITY UNIVERSITY

Page 49

BUYERS LINE OF CREDIT

Raghu palat, 2006 Crystal phosphates annual report. (2008-09) Crystal Crop Protection Pvt. Ltd. Annual Report (2010-11)

11.0

ANNEXURES:

a) My experience with Crystal Phosphates Ltd.-

AMITY UNIVERSITY

Page 50

BUYERS LINE OF CREDIT

My faculty guide- Mr. Abhishek Agarwal (Finance manager) Period of internship- 7th May 12- 29th June 12 My experience with crystal phosphates was really overwhelming. I had learnt a lot about what actually people do in an organization and had gained a lot of knowledge practical implementation of our theoretical subjects into the real world. My knowledge had increased immensely while working with CCPL, I used to make lists of our suppliers in China from which CCPL have taken certain exclusive registrations worth Rs.2crores so that only CCPL can import goods from them as well as I have also attended certain seminars given by various heads of the organization. In last 10 years company has spend a considerable amount of Rs.44crores for the same (to get exclusive registrations.) In the first week I was just being introduced to the company and I was asked to make an excel sheet containing details of some important suppliers from which exclusive registration has been done which is worth Rs 2crores and in last years company had already paid Rs. 44crores for the same. As I started working on some financials I came to know that last financial year (2008-09) CPL (Crystal Phosphates Ltd.) had the second highest turnover (total net sales being around Rs. 379crores)among the companies dealing in fertilizers and crop nourishment, first being TATA Chemicals. CPL has recently been in a joint venture with a company in china which is the biggest in their history.

The topic "Buyer's line of credit has been suggested by my industry guide Mr. Abhishek Agarwal and had proven to be great! According to him this is a new and interesting topic to learn. As the company deals among international trade so buyers credit is the best mode to make payment. Other than this I need to work upon the financials of the company, major work being to look after petty cash expenses and to make lists of Chinese suppliers. In the end last weeks were though quite relaxing as I didn't had much of work in the office. I had learnt about the new guidelines of buyer's credit and how company is actually benefitted by using this credit.

AMITY UNIVERSITY

Page 51

BUYERS LINE OF CREDIT

As CPLs trading is basically related with China so while working there I got to see a lot of Chinese businessmen walking out in CPLs main conference hall and thereby I also got to know about the formalized culture that actually prevails in the organizations. Understanding the culture of any organization is really exciting as you get to know so many people and so their managerial tactics. Though I notice some of the managers speaking to them in Chinese only but I could only hear to it and smile being totally unaware about the language!! But still I learnt a lot about the organization culture and the practical implementation of our theoretical subjects in the real world. Hence overall it was an amazing experience and whatever I have learnt there in 8 weeks will help me throughout my life

Annexure: 2

COMPANY NAME Anhui Huaxing Chemical Ind. Ltd. ADDRESS Add:Hongfeng Road, Hefei, Anhui Province P.R. China P.C:230088 CONTACT NUMBER Tel:0086-551-5848124, Fax:0086-5515848133,5620968 CONTACT PERSON Zheng Wei (Senior Manager, I.T.D) Mob: 13856035295,

AMITY UNIVERSITY

Page 52

BUYERS LINE OF CREDIT

Anhui Huaxing Chemical Ind. Ltd. Factory Add: Wujiang town, Hexian County, Anhui Province , P.R. of China Tel: 0086-551-5848116 Xie Ping ( Chairman) Mob.13866758555

Jiangxi NewReyphon Biochemical Co.,Ltd. Jiangsu Tianrong Group Co.Ltd.

Add: 263 Chengnan Industry Zone, XinGan,Jiangxi 331307 China

Tel: 86-796-2676038, Fax: 86-796-2676028

Want Yan (Vice General Manager) Mob. 13907065320

Add: 10F, B Building Changfa Center, No 300 Zhongshan East Road, Nanjing, China Add: Room1801, TowerB, Shenfang Plaza, RenminRoad(South), Shenzhen, China. P.C.518005 Add: Room1203, GuTai Mansion, No.969, ZhongShah Rd.(S) Shanghai, P.C. 200011 Add: Xiyangling, South East No.2c Ircle Way, Shijiazhuang,Hebei, China, P.C. 050035 Add: Hongguozi, Huinong, Ningxia, P.R. China Add: Room 1213, Building C, Green Land Technology Square, 58#East Xinjian Road, Shanghai, China 201100

Tel: 86-25-84563019, Fax: 86-25-84563013

Jackie Xu ( Export Manager) Mob. 13913809560

Iprochem Co., Ltd.

Tel: 86-755-82353001 ext 506, Fax: 86-75582225900 ext506 Tel: 86-21-63355320(21)806, Fax: 86-2163355322 Tel: 0311-85321693, Fax: 0311-85321692

Lynn, (Mob:) 15889605133

Shanghai Biochemical SciTech Co.Ltd. Hebei Yetian Agrochemi Cals Co., Ltd Ningxia Yunong Chemical Corporation Zhejiang E-Tong Chemical Co., Ltd

Yang Jin Bo ( General Manager, Int Trade Dept.) Mob: 13951229887 Li Ming Sheng ( Assistant G. M), Mob: 13931120500

Tel: 0952-7681789, Fax: 0952-7681890 Tel: 86-21-5169 8968-8013, Fax: 86-21-6413 8597

Zhao Qi ( Sales Manager), Mob: 13772466986 Michael Feng ( Sales Manager), Mob: 139 1748 5545

Sinochem Shanghai Corp.

Add: 17-19th/ Floor, No.33 Henan Rd.(S) Shanghai, China, P.C. 200002

Tel: 8621-63289888 X 1816 63375004, Fax: 862163375874 Tel: 86-25-86581144/45, Fax: 86-25-86581187

Andy Zhu (Crop Protection Dept.), Mob. 13402060988

Jiangsu Pesticide Research Institute Co., Ltd Hebei Veyong BioChemical Co., Ltd.

Add: No. 80 Luo-si-qiao, Nanjing, 210019 China

Bill Hui ( Foreign Trade Manager), Mob: 0086(0) 15601560586 Liu Wenfeng ( Area Manager, Export Dept), Mob. 13832339039 Lisha Luo ( Vice G.M. ), Mob: 13603085512

Add: 393 East Heping Road Shijiazhuang 050031 China

Tel: 86-311-85916004, Fax: 86-311-85665324

Honbor Industrial Group

Add: C Zone 11/F International Trade Building. No.3002, Renmin South Rd. Shenzhen, China

Tel: 86-755-88861689-812, Fax: 86-755-82214398

Annexure: 3APPLICATION FOR BUYERS CREDIT/ SUPPLIERS CREDIT 1. 2. 3. COMMODITY BY IMPORTED/ TO BE IMPORTED WITH CUSTOM NUMBER OF COMMODITY :TYPE OF GOODS (CAPITAL/ NON CAPITAL) :CURRENCY & AMOUNT OF LOAN

AMITY UNIVERSITY

Page 53

BUYERS LINE OF CREDIT